Well my holiday is over. Not that I had one! This morning we submitted the…

German debt brake is bad economics and undermines democracy

It’s Wednesday and today I don’t comment on the US Supreme Court decision to embed criminal behaviour in the presidency (how much of a joke will the US become) or the Presidential debate, which has focused on the performance of Biden while, seemingly ignoring the serial lies told by the other contender. If these two are all that the US has to offer as the leader then what hope is there for that nation. We will shift focus today from the idiocy of the US to the idiocy of the German government and its fiscal rules. After a temporary suspension during the pandemic, the German debt brake is being applied again and reintroduces a rigidity into fiscal policy that makes it hard for the government to actually run the economy responsibly. By prioritising an arbitrary financial threshold between good and bad, the debt brake undermines the capacity of the government to address the decaying public infrastructure (also a victim of the past austerity) and meet the climate challenges ahead. Through its negative impacts on well-being in Germany, it has also generated the political space for the right-wing extremists to gain ground. Bad all round.

German Debt Brake madness

The European Parliamentary elections delivered a major blow to the German SPD – the Alternative for Germany (AfD) came in second, with Chancellor Olaf Scholz’s SPD trailing behind with just 14 per cent of the vote.

This was the worst electoral outcome for the SPD in more than 100 years and Scholz is now under pressure to follow Macron into political oblivion by calling a general election.

The German Greens plunged in their vote partly due to their membership of the coalition with SPD.

The other ruling coalition member Free Democrats (pro business) also lost votes relative to the 2021 national election results.

But the ruling coalition continues in Germany although they are now very unpopular.

Scholz is now about to release a new fiscal statement where he will try to buy some votes by promising to spend on renewing public infrastructure and boosting military spending.

Years of austerity have left German infrastructure in a parlous state.

For example, its train system has been particularly degraded (Source).

But all is not well within the coalition.

The Finance Minister who is from the pro-business Free Democrats has told his coalition partners that Germany will have to reassert the – Debt Brake – which was made part of the German Basic Law (its Constitution) during the GFC.

The so-called ‘German balanced budget amendment’ was introduced in 2009 and meant that:

1. The federal government fiscal deficit not exceed 0.35 per cent of GDP from 2016.

2. The German states could not take on debt after 2020.

Like the European Union’s Stability and Growth Pact (SGP) the fiscal rules can be relaxed in an emergency.

The German government suspended its application in the early period of the pandemic and they have been arguing ever since about when it would be reinstated as a brake on fiscal policy.

Scholz also was able to use his position in the coalition to get more cash for defense spending which was quarantined from the rule.

The application of the rule leading up to the pandemic has seen government investment spending starved with the resulting negative impacts on the state of infrastructure as noted above.

The current fiscal position is summarised in this press release (issued February 23, 2024) – Government deficit dropped slightly to 87.4 billion euros in 2023 – which reported that the 2023 fiscal outcome recorded a deficit of 2.1 per cent of GDP and:

… means that the 3% reference value of the European Stability and Growth Pact, which remained suspended in 2023, would have been met.

So while the German government was within the SGP rules, it was violating the debt brake limits, which are significantly harsher.

But (Source):

In the context of dwindling tax-revenue estimates, Lindner has insisted that ministries — with the exception of defense — scale back spending, ignoring calls from coalition partners, industry groups and economists to show more flexibility.

Lindner is the Finance Minister.

Meanwhile:

1. GDP growth was down -0.9 per cent in the March-quarter, the fourth successive quarter of contraction.

2. Per capita GDP also fell in the March-quarter 2024.

3. Labour productivity slumped by a further 1.2 per cent the fifth consecutive quarterly decline.

4. 20.9 per cent of the population “Just over 17.3 million people in Germany were affected by poverty or social exclusion in 2022” (Source).

5. 2.6 million Germans did not have the money to sufficiently heat their homes in 2021.

6. Employment growth is heading towards zero.

Even though the fiscal rules have been somewhat relaxed in recent years, the austerity resumed in the current period.

