The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

Australia’s monthly inflation rate falls yet the media scream for more rate hikes

Today (June 26, 2024), the Australian Bureau of Statistics (ABS) released the latest – Monthly Consumer Price Index Indicator – for May 2024, which showed that the annual inflation rate rose 4.1 per cent, which is higher than most predicted. And now the media are beating up the story that the RBA will have to hike interest rates some more. Well if we understand the underlying movements in the components that have delivered this result, the last thing one would do is hike interest rates. If we look at the All Groups CPI excluding volatile items (which are items that fluctuate up and down regularly due to natural disasters, sudden events like OPEC price hikes, etc) then the annual inflation rate was lower at 4 per cent relative to 4.1 per cent in April. Further, the monthly rate in May revealed a lower inflation rate than the April figure, so there is no hint that we are about to see an acceleration in the overall inflation situation. Much of today’s result relates to base issues in 2023. The annualised rate over the last 12 months is 0.98 per cent – which is below the lower band of the RBA’s inflation targetting range. The general conclusion is that the global factors that drove the inflationary pressures are abating and that the outlook for inflation is for it to fall rather than accelerate. There is certainly no case that can be legitimately made for further rate hikes, although the RBA will be keen to threaten them and maintain its position at the centre of the debate, because it seems to thrive on attention.

The latest monthly ABS CPI data shows for May 2024 that the annual results are:

- The All groups CPI measure rose 4 per cent over the 12 months.

- Food and non-alcoholic beverages 3.3 per cent (down from 3.8).

- Clothing and footwear 3.8 per cent (up from 2.8).

- Housing 6.7 per cent (up from 6.5). Rents (7.4 per cent cf. 7.5 per cent).

- Furnishings and household equipment 2.8 per cent (from 2.4).

- Health 2.9 per cent (from 2.1).

- Transport 5.2 per cent (from 4.9).

- Communications steady at 4.9 per cent.

- Recreation and culture 6.5 per cent (from 4.2).

- Education -1.1 per cent (from -0.8).

- Insurance and financial services steady at 6.1 per cent.

The ABS Media Release (February 28, 2024) – Monthly CPI indicator rose 3.4 per cent in the year to May 2024 – noted that:

The monthly Consumer Price Index (CPI) indicator rose 4.0 per cent in the 12 months to May 2024 …

The most significant contributors to the annual rise to May were Housing (+5.2 per cent), Food and non-alcoholic beverages (+3.3 per cent), Transport (+4.9 per cent), and Alcohol and tobacco (+6.7 per cent) …

Housing rose 5.2 per cent in the 12 months to May, up from 4.9 per cent in April. Rents increased 7.4 per cent for the year, reflecting a tight rental market across the country. The annual rise in new dwelling prices remained steady at 4.9 per cent with builders passing on higher costs for labour and materials …

The introduction of the Energy Bill Relief Fund rebates from July 2023 has mostly offset electricity price rises from annual price reviews in the same month. Excluding the rebates, Electricity prices would have risen 14.5 per cent in the 12 months to May 2024 …

Despite the monthly fall in May, Automotive fuel prices rose 9.3 per cent annually up from 7.4 per cent in April. The annual increase was largely due to base effects where the fall in May this year was smaller compared to the fall in May 2023.

So a few observations:

1. While everyone is touting the rise in the annual rate of inflation as measured by the Monthly Indicator (May 2023 to May 2024), the reality is that the CPI Indicator fell between April and May by around 0.1 per cent.

2. So when I read commentary from so-called experts who claim the result “can only be described as a shocker”, I wonder what planet they inhabit.

3. Further, if we look at the All Groups CPI excluding volatile items (which are items that fluctuate up and down regularly due to natural disasters, sudden events like OPEC price hikes, etc) then the monthly inflation rate fell to 0.082 per cent from 0.659 per cent in April. The annualised rate over the last 12 months is 0.98 per cent – which is below the lower band of the RBA’s inflation targetting range.

4. If we take the annualised rate of that series, over the last three months, then the inflation rate is 2 per cent, at the bottom of the RBA’s range.

5. The rent inflation is partly due to the RBA’s own rate hikes as landlords in a tight housing market just pass on the higher borrowing costs – so the so-called inflation-fighting rate hikes are actually driving inflation.

6. The electricity component is rising because the federal government is withdrawing its relief package and the underlying profit-gouging in the energy sector is now emerging again.

7. Why on earth would anyone think that increasing interest rates would do anything here other than further punish low-income mortgage holders at the expense of high-income financial asset holders.

