In the annals of ruses used to provoke fear in the voting public about government…

Monetary policy in the hands of the central banker sociopaths is advancing the class interests of the elites

Recently, I wrote about the conditions that dictate what impacts interest rate changes will have on aggregate spending and demand-driven inflation in direction, magnitude and temporality – see RBA governor’s ‘Qu’ils mangent de la brioche’ moments of disdain (June 8, 2023). It is highly likely in many cases, the decisions by central banks to increase interest rates, ostensibly to ‘fight inflation’ actually make inflation worse. More people are starting to understand that point even though central bankers appear to be still talking big about further interest rate rises. But the evidence is mounting against their position and ultimately that evidence is exposing the deep flaws in mainstream macroeconomics. I argue today that the problem is not only that the interest rate hikes can be inflationary but they are also facilitating a major reinforcement of the class divisions in our societies whereby the low income cohorts are transferring massive income benefits to the higher deciles. I also discuss cricket which recently has provided a demonstration of how the class divisions work. Then some music, given it is a Wednesday.

Interest rises have been inflationary

Bloomberg published an article yesterday (July 4, 2023) – Savings Lift Helps Blunt UK Household Mortgage Pain – which suggested that the interest rate rises from the Bank of England have been counterproductive in terms of the ‘fight against inflation’, and, have also worsened income and wealth inequality.

It is interesting that for several decades, the New Keynesian orthodoxy that prioritises the assignment of macroeconomic policy to monetary policy and largely eschews the use of fiscal policy has strutted the world stage in dominance.

Anyone who questioned that dominance were told they didn’t understand how monetary policy in the hands of so-called ‘independent’ central banks was a superior anti-inflationary tool and that fiscal policy was likely to be corrupted by the political process (trying to satisfy vested interests).

It is important to realise though that this dominance was practised during a period of benign inflationary pressures from the 1990s and so the actual effectiveness of monetary policy (interest rate variation in the main) has never really been tested.

That is, until now.

With the current inflationary pressures, central bank policies have been put to the test and the empirical data that is coming out of various countries as more time passesis suggesting a monumental failure of this approach to macroeconomic policy.

Even commentators who have been devout neoliberals are being forced to reappraise their position on these matters.

The Modern Monetary Theory (MMT) economists have been consistently arguing that a reliance on monetary policy to stabilise output growth and inflation would fail.

We took a lot of flak from Oxbridge New Keynesian types – mostly cheap insults along the lines of who are we to know better than them – la de dah!

The Bloomberg article finds that the:

Bank of England’s interest-rate increases are benefitting savers more than they’re costing mortgage payers — for now at least.

As yet, the full impact of the increases in mortgage rates have not flowed through to borrowers because “so many mortgages are on fixed rates that have yet to expire”.

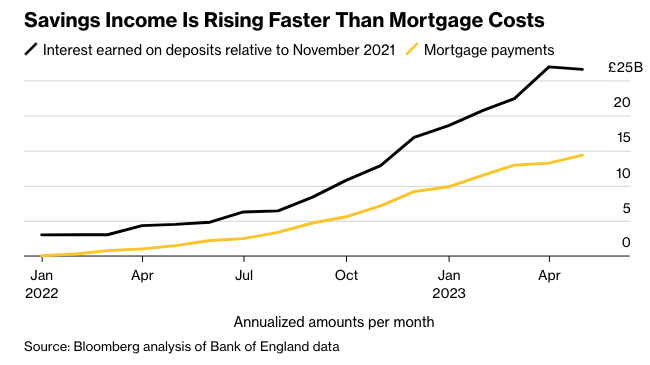

The article provided this interesting graph, which shows that “savings income is rising faster than mortgage costs”.

This is exactly the point I made in the blog post linked above.

In effect, the monetary policy changes are boosting the income of people with financial assets and only partially punishing those with debt.

Bloomberg calculate a net boost to income in Britain of around £10 billion since the November 2021 (£24 billion gained by savers and £14 billion lost in debt interest by mortgage holders).

In effect, the monetary policy changes are working like a fiscal stimulus, which is why the British economy has yet to enter recession.

