In my commissioned research activities, which are separate from the basic academic research that occupies…

RBA confounds the market economists – but that’s easy

The Reserve Bank of Australia (RBA) announced today that its policy rate would stay unchanged at 4.5 per cent. It means that the policy rates have been on hold since May after the tightening cycle began in October 2009 and led to 6 rises. The RBA has clearly been looking out the window. It is seeing the Eurozone deteriorating further as the fiscal austerity bites. The UK is now slowing and likely to head back into recession courtesy of the vandalism of its government which thinks it has run out of money. And the US economy is slowing again as its dysfunctional political system is demonstrating it is incapable of maintaining spending growth at levels sufficient to reduce its obscenely high unemployment. Deflation is the threat now. In terms of the local economy there are conflicting tendencies. Private spending remains flat and the fiscal stimulus is waning. Parts of the economy are buoyant as a result of the boom in primary commodity demand (from Asia). The labour market is also still fairly fragile with 13 per cent of our labour resources idle (unemployed or underemployed). Further, inflation is stable in Australia. So it is hardly time to be increasing interest rates. But try telling that to the bank economists who mostly predicted a rise today. They were wrong. They often are. That is no surprise given the narrow way they think about the economy. The RBA made the correct decision today.

I actually love the week leading up to the RBA decision because it brings out all the self-important bank economists who revel in the attention they get from the media. They apply their obsession with inflation and their failure to understand the macroeconomics of the monetary system and typically predict the RBA will increase rates. They are usually wrong. Most of them were wrong again today. They should learn that full capacity does not entail labour underutilisation rates of 13 per cent (as we have in Australia at present) and that inflation has to be driven by something. Economic growth does not inevitably lead to inflation when there is excess capacity. They get that wrong every time.

As another aside, I was watching the news last night from the UK and happened to see the speech by the British chancellor at the Conservative Party’s Annual Conference in Birmingham. It was comedy at its best. How this idiocy can parade as informed statements from a senior politicians with the fate of millions in his hands is anyone’s guess. The triumph of neo-liberalism.

Here is an excerpt:

Let me tell you what a structural deficit is.

It’s the borrowing that doesn’t go away as the economy grows, and we have £109bn of it.

It’s like with a credit card.

The longer you leave it, the worse it gets.

You pay more interest.

You pay interest on the interest. You pay interest on the interest on the interest.

We are already paying £120m of interest every single day thanks to the last Labour government.

Millions of pounds every day that goes to the foreign governments we owe so they can build the schools and hospitals for their own citizens that we aren’t able to afford for ours. How dare Labour call that protecting the poor?

Delay now means pay more later.

Everyone knows it’s the most basic rule of debt.

In fact, a “structural deficit” is the discretionary component of the budget outcome which reflects the decisions by the national government to underwrite aggregate demand and to provide public services and infrastructure. It is also the non-cyclical surplus of the non-government sector and allows private households to reduce their indebtedness.

It is a flow of spending rather than a stock of debt. The association with “borrowing” is totally voluntary and reflects the dominant neo-liberal bias which aims to discipline public spending. There is no necessity to borrow when the national government net spends (that is, runs a deficit). In fact, the borrowing merely provides corporate welfare (to the bond markets) and should be curtailed.

The public deficit is nothing like a credit card held by a private individual. There is no valid analogy between the sovereign government budget and a household budget. The latter uses the currency and is always financially constrained. It can only get access to credit if the provider is certain they have funding necessary to pay the advances back. The former is never intrinsically revenue constrained because it is the monopoly issuer of the currency.

Words such as “worse it gets” have no real application when applied to a sovereign government that faces no solvency risk. A rising public debt ratio is not a deterioration any more than a falling public debt ratio is an improvement. The policy focus should always be on the real economy which can get better or worse. The budget deficit may rise because the real economy is deteriorating or in better shape. A focus on the budget balance is thus misguided.

Further, no sovereign national governments needs to or should borrow from any foreign governments or foreign institutions. While this sort of borrowing is unnecessary it also exposes the sovereign government to solvency risk.

