I started my undergraduate studies in economics in the late 1970s after starting out as…

Not the time to be cutting spending or raising taxes

Today I have had several media requests for interviews about various topics including the flood reconstruction in the eastern states of Australia and their implications for the budget aims of the Federal government (to record a surplus in 2012-13). My position seems to be alone in the debate. In the conservative pro-business publication – Business Spectator article (January 19, 2011) – A flood levy would not break Labor – we read more about the alleged budget dilemma facing the Government as a result of the devastating floods that Australia is currently enduring. To put the article in context, the author was a former advisor to past Labor government ministers – which when you read it tells you how far to the right the political “centre” has gone. While I doubt that the floods alone will undermine economic growth over the next 12 months, I certainly consider that the Australian economy requires further fiscal stimulus to keep growth going and the response to the disaster is a politically acceptable way to inject that stimulus. It is certainly not the time to be trying to raise taxes or cut spending in other areas to “pay for” the reconstruction effort.

The author says that:

After the floods, the federal government faces a daunting challenge to its economic management credentials. Selling its policy response to a dubious electorate is an even tougher test. To absorb the coming budget shock, Treasurer Wayne Swan has three obvious paths available to him: defer promised budget surpluses, introduce a dedicated flood levy, or find the savings elsewhere.

So the economic management credentials are not measured in terms of how effective the government is in supporting the reconstruction of the damaged infrastructure. Nor apparently is it to be measured in how effective the government is in ensuring that the labour market is not disrupted (that is, employment).

No, the credentials rest – and this is one of many articles that is pushing this line at present – on whether the budget deficit goes up or down. What nonsense is that?

What impact on the lives of communities will be felt if the budget deficit rises by 1 per cent of GDP or not outside of what the actual spending programs that would deliver such a result do for the restoration of the damaged communities? Answer: No-one would know the difference.

The effectiveness of the government response will not be measured by the budget parameters. Whether the deficit goes up or down is irrelevant. What matters is the real resources that are deployed by the government reconstruction program and whether this deployment is sensible and promotes welfare improvements. The dollar figure next to the budget item “reconstruction” is irrelevant.

Why is that? Simply because the Australian government is fully sovereign in its own currency and has no financial constraint when considering its spending decisions. The latter should be guided by the need to stimulate aggregate demand levels such that they correspond to the capacity of the economy to respond in real terms (that is, non-inflationary terms).

If the budget deficit has to be 3 per cent of GDP or 5 or 1 to achieve that aim it is of no economic consequence or meaning.

But the whole flood response debate is being quickly shoehorned into a manic discussion about whether the Government will be able to deliver on its promise to “get the budget back into surplus by 2012-13”. The Government foolishly is continuing to claim it will and has to face harsh spending decisions. I last considered the Government’s response in this blog – Flooded with nonsense.

The Opposition (the so-called conservatives although both sides of politics are pretty far gone in that direction) are using this disaster as a chance to push their rabid fiscal austerity model and to suggest that key government infrastructure programs like the National Broadband Network should be abandoned “to pay” for the flood relief. I will come back to that point later.

The point is that the Australian government can always pay for the flood relief by crediting bank accounts for its purchases and transfers. As long as there are real resources available either in the form of final goods and services or idle labour and capital then the Australian government will be able to purchase those resources and put them to use in the reconstruction effort.

Read: always.

The Government doesn’t have to reduce any other spending to provide the necessary relief to the flood reconstruction effort. But while it is clear they do not have to cut spending elsewhere to provide the flood support that doesn’t mean that they should not do so.

Whether it is wise to increase the deficit in a discretionary sense (quite apart from what the automatic stabilisers might do) depends on the context – what is the overall state of aggregate demand and what are the regional implications for increased nominal demand?

Given that a lot of the reconstruction will require low-skilled and semi-skilled labour (not to mention the skilled trades etc) this will be a perfect opportunity to really absorb the large pools of unemployed and underemployed workers in Australia. Locally first and then via mobility inducements should that be required.

While the conservatives are claiming there is a labour shortage I think otherwise – given we have 12.5 per cent of will labour resources idle at present in one way or another. Further, when you realise that the flood damage is in the most populace states from Queensland (in the north) to Victoria (in the south) you also will appreciate that a significant number of this 12.5 per cent could be utilised via government employment programs to assist in the flood reconstruction which is expected to take years, given its severity.

