I started my undergraduate studies in economics in the late 1970s after starting out as…

The US government has run short of money

The government of the largest economy in the World has run short of money. At least that is what the US President was trying to tell his Jobs and Economic Growth Forum yesterday. Fancy that. This is a national government which issues its own sovereign currency trying to tell the world it is broke. This is a sovereign government that is responsible for capacity utilisation rates at 70 per cent and 15.7 million unemployed saying that is is running out of capacity to deal with the problem. My conclusion is that the only capacity they lack is sound economic advice. They should sack their existing advisors and hire some people who actually understand how the monetary system operates.

Before I update what happened at today’s CofFEE conference I reflect on President Obama’s latest statement – this time to a jobs summit. There are some news stories I read that I have to re-read to see if I have missed something. Take this New York Times article – Obama Tackles Jobless Woes, but Warns of Limited Funds – which was published on December 3, 2009.

I thought I had better go to the source and I am sorry I did. You can read the full speech which was delivered as the opening address to the Jobs and Economic Growth Forum being hosted at the Whitehouse.

The Vice-President started proceedings by saying that:

We need help, for we realize that even after all we have done in these last 10 months that — to revitalize American communities, our capacity, the government’s capacity, is still somewhat limited.

It is unclear what he means by “the government’s capacity” in this context. If he, as I suspect, means its financial capacity then the US government, as a sovereign issuer of its own currency has all the capacity it needs. So this comment is The US government like any sovereign government has all the financial capacity it wants and can purchase anything that is available for sale at any point in time.

However, it might be that he is talking about “institutional capacity” – for example, program delivery capacity – which is a serious constraint on less developed countries. It is clear that one constraint on the US Government’s capacity lies in it appalling lack of sound economic advice. Here are 8 reasons for sacking Larry Summers.

The President started by summing up the fact that the unemployment and underemployment situation in the US was bad but that the Recovery Act (the stimulus) has helped the stabilise the free fall. He then asked:

How do we get businesses to start hiring again? How do we get ourselves to the point where more people are working, and more people are spending, and you start seeing a virtuous cycle and the recovery starts to feed on itself? … [and] … I am not interested in taking a wait-and-see approach when it comes to creating jobs.

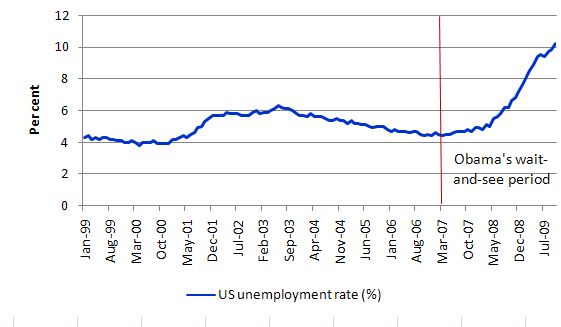

His final assertion is enough to take your breath away. The low point unemployment rate in the previous growth phase was 4.4 per cent in March 2007. That was 31 months ago. The unemployment rate has risen every month since then and now stands at 10.2 per cent.

The following graph shows the official US unemployment rate (%) since January 1999 to make this point.

So that is a lot of “wait-and-see” time. Despite having the capacity to stop any net attrition of jobs in the US economy, the US Government has instead overseen the loss of some millions jobs. So you have to take that comment as an example of sheer political cant.

After repeating his sense of urgency, the President then made the most extraordinary comment:

But I want to be clear — while I believe that government has a critical role in creating the conditions for economic growth, ultimately true economic recovery is only going to come from the private sector. We don’t have enough public dollars to fill the hole of private dollars that was created as a consequence of the crisis. It is only when the private sector starts to reinvest again, only when our businesses start hiring again and people start spending again and families start seeing improvement in their own lives again that we’re going to have the kind of economy that we want. That’s the measure of a real economic recovery.

Who wrote that part of his speech?

We can have a discussion about what a real economic recovery actually constitutes. The implication in Obama’s statement is that he only sees private initiative as real and public activity as unreal. That is one thing that is debatable.

But the point “We don’t have enough public dollars to fill the hole of private dollars that was created as a consequence of the crisis” is preposterous. Any advisor who wrote that should be dismissed. The President should resign immediately because he isn’t qualified to lead the largest economy in the world.

The US dollar, last time I knew, is issued by one institution only. That institution is the US government. It issues the US dollar under monopoly conditions. The issuance of US dollars is accomplished, in the main, by electronic transactions between the US Government and the commercial banking system.

A keyboard operators within the US Government could type 1,000,000 billion or 1,000,000,000 billion into their computer when making one of these electronic transactions and the funds would show up as increased reserves in the banking system. It might be undesirable that the higher amount actually was injected into the spending stream (depending on the available real capacity of the economy) but that is a separate issue – not unimportant but separate.

