I started my undergraduate studies in economics in the late 1970s after starting out as…

On human bondage

Today I have been thinking how extraordinarily stupid human beings are. The so-called Club Med Eurozone nations are being fast tracked into a crisis by a pernicious concoction of corrupt and lazy ratings agencies, Northern European truculence, and a ridiculous monetary system that provides no fiscal support within what is really a federal system. And as the ailing governments boldly and stupidly declare a willingness to play ball with the Brussels-Frankfurt consensus bullies there are signs that social order is beginning to break down. Then I read that an American city is turning its lights off at night to save money. Then I read some goon telling everyone to short US bonds because there will be a debt meltdown. And all of this stuff stems from unnecessary constructions and constraints that we have placed on systems that should be geared to advancing general welfare.

Economies are not ends in themselves. How stupid are we as a collective to have allowed this absurd state of affairs to emerge where mindless big-noting bullies can command media space and promote a climate of fear which then turns into policy moves that undermine general welfare.

The title for today comes from the W. Somerset Maugham’s wonderful book of the same name which you can read in its entirety on line – HERE. I recalled that Maugham had taken the title from Dutch philospher Baruch Spinoza who in his Ethics Demonstrated in Geometric Order devoted a section of ethical thinking to the issue of Human Bondage.

While Spinoza was on about the perfection of divinity – his point that human bondage occurs when emotions and passions (maybe ideology) controls out lives and turns us into slaves has resonance. His solution was to act and promote reason above emotion. There are many things that are beyond our control and we become hostages to fortune. But action can reduce the things that are beyond our control and allow us to free ourselves from the bondage of emotions.

We have spent several Saturday morning cup of tea session talking about Spinoza. The topic is now banned!

But the points are valid. The deficit terrorist spin doctors have largely enslaved the citizenry and their principle mind control techniques are to tweak emotions rather than advance reason. In fact, when you read or hear some of the constructions these characters are putting on current events you realise they are just emotional wrecks themselves – they have no understanding.

If the general population really understood how monetary systems worked and the role of government in a fiat monetary system then then they could start operating at the level of reason which blunt the relentless political pressure coming from the spin doctors.

The dominance of the conservative position and the support it gets from the enemies from within (the faux progressives) is clearly pushing these sponge-like neo-liberal governments into taking positions that damage their citizens. And all the time the sophistry is dressed up as fiscal sustainability and the general population believes it.

The signs of these human imposed bondages are everywhere at present. Yesterday the US Bureau of Labor Statistics reported that:

In December 2009, 31 of the 32 metropolitan divisions – which are essentially separately identifiable employment centers within metropolitan areas – reported over-the-year employment losses.

So expect little labour market recovery in the coming months. The persistently high unemployment in the US will become increasingly deflationary as the fiscal stimulus starts to taper. There is a desparate need in the US for a job-focused stimulus but the merchants of gloom are winning the political battle and a double-dip scenario is still a very real possibility.

But then you head over to Europe and you how advanced the damage is that arises from our collective human madness. All the current developments are pointing to things turning very nasty in Euroland at present. I have examined this question often. See the links at the end of this blog for some of the previous blogs on this topic.

There are now major ructions occuring in European financial markets and signs of major social unrest becoming endemic in Greece.

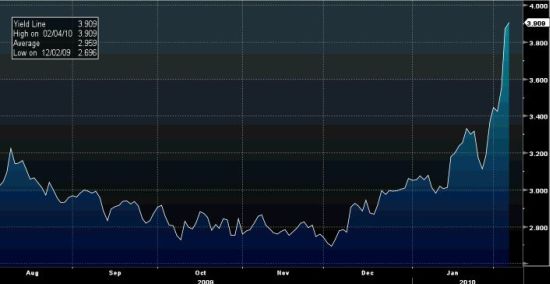

The following graphs are taking from daily data for Greece (first) and Portugal (second) and show the current 5-year bond yields. As the commentary goes – they are going parabolic which is a sure sign of an impending crisis.

To put the charts in perspective – the German 5-year bond yields were at 2.23 per cent and 10-year bonds yields were at 3.16 per cent today (which were slightly below the coupon rates). Portugal 5-year bonds were at 3.9 percent and Greece was at 6.562 per cent. So the spread on the “safer” Bund (German bond) was large and rising. Japan, a sovereign nation, unlike the EMU members and with the World’s highest debt/GDP ratio, had yields of 0.52 per cent on 5-year bonds and 1.36 per cent on 10-year bonds today (which were above the coupon rates) (Source).