Businesses on the east coast are no where near full capacity at present and so there is clearly the capacity left for real expansion.

When you consider that the September quarter National Accounts showed us that Australia was creeping along and contracting (and news since has not been contrary to a continuation of that sombre trend) and the last inflation data showed us that core inflation is falling then you also would conclude that there is scope for further fiscal support.

The reconstruction of infrastructure and public spaces in the eastern states to repair the flood damage is a perfect opportunity for the federal government to expand the discretionary deficit.

But not too many people are coming to that conclusion – and the reason is that their brains have become addled by neo-liberal gibberish.

To see how skewed political commentary has become we read in the Business Spectator article that:

Slash and burn may win plaudits and boost Labor’s position in the polls in the short-term, but the implementation would almost certainly trigger a series of rolling political crises that the Gillard government does not appear robust enough to withstand.

So now austerity which means less income growth and higher unemployment than otherwise is the way to elicit political popularity? If it wasn’t serious it would be a joke.

Apparently, the author also thinks that:

Deferring the promised restoration of budget surpluses seems the most painless and straightforward solution to Labor’s fiscal dilemma, but both the Prime Minister and Treasurer reasserted their commitment to the 2012/13 target in separate media appearances this week.

Their reluctance to take this path is understandable. Labor faces an uphill battle winning and retaining public trust when it comes to economic management …

To some extent the public has been so conditioned to believe that surpluses are good and deficits are bad that you can understand the Government’s dilemma. But the dilemma is one of its own making. They have been consistently leading the rhetoric on the virtues of budget surpluses – lying about their impact – refusing to acknowledge that they undermine economic activity and provide no future spending capacity to a government that can always spending what they like subject to real resource availability.

They had so much “political space” when they came to power in 2007 after 11 hard years with the conservatives. They could have used that space to change the whole nature of politics and the way the public perceive budgets and the role of government. They didn’t take that opportunity because they are, in fact, a bunch of neo-liberal conservatives themselves.

The author says that the Government:

… may not want to take to the next election an economic record that hinges on the patient understanding of voters. “We broke our surplus promise, but…” is a bad start to a terrible sentence.

The problem of-course is in the promise they made at a time when Australia was still experiencing sluggish growth (and still is) and had 12.5 per cent of its willing labour resources idle (and still has). The fact that the promise and the obsession with the fiscal rules that support the promise is not the question is a reflection of how poor the scrutiny from the commentariat is.

The author then proposes that:

A dedicated flood rebuilding levy may be the best of a bad bunch of options. By making it temporary and transparent, a one or two-year add-on to the Medicare levy may serve both political and budgetary ends. It would allow the government to deliver promised surpluses without suffering the consequences of wide and deep cuts to popular programs and services.

First, I agree that now is not the time to be cutting public spending. More public spending is required given how slack the economy is at present.

Second, the flood levy is a tax rise – temporary or otherwise – whatever you call it. It would negatively impact on aggregate demand. While the net impacts of the spending and taxation changes are not clear without more detailed modelling it might mean that the government would not deliver on its “promised surpluses”.

Once again the question not answered is what is the desirable net public spending position at present? This question is continually ignored in the analysis and commentary in the mainstream media on this issue.

You could mount a case for a tax increase to withdraw private purchasing power (not to finance the public spending) to make “room” for expanded public spending on the flood reconstruction. Net exports might be so strong that a budget surplus would still allow economic growth to be sufficient to absorb the pool of underutilised workers while still allowing the private domestic sector to save.

Then all this talk about surpluses and the necessity for the government to ensure it doesn’t stimulate demand in net terms would make sense. But net exports are still a negative contributor to growth and the private domestic sector is desperately of debt reduction. Combined with the fact that there is still a significant output gap (12.5 per cent idle labour resources) then you should not be mindlessly pursuing a budget surplus position.

The other point about the budget outcome is that to some extent it will not depend on what the Government does. As I have written in the past – for example, in my blog – Structural deficits and automatic stabilisers – the budget outcome is what economists call endogenous.

That is, it is determined by spending decisions in the whole economy – government and non-government, public and private. In this sense, the budget outcome is not something the government can control anyway. The non-discretionary components arises from the operations of the sutomatic stabilisers – the tax and spending components of the budget that are sensitive to the state of the business cycle.

So when economic activity wanes, tax revenue falls and welfare spending rises – and as a consequence the budget outcome moves closer to deficit (from a surplus) or into a larger deficit. This is a good thing because it automatically attenuates the drop in aggregate demand and puts a floor into the overall economic collapse.