The point is that the US Government can spend as much as it likes as long as there are goods and services available for sale.

So think about “the hole of private dollars”. What does that mean? At any point in time there is stock of productive capacity available which firms use to produce goods and services for sale. They hire workers as part of this productive capacity when they receive orders – that is, when they sense there is spending intentions.

In other words, spending has to be at a certain level at any point in time to ensure that firms are willing to maximise the utilisation of their productive capacity which in turn maximises employment. Over time, growth in spending has to keep pace with growth in productive capacity (the real capacity of the economy to produce goods and services).

The hole in private dollars is just the fall in private spending brought about by an increased saving desire. The hole means that productive capacity will become unused and the jobs that could have been applied to that capacity are lost. So in March 2007, when the unemployment rate was 4.4 per cent, the total US capacity utilisation rate was 80.5 per cent. At present, in October 2009, capacity utilisation in the US was 70.7 per cent (Source). That is a very sharp decline in capacity usage which has been driven by decline in private spending.

The US Government can always “fill that hole” if it has the political will. This US government does not have that political will despite its rhetoric. The evidence for that statement is that the unemployment rate has been continually rising since March 2007.

Obama then said that his jobs forums will be rolling out across the country to find out how more jobs can be created. Does he really not have a grasp of how the economy generates jobs? Its simple, various sectors spend … the domestic private sector (consumption and investment), the foreign sector (net exports) and the public sector. The spending prompts employers to hire labour so they can produce goods and services to meet the demand. Do I need to go on?

Less spending by one sector has to be matched by more from another sector if output and employment is not to fall. With the current account (net exports) subtracting from spending (deficit), and the private domestic sector overall now saving … the only other sector left which can fill the spending gap is the government sector. If Larry cannot tell his President that then what use is he?

Obama then said:

Now, let me be clear. I am open to every demonstrably good idea, and I want to take every responsible step to accelerate job creation. We also, though, have to face the fact that our resources are limited. When we walked in, there was an enormous fiscal gap between the money that is going out and the money coming in. The recession has made that worse because of fewer tax receipts and more demands made on government for things like unemployment insurance.

So we can’t make any ill-considered decisions right now, even with the best of intentions. We’re going to have to be surgical and we’re going to have to be creative. We’re going to have to be smart and strategic. We’ll need to look beyond the old standbys and fallbacks and come up with the best ideas that give us the biggest bang for the buck.

Questions that arise:

1. Which resources exactly are limited? In October 2009, overall US capacity utilisation was 70.5 per cent and the figure was lower in Manufacturing. There were 15.7 million people unemployed (Source).

So there seems to be a lot of real resources available that are idle and would be brought back into productive use if spending was higher.

2. What exactly is an enormous fiscal gap? In relation to what? Certainly not in relation to the underutilised resources.

Given that idle resources are direct evidence that aggregate spending is deficient and that budget deficits (the “fiscal gap”) add to spending then the only reasonable conclusion is that the “enormous” fiscal position is actually not enormous enough.

There is very little hope for the US unemployed and those who depend on them if their president thinks it is reasonable to repeat this sort of nonsense in public.

Yes recession has reduced tax receipts and increase outlays on unemployment benefits and together they have pushed the budget deficit up. That is just saying that the automatic stabilisers are at work – and they have put a floor in the downturn by adding to demand in a counter-cyclical manner. So what?

To suggest that this is a problem just shows that you have taken your attention of the main game. The problem is the lack of jobs. The solution is higher aggregate demand. The government has the capacity to address that problem. Its reluctance to do so – and its willingness to smother that lack of commitment with spurious claims about unresolvable “holes” and “enormous gaps” is disengenuous in the extreme.

He continued:

I want to be clear: We won’t overcome our unemployment challenge in just a few hours this afternoon. I assure you there is extraordinary skepticism that any discussions like this can actually produce results. I’m well aware of that. I don’t mind skepticism. If I listened to the skeptics, I wouldn’t be here. (Laughter.)

I am glad the audience were amused.

But the President could within a few hours announce a national Job Guarantee, which while not representing the total solution to the problem, is the first step toward providing some income security to workers.

If the government cannot organise enough jobs immediately they should just start paying the job guarantee wage (a living minimum wage) from tomorrow morning to all those who register for work and then get cracking on getting some productive jobs organised.

He concluded:

And if we get serious, then the 21st century is going to be the American century, just like the 20th century was. But we’re going to have to approach this with a sense of seriousness and try to set the politics and the chatter aside for a while and actually get to work.

Well surely it is the “politics and chatter” that is preventing the US government from fulfilling the responsibilities. It is not a lack of financial capacity. it is not a shortage of real resources. It is just ignorance and/or venal vested interests that has seen the unemployment rate rise to 10.2 per cent and their broader measure of labour underutilisation rise to over 17 per cent.