Consulting the latest Growth from Knowledge (GfK) – Consumer Confidence Index – (published June 23, 2023) – which is a fairly reliable indicator of consumer sentiment in Britain, we learn that;

1. “Consumer confidence improves by a further three points in June, the fifth monthly improvement in a row.”

2. “The most telling finding is how we see our personal financial situation in the coming year – the money going in and out of our bank accounts – which shows a healthy seven-point increase.”

This is totally at odds with the New Keynesian theory, which, given the rapidity and magnitude of the interest rate rises to date, would have predicted a loss of consumer confidence and a rapid deterioration in household finances.

The opposite has occurred.

This is not to say we should be unambiguously happy about the current situation.

Underlying the observation that savings income has outstripped the rising cost of mortgages, is an ugly shift in income distribution towards the high income groups, which will worsen wealth inequality.

The Bloomberg article notes that:

While some households will be in financial distress due to rate rises, others – including the wealthy and many pensioners — will be better off.

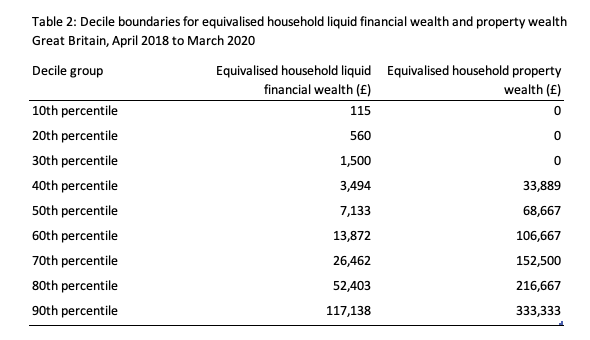

So, while the net (macro) effect is expansionary, low income mortgage holders with little or no savings will be enduring the brunt of the Bank of England’s interest rate rises, while those with financial assets (and perhaps no debt) are receiving bountiful increases in their income.

It is the low-income employed and the unemployed that Bank of England is damaging.

Data from the British Office of National Statistics (ONS) – Household income, spending and wealth, Great Britain, April 2018 to March 2020 – shows how skewed the holdings of liquid financial wealth and property wealth in Britain is.

So, in fact, the dominance of monetary policy advocated by New Keynesian economists (the ‘mainstream’ in my profession) actually reinforce class divisions in society and increases income and wealth inequality, even though they do not necessarily achieve the stated anti-inflationary objective.

More and more commentators are starting to twig that this is going on.

I am reading more articles now each day that note that the central banks are forcing all the anti-inflationary adjustment on a minority of the population (those holding mortgages) and the negative impacts are concentrated on low-income persons and households while the rich are getting richer both in income terms and flow of those income increases into their wealth portfolios.

The reason the negative impact is disproportionately being borne by low-income earners is because they have little or no savings and their mortgage servicing requirements are usually a much higher as a proportion of their income than for higher-income individuals.

This commentary from Michael Pascoe in the New Daily today (July 5, 2023) – Just because the horse is dead doesn’t mean the RBA won’t flog it – is indicative of how farcical the situation has become with respect to monetary policy.

You should also reflect on the speech given by the ECB Executive Board Member Isabel Schnabel on June 19, 2023 – New challenges for the Economic and Monetary Union in the post-crisis environment – which demonstrates how central bankers have been sociopaths.

She runs through the usual central bank spin about how the inflation risks are “tilted to the upside” but then gets onto a discussion about climate change.

She said:

There are also other shocks, however, that we know exist but that are difficult to integrate into the baseline, so-called “known unknowns”.

El Niño is a case in point. The US Climate Prediction Center has recently declared that El Niño conditions are now officially present and are expected to gradually strengthen in the northern hemisphere in the winter of 2023/24.

ECB analysis suggests that a one-degree temperature increase during El Niño historically raised global food prices by more than 6% after one year …

El Niño also reinforces the risks of extreme weather events stemming from global warming. Sea surface temperatures in the North Atlantic are currently significantly above their average over the past 40 years

Okay, we know that.

