These notes will serve as part of a briefing document that I will send off…

Sad day for America

I followed the US mid-term election campaign as best I could – being an outsider. Sometimes the level of debate appeared to be below that which I imagine the primates engaged in back then. I don’t intend to become a psephologist (not qualified) but I am interested in exploring why these witless conservatives have made ground. In Australia’s recent national election where the so-called progressive Labor Party (not!) lost office in their own right the swing was to the Greens rather than the conservatives. This does not appear to be the case in the US. So there are two questions I am interested in. First, what role did the neglect of the unemployed play in the election results? Second, do the result really amount to an endorsement of the neo-liberal economic approach? But the reality is that the US political debate has become so divorced from reality – which in my parlance means that it has totally failed to provide a vibrant debate about the options that the monetary system offers government to improve the lives of the citizens. Instead, candidates who have no understanding at all have been elected on the basis of a pack of lies and only demonstrate total ignorance when it comes to informed debate. In that sense, the mid-term elections have foisted a number of very dangerous individuals into office. Sad day for America!

With 96 per cent of the Senate vote counted in Connecticut, I can confirm that 10,888 (1 per cent) of the voters demonstrated good judgement (voting for my mate Warren Mosler). That is not many. They prefer to elect a person who cannot tell the truth about his background but more importantly doesn’t understand how the economy works over someone (Warren) who actually knows how the monetary system operates and has a solution to the current crisis. Okay, their choice.

But this result was magnified throughout the states – with big swings to candidates who by their public statements similarly demonstrate a gross ignorance of the way in which the monetary system operates and the potential that government has to reduce the impacts of the current crisis.

We would never put a person who couldn’t fly in charge of a plane – why do we entrust positions of government to those who cannot possibly make the correct decisions especially at a time when government has to make the right moves or else millions more will lose their jobs.

Over the course of the campaign there have been so many classic statements by these nonsensical conservatives. The Democrat candidates have mostly been no better by the way. I have no truck for either side of politics in the US. A complete clean sweep of the Democratic party machine is required to purge it of its conservative ignorance.

For Australians, I would advocate the same purging of the Labor Party and the neo-liberal inspired Greens. Please read my blog – Neo-liberals invade The Greens! – for more discussion on this point.

Some of the statements made by the t-party candidates sum up the malaise that the US polity is now in.

For example, on October 10, 2010, the New York Times carried the story – In Pennsylvania, Anger Fuels a Race for Senate

– Republican tea party candidate Pat Toomey said:

These guys in Washington are creating an environment that is having a chilling effect on small businesses and medium and big businesses, as well, and that’s a big part of why we don’t have the job growth that we badly need … They are creating a staggering amount of debt, debt that is eventually going to have much higher interest rates, probably lead to very high inflation … It’s a very worrisome combination, and we have got to get on a new track.

He was then asked what that new track might look like and he struggled. He supports making the “Bush-era tax cuts permanent for all Americans” (including the rich) but simultaneously wants to cut the deficit and balance the budget.

But the best part of the article was this interchange:

Mr. Toomey says he favors making the Bush-era tax cuts permanent for all Americans – which would add $700 billion more to the deficit over 10 years than the plan advocated by President Obama to let the lower rates expire for the rich. But he also expresses a desire to reduce the deficit.

At the ironworks shop, Mr. Toomey brushed aside a question from a local reporter who pointed out that real income for American workers dropped after the Bush tax cuts, saying he did not believe the data.

So this brand of conservatism has learned the lesson I was taught by a right-wing professor when I was a student once. When it was clear that the theoretical models he was propounding had no correspondence with the data of the real world he told us that “the data was simply wrong”.

Okay, measurement area and other statistical bewilderments can clearly occur but the data put out by the national statistical offices is typically of a very high standard. But still if the message of the data gets in the way of your pet theory then the answer is simple: the data is wrong. I think that is called blind ideology – or religion.

Another gem from the mid-term elections was the lesson in macroeconomics offered by another extremist Rand Paul who spoke to CNN after he was successful yesterday. Here is the video snippet of what is a most extraordinary interview where he declares there is no poverty in America – just interlocked consumers and producers.

As you can see he wants a balanced budget and wants to get there by spending cuts. This section of the interview was particularly revealing. He was asked what he would say to those who wanted to reduce the deficit by stopping the Bush-tax cuts for the highest income earners and he replied:

RAND PAUL: I would say that they must be in favor of a second American depression, because if you raise taxes to that consequence, that’s what will happen in this country. Raising taxes in the midst of a recession would be a disaster for our economy. And anybody who proposes such a policy really is, I think, unfit to be making decisions.

CNN: What if they just raised taxes on the richest, those making more than 250,000 dollars a year?

RAND PAUL: Well, the thing is, we’re all interconnected. There are no rich. There are no middle class. There are no poor. We all are interconnected in the economy. You remember a few years ago, when they tried to tax the yachts, that didn’t work. You know who lost their jobs? The people making the boats, the guys making 50,000 and 60,000 dollars a year lost their jobs. We all either work for rich people or we sell stuff to rich people. So just punishing rich people is as bad for the economy as punishing anyone. Let’s not punish anyone. Let’s keep taxes low and let’s cut spending.

Anyway enjoy the video. If it wasn’t serious you would think this was a comedy skit. But presumably, a huge government order of all the products that the rich make would help the economy, no?

The progressive side of politics is to blame for this debacle. It was clear in the weeks after Obama was elected that their economic policy was lost. The Democrats and the President’s administration have perpetuated all the deficit terrorist myths that the t-partiers have now crucified them with.

They allowed unemployment to persist and white-ant peoples’ lives and undermine the continuity of local communities. Obama’s economics team has been culpable in that regard but given their New Keynesian slant it was no surprise that they would ignore a quick fix for the unemployment. The economics paradigm that rules in the White House doesn’t understand the basis of mass unemployment.

I thought this retrospective (October 20, 2010) written in the New Yorker was interesting. The related articles from 2008 are – The Fall of Conservatism and The New Liberalism.

The writer Tom Perriello had previously postulated that:

… after decades of ascendancy, the modern conservative movement had run out of ideas and talent, with no serious answers to the central problems of our time. For all the right wing’s noise and energy and apparent momentum going into this year’s midterms, these points are no less true today, and the Tea Party provides nonstop proof. There are no new conservative ideas, only the old ones presented in their most extreme form. Government is still the problem, tax cuts and deregulation are still the solution, liberal élites are still the enemy. All that’s changed is the level of vituperation, ideological rigidity, and anti-intellectualism.

I think that is a very insightful summary of what has happened. I am looking into the results a bit further and I am conjecturing that the agony of unemployment has led people to fall prey of these popularists who really just wheel out slogans that bear no relation to the reality they seek to address.

I believed that the crisis would see the end of neo-liberalism and a major re-appraisal of the dominant economic theory. I naively held onto that belief in the early months of the crisis. I soon realised that there was not going to be any major paradigm change this time around.

The election results in the US yesterday clearly demonstrate how the moribund conservatives can still command electoral appeal – aided and abetted by the corporates (media, health care companies, Wall Street bankers etc) – without having any understanding of the problems at hand.

Perriello noted Toomey’s data denial. He said (remember this was written on October 20, 2010):

But if a candidate deals with core economic realities by asserting his right to his own facts, that’s not a sign of a vibrant political creed, however good his poll numbers …

That is the problem. Politics has become divorced from reality. The media onslaught funded by the top-end-of-town (who have done very well out of the fiscal interventions) has played on the insecurity of the unemployed. Never mind the facts – it is all emotion and positioning.

