In my commissioned research activities, which are separate from the basic academic research that occupies…

RBA finally decides to stop sabotaging growth

The Reserve Bank of Australia (RBA) announced today that its policy rate would stay unchanged at 4.5 per cent. This brings to an end (for now) the tightening cycle which began in October 2009 and has seen 6 rises since that time. The scene is clear. The Eurozone is deteriorating further into another crisis with social unrest coming to the fore. In terms of the local economy all the talk of an impending boom is waning. The proximate indicators suggest that economic growth in Australia is very weak (across many indicators) and it is hardly the time to be further increasing interest rates. Today’s decision also put into stark relief the calls from the OECD last week to impose a very significant monetary tightening to accompanying fiscal austerity measures. The RBA is clearly not following that nonsensical logic.

Last week, the OECD published their latest May Economic Outlook which predicted that interest rates around the world would have to rise substantially in the coming year. In the case of Australia, they argued that the RBA would have to push rates up a further 1.2 per cent within the year which would push mortgage rates towards 9 per cent.

They also advocated significant fiscal consolidation. If you look at their growth projections it is clear that they are more optimistic than most including me. I don’t believe the world economy will reach anything like what they are projecting. I also don’t think the Australian economy will achieve the forecasted growth. We will know what the Australian growth rate is for the first quarter tomorrow when the National Accounts data comes out.

Paul Krugman’s column yesterday (May 31, 2010) – The Pain Caucus – noted that:

What’s the greatest threat to our still-fragile economic recovery? Dangers abound, of course. But what I currently find most ominous is the spread of a destructive idea: the view that now, less than a year into a weak recovery from the worst slump since World War II, is the time for policy makers to stop helping the jobless and start inflicting pain …

Now, however, demands that governments switch from supporting their economies to punishing them have been proliferating in op-eds, speeches and reports from international organizations. Indeed, the idea that what depressed economies really need is even more suffering seems to be the new conventional wisdom …

His argument is consistent with my blog which coincidently came out yesterday too – The “gas now, pay later” myth.

Krugman’s observation on the OECD’s position is excellent:

What’s particularly remarkable about this recommendation is that it seems disconnected not only from the real needs of the world economy, but from the organization’s own economic projections.

Thus, the O.E.C.D. declares that interest rates in the United States and other nations should rise sharply over the next year and a half, so as to head off inflation. Yet inflation is low and declining, and the O.E.C.D.’s own forecasts show no hint of an inflationary threat. So why raise rates?

He guesses that the OCED is being motivated by the belief that inflation expectations might get out of control. It is hard to see any real inflationary impulse at present. The persistent unemployment remains a highly deflationary force.

The obvious point I have been regularly making is that fiscal austerity combined with tightening monetary settings will damage growth and in the end the governments are likely to have rising deficits because the automatic stabilisers will generate a further loss of tax revenue.

Krugman explains the seeming illogical nature of these policy recommendations by quoting Financial Times writer Martin Wolf – policy makers have to be seen to be:

… giving the markets what we think they may want in future – even though they show little sign of insisting on it now …

So you can see how absurd the policy debate has become. We are coming out of this crisis with such a twisted perspective on priorities and causation that all we are doing is setting our economies up for the next crisis. Then we will hear – sorry, there is no further space for fiscal expansion.

Krugman is correct:

More and more, conventional wisdom says that the responsible thing is to make the unemployed suffer. And while the benefits from inflicting pain are an illusion, the pain itself will be all too real.

Today’s decision by the RBA has to be seen in this context.

In the formal statement from the RBA Governor we read that:

Since the Board last met, concerns about sovereign creditworthiness in several European countries have been a focus of financial markets. Investors have generally displayed a good deal more caution. As a result, equity prices have fallen and long-term government bond rates have declined outside of the countries most affected by the sovereign concerns. The Australian dollar fell sharply as part of this adjustment. Commodity prices have also softened, though those important for Australia remain at very high levels … The effects of these various factors on the world economy will need to remain under review …

In Australia, with the high level of the terms of trade expected to add to incomes and demand, output growth over the year ahead is likely to be about trend, even though the effects of earlier expansionary policy measures will be diminishing. Inflation appears likely to be in the upper half of the target zone over the next year.

In past months there has been an emphasis on housing markets and the impending explosion in house prices in these statements. The recent data (and some below) suggests that there isn’t going to be a real estate price bubble anytime soon in Australia.

Now the RBA is expressing a concern for the likely deflationary impacts of the EMU meltdown which is rendering the world environment unstable. I agree with that assessment. The EMU problem is not going to go away. It is a design flaw and unless the ECB starts buying up member nation’s debt and then hit the delete key to wipe it off for good in the short-run that flaw will further generate crises in the Eurozone.