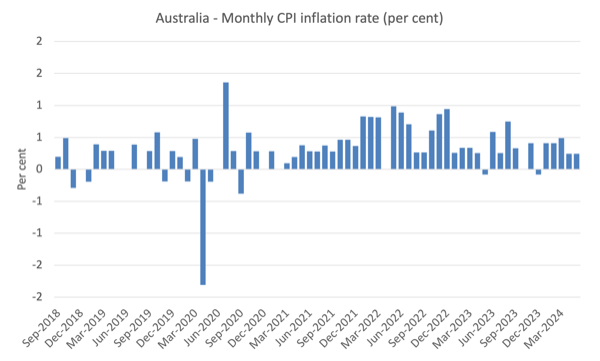

The next graph shows the monthly rate of inflation which fluctuates in line with special events or adjustments (such as, seasonal natural disasters, annual indexing arrangements etc).

There is no hint from this data that the inflation rate is accelerating or needs any special policy attention..

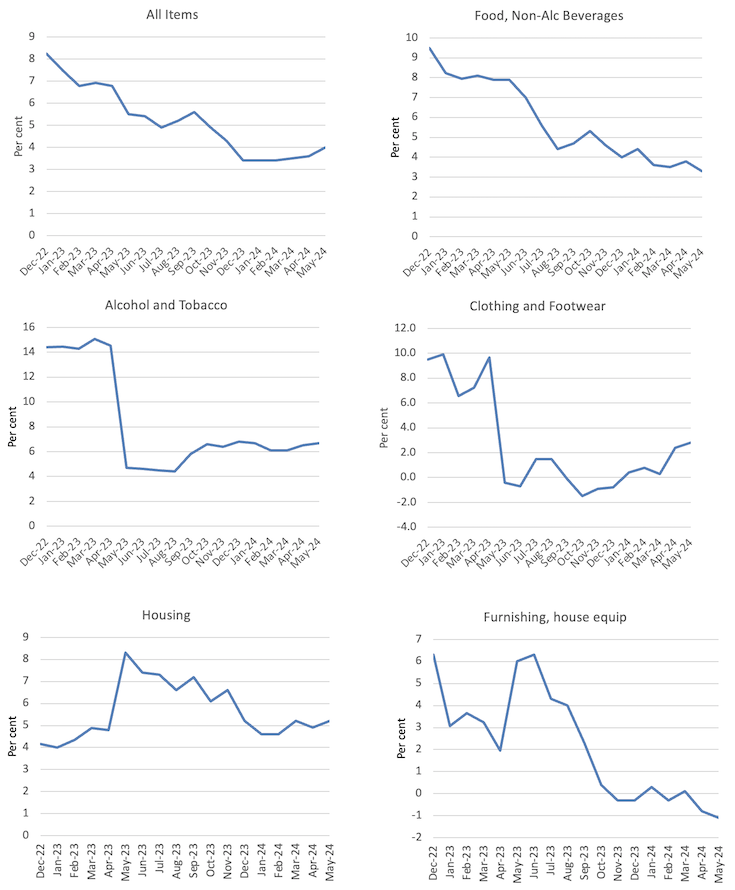

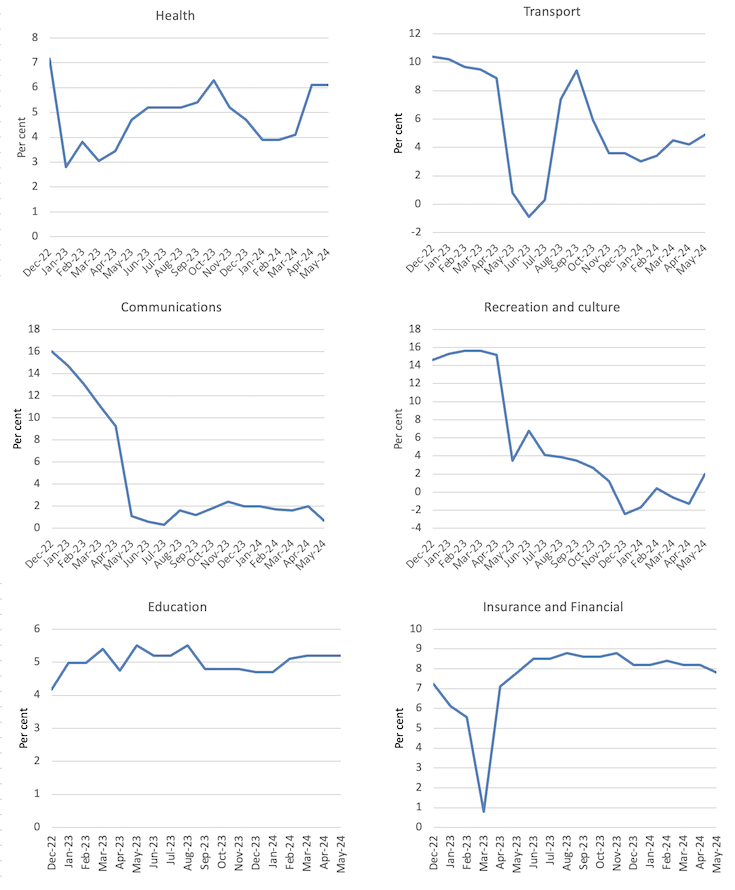

The next graphs show the movements between January 2022 and May 2024 for the main components of the All Items CPI.