Perriello’s insight is interesting. He said that despite the 2008 US election being a vote “against conservatism”, there has been no “self-reform or self-purification”:

Instead … conservatives have resorted to saying the same thing louder (much louder). It will happen again in 2012. The grassroots zeal on the right has been astounding. The party’s refusal to make any effort to help the Administration solve problems created under Republican rule has been shrewd (and deeply irresponsible-I’d say unpatriotic). These things will benefit Republicans next month. Over the longer run, they will help marginalize the party.

We have endured nearly three years of the conservative screaming. As a macroeconomist I have seen total falsehoods paraded out each day by so-called experts on the financial channels and radio shows. The politicians have just picked those lies up and broadcast them far and wide. The harvest has been an unbelievable distortion of reality … and persistently high levels of unemployment.

That real damage will worsen if these characters – who have now taken over the US government – actually implement their promises. The problem is that the “progressives” will chase them to the right – as you can see in Australia with the Labor party. They are not more right wing than the long-standing post WW2 conservative government.

Perriello also reminisces about the the progressive failings in the US. He says:

We’ve seen several pieces of landmark legislation, including the most important social reform since the Great Society, health care, which is also the first significant blow to economic inequality since the trend started in the late seventies. But there’s no new or revived ism to sustain the values and ideas behind these achievements … F.D.R. had the labor movement; L.B.J. had the civil-rights movement. Obama had Obama for America. His campaign was based on the man more than any set of ideas or clear vision of the future. Everyone knew what Reaganism stood for. No one knows what Obamaism means, which has allowed his enemies to fill in the blank.

I actually see it as being worse than that. From the perspective of my expertise (economics) the Obama Administration and the Democrat politicians chose to perpetuate all the major mainstream macroeconomic myths about budget deficits, interest rates, and debt.

When the US president announced to his nation on December 3, 2009 that the – The US government has run short of money – it was game-over syndrome for the progressives.

He got to that point by appointing a host of neo-liberal economists who made some “progressive noises” about deficits but ultimately continued to fuel the deficit terrorists.

Where were the papers from the Council of Economic Advisers pointing out the way the monetary system operates and the opportunities that the national government had to resist the private spending collapse? Why didn’t the US government take advantage of its early political popularity and implement a huge FDR-style public job creation program?

Such a program would have reduced the immediate severity of the private spending collapse, bolstered the housing market, reduced the bad debts that the banks were forced to carry and led to an earlier return to economic growth. It was an obvious policy option – for anyone not imbued with the years of mainstream macroeconomics logic that eschewed the use of fiscal policy.

Perriello notes in this context that:

Skepticism of government’s ability to improve people’s lives runs deep. The White House designed the positive effects of the stimulus bill (there have been plenty) to be undetectable to the naked eye. Americans’ economic circumstances have gotten harder, not easier, since Obama took office. Arguably, the same could have been said of F.D.R. in 1934 (the midterms that year went his way), but back then people were more desperate and less informed, meaning less likely to convince themselves that they shouldn’t “believe the data.” And conservative, pro-rich populism didn’t exist. The Liberty League, unlike the Koch brothers, had no Glenn Beck.

One of the failings of the progressive movement over the last three decades is never more obvious now. I refer to my long standing beef that the rise of the “think tanks” has been a largely conservative innovation. These institutes and lobby institutions have proven to be a spectacular success for the conservatives and have assailed the public with a massive quantity of propaganda dressed up as science.

They have been able to muster massive funding sources and have developed excellent media presences. Daily they can wheel out “experts” to advance the deficit terrorist cause.

The progressives have been very unsuccessful and even loathe to follow suit. I agree that the tie in to the corporate dollars has been easier for the conservatives and so the progressives have less capacity to raise funds to underpin the creation of these institutes etc.

But the progressive institutions that do have funds – for example, trade unions – have propped up political parties and their machines which have been steadily moving to the right. They have declined to support truly progressive organisations that could have been capable of presenting a truly alternative viewpoint.

We get what we sow!

Anyway, the media is now full of talk of liberty and balanced budgets and reducing debt slavery and all the rest of it.

But very little of the commentary or statements by those coming into office bear any semblance of an understanding of the problem facing the US or its solution. Ultimately, whether you like it or not, the solution has to be found in manipulating the monetary system. The policy directions now being espoused are exactly the opposite to what is required.

US Sectoral Balances

One of the things that always amuses me about public commentary from conservatives (and progressives too) is that they make statements that cannot possibly be true. It is clear they make them not realising that all the propositions they advocate are impossible to achieve. Whenever I hear these sorts of statements I conclude that the person does not know how the macroeconomy works and is thus a danger in public office.

I have always urged my macroeconomics students to understand the national accounts and the summary sectoral balances as one of their first tasks in dealing with macro-level reasoning. For many students this is an unattractive option – not very exciting – “we didn’t enrol in accounting!”. But a failure to really grind this framework into one’s understanding leads to persistent errors of reasoning when things get a bit more interesting …. and complicated.

Recall that aggregate spending and income (Y) is comprised of consumption spending (C), investment spending (I), government spending (G), exports (X) and imports represent a leakage from the expenditure stream. The external sector contribution to demand is measured in net terms as Net exports (X – M). So:

(1) Y = C + I + G + (X – M)

This income is distributed ultimately to households who either consume it (C), save it (S) or pay taxes with it (T). So from the perspective of uses of national income (which is just another way of looking at the aggregates) we write:

(2) Y = C + S + T

Bringing these two perspectives together we get:

(3) C + S + T = Y = C + I + G + (X – M)

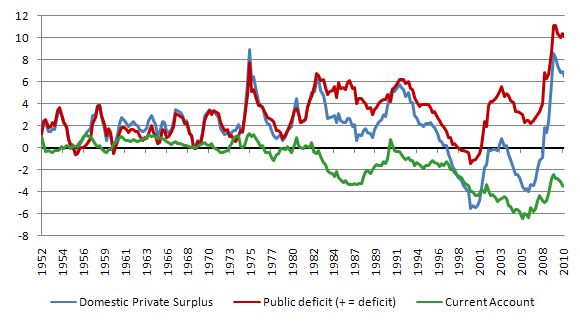

And we re-organise that to get the familiar sectoral balances accounting relations which are depicted in the following graph:

(S – I) = (G – T) + (X – M)

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)), where net exports represent the net savings of non-residents.

Typically we express these balances as percentages of GDP to scale them accordingly.

Another way of saying this is that total private savings (S) is equal to private investment (I) plus the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)), where net exports represent the net savings of non-residents.

All these relationships (equations) hold as a matter of accounting and are not matters of opinion or debate. The interpretation of the causality can form an interesting debate but not the result that has to hold at all times.

So think about the statement – debt is enslaving us – and so we want government to reduce it debt and balance the budget. Under certain conditions that can be achieved.