The problem ahead is that the debt brake will not allow the nation to meet the challenges ahead in terms of renewing its infrastructure and dealing with climate change.

These challenges will require massive public spending outlays which would not be possible within the fiscal rule parameters.

While a growing proportion of German economists have started to realise this, the majority of economists still believe the iron rules should remain to ensure fiscal “discipline” (Source).

This is an example of how mainstream economists prioritise financial ratios over the advancing of well-being.

I thought this input from the Berlin Social Science Center (March 27, 2024) – Why the debt brake is a threat to democracy in Germany – was useful in highlighting why these rigid fiscal rules go well beyond being bad economic policy.

They construct the fiscal rules in Germany as a threat to democracy after the Federal Constitutional Court asserted the German Basic Law to declare the fiscal position of the German government unconstitutional.

The debt brake is to be reinstated in the current fiscal period and that will force cuts to the climate transformation fund and other areas of need.

The Berlin SSC report concludes that:

The budget cuts and foregone public investment required by the debt brake are highly unpopular, politically divisive, and will impose significant economic costs on an already struggling German economy. Moreover, given Germany’s position as the Eurozone’s largest and most important member, the debt brake will have substantial spillover effects at the EU level, posing a serious threat to the long-term stability of the Eurozone.

It is no wonder that the Right are making political gains in Germany and France.

Fiscal rules like the debt brake violate what we know about the role fiscal policy plays in promoting well-being.

The Berlin SSC report notes that:

… fiscal retrenchment of this kind rarely works. In the short term, it is associated with slower economic growth and rising inequality. In the longer run, this “procyclical” approach is associated with increases, rather than decreases, in government debt levels. Even the International Monetary Fund, long an advocate of fiscal austerity during economic crises, has found that fiscal consolidations in advanced economies do not, on average, reduce debt-to-GDP levels. Similarly, there is little, if any evidence, that high debt levels reduce economic growth. In fact, when one compares the policy responses and recoveries from the pandemic economic crisis in the US versus Germany and the Eurozone, one sees again that more aggressive fiscal policy actually seems to be correlated with both stronger economic growth and declining debt/GDP levels.

Now the only reason why a comparison between a Eurozone Member State and the US (For example) is credible here is because the SGP has been suspended in the EU for a time.

But the point is obvious – fiscal rules are generally damaging to economic prosperity and are self-defeating.

The authors also note the obvious – that if Germany is restricting domestic demand then it makes it hard to reduce its reliance on the over-the-top external surpluses, which, in turn, “makes it nearly impossible for Southern deficit countries to enhance their competitiveness, and it imposes expectations of large-scale, one-sided macroeconomic adjustment on countries such as Italy and Greece, which have already endured years (or, in Italy’s case, decades) of painful and politically unpopular austerity.”

But Germany has gamed its monetary union partners from day one and that is one of the reasons the GFC was so damaging.

It is hard to see a shift in German sentiment in that respect, which means the EMU remains dysfunctional and crisis prone.

The authors, though, add another dimension to their critique of the debt brake:

Yet while the debt brake is bad economic policy, the even greater concern is that it may also be very bad for German democracy. There is now overwhelming evidence that fiscal austerity not only has negative effects on the economy, but also is associated with deeply concerning political outcomes.

They point to the rise of right-wing extremist parties, poor engagement by voters (low turnout) and “a rise in political fragmentation”.

The “research does show that voters exposed to the material impact of economic shocks and financial crises are more likely to support the far right, and we know from the aforementioned literature that austerity in response to these crises further aggravates the problem.”

Anyway, watch the response to the draft German fiscal statement, which Scholz will probably release this week.

None of these concerns will be evident I suspect.

It is hard to see how Germany (and Europe in general) can respond effectively to the challenges before them.

Life expectancy declining in Australia

Yes, as we transition from FLiRT to the latest COVID variant FLuQE,the Australian Health and Welfare Institute reports that life expectancy in Australia has now fallen as COVID becomes the third-ranked killer.

