I started my undergraduate studies in economics in the late 1970s after starting out as…

Another conservative front opening up – minimum wages

Today I have been reflecting on minimum wages and employment. As the Australian economy slides slowly along the bottom (close to zero growth), the conservative forces are mobilising to attack the changes that the current federal government made to the industrial relations laws when they won the last election. Ex-liberal party hack (advisor) and now Director of the conservative Sydney Institute and regular Sydney Morning Herald columnist Gerard Henderson is one person who is leading the charge. While the first of the changes will not come into effect until next month, employers who have revelled in the massive redistribution of national income that the deregulation the labour market delivered to them are already enraged and looking to commentators such as Henderson for succour. The problem is that there is no argument they can make that is defensible. This will become a new battlefront for unions who seek to defend the interests of the most disadvantaged workers in the land.

In his SMH article today – Labor’s good intentions fail to guarantee jobs for youth – Henderson claims that the retrenchment of the pernicious Work Choices laws (pernicious is my word not his) is undermining employment prospects.

He asserts that:

The fact Australia has one of the strongest economies in the OECD today is primarily due to the economic reforms undertaken over the past quarter-century by the governments led by Labor’s Bob Hawke and Paul Keating and the Coalition’s John Howard. The deregulation of Australia’s once highly regulated industrial relations system was a central part of this reform process … Kevin Rudd and his Minister for Workplace Relations, Julia Gillard, have been busy in the past two years re-regulating the Australian labour market. This procedure will be finalised in January when the Rudd Government’s Fair Work Act comes into effect.

This will at least take Australia’s industrial relations system back to March 1996, when the Howard government was elected.

The assertion that the Australian economy avoided the worst of the recession because it privatised, aggressively deregulated the labour market, cut real wages, introduced onerous welfare-to-work provisions, and ran budget surpluses for a decade or so is now often-repeated by all sides of politics in Australia.

My view is that it is an unfounded assertion that is not borne out by the data.

Consider my blog yesterday – Lesson for today: the public sector saved us – where I show using Australian Bureau of Statistics data that the private labour market shrunk dramatically and the loss in total employment between June 2008 and June 2009 was all down to the major increase in public sector employment.

I also used Treasury estimates to show that if the discretionary component of the fiscal intervention had not have been delivered then we would have had at least 3 quarters of “official” recession (measured in terms of GDP losses).

The secret of the relatively better (but still appalling) performance of the Australian economy in this downturn lies in the timing (early); the magnitude (several percent of GDP) and the composition (geared at directly boosting aggregate demand) of the fiscal intervention. Without it we would have looked fairly bleak.

Henderson then starts to take us to his main point – circuitously:

The evidence suggests that in contemporary Australia, the well-educated and well-off can look after themselves. Certainly, the global financial crisis has caused some hardship for all socio-economic levels of Australian society.

Yet this downturn – unemployment has increased in the past two years by nearly 50 per cent, from about 4 per cent to nearly 6 per cent – has hit hardest among “blue-collar” workers, especially those employed in manufacturing and construction.

In most economic downturns or recessions, the young are most disadvantaged since they find it difficult to obtain employment. Those with the least educational qualifications are usually the worst off. Their plight is frequently overlooked by journalists, who tend to be young but well-educated.

I agree with some of this description. Manufacturing employment in particular has been significantly cut losing 90 thousand jobs or nearly 8.3 per cent of its total employment since the downturn began in February 2008. However, this has been the common theme in previous recessions.

Henderson is however wrong in his statement about construction. It actually gained employment in the period since February 2008, which in part, is courtesy of the impact of the fiscal expansion on infrastructure development.

He is correct to say that the young and the low-skilled are dealt the worst blow in any downturn and are the last to really benefit from recovery. That is one of the reasons I advocate a Job Guarantee to ensure there are always jobs available for the least advantaged workers in the labour market.

Henderson then reported on an interview on the ABC Lateline’s Friday Forum broadcast on December 11, 2009.

The exact interchange Henderson mentions went as follows (Presenter is Leigh Sales, Mark Arbib is the Minister for Employment Participation and Scott Morrison is the Opposition’s spokesman on Immigration):

LEIGH SALES: OK. Now we’ve had – there’s been a lot going on this week and I wanna whip us throw a heap of things really quickly, so let’s move on. Unemployment: Mark Arbib, this week we saw the third consecutive gain in jobs in Australia. How much longer can Labor argue that the stimulus doesn’t need to be recalibrated given that it’s based on Treasury forecasts that haven’t been realised?

