I started my undergraduate studies in economics in the late 1970s after starting out as…

Lesson for today: the public sector saved us

The calls from the conservatives right across the globe for a fiscal retrenchment are growing. They have seen the share markets rise and Wall Street are talking billion-dollar bonuses again and so it is assumed that all is well. But the wiser heads know that the economic situation is very fragile at present and the growth process is poised delicately on a knife’s edge. It is also clear that public net spending is driving growth everywhere and that the recovery in private spending is some way off yet. The private sectors around the world have barely started to repair their precarious debt-laden balance sheets. That process will require some years of robust saving and hence will contribute to on-going spending drag. So it is interesting to reflect on some data that shows categorically the impact that the fiscal intervention has had in underwriting growth and reducing employment losses.

This week’s Economist Magazine carries a story entitled – The Great Stabilisation which argues that the “recession was less calamitous than many feared” but its “aftermath will be more dangerous than many expect”.

They say that the “Great Recession” could easily be called the “Great Stabilisation” because “2009 was extraordinary not just for how output fell, but for how a catastrophe was averted”.

They note that “there has been a lot of collateral damage” with “Average unemployment across the OECD is almost 9% … years of progress in poverty reduction have been undone” but “For many people on the planet, the Great Recession was not all that great”.

In this regard they conclude that:

That outcome was not inevitable. It was the result of the biggest, broadest and fastest government response in history. Teetering banks were wrapped in a multi-trillion-dollar cocoon of public cash and guarantees. Central banks slashed interest rates; the big ones dramatically expanded their balance-sheets. Governments worldwide embraced fiscal stimulus with gusto. This extraordinary activism helped to stem panic, prop up the financial system and counter the collapse in private demand. Despite claims to the contrary, the Great Recession could have been a Depression without it.

So a tick for fiscal intervention.

The Economist also considers that notwithstanding the semblance of stability that is emerging in the World economy, the way forward is “worryingly fragile, both because global demand is still dependent on government support and because public largesse has papered over old problems while creating new sources of volatility.”

They emphasise that:

Apparent signs of success … make it easy to forget that the recovery still depends on government support. Strip out the temporary effects of firms’ restocking, and much of the rebound in global demand is thanks to the public purse, from the officially induced investment surge in China to stimulus-prompted spending in America. That is revving recovery in big emerging economies, while only staving off a relapse into recession in much of the rich world.

This insight is very apparent in Australia, one of the least affected economies in terms of real GDP loss and unemployment increases.

Last week’s National Accounts brought home categorically how much the national economy was relying on public spending. Please read my blog – Creeping along the bottom only – for more discussion on this point.

Even the right-wing oriented national daily The Australian carried a story today – Reserve may have rushed on interest rate rises.

The article, written by economics correspondent David Uren (who is actually quite reasonable and I have dealings with him often in helping him out with his stories), makes the point that:

THE Reserve Bank may have jumped the gun with its three consecutive interest rate rises. Growth will have to accelerate sharply to meet the bank’s forecasts that it will reach 1.75 per cent this year, and 3.25 per cent next year … The Reserve Bank has been lifting interest rates in the face of advice from the International Monetary Fund and the G20 that neither fiscal nor monetary stimulus should be withdrawn until it is clear that a self-sustaining recovery has been established.

Uren reflects on last week’s National Accounts result and says it is clear that Australia “remains in the grip of a serious economic downturn and highly reliant on government stimulus spending to achieve growth at all.”

Certainly in terms of the production measure of GDP, Australia has been in a recession (December and March quarters) and was struggling to grow during the September quarter. Over the 12 months to September, the production measure shows total output remains lower than it was in September 2008.

Uren notes that:

The marks of the government’s stimulus program are to be found all over the national accounts. The Treasurer said the home insulation program had contributed to the 5.9 per cent lift in housing investment, which was led by alterations and renovation. This included the installation insulation in a staggering 800,000 homes. Swan said the government had a total of 49,000 construction projects (including many repairs to public housing) under way.