The ABC report (July 2, 2024) – Life expectancy has dropped in Australia for the first time in decades, a new government report says – notes that:

For the first time since the mid-90s, Australia’s life expectancy has fallen.

Australia’s population is ageing, and requiring more primary care than ever with more people living with a chronic disease, and spending more time in ill health.

The decline in life expectancy is due to COVID and the rising death rate associated with that disease.

And: “People living in the lowest socio-economic areas had the highest rates of use of public health but had the lowest rates of service” – which is the usual result.

The poor suffer more than the rest of us.

Other nations are also witnessing a declining life expectancy due to COVID.

Aren’t we stupid?

Some simple precautions like wearing a N95 mask when in public situations could have reduced the death rates considerably.

But we are too stupid to realise that and it is becoming clearer that we have now passed ‘peak’ human health and COVID marks a steady decline into an increasingly compromised health status.

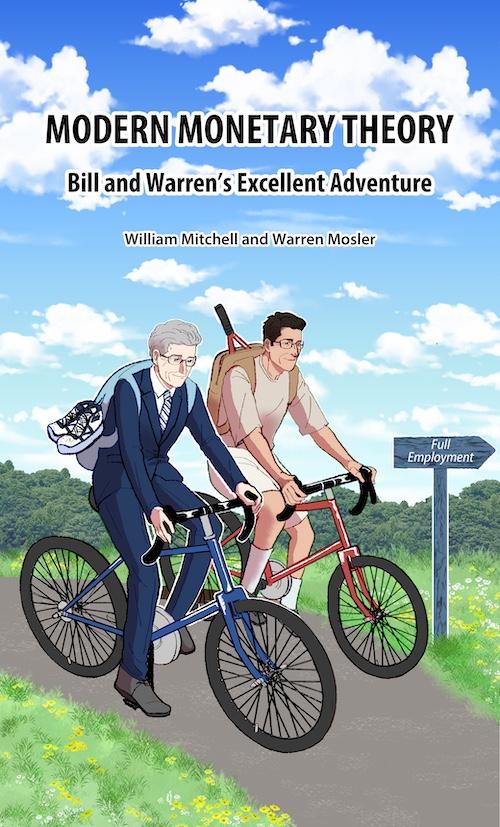

Advance orders for my new book are now available

The manuscript for my new book – Modern Monetary Theory: Bill and Warren’s Excellent Adventure – co-authored by Warren Mosler will be published on July 15, 2024.

It will be launched at the – UK MMT Conference – in Leeds on July 16, 2024.

A promo video is coming.

Here is the final cover that was drawn for us by my friend in Tokyo – Mihana – the manga artist who works with me on the – The Smith Family and their Adventures with Money.

The description of the contents is:

In this book, William Mitchell and Warren Mosler, original proponents of what’s come to be known as Modern Monetary Theory (MMT), discuss their perspectives about how MMT has evolved over the last 30 years,

In a delightful, entertaining, and informative way, Bill and Warren reminisce about how, from vastly different backgrounds, they came together to develop MMT. They consider the history and personalities of the MMT community, including anecdotal discussions of various academics who took up MMT and who have gone off in their own directions that depart from MMT’s core logic.

A very much needed book that provides the reader with a fundamental understanding of the original logic behind ‘The MMT Money Story’ including the role of coercive taxation, the source of unemployment, the source of the price level, and the imperative of the Job Guarantee as the essence of a progressive society – the essence of Bill and Warren’s excellent adventure.

The introduction is written by British academic Phil Armstrong.

You can find more information about the book from the publishers page – HERE.

You can pre-order a copy to make sure you are part of the first print run by E-mailing: info@lolabooks.eu

The special pre-order price will be a cheap €14.00 (VAT included).

Music – Portrait in Jazz 1960

This is what I have been listening to while working this morning.

I dug this record out this morning from a box (I still haven’t really finished unpacking from my house move last year).