In general, most components are seeing dramatic reductions in price rises as noted above and the exceptions do not provide the RBA with any justification for further interest rate rises.

For example, the Recreation and Culture component that was driving inflation in 2023 is now deflating – this just reflected the temporary bounceback of travel and related activities after the extensive lockdowns and other restrictions in the early years of the Pandemic.

It was always going to adjust back to more usual behaviour.

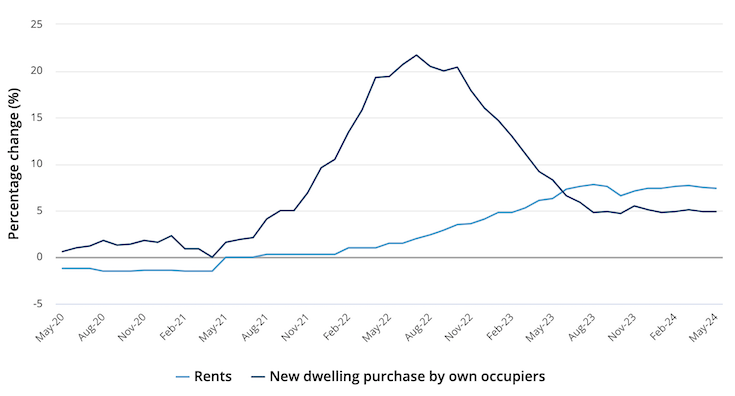

The next graph taken from the ABS shows the movements in the housing component (with rents separated out from the new dwelling purchase by owner-occupiers.

The rent component has risen almost in sync with the RBA interest rate hikes and now the rate hikes have ended (for now), the rent inflation has levelled off.

The construction costs for new dwellings have been in retreat since early 2022 as the supply constraints arising from natural disasters (fire burning down forests), the pandemic (building supply disruptions), and the Ukraine situation have eased.

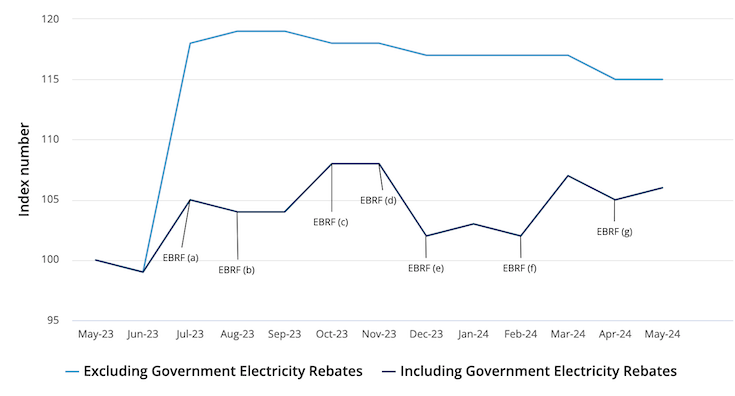

The ABS also published an interesting graph, which compares the electricity prices under the Federal government’s – Energy Bill Relief Fund – rebates which were introduced in July 2023 and what they would have been in the absence of that fiscal intervention.

The Relief Fund provided subsidies to households and small businesses depending on the locality.

For example, a Victorian household was given a rebate of $250.

The ABS report that without the rebates “Electricity prices would have increased 14.5% in the 12 months to May 2024”.

Here is the impact of that simple and very modest scheme.

It demonstrates that targetted fiscal policy can indeed be anti-inflationary, which means that the spending-inflation nexus is never straightforward as the mainstream narratives might have you believe.

The problem though is that the impact of fiscal policy overall has been negative over the last few years.

There has been a major slowdown in GDP growth and the declining retail sales figures as fiscal policy has shifted from producing deficits to surpluses over the last 243 months.

The mainstream perspective is that it has been the interest rate hikes that have caused the slowdown.

But during the GFC, the Australian Treasury conducted research to estimate the relative contributions of monetary and fiscal policy to the modest recovery in GDP after the massive global financial shock that we imported.

