These notes will serve as part of a briefing document that I will send off…

The European Union has been designed and run to maintain the corporate interests of the elites – no surprises there

After the Far Right National Rally (RN) took the prizes in the recent European Parliament elections and seriously dented the electoral appeal of Emmanual Macron’s grouping, the French President decided to follow the British script and dissolved the French Parliament and called a snap election, the first round of which will take place on June 30, 2024 and the second round a week later. Far right parties also did well in Germany, Italy and Austria, but all the talk of a sharp swing to the right in Europe was overstated, given that in other nations, the Right vote was not as strong. The deals to give the European Commission presidency to VDL for another term were then in full sway. And within days we started to observe some strange behaviour in the bond markets with the 10-year bond spreads against the German bund rising sharply with accompanying warning bells from the mainstream politicians – some even venturing to claim in France’s case that it would experience a ‘Truss moment’ if Macron was not returned to office, despite his government floundering due to its poor policy making. None of this should come as a surprise. The European Union is the most advanced example of neoliberalism, given that the ideology is built into its legal structures and the institutions are required to enforce it. There are countless examples, of the main institutions – the Commission and the ECB – acting individually and together to drive political outcomes that they deem to be desirable from the perspective of maintaining the status quo. All the angst in the last few weeks about interference in the upcoming French election is really surprising given the track record of these bodies. The whole system has been designed and run to maintain the corporate interests of the elites. Pure and simple. The current situation is no exception.

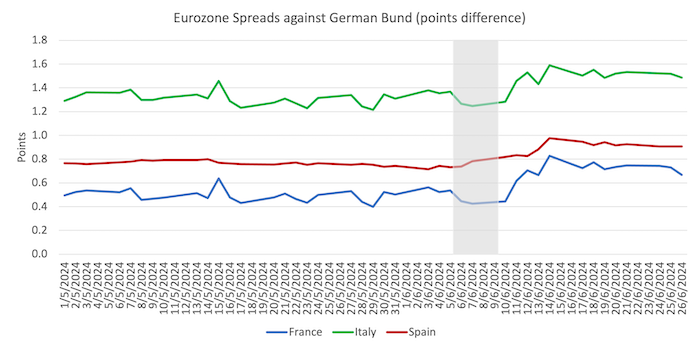

The graph below shows the 10-year bond spreads for France, Italy and Spain from the start of May 2024 up to yesterday (June 26, 2024).

Italy and Spain diverged from France during the GFC, and then Italy diverged from Spain around 2018.

The most recent data shows that the gap between France and Spain has narrowed considerably over the last month.

The grey area is the period of the European elections (June 6-9, 2024).

Over the period shown, the 10-year bond yield for the German bund has barely moved, falling slightly, whereas the other nations shown have seen their bond yields (and deficit financing costs) rise marginally.

Don’t be deceived by the scale of the graph – the bond yields in France rose from 2.988 per cent on June 6, 2024 to a peak of 3.239 per cent on June 11, 2024 and then fell back to 3.119 per cent on June 26, 2024.

For Italy, they rose from 3.807 per cent on June 6, 2024 to a peak of 4.081 per cent on June 11, 2024 and then fell back to 3.93 per cent on June 26, 2024.

For Spain, they rose from 3.282 per cent on June 4, 2024 to a peak of 3.493 per cent on June 10, 2024 and then fell back to 3.358 per cent on June 26, 2024.

These shifts are nothing like we witnessed during the GFC when Spain and Italy diverged from the German 10-year bond yield by at least 6 percentage points and France by more than 1 point.

The coincidence between the end of the election period and the revelations that accompanied the publication of the results led many Leftish commentators to pronounce that it was a conspiracy led by the financial markets to derail anything other than pro-euro (centrist) governments so that Ursula VDL would return to the Presidency and the elites would continue to enjoy the smug prosperity that the common currency has delivered to them – at the expense of the many.

There were rather inflammatory remarks in the press that the ECB was manipulating markets to allow the centrists (a misnomer if there ever was one) to remain in control.

There have been changes on the ECB front with the phasing out of the Asset Purchasing Programs that have dominated monetary policy since the GFC and the 2022 introduction of the so-called – Transmission Protection Instrument (TPI) – or anti-fragmentation tool to replace the bond yield control that the APPs gave the ECB.

The ECB claimed the TPI was essential to allow for a normalisation of monetary policy – which is the same sort of justification it gave for each of the various asset purchasing programs that began in May 2010 with the introduction of the Securities Markets Program.