But George Osborne should resign for lying. The statement that by paying interest on debt to foreigners which they might use to builds schools and hospitals means that the British government cannot afford to provide to their own citizens is false. It is a blatant lie. The British government can always afford to provide any amount of public infrastructure as long as there are real resources available. They might choose – politically – not to provide this infrastructure but that decision will never reflect an intrinsic financial constraint.

Anyway, that little diversion helps to explain why the RBA has kept its rates on hold. Major countries are now in the hands of governments that are intent on undermining the fragile recovery that was emerging as a result of the fiscal stimulus that was provided but which is now being prematurely withdrawn.

The danger of a double-dip recession is all policy induced now. Governments are deliberately trashing their economies and putting more of their citizens into unemployment and poverty as a result. As I noted in yesterday’s blog – Its simple – more public spending is required. But with treasuries being run by the likes of George Osborne, and the Eurozone bullies killing demand there, and the US being cruelled by its moronic political state, the trend is pointing towards recession again or at best slow growth.

The RBA is mindful of the fragile state of the world economy and its potential to derail the stronger growth prospects that we enjoy courtesy of the buoyant demand for our minerals from China.

In most countries, there is no appetite among private investors and consumers to spend at sufficient volumes to kick-start growth. The large pools of unemployment in many advanced economies are providing strong deflationary forces.

The misguided fiscal austerity being implemented in Europe is undermining its growth prospects. The claims that export-led growth would replace the public spending withdrawal have not been justified. Europe is falling back into recession – the “double-dip” scenario. The US economy, which drives world growth, is also slowing as the fiscal stimulus is prematurely withdrawn. A double-dip recession in the US is now likely.

China avoided recession because it used fiscal policy more liberally than the West and maintained strong domestic demand conditions by investing heavily in public infrastructure. The Chinese government’s prudent fiscal strategy has benefited the Australian economy as a result of its demand for our minerals.

Today’s decision by the RBA has to be seen in this context.

In the formal statement from the RBA Governor we read that:

… In Europe and the United States, growth prospects appear to be modest in the near term, a legacy of the financial crisis and its impact on private and public finances. Financial markets are still characterised by a degree of uncertainty, and are responding both to differences in growth outlooks between regions and evident strains on public finances and banking systems in several smaller countries in Europe. Most commodity prices have changed little over recent months, and those most important to Australia remain very high.

Information on the Australian economy shows growth around trend over the past year. Public spending was prominent in driving aggregate demand for several quarters but this impact is now lessening, while the prospects for private demand, and in particular business investment, have been improving. This is to be expected given the large rise in Australia’s terms of trade, which is now boosting national income very substantially.

Asset values are not moving notably in either direction, and overall credit growth is quite subdued at this stage, notwithstanding evidence of some greater willingness to lend. Inflation has moderated from the excessive pace of 2008. The effects of the rise in tobacco taxes aside, CPI inflation has been running at around 2¾ per cent over the past year. That looks likely to continue in the near term.

The current stance of monetary policy is delivering interest rates to borrowers close to their average of the past decade. The Board regards this as appropriate for the time being. If economic conditions evolve as the Board currently expects, it is likely that higher interest rates will be required, at some point, to ensure that inflation remains consistent with the medium-term target.

So there is no immediate threat of inflation outside of their target band (2 to 3 per cent), the economy is growing but not above trend and there is uncertainty in the world economy.

The inflation-obsessives continue to claim that the economy is close to full capacity and a housing price bubble is going to emerge some time soon. I feel for them. They must have a really fearful life always anxious and shuffling their paper money into silver or gold or whatever.

The reality is that there is no real estate bubble in Australia likely to emerge anytime soon.

Further, the likely deflationary impacts of the EMU meltdown will continue for some time. The EMU problem is not going to go away. It is a design flaw and as soon as the ECB stops buying up member nation’s debt the inherent issues will re-emerge, notwithstanding the news in the last few days that China is now buying Greek government debt.