The Opposition Treasury spokesperson Joe Hockey, who is leading the charge against the fiscal intervention, came out on the ABC 7.30 Report the night after the national accounts were released (December 17, 2009) and among crazy comments was this one (Kerry O’Brien is the presenter):

KERRY O’BRIEN: … But do you accept the Treasury’s figures that without the stimulus spending that’s taken place so far, Australia would be two per cent in the red, that the economy would have actually shrunk by two per cent, instead of growing by half a per cent this year?

JOE HOCKEY: Well there’s a lot of figures you could use. For example, the trade accounts were incredibly favourable to us. In March of this year, which ensured we did not have a negative quarter. In the last quarter of the national accounts – September, released just a couple of days ago – the trade accounts were very unfavourable to us. If they were as favourable as they were six months ago we would have had a very strong economic performance in the last quarter …

Uren notes that “Hockey, produced a highly misleading media release after the national accounts, subtracting the contribution of imports but not the contribution of stocks to claim the domestic economy was going gangbusters”.

The reality is that the Australian economy is barely growing and certainly not fast enough to absorb the new labour force entrants and the rising productivity growth rates evident in the September quarter figures.

The actual ABS data shows that in spite of this blustering by Hockey, if you took the discretionary stimulus out then GDP growth would have been negative for some quarters now, irrespective of the the external accounts. There is no case to be made for withdrawing the fiscal intervention based on this data.

Further, Uren concurs with the point I made last week in my blog – Creeping along the bottom only – that per capita GDP figures “have been going backwards now for five quarters, with a total 1.8 per cent fall in the last 12 months”.

The point? The Australian economy like the World economy remains very dependent on fiscal spending impacts and the deficit terrorists must be on another planet not to see that in the data.

The fiscal impact

On December 8, 2009 the Federal Treasury made a presentation entitled The Return of Fiscal Policy to the Australian Business Economists Annual Forecasting Conference 2009.

I would note that I disagree with most of the theorising presented by the Treasury. Statements that “Australia was in a position to implement a fiscal response that was large relative to other advanced economies because it started in such a strong fiscal position” are without any economic meaning in the context of the fiat monetary system.

Perhaps in a political sense it was easier but then the real economy would have soon softened the political debate as it has in other countries where deficits are very much larger as a percentage of GDP – as they should be – than anyone would have deemed “politically possible” a few years ago. Everyone is becoming attuned to the idea that maybe the last dollar of net public spending saved their very own job.

But the Treasury remains a neo-liberal haven and so their rhetoric is what you expect. But the graphs are interesting (although I am sure that I would have qualms about some of the underlying assumptions in the modelling that produced some of the estimates). I suspect though that my qualms would lead to the conclusion that the estimated impacts would be understated rather than biase upwards.

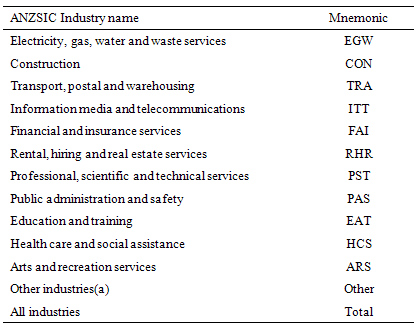

The following graph is reproduced from Graph 10 in the Treasury presentation (using the fabulous Enguage software).

The accompanying text said:

Chart 10 shows Treasury’s estimates … of the effect of the discretionary fiscal stimulus packages on quarterly GDP growth. These estimates suggest that discretionary fiscal action provided substantial support to domestic economic growth in each quarter over the year to the September quarter 2009 – with its maximal effect in the June quarter – but that it will subtract from economic growth from the beginning of 2010.

