I am late today because I am writing this in London after travelling the last…

Australian labour market bounces back after two months of gloom – the RBA will not be pleased

The Australian Bureau of Statistics (ABS) released of the latest labour force data today (March 16, 2023) – Labour Force, Australia – for February 2023. My overall assessment is that after two months of decline (some of which was related to abnormalities during the holiday period), the February result is much stronger. All the things one looks for improved – employment rose by 64,600 (0.5 per cent) with a bias towards full-time work; unemployment fell 16,500 to 507,500 persons and the official unemployment rate fell by 0.3 points to 3.5 per cent; and the participation rate rose 0.1 point Some caution needs to be observed though – the underlying (‘What-if’) unemployment rate is closer to 5.1 per cent rather than the official rate of 3.5 per cent, which indicates the labour market still has slack. There are still 1,343.2 thousand Australian workers without work in one way or another (officially unemployed or underemployed). The problem is that the RBA, which is intent on increasing unemployment in the misguided belief that the inflationary pressures are coming from the labour market, will hike further and eventually kill off employment growth.

The summary ABS Labour Force (seasonally adjusted) estimates for February 2023 are:

- Employment rose by 64,600 (0.5 per cent) – full-time employment increased by 17,900 and part-time employment increased by 1,800.

- Unemployment fell 16,500 to 507,500 persons.

- The official unemployment rate fell by 0.3 points to 3.5 per cent.

- The participation rate rose 0.1 point to 66.6 per cent.

- The employment-population ratio rose by 0.2 points to 64.3 per cent.

- Aggregate monthly hours rose by 72 million hours (3.9 per cent).

- Underemployment fell by 0.4 points to 5.8 per cent (a fall of 43.4 thousand). Overall there are 835.7 thousand underemployed workers. The total labour underutilisation rate (unemployment plus underemployment) fell by 0.4 points 9.4 per cent. There were a total of 1,343.2 thousand workers either unemployed or underemployed.

In its – Media Release – the ABS noted that:

The seasonally adjusted unemployment rate fell to 3.5 per cent in February … with employment increasing by around 65,000 people, and the number of unemployed decreasing by 17,000 people, the unemployment rate fell to 3.5 per cent. This was back to the level we saw in December …

… the employment to population ratio increased 0.2 percentage points to 64.3 per cent in February, back to the level in December 2022.

The participation rate rose 0.1 percentage point to 66.6 per cent in February, also back to the level in December 2022 …

Seasonally adjusted monthly hours worked increased by 3.9 per cent in February 2023.

Conclusion: the weakness in the employment data over the last few months was not a foreboding of a major contraction – yet.

Employment is up, participation is up and unemployment is down.

That is usually the sign of a good conjunction of events emerging.

How that impacts on the RBA’s decision making is unknown but they will be more likely to use it as cover for more rate hikes.

Employment rose by 64,600 (0.5 per cent) in February 2023

1. Full-time employment increased by 17,900 and part-time employment increased by 1,800.

2. The employment-population ratio rose by 0.3 points to 64.3 per cent.

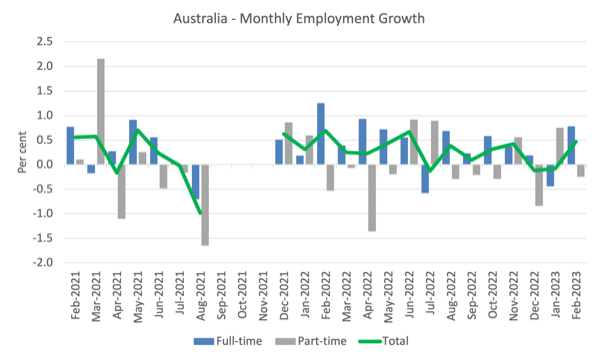

The following graph shows the month by month growth in full-time (blue columns), part-time (grey columns) and total employment (green line) for the 24 months to February 2023 using seasonally adjusted data.

I took out the observations from September to January 2021 – they were outliers due to the Covid wave at that time.