CofFEE Conference Day 2 Report

Today was Day 2 of the 11th Path to Full Employment Conference/16th National Unemployment Conference which is the annual conference run by my research centre.

The first feature session this morning was a talk from Louise Tarrant, General Secretary, Liquor, Hospitality and Miscellaneous Workers Union on Low pay workers in Australia. It was a really interesting talk which was focused on the strategies that the union, which services all the low wage sectors had taken to confront the neo-liberal attack on workers’ pay and conditions.

She highlighted the gap between the political rhetoric (workers have never had it so good) and the reality of outcomes as Australia indulged increasingly in neo-liberalism. She said there was a marked shift in attitudes among the “bosses” in the mid-1980s along the lines that “communism was dead” etc. This led to a breakdown of the traditional accord that capital had had with labour in the full employment era.

The breakdown was accompanied by two broad responses: (a) political responses – rise of conservative government; and (b) major changes in work – the rising casualisation and precariousness of work. The increased importance of service industries along with fragmentation of labour market – “who do you actually work for” (labour hire companies etc) led to work becoming increasingly undervalued. This was particularly the case in the low wage jobs.

Another interesting part of her talk was the trend to externalisation of traditional female labour.

Louise also demonstrated how these responses were accompanied by a conscious attack on unions by employers and government. Taken together these trends very it increasingly difficult for trade unions to organise. The result was increased workloads, increased insecurity and lower wages.

Low wage unions could no longer rely on the traditional legal frameworks which had protected workers. Nor could they enter into the burgeoning bargaining environment because unionised firms would be made non-competitive in the face of a growing number of non-union firms.

The union had to consider the options that were available to them to allow them to improve the circumstances of low wage workers They concluded that they neeeded to operate beyond traditional means.

Case study presented: Clean start campaign. Contractors themselves were being squeezed. Who owns the buildings? Who funds the work? Commercial cleaning market – 1348 buildings – $13 billion investments = 16 major corporateions control over 60 per cent of the property market (Deutsche Bank, IMG, etc). So focus negotiation on this smaller group rather than the contractors.

There was concerted industrial action every lunchtime outside the major city office buildings which served to bring the issue of the low wages and poor conditions of cleaners into the public domain. The campaigns constituted political pressure on the major companies to sign up to the agreement only to hire “clean start” contractors. The campaign has been relatively successful and is unfolding.

The point of the case study was to show how unions have had to adapt and adopt new strategies to help their members in the face of the considerable challenge that neo-liberalism presented the union leadership.

The second feature session was a Modern Monetary Theory Workshop – which was conducted in a panel format. The panel comprised myself, Professor Randy Wray and Warren Mosler. There were two discussants – regular billy blog commentators – V. Ramanan and Dr Scott Carmody.

The format of the workshop (100 minutes in duration) was as follows: 7 questions/issues were put to the panel (Mitchell, Wray and Mosler) and each panel member had a maximum of 3 minutes per question. The two discussants – who both work in the financial markets – had 5 minutes each to sum up the discussion. Then there was open floor discussion.

It didn’t follow that exact order but in general the discussion was interesting and we received good feedback.

The questions were:

1. What is the public purpose of the financial system and how does it serve this purpose?

2. How does the national government interact with the monetary system?

3. What does sectoral accounting mean?

4. What is the difference between a convertible currency and a non-convertible currency?

5. Won’t the deficits and the build-up of public debt push interest rates and taxes up?

6. Can a sovereign government run out of money?

7. How does MMT reflect on current macroeconomic policy around the world?

There was a video made of the Workshop but we think there might be sound problems. I will update this blog later if the video is usable at this stage.

Saturday quiz is back

Tomorrow another Saturday quiz will be available. I am sick of the boasting that is going on about getting 5 out of 5 so a diabolically difficult test will emerge … if I can think of one (-:

“But the point “We don’t have enough public dollars to fill the hole of private dollars that was created as a consequence of the crisis” is preposterous. Any advisor who wrote that should be dismissed. The President should resign immediately because he isn’t qualified to lead the largest economy in the world.”

Bingo.

“Does he really not have a grasp of how the economy generates jobs? Its simple, various sectors spend … the domestic private sector (consumption and investment), the foreign sector (net exports) and the public sector. The spending prompts employers to hire labour so they can produce goods and services to meet the demand. Do I need to go on?”

Apparently, you should. At least someone needs to with this US Gov’t.

“If Larry cannot tell his President that then what use is he?”

Another good question. One that many people in the US have been asking for years.

“There is very little hope for the US unemployed and those who depend on them if their president thinks it is reasonable to repeat this sort of nonsense in public.”

This is very true and has been on my mind for many, many months now. I fear we may get to a point where people who once were relatively prosperous are literally starving because of our gov’t’s policies (in the US). Hopefully, the gov’t will still allow people to leave the country, if they cannot find work there.