Deflationary impacts are also coming via the impact of the mining boom on the $AUD. While the move towards parity with the US dollar is reducing our international competitiveness – thus putting a brake on export growth – it also has taken pressure of the inflation rate.

Finally, the commercial banks have traditionally increased mortgage rates in proportion with increases in the RBA’s policy rate. In the last year, the banks have broken that pattern and pushed their rates up faster. While the politicians and the public have (rightly) complained about the greedy banks, the RBA has taken the view that this allows it to keep its rate lower than otherwise while still getting its desired (yet misguided) contraction in the demand for credit.

While the RBA refers to the strong terms of trade which is being driven by growth in Asia, the fact is that Australia is now a dual economy. The mining boom is creating significant growth in some states while the remainder of the nation is languishing and families are struggling with high debt burdens.

During the growth period before the crisis, Australian households maintained strong consumption growth by accessing credit and this resulted in record levels of household indebtedness in Australia and increasingly onerous debt-servicing burdens. The Federal government (1996-2007) thought it was a sensible growth strategy to run ever-increasing budget surpluses and allow private spending to be maintained by ever-increasing private debt levels.

The only way the Federal government was able to run such surpluses for so long was because growth was being propped up by the debt-binge in the private sector. Of-course, it was an unsustainable strategy because the private sector became increasingly exposed to insolvency.

These trends have been repeated around the globe and the combination of tight fiscal positions and a massive credit expansion were the factors that combined to bring this crisis on (as well as some lax regulation and other factors).

Once the crisis hit, I was hoping that out of the carnage, households would seriously reduce their levels of indebtedness. That occurred for a while and the lower interest rates certainly reduced the interest-servicing burden. But with rates rising again in recent months, the servicing burden is also rising given the debt hasn’t come down as a percentage of disposable income in any significant way.

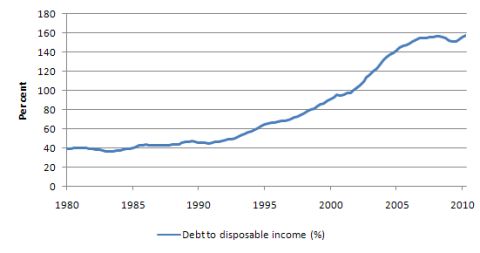

The following graph shows household debt as a percent of disposable income. The data is from the RBA. The economic slowdown has clearly not been severe enough to drive significant reductions in household indebtedness and the very high levels remain a major problem for sustained future growth. This is especially the case with the national government now pursuing a fiscal contraction strategy in their misguided pursuit of budget surpluses.

Monetary policy is a blunt instrument which is incapable of targetting areas of spending. In that sense, the growth duality in the Australian economy presents the RBA with a major problem because increasing interest rates punish slower growing areas disproportionately and also push highly indebted households closer to bankruptcy.

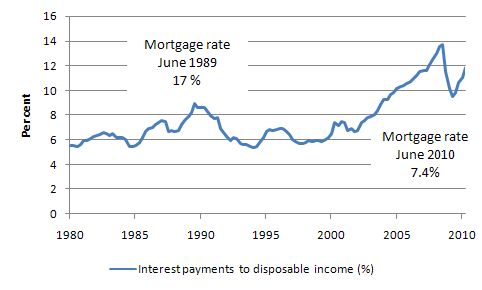

The following graph shows the household interest-servicing payments as a percentage of disposable income. In 1989, the interest rate was 17 percent. But when interest rates were 17 per cent, the average mortgage holder was better off than now because the mortgage repayments as a percent of average household’s disposable income were much lower. This is because wages growth was stronger then and the debt levels were lower.

The interest burden on household debt as a percentage of disposable income (what you have to spend after taxes) has risen dramatically in recent years because of the private debt binge.

In June 1989, the mortgage rate was 17 percent but interest payments only constituted 8.7 per cent of disposable income. In June 2010, while the mortgage rate was down to 7.4 per cent, the interest burden was 11.9 per cent.

So the average mortgage holder is worse off now even though rates are lower. Many households are walking a financial tightrope and further interest rate rises will challenge their solvency.