If the floods cause a major economic slowdown for long enough then the Government will not be able to achieve its budget surplus targets no matter what its intentions are. That is why the use of fiscal rules and a blind adherence to some pre-conceived budget surplus number is not an indication of responsible fiscal management. Exactly the opposite!

Growth impact

The former Prime Minister (now Foreign Minister) told the Melbourne Age (January 19, 2011) that we Need to ‘brace’ for economic hit. I liked his way of expressing the obvious:

You can’t close down a capital city for a week and for it not to have an effect on gross state product and gross domestic product.

It is true that the Queensland economy has been at a standstill for some weeks and it comprises about 30 per cent of our exports. The state contributes more than 50 per cent of our coal exports and while environmentalists (and me) would think a slowdown in coal production to be a good thing the fact is that from a real GDP impact there will be some slowdown. More than 60 per cent of Queensland’s coal mines have been impacted by the floods.

Further, Queensland is a significant seasonal producer of fruit (more than 25 per cent of national production) and vegetables (more than 30 per cent) and is the dominant producer (over 90 per cent) of our sugar output. It is also a very large cotton producer and a major tourist destination.

How much will this impact on real GDP growth? Estimates are rising and suggest that the annual loss for the nation could be between 0.5 and 1 per cent of GDP. That would dent the recovery significantly. The question is what will be the temporal distribution of these losses?

What will be the profile of real GDP losses over the next few years? The other point to consider is that reconstruction effort will be positive for economic growth as it gathers pace. The overall net effect and the timing of the negatives and the positives is unclear at this stage which means that it is impossible to judge whether the automatic stabilisers will work for or against the government’s (poor) fiscal strategy.

But my guess is that the December quarter real GDP growth will be positive but not strong – confirming the trend suggested by the September quarter outcomes and more recent data. For example, today’s ABS International Merchandise Imports data for December showed a decline and this will feed into the December quarter National Accounts result.

Given the scale of the flood disaster which is spread across 3 populace states and production areas I expect that real GDP will shrink in the March quarter 2011. By then the reconstruction spending will be coming on more strongly and it would be hard to imagine that spending not providing a significant stimulus to national income for the rest of 2011 and probably into 2012.

Both private and public spending growth directed at the reconstruction will stimulate real GDP growth over this period. Remember: spending equals income.

As a result it is unlikely that Australia will recess given the scale of public spending that will multiply throughout the expenditure system and stimulate economic growth. Growth out of chaos.

But the point is that this will again demonstrate the effectiveness of fiscal policy. Whether it be a financial crisis spilling over into the real economy or a natural disaster that motivates the expansionary fiscal policy – growth follows public spending.

The only way this will be derailed is if the Government listens to the Opposition and the conservative lobby in general and starts seeking budget neutral ways to respond to the flood disaster. Growth will occur if there is a net add to spending from the government. Otherwise, the disaster is likely to undermine growth and at the same time push the automatic stabilisers into a negative response. The budget aims of the government will then be also compromised but that would just reflect the fact they are mindless aims anyway.

So while the budget surplus aspirations of the Federal government are just ideologically motivated (one way or another) I doubt that the flood reconstruction will compromise them very much anyway if economic growth is strong enough. That is not to say I agree with the aims. It seems folly to be pursuing public surpluses when there is a net exports drain and the private domestic sector is heavily indebted.

As an aside, the non-informed observer might confuse all the property damage with lost production. The statistician does not include these items in the measure of real GDP. It might be that the floods have destroyed productive capacity which means our future growth path will be more restricted which means that the “output gap” has been closed from the wrong direction.

The output gap is a measure of the actual production compared to its potential if all productive resources were being fully deployed. It can fall if actual production rises (and real GDP growth improves) which is good but it can also fall if the capacity ceiling falls which is bad. This means that the scope for increased nominal aggregate demand growth becomes smaller before inflation barriers are hit. It is hard to assess at this early stage the extent to which this supply-side impact has occurred.

Some are arguing that the Reserve Bank will react to the higher inflation (from rising food prices) and increase the policy rate. I don’t think they are that stupid and they clearly understand transitory inflationary effects which pose no long term problem.

Tsunami impact

I was curious to see what impact the 2004 Tsunami had on real GDP growth in the nations most affected. It seems that every day is driven by a curiosity of one form or another – the life of a researcher.