MARK ARBIB: Well, look, we welcome the drop in unemployment. But you gotta remember though there’s still 650,000 Australians that are outta work and there are probably 100,000 of them, even more, that are under-employed – people who were looking for more work, more hours, but can’t get it.

LEIGH SALES: But the results are coming in that are better than what you anticipated when you set up the stimulus package.

MARK ARBIB: Sure, but on the ground, when you go out to communities, and I’ve just got back from Cairns where unemployment is over 11 per cent; a month ago it was 14 per cent. We had a job expo up there. 400 jobs on offer. 5,000 came through the door. And I was talking to people who are distressed. Like we talk about unemployment, but we don’t talk about the effect it has on people. They are distressed. And there’s gonna be a lot of people, Leigh – it’s not just there; in south-west Sydney at the moment, 47 per cent of teenagers are unemployed. We need to act and we need to keep stimulating the economy with these infrastructure projects, keep people employed.

LEIGH SALES: Scott Morrison, there is no doubt that Australia has weathered the global financial crisis better than almost any other country in the world, probably better than any other in the country in the world. Will the Coalition give Labor credit for its management of the situation?

Henderson’s claims that that Arbib’s comment that “47 per cent of teenagers are unemployed” in a certain area of Sydney:

… should have ignited astonishment. But Sales ignored the point and then suggested to Liberal Party frontbencher Scott Morrison that the Coalition should give Labor credit for its management of the economy. It was as if Arbib had not mentioned the 47 per cent figure.

I agree with him. Leigh Sales should have hammered him on this point and the regional disparities in labour market outcomes generally. Please read my blog – Maybe the unemployment rate has peaked – for more discussion on the regional issue.

It is also clear that the way the current government has disregarded the teenagers during this recession is a national disgrace and represents the true intergenerational burden that will emerge from the downturn in economic activity.

The conservatives like to think the public debt increase will punish future generations. That claim of-course only belongs in the mythology of the ignorant. However, the true disadvantage lies in denying teenagers the opportunity to work if they do not wish to stay at school.

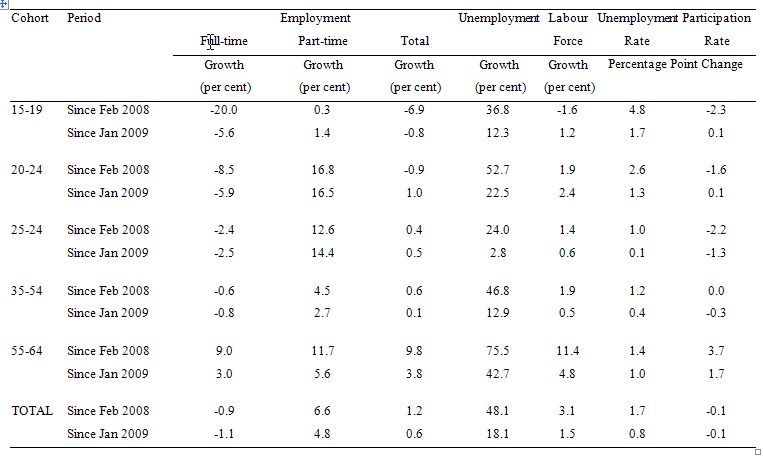

The following table is derived from ABS Labour Force data and shows the growth in employment (full-time, part-time, and total); unemployment and the labour force (per cent) and the percentage point change in the unemployment rate and the participation rate for the various age cohorts.

The selected periods are from February 2008 to November 2009 (the low-point unemployment month to the latest period) and from January 2009 to November 2009 (the period most affected by the fiscal stimulus).

The Table shows that the employment loss over the entire period of the downturn to date for teenagers has been 6.9 per cent compared to a modest rise in overall employment. Teenagers are losing full-time jobs at a faster rate than any other cohort and not enjoying the same growth in part-time employment as other groups.

The rise in the unemployment rate to date has been 1.7 per cent overall but for teenagers it has been 4.8 per cent. The impact of underemployment (not shown) has been very severe on the teenagers.

The reality is there are not enough jobs or hours of worked being created and when the labour market is rationed like that the employers use screening mechanisms to shuffle the jobless (and underemployment) queue. They use formal education, experience and other traits to ration the excess supply of labour.

Henderson then – finally – gets to his main issue. He says:

Before Sales diverted the conversation, Arbib suggested the only way to overcome high teenage unemployment was to “keep stimulating the economy with these infrastructure projects”. But this overlooks the fact most of the stimulus package has already been allocated. Also, the Rudd Government has already spent a significant amount of money in providing incentives for employers to hire apprentices.

Arbib’s concern about the high level of unemployment in Cairns and the large number of unemployed youth in south-west Sydney was genuine. But he failed to consider – and was not asked to consider – whether Labor’s re-regulation of the labour market may have contributed to the problem.