We also agree with the US Federal Reserve Bank of St. Louis that “suggests that food price inflation matters … highest … predictive power for future headline inflation, more than any core inflation component.”

When I say it matters, I am thinking of the distributional implications – food price inflation hurts the poor who tend to be less nourished in quantity and quality terms anyway relative to the rest of the population.

When a central banker say it matters, they are just thinking in terms of how much higher they need to crank up interest rates.

Schnabel is no exception and the conclusion of that speech was that a “tighter monetary policy stance” (that is, higher interest rates) was necessary:

We thus need to keep raising interest rates until we see convincing evidence that developments in underlying inflation are consistent with a return of headline inflation to our 2% medium-term target in a sustained and timely manner.

Meanwhile, she admitted in the Speech that central bankers have a limited understanding of the real world and often make major mistakes in their predictive knowledge.

Her solution – go even harder on the interest rate hikes just in case the original inflation forecast was biased downwards.

Can you believe that?

Basically, we haven’t got a clue and the external environment is deeply uncertain such that it evades accurate forecasts, so we need to overshoot just in case, and f*ck those who suffer – like those who lose their homes due to insolvency and their jobs through the ultimate recession that such a mentality causes.

Socio-pathological logic.

The major driving factors in this current inflationary episode – pandemic related supply constraints, the Ukraine War, and the OPEC+ profit gouge – have not been sensitive to the interest rate hikes.

Monetary policy cannot make workers who have been sick and disabled from Covid better, nor end the War.

So how does Schnabel think that continually forcing interest rates up, with all the negative distributional impacts I have discussed above, will deal with the climate change impacts from El Niño on food prices.

Other than to make life so difficult for low-income families that they stop being able to buy food altogether. A ‘master plan’.

Effectively, rising interest rates will ultimately cause the damage currently concentrated in low income families to spread to other cohorts through recession and unemployment.

In the meantime those with savings are out partying the recession is delayed.

Hopefully, the supply constraints, which are not sensitive to the interest rate changes continue to ease quickly and the sociopaths in the central banks run out of ruses to inflict further rate rises.

Undoubtedly they will claim success, just as Paul Volcker erroneously claimed success.

The New Keynesian macro economist will be Tweeting or whatever about how robust their framework is.

And the damaged will be trying to start again.

And if you think class divisions are over in Britain ….

Go to the cricket!

Many readers will undoubtedly have read about the furore in recent days following the recent Second Test match at Lords in London, which saw Australia convincingly beat England to go 2-0 up.

If you haven’t become aware of this then perhaps you can skip the rest.

I am, in fact, not a big cricket fan but I have a passing interest and so familiarise myself with the results (sometimes).

But the latest incident, which has seen the British Prime Minister advocate players abandoning the formal rules of the game in the ‘spirit of the game’ and the retort from the Australian Prime Minister congratulating the Australian players on their sharpness and acumen, has exposed the class divisions in British society like nothing else recently.

First, after a series of shocking racism scandals in English cricket where the ‘Jonty white boys’ of English cricket treat their sub-continent and Caribbean immigrant teammates with breathtaking disdain and rudeness, the – Independent Commission for Equity in Cricket (Icec) – was established by the English Cricket Board to investigate.

The final report of that process – Holding up a Mirror to Cricket – was released last month (June 2023) and found that:

… racism, sexism, elitism and class-based discrimination have a long history within the culture and institutions of English and Welsh cricket … our evidence shows that elitism alongside deeply rooted and widespread forms of structural and institutional racism, sexism and class-based discrimination continue to exist across the game.

No surprise, which is one of the reasons I am not a big fan of the game – given it came out of the upper-class, private school elites of England.

Icec results were “unequivocal … Discrimination is both overt and baked into the structures and processes within cricket. The stark reality is cricket is not a game for everyone.”

They found a:

… prevalence of an elitist and exclusionary culture within English and Welsh cricket. This culture is, in part, enforced through the dominance of private school networks within cricket’s talent pathway, together with sexist, racist and other discriminatory practices and policies that lead to discriminatory outcomes across the game … behaviours include, but are not limited to: racist, misogynistic, homophobic and ableist comments and actions, and a ‘laddish’ drinking culture that can sometimes make women vulnerable and at risk of unwanted or unwelcome behaviour, as well as alienating others due to religious and/or cultural beliefs.