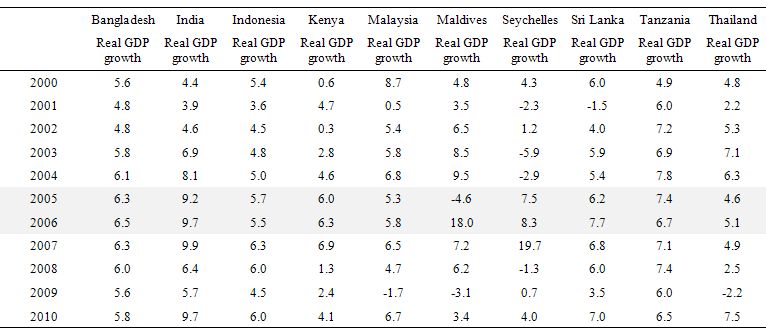

The following Table shows the evolution of real GDP growth (per cent per annum) from 2000 to 2010 for most of the nations immediately impacted by the disaster. The data used is from the IMF World Economic Outlook database which was last made available in October 2010 and means that the figure for 2010 is an estimate. I didn’t get the data for the Andaman and Nicobar Islands, Myanmar, or Somalia. The nations shown were directly impacted with Indonesia being the worst affected in terms of lives lost and damage to physical infrastructure.

The data shows that despite the massive loss of life and wrecked homes and the displacement of millions of people the macroeconomic impact measured by real GDP growth was not detectable except for the Maldives (although it bounced back next year after receiving significant international recovery assistance). The same result appears when you compute the impact on real GDP per capita. There are several possible reasons to explain this including the types of industries that were most damaged (small and local) and the location of the impact (mostly rural).

The raw real GDP figures hide the social and environmental losses which were huge. It is also clear that the poorest were more affected than those with stable incomes.

But the reconstruction efforts over time provided a strong growth environment as the economic damage from the disaster dissipated.

Opposition stupidity

The Sydney Morning Herald (January 18, 2011) reported the Opposition leader’s solution – Scrap NBN to pay for floods: Abbott.

For international readers, the NBN refers to the development of a fibre-based national broadband network to replace the archaic, slow network that exists now based on dated technology (copper wire). It will also offer high-speed broadband access to all Australians whereas at present many regional areas do not have any access. Please read my blog – Free public broadband is required – for more discussion on this point.

The Opposition leader told the media (January 18, 2011) that the Government had to “re-prioritise” its spending and scrap the NBN. He was quoted as saying (Source):

It is time for the government to stop spending on unnecessary projects so that it can start spending on unavoidable projects such as the reconstruction that will be needed in Queensland … It can start with the National Broadband Network. The National Broadband Network is a luxury that Australia cannot now afford. The one thing you don’t do is redo your bathroom when your roof has just been blown off.

Where does one start with that nonsense? Answer: no where.

This is like saying that the development of the railway system or the national highway system at different points in history was “unnecessary”. The NBN will deliver benefits for many years to businesses, to health professionals (network diagnosis and operations); to educators; to researchers; to consumers and to just about everybody.

There is no sense that the Government cannot “afford” its planned expenditure to develop the network. The conservatives who are opposing this grand infrastructure scheme are effectively luddites and probably hate the increased democratisation that greater access to high speed networking permits (if used to advance community networking).

The point is that you do not undermine long-term potential growth to deal with a temporary issue.

Further, the Opposition clearly have forgotten that the only reason the independents supported the Government after the last election (in August) delivered a hung parliament was because the Government proposed the developed of the NBN which suited the regional interests of the independents.

The only thing I agree with that the Opposition leader said is that there should not be a new tax. At this stage of economic recovery we do not need new taxes draining purchasing power and undermining economic activity.

Limits of public assistance

This is the part of the blog where I have to be sensitive. The same situation occurs after a major bushfire which regularly is the case in Australia. I recognise that economists (even the most progressive of our species) take a particular view of things which at times, might seem cold and calculated to those who live in the world of emotion.

I recognise that many people have died in the floods. Sure, there is some criticism of Australia that we are being insensitive to the Brazilian catastrophe which in numerical terms is infinitely more severe than our floods. The news coverage of the Brazilian situation has been dominated by the Queensland floods that is true. There has also been fairly detailed coverage of the Latin American disaster.