What about the US at present? It has a large external deficit (X – M < 0) and that is not about to change anytime soon. Even if they persuade the Chinese to revalue their currency, this will just shift the external deficits between countries not increase American exports in any significant way. Further, there are no signs that there will be a significant revival of US exports or a significant decline in imports. From a Modern Monetary Theory (MMT) perspective that just means that the US is enjoying the real resources of the rest of the world at very favourable real terms of trade (that is, they are sacrificing less of their own resources to get more of the foreign real resources). They should enjoy that while they can for it may not last indefinitely. Anyway, for the purposes of discussion, we should assume that the external deficit will persist over the next decade or so at least. Logically, under these conditions, if you want the government to balance its budget (G - T = 0) then you must simultaneously be endorsing a private domestic deficit equal to the external deficit. That is tantamount to endorsing increasing private sector indebtedness. While private spending can persist for a time under these conditions using the net savings of the external sector, the private sector becomes increasingly indebted in the process and eventually the house of cards collapses under the strain of servicing this debt. It is clear that one of the major problems at present is the level of private debt. The credit boom foisted massive levels of debt onto households and business firms (in some countries). The banks (many partly or fully nationalised) are carrying some of the burden of the debts that went sour. But it still remains that the private domestic sector in the US and elsewhere is carrying very heavy debt burdens. One of the reasons there is a reluctance to borrow and expand credit again relates to the debt burdens. A sustainable growth path will require the private domestic sector overall to reduce its debt levels. That means the sector as a whole has to start saving and keep saving for years to come (in net terms). So if you want to reduce the "private debt slavery" what does that imply about the conduct of fiscal policy? Answer: it is glaringly obvious. Given our assumption of an on-going external deficit, then if the nation is to provide the capacity to the private domestic sector to net save, the government sector has to sustain deficits.

That is not my opinion! It is a fact that emerges from a thorough understanding of the way macroeconomics works in the real world.

It might soothe the voters for a candidate to scream that he/she will bring down all debt (public and private) but given the reality it is impossible to reduce both private and public debt levels as a percentage of GDP.

Further, the relationship between net public spending (deficits) and debt-issuance is entirely voluntary under a fiat monetary system. There is no necessity at all for public debt to rise $-for-$ with net spending. The institutional arrangement that renders that outcome inevitable has no grounding in the operational reality of the monetary system.

It is a political construct designed by neo-liberals post the collapse of the Bretton Woods convertible currency system (1971) to limit government activity. It is a mindless constraint on government because it serves no productive purpose.

The opposite cannot be said for the private domestic sector. Its deficits (S < I) has to be financed by increased indebtedness (ultimately). The difference between the two sectors is obvious to anyone who understands the nature of a fiat monetary system.

A sovereign government is never revenue constrained because it is the monopoly issuer of the currency. The household, as the user of the same currency, is always revenue constrained and has to “finance” every penny they spend (either by earning income, running down savings, selling assets or borrowing).

The following graph shows the US sectoral balances from the first quarter 1952 to the third quarter 2010. The balances are expressed as a per cent of GDP. Thanks to my mate Scott Fullwiler for the data.

You can see that there is a close relationship between the private domestic balance and the government deficit. The current situation is characterised by a strong desire by the private domestic sector to net save and that is being “financed” by the public deficits given the external situation. I use the term “finance” here to denote the fact that the public deficits are maintaining most of the economic growth in the US at present which is generating the national income growth that private saving requires.

If the deficit was not moving in this direction, the US economy would have collapsed (worse than it has!) and the private sector would have been highly constrained its obvious desire to save. Yes, the collapse would have reduced the leakage from imports but not by enough to “fund” the private saving ambitions.

It is also clear that with US economic growth languishing and unemployment still persisting at ridiculously high levels, there has to be greater deficits right now to support the direction of private domestic saving and stimulate further growth.

The t-party conservatives have demonstrated no capacity at all to understand any of this. That is why they will be highly dangerous once they get their (ignorant) hands on the steering wheel.

The latest announcement of the US Federal Reserve Bank that they will expand their assets purchase program by $US800 billion should inform all of us that there are no “financial” constraints on government spending. The bank is, after all, a component of the consolidated US government when viewed from a monetary perspective.

All the politics in the world and rhetoric about central bank independence cannot cover the fact that from a monetary perspective the central bank in a fiat currency system is as much a part of government as the treasury is. Please read my blog – The consolidated government – treasury and central bank – for more discussion on this point.

Anyway, the US Federal Reserve Bank said (November 3, 2010) that:

To promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to expand its holdings of securities. The Committee will maintain its existing policy of reinvesting principal payments from its securities holdings. In addition, the Committee intends to purchase a further $600 billion of longer-term Treasury securities by the end of the second quarter of 2011, a pace of about $75 billion per month. The Committee will regularly review the pace of its securities purchases and the overall size of the asset-purchase program in light of incoming information and will adjust the program as needed to best foster maximum employment and price stability.

So where are they going to get the “money” from? Answer: nowhere. They can create non-interest bearing claims on government without limit anytime they like. The central bank and the treasury (finance department) can issue unlimited claims denominated in the currency that the government issues under monopoly conditions.

They can always pay their bills and honour their liabilities.

They never have to tax to pay back debt or service the interest payable on that debt.

They can bail out any private company/bank should they see that to be in the interests of the public.

Readers might enjoy a flashback to September 1997. The then US Federal Reserve Chairman (Greenspan) made the following comments to the Jackson Hole Economic Symposium:

Let me begin with a nation’s sovereign credit rating. When there is confidence in the integrity of government, monetary authorities-the central bank and the finance ministry-can issue unlimited claims denominated in their own currencies and can guarantee or stand ready to guarantee the obligations of private issuers as they see fit. This power has profound implications for both good and ill for our economies.

Central banks can issue currency, a noninterest-bearing claim on the government, effectively without limit. They can discount loans and other assets of banks or other private depository institutions, thereby converting potentially illiquid private assets into riskless claims on the government in the form of deposits at the central bank.

That all of these claims on government are readily accepted reflects the fact that a government cannot become insolvent with respect to obligations in its own currency. A fiat money system, like the ones we have today, can produce such claims without limit.

Very prescient! Where will you find that understanding expressed in the modern macroeconomics textbooks? Which of the t-party candidates understand that? Which of the conservative commentators understand that? Ask your macroeconomics lecturer whether they understand that?

Clearly, if the government expands aggregate demand beyond the capacity of the economy to absorb that then there will be inflation. Deficits always involve inflation risk and that risk has to be judged according to the prevailing spare capacity (correctly measured) in the economy. There is no issue that there is an inflation risk.

But there is no such thing as the government running out of money or a government having to impose debt slavery us or higher taxes (to reduce the debt slavery) if it runs deficits.

If there is an external deficit, then the government has to run a deficit to allow the private domestic sector to reduce its debt level and to net save. Get used to it!

By trying to run budget surpluses to get the public debt levels down the government will undermine the capacity of the private domestic sector to restructure its balance sheet (that is, to reduce its debt).

The resulting short-fall in aggregate demand will reduce national output and income and reduce national saving (which is a function of income). It will also most likely drive the public balance into larger deficits as economic activity falters and tax revenue shrinks. We are seeing that result occuring in Europe at present as the austerity drives undermine economic activity.

Keeping vigilant – on the lookout for that inflation outbreak!

As regular readers will know I have upped my sense of responsibility as a citizen lately and now provide a frequent “inflation watch” service. The RBA tells us that inflation is going to rise soon despite it actually falling at present. So we all better be on our toes.

Today, the Australian Bureau of Statistics (ABS) released two pertinent data series: (a) Retail Trade which tells us whether consumers are running riot or not in the goods market; and (b) International Trade in Goods and Services which tells us whether our so-called once-in-a-hundred years export bonanza is flooding the economy with so much demand that all labour, capital, housing and other real resources are soon to be fully utilised.

What did the data tell us today?

1. Retail sales are stagnant – rising modestly only. The ABS report that “the seasonally adjusted estimate for Australian turnover rose 0.3% in September 2010 following a rise of 0.3% in August 2010 and a rise of 0.7% in July 2010”. This is also consistent with the flat credit demand. So no consumer led boom. The last surge in retail trade figures coincided with the fiscal stimulus effects. Since then the growth has been very muted.