It was a ludicrous argument – pretending that the ECB needed to buy billions of euro worth of government bonds to allow for smooth open market operations and repos to be conducted.

Only a small fraction of what they actually ended up buying was needed for those monetary policy purposes.

The justifications were a smoke screen to obscure the reality that the ECB, as the currency-issuer was indirectly funding fiscal deficits in the Eurozone for fear that if it didn’t many nations including Italy and Spain would be forced to default on its outstanding government debt, which would ultimately result in a break-up of the common currency.

The ECB couldn’t come clean because it would have meant they were publicly acknowledging a violation of their legal obligations under the European treaties pertaining to no bail outs.

But that is all history.

More recently, as it phased out the asset purchases, it realised that the Member State bond markets were still at risk of financial instability because everyone knows the debt issued by these nations carries credit risk.

The reason is that the Member States use what is effectively a foreign currency and must borrow from the bond markets to run deficits.

If the deficits get too large, the default risk rises and the bond markets demand higher yields up to some point, after which they will stop buying the debt.

But as I have noted many times before, the ECB can prevent this form of financial instability very easily – by purchasing the debt in the secondary bond markets after it has been issued, which drives up the demand for the assets (and the price) and drives down the yields on the paper.

The TPI thus allows the ECB to claim that it is normalising its balance sheet by phasing out the earlier bond purchases.

But that is smoke and mirrors too – because the TPI is just another version of the same asset purchasing programs that have become a sort of alphabet soup as the ECB changes the names to give the impression it is evolving its policy stance.

The ECB tells us that the TPI means that:

… the Eurosystem will be able to make secondary market purchases of securities issued in jurisdictions experiencing a deterioration in financing conditions not warranted by country-specific fundamentals, to counter risks to the transmission mechanism to the extent necessary. The scale of TPI purchases would depend on the severity of the risks facing monetary policy transmission. Purchases are not restricted ex ante.

In English – the ECB and its partner Member State central banks can buy up the debt of any Member State government in unlimited quantities if the bond spreads rise and threaten financial stability.

Clear enough.

As usual, there is conditionality – “The Governing Council will consider a cumulative list of criteria to assess whether the jurisdictions in which the Eurosystem may conduct purchases under the TPI pursue sound and sustainable fiscal and macroeconomic policies.”

So:

… (1) compliance with the EU fiscal framework: not being subject to an excessive deficit procedure (EDP), or not being assessed as having failed to take effective action in response to an EU Council recommendation … (2) absence of severe macroeconomic imbalances … (3) fiscal sustainability: in ascertaining that the trajectory of public debt is sustainable … (4) sound and sustainable macroeconomic policies: complying with the commitments submitted in the recovery and resilience plans …

This where the politics enters.

The EU has not been consistent in its application of any of the fiscal enforcement rules.

Different nations have been treated differently despite having similar rule breach magnitudes.

Which is, in part, why people are accusing the ECB of being political.

The question they ask is why the ECB didn’t invoke the TPI in the days following the European elections when the spreads started to rise?

The French economy is in dire shape after years of the neoliberal policies that have stifled innovation and reduced productivity growth as well as living standards.

And then France already reeling from the policy abuse came up against the pandemic, the supply constraints, the Ukraine war and the resulting the inflationary pressures.

Life for the average worker in France in material terms has deteriorated significantly over the course of Macron’s tenure.

But the claims that the financial markets were “spooked” by the fiscal situation and that led to the bond yields rising (Source) do not stack up.

The fiscal situation has been known for some years (since the pandemic) and has been absorbed by the financial markets.

The RN leader has also been clear that the Party is not about to go on a spending spree should it gain a parliamentary majority in the upcoming election.

The Party has promised to (Source):

… bring France’s deficit back to 3 per cent of gross domestic product by 2027, which is the level set out by EU rules.

In fact, he is promising more severe austerity than Macron has announced.

The European Commission also entered the fray and decided that it would do what it could do influence the election result by announcing that France was being placed in the – Excessive Deficit Procedure.

On June 19, 2024, the Commission released a – Report under Article 126(3) of the Treaty on compliance with the deficit and debt criteria – which represents:

… the first report under Article 126(3) TFEU after the deactivation of the general escape clause at the end of 2023, is in accordance with the rules of the reformed framework.

So the relaxation of the fiscal rules during the pandemic is over and the Commission is now targetting Belgium, Czechia, Estonia, Spain, France, Italy, Hungary, Malta, Poland, Slovenia, Slovakia and Finland for excessive deficits.