They are also acknowledging the undeniable fact that there is no inflation problem in Australia at present despite what all the conservatives and gold bugs are claiming.

However, they do not seem willing to acknowledge that the Australian economy is very fragile at present. If you examine factors closer to home one doesn’t see much indication that the strong growth predicted by the OECD in the Outlook will be remotely achieved.

Current inflation trends

What is the current inflation data telling us? In this blog – Rates go up again down here – I provided an explanation of the different inflation measures that are published in Australia and how the RBA uses them. Some of the measures used attempt to derive a central tendency by giving lower weighting to volatile elements. One such “trimmed” measures that is used by the RBA is the “the 15 per cent trimmed mean (which trims away the 15 per cent of items with both the smallest and largest price changes)”.

The following graph shows the four (data) that are published by the ABS – the annual percentage change in the all items CPI (blue line) and the annual changes in the trimmed mean (green line). The two red horizontal lines represent the upper (3 per cent) and lower (2 per cent) bound that the RBA targets.

My interpretation is that inflation has moderated and is within the RBA’s inflation target band.

The RBA certainly think that even more recent information is telling them that the inflation rate is firmly within their target range and all forces operating at present are of a deflationary nature.

Other indicators of activity

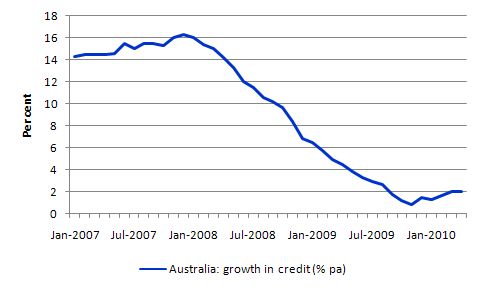

The following graph shows the growth in credit in Australia since January 2007 using RBA data. One commentator observed yesterday that “(t)he credit data is absolutely categorically weak, and is a very good leading indicator. This will weigh on the RBA” (Source).

Business credit, which drives investment in new productive capacity declined in the year to April 2010 by 7.0 per cent and has no upward trend discernable (Source).

Prior to the RBA decision this afternoon, the Australian Bureau of Statistics issued three data series which give some insight in how strong the economy is at present and the direction of change.

The ABS released its Manufacturing Indicators today which showed that in March 2010, the Key Australian Performance of Manufacturing Index continued to deteriorate – dropping 6.7 percentage points on the previous month, after showing some signs of recovery earlier in the year. So this sector, which still employs a substantial number of workers is now showing signs of resurgence.

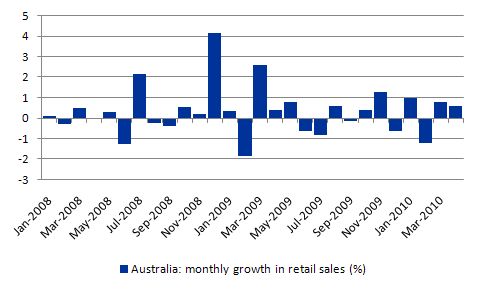

The ABS also released their Retail Sales data for April 2010 today. The following graph shows the seasonally adjusted and trend series from January 2008 to April 2010. That M-shaped period above the trend line is the direct result of the two fiscal stimulus packages that were introduced in December 2008 and then February 2009 and helped stave of an official recession.

But with the consumer-focus of the stimulus withdrawn now and price spending very flat, retail sales are very flat at present.

The next graph is the monthly growth (per cent) in retail sales (seasonally adjusted) since January 2008. As you can see there is no discernable boom emerging. The month-to-month figures are fairly weak.

The ABS also put out their Building Approvals data for April today. The data shows that the trend for total dwelling units remains flat in April 2010 while the seasonally adjusted series fell by 14.8 per cent in the last month.

In terms of private sector houses, the seasonally adjusted estimate fell by 13.5 per cent and the trend is now downward. As the following graph (courtesy of the ABS shows, the peak in private sector houses approved occurred at the height of the fiscal stimululus (aided by the first-home buyers grant) and at the time the RBA started to hike interest rates.

So the conclusion I draw from this data plus the Labour Force data for May is that the Australian economy is in a fragile state and continued growth is not guaranteed, especially if China starts to get infested by Chicago graduates who come home and tell the policy makers that inflation is the main thing to worry about.

We will get a better picture of economic growth in Australia when the National Accounts data comes out tomorrow.