The estimates imply that, absent the discretionary fiscal packages, real GDP would have contracted not only in the December quarter 2008 (which it did), but also in the March and June quarters of 2009, and therefore that the economy would have contracted significantly over the year to June 2009, rather than expanding by an estimated 0.6 per cent.

So for all the conservatives who wanted no fiscal response – the message is clear – Australia would have been in a 3-quarter recession if the intervention had not have occurred. Note this is the discretionary action only.

The automatic stabilisers also add to aggregate demand as the business cycle nose-dives. The Treasury do not estimate this impact but I suspect it will significant given the collapse in tax revenue.

They also estimated the impact of the rapid reduction in interest rates by the Reserve Bank on GDP growth rates and concluded that:

… this fall in real borrowing rates would have contributed less than 1 per cent to GDP growth over the year to the September quarter 2009, compared with the estimated contribution from the discretionary fiscal packages of about 2.4 per cent over the same period.

So discretionary fiscal policy changes are estimated to be around 2.4 times more effective than monetary policy changes (which were of record proportions).

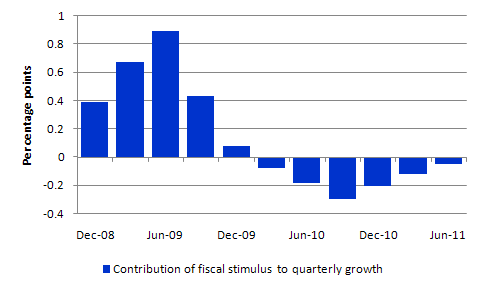

To see what might have happened I compared actual quarterly real GDP growth (the upwardly biased expenditure measure) from September 2007 to September 2009 with and without the estimated impact of the discretionary fiscal stimulus. The following graph shows you what might have happened. Australia would be languishing in recession (at least up until the September 2009 quarter) and the labour market would be in considerably worse shape than it already is currently in.

The information also allows us to reflect on the conservative statements that the Australian economy escaped recession because of the free market-oriented reforms that have been inflicted on us over the last 20 years. There has been a cacophony of claims to this end – “we are more resilient as a consequence” etc. Well we begin to look like other nations (not the worst but most others) when you take out the public contribution to output growth over the downturn period.

What about employment?

Analysis of GDP is really just a means to an end – to what is going on in the labour market. So what has been the impact of public employment changes over the last year or so?

Last week the ABS released its Employment and Earnings, Public Sector, Australia, 2008-09, which is in its second year of publication.

This publication documents the changes in public sector employment between June 2008 and June 2009. We can also marry this data with the Labour Force Survey data (Table 04. Employed persons by Industry – Trend, Seasonally adjusted, Original) to compare the relative contribution of public employment changes to the overall labour market outcome.

Some gymnastics were required given the detailed industry labour force data is quarterly only (aligned at May) and the public employment data is for June. I took the actual Labour Force totals for June 2008 and June 2009 and then prorated those respective totals by industry using the share in total industry employment at May 2008 and May 2009, respectively. This assumes the industry shares are static between months which is not 100 per cent accurate but not so inaccurate that the results would be very different.

So the analysis allows us to see in net terms where the jobs have been expanding and contracting by industry with public and private sector breakdowns. That is what the next discussion is about. We should be clear that the analysis in this part does not show the impact of the discretionary fiscal stimulus – some of which boosted employment in the private sector directly.

But what it does show is the counter-cyclical response of public employment, which is in stark contradistinction to the behaviour of the Keating government in the 1991 recession. Over the 1991 recession, federal public employment became pro-cyclical. That is, under the misguided neo-liberal fiscal mentality that the Keating government advanced they sought savings in public sector employment “to pay for” other initiatives. Further, the ultimate fiscal response during that period came too late to stop the damage that the downturn caused. It was a very bleak (and irresponsible) period for the conduct of macroeconomic policy.