On Wednesay, Portugal reduced its bond tender because the yields being demanded were excessive.

The Guardian reports (February 4, 2010) that:

Doubts over Greece’s ability to pay its debts extended to Spain, Portugal and eastern European countries, all labouring under high budget deficits. The cost of insuring $1m of Spain’s sovereign debt rocketed to $162,000 (£103,000,) twice as much as Britain and about four times the cost to insure Germany’s bonds, according to Markit, the credit data provider. Portugal only raised €300m of the €500m it was expecting in a bond sale, further fuelling the uncertainty.

Greece is now in deep trouble and Spain and Portugal are fast heading in the same direction. Given the destructive logic of the EMU treaty – a totally contrived document reflecting ideological conservatism and totally devoid of any economic justification (such as the optimal currency region claims) – the only solution for these economies is to cut borrowing which means they have to cut net spending.

No-one in their right mind who understood how a monetary system can work if freed from anti-people constraints and who further understood the tragedy of mass unemployment that guarantees crippling economic and social costs are borne by generations would design a system like the EMU. It is a ideological contrivance that reflects our capacity to accept bondage and allow ruling elites who never bear the costs to trample over our freedoms.

When announcing the ECB decision to hold the key ECB interest rates constant, Trichet said that unemployment in the Euro zone would increase in 2010 as investment and consumption continued to fall. But:

As regards fiscal policies, many euro area countries are faced with large, sharply rising fiscal imbalances, leading to less favourable medium and long-term interest rates and lower levels of private investment. Moreover, high levels of public deficit and debt place an additional burden on monetary policy and undermine the Stability and Growth Pact as a key pillar of Economic and Monetary Union. Against this background, it is of paramount importance that the stability programme of each euro area country clearly defines the fiscal exit and consolidation strategies for the period ahead. Countries will be required to meet their commitments under the excessive deficit procedures. Consolidation of public finances should start in 2011 at the latest and will have to exceed substantially the annual adjustment of 0.5% of GDP set as a minimum requirement by the Stability and Growth Pact. A strong focus on expenditure reforms is needed.

I guess his job is not at risk.

In a press conference later, Trichet was reported as saying (Source):

When you share a common currency, the counterpart is that you have to behave properly … European countries must get their budgets under control to set the stage for lasting growth … [he called for] … a very, very strong call for full respect of the Stability and Growth Pact

The whole Eurozone is now open to credit risk with national government exposed to insolvency and all bank deposits in jeopardy (because the national governments cannot bail them out if a run occurs).

Further as investors bail out of Euro into safer assets (like US dollars and gold) the share markets suffer. This impact will spread. Today the Australian share indexes were down by around 2.5 per cent.

Greece is now facing union-led strikes which will undermine its ability to make fiscal cuts. I expect serious social unrest to spread to the other “Latin” EMU nations if the intrangisence of the system continues.

How can Trichet expect nations to behave in the common currency system if one of the essential features that should be present – a fiscal redistribution mechanism to account for disparate real outcomes – is absent – by design?

What sort of mad human mindset produced a system which excluded a major safety valve that could stop this instability (to some extent)?

Its not all confined to Europe though …

Then you read about Colorado Springs, a town in the US which is now being hamstrung by these self-imposed constraints. Colorado Springs is a beautiful place geographically but is an epicentre of deficit terrorism. But now the chickens are coming home to roost for this town. The only problem is that it is possible that the deficit haters are not the ones who will suffer.

The Denver Post reported that:

This tax-averse city is about to learn what it looks and feels like when budget cuts slash services most Americans consider part of the urban fabric. More than a third of the streetlights in Colorado Springs will go dark Monday. The police helicopters are for sale on the Internet. The city is dumping firefighting jobs, a vice team, burglary investigators, beat cops – dozens of police and fire positions will go unfilled. The parks department removed trash cans last week, replacing them with signs urging users to pack out their own litter. Neighbors are encouraged to bring their own lawn mowers to local green spaces, because parks workers will mow them only once every two weeks. If that. Water cutbacks mean most parks will be dead, brown turf by July; the flower and fertilizer budget is zero. City recreation centers, indoor and outdoor pools, and a handful of museums will close for good March 31 unless they find private funding to stay open. Buses no longer run on evenings and weekends. The city won’t pay for any street paving, relying instead on a regional authority that can meet only about 10 percent of the need.