2. Net exports – Exports of rural goods fell by 8 per cent and exports of non-rural goods (including minerals) fell by 3 per cent. So notwithstanding the booming terms of trade, overall exports are down and the trade surplus narrowed.

Conclusion: Still waiting for the signs that our economy is dangerously overheating.

Conclusion

Mid-term elections? Sad day for the truth. Sad day for America. Sad day for the unemployed who desire liberty but require a job to enjoy it.

Data request

If there are any keen psephologists out there that have compiled the US mid-term election data by state for the House and Senate in terms of the party votes, proportions, seat changes, and swings since 2008 I would love to get the data.

I can do it myself but because it is not core research for me I am reluctant to spend the time. I want to write a blog investigating whether the swings to the conservatives are related in any way to the movements in unemployment by region since the crisis began. My conjecture: we should find a very significant relationship.

If so, the solution for the Democrats is easy: create some jobs immediately and target the creation by region. The best place to start is with a Job Guarantee. Then start building up from that.

But I will gratefully receive any aggregated data and acknowledge the effort. If anyone is keen to help you can get semi-aggregated data with incomplete information from the UK Guardian (excellent coverage by the way) – House – Senate. That would be a good place to start if you have some time to organise it more simply.

That is enough for today!

This article by George Monbiot might shed a bit of light about at least the rise of the Tea Party in this election cycle… portions from the early part of your post dovetails into this article:

The Tea Party movement: deluded and inspired by billionaires

http://www.guardian.co.uk/commentisfree/cifamerica/2010/oct/25/tea-party-koch-brothers

Here’s a link to the film he refers to, to its trailer:

(Astro) Turf Wars

http://astroturfwars.org/ (awfully disheartening… not sure how to counter this)

I live in Houston, Tx. It felt futile in a sense to do so, but I can at least say that I voted; not many of us not filled with the zeal of the mid-term “right”… voted this election (which is usually the case during mid-terms)… And I can’t be particularly proud for voting… I’m not sure my sister would have let me into our shared home if I did not show up with my “I voted today!” sticker on my blouse…

I cannot answer any questions, but, living in the States, I observed a very strong propaganda onslaught this year, apparently aimed at killing any additional stimulus and guaranteeing a Republican victory in the polls. In February and March there were questions about future inflation, which were taken up by mainstream economists. What about an “exit strategy” for the Fed, for example? This, I thought, was misdirection, to take focus away from unemployment and the need for more stimulus. Then, in the spring, came a full fledged attack by debt/deficit hawks, spreading out and out falsehoods, such as that the U. S. was in danger of bankruptcy. This was largely ignored by mainstream economists, and not questioned by the media. That passed by late spring or early summer, when the drive for austerity in Europe had some spillover, and questions about the future again came to the fore. The question of whether U. S. unemployment was structural was also discussed.

I do not know if this was coordinated propaganda, but if it was, it was, IMO, masterful. The outright lies only lasted for six weeks or so. The rest of the time otherwise reasonable people were induced to act as though our real problems were nebulous future possibilities or problems that only time could heal.

It was disturbing that economists did not rise en masse with James Galbraith to debunk the lies, and that the Dems also failed to respond. When the Reps blocked extending unemployment benefits in late summer, I thought that they had shot themselves in the foot, given that polls indicated that the electorate thought that unemployment was the main economic problem. But the Dems did not take advantage, or even try to do so.

Most peculiar, Mama!

It’s interesting how when the CB wants to purchase a trillion or so of securities, then there is almost no political opposition either from the media, or from mainstream economists, or from the punditry at large. There is no government budget constraint when there is a chance of raising asset prices. The wildest schemes with 9 zeroes are quickly adopted without much fanfare other than “will it work?” Everyone intuitively understands that the CB can make as much money as needed.

But when it comes to investing in real resources, or paying for social security, or healthcare, then suddenly we have a budget constraint. Then, we are broke and need to borrow from China. The same economists who enthusiastically speculate about spending trillions on purchasing equities in the hopes that maybe someone will get hired from this become hard money men when congress, rather than the central bank, does the spending. Fiat money for troubled assets, gold-standard for troubled lives.

Stiglitz was interviewed today with regards the failings of the Democrats and resurrection of the Republicans and said Obama could easily have redirected a significant part of the military budget which is spent on ‘weapons that don’t work for use against enemies that don’t exist’. That way he could have been perceived as using wasted money as stimulus elsewhere while keeping an eye on deficit reduction.

I really can’t see how the Republicans’ policies can be any worse than what is currently out there and maybe a bit of gridlock and reversal Obama’s bills already in play may not be a bad thing.

Clearly Americans this week have shown they do not agree with your views of spending like crazy but I guess that means they are stupid and you are right.

It looks to me as if the Democrats have completely lost the plot. I watched two Democrat Senators on a CNBC panel smiling smugly at the riduculous claims of right wing GOP’ers and Tea pots. They had no counter arguments, nothing to say whatsoever. One completely crazed flat taxer came on (with a strange hairdo like a toupe). An economist (a smart black guy) who appeared to understood the monetary system, easily trounced his childish arguments.

The lack of a decent unfied message from the Democrat side was appalling incompetence. They deserved everything they got. The GOP arguments, whilst rabid, are not particularly strong and easily debunked. As Bill said, the Dem’s sealed their own fate when they admitted there was a terrible national debt and promised to reduce the deficit. The Republicans have them by the balls now, it’s painful to watch. Can they possibly think the GOP will be stupid enough to cut spending and accept blame for a double dip?

Unless senior Dem’s have an epiphany, I guess all they have is two years of bickering over programs, whilst the unemployed atrophy. Maybe Obama is fed up already and want’s out quickly, he has the same detached look Bush had in his second term.

Nice take on the elections. I can understand the political realities facing the Obama administration, and I do appreciate the progressive legislation which was passed under his watch, but I think he made some key mistakes early on which cost him and his party dearly. If I recall correctly, Christine Romer, his chief economic adviser, wanted a stimulus package of around 1.2 trillion, most of it composed of direct spending. This estimate was based on overly-optimistic forecasts, even relative to the very-mainstream CBO forecast of unemployment at the time. The Administration axed Romer’s proposal immediately, arguing that it was a political non-starter. The result was a stimulus plan 400B less than Romer’s optimistic estimate, and, in addition, a package composed mostly of tax cuts. The optimistic forecasts were shredded within a matter of months, the employment situation continued to deteriorate, and Obama’s popularity plummeted as the stimulus began to be perceived as ineffective and wasteful.

Lyndon Johnson once told his economic advisers that it is their duty to tell him what is needed and his duty to sell it to the people. In late-2008/early-2009 Obama did the opposite. His political team told his chief economist what could be done and then sent her out on the road to defend the decision. It was a huge mistake.

The only point I would make with your analysis is the idea that conservative ideas are old and always the same. I hear this argument used a lot amongst liberals and I find it pretty weak. Was not the very progressive idea that government should act to sustain demand and maintain full output most forcefully articulated by Keynes back in the 1930’s? The progressive ideas are very old too — the only difference is that they are right!

Also as an aside — we say tea-party over here as opposed to t-party. Thanks!

RSJ,

You make a great point. It is a sign of the times we live in. When Thatcher extended share ownership and more pension schemes were privatised in the UK, millions of Britons became new stakeholders in the capitalist ideal. All it took was a bribe of 300 BT shares worth a hundred quid. I’m sure other countries had had similar “equity sharing” schemes. The minions became proselytes for their masters ideals without understanding the eventual consequence. The Labour party became unelectable under the old rules and had to adopt free market ideals under Blair to get elected.