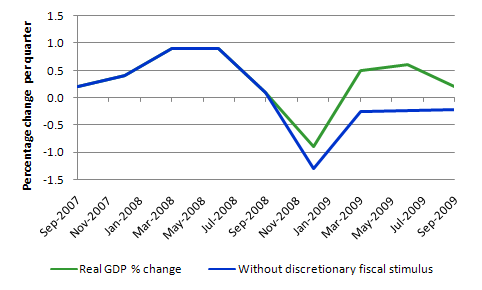

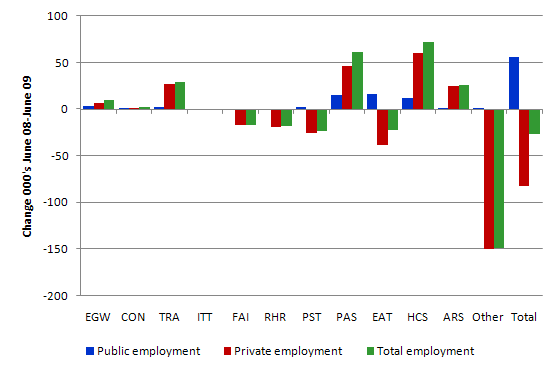

The following table shows public and private employment by industry (in thousands) and the public share in total employment (per cent) for June 2008 and June 2009. Overall total employment in Australia (seasonally adjusted) fell between June 2008 and June 2009 by 26 thousand in net terms. However, private sector employment actually contracted by 82 thousand overall. The increase in public sector employment by 56 thousand jobs helped offset the private contraction.

Further, some of the private sector employment growth (in particular industries) reflects the public spending initiatives (particularly the cash bonus and the infrastructure spending). So the impact of the fiscal intervention on employment is significantly greater than is shown here.

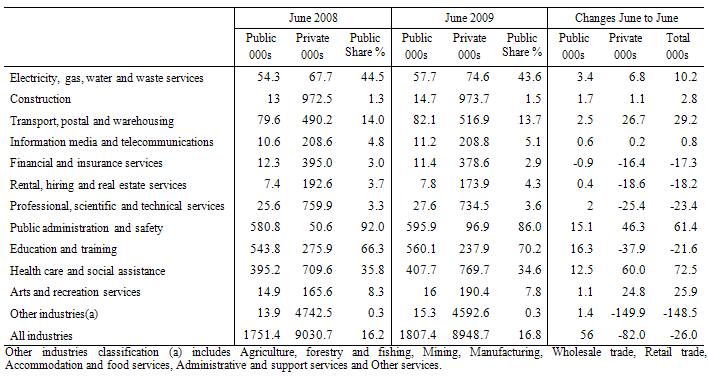

The following graph shows the same information for those who prefer to see things in pictures. The final column shows the total impact and the positive contribution of the public sector (blue bar) is striking. By way of interest 82.7 thousand jobs of the 148.5 thousand lost in Other industries were in manufacturing. Mostly male full-time jobs.

The industry codes in the graph are as follows:

What if?

While total employment fell by 0.24 per cent over over the 12 months to June 2009, private employment declined by nearly 1 per cent while public employment grew by 3.2 per cent.

Clearly, the extraordinary growth in public employment has reduced the rise in the unemployment rate.

What would have happened if public employment had not have grown over this period? As a rough approximation we assume that that there was no change in participation so the labour force grew at its actual rate over the 12 months to June 2009 (1.41 per cent), and all the extra public sector jobs created in the year ended up in the jobless queue so that public sector employment was static.

Under these assumptions, unemployment would have risen from 661 thousand to 717 thousand and the official unemployment rate would have been 6.3 per cent instead of 5.8.

But of-course without the strong public employment growth private employment would have declined even further than it did although there would have been increased leakage via a falling participation rate which would have attenuated the jobless rise.

However, the unemployment rate would have probably increased higher than 6.3 per cent given that the public employment growth impact understates the full impact of the discretionary fiscal policy expansion.