And the article just gets worse as you read on. I urge you to read it and see how destructive these morons are. As the reporter says “Colorado Springs’ woes are more visceral versions of local and state cuts across the nation”.

This could be prevented by a simple payment on a per capita basis by the national US government to all state governments. That is, a federal fiscal support strategy.

Meanwhile … not everyone is stupid

When you read articles like the latest from Keynes’ biographer Robert Skidelsky (February 1, 2010) – The bogey of inflation – in which he extols us to not have a fear of inflation at present because “economies are still on life support and to withdraw the stimulus at this point would be catastrophic” – you realise that my initial hypothesis that all humans are idiots cannot be maintained.

Skidelsky says that:

If inflation has succeeded recession as today’s main problem, governments should withdraw their stimulus policies (money out of the economy) as soon as possible. If recession remains the problem, the stimulus policies should stay in place, or even be strengthened.

He notes that the low inflation period “which dates from the early 1990s” were claimed by the Monetarist central bankers to vindicate their position of focusing exclusively on price stability. But he correctly notes that “monetary policy had little to do with it. Low inflation resulted from a combination of cheap supply and low demand. There was huge downward pressure on manufacturing prices from low-wage Asian economies, while unemployment in the developed world averaged 5-6% – about twice as high as in the earlier post-war decades.”

The upward movement in inflation rates prior to recession was largely due to “spiking commodity prices”. So not lax economic policy.

He then emphasises that in judging “the reality of today’s inflation threat”:

The first thing to notice is that, as a result of the slump, capacity utilisation is lower than it was 15 months ago: global output has declined by roughly 5% since 2008, and developed-country output by 4.1%. One would expect inflation to fall with the decline in output, and this is exactly what happened … In other words, the low-inflation era will become the lower-inflation era.

Not to mention the dramatic rises in unemployment and underemployment across all countries which will suppress any wage demands for some years to come.

He then tackled the “quantitative easing” issue and says that “(s)urely that means that inflation is just round the corner unless the money is withdrawn fast, right?” I thought his next turn of phrase was lovely:

For those who have had a couple of lessons in the quantity theory of money, this seems a plausible conclusion.

Most of the commentary that comes from the “markets” is from those who have only had a “couple of lessons” from a mainstream textbook and then consider their own experience in “trading” tells them all they need to know. That is the problem in this debate the blind lead the blind yet parade as though they have full vision.

Skidelsky says that “as John Maynard Keynes never stopped pointing out, the quantity theory of money is true only at full employment. If there is unused capacity in the economy, part of any increase in the quantity of money will be spent on increasing output rather than just buying existing output”.

In other words, if nominal demand is insufficient to deploy all the available capacity it is in the firms’ interest to increase output rather than prices.

Then Skidelsky shows he understands the banking operations somewhat:

This is only half the story, however. By “quantity of money,” experts normally mean M3, a broad measure that includes bank deposits. Flooding banks with central-bank money is no guarantee that deposits, which arise from spending or borrowing money, will increase in the same proportion.

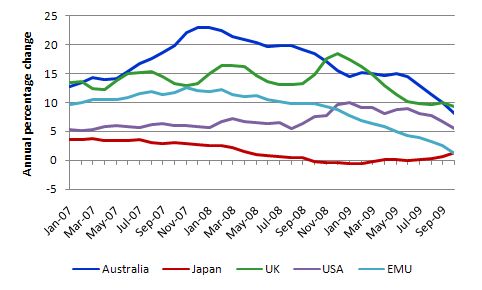

The following graph shows annual growth in broad money for selected nations plus the EMU from 2007 to late 2009 (data from OECD Main Economic Indicators).

This is what Skidelsky is talking about. So even if you were a believer in the QTM you would be predicting deflation right now not inflation.

Skildesky says emphatically:

What matters is not printing money, but spending it. It is when money is spent that it becomes more than an inert bundle of useless paper. A central bank can print money, but it cannot ensure that the money it prints is spent. It may pile up in bank reserves or savings accounts, or it may produce asset bubbles. But in such cases, little or no increase in the money supply occurs. The new money simply replaces the old money, which has been liquidated by economic collapse.