It is far better to use fiscal policy to stabilise aggregate demand instead of monetary policy because the former can be targetted and is more direct (not subject to uncertain lags).

Current inflation trends

What is the current inflation data telling us?

The data is telling us that there is no inflation problem in Australia at present despite what all the conservatives and gold bugs are claiming. The latest private survey which was released yesterday (October 4, 2010):

… provides the RBA with a signal to relax into 2011. The annual three month moving average price change has plummeted from 4½ per cent to 2½ per cent just in the last three months. We do not forecast inflation to be a concern until the second half of next year, a lagged response to shrinking capacity constraints in the capital and labour markets … On our calculations, the September CPI report is likely to be benign, and is highly unlikely to be a smoking gun for those expecting an early November tightening of the cash rate. We look for a very mild 0.5 per cent rise for the trimmed measure of inflation, yielding an annual rate of only 2.4 per cent. For headline inflation, we expected a lift of 0.7 per cent in the quarter, yielding an annual rate of 2.8 per cent.

So goldies, relax for a while and take walk in a park to ease your anxieties!

The official data will be released for September quarter on October 27, 2010.

As an update on the most recent official consumer price index data the following graph shows the four (data) that are published by the ABS – the annual percentage change in the all items CPI (blue line) and the annual changes in the trimmed mean (green line). The two red horizontal lines represent the upper (3 per cent) and lower (2 per cent) bound that the RBA targets.

To understand the terminology you might read this blog – Rates go up again down here – where I provided an explanation of the different inflation measures that are published in Australia and how the RBA uses them. Some of the measures used attempt to derive a central tendency by giving lower weighting to volatile elements. One such “trimmed” measures that is used by the RBA is the “the 15 per cent trimmed mean (which trims away the 15 per cent of items with both the smallest and largest price changes)”.

It is clear that the official inflation rate was moderating up until the June quarter and was within the RBA’s inflation target band. The more recent private survey information doesn’t suggest that much has changed.

Other indicators of activity

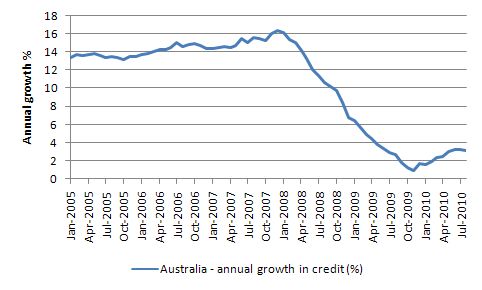

The following graph shows the growth in credit in Australia since January 2005 using RBA data. Total credit growth is a good leading indicator of demand pressures. The recession certainly brought the credit binge to an end and there has been no robust recovery. The credit data remains weak and there was a slowing in growth in August 2010.

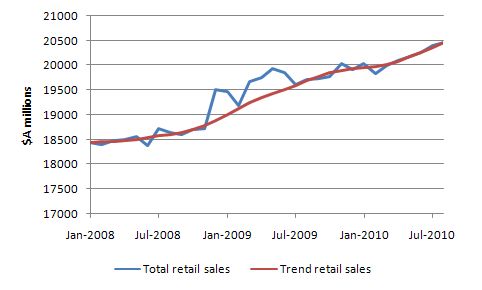

The ABS released their Retail Trade data today for August 2010. The following graph shows the seasonally adjusted and trend series from January 2008 to April 2010. That M-shaped period above the trend line is the direct result of the two fiscal stimulus packages that were introduced in December 2008 and then February 2009 and helped stave of an official recession.

But with the consumer-focus of the stimulus withdrawn now and price spending very flat, retail sales are very flat at present.