The rate at which labour has been devalued and capital has ascended has been slow but steady. Small growth in living standards of the common man blinded him to the exponential growth of living standards at the top end.

Labour has not had a fair share of the rewards for productivity increases but many people feel they have benefited as small stakeholders in free market capitalism. It’s taken me 35 years before I saw a burning bush and the scales lifted from my eyes. Slowly others will come to their senses one by one. The flat tax madness will help.

There is another reason, apart from pure ignorance, that conservatives sound so stupid when they talk economics. They must obfuscate their real agenda, which is to transform the US into a neo-feudal state with the bottom 80% working at subsistence wages for the benefit of the top 20% (which will obviously include themselves and all their friends). Obviously they can’t use this as a selling point during election time.

There are a wide range of problems, but what gets shown on TV is just for distraction. You can see how big the gap is on specific issues by looking at public opinion polls (like http://www.gallup.com/Home.aspx and http://pewresearch.org/). The problems are generally: extremely limited media access for alternative views, a really terrible electoral system, and issues with campaign financing. See this article by Noam Chomsky: http://www.chomsky.info/articles/20100124.htm

Bill

Just to clarify are you and MMT’ers saying that printing money can solve economic problems:

1. Temporarily – rather like a blood transfusion after an acccident.

or

2. Permanently, because printing money has no negative consequences?

or

3. Something else

Thanks

Guys – does no one reading this blog have any influence with politicians or journalists such as to try and spread the word a bit faster?

MMT understanding is getting disseminated via this blog, UKCM, and Mosler’s efforts, but frustratingly slowly. Not only is this disastrous for the economy in terms of human misery and lost GDP output, it risks Obama being a one-term pres.

A new approach is surely required.

MMTP

Dear Ray (at 2010/11/04 at 19:02)

You said:

I know we disagree on things if your comments are anything to go by but where can you find even a scrap of evidence in my written work (academic or blog or Op Ed) – and you have millions of words to use as the body of work over more than 30 years now – that I have ever advocated “spending like crazy”.

Please provide some quotes to back your statement. If you cannot please do not comment on my blog again! I am happy for diversity of opinion on my blog but I will not support unsubstantiated lies.

best wishes

bill

Dear ds (at 2010/11/04 at 19:52)

Thanks for your comment.

You pointed out:

I know that. But I just happen to love drinking tea each day and I don’t want that experience associated with the moronic ideas of these conservatives. So I invented my own depiction of them, which I am sticking to – t-party.

best wishes

bill

If it’s any consolation to you, the Swiss Social Democratic Party that attracts ca. 20% of votes has just adopted a revised manifesto that includes: the aim to overcome capitalism (!), to abolish the Swiss armed forces, fair taxes (which means no more loopholes for the rich > fat chance), not raise the retirement age, expand universal health care and other social institutions. Sadly it also commits itself to achieve full European Union membership, which will probably include the beloved Euro – but that’s not going to happen any time soon. At least they’re not afraid to voice strong and somewhat coherent opinions. Pity the Swiss executive is run by representatives of 4 parties (not that they’d ever win a majority with that programme…).

Bill

You said above:

“So where are they going to get the “money” from? Answer: nowhere. They can create non-interest bearing claims on government without limit anytime they like. The central bank and the treasury (finance department) can issue unlimited claims denominated in the currency that the government issues under monopoly conditions.

They can always pay their bills and honour their liabilities.”

If the government prints the liabilities they progressively lose their value. You cannot honour liabilities by printing them. To be honourable those liabilities have to be able to buy assets of the country at a known future value when the liabilities are created.

Ray – surely you’ve spent enough time on the MMT blogs by now to realise that MMT encompasses – and is consistent with – a range of views of the optimal size of the state? Mosler is more inclined towards tax cuts, whilst others incl Bill are more inclined to increase spending (incl on JG). All positions on this spectrum would agree, though, that the deficit should be sized based on real resource constraints, not any spurious ‘financial’ constraints.

And surely you would agree that extending the tax cuts for the upper echelons – where the Republican focus – must have a lower multiplier effect on the economy than pretty much any other fiscal measure?

MMTP

Dear Andrew (at 2010/11/04 at 20:47)

You have repeated a statement you have made several times here:

That is a false statement as it stands. The currency unit only loses it value if nominal demand is unable to be absorbed by real production.

Please update your understanding of this. You sound like a (mindless) quantity theorist who believes in permanent full employment.

best wishes

bill

RSJ, good point. I suggest that as many people as possible repeat this point on Republican / conservative blogs.

MMT Proselyte, re your frustration at the slow progress, it’s probably just going to be a long hard slog. I’ve spent half an hour a day over the last year seeking out anti-deficit conservative sites and contradicting what they have to say. I’m happy to go on, and on, and on. I enjoy it!

Bill

I dont understand your answer but if you want MMT to be mainstream it might be better to be polite to curious people like me rather than suggesting they are mindless.

For example please direct me to something i can read to ‘correct my understanding’

Thanks

First, what role did the neglect of the unemployed play in the election results?

None. Unemployment played the significant role here. Not “neglect.”

Second, do the result really amount to an endorsement of the neo-liberal economic approach?

I’ve been reading Keynes and Smith for 33 years now, and I don’t know what “neo-liberal” means. You can bet most U.S. voters don’t know, either.

But the reality is that the US political debate has become so divorced from reality – which in my parlance means that it has totally failed to provide a vibrant debate about the options that the monetary system offers government to improve the lives of the citizens.

Reality is divorced from reality? Anyway, No, no discussion of economics at all. Only politics. Meanwhile I’m still trying to figure out where the idea came from that government debt-and-deficits are the cause of our economic troubles. There has never been an explanation of that. Only that taxes are too high.

On another note, you cannot use words like “these witless conservatives” who “demonstrate total ignorance,” and expect those people to listen to you.

In that sense, the mid-term elections have foisted a number of very dangerous individuals into office. Sad day for America!

Amen.

Yes, good point, RSJ.

Dear RSJ (at 2010/11/04 at 19:01)

That was the point I was making in introducing the Federal Reserve’s decision in the discussion about balanced budgets. And the Federal Reserve officials are not even elected!

best wishes

bill

Andrew – the only thing that makes the currency unit lose value is inflation – pure and simple.

If increasing the money supply leads to inflation, then your statement is correct; but in fact this assumption (that the money multiplier is a constant) has been overturned by the experience of ballooning reserves in the face of shrinking broad money in both Japan and now US and other countries. Here is a handy graph to illustrate: http://ftalphaville.ft.com/blog/2010/11/03/392846/charts-du-jour-qe2-edition/

At the very least, if you want to claim that printing money = devaluing the ccy unit, you need to defend the money multiplier – you can’t just assume it or else (I’m afraid to say) you risk coming across as mindless! No offence intended though I’m sure.

Best wishes

MMTP

” Fiat money for troubled assets, gold-standard for troubled lives.”

That is a beautiful line. It sums it up in a nutshell.

“For example please direct me to something i can read to ‘correct my understanding'”

OK. If you have a baker with a loaf of bread available for one groat and two people with one groat each who want bread. What will the baker do tomorrow morning, double their price or bake another loaf of bread?

also to RSJ’s point at 19:01:

It seems there are 2 measures for inflation, the type that profits capitalists and goes by the friendly name of ‘asset price appreciation’ and the type that profits the rest of us, mainly through wage increases, that goes by the ugly name of inflation. The fact that the two are functionally detached to a certain degree (is that correct?) means that one can be played off against the other to achieve a relative benefit. If I remember correctly, until the ’70s households were net creditors and corporates net debtors within the private sector – a position that has since been reversed – which means the implications of the two kinds of inflation for the respective sectors has also reversed, no?

how will the baker get twice as much yeast flour and so forth, when every buyer wants twice as much and production is the same? What will the flour grower spend his rising income on? Will he pay more for property?