I might take exception to some of the terms here but the point is correct. Please read my blogs – Building bank reserves will not expand credit – Building bank reserves is not inflationary – for more discussion on this point.

He concludes that all the data is pointing to “extremely low inflation rates over the next few years, despite the monetary and fiscal stimulus” which is the same thing as saying that “there will be little recovery over the next five years.”

And this leads to the obvious conclusion:

Our economies are still on life support. To withdraw the stimulus at this point would kill the patient. To talk about the dangers of inflation is scaremongering. Instead, we should be thinking of ways to restore the patient’s health … But, unless firmer evidence of recovery comes in the next quarter, European and American officials should prepare to accelerate and expand their spending programs. Otherwise, their economies risk remaining stuck in recession.

Skidelsky is not a modern monetary theorist but he understands how macroeconomic systems operate and the inherent dangers in leaving aggregate demand too low.

Meanwhile … UK banks get a shock

The UK Telegraph reports that:

In an extraordinary ultimatum that has shocked some of the City’s biggest companies, the Financial Services Authority (FSA) told bank bosses that 60pc of all pay must be deferred, with no exceptions, even for those whose contracts conflicting with the edict. Many of the global players have in recent weeks made representations to the City watchdog, in particular about pre-existing employment contracts that guarantee bonuses over a year or more. But their appeals have been met with the FSA’s toughest yet response.

The FSA has told the banks that they won’t get involved in contractual legalities – they were for the banks and their managers to deal with. But what the FSA was legally able to do was to revoke the banking licences that allows them to operate in London.

So that is good news.

And … I haven’t even started on …

There was some discussion overnight within our little group about the latest nonsense from the Black Swan guy – Nassim Nicholas Taleb. I also noticed a comment on the blog as well about his statements.

My mate, Marshall Auerback describes him as a blind squirrel who accidently stumbled on a few acorns – very North American imagery I thought. So if you run your mouth at some fast pace in a more or less random fashion you are sure to say something that is sensible once in a while. His book “The Black Swan” had some good analysis in it but nothing much more than Mandelbrot had laid out in his fractal geometry which inspired chaos theory.

So a few acorns here and there but overall no understanding of how the monetary system operates.

Anyway, Taleb who keeps telling his readers how clever he is (if you have been unlucky enough to read his book you will know what I mean) now says (Source):

It’s a no brainer to sell short Treasuries … Every single human being should have that trade.

This is because the US economy is approaching Armageddon day. Yes, another doomsday approaches. I think he should name the date and then we can send him our commisserations when he fails to stumble on the acorn.

Taleb went on and said (Source):

Deficits are like putting dynamite in the hands of children … They can get out of control very quickly … The problem we have in the United States, the level of debt is still very high and being converted to government debt … We are worse-off today than we were last year. In the United States and in Europe, you have fewer people employed and a larger amount of debt. Democracies can’t handle austerity measures very well … We’re going to have a severe problem

Exactly how can a deficit get out of control when you have 10 per cent unemployment, 17 per cent if you count those who have given up looking, your productive capital is about 70 per cent in use, and no jobs were added in 2009?

It beggars belief that a character like this can strut around and command attention. The high levels of indebtedness in the US private sector had to come down – there is no doubt about that. The complex web of financial assets that evaded sound risk assessment were time bombs and as they have exploded damage has been done.

Taleb was not alone in getting that bit right.

But public debt is nothing akin to private debt – Please read my blog – Debt is not debt – for more discussion on this point.

Given the voluntary constraints that the US government places on itself – the bondage – they had to substitute public debt for private debt to ensure that aggregate demand didn’t collapse completely.

Had the US government not introduced stimulus measures the increase in public debt would have been even greater – because of these voluntary bondage arrangements – and the real damage to the economy would have been catastrophic – given the scale of the private spending collapse.

The US economy and its people are “better off” now because of the intervention than they would have been. The stimulus was inadequate and poorly targetted but it was better than doing nothing.

The only thing democracies cannot handle is a biased media in the hands of a few who use their power to perpetuate wholesale lies and misunderstandings to further the entrenched position of the elite. Taleb is part of the problem not the solution.

And for all you people who rushed out and took his advice and put that “trade” on you will already be losing! US government bond demand rose strongly yesterday and yields fell. Australian government bond yields are also down.