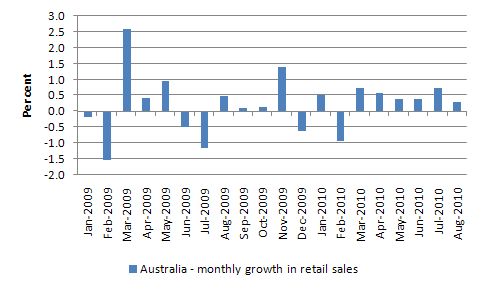

The next graph is the monthly growth (per cent) in retail sales (seasonally adjusted) since January 2008. As you can see there is no discernible boom emerging. The month-to-month figures are fairly weak. The seasonally adjusted growth estimate rose 0.3 per cent in August 2010. This follows a rise of 0.7 per cent in July 2010 and a rise of 0.4 per cent in June 2010.

Do interest rates matter?

I am always in two minds when it comes to thinking about these decisions.

There are two important questions regarding the role of monetary policy. First, how sensitive is the real economy to interest rates movements? During recessions, monetary policy has little proven effects in activating an economy. In bad times lower interest rates do not induce consumer expenditure. And likewise, lower interest rates do not induce more investment (by making borrowing cheaper) as during these periods there tends to be excess capacity and output is not being sold.

Empirical evidence suggests that the interest elasticity of investment is at best low, non-linear, and asymmetric. While an increase in interest rates might moderately reduce investment during economic booms (when the economy is at or above capacity), the reverse is not true. In general, it is the outlook for profitability, rather than the price of credit, that influences investment. For this reason, direct credit control is a more effective instrument of monetary policy than the interest rate. If monetary policy includes direct credit controls it may be reasonable to assume that there will be some effect on aggregate demand.

Monetary policy is therefore a very ineffective means of managing aggregate demand. It is subject to complex distributional impacts (for example, creditors and those on fixed incomes gain while debtors lose) which no-one is really sure about. It cannot be regionally targeted. It cannot be enriched with offsets to suit equity goals.

The regional issue is important. In cases like this, when, say a major city (for example, Sydney) is booming and housing prices are escalating, increasing interest rates impacts severely on the stagnant areas of the country.

This would not be the case using a well-targetted fiscal instrument – mostly in the form of specific taxation measures that can discriminate by region and demographic-income-property cohorts. You can never get that richness in policy design using monetary policy.

Further, if public housing is considered undesirable as a solution the federal government (with some constitutional reforms) could set up a fund to allow access to cheap mortgage instruments to low-income families and allow them to purchase housing (publicly- or privately-provided) with minimal distortion to the price distribution. MMT tells us that the federal government can always afford to do this.

Conversely, fiscal policy (when properly designed and implemented) is a much better vehicle for counter-stabilisation.

However, the impact of monetary policy also has to be considered in relation to the levels of debt that households are currently holding. Australian households have record levels of debt and in the financial crisis lost a large slab of their nominal wealth. The RBA has always claimed that the debt was manageable because asset values were rising at a faster rate.

I always found the argument to be dubious given that a rising proportion of the “assets” being purchased with the increased debt were subject to significant private volatility (for example, margin loans to buy shares). But even more troublesome was the direct link between the debt-binge and the real estate booms which have pushed “investment” funds into unproductive areas at the expense of other areas of economic activity which would have generated more employment.

When the private sector is carrying very large debt burdens, the number of households and firms who are on the margins of insolvency increases. Their capacity to make compositional changes to their expenditure to maintain their nominal contractual commitments declined dramatically in situations such as that.

At that point, interest rate rises can quickly accelerate the bankruptcy rates and lead to further real output falls.

Second, what is the impact of interest rates on inflation? Increases in interest rates might be effective when inflation is caused by demand pressures. However, interest is a cost of doing business, and tends to be included in price. For this reason, raising interest rates will reduce inflation only if the effects on interest-sensitive spending (lowering aggregate demand) are greater than the effects on costs and prices. When inflation comes from the supply side, it is quite unlikely that higher interest rates will do anything to lower prices, indeed, they will probably add to supply-side induced inflation by raising costs.

Some believe that increases in interest rates allows a nation to avoid importing inflation due to currency depreciation. The down side is that higher interest rates may dampen investment prospects and the higher currency value may negatively affect exports. Likewise, higher interest rates will increase costs and thus induce higher prices. History is full of many examples of countries trying to use higher interest rates to protect the currency, only to find that the policy was impotent.