The dark cloud still over us

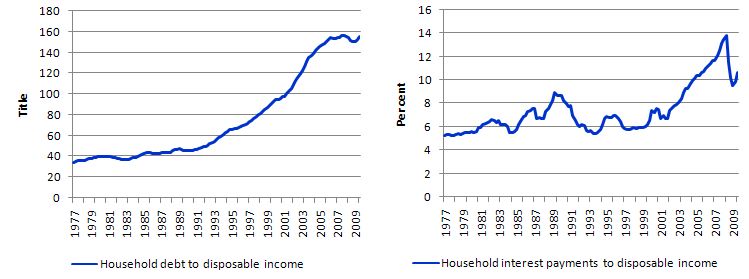

Further, in the growth period before the crisis, households in Australia maintained strong consumption growth by access credit and this resulted in record levels of household indebtedness in Australia and increasingly onerous debt-servicing burdens. The Federal government (1996-2007) thought it was a sensible growth strategy to run ever-increasing budget surpluses and allow private spending to be maintained by ever-increasing private debt levels.

The only way the Federal government was able to run such surpluses for so long was because growth was being propped up by the debt-binge in the private sector. Of-course, it was an unsustainable strategy because the private sector became increasingly exposed to insolvency.

These trends have been repeated around the globe and the combination of tight fiscal positions and a massive credit expansion were the factors that combined to bring this crisis on (as well as some lax regulation and other factors).

Once the crisis hit, I was hoping that out of the carnage, households would seriously reduce their levels of indebtedness. That occurred for a while and the lower interest rates certainly reduced the interest-servicing burden. But with rates rising again in recent months, the servicing burden is also rising given the debt hasn’t come down as a percentage of disposable income in any significant way.

The graph shows household debt as a percent of disposable income (left-panel) and household interest-servicing payments as a percent of disposable income (right-panel). The data is from the RBA. The economic slowdown was not severe enough to drive significant reductions in household indebtedness and the very high levels remain a major problem for sustained future growth.

Do interest rates matter?

I am always in two minds when it comes to thinking about these decisions.

There are two important questions regarding the role of monetary policy. First, how sensitive is the real economy to interest rates movements? During recessions, monetary policy has little proven effects in activating an economy. In bad times lower interest rates do not induce consumer expenditure. And likewise, lower interest rates do not induce more investment (by making borrowing cheaper) as during these periods there tends to be excess capacity and output is not being sold.

Empirical evidence suggests that the interest elasticity of investment is at best low, non-linear, and asymmetric. While an increase in interest rates might moderately reduce investment during economic booms (when the economy is at or above capacity), the reverse is not true. In general, it is the outlook for profitability, rather than the price of credit, that influences investment. For this reason, direct credit control is a more effective instrument of monetary policy than the interest rate. If monetary policy includes direct credit controls it may be reasonable to assume that there will be some effect on aggregate demand.

Monetary policy is therefore a very ineffective means of managing aggregate demand. It is subject to complex distributional impacts (for example, creditors and those on fixed incomes gain while debtors lose) which no-one is really sure about. It cannot be regionally targeted. It cannot be enriched with offsets to suit equity goals.

The regional issue is important. In cases like this, when, say a major city (for example, Sydney) is booming and housing prices are escalating, increasing interest rates impacts severely on the stagnant areas of the country.

This would not be the case using a well-targetted fiscal instrument – mostly in the form of specific taxation measures that can discriminate by region and demographic-income-property cohorts. You can never get that richness in policy design using monetary policy.

Further, if public housing is considered undesirable as a solution the federal government (with some constitutional reforms) could set up a fund to allow access to cheap mortgage instruments to low-income families and allow them to purchase housing (publicly- or privately-provided) with minimal distortion to the price distribution. MMT tells us that the federal government can always afford to do this.

Conversely, fiscal policy (when properly designed and implemented) is a much better vehicle for counter-stabilisation.

However, the impact of monetary policy also has to be considered in relation to the levels of debt that households are currently holding. Australian households have record levels of debt and in the financial crisis lost a large slab of their nominal wealth. The RBA has always claimed that the debt was manageable because asset values were rising at a faster rate.

I always found the argument to be dubious given that a rising proportion of the “assets” being purchased with the increased debt were subject to significant private volatility (for example, margin loans to buy shares). But even more troublesome was the direct link between the debt-binge and the real estate booms which have pushed “investment” funds into unproductive areas at the expense of other areas of economic activity which would have generated more employment.

When the private sector is carrying very large debt burdens, the number of households and firms who are on the margins of insolvency increases. Their capacity to make compositional changes to their expenditure to maintain their nominal contractual commitments declined dramatically in situations such as that.

At that point, interest rate rises can quickly accelerate the bankruptcy rates and lead to further real output falls.