So you no-brainers perhaps you better follow the genius and go short but not on US bonds – buy Greek bonds. But that doesn’t require any insight at all. The EMU system ordains that yields will rise there until there is rioting in the streets and Greece goes free and sets an example for Spain, Portugal and even Italy.

Immediate solution guaranteed to work thought experiment

Mass unemployment arises because aggregate demand is insufficient to deploy the available labour resources in employment. Please read my blog – What causes mass unemployment? – for more discussion on this point.

If private spending is inadequate then public spending has to fill the gap. If there is pressure on the government to restrain itself from adequately filling the spending gap then the inevitable consequence will be unemployment. The larger the spending deficiency the larger the gap.

Let’s assume that the spending gap is left at 3 per cent of GDP and this leads to 10 per cent unemployment.

The constitution in each nation should be amended so that a national ballot is held year applying to all those currently in the labour force to draw out the selection of who will take the unemployment duties that are required given government is being forced by its electorate to underspend. So lawyers, investment bankers, CEOs, financial market commentators, would be denied the opportunity to earn an income for that year.

How long do you think the deficit terrorism would persist? Its easy when it is someone else’s job – typically a lowly educated person without a voice or any lobbying capacity. Too easy.

When their own jobs are not at stake, the bankers and the brokers and the rest of them can interrupt their expensive lunches and tear themselves away from their blackberries for a moment and tell the journalists how bad the deficits are. Meanwhile they have just been on their blackberries making sure that their jobs are saved by massive government bailouts.

So a national ballot would fix them all up. They would have an equal chance to take the unemployment. They would soon be on their blackberries telling the government to make sure we had full employment and to get some jobs action going. Firms would be short of skilled labour and have to do something about that – like lobby the government to get some jobs action going so the ballot became unnecessary.

Just thinking out aloud!

Related blogs – among many

=> On voluntary constraints that undermine public purpose

=> Time to outlaw the credit rating agencies

Saturday Quiz

As usual to test your progress towards qualification for the MMT army. Trepidation comes to mind as I think of the questions 🙂 … it will be posted some time tomorrow.

I read Nassim Nicholas Taleb comments as well, and also saw comments that the cost of Credit Default Swaps on UK and Australian government debt (as well as CDSs on OZ bank debt because of concerns on the OZ government honoring its guarantee) and was wondering how a retail investor could sell CDSs because there is no default risk on OZ, UK, Japan or US government debt.

But would that be moral to sell insurance on an event that has a zero possibility unless they change the rules?

I guess we could always buy the Treasuries from Taleb’s hedge fund, and then sell them to the Fed Reserve when they move in to keep interest rates within their desired range.

Could Taleb be the Great Depression 2.0’s Iriving Fisher?

Bill . . . I had breakfast last spring with Skidelsky and he was very interested in learning about monetary operations . . . did all I could in about 30 minutes. Goodhart had told him they were important to understand, if I recall. (Not meant to imply he’s not smart . . he is–VERY . . but you can’t be the expert in everything.)

Neal . . . Taleb as GD 2.0 is exactly what I was thinking when I read that yesterday

In line with the philosophical theme, it is ironic that a crisis of private indebtedness is manipulated into a fear of public spending, the very thing that would free those under human bondage – a campaign led by the bond(age) market. A dialectical inversion, indeed.

Taleb is just an idiot charlatan – full stop. He already destroyed his first hedge fund with his dumb ideas. Even in the area where he is supposedly an expert, options pricing, he is completely clueless. He thinks that long tail risks are underpriced, but then what the hell is the volatility smile??? Why is Warren Buffet so rich from selling long tail insurance? All empirical evidence points to those risks being overpriced, rather than underpriced, as Taleb contends. Maybe that’s why he went broke buying them. The man is just a complete moron IMO.

Garth Brazleton over at Reviving Economics presents A Teaching Dilemma he faces in his macro class on teaching the chapter on monetary policy.

He writes: I will be teaching the intro macro chapter on monetary policy and the role of the Fed in a few weeks. For the 4 years or so I’ve been teaching I’ve always had concerns about the best way to teach ‘the money’ chapter because, frankly, most all of the ‘money’ chapters I’ve seen in many intro texts (Mankiw, Case, Hall, etc) really could be torn from the book’s binding and probably the students would be better off.

I posted a comment there. Anyone else want to help him out?