Raising interest rates by hundreds of basis points cannot compensate investors for losses due to large currency depreciations. Indeed, the higher rates can stoke a run out of the currency as currency speculators bet that the monetary policy will fail to stabilise the currency.

Conclusion

With domestic inflation stable and global uncertainty high, the RBA has made the correct decision. The last thing it wants to do is to follow the rest of the world and derail our recovery.

That is enough for today!

Ben Bernanke spreads myths:

Fiscal Sustainability and Fiscal Rules http://www.federalreserve.gov/newsevents/speech/bernanke20101004a.htm

Speech, Chairman Ben S. Bernanke, At the Annual Meeting of the Rhode Island Public Expenditure Council, Providence, Rhode Island, October 4, 2010

bill said:

“I actually love the week leading up to the RBA decision because it brings out all the self-important bank economists who revel in the attention they get from the media.”

For once Bill I agree with you 100% and this time was the funniest I have experienced in many years.

After the speech by Stevens last month all of a sudden our favourite tabloid economist/journo (I won’t mention his name here but he looks more like Gollum then, um, Gollum does) pops up with his usual proclamation as to what the RBA is going to do.

He unequivocably states that the RBA will hike in Oct, backs it up again the next day with some other obscure evidence from the speech and finally this week reiterates the same and puts the slipper into Gillard and Swan for prompting it due to overspending. What was pretty shocking was how 25 other bank economists jumped on the same bandwagon.

Come 2:30pm today and there is no change with a cool Stevens repeating word for word his previous message that rates are fine for now but may need raising if the economy is stronger than expected. Absolutely hilarious and I can’t wait to read tonight the tabloid backflip.

I am glad the RBA saw sense. There is absolutely no need to attempt to slow things in Australia when the rest of the world is worried about deflation and we really have a good thing going. As if a hike or 2 anyway is going to relieve tight capacity in the export sector without ripping the guts out of private homeloan borrowers and small businesses at the same time.

If the Govt wants to continue its stimulus spending then they should allocate 90% of it into new housing to try to relieve the drum-like property sector which is killing the Australian dream. Stick the rest into the hospitals.

What I am concerned about is the 2-3% inflation target of the RBA. They appear to have no room to allow it to run at say 3.5% for a period while other countries are fighting deflation. This really is an opportunity to power through this period of dire global machinations without needlessly attempting to slow things with higher rates.

Oh I meant to add, did anyone read why our friend suggested that a hike should occur in Oct rather than Nov?

Because the Q3 CPI is released this month and if it was low than the RBA would lose an opportunity to pre-emptively raise rates (in Nov) so better off jacking them up in Oct and leaving them on hold if CPI is low.

Someone tell me how that fits with a central bank which targets inflation. lol

Cameron repeated the same analogy with a household credit card debt this morning on Radio 4. Do they actually believe this stuff? What the hell did they teach them at Oxford?

The line I use is: yes it’s like a credit card, but with one hell of a cashback deal. Every time the government uses the credit card it gets a percentage of the transaction back. And it every time that same money is spent again in the economy the government gets a percentage. And that carries on until the cashback equals the initial amount of money spent.

The only time there will be a balance on this credit card is if people save the money rather than spending it. Because then the cashback won’t equal the initial spend.

And that is what the deficit is. It is money that has been spent, that has not been subject to the cashback deal. In other words our savings.

I don’t think we should encourage any analogy with a household credit card debt. We can understand Government Deficit equals (ex post) the non-Government Sector’s savings without using any reference to such an analogy.

can anyone explain to me why the yen is so strong and the us $ weak. the conventional explanation is the dollar is down because of impending qe2, but japan has been doing the same for years. thanks

“The misguided fiscal austerity being implemented in Europe is undermining its growth prospects. The claims that export-led growth would replace the public spending withdrawal have not been justified.”