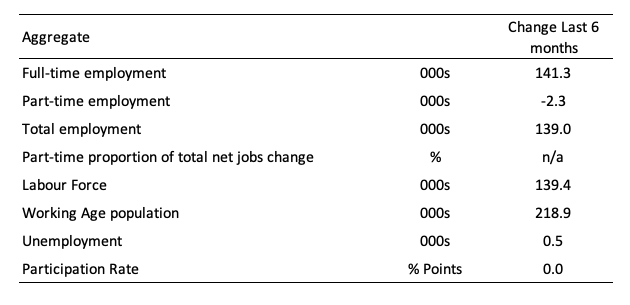

The following table provides an accounting summary of the labour market performance over the last six months to provide a longer perspective that cuts through the monthly variability and provides a better assessment of the trends.

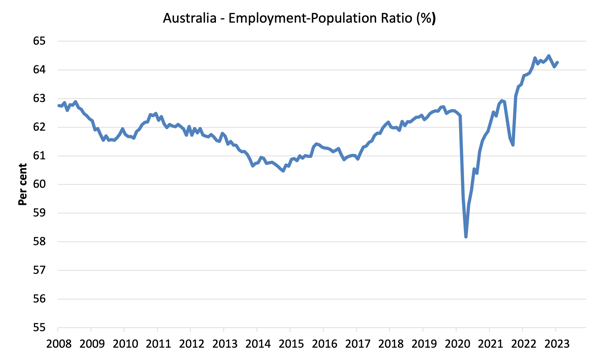

Given the variation in the labour force estimates, it is sometimes useful to examine the Employment-to-Population ratio (%) because the underlying population estimates (denominator) are less cyclical and subject to variation than the labour force estimates. This is an alternative measure of the robustness of activity to the unemployment rate, which is sensitive to those labour force swings.

The following graph shows the Employment-to-Population ratio, since January 2008 (that is, since the GFC).

The ratio ratio rose 0.2 points to 64.3 per cent in February 2023.

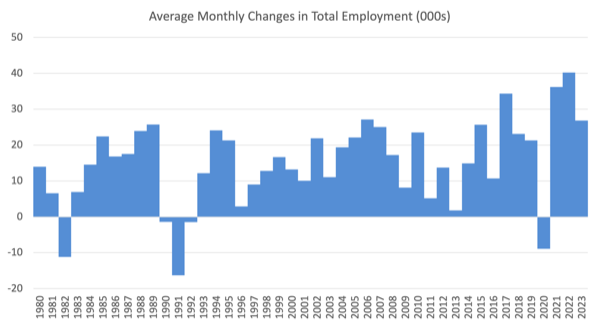

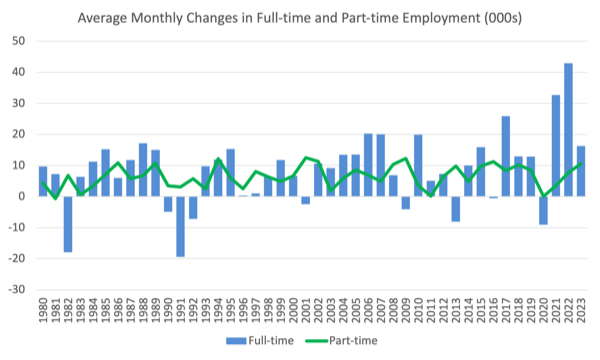

For perspective, the following graph shows the average monthly employment change for the calendar years from 1980 to 2022 (to date).

1. The average employment change over 2020 was -8.8 thousand which rose to 36 thousand in 2021 as the lockdowns eased.

2. For 2022, the average monthly change was 37.7 thousand.

3. So far, in 2023, the average change is 26.8 thousand (but that reflects the poor result for January).

The following graph shows the average monthly changes in Full-time and Part-time employment (lower panel) in thousands since 1980.