Thanks for the Spinoza reference. Nice to learn something new, as a bonus in addition to MMT…

Scott –

You probably know this already, but, Fisher eventually figured out he could no longer obey general equilibrium dictums, as they clearly had little to do with the actual world he inhabited. But he had to lose his rolodex fortune, and then his house to Yale, and live off loans from in laws, before he finally arrived at the debt deflation approach which he wrote up in 1932 and 1933…and the vast majority of the economics profession continues to ignore, as if his last works never existed, although Geneakoplos appears on his way to reinventing parts of it, appropriately defanged and mathematically embellished for the consumption of the profession.

Taleb, on the other hand, just keeps getting more punch drunk on his one note wonder which, I think Bill is largely right, can be seen as a pale shadow of Mandelbrot’s observations five decades back (which on their own should have derailed the EMH blunder).

The lesson seems to be we should have no illusions that economics is a cumulative science. The direction can go distinctly retrograde for decades on end…and amazingly, can continue so, even in the face of major global macrofinancial disruptions.

Well said, Rob. Like you and Bill, I prefer Mandelbrot. The original arguments without the massive ego of Taleb.

By the way, it’d be quite interesting if a predictable event from within the framework of MMT (Spain, Portugal, Greece) caused the author of The Black Swan to lose his fortune. Though the story’s far from told, the last two days haven’t been too good for him, but the MMT people I know have been safe and even earning a little on their Tsy’s.

Rob, David Sloan Wilson has some interesting things to say about this in his (thus far) three part series on economic and evolutionary paradigms here. Part III is especially devastating for neoliberalism while being kind to Keynes.

Mainstream economics hasn’t been able to make the necessary paradigm shift due to cognitive bias. See Dougalss C. North, Economics and Cognitive Science on this. So far, the established narrative continues to dominate the universe of discourse and influence institutions in spite of abject failures that introduce anomalies calling to be addressed.

BTW, Mandlebrot appeared in a ten minute PBS video with Taleb some time ago discussing fractal finance. It was all the buzz then.

Bill, there’s an interesting (short) post on the ramifications of globalization over at Angry Bear today – Globalization….lifted from comments. The lede is Stiglitz’s observation, ” … the export of T-bills is different from the export of cars or computers or almost anything else: it does not create jobs. That is why countries whose currency is being used as a reserve, and exporting T-bills rather than goods, often face an insufficiency of aggregate demand.”

I think I am beginning to get a handle on MMT as it relates to national income accounting, stock-flow consistent macro models, and monetary/fiscal policy, but I would like to know more about the international implications of currency issuance and debt issuance, if anyone can point me in the right direction. Seems like this is coming to the fore now with the international turmoil that is unfolding. Thanks.

> Even in the area where he is supposedly an expert, options pricing, he is completely clueless. He thinks that long tail risks are underpriced, but then what the hell is the volatility smile???

FYI Taleb was already criticized on this point and his answer is here : Brief Discussion of Empirical and Logical Mistakes in Tyler Cowen’s Review of The Black Swan in Slate.

Besides, I don’t see how the existence of volatility smile disproves this particular claim.

Would someone be so kind as to offer me respite from thinking in circles by answering this question:

Is net spending by a EMU member state a horizontal or a vertical transaction?

We can ignore the 3% deficit rule in answering this because 3%>0 which still allows net spending and it’s not strictly enforced anyway.

I’m leaning towards Yes based on the Article 101 of the founding treaty which “forbids the ECB and the NCBs to provide monetary financing for public deficits using “overdraft facilities or any other type of credit facility with the ECB or with the central banks of the Member States”

but I can’t resolve myself to the implication that assuming net exports are zero, the private sector cannot save.

Any help would be appreciated.

> The high levels of indebtedness in the US private sector had to come down – there is no doubt about that. The complex web of financial assets that evaded sound risk assessment were time bombs and as they have exploded damage has been done. Taleb was not alone in getting that bit right.

The paper Understanding Financial Crisis Through Accounting Models (perhaps first mentioned on this blog or some other non-mainstream econ blog) says this:

”

– Only analysts were included who provide some account on how they arrived at heir conclusions.

– Another criterion was that analysts went beyond predicting a real estate crisis, also making the link to real-sector recessionary implications, including an analytical account of those links.

– Third, the actual prediction must be made by the analyst and available in the public domain, rather than being asserted by others.

– Finally, the prediction had to have some timing attached to it. ”

Too bad these criteria were defined after the fact but the likes of William White at the BIS don’t even qualify, so needless to say Taleb is not even a nominee.