Conclusion

The data for Australia categorically supports the claim that the early and significant fiscal intervention that the federal government introduced (starting late 2008) has saved Australia from a very deep recession and protected thousands of jobs that would otherwise have been lost.

Was this the correct response? While its timing was sound I think the deficit should have been increased by a few more percent of GDP to really arrest the labour market deterioration. I would have used this crisis to introduce a Job Guarantee and protect the most disadvantaged workers who are bearing the brunt of the downturn.

And to all those who wanted to let the “markets sort the mess out”, all economies would have ended up with rising budget deficits – and they would have been accompanied by even further declines in tax revenue, even higher unemployment and household and firm bankruptcies would have been far greater in incidence. In other words, a bad budget deficit driven by the automatic stabilisers as a result of the very ugly decline in aggregate demand.

The deficit terrorists can deny that if they like but it is indisputable that the outcome would have followed those lines – only the magnitude of the decline is uncertain.

Further, the economy is clearly very fragile as is the World economy and governments are going to have to continue supporting growth for a long time yet. The evidence demonstrates that it is too early to even think about fiscal contraction.

In that regard, pity the UK, pity Greece, and pity other places that are falling into the neo-liberal trap.

ps: as a nice story about public sector job creation schemes this World Bank video, which shows the way in which a roads building project is reducing poverty in Yemen, is short but sweet.

Great post.

Is it possible that Bernanke is deliberately leading the economy back into recession? After all, That does follow the neoliberal gameplan, doesn’t it?

Bernanke, Summers, Geithner and Obama are all singing from the same hymnal now–Cut the long-term deficits and to hell with unemploment.

I don’t think Bernanke is stupid. In fact, he is very bright. He knows that quantitative easing hasn’t revved up lending. Just like he knows that cuts to government spending will lead to a double dip recession. So what’s the plan?

Looks like its “starve the beast”–create another crisis by slashing fiscal spending and then let private industry pick up public assets and services for pennies on the dollar?

Am I wrong, Bill?

The primary concern is that the deficits will sap and impurify our precious bodily fluids.

MMT’ers should fight – no sniping (especially with blanks)!

Dear Bill – thankyou for the introduction to MMT this year. One thing I have noticed is the rather meek call to activism now and again; or the hope that someone may instigate a class action against the RBA for abandoning its charter!

The strength of MMT is in its perspective: the helicopter that flies above the traffic ‘accident’, whilst the authorities on the ground scramble with the mess, and the rest of the system blindly channels more traffic into an inevitable systemic (human) fiasco.

I visit the ‘progressive’ financial blogs each day (the MMT camp first) to keep track of the conceptual drift. Another thing I notice is how each blog is like a little cloud floating around in the atmosphere, quite separate from all the rest. This is what I mean by sniping with blanks. If MMT’ers have anything to say about the ideology and print of any other camp – be it global like the OECD, IMF, BIS or World bank; or local like a Reserve Bank or Treasury; or individual – then that is the ideological cloud in which the response must be made. Face to face as it were, or as close up as possible. Any ideological battle should be fought hand to hand – how else can you respect your antagonist? How this can best be done requires some thought.

MMT has the perspective to accomplish this! And enjoy the battle!

Macroeconomics is global as is neoclassical ideology, which leads to the conclusion that the message needs the absolute minimal global coordination to produce the maximal message output. In this sense there is no reason why the message cannot be clothed in street wear, as well as institutional finery.

For example, MMT’ers might organise amongst themselves to respond to selected ‘ideological clouds’ with short point positional statements and explanations, that link to their own analysis and blogs. One global MMT website could index, link and coordinate these. Other MMT’ers might respond to street media churning of ideological misconceptions. Of course it is the ideology that needs to be challenged, not the people under its sway. Activism means activity that is effective, by people working together with a plan and a purpose, responding dynamically to results.

What can change in 2010?

I can see it now. Ninety-nine percent of economists and policy makers resigning from their jobs tomorrow saying ” we were wrong”. Not likely.