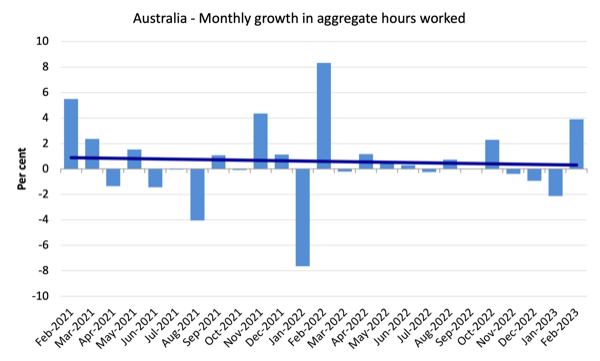

Hours worked rose by 72 million hours (3.9 per cent) in February 2023

The following graph shows the monthly growth (in per cent) over the last 24 months.

The dark linear line is a simple regression trend of the monthly change (skewed upwards by the couple of outlier results).

This month’s result is an break from the weakness over the last 12 months. The trend is downward but that could change if the next few months are as strong as February.

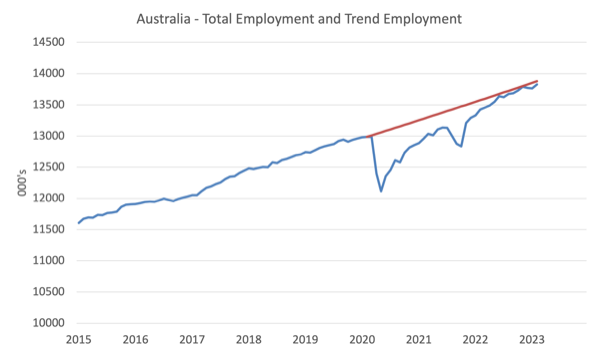

Actual and Trend Employment

The Australian labour market is now larger than it was in February 2020 and employment is now close to returning to the pre-pandemic trend.

The following graph shows total employment (blue line) and what employment would have been if it had continued to grow according to the average growth rate between 2015 and April 2020.

In February 2023, the gap fell by 39 thousand to 50.8 thousand jobs.

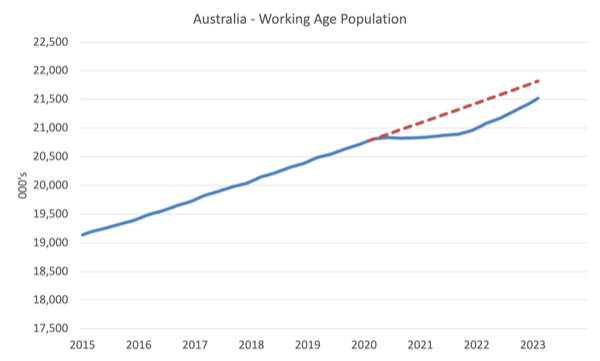

The Population Slowdown – the ‘What-if’ unemployment analysis

The following graph shows Australia’s working age population (Over 15 year olds) from January 2015 to February 2023. The dotted line is the projected growth had the pre-pandemic trend continued.

The difference between the lines is the decline in the working age population that followed the Covid restrictions on immigration.

The civilian population is 300 thousand less in February 2023 than it would have been had pre-Covid trends continued.

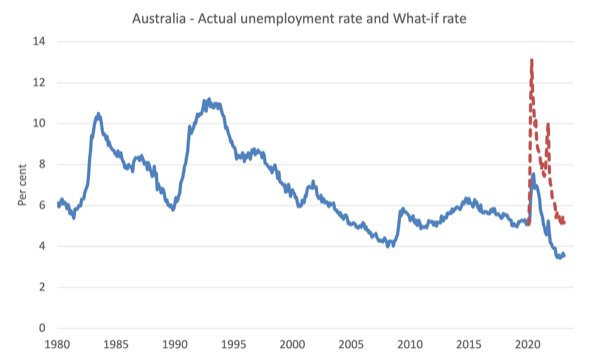

The following graph shows the evolution of the actual unemployment rate since January 1980 to February 2023 and the dotted line is the ‘What-if’ rate, which is calculated by assuming the most recent peak participation rate (recorded at November 2022 = 66.8 per cent), the extrapolated working age population (based on growth rate between 2015 and February 2020) and the actual employment since February 2020.