I made a little historical expose on the export-led growth strategy concerning Sweden from 1970 – 2008, comparing some export numbers with Germany, Japan and China. And how a successful export-led growth maybe correlated with unemployment, although I could only get statistics from 1980. Numbers are from World Bank and Eurostat. The text is in Swedish but the graphs are in “English” and the main messages is in the graphs.

http://teckentydaren.blogspot.com/2010/10/den-fortvinade-exportnationen.html

@/L

Ick nurt spaken den Svedish.

Just like to say. Export driven growth cannot work if all countries follow the same strategy, there has to be a balancing volume of net imports. Logically it’s a win/lose scenario. I’m not even sure who are the winners and losers. If the UK and US try this strategy together, the world economy will go bonkers.

With a job guarantee MMT driven growth strategy everyone’s a winner. Whoo hoo!

Ray,

I agree with your comments. Australia has an opportunity to capitalise on the commodities boom, and pull through a difficult economic situation in reasonable shape. Hospitals and new housing are great places to spend. I’m equally concerned about the social effects of the house price boom.

There’s also the question of the bank’s gross exposure to overseas funding. Although not mentioned much by the RBA, this is influencing rate decisions. It should not have been allowed to happen.

I know the RBA doesn’t have a specific currency target, in place , however I cant help wonder given that right across the world at the moment, every one is trying to devalue their currencies so as to have competitive exports. Given expected rises in electricity, food, rates, water etc, actual costs of running a property either as an investment or even as a principal residence are far outripping wage growth, I suspect the RBA is fully aware of how stretched households are.

Bill, you are probably aware of how Australia actually practiced some form of MMT and even I suppose a form of the job guarantee, the only problem was that it was during WW1.

Am I correct in my understanding based on my reading from the following website.

http://www.huffingtonpost.com/ellen-brown/escaping-the-sovereign-de_b_669564.html

Hi Bill,

Regarding the statement:

“The reality is that there is no real estate bubble in Australia likely to emerge anytime soon.”

versus the following:

“Australian households maintained strong consumption growth by accessing credit and this resulted in record levels of household indebtedness in Australia… The interest burden on household debt as a percentage of disposable income (what you have to spend after taxes) has risen dramatically in recent years because of the private debt binge”

Don’t the latter suggest that the former may already have emerged, in the form of speculation on real estate?

Thanks.

Dear WTF (at 2010/10/06 at 14:37)

The debt is a hangover from the last property boom. The danger now is that property prices may fall leaving many people with negative or close to negative equity. Then things get really tricky.

best wishes

bill

AW,

regarding bank cost of funding (deposits which make up 50% vs overseas funding which makes up about 20%). All I can say is that I have been a “banker” for many years and even I believe this is absolute bollocks on the banks’ behalf. Just take a look at the net margin figure on their reports and you will see that their cost of funding is not actually rising to the extent that warrants 10 or 15 bps slapped onto the rba hike.

The banks are absolutely wrong to charge this and the press are too stupid to do their homework and expose this as the fraud that it is.

Much of banks’ funding comes from issuing bank bills at the daily BBSW rate set and paying swaps to match loan duration. This is still the cheapest form of funding and has not changed spread-wise since before the GFC.

If the regulators had balls they would nail the banks on these points alone.

Ramanan, re Bernanke’s foray into fiscal policy hysteria…. I skimmed the speech last night and it sounded a bit like a party political in parts. If he really wanted a level political playing field, he wouldn’t have stopped at the deficit ratio in the years 05-07….he should have also included the ratio from the day Obama took office. This is important given the heated debate about deficits at the moment and the massive scare campaign. But either way it’s pretty meaningless because it’s a flipside of the private sector economy. I truly don’t know why he doesn’t get this, and a cursory glance at a chart of the deficit (as a % of GDP) which I did today, or the output gap (est. at $922bn, or over 6% of potential currently) fits the unemployment data like a glove, whether it’s U3, mean unemployment, over 27wks, whatever). How strange!!!