So a nice game really.

The – Marylebone Cricket Club – for which the Lords oval in North London is home, is the founding club in the game and began as a ‘gentlemen’s club’ in the C18th.

Only recently have women been allowed to join although there is a 29-year waiting list so not many women actually become members.

The male members are the ‘toffs’ of the game

First Dog on the Moon this week (July 3, 2023) – Was it in the spirit of the game? A NATION CRIES WHITHER CRICKET?! – referred to them as being:

… some of the world people in the world (MCC members) …

An hilarious but apposite description.

These characters wear their ties and blazers and frequent the so-called ‘Long Room’ in the pavillion at the Lords ground.

The tradition is that the players must pass through the Long Room to traverse to the playing surface from their dressing rooms.

So the G&T blazered characters can mutter ‘jolly good show’ and all the rest of it as the players pass.

The problem this week was that an Australian player acted quickly in the second English innings to dismiss a batsmen in an unusual but legal manner (as in within the rules).

England were losing and they are poor losers (like the Australians really).

So suddenly, because the dismissal was an unusual one in the gammit of legal dismissals, the losers cried foul and claimed it wasn’t in the spirit of the game.

This elusive ‘spirit’ concept is seemingly defined by the blazer and tie wearers in the Long Room.

Except when the players left the field for a break (after the incident) the ‘spirit of the game’ definers demonstrated just how unrefined they actually are despite their private school accents and their networks of privilege.

The MCC members shouted abuse at the Australian team – ‘cheats’ etc, jostled them and it seems made racist remarks to one of the Australian players who happens to have been born in Pakistan.

The article by Marina Hyde (who is not herself devoid of a privileged English upbringing) in the UK Guardian today (July 5, 2023) – Who’s for political Bazball with Rishi? Voters? Tories? Anyone? – is a good account of the hypocrisy of the British elites.

It is these types who command central bank policy positions among other positions of power and influence.

Music – Post Minimalism

This is what I have been listening to while working this morning.

This piece – Mercy – was the final track on the 2020 Album released by – Max Richter – entitled Voices.

It fits my theme today of how the elites are handing out punishment to the working class.

The song was written by – Hilary Hahn.

Here is a review from the British Gramophone site of the album – Richter Voices.

We learn that “the work is based on the Universal Declaration of Human Rights” and Max Richter’s disdain and concern for the “post-truth politics in the 21st century”.

He regularly produces albums and flows of music that intertwine political and social issues with the post minimalist style he works within. No mean feat.

The piano is played by Max Richter and the solo violin is played by Norwegian violinist – Mari Samuelson

It is another magnificent example of post minimalism.

The tone suits my mood today.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved. ,h2

As we all know, the economy is a sum of many different economic sectors and inflation is affecting them in very diferent ways.

Inflation is affecting more those products and services that we all need to buy for our daily needs: energy, food, housing, clothing.

From these sectors, it spills to the others.

An example: QE in the west, from 2012 to 2022, created a huge bubble in the real estate sector, driving prices up, that inevitably ended up spilling to other sector.

The result is that landlords got richer (although QE was designed to recover asset portfolios, lost in 2008), and tenants got poorer

We can conclude from this that inflation in 2023 is a scam to transfer wealth and income from the 99% to the 1%.

There is a small question we need to answer: who is ushering this transfer?

I believe we have only one culprit to point the finger at- central banks.

They have been at the center of it all since 2012.

And it is a crime.

Thinking about Schnabel’s comment, it is not only cruel as you point out, it is not very clever from a macroeconomic point of view. Presumably her reasoning is:

increase interest rates (enough) -> recession -> demand falls -> prices fall

But a large fraction of food prices are determined globally as the following chart illustrates: https://fred.stlouisfed.org/graph/?g=16Mrr

The people who have to suffer most in order to reduce food prices due to reduced supply globally are the world’s poorest, not necessarily those in Europe.