In the first four quarters of the GFC (January-quarter on), they estimated that the fiscal stimulus had contributed significantly to the quarterly growth rate.

On January 8, 2009 the Federal Treasury made a presentation entitled – The Return of Fiscal Policy – to the Australian Business Economists Annual Forecasting Conference 2009.

I wrote about that in this blog post – Lesson for today: the public sector saved us (January 21, 2009).

The other interesting part of their work was the estimates of the impact of the rapid reduction in interest rates by the Reserve Bank on GDP growth rates

This analysis provided a direct comparison between expansionary fiscal policy and loosening of monetary policy.

The conclusion was clear:

… this fall in real borrowing rates would have contributed less than 1 per cent to GDP growth over the year to the September quarter 2009, compared with the estimated contribution from the discretionary fiscal packages of about 2.4 per cent over the same period.

So discretionary fiscal policy changes was estimated to be around 2.4 times more effective than monetary policy changes (which were of record proportions).

While interest rates have been hiked 11 times since May 2022, the fiscal balance has shifted from a deficit of 6.4 per cent of GDP in 2020-21 and a deficit of 1.4 per cent of GDP in 2021-22, to a surplus of 0.9 per cent of GDP in 2022-23.

The Federal government recorded a small surplus in the 2023-24 fiscal year.

That is a major fiscal shift and the fiscal drag explains most of the slowdown in growth and expenditure.

Julian Assange is free – finally

The US has finally allowed Julian Assange to do a deal, which compromises him only marginally, and go free.

The whole end-game demonstrates the hypocrisy of the sanctimonious Americans who call their country the ‘land of the free’.

How can you claim the First Amendment of the US Constitutes guarantees freedom when the US state persecutes a person for exercising free speech?

Further, Julian Assange brought to the attention of all of us the grave breaches of human rights and deliberate war crimes that the US state through its military produced.

The fact that the US state wanted to punish someone for revealing their heinous crimes is the issue and should have led to him being celebrated for demonstrating system failure.

Although, of course, from the US perspective they only ever win – eh!

A good day for Julian.

Advance orders for my new book are now available

The manuscript for my new book – Modern Monetary Theory: Bill and Warren’s Excellent Adventure – co-authored by Warren Mosler is now with the publisher and will be available for delivery on July 15, 2024.

It will be launched at the – UK MMT Conference – in Leeds on July 16, 2024.

Here is the final cover that was drawn for us by my friend in Tokyo – Mihana – the manga artist who works with me on the – The Smith Family and their Adventures with Money.

The description of the contents is:

In this book, William Mitchell and Warren Mosler, original proponents of what’s come to be known as Modern Monetary Theory (MMT), discuss their perspectives about how MMT has evolved over the last 30 years,

In a delightful, entertaining, and informative way, Bill and Warren reminisce about how, from vastly different backgrounds, they came together to develop MMT. They consider the history and personalities of the MMT community, including anecdotal discussions of various academics who took up MMT and who have gone off in their own directions that depart from MMT’s core logic.

A very much needed book that provides the reader with a fundamental understanding of the original logic behind ‘The MMT Money Story’ including the role of coercive taxation, the source of unemployment, the source of the price level, and the imperative of the Job Guarantee as the essence of a progressive society – the essence of Bill and Warren’s excellent adventure.

The introduction is written by British academic Phil Armstrong.

You can find more information about the book from the publishers page – HERE.

You can pre-order a copy to make sure you are part of the first print run by E-mailing: info@lolabooks.eu

The special pre-order price will be a cheap €14.00 (VAT included).

Music – Free Association

This is what I have been listening to while working this morning.

It features American Jazz guitar player – Jim Hall – and American pianist – Geoffrey Keezer – from the album – Free Association – which was released in 2005.

It was recorded live at the New School Performance Space, New York, June 13-14, 2005

It isn’t the most popular album around but it combines an ageing legend (Hall) with an upcoming player (Keezer) to produce a really clean sound.

The guitar playing is very mellow and crisp.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

That the USA styles itself as the land of the free is of course a misnomer, and unfortunately applies to its bagman, the UK, that kept Assange in a high security prison for over 5 years at the behest of the USA.

I still remember one of the simplest and verifiable economic observations made by my O level economics teacher back in the mid-70s, ran along the lines of fiscal policy has impact whereas the impact of interest rate movements is much less clear and untimely. The economics profession and all of our neo-liberal governments need to go back to a 1970s secondary school (plus educate themselves using a MMT textbook of course).

Preparations are underway in many areas of American society for the potential return of Trump to the White House.

Biden moved to free Assange to ensure that Assange would not be in jeopardy should Trump win in November.