It shows what the unemployment rate would have been given the actual employment growth had the working age population trajectory followed the past trends.

In this blog post – External border closures in Australia reduced the unemployment rate by around 2.7 points (April 28, 2022), I provided detailed analysis of how I calculated the ‘What-if’ unemployment rate.

So instead of the current unemployment rate of 3.5 per cent, the rate would have been 5.1 per cent in February 2023, given the employment performance since the pandemic.

This finding puts a rather different slant to what has been happening since the onset of the pandemic.

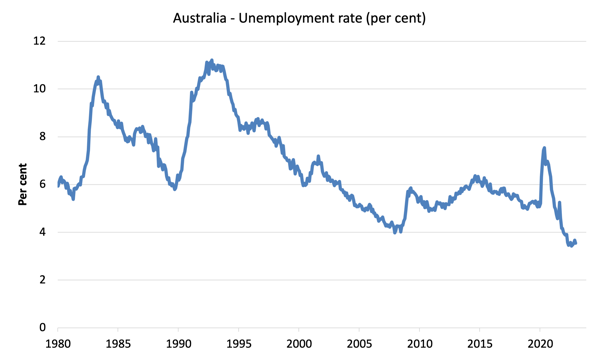

Unemployment fell 16,500 to 507,500 persons in February 2023

The fall in unemployment and the unemployment rate reversed two consecutive months of rises.

Unemployment fell because the net change in employment (64,600) outstripped the rise in the labour force (10,600 thousand).

As a result the unemployment rate fell back to 3.5 per cent (a 0.2 point drop) and with participation also rising, the data is resisting any notion that the labour market is contracting into recession.

But, also so bear in mind the ‘What-if’ analysis above and see the impact of the fall in participation below.

The following graph shows the national unemployment rate from January 1980 to February 2023. The longer time-series helps frame some perspective to what is happening at present.

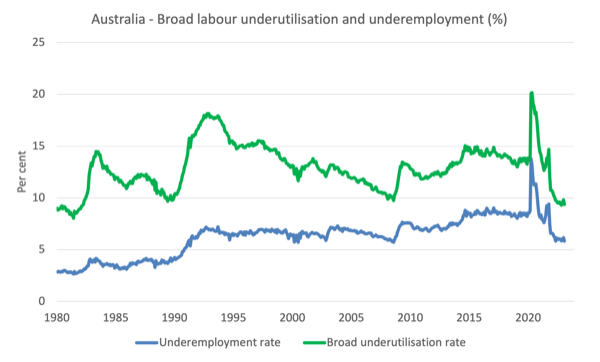

Broad labour underutilisation fell 0.4 points to 9.4 per cent in February 2023

1. Underemployment fell by 0.4 points to 5.8 per cent (a fall of 43.4 thousand).

2. Overall there are 835.7 thousand underemployed workers.

3. The total labour underutilisation rate (unemployment plus underemployment) fell by 0.4 points 9.4 per cent.

4. There were a total of 1,343.2 thousand workers either unemployed or underemployed.

With full-time employment rising both unemployment and underemployment fell – a good result.

The following graph plots the seasonally-adjusted underemployment rate in Australia from April 1980 to the February 2023 (blue line) and the broad underutilisation rate over the same period (green line).

The difference between the two lines is the unemployment rate.