So you see the point. Henderson hates what he calls the “industrial relations club” which is characterised by labour laws that are administered through the unique wage tribunals we have in Australia and prevent the worst ravages of the competitive system.

It is true that “the stimulus package has already been allocated” and that the Federal government has “spent a significant amount of money in providing incentives for employers to hire apprentices”.

But Henderson’s argument is a non-argument. All he is telling us is that the amount and composition of the stimulus have been inadequate to reduce the rising joblessness in the face of the largest world downturn in 80 odd years.

In yesterday’s blog – Lesson for today: the public sector saved us – I showed how important public job creation has been in attenuating the rise in unemployment. Over the year to June 2009, private employment crashed (82 thousand jobs lost in net terms) while public employment growth was 3 per cent overall (adding 56 thousand net jobs).

It is clear that the Federal government could have added more jobs via a direct job creation strategy and targetted them at the youth. This would have significantly reduced their disadvantage.

The loss of jobs has nothing to do with the “re-regulation of the labour market” because the main provisions of that legislative change have not even taken effect (see below).

Mass unemployment arises from a lack of effective aggregate demand. Cutting wages in the face of a collapse of aggregate demand just makes the situation worse. Cutting specific age-related wages in the face of a collapse of demand will not have any impact on overall levels of employment but may at the margin shuffle the jobless queue – so the teenagers get employed on below-poverty line wages and the 20-24 year old group lose their jobs.

When there is a job ration operating wage cuts make the situation worse.

Henderson introduces the OECD Report Jobs for Youth: Australia which was released in April 2009. You can see a Summary of the report.

The main thrust of the Report was a review of the “transition of young Australians from school to work” and emphasised the need to improve educational attainment among the youth. As a legacy of the decade or more of conservative government and the neo-liberal policies of previous Labor governments, all obsessed with trying to run budget surpluses (by cutting its contribution to educational spending) Australia has:

- More chilren who leave school at 16 than in most other OECD nations.

- The percentage of young people leaving school early is higher than the OECD average.

- Employment and educational attainments are disturbingly low for Indigenous young people.

- For a minority of young people reliance on income support is the norm.

- Australia is the worst performer in terms of investment in early childhood education in the advanced world.

So when the labour market is rationed by inadequate aggregate demand (that is, not enough jobs being created) it is the youth that are most disadvantaged.

Henderson however focuses on one small section of the Report which talks about the industrial relations changes. The OECD said:

The Labour government has started removing some aspects of the WorkChoices legislation implemented by the former government. The new policy will include an enlarged safety net (reinstatement of dismissal rules for workers in firms with less than 100 employees and more minimum terms of employment and pay) and a phase-out of AWAs. Changes designed to protect vulnerable workers, including youth, who were found in some cases to be disadvantaged under WorkChoices bargaining arrangements, are welcome. However, care should be taken to avoid discouraging bargaining at the workplace level and pricing low-skilled youth out of entry-level jobs. The process of streamlining and modernising awards started under WorkChoices should also be continued.

AWAs were the Australian Workplace Agreements that the conservatives introduced to undermine pay and conditions. Workers were confronted with take-it-or-leave-it contracts and the rules allowed these contracts to reduce their existing conditions. Prior to the introduction of the Work Choices legislation bargaining could only improve overall conditions not reduce them.

The evidence is clear that the youth were savaged by Work Choices and it is one of the reasons they turned against the conservatives in the Federal Election in November 2007. It was an election fought on Work Choices and Climate Change (the most important of other issues). It is interesting that the same issues that the country overwhelmingly rejected in favour of more regulation and an interventionist approach are now emerging again as the key issues in the coming 2010 federal election campaign. The conservatives just do not get it – our nation does not want pernicious industrial relations rules that strip essential protections.

Anyway, Henderson picks up on the OECD statement that “care should be taken to avoid discouraging bargaining at the workplace level and pricing low-skilled youth out of entry-level jobs” and concludes that:

Small business is the main employer of young Australians. The re-regulation of the labour market, in particular the reintroduction of unfair dismissal legislation, has provided a disincentive for small businesses to employ young Australians. This is particularly the case with teenagers who have left school early and are not undertaking further education.

From next month most of Labor’s industrial relations agenda will be in place. The advent of Fair Work Australia will correspond with the seasonal entry of school leavers and young graduates into the workforce. Some will be taken on by the ever-growing public sector.

The main reason the teenagers do not have enough jobs is because there is deficient aggregate demand and they are disadvantaged in the shuffling of the jobless queue.