The behaviour and attitudes of the “independent” central banks confirms my intuition that they are, by design, essentially aristocratic institutions inimical to labour. And monetary dominance is simply the ideological justification for elected representatives abdicating responsibility (and therefore accountability) for managing the economy via fiscal policy to best arrange socioeconomic circumstances for human flourishing among citizens.

As a result, all central bank rate decisions amount to a “heads I win, tails you lose” situation on behalf of the top end of the income and wealth distributions and at the expense of the bottom half. Hence much of the heat and light of arguments over the rate serve as a distraction from the abdication of responsibility by elected representatives to prevent the “trickle up.” The only solution for the exploited is to end the “game” of monetary dominance and insist upon a return to fiscal dominance.

‘Bank of England’s interest-rate increases are benefitting savers more than they’re costing mortgage payers — for now at least.’ and ‘savings interest is rising faster than mortgage costs.’ The main beneficiaries are the banks, in the UK laughably called in for a chat with the PM, previously a junior banker gambler, (after the profiteering supermarkets) to put pressure on them to increase savings rates. The biggest losers are the renters, 19% of households, and a much larger % of population and younger adults, whose rent can and usually has increased each 6 months with tenancy renewal, as their landlords have profiteered from short supply while they have already paid off the mortgage or bought with cash or put rent up in advance of their own mortgage going up (most council housing has been sold off or transferred to Housing Associations falling back on private finance). Some landlords are now complaining that they have to sell up and get out of the game.

I guess the BofE’s theory (whether believed or not) is that households will cut back on spending in expectation of fixed-rate mortgages ending and having to be renewed at higher interest, but either the expectations theory isn’t working or it’s being counteracted by those who’ve paid off mortgages or been gifted homes to avoid inheritance tax, and those at the top end who carried on earning as normal during ‘covid’, and are still spending the excess built up when they couldn’t spend quite so freely.

Cricket is like much else in England (private pensions being another example), at the elite end dominated by the fee-paying school class, while also to an extent encouraged among the lower villager people. Its darker side is now outed (unfortunately few sports avoid mirroring the ills of society). Having said that, my local cricket club (fairly posh, in Middlesex) is now inundated with local children of Asian heritage. If the English team is still 10 white blokes in 10 years time, we will know that progress hasn’t been made.

The MCC members and Sunak, man of the people at every opportunity, are rightly ridiculed. And Bairstow was dim. And Carey, Aussie wicket-keeper’s action was quick and clever. Nevertheless, Cummings the Captain had a choice, unlike in other games with no rules leeway, and chose the one that reflects badly on him. Difficult to say who would have won, as England have got close to winning both matches despite awful decision making and their stalwart spinner being out injured before the first test-match. The Aussie women are certainly a grade up on the Brits, although they were run pretty close in the last T20.

Hi Bill,

I mentioned in comments last week about the possibility of higher interest rates leading to higher inflation. Glad to see you expand and better explain my thoughts. Best wishes.

Historically the Treasury sold bonds to protect its gold supply. The currency that was used to buy the bonds was taken out of circulation and couldn’t be presented to the Treasury for conversion to gold. The interest paid was motivation and reward for the bond buyer assuming the risk that the Treasury would default before the bond matured. Under a fiat currency regime there is no public purpose in paying interest on risk free Government liabilities. It’s just giving money to people because they already have money.

Re English cricket bashing: Can I remind you of Smith, Warner and Bancroft with their unique method of polishing the ball with sandpaper? People in glass houses etc…

Dear Tom (At 2023/07/06 at 10:55 pm)

You missed the point. Sure enough the Smith etc episode was a disgrace and in my view they should never have played again for Australia even though they served long suspensions and lost the captaincy (or pretensions to it in the case of Warner).

As to ‘glass houses’ – I don’t represent Australia or Australian cricket. I don’t defend the behaviour of the Australian national team which I find off-putting to say the least. But it is not based on old-boy class networks.

The point I was making was about the existence of class and the networks that permeate sport, government and policy making.

The hypocrisy that was displayed at Lords last week was testament to the role the elites play in our society.

best wishes

bill