While Spinoza was on about the perfection of divinity – his point that human bondage occurs when emotions and passions (maybe ideology) controls our lives and turns us into slaves has resonance.

The universe expands and contracts (breathes) and is finite – we are a part of it, bound to it. No amount of reasoning can change that, whatever lifestyle or haircut we arrange for ourselves. What is left when it contracts and what is still there when it expands is also a part of us – that which always was, is, and will be (infinite). If freedom was within the grasp of reason, cash, or triumph, there would probably be some crash course on it somewhere. Whatever we dream up, it will always be what our aboriginal brothers point out to us from time to time: ‘our dreamtime’ – imposed on the universal dreamtime. How significant are we again? I don’t know what Spinoza thought, but Freedom is an attribute of the infinite only!

At the very least we should dream up something that is human; showcase the best in our nature instead of the gravel. Then, maybe we should turn our attention towards something that is real …..

His solution was to act and promote reason above emotion.

[Bursts of laughter] …. I wonder if he read the newspapers – some Generals and Treasury Chiefs are among the most highly educated people on the planet!

There are many things that are beyond our control and we become hostages to fortune.

But more often hostage to our own unconsciousness.

But action can reduce the things that are beyond our control and allow us to free ourselves from the bondage of emotions.

Well, we are sentient beings. It’s what we feel that is the problem. When I am feeling joy I do feel incredibly free! Like when I read Billy Blog!!

Cheers …

jrbarch

“but nothing much more than Mandelbrot had laid out in his fractal geometry which inspired chaos theory.”

I think Henri Poincare might disagree if he were still alive. Many would suggest that his work on the three body problem is where it all started.

“FYI Taleb was already criticized on this point and his answer is here : Brief Discussion of Empirical and Logical Mistakes in Tyler Cowen’s Review of The Black Swan in Slate.

Besides, I don’t see how the existence of volatility smile disproves this particular claim.”

What claim are you talking about? and where does he address that question?

According to Taleb’s thesis, Warren Buffett should have gone broke, but he has not. Taleb on the other hand has gone broke, taking the other side of similar trades.

>What claim are you talking about?

The claim I was referring to is the one you seem to be denying :

> He thinks that long tail risks are underpriced

Regards.

bx12, there no horizontal or vertical transactions in the EMU as it operates under the gold standard.

Re private savings and export position the situation in the EMU is very heterogeneous and I’d rather not make EMU-wide statements. German is net exporting country but also very private saving. Spain is similar to the US – import a lot with budget surpluses, i.e. increasing indebtness. Greece seems to be in the middle with weak exports but also little private savings. I do not think you will be able to reconcile it on the EMU level since there are no common sectoral balances.

Sergei, thanks for taking me up on this issue.

> bx12, there no horizontal or vertical transactions in the EMU as it operates under the gold standard.

As an analogy you mean?

I agree with your description of the current state of saving and exports in the EU, but for the sake of argument we can assume NX = 0 and forget about the SGP. That leaves G-T = I-C. I argue here (but I’m not 100% certain)

bilbo.economicoutlook.net/blog/?p=7679&cpage=1#comment-3172

bilbo.economicoutlook.net/blog/?p=7639&cpage=1#comment-3147

that net savings have to be zero on average i.e. E[G-T] = 0, hence E[I-C] = 0.

If Bill reads this, it would be nice some time in the future to have a table that categories monetary systems, past and present, and scores them by MMT criteria. For example,

EMU

Period 2002 –

MU Yes

Currency : FL+RC

Money:

Issuer : ECB

Supply : FR

Final targets : PS

Intermediary targets : IRT

Main instrument : OM

Fiscal:

Financial constraint SGP+BF

OCA NO

MMT judgment A time bomb 😉

MU = Monetary union.

ECB = European Central Bank

FL = Floating

RC = Reserve currency (held significantly by non-resident)

FR = Fractional reserves

PS = Price stability

IRT = Interest rate targeting

OM = Supplies/drains monetary base by buying/selling gov securities usually to meet an interest target.

BF = Government must finance its net spending by borrowing from the private sector so that on average G-T = 0, hence I-C = NX

SGP = Stability and growth pact requires G-T < 3% GDP and Debt < 60% GDP.

OCA : Optimal currency area

Just an idea…