Henderson also says that “Arbib knows the problem but there is no evidence that he understands a possible solution” – thus trying to link the industrial relations issue back to the ABC interview I noted above. But the regional dispersion of unemployment and the age-cohort effects have occurred under the existing industrial rules that will be changed in January 2010.

That is, the new rules haven’t even been brought in. So that situation reflects the old rules. Why didn’t Henderson point that out rather than blurring the argument?

But there is a substantial body of evidence generated over a long period of time (including that produced by the OECD itself) that would reject the sort of conclusion Henderson is making.

For example, before the previous conservative government dismantled the judicial minimum wage setting process and installed a flakey employer-friendly process in its place, I was called regularly as an expert witness to the full bench proceedings.

In the May 2004 Federal National Safety Net decision (minimum wage hearing), the Full Bench of the Australian Industrial Relations Commission noted that

[163] Professor W Mitchell, Professor of Economics and Director of the Centre of Full Employment and Equity at the University of Newcastle, in a critique included in the ACTU’s reply submissions, raised a number of limitations in the methodology applied in regression analyses …

[166] Based on the material before us, we adhere to the conclusion reached in the May 2003 decision that it has not been demonstrated that there is a negative association between safety net adjustments and productivity growth. There is no necessary association between award coverage, safety net adjustments and productivity growth.

The last “national safety net” hearing in the AIRC before the conservatives dismantled the process was determined on June 7, 2005. The Reason for Decision the AIRC rejected the main employer groups claims that a rise in minimum wages is harmful with respect to employment. The Full Bench noted that:

[275] We do not propose to place any weight on the Commonwealth’s submission based on the data in Chart 14 above. The analysis undertaken by the Commonwealth relies on only a small number of observations. In the May 2004 decision, the Commission referred to the evidence of Professor Mitchell in which he raised a number of limitations in the methodology applied in regression analyses undertaken by the Commonwealth in those proceedings …

[276] It seems to us that at least the first two limitations identified apply with equal force to the Commonwealth’s analyses in these proceedings. Given the technical limitations of the exercise, the material does not allow us to reach any conclusions as to the impact of safety net adjustments on employee hours worked in the three most award-reliant industries …

[278] Based on the material before us, we are not persuaded that there is any necessary association between award coverage, safety net adjustments and employment growth.

I could quote several more instances where the claim that the coverage of awards undermines employment is rejected after exhaustive examination of the evidence before the AIRC.

There is also significant international evidence that rejects Henderson’s claims. In the face of the mounting criticism and empirical argument, the OECD begun to back away from its hardline Jobs Study position (that deregulation was essential).

In the 2004 Employment Outlook, the OECD (pages 81 and 165) admits that “the evidence of the role played by employment protection legislation on aggregate employment and unemployment remains mixed” and that the evidence supporting their Jobs Study view that high real wages cause unemployment “is somewhat fragile.”

In the 2006 OECD Employment Outlook entitled “Boosting Jobs and Incomes”, which is based on a comprehensive econometric analysis of employment outcomes across 20 OECD countries between 1983 and 2003. The sample includes those who have adopted the Jobs Study as a policy template and those who have resisted labour market deregulation. The report provides an assessment of the Jobs Study strategy to date and reveals significant shifts in the OECD position.

The OECD found that:

- There is no significant correlation between unemployment and employment protection legislation;

- The level of the minimum wage has no significant direct impact on unemployment; and

- Highly centralised wage bargaining significantly reduces unemployment.

The OECD (2006) found that unfair dismissal laws and related employment protection do not impact on the level of unemployment, merely the distribution. Critics of the OECD approach (including my own work) have consistently pointed this out.

In a job-rationed economy, supply-side characteristics will always serve to shuffle the queue. Internationally, there is a growing sentiment that paid employment measures must be a part of the employment policy mix.

The lack of consideration given to job creation strategies in the unemployment debate stands as a major oversight. There is growing recognition that programs to promote employability cannot, alone, restore full employment and that the national business cycle is the key determinant of regional employment outcomes.

In my recent book with Joan Muysken – Full Employment abandoned we consider the evidence in considerable detail.

There is also an interesting study from Stephen Machin entitled – Setting minimum wages in the UK: an example of evidence-based policy, which was presented to the Fair Pay Commission’s swansong research forum in Melbourne last year. In this volume you will also see an invited paper that I gave at the same forum.

Stephen Machin is Professor of Economics at University College London, Director of the Centre for the Economics of Education and a Programme Director (of the Skills and Education research programme) at the Centre for Economic Performance at the London School of Economics, an editor of the Economic Journal (one of the top academic journals), has been a visiting Professor at Harvard University and at MIT. So in mainstream terms he is thoroughly one of the orthodox club.