Second, what is the impact of interest rates on inflation? Increases in interest rates might be effective when inflation is caused by demand pressures. However, interest is a cost of doing business, and tends to be included in price. For this reason, raising interest rates will reduce inflation only if the effects on interest-sensitive spending (lowering aggregate demand) are greater than the effects on costs and prices. When inflation comes from the supply side, it is quite unlikely that higher interest rates will do anything to lower prices, indeed, they will probably add to supply-side induced inflation by raising costs.

Some believe that increases in interest rates allows a nation to avoid importing inflation due to currency depreciation. The down side is that higher interest rates may dampen investment prospects and the higher currency value may negatively affect exports. Likewise, higher interest rates will increase costs and thus induce higher prices. History is full of many examples of countries trying to use higher interest rates to protect the currency, only to find that the policy was impotent.

Raising interest rates by hundreds of basis points cannot compensate investors for losses due to large currency depreciations. Indeed, the higher rates can stoke a run out of the currency as currency speculators bet that the monetary policy will fail to stabilise the currency.

Conclusion

The RBA has taken fright and perhaps today’s decision is consistent with the view that has been around lately in some quarters that they were too aggressive in pushing rates up so quickly when there is so much uncertainty in the recovery phase.

It is clear that we have a fairly weak economy (certainly not booming) and there remain very high rates of labour underutilisation with no policy development in sight to redress this wastage.

The RBA is also worried that the EMU crisis will generate a second major banking and financial crisis.

That is enough for today!

I agree on your take on the RBA, and there’s a reason that monetary policy is increasingly less effective as rates go lower – interest rate sensitivity is merely a measure of risk appetite. In bad times, as you note, and as Krugman notes in his liquidity trap musings, risk takers are pretty well contained….rates are so low for a reason, and it resonates through the RBA statement today where they can find only a measly (small) paragraph to comment on the Aussie fundamentals, such as they are. The rest is all about offshore developments, Europe in particular. We in Australia are too caught up in the inflationary impact of the terms of trade. We are a small player in a big pond, a pond where pricing power is going down the gurglar.

I’d like to see the RBA given a broader set of tools with which to manage the economy. We all know interest rates is akin to a scatter gun approach that leaves alot of collateral damage when fired but that’s all the government has given the RBA to use. In alot of ways, I agree with the rate rises. Clearly, Australians went on a low interest rate property binge topping up their new over priced purchase with an even newer 985cm plasma TV and U2 concert sized surround sound system. So rather than investing in productive assets that create wealth, we went on a debt binge instead. The banks further crucified those who did take out a business loan by charging even higher interest rates. Why be productive when you can binge on a lower interest rate? By not having the ability to target the mortgage sector, the RBA had to raise interest rates to temper the consumer binge taking out small business and enterprises in the process. That’s why the need to be able to target specific sectors of the economy so as not to broadly affect the broader environment.

Talk about ceding power to the bond markets:

Krugman: Thus, the O.E.C.D. declares that interest rates in the United States and other nations should rise sharply over the next year and a half, so as to head off inflation. Yet inflation is low and declining, and the O.E.C.D.’s own forecasts show no hint of an inflationary threat. So why raise rates?

The answer, as best I can make it out, is that the organization believes that we must worry about the chance that markets might start expecting inflation, even though they shouldn’t and currently don’t: We must guard against “the possibility that longer-term inflation expectations could become unanchored in the O.E.C.D. economies, contrary to what is assumed in the central projection….”

The best summary I’ve seen of all this comes from Martin Wolf of The Financial Times, who describes the new conventional wisdom as being that “giving the markets what we think they may want in future – even though they show little sign of insisting on it now – should be the ruling idea in policy.”

BTW, keeping the bond market happy was the basis of the “Rubinomics” that Robert Rubin convinced Bill Clinton was the secret to the success of his presidency. This thinking still seems to dominate in “New Democrat” circles, and includes Rubin’s proteges, notably Larry Summers. A WH Chief Economic Advisor, Summers seems to be pushing a similar view on Obama, with Tim Geithner chiming in. Bad news for progressives – and the economy. At least Bernanke is just making noises to reassure the bond crowd he’s on their side so far, but not doing much to tighten.

Tom . . . exactly right on Clinton/Rubin. I still recall Clinton telling us all in 2000 that because of “his” surpluses we now had lower interest rates, while at the same time I was purchasing a house with a 9% rate on the mortgage. A few years later, with the $200B surplus now a $400B deficit, I would refinance at 6%.