If gold is the currency because it is rare and the government finds the centre of the earth is made of gold will gold be as valueable as before? Air is also valueable to humans but there is plenty of it.

Oliver – interesting point. There certainly has been a switchover in the past 10-20 years from the traditional financial balances structure with households running a surplus and corporates runninga deficit (ie sucking up capital, as would be proper for the economy). Most recently, HH have been running deficits whilst corporates (particularly in the UK, less sure about the US) have been runnign a surplus or ‘decapitalising’. But I think HH are still net creditors in terms of financial assets (and even more so if you add in real assets incl housing).

Best

MMTP

Andrew,

I think you just picked a bad day to post questions here. That said find a day or two (whole days too) and read through Bill’s articles. You’ll find your answers – just be prepared to be absolutely confused at first you need to be de-programmed (like most of us).

Yes, we have a Tea Party in the US. It is time for a CofFEE Party!

Bill:

The Guardian UK (of course, why would a US paper have this) – has a spreadsheet with the results by US district:

http://www.guardian.co.uk/news/datablog/2010/nov/03/us-midterms-2010-election-results-data#data

P.E. Bird

Bill and Andrew: “If the government prints the liabilities they progressively lose their value. That is a false statement as it stands. The currency unit only loses it value if nominal demand is unable to be absorbed by real production. Please update your understanding of this. You sound like a (mindless) quantity theorist who believes in permanent full employment.”

-I get the impression that Andrew is struggling with the same aspect of MMT that I have also failed to grasp despite my following this bog for a few months now. I can totally see how “printing money” does not create consumer price inflation in the current circumstances but equally I fail to see how anyone can fail to see that it does lead to asset price inflation (taking a diversified global mix of assets and looking at a >decade long time scale). Andrew did expressly say value of money for buying assets didn’t he. Dismissing asset price inflation by using arguments about consumer price inflation seems a key way that MMTers ensure that they remain a fringe sect :).

stone – whether consumer or asset price inflation, the point is you can’t simply equate narrow money growth with either, unless you demonstrate a transmission mechanism.

You seem to be saying that there is an empirical correlation observable (if you define it properly) – but that isn’t the same as causality. Back in the 1970s monetarists relied on correlation too; they supplied an ostensibly ‘causal’ framework in terms of fractional reserve banking, although that has now been debunked as inapplicable to contemporary economies (not least on this site). With FRB and the money multiplier debunked, I think you are left with statistics alone, which is not going to convince anyone.

There’s a great piece at the Levy Institute from September on Goodhart’s Law (“Innocent Frauds Meet Goodhart’s Law in Monetary Policy”) – statistically observed relationships tend to break down if pressure is put upon them. That about sums up the money multiplier.

Best

MMTP

” Dismissing asset price inflation by using arguments about consumer price inflation seems a key way that MMTers ensure that they remain a fringe sect ” .

Are they dismissing asset price inflation? I always thought the implication was that asset price inflation should be dealt with in other ways i.e. taxation.

@MMTP

I can see the difference between base money inside a computer belonging to a bank, and credit money inside a computer belonging to consumers. So no surprises there.

@Adam

From your comments yesterday I wonder if you are seeing the relationship between cash and reserve balances correctly. They are effectively the same thing. A bank is always going to invest most cash and reserve balances but outside of a systemic crisis they can always be made liquid again.

MMTP

FRB is not debunked. Banks have always levered their balance sheets to create liabilities subject to the demands this creates upon them to issue the assets backing those liabilities. The art of banking has always been to act as intermediatory between a willing buyer and a willing saver where neither have any money.

stone and Andrew: Why would asset price inflation be inevitable, so long as people are happy to hold their savings in fiat money or government bonds?

I would also appreciate learning more about what Bill’s take is on this issue, but it certainly doesn’t seem like asset price inflation would be inevitable from where I stand. It would only follow if the private sector wanted to get rid of money – in favour of other assets like land, houses, whatever. But then again, this kind of asset price inflation can happen totally independent from the size of the budget deficit.

Brainstorming a bit more about this: MMT tells us that reducing the budget deficit is an appropriate response to inflation. The question is, how do you react to an asset price inflation with simultaneously stable consumer prices. Just let the market do its thing, i.e. let asset prices increase until people realize the silliness of what they’re doing and they start affecting consumer prices instead? Try targeted taxation to cool off those asset markets? If so, what kind of taxes?

These all seem interesting questions to me. However, it’s not really fair to blame MMTers for not talking about them much – after all, nobody else is coming forward with any reasonable proposals, either!

Andrew – you’re not engaging; you just seem to be ignoring what MMT says.

If you’re going to claim that FRB hasn’t been debunked, then I think you need to engage with the extremely expansive MMT account which says that the banking system doesn’t check it has sufficient reserves before it makes loans. If you’re going to ignore that, then I think MMTers are likely to ignore you.

You seem to be claiming that increasing bank reserves will inevitably lead to an increase in the money supply and then in prices. How do you square this with the facts of Japan, US etc?

Best wishes

MMTP

Nicolai

When people expect inflation they spend money quickly rather than expect to get a return from a bond or a bank deposit which is being intentionally devalued at the inflation rate by the government.

Anyway if you have a bank deposit or government bond your money is not *inside* those things. You are the creditor and the debtor has your money to spend. It would be different if it went in your mattress.

MMTP

Since thousands of years a bank with 100 gold could issues loans of 200 banknotes for 50% reserve with no requirement to get more deposits once it began issuing those banknotes. Nothing new there.

“when every buyer wants twice as much and production is the same?”

And that is the nub of your problem. You don’t believe that humans can create more stuff to absorb the money – that real ‘aggregate demand’ can increase.

Bill implies here that the econometric data points towards an expansion in the production of real goods and services in response to a monetary demand stimulus when there are idle hands in the economy (unemployment and underemployment). No doubt there are others that suggest that real production remains flat and prices go up. Have they the data to back that up?

@stone,

Similarly with assets. We will create more ‘real’ stuff underlying the assets – more houses, larger companies, and frankly more gold and diamonds (if you want to call them assets).

Nicolai Hähnle “it certainly doesn’t seem like asset price inflation would be inevitable from where I stand. It would only follow if the private sector wanted to get rid of money – in favour of other assets like land, houses, whatever. But then again, this kind of asset price inflation can happen totally independent from the size of the budget deficit.”

-As far as I can see, if someone has savings, then if they keep them as cash, then they will be getting 2.5% interest and consumer price inflation is say 3.5%, so they will be loosing value. If they buy assets then depending on what budget they have to pay for managing the portfolio of assets, they will either loose money or (if they can afford the best management) get >15% annually compounded decade after decade. I find it very hard to get my head around the idea that with so much of the wealth in the hands of people able to afford such expert management, asset prices are not being pushed up.