He examined the impact of the creation of the UK Low Pay Commission, which the Blair Labour Government established to try to remedy some of the worst excesses that the neo-liberal era had delivered to low wage workers. Both sides of politics in the UK from Thatcher onwards were remiss in this regard.

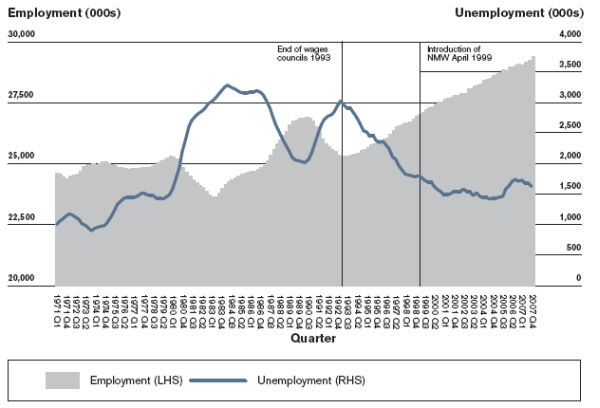

The UK Low Pay Commission (LPC) was established in 1997 and was given the task to define an effective National Minimum Wage (NMW). The following graph is taken from his Figure 1 (page 15) and is self explanatory.

Machin’s commentary is as follows:

The NMW was introduced in April 1999 at an hourly rate of £3.60 for those people over 21 years of age, with a development rate of £3.00 for those aged 18 to 21 years. The key economic question has been the impact of minimum wages on employment …

Over the period 1999 to 2007, the macroeconomic picture indicates that employment continued to grow as minimum wages rose (Figure 1).

What about effects on specific age cohorts. Machin concluded that:

Across all workers, there was no evidence of an adverse effect on employment resulting from the introduction of the NMW.

What about the effects in the most disadvantaged sectors? Machin reports on research that “searched for minimum wage effects in one of the sectors most vulnerable to employment losses induced by minimum wage introduction, the labour market for care assistants”.

He concluded that:

Even in this most vulnerable sector, it was hard to find employment losses due to the introduction of the minimum wage.

I would also note that a sophisticated society requires a decent minimum wage that is determined on the basis of what we want the floor in living standards to be. In the absence of regulation it is almost certain that the “market” would drive the wage below that level. In such cases, the employment is not desirable and so a Job Guarantee could set the minimum alternative employment that the private employers then have to better. They need to invest and ensure productivity can support the higher wage level. Its called a win-win.

Conclusion

Expect more from the conservatives on the industrial relations front. They lost the battle when the current federal government watered down the draconian legislation that gave employers a free for all.

Well lost the battle is a bit of an overstatement given that the current Labor government has hardly restored balance in the labour market. The rules are still biased towards the employers.

But the legislation did get rid of some of the major excesses in the conservative legislation that systematically undermined pay and conditions particularly those pertaining to the youth.

Digression: UK Opposition Shadow chancellor thinks they are part of the EMU

… or hasn’t got a clue where he is.

I lived in the UK for some time (studying for my PhD) during the dark years of Thatcher and the famous mining strike. But it seems that the conservatives are not as cunning anymore.

The Guardian carried this story today (December 21, 2009) – Osborne warns UK risks Greek-style crisis – where the probable future chancellor (George Osborne) thinks that “Britain is at risk of following Greece with rising interest rates and soaring debt repayments”.

In claiming the UK government needed a credible exit plan – the latest buzz phrase that is being bandied by conservatives everywhere – Osborne is quoted as saying that:

The people of Greece know what happens when the world loses confidence in your ability to pay your bills … It’s costing them an additional 2.5% on the interest rates they are paying to borrow.

Last time I looked into it, Greece was part of the EMU fixed-exchange rate system which places severe constraints on the independence of its fiscal policy and takes monetary policy out of their hands.

Further, I had not heard the news that Britain joined the EMU overnight. Maybe George knows something that no-one else in the World has worked out yet.

Pity our UK brethren if this character actually becomes Chancellor. Not that Alistair has much going for him given the state of the UK economy and his obsession with cutting public deficits even though the economy is still contracting.

Bill: The para just above your conclusion says “a sophisticated society requires a decent minimum wage that is determined on the basis of what we want the floor in living standards to be.”

I basically don’t agree with the principle that it is the employer’s job to pay a wage that equates to what some group of well intentioned do-gooders regard (rightly or wrongly) as being the minimum that is socially acceptable.