It is the 1960 album – Portrait in Jazz – from the – Bill Evans Trio – which was the fifth studio album recorded by Evans but the second with his Trio consisting of:

1. Bill Evans – Piano.

2. Scott LaFaro – Double bass.

3. Paul Motian – Drums.

Scott LaFaro died the year after the release at the age of 25 from a car accident and the world lost one of the greatest prospects on double bass ever.

This album was recorded shortly after Bill Evans ended his work with Miles Davis (Kind of Blue).

This piece is the famous – When I Fall in Love – written (the music) by American composer and orchestra leader – Victor Young – in the early 1950s.

The most famous version is from Nat King Cole in 1956.

But I like the instrumental version from the Bill Evans Trio the best and although my album is old and quote worn out, it is still very mellow to listen to.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

Hi Bill, a recent blog on the ‘nakedcapitalism.com’ site made reference to this paper called ‘ Austerity and the Rise of the Nazi Party’ in the Journal of Economic History , which can be found here –

https://www.cambridge.org/core/journals/journal-of-economic-history/article/austerity-and-the-rise-of-the-nazi-party/7FB1BC0E727F47DC790A23D2A4B70961

kind regards

Arron

Does anyone have the ability to name a living or dead politician that hasn’t lied? Electoral campaigns are all about lying. They do it so branzenly, that they think lying is a God given right (for a politician on their side, that is).

You can say of old Joe that he is only reading a script, so he’s not lying, but reading other people’s lies.

But, question yourself on this: who’s in charge?

Are we talking about a democracy, a dictatorship or a banana republic?

As for the EU and Germany, all are in an accelerated process of decadence, comparable to the decline of the roman empire.

The most venal people on the continent are in charge, so things are not that different from what’s happening on the other side of the pond.

And focus on this: nobody cares. As long as the elites are kept happy, playing with their bubbles, who gives a hoot about decline?

Apparently these fools running Germany are utterly unfamiliar with the work of Karl Polanyi.

Oh well, the whirlwind it is, then …

Swedish World History Encyclopedia – “Bra Böckers Världshistoria”, Volume 13, pages 156-157 states this:

“In 1928, a new majority government was formed with the Social Democrat Herman Müller as Chancellor and the Conservative Gustav Stresemann as Foreign Minister…

In the 1928 elections, /Hitler’s party/ NSDAP – National Socialist German Workers’ Party/ joined the ranks of the many small parties and won 2.6% of the vote…

The world crisis led to the collapse of the government in March 1930. It was replaced by a bourgeois minority government led by the Catholic Center Party’s Heinrich Brüning….

Brüning, an economist, like so many other statesmen, met the crisis with a policy of deflation, and he did so more consistently and energetically than most. In his view, the whole economy had to be adjusted to the falling prices. Wages and, ideally, taxes had to be reduced and, above all, the public budget had to be balanced to avoid inflation. The result was a sharp reduction in purchasing power in the domestic market, which made matters worse. Many companies went bankrupt. Heavy industry and construction were almost completely paralyzed, and in 1932 almost 6 million people were registered as unemployed. To these should probably be added another million long-term unemployed who had slipped completely out of the social system.

With falling private incomes came falling public tax revenues, and in 1932 municipalities, cities and even a state had to go bankrupt and place themselves under national administration…

When Brüning’s austerity drive was eventually extended to state subsidies to landowners east of the Elbe, /President/ Hindenburg’s patience wore thin [himself an eastern landowner], and on May 30, 1932, a new government took office, led by the extremely conservative former centrist politician Franz von Papen. His government had virtually no parliamentary support and stunned contemporaries by the fact that the majority of ministers were nobility.

The Social Democrats brought down the government. New elections were then called.”

The increasingly desperate population came to view Hitler as ”unsere letzte Hoffnung” – our last hope.

NSDAP got 2.6% in 1928, in the 1930 election 18.3% and then 37.3 in 1932.

Where is the alternative for common people who want another political/economic order, that works for them?

What goes for “Left” or Labour/Social Democrats has wholeheartedly joined Brüning’s economic model, aka the EU’s.