“reducing the budget deficit is an appropriate response to inflation. The question is, how do you react to an asset price inflation with simultaneously stable consumer prices. Just let the market do its thing, i.e. let asset prices increase until people realize the silliness of what they’re doing and they start affecting consumer prices instead? Try targeted taxation to cool off those asset markets? If so, what kind of taxes? These all seem interesting questions to me. However, it’s not really fair to blame MMTers for not talking about them much – after all, nobody else is coming forward with any reasonable proposals, either!”-

As far as I can see it both MMT and neolibralism are constrained by an apparently unquestionable imperative that “leakage to savings” must be accommodated by monetary expansion. It is important to keep in mind that if someone starts saving at 20 years old in order to pay for pony and piano lessons for future grandchildren 60 years later, then that is not “leakage to savings”. The “leakage to savings” is money that is never ever to be spent and is just to add to the ever increasing global accumulation. If the tax burden was moved to an asset tax (on cash, real estate, stocks etc), and the budgets were balanced such that there was no accommodation for “leakage to savings” then I do not see how there could be any form of long term global asset price inflation. I think the much reviled Austrian School say the same thing but they also tend to advocate no government and no redistribution of wealth and such objectionable opinions that I don’t think need be connected to the principle of no monetary expansion.

We can all see if demand for cars doubles there is going to be a delay tooling up the production to handle the demand. Importantly the manufacture might attempt to increase production with overtime before he hires new people and buys new factories – he does not know the final demand when it begins rising – it is not a maths problem where he sees the answer. You are looking at it as if the corn for the flour can be produced overnight to satisfy higher demand by the bakers.

MMTP

You also need to realise that for each new deposit backed by the banks equity the bank has a lower fractional reserve.

For the basel bank total owned assets are the reserves that back the deposits.

What we know today is that the banks are excessively levered. They have insufficient equity for created deposit money.

Lehmans failed at 2.5% or 40:1

Andrew – I’m afraid I don’t follow your “nothing new there” point – seem to be at cross-purposes. If this is arguing against some claim of mine (or someone else’s), please can you be more explicit?

Are you declining to even try and defend your belief in the money multiplier?

Best

MMTP

Neil Wilson “We will create more ‘real’ stuff underlying the assets – more houses, larger companies, and frankly more gold and diamonds”

That is what I see as the real tragedy of both MMT and neolibralism and of monetary expansion generally. That amounts to pure waste and pollution. -Apparently about half the World’s gold has already been mined. Gold now sells for about twice what it costs to mine. So the remaining half will be mined in order to sit in a vault. People die gold mining. Rivers are polluted by gold mining.

-In Manchester near where I live, there are streets full of boarded up perfectly good houses and blocks of newly built unsold apartments.

-The “larger companies” you talk about are what exactly? The FTSE100 for instance has become dominated by finance companies that are just part of a positive feedback loop where monetary expansion leaks to savings that get invested in financial companies to invest the savings etc etc.

MMTP

Money multiplier is wrong. Obviously i can create a loan of 100 for you and worry about paying you later. I have zero reserve for 100 deposits.

All that MMT does is point out that banks can lend today and worry later. This is not new or news.

However it is still true that banks usually have millions in cash in the branchs and ATM. But obviously 100 is not placed on the loan officers desk when he creates the loan money.

The banks are even so Fractional reserve banks. Their created deposit money is only backed by a much smaller amount of money.

If the bank goes to the CB for a loan then that is another deposit for the bank. Meanwhile the bank does not expect all depositors to want their money back simultaneously. It is the way banks have always operated.

There is no difference other than the inflation targeting method via supplying or removing reserves to maintain the target rate.

MMTP

You appear to be confusing:

1. a reserve of something which is kept in case the depositors want money which can be a bond that can be sold for money or some amount of cash to meet a few days withdrawals, which amounts to a fraction of the total deposit liabilities

with

2. Reserve balances held at the central bank which are just there to make it easier to manage the banks cash needs rather than trucking around tonnes of paper and where out of convenience the fractional reserve has been administered by the central bank using these reserve balance accounts.

Andrew –

This is the second blog this week I can tell that you have commented on with a deluge of questions and observations about an esoteric topic completely irrespective of the purpose of the subject blog: the EU monetary and political system and the US midterm election and sectoral balances. Come on man!

Please re-read Bill’s response: “That is a false statement as it stands. The currency unit only loses it value if nominal demand is unable to be absorbed by real production.” De-program your first impressions and read the number of blogs that Bill has written that address banking, reform of this part of the economy, and asset price inflation (specifically he addressed housing).

Talk about the US elections and your impressions to stay on topic.

“The “larger companies” you talk about are what exactly?”

Ones that are more productive than they are today.

Rob

How can my responses to Bills comment and my interactions with people about MMT and FRB be esoteric on this board??

But you have a point. It is a pity there is not a room here where people can talk about banking

As a US citizen living and working abroad but closely following US politics, here is my take…

1) The electin of a “black man” to the White House triggered a lot of racial sensitivities, including immgration issues from south of the border, that have been stewing just under the surface. As jobs became scarce, the racial fears of losing jobs to “those people” grew dramatically. Rather than work to change the Obama/Democratic policy, the Republicans (like Mitch McConnell) have as their goal to keep Obama to a single term president. Thus, hatred and anxiety an intolerance rose amongst a disaffected and fearful public. The party of “No” and the enormous disrespect shown to a sitting president (remember the famous Joe Wilson “You Lie!” shout at the president? For more on this racial aspect, read Paul Krugman’s book “Conscience of a Liberal”.

2) The Republicans and Tea Party-ers managed to get their message out in pithy sound bites that progressives and Democrates couldn’t or wouldn’t match. The whole heath care debate was a shambles…something that should have been passed (with a full public option) in 3 months. This would have left plenty of time for more focus on the economy and possible stimulus (stimulus is itself now a dirty word, unless of course it is “Fed stimulus”, which is somehow acceptable to some parts of society) led to outrageous claims of “death squads” and “kill granny”. (Thank you, Sarah Palin). This right-wing group has remarkably talented (but outrageously wrong) and inflammatory spokespeople in the guise of Rush Limbaugh and Glen Beck. Fox news and Murdoch are helping here. But Obama must take some of the blame for not marshaling his forces and voices.

3) Like any big country, the US has a mass of politically and economically ill- or at least mis-informed…and maybe a bit lazy about learning something new about the way things really work. Most just want to have a job and aspire to the old American goal of creeping of the ladder of the middle class..don’t confuse them with facts. For someone to have a discussion with most of these people about topics like MMT and the non-issue of sovereign government debt and the over-emphasis on deficits seems to be too much for this group to listen to…or at least it is hard to make the arguments when shouted down by the simple minded but high volume slogan-banging discontents.

4) Electioneering in the US has become largely a game of who can spend the “mostest the fastest” with the “bestest” slogan sound bites (one exception: Meg Whitman, although spending a record USD150 million of her money on the campaign for CA governor, lost to Jerry Brown). With the US Supreme Court now run as a W Bush club under Justice Roberts, corporations were given unlimited ability to advertise and support political campaigns. And most of the corporations have no interest in a progressive agenda. In fact, the corporate supporters of Obama in 2008 have abandoned him, apparently because of hurt feelings that he is not “pro-business” enough…whatever that means. Imagine, the very banks that were being rescued were spending billions of the taxpayers’ money on lobbying against the Obama Dodd-Frank reforms designed to try to prevent the need for future bailouts…incredible, is it not?

This is my take…I am very saddened and would have to agree now with Mitchell’s comment several days ago about the USA becomng a “falied state”. Very saddened, indeed…

I seriously wanted to write a rebuttal to the Toomey/ anti government rhetoric that was being written in the local papers in PA. Problem is outside of the standard “letter to the editor” an Op Ed piece needs to be very well written and edited. Being fairly new to the MMT topics I did not feel confident in creating a rebuttal that would not have been reviewed prior to submission. Additionally many papers require some “expertise” to be associated with the Op Ed. The TP and other conservative organizations have recognized this and have either created pieces for submission or support Op Ed commentary.