Indeed, it is bizarre that this principle is regarded as near sacrosanct in relation to minimum wages, yet the principle is widely flouted in other areas: that is, large sections of the working population in the UK and elsewhere are entitled to means tested in work benefits. Such people are being paid less by employers than is regarded as socially acceptable.

The underlying principle should be that it is the employer’s job to pay the market price for each employee’s labour (that way, GDP is maximised). In contrast, it is government’s job to tax the high earners and subsidising the low earners so as to produce some sort of socially acceptable outcome.

The latter principle (in principle (lol)) should produce a Pareto efficient outcome.

Hi, Bill-

Sorry to be dense here, but I don’t get this statement: “The conservatives like to think the public debt increase will punish future generations. That claim of-course only belongs in the mythology of the ignorant.”

Minimally, such debt promises interest+principal payments to be made out of the general treasury to the bond holders for the term of the bond. That doesn’t represent a net loss to the future national balance sheet, but it does lock in redistribution of wealth (interest) that seems unproductive and regressive, punishing future taxpayers.

While I understand that future government can pull money from any number of sources (taxes, debt, monetary, inflation), they have to use taxation to some degree, and insofar as they do, debt payments displace other useful spending. In the limit case, if future governments used no taxation at all, but only debt to pull money from the economy, would that be sustainable? I don’t believe so. The interest would have to come from somewhere else, assuming it was over the inflation rate.

Hi Burk:

Welcome to the blog. To answer your question we need to go through several old blogs Bill wrote enlightening the subject. A good starting point will be this one (atleast for me when I go introduced to these ideas,. Business card economy. In short, In a modern monetary economy, Governments have monopoly issuance over currency issuance and they per se need not “finance” their spending. In fact currency comes in to existence when the government spends. Hopefully some of these older posts that Bill made will help. Billy Blog in one page. Bill’s assertions may seem pretty radical initially, but once you try to think about it with a blank slate and try to look at the accounting behind the approach, it is straight forward.

Hoping to see more of you here.

Vinodh

Hi, Vinodh-

I realize there is no absolute financing constraint, but there is a monetary constraint- i.e. avoiding inflation, which in normal times requires some degree of “financing”, i.e. balancing incomes with outgoes of the respective sectors. Governments can not build up infinite amounts of debt, nor the private sector infinite corresponding savings. So there is a stop to the process, brought about by a desire for monetary stability, and it seems MMT are reluctant to address this part of the issue.

The business card economy is very nicely done, but again, why not give everyone infinite amounts of business cards, if you want to be nice to them, and demand minimal taxes/gov spending in return? Where does the free lunch end? I would speculate that it ends in inflation, which at the current moment is not the pressing issue, but in general is indeed a pressing issue.

Hi Burk,

I think you are not giving Bill enough credit. He is not arguing that the public sector should add assets in unlimited amounts, but that rather that the government should supply sufficient assets to meet the financial savings desires of the non-government sector.

By definition, the desire to accumulate financial assets means that you will not sell those assets and use the proceeds to buy goods. You are trying to divert some of your income from spending on goods to wealth accumulation, and therefore the government can step in and spend on goods without this being inflationary.

If the private sector on a net basis changed its mind and wanted to sell off some of their holdings and use the proceeds to spend, then you must admit that this means that the private sector is trying to reduce their financial holdings, in aggregate. At that point, the government could reduce it’s spending, increase taxes, and/or take other measures (e.g. tighten down on credit growth) to limit inflation.

So a policy to supply the private sector with sufficient government assets to satisfy their desires to increase their financial holdings cannot be inflationary — by definition. You can argue that it may be difficult to discern the turning points, etc, and that the proposed mechanism may lead to overshoots, but that is a separate issue and might lead to a productive discussion — rather than blanket claims of free lunches and infinite spending.

I would argue that such a policy is not always in the long term best interests of the nation — it depends on other factors, such as the reason why the private sector wants to save; the best response might be for the government to decrease the desire of the private sector to save (such as organizing debt-defaults). And I don’t necessarily think that the MMT people would oppose using other tools in their toolbox. They are simply pointing out that this is one tool that is being ignored. But regardless of which tool you prefer to use, you cannot argue that the MMT policies are inflationary.

Vinodh

Thanks for the link to “Business Card Economy”, there is so much of Bills stuff that Ive missed.

One thing that seems to be emerging from my cogitating on this paradigm is the idea that what the neo liberals really want is for the rich to act as currency issuers to the masses while the govt provides the rich with their savings. I’m not sure they would state it that way but all their actions and words lead one to believe that. Maybe some of you are thinking “Well duh, what took you so long to figure that out?!” and in that case, I guess I’m a little slow. Maybe that is the essence of trickle down thinking.