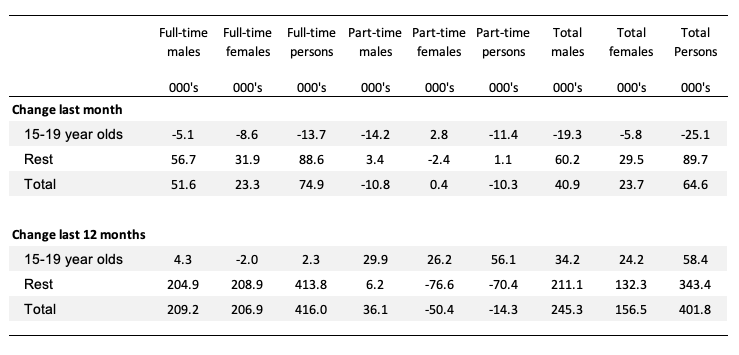

Teenage labour market deteriorated again in February 2023

While the rest of the labour market improved in February, the teenage situation deteriorated further.

The following Table shows the distribution of net employment creation in the last month and the last 12 months by full-time/part-time status and age/gender category (15-19 year olds and the rest).

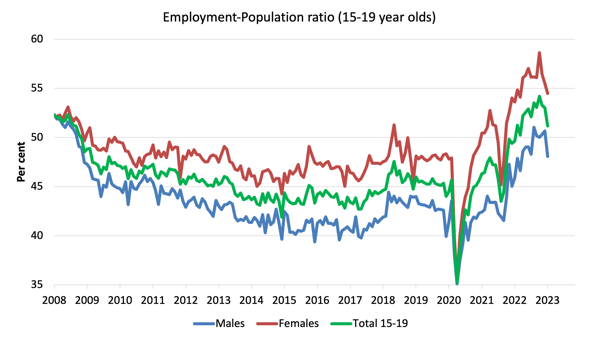

To put the teenage employment situation in a scale context (relative to their size in the population) the following graph shows the Employment-Population ratios for males, females and total 15-19 year olds since June 2008.

You can interpret this graph as depicting the change in employment relative to the underlying population of each cohort.

In terms of the recent dynamics:

1. The male ratio fell 2.6 points over the month.

2. The female ratio fell by 1.0 points.

3. The overall teenage employment-population ratio fell by 1.8 points over the month.

Conclusion

My standard monthly warning: we always have to be careful interpreting month to month movements given the way the Labour Force Survey is constructed and implemented.

My overall assessment is:

1. After two months of decline (some of which was related to abnormalities during the holiday period), the February result is much stronger.

2. All the things one looks for improved – employment rose by 64,600 (0.5 per cent) with a bias towards full-time work; unemployment fell 16,500 to 507,500 persons and the official unemployment rate fell by 0.3 points to 3.5 per cent; and the participation rate rose 0.1 point.

3. Some caution needs to be observed though – the underlying (‘What-if’) unemployment rate is closer to 5.1 per cent rather than the official rate of 3.5 per cent, which indicates the labour market still has slack.

4. There are still 1,343.2 thousand Australian workers without work in one way or another (officially unemployed or underemployed).

5. The problem is that the RBA, which is intent on increasing unemployment in the misguided belief that the inflationary pressures are coming from the labour market, will hike further and eventually kill off employment growth.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

I’m sorry that what follows got nothing to do with today’s post, but maybe more with yesterday’s.

It’s a filthy scandal that the ECB is so willing to save Credit Suisse from bankrupcy – a private bank of a country alien to the euro and the EU – and at the same time demanding austerity to 127 million people (the combined population of Portugal, Spain, Italy and Greece), after 15 years demanding the same, to the same people.

This ciminals have only one way to go: jail!

@Paulo Rodrigues I may have missed the ECB involvement, but all the news I’m reading reports that the Swiss Central Bank has provided funds to Credit Suisse. I take your general point that it is scandalous that members of the parasitic big banks club can always rely on governments’ support while support for the general citizen is cut.

With regard to Australian employment, I wonder how much the improvement has been influenced by China getting back to more normal working (for the time being) after the covid explosion.

So which does the RBA see as the greater threat? Unemployment or bank collapses. Does it have a number of how many banks need to go under before it stops increasing rates.

Patrick B. The Suisse Central Bank did make a loan to credit suisse, but the ECB had pledged to save the bank the day before.

How do I subscribe to your blog? Would love to receive your updates!