The other thing I find weird about the monetary – fiscal debate is speeches like the Fed’s Evans last night (and their ilk). Here we have a call for more QE because he’s “…..come to the conclusion that (unemployment) is just not coming down nearly as quickly as it should….”. So the Fed believe they are responsible for all matters economic…..not completely strange because the politicians have let them do this, basking in false prosperity as Greenspan and the Fed’s market-based policies blew bubbles for 2 decades….until they could no more. Meanwhile, the President and his Administration, who actually should be doing something about it, aren’t, because they’re cowering in the face of critical conservative drivel (as Bill notes in the above essay). All very odd. No wonder they’re a mess.

@Andrew Wilkins

“Just like to say. Export driven growth cannot work if all countries follow the same strategy, there has to be a balancing volume of net imports.”

If the goal is to create jobs and get unemployment down does not necessarily works even if the strategy succeeds in creating export-led growth and export is booming in a environment of international growth that tow.

One of the points was that the more export there was the more unemployment we got. In the early 1990s export per capita was in constant US dollars 6000, 2008 it had climbed to 18000 per capita, a period with very high unemployment every year.

Total unemployment and export:

http://img815.imageshack.us/img815/1534/unempexpswe2.png

The higher the net export surpluses the more unemployment, lower net export lower unemployment. Now this is probably more due to there was forced high net export due to tighter fiscal and monetary policies that curbed consumption and import for household consumption.

Total unemployment and net export:

http://img185.imageshack.us/img185/2899/unempnetexp.png

So increased export have not at all alleviated unemployment, not a bit, the more export the more unemployment one could say. It indicates the importance of the domestic market if unemployment shall be alleviated.

Ray,

I didn’t realise just how far the Banks had sunk with the latest proposed mortgage rates. Unfortunately it’s a common commercial practice to increase prices using erroneous rationale. Whether it’s a Bank or a Greengrocer it stinks just as bad.

Being in the trade, what is your view on the systemic risk to the banking system posed by the 20% of funding from overseas?

For example. What if the perefct storm happens: House prices fall, households de-leverage, commodity terms of trade fall, RBA lowers rates, Fed increases rates and the AUD comes under intense carry trade pressure. Are any of the big 4 toast?

Please appreciate I am biting my tongue on your choice of profession. I did have a few comments spring to mind :).

@/L

Thank you for the clarification. I’m guilty of not understanding a post ….. yet again … sigh!

Andrew Wilkins says:

Wednesday, October 6, 2010 at 16:10

“Ray,

Being in the trade, what is your view on the systemic risk to the banking system posed by the 20% of funding from overseas?

For example. What if the perefct storm happens: House prices fall, households de-leverage, commodity terms of trade fall, RBA lowers rates, Fed increases rates and the AUD comes under intense carry trade pressure. Are any of the big 4 toast?

Please appreciate I am biting my tongue on your choice of profession. I did have a few comments spring to mind”

AW, the risk is zero or close to it. The Australian Big 4 are among the most solid and conservative of all banks globally. The biggest risk that I can see is housing prices falling and leveraged households suffering a loss of equity. This could push up defaults but remember that in Australia all loans are full-recourse to other assets so the banks would not suffer catastrophic losses. Furthermore, securitisation of mortgage books is done at a realistic LVR and there are very few CDOs written on these so leverage is under control. Banks are not the end holders of these things either in Australia.

The Fed will not be hiking within the next 2yrs given that unemployment is so bad in the US (you won’t see a hike until it falls below say 7.5%).

If the capital markets froze again due to a double dip then the RBA simply would ease aggressively given they have plenty of ammo and ensure bank funding was guaranteed. The deposit and borrower guarantees were the 2 smartest moves in Australia during the whole GFC.

At the end of the day if offshore funding costs rise then the banks just pass it on. At the margin the banks will simply lend less if they can’t raise the amounts they are seeking.

The AUD is a natural buffer against commodity prices. Much has been made of the huge surge in the gold price is USD terms. Now look in AUD terms and it is far less dramatic. If global growth slumps and China pulls its head in, the resultant fall in the AUD will somewhat buffer the lower commodity prices.

No need to stick your hard-earned under the mattress just yet, Australia is God’s own country for the nonce.