They seem to view the world strictly form the aspect of horizontal transactions within the private sector. Hence they say things like “savings lead to investments” or use terms like “crowding out”. The world is so much bigger than they imagine and they are holding on for dear life to their myths.

Bill,

Finally got time to read your blog again since commenting within ‘Oh my darling … mystery phenomenon spreads’ (Dec 9th, 2009), where I said in the course of events a Sovereign fiat-issuing Govt could become money-constrained during economic extremis, due to insufficient tax revenues or willingness to service unaffordable NET public debt growth.

I was gratified to read your oblique concession of this point on Dec 13th within “Building bank reserves will not expand credit” where you said, “Conclusion – It may be true that the politics in the US are so destructive that its sovereign government is constrained from using its fiscal instruments to advance public purpose. From my perspective-of understanding the intrinsic operations of the modern monetary economy-it is extraordinary that we allow ideological constraints to be imposed on our governments which conspire to prevent millions of disadvantaged workers from being able to work and force them and their families to live in poverty. …”

—

Thanks for acknowledging this as I was beginning to wonder if MMT was applicable to the real world. MMT is a beast that defies ideological pigeon-hole.

I cringe at Tony Blair’s abominable “Third-Way” crapulous nonsense from the mid-1990s. But perhaps MMT offers this possibility, a genuine third-way of doing business, both socially agreeable and economically stable.

I think most realise a detour through pseudo-alternative Green-party phantasms is a non-starter-interesting they are taking notice of MMT though. The Greens won’t govern Australia this century. Mainstream party bullyboys and exec-producers of major media outlets (privatised propaganda ministries-they got $400 million from Howard’s ‘advertising’ in 2007, and Rudd is doing the same) control Australian policy debate and direction.

Another post, “Direct public job creation now being debated”, where you propose a ‘Job Guarantee’ is the most promising and practical notion I’ve read on the topic of unemployment. I fully support what you said therein. Your ancillary social and efficiency comments get you a gold star and could even merit one of those much debased peace prize thingys.

i.e.

Article 22.

Everyone, as a member of society, has the right to social security and is entitled to realisation, through national effort and international co-operation and in accordance with the organisation and resources of each State, of the economic, social and cultural rights indispensable for his dignity and the free development of his personality.

Article 23.

(1) Everyone has the right to work, to free choice of employment, to just and favourable conditions of work and to protection against unemployment. (2) Everyone, without any discrimination, has the right to equal pay for equal work. (3) Everyone who works has the right to just and favourable remuneration ensuring for himself and his family an existence worthy of human dignity, and supplemented, if necessary, by other means of social protection. (4) Everyone has the right to form and to join trade unions for the protection of his interests.

Article 24.

Everyone has the right to rest and leisure, including reasonable limitation of working hours and periodic holidays with pay.

Article 25.

(1) Everyone has the right to a standard of living adequate for the health and well-being of himself and of his family, including food, clothing, housing and medical care and necessary social services, and the right to security in the event of unemployment, sickness, disability, widowhood, old age or other lack of livelihood in circumstances beyond his control. (2) Motherhood and childhood are entitled to special care and assistance. All children, whether born in or out of wedlock, shall enjoy the same social protection.”

Source: Universal Declaration of Human Rights – Adopted and proclaimed by the UN General Assembly resolution 217 A (III), December 10th 1948.

—

This Universal Declaration of Human Rights was instituted ASAP after WWII to build a global community that’s educated, developed, healthy, fair, just, and enjoys material, resource and trade adequacy. The declaration expresses the realisation that if countries and civil societies are less desperate and more secure, and informed, they will be less likely to lash out, as nuclear weapons technology proliferates unstoppably (i.e. they were planning for today). It’s a long-term plan for a sustainable global civilisation.

Employment and a viable wage were identified as key components for avoiding social and political-ideological ferment that degenerates into nationalist, class and racial inequality, which sprouts general violent conflict. It worked thus far-but only just-and may not work much longer if there is a second wave decent into depression.

We neglect these UN Human Rights articles at our very great mutual peril.

If the second most geopolitically and economically significant power has little (if any) respect for the 30 concise Human Rights articles we all have a big problem, especially when they tend to make authoritarian dictatorship look respectable, acceptable and fashionable at a global governance level.

If we want to avoid the blowback of geopolitical dislocation (many foresee) we best apply the UN Declaration of Human Rights 1948 and require full-observance from all trading partners, by 2020. Ten years notice-they’ve had >60 already. Meddling in your internal affairs? Then buy commodities elsewhere at much higher prices. They will scream but they will realise they have to get into step by 2020.