“The problem is the lack of jobs.”

Gee, and to listen to this gov’t, you would think that the problem is Fox News. Or, health insurance companies. Or, gas-guzzling vehicles. Or, republicans. Or, email theft. Or, [insert anything but jobs here].

Another interesting question is: If Obama is as smart and saavy as his supporters say he is, then why is he acting like this?

Oh, and the other interesting thing about Mr. Obama’s jobs summit speech yesterday was that he blamed the lack of jobs on business owners because they are not hiring. I wish I could laugh. Certainly the fault could not be placed on anyone in the current administration — after all, Mr. Obama has been very clear that the problem is with Mr. Bush (even now). Or, was the problem with small business owners? No wait, wasn’t it Fox News?

Crumbs. I wish I could laugh.

Bill, as someone who has been involved in educational video, I can report that video is pretty simple to do acceptably, but audio is a different story. The threshold of acceptable sound is a pretty high and requires some professional equipment, as well as someone who knows how to capture good sound in different acoustic environments. As a musician I guess you know this already, but I’m writing in the interest of all of us who are hanging on your words and those of the others presenting. While I really appreciate the videos you put up a few days ago of the interview with you and Randy Wray, I confess I had difficulty at times understanding what you were saying.

> The President should resign immediately because he isn’t qualified to lead the largest economy in the world.

It just occurs to me the last time heard this (in similar terms) was for the opposite reason :

http://www.bloomberg.com/apps/news?pid=20601087&sid=aBormXavA0xU

and this acclaimed author in separate statements also predicts Weimar style hyperinflation. Some reputations will be made or un-made.

Let’s hope Ralph Nader enters the senate race. Not enough to steer the titanic in a new direction, but exposing the captain’s nudity would be fun.

Another great post. Thanks.

Does it matter whether stimulus is fiscal or monetary?

The reason I ask is because Joseph Gagnon of the Peterson Institute recommends that central banks purchase $6 trillion of long-term assets (gov bonds, I presume) to put the global economy back on track. He’s very persuasive, but I have a hard time understanding how monetary stimulus gets past the credit chokepoint created by malfunctioning banks. (that are reducing credit to households and businesses) Wouldn’t it be more efficient to create jobs programs (as you suggest) to bypass the banks and get money directly into people’s hands who can spend it and increase demand???

Brad Delong suggests something very close to Gagnon. Here’s the link if you have time.

http://www.piie.com/publications/papers/gagnon1209.pdf

I sent a similar question to Marshall Auerback.

Thanks , Mike Whitney

link http://www.piie.com/publications/papers/gagnon1209.pdf Joseph Gagnon Peterson Institute

Mike,

I think you answered your own question. And “Peterson Institute” is the tip-off as to the bias of Gagnon’s proposal.

Gagnon essentially argues that buying the long-term government securities will stimulate the economy by lowering long-term interest rates. Short term rates have already run up against the zero bound. He admits that fiscal policy can also be used but it increases the national debt, whereas his proposal lowers it. The problem with this proposal is that it just switches assets from one form to another, interest-bearing time to interest-free liquid). But in a liquidity trap such as we are presently experiencing, this difference is pretty much immaterial, and lower rates are not going to spur increased spending or investment when AG is low, investment opportunities limited, and loan demand by the credit-worthy limited. If government followed this course, bank reserves resulting from the purchases would either languish along with current excess reserves, or be switched back into interest-bearing assets, or committed to leveraged speculation, possibly leading to asset bubbles (Gagnon unconvincingly addresses this later point). As a matter of fact, the increase in oil price from $40 to $70 was an unforeseen and unwanted effect of monetary “stimulus,” while siphoning a lot of the fiscal stimulus out of the real economy through increased prices at the pump.

The effect on borrowing lies really in the interest it injects in the economy, which could be inflationary with an economy running at capacity. However, that\’s far from the case now. To withdraw the interest by purchasing long-term governments would decrease AG in the present environment and exacerbate the situation instead of helping it.

As you say, fiscal stimulus can be targeted to where it will do the most to increase AG. The ploy of purchasing bonds to inject reserves is unnecessary, since the government is just creating the money anyway and doesn’t need any ploy to do it, as long as it is not limited by meaningless voluntary constraints in the name of myths like “sound money” and “fiscal responsibility,” the basis for which disappeared with the gold standard.

The problem with monetary approaches such as Gagnon’s is that they don’t really take unemployment seriously. The assumed chief priority is “economic efficiency,” irrespective of the human cost. However, Gagnon hasn’t even made the case for economic efficiency.

Dear Bill,

what did Louise Tarrant mean by

“…the trend to externalisation of traditional female labour.” ?

best wishes

Graham

Dear Graham

Traditional female labour – home services, cleaning etc – has been increasingly commodified and made “external” to the home. It is not valued and paid low wages.

best wishes

bill