But when the water is rising in your own backyard and people are being airlifted off roofs then the attention does get focused locally. I don’t think we should feel guilty about that.

I also recognise that people to the north of me (Queensland, Northern NSW) and now people to the south of me (Victoria) have been hit by very severe floods which have cast aside their dreams and the more concrete realities – their houses and all that was within them. So empathy for the troubles that those who have lost their loved ones and had their material lives compromised is important at all times. Especially now that it turns out that the insurance industry is once again taking the technical route to minimise their exposure – as always.

But here is the cold and calculated part of the story. We are a land that is prone to these natural disasters and we also keep hearing about our magic economy built on entrepreneurial zeal. The latter is a gross overstatement given the importance of government in maintaining economic growth. But the “freedom” rhetoric is alive and well over here as well as in other places such as the US.

This raises two questions. First, why would our planning laws allow people to build on land which is prone to bushfires and/or floods? Second, given we allow people to build in these areas (and often they are the higher income earners in rural retreats bordering major cities) why do we expect the risk of those “private” decisions to be carried by the public sector when the inevitable crises occur?

In the mountain areas around Melbourne where I grew up there are very salubrious houses (within commuting distance of the city) and the bush amenity is gorgeous. The residents enjoy larger blocks of land, an ambience with trees, peace, etc The physical amenity delivers rewards to these residents that are not enjoyed by other people in the city. And … no-one forces them to build houses in these areas.

The reality is that bushfires ravage these areas from time to time but when a major fire goes through there, considerable loss of life and property is normal. At that point, everyone expects the public sector to bail out the homeowners. The robustly private citizens thus do not take all the risk of their own decisions.

I always thought that if the insurance industry had any purpose it was to assume this risk. The reality is different and the private insurance industry does all it can to shed this risk – often with dodgy small print in contracts that most of us cannot understand. And when disaster strikes the private benefits give way to social bailouts.

There is a case to be made for a national insurance body to offer low cost but full coverage insurance for all citizens. Those who live in disaster prone areas would pay the premium commensurate with the risk and not expect public handouts when disaster strikes.

I find it inconsistent that those who eschew government action for the disadvantaged and the poor in normal times are always ready to accept government aid during times of disaster for the consequences of what are essentially (but not always) poor private decisions.

Conclusion

So a rising budget deficit is required to meet this national disaster and that will reflect responsible fiscal leadership from the Federal government.

Anyway who wants offsetting (more or less) tax rises and/or spending cuts elsewhere do not understand how budgets work and what their role is. Unfortunately, I suspect the government itself is in that camp.

That is enough for today

Hi Bill , Ive been reading your ‘reality changing’ blog for a year or so . I dont usually feel up to speed enough to comment as Im still learning huge amounts from your posts and the comments .

However I just spotted this -http://www.independent.ie/business/irish/central-bank-steps-up-its-cash-support-to-irish-banks-financed-by-institution-printing-own-money-2497212.html

I dont know enough about the technicalities but apparantly the Irish central bank is printing money (euros, and actually printing rather than opting for QE via assets etc) to bail out its banks !

Would be interested to read what yourself or other MMTers think about it – are the Irish (or ECB that are aware) acting as a sovereign govt that understands the system ? even though they do not control their currency ?

Oops , I think its more precise to say the media is reporting that the Irish central bank is ‘creating’ money, I’m not sure that any if this is being printed.

From the article,

“A spokesman for the ECB said the Irish Central Bank is itself creating the money it is lending to banks, not borrowing cash from the ECB to fund the payments. The ECB spokesman said the Irish Central Bank can create its own funds if it deems it appropriate, as long as the ECB is notified.

News that money is being created in Ireland will feed fears already voiced this week by ECB president Jean-Claude Trichet that inflation is a potential concern for the eurozone.

However, a source at the ECB said the European bank is comfortable that the amounts involved are small enough not to be systemically significant. The ECB has been lending money to banks in Ireland at just 1pc, as long as the banks can put up acceptable collateral. “

Bill,

A good article.

It is also important to note that current estimated of the flood damage are south of A$13B, and the final costs are likely to be much higher. It is also important to realize why private insurance never works in large catastrophic conditions, and Government deficits ar always required. Let us assume a figure of A$13B as the flood cost. In the absence of Government action is as a direct reduction in the money supply of $13B. It is either a direct loss of social capital, or downward pressure on the financial markets as insurance companies liquidate to meet insurance obligations. Private insurance only covers normal statistical variation within normal limits. The purpose of private insurance is to cover this type of loss that can be statistically quantified and planned for, and which does materially effect the financial stability of the insurer, and is of a small enough magnitude not to have a systemic effect.