A Job Guarantee funded via MMT would be a serious new step in the right direction, provided the wage is set at a sufficient level to be socially viable. And soundly indexed-current indexing of welfare rises definitely do not track the actual price rises to cost of living (and I’m 100% certain the Govt and public service gurus know it).

I think anyone who can excel at something will. I certainly don’t think a Job Guarantee would in any way hinder excellence-I expect precisely the reverse over time.

And let’s not forget;

“Article 4. No one shall be held in slavery or servitude; slavery and the slave trade shall be prohibited in all their forms.”

The current Australian single adult Newstart rate is $228 per week. If you do work for the dole you get $10 per week more, regardless of whether you are obligated to do 6 hrs per week, or the maximum 25 hours per week. See if you don’t end up in a poverty trap, isolated, socially embittered, and likely homeless, with little regard for the system or Canberra scumbags that drove you there. Why would anyone at the bottom of society fight to the death to defend that unjust system? Or have any respect for state authority figures, law, public order, or even private property? At best Australian Centrelink welfare payments are designed to cap civil mutiny.

Rudd’s current desire to ‘quarantine’ all welfare payments is just the most recent example of how ignorant major Parties are about the daily challenges unemployed people face, and how little money they have (i.e. none), and why their lives and families routinely fall to pieces. Quarantined payments can not possibly improve a thing in that regard-but considerably more money definitely would.

When direct stimulus handouts were sent out this year the only group that didn’t get it were the unemployed who actually needed it more than anyone else in Australia. And because these people’s lives have fallen to pieces, the Government will now swoop in with payment quarantines until recipients can prove how they will spend it.

Most of these people pay 65 to 70% of their payment on exponentially increasing rent!

Rudd and his employment minister haven’t a clue, they just want to look like they’ve done something, “for the sake of the children”-pure political cynicism. The Conservatives are even more destructive of these families!

Govt skills training placement programs are a joke. Last I checked, during the peak of the boom a two-year Cert-4 apprenticeship position paid $35 per week >LESS< than work for the dole! I couldn’t believe it, it had to be a mistake, but on investigation was confirmed!

Could you live on that for two years?

Remember that the next time Rudd and his ministers spruik hundreds of thousands of new training placements, during next year’s election lie-athon. These are financial suicide for any independent participant. Unless you are supported by family, wealthy, or get a very large loan, or sell lots of drugs, forget about government skills training placements-they are a cynical charade structured to ensure abiding poverty and social desperation, while failing employer demand. Both parties are doing it.

Hence plundering of cheap pre-skilled immigrants from other countries skills base.

Your Job Guarantee is the only sensible suggestion I’ve read that could perfectly, directly and immediately solve the social need. “If it looks too good to be true, it probably isn’t”, is my perpetual suspicion, but if MMT really works as advertised, then it’s the only economic and social solution I see today.

Notice you say inflation is the only serious threat to be checked in MMT. I’d appreciate some plain-speak expounding before finer technical details.

PS: Tried ordering your new book today but retailer says not available on their listing yet.

Burk (23rd Dec) suggests that repayment of government debt (plus the interest on it) is some sort of burden on future generations. Vinodh (23rd Dec) answered Burk’s point by reference to fiat currencies, modern monetary theory,etc.

I agree with most MMT ideas, but one does not need to appeal to anything connected to fiat currencies or MMT to answer Burk’s point. The answer to Burk’s point lies very largely in Physics (believe it or not), rather than in economics.

To illustrate, if government borrows and spends money in year X on let’s say infrastructure projects, there is no physical way that the concrete, steel etc can be produced by people in ten year’s time. That is, there is no way that people living ten years after year X can make any sort of physical sacrifice to create the infrastructure. And getting new born babies and the as yet unborn to supply the labour to create the infrastructure is a slight problem too! That is, the real sacrifice, or the real cost of this spending absolutely has to be born in year X (assuming there are not excessive piles of steel etc left over from the previous year).

Incidentally, exactly the same point applies where government borrows to fund current rather than capital spending.

That is, where government borrows and spends (on capital or current expenditure items) in year X, some other form of consumption absolutely has to be forgone to provide the resources (assuming the economy is already working at capacity).

Burke also claims that “debt payments displace other useful spending”. No – debt repayments cannot displace any sort of PHYSICAL output in the years after year X. These repayments simply shuffle money between different sections of the population.

The only way round this physical point is to borrow money from abroad. That way, at least to some extent, foreigners make real sacrifices to supply the steel, concrete, etc.

You must be kidding Ralph. The government has no budget constraint in terms of its own currency.

If the government decided to borrow money abroad it would be a political choice not because they had no other options.