A big part of the problem is that most economists, particularly those working in monetary economics and thus also working in research departments for central banks, believe that real interest rates are the ones that matter. And even though nobody’s ever really come up with a good measure of real interest rates to use empirically (at least not a commonly accepted one), the argument that real interest rates are what matter has become essentially tautological. So, sluggish growth in Japan even with short term nominal rates at 0% is merely evidence to them that the real interest rate is too high. So they’re generally not persuaded by much of the evidence Bill cites above–again, since they’re position is tautological, why would they be? There’s also the related problem of focusing on the overnight rate, rather than the rates at which that private sector households and firms would actually borrow or service debt–these have credit risk spreads over longer-term Tsy’s that move countercyclically.

Scott: A big part of the problem is that most economists, particularly those working in monetary economics and thus also working in research departments for central banks, believe that real interest rates are the ones that matter. And even though nobody’s ever really come up with a good measure of real interest rates to use empirically (at least not a commonly accepted one), the argument that real interest rates are what matter has become essentially tautological.

This gets to the nub of it. Economic anthropologists have had a running battle with neoliberal economist for some time over the neoliberals’ formalism as opposed to anthropologists’ substantivism and culturalism. In A Short History of Economic Anthropology posted at The Memory Bank, Keith Hart observes:

His [Herskovitz] main criticism, however, concerned epistemology. The other social sciences, including institutional economics, were empirical and neo-classical economics alone, “…effectively uses inference from clear and abstract principles, and especially intuitive knowledge, as a method….[T]he conceptual ideal of economic behaviour is assumed to be, at least within limits, also a normative ideal, that men in general…wish to make their activities and organization more ‘efficient’ and less wasteful…”

The criticism is heard from across the spectrum, from philosophers of science, to evolutionary biologists, to anthropologists, to psychologists, and to heterodox economists. The conventional wisdom in economics is anti-empirical and anti-scientific in that the assumptions are held to be intuitive and that economics norms like rational choice are taken to be universals of human nature, whereas this has no empirical support through research. In fact, research in other life and social sciences seems to either call into question or even disconfirm such assumptions.

In this regard, conventional economics is a holdover of the Aristotelianism that the scientific revolution overthrew. Because of this, neoliberalism has been rightly criticized as “philosophical speculation” or “religion” instead of science, using abstruse mathematical modeling to disguise this defect. Putting forward its conclusions as fact-based and scientifically derived is simply false, and for so-called experts and professionals to do so is disingenuous. The current system is run by a high priesthood, with all that entails, as the effects go to show.

Dear Tom,

You are making good points about economic theory. However, it is not the fault of Aristotle and his philosophy who has established the foundations of scientific inquiry and principles of logic. Furthermore, his concept of the ariston is a far superior concept of optimum based on the metric (παν μετρον αριστον) between extremes allows the incorporation of externalities and their collateral effects that the extremum concept fails to acknowledge.

Tom . . . thanks for the link; the essay sounded right out of the mouth of my professor, Greg Hayden, at Nebraska (http://books.google.com/books?id=VXGHSR69JNIC&printsec=frontcover&dq=hayden+policymaking+for+a+good+society&source=bl&ots=LAshB943gF&sig=tGP3RxS4NOn67dzYBzT1-pnHcxM&hl=en&ei=0XMFTKvtGYq2NpyRtDs&sa=X&oi=book_result&ct=result&resnum=1&ved=0CBQQ6AEwAA#v=onepage&q&f=false)

Thanks Tom for steering this conversation to the absurdity of both monetary and fiscal policy being controlled by some bankers who think the credit markets are expecting such a thing and, by gum, we always do what the credit markets want.

At this point, to me, the whole fiscal policy discussion is it being framed within the limited policy options of whether there should be any government support of our economic well-being by borrowing money from the private sector that owns the power to create the money at the moment.

If this is supposed to be a discussion of monetary sovereignty, you now, the GOVERNMENT-ISSUER of its own currency(circulating medium of exchange), then where is that discussion today?

What is needed is the additional element of who owns the money system.

Ultimately, completely and absolutely.

The power of the people to issue their own currency is what makes the difference whether many of these “fiscal stimulus” discussions are worth having.

If we need to borrow the circulating medium of exchange into existence, then the capital free-marketeers get to say what they want for the loan. And the fiscal squeeze goes on between regulating the oil companies and single-payer.

The power of the people to issue the money without issuing debt is the first order issue of any of these reforms.

Let the privateers of debt lend the money to themselves after they control it.

The Money System Common

I have to echo Joe’s extremely critical point: “What is needed is the additional element of who owns the money system.” Does a private banking cartel own the money system, or is it owned by the public who uses it? Why does the public need to borrow money into existence, and then pay interest on that money to a central bank?