The question that is impossible to answer clearly is whether they lumped all the other nations into this edict to hide the fact they wanted to influence the French election.

My answer is that the Commission was not discriminating in that way.

The French government though hasn’t helped matters.

The Economy Minister, the bumbling Bruno Le Maire claimed that if the voters chose RN in the upcoming election:

A Liz Truss-style scenario is possible …

Someone should have pointed out to Le Maire that comparing France, without a currency, to Britain with its own currency and unlimited capacity to create it, just demonstrates the ignorance of the person making the comparison.

But you can see how quickly the sound finance types adopt ‘lines in the sand’ or ‘lurid examples’ to push into the political fray whenever it seems convenient, irrespective of the validity.

The Left does this often – the Britain forced to borrow from the IMF in 1976 lie, the Mitterand had to impose austerity in 1983 lie, the Black Wednesday lie, and, now it seems the “Liz Truss-style scenario” lie.

The situation in Britain arose because the financial markets knew that Truss was on shaky political ground and would back down at the slightest problem.

So they knew they could force the weak government to ratify their financial market bets in their favour.

The same sort of actions have been tried in Japan for years without success because the authorities stare the markets down.

But the French government cannot easily stare anyone down because it doesn’t have its own currency sovereignty and is reliant on an ideologically-obsessed ECB (the currency issuer) for financial solvency.

The ECB and the EC then combine (with the IMF added sometimes) to bully the Member States into submission.

Nothing like the political situation in the UK.

The markets know that it can impose a Greek-style compliance on France and the French government has little volition – simply because it surrendered its own currency.

So what about the ECB’s reluctance to invoke its TPI?

The official line, which was expressed by the chief economist and board member to an audience in London on June 17, 2024 was:

What we’re seeing in the markets is, of course, a repricing … It’s not, you know, the world of disorderly market dynamics … So it’s very important that the ECB makes clear that we will not tolerate unwarranted and disorderly market dynamics that would pose a serious threat to the transmission of monetary policy … We cannot have a case where essentially market panic, market illiquidity, market sentiment disrupts our monetary policy.

Was that a reasonable assessment?

Well if you look at the graph above it is clear that the bond market pressures are abating somewhat, without the TPI being used.

That doesn’t suggest that the ECB through its reluctance to do anything as the spreads rose is trying to orchestrate some chaos in France.

The more likely interpretation is that the financial markets are skittish at the best of times and responded to the election results in early June by selling off bonds they deemed to be risky until further information emerged.

The sell-off impacted not only France but other weaker Eurozone Member States.

And once things became a little clear, the situation stabilises.

Of course, the ECB probably realised that leaving the spreads to rise for a few days would heap pressure on likely loose cannons (read RN in France) to appease the markets.

Sure enough RN, for example, has been at pains to assure everyone that they are not a wild spending outfit.

That shouldn’t surprise anyone.

The ECB has consistently, through its conditionalities, acted in a political way to backup the Commission in its austerity bias.

The whole Greek fiasco in June 2015, when the ECB effectively abandoned its remit to maintain financial stability, is an extreme example of its political role.

The whole common currency is a political structure to maximise the control of the corporate elites of Europe.

The neoliberal ideology is embedded in the legal structure of the union, which is why I have called the European Union the most advanced example of neoliberalism.

Which, in turn, is why I supported Brexit.

That reality is why the progressive arguments for reform of the treaties is bunk.

In the current situation, the pressure is being placed on RN, which is at the opposite end of the spectrum from the Left-wing parties that aspire to power.

But any political group that doesn’t toe the line and support the status quo in Europe will be punished by the bond markets and the EC and ECB will manipulate that to ensure the message is sent but not to the extent that insolvency and exit becomes a reality.

The conduct of these institutions since the GFC makes that very clear.

Which means, that any progressive aspirations must include exit and the reintroduction of currency sovereignty, which would free the nation from the bond markets and the neoliberal ECB and EC.

Conclusion

No real surprises in any of this.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

For the blob, it is desirable that the far-right reach to power.

It’s the best way to wreck all the democratic checks that european countries took so long to build. Those checks stand in the way of neoliberalism.

That’s exactly what’s happening in Hungary, in Poland, in Italy.

These people are just cheap oportunists, feeding on the woes of the working people, whose future was sold by the same people that appeal now for fascists solutions.

Cheap oportunists, just like the centrists, inclunding Macron’s party.