Imagine Chris Richardson making an anouncement such as: “Access economics will be closing it’s doors because we have no idea how the macroeconomy functions”.

Perhaps all RBA employees and Treasury employees will submit their resignations, and while we are at it lets add all the neoliberal academics and media commentators who have got it wrong to the list as well.

You lot live in a fantasy world if you think the truth has any value in this pissant country.

What matters is that the gap between rich and poor is as wide as possible and the sooner any remaining wealth the middle-classes has is transfered to the rich the better.

Good to see you’re still putting Engauge to good use Bill!

Alan Dunn says: Tuesday, December 22, 2009 at 10:00

“You lot live in a fantasy world if you think the truth has any value in this pissant country.

What matters is that the gap between rich and poor is as wide as possible and the sooner any remaining wealth the middle-classes has is transferred to the rich the better”.

Dear Alan – I take it from the first idea above that you are feeling a little piqued by what you see around you. You are not alone. In the next idea you don’t say why the gap matters or the wealth transfer is better so I’ll leave that one? But because you are not alone – the issue of the surrender people make in the belief that problems are insurmountable, should be explored.

Where on earth, for example, would an unknown student get the courage to stand up in front of a tank in Tiananmen Square, and become an enduring symbol that continues to grow in power; or a Nelson Mandela; or Martin Luther King et al. They were in their beginning and end – just human beings. Their real power lay in the people that stood behind them, for whom hope was their shield. There is a passion there that resolutely defied all odds – and is not ‘logical’. There is something in the human spirit rises to the surface, and is far more powerful than the forces that hold even a regime together. The walls of China, Berlin and Gaza all built by people who didn’t understand that. The economic, social, political and religious walls will all, in good time, prove the same – and I can say this with absolute certainty. Why?

Because I understand the true nature of a human being. Is there ‘good’ in you, or are you totally corrupt? I think not. That there is a battle royale that goes on within you every day between the good and the usual human complaints of selfishness, emotional disturbance and mental error, just means you are in the same boat as everybody else on the planet. However, this does not diminish in any way the intrinsic value of the good (or you). Look into the good within you and you will see how it has shaped your life; look into the good in humanity and you will see how it is the penultimate force that shapes the planet. The history books have it wrong – I am sure this would not surprise you! People look in fear at the shadows in this world, but if they would just turn around, they would see that shadows are caused by something in front of the light.

A friend of mine once told me, if there is just a small sliver of light in a dark room, you cannot improve things by trying to bucket the darkness out of the room. Wasted energy, wrong thought, wrong battle. Bring in just a little more light and automatically the darkness is removed. That is why the efforts of the MMT’ers in my view, are courageous and worthwhile. A seed is planted and watered and cared for. Every truth will have its day.

Given the power to feel, to think and to act – what we feel, what we think about, what we action – is down to each individual. Your consciousness is your own real estate, and the state of your property your own maintenance – of course sometimes the storms will come. The good in you, I would wager, has always been your safe-haven! Unless of course you believe the advertising fraternity, who want to sell you things like ‘Hahn’ as your safe-haven! Has not all personal growth you have ever made, been in some way, when everything is boiled down to its essence, a response to the good in you? The quest to be fulfilled, the need to be content, the thirst for knowledge, the need to understand. An innate desire for justice, the longing for right human relationships; the need for peace. That is what it means to be a human being. Why should you not fight to assert your humanity and dignity as a human being – it’s who you are! MMT, in my view, takes this fight to the collective.

Obviously you can think very clearly when it comes to identifying some problems. Why not use that clarity to write to Mr. C. Richardson and tell him yourself what you think. He always looks half smug – half really worried on TV when he makes predictions and statements – maybe he doesn’t really believe, either in himself or in what he is saying? Maybe, what you say will open up the impasse a little wider?

When people talk to other people, if the topic is worthwhile, it will be passed on.

Cheers …..