In a gold standard economy. this would have been a total unmitigated disaster. Fiat economies have a way to manage this, and to rebuild, and you rightly point out, now is not a time to cut spending or to increase taxes

Professor Mitchell, is it possible you could do a post on the quasi-monetarists (Scott Sumner, David Beckworth, Bill Woolsey, and Nick Rowe) and their idea of NGDP targeting?

Bill

Maybe some should reraise the concept of your job guarantee via an environmental land army for the 250,000 unemployed between 18 – 24 to assist in flood/fire/disaster relief as well as assisting the regional australia. See what the media could do with that

@ Jack, the US has two programs, the Peace Corps and America Corps (VISTA), that get young people involved in community service both in the US and abroad. These programs have been very successful, both wrt to service, training, and results. A JG program for “displaced” youth could be modeled along these lines.

Trendmeister Gerald Celente is predicting that global youth unemployment is going to be a big trend in 2011, and it has already toppled the Tunisian government. Gordon Brown is also sounding the warning call.

Although the RB may not raise interest rates, there is a good chance that the banks will do so anyway (despite the vituperation that will undoubtedly come their way) because of increases in their international funding costs. Probably they will try to reduce the adverse publicity by combining rate rise announcements with the announcement of other measures, such as temporary interest moratoriums for flood affected customers.

One bank in particular (Suncorp) is in a particularly bad position, being both a bank with many Queensland customers and a major insurer in that state.

Bill Said: The robustly private citizens thus do not take all the risk of their own decisions.

Bill, in Brisbane, Queensland the Wivenhoe Dam was built in response to the 1974 floods. The community was tricked into believing that another 1974 style flood would not occur again because the Dam would manage the problem. Real Estate agents and the Local and State Governments combined to promote this lie. The Local Government continued to approve new construction in areas previously flooded. This was done to prevent urban sprawl. The policies of controlled land release in Brisbane caused a supply side squeeze forcing the public to build and renovate in flood prone areas. If people cant trust its leaders to inform them of where not to buy or build what is the point of having leaders.

To now blame these poor people for buying or building in the flooded areas is to put the blame in the wrong place.

Our leaders need to tell people the truth. Between 1885 and 1895 there were 4 floods all bigger than the one we just had. The public should be warned to prepare for the next flood now.

Insurance companies are in the business of “not paying out”. The better at this they are the more money they make for shareholders. In Queensland you only get affordable priced flood insurance if you live on top of a hill. Its very sad that people not flooded can view the bad luck of flooded families as their own fault. Governments use taxes to employ highly educated boffins to advise them. We the public have a right to rely on that advice from the Government. Cheers Punchy

Limits of public assistance

In principal I agree. The only hard part is determining the risk.

Take the 1 in 100 flood level for Brisbane for example. A study was published in 1984 to estimate this figure. Studies were then done in the mid-late 90’s indicating that the levels estimated in 1984 materially underestimated the 1984 levels, which planing laws are developed around. One of those studies was produced in 1999 by the Brisbane City Council itself, which estimated that the 1 in 100 flood level had been under-estimated by 1 to 2 metres. This study was reviewed by a Professor from Monash who said that the study over-estimated the data because of the number of reasons including that it assumed that the dams were already full, and even though we only have 160 years of data, we will largely discount that which happened prior to 1900, during which time Brisbane sufferred floods twice the level of 1974. When this 1999 study finally saw the light of day in 2003 the Council commissioned a new study, and then appointed the Professor to a panel to review this new study. Guess what – the 2003 study and review panel came to the conclusion that the 1 in 100 level was more like the 1984 level upon which all planning laws were based.

I guess we will hear more about this in the Commission of Inquiry.

The other thing the 1999 council report said was that Wivenhoe would be of no assistance in a major flood event – which has been proved in this event to be true.

The Council’s 1999 report also estimated that the 1974 flood (which is used as the benchmark in Brisbane) was a 1 in 40 year event, not a 1 in 100 year event as commonly believed!

The only way Abbott’s suggestions re the NBN vs reconstruction could make sense would be if the NBN rollout and the flood reconstruction were competing for the same resources. In a minor way, they could be. But not enough to validate scrapping the NBN.