In other words if you want a grass root effort you need create the environment to grow it outside this blog. The video conference was a great resource of information for learning but I could not take information and actually apply it.

Just my thoughts.

Andrew, you are definitely confusing reserves with … reserves.

Your two points are effectively one point which describes reserves as liquidity of a bank regardless of whether it is retail (cash) liquidity or interbank liquidity. As you are clearly aware your two types of reserves are convertable at par at short notice and at will of commercial bank. The fact that they operationally serve different purposes does not mean that they are uniquely different. They are one thing with the goal to settle liabilities should a customer request come in. And obviously, a customer request to settle liability of your bank will one way or the other become a liability of another bank. That is the reason why reserves do not matter on the macro-level of the banking system. The rest of your arguments simply describes the cost effects of liability management of different banks and banking system. Important? Yes. But not to such extent as to define or influence operational procedures of the banking system.

Bill,

I have been reading your blog for some time now and I really feel enlighten by it. Thank you for that.

I am italian and feel frustrated that it appears no one has grasped the foolishness of the stability pact and austerity measures being passed on to the public. There is no dispute whatsoever whether such measures are grounded on sound economic principals. Both economics on each side of the parliamentary spectrum embrace a rigid stance against deficit and public debt.

I wonder whether you know of anyone in Italy embracing an MMT perspective trying to debunk all this neoliberal economical nonsense.

Thanks

Alessandro

“how will the baker get twice as much yeast flour and so forth, when every buyer wants twice as much and production is the same? What will the flour grower spend his rising income on? Will he pay more for property?”

This is an excellent question, Andrew, because it ties the monetary system to the real economy.

The baker can buy more ingredients if the real economy is not resource constrained. So, yes, in that circumstance, the baker will be able to buy more supplies. If the economy is already operating at full capacity, then the government would need to reduce private sector purchasing power by taxing.

I’m working to get my arms around MMT, too. and that means unlearning most of the nonsense preached by my U Chicago professors.

Andrew – appreciate the contributions, but I have struggled to see their relevance. I am simply trying to discuss your claim that printing money / increasing narrow money leads to inflation. I can see that is looks plausible in you believe if the multiplier, but as you don’t, why do you believe it? I’m happy to be convinced, but you don’t seem to be offering an explanation.

Sergei explains it well; the wider reserves definition; I don’t think it’s that helpful in this discussion to split out cash holdings from CB reserves, and that certainly wasn’t my intention.

“All that MMT does is point out that banks can lend today and worry later” – this just isn’t true. MMT points out (int. al.) that reserves are ‘pulled’ by individual banks’ lending activity (specifically, the funding of such loans). This is the opposite to the orthodox model which suggests that the reserves themselves ‘push’ increased loan activity. You say “nothing new” but this seems quite important.

Best

MMTP

“It is a pity there is not a room here where people can talk about banking”

Andrew,

It is becoming clear the more I read your comments that you are a master at misinterpretation and changing the subject rather than carefully listening and engaging the actual responses to your own comments. Rob specifically said, “read the number of blogs that Bill has written that address banking, reform of this part of the economy, and asset price inflation (specifically he addressed housing). ” That is, there ARE many, many places on this blog to discuss these issues, and Rob was inviting you to comment there.

So where will our new “U.S. Political Leaders” take us? A repeal of the health care bill? The dismantling Social Security? The implementation of Medicare Death Panels? More endless wars? The elimination of clean air and water regulations? Repeal of Civil Rights Legislation? No worries – the market will make everything right!

We’re on the path to a 3rd world income distribution. The serfs only exist to serve the needs of out Lords.

You think it is a Sad day for America. How about this for a sad day in the UK:

…He added: “Monetary policy is the principal tool for creating and regulating demand.”…

That from our Chancellor of the Exchequer in evidence to the Treasury Select Committee.

http://www.telegraph.co.uk/finance/economics/8110452/George-Osborne-Bank-of-England-could-print-more-money-next-year.html

So, why do we have to pay taxes in a fiat-money system then??

MMTP

We are going in circles here.

I already agreed that if the central bank has a cash rate target and a posative inflation target then the CB will keep increasing the amount of reserves in response to the banks creating a demand for more system reserves so that the cash rate does not go higher than the target.

But we still have an FRB system. I then wondered if you were confused between:

bankers balances which are used to enable banks to avoid moving tonnes of cash around which are *also* used to manage fractional reserves when that applies and are therefore called reserve balances and

The banks capital, where the capital backs the deposits the bank creates.

Additionally the banks have millions of cash as a small fraction of cash to back the total created money deposits.

The banks obviously operate exactly like they always did. The only difference is that interest rates can be kept lower if inflation is low by ensuring the cash rate cannot spike higher and sound banks can easily borrow amongst each other using the available total supply of reserves.

I am not saying inflation can be created by additional reserves. I am not saying Money multiplier theory is valid.

@sergei I think you have got confused by what i was attempting to explain to MMTP? ie that the banks are FR banks. And that FRB ís not debunked.

@Scott Your comments against my character are not very helpful. On a point of information your comment yesterday that banks do not use their bonds or assets to get central bank loans *only* applies for the USA. Where up to a certain limit a bank can get *daylight* loans only without collateral – but even then conditions apply. The fact is the only way the banks can simply go to the feds to get unlimited money is if money itself is devalued by the feds taking junk assets and not wanting the money back. You cannot take todays mess and then say it can always be like – because for sure it will be another mess if banks can just get cb money whenever they want without good quality collateral

Andrew

collateral just raises the effective price of borrowing and is well understood by mmt’ers. it does not have anything to do with validating the multiplier or FRB.

Also, I should have referred to your comments, rather than to you–my apologies. At any rate, at issue is the fact thus far you have danced around many of the issues that have been raised in reply to your comments. Note how often you and others appear to be talking past each other, or how long these threads have become the past few days with virtually no progress in understanding respective positions. Again, as Rob noted, there are MANY previous posts and comment threads on the issues you are raising the past few days.

If people here think there are better locations to discuss this then why not invite a newcomer like me to that place rather than being hostile about my presence? That would be the friendly response that encourages learning. Surely it is a two way street?

Regarding why politics in the US are so confused and disheartening: things only change for the better if people take collective action to make them change. Sadly, as it stands in the US there is no-one left organising for progressive change. Perhaps one day…

Take a look at Chris Hedges’ Death of the Liberal Class at http://www.truthdig.com/chris_hedges.

Andrew – we are certainly going in circles. I’ve spent long enough on this blog not to confuse reserves with capital (asset vs equity). Some of the things where you say “we agree that [ ]” I don’t agree with; but let’s forget FRB and get back to the nub of this.

I repeat: the starting point was your claim that printing money (ie increasing narrow money) equals inflation. I am interested to hear you defend or substantiate this claim by reference to a link or transmission mechanism. If you decline to do so, that’s absolutely your right, but I’ll struggle not to agree with Scott’s conclusion about your tendency to change the subject.

Best wishes

MMTP

Andrew–I personally don’t have a problem with you having this discussion here. I was just pointing out that you had misinterpreted Rob’s comments. My rationale for repeating Rob’s suggestion a second time was to point out that the issues you’ve raised have been discussed many times–this is all well-tread territory–not to force you to take you comments to those pages.

But, I agree with you that it would be nice to direct you to some of those places. I can’t do that off hand, but perhaps others can help out.

MMTP