I started my undergraduate studies in economics in the late 1970s after starting out as…

Studying macroeconomics – an exercise in deception

Several readers have asked me to explain in a little more detail what I mean by statements such as investment brings forth its own saving or government budget deficits finance non-government saving. So this blog is about those topics and takes you on journey from what you won’t learn if you study macroeconomics in a typical university through to a clearer understanding of the way macroeconomies work via modern monetary theory (MMT).

The mainstream representation of these matters is taken from Mankiw’s Principles of Economics (First Edition, 1998). Nothing much has changed in subsequent editions. Mankiw’s book is a highly popular text book among university lecturers and is one of the major vehicles responsible for leading students into a state of increased ignorance about the way the fiat monetary system operates.

I offer the following assessment for all the economics students out there – if you have understood the contents of Mankiw and scored well in your exams then you have understood very little about the system we live in. Most of the policy advice that comes from this book is erroneous and dangerously so.

It is a disgrace that it has such a standing in our educational processes. What I learned long ago was that economics education in universities is mostly brainwashing and degrades our conception of education as a means of accumulating meaning and knowledge.

I was also reminded of this by an E-mail I received yesterday from a student studying university macroeconomics. I won’t give all the details to protect the person but an edited summary of what was relayed is as follows:

… I am … [studying] … economics but I have found myself somewhat dissatisfied with what is being taught. I’ve been reading around about the various economic schools and have found myself in agreement with the Post Keynesian School and recently via an interest in the history of money I … [have been] … drawn … to Modern Monetary theory (MMT) … [I proposed in class some of the fiscal principles that MMT provides insights into] … I somewhat regret this decision in retrospect … [the lecturer was very aggressive and accusative and pointed to the fact fiscal policy creates] … a crowding out effect, higher taxes, inflation and higher interest rates … [and that financial markets reject expansionary fiscal policy] …

Those financial markets have certainly not taken a cent of public money in the current crisis eh!

This sort of intellectual bullying goes on daily in universities all around the globe. The teachers don’t teach … they berate. They are ill-equipped themselves to deal with anything that is outside the confines of the textbooks which come to represent their bibles. I recall when I was a post graduate student a leading professor, now deceased, said “you are very bright billy but you should get rid of those stupid ideas”, some other professor called me a “pop sociologist” even though I was more technically advanced (by far) than he was and could run rings around him on the technicalities of his own theoretical paradigm. Put downs, insults, and the rest of it … are the ways they suppress debate.

Anyway, back to saving.

In Mankiw’s Principles of Economics Chapter 25, it is claimed you will “consider how the financial system is related to key macroeconomic variables”, “develop a model of supply and demand for loanable funds in financial markets”, “use the loanable funds model to analyze various government policies” and “consider how government budget deficits affect the … economy”.

As I will demonstrate and explain … in fact, you would learn nothing from this Chapter.

On page 548, Mankiw says that:

The rules of national income accounting include several important identities. Recall that an indentity is an equation that must be true because of the way the variables in the equation are defined.

No disagreement at all. Learning the way in which the economic sectors (government and non-government) interact is critical and the starting point is national income accounting.

He then introduces the aggregate output-expenditure identity Y = C + I + G + NX, where Y is GDP, C is household consumption, I is business investment (in productive capacity not financial assets), G is government spending and NX is net exports or (exports minus imports).

So every item of expenditure on the right-hand side has to show up as GDP (output). Note that all output and spending flows are expressed in real terms in this sort of analysis.

I will come back to the open economy model later but Mankiw says to “simplify our analysis” he assumes a closed economy. There is nothing really lost in doing that at this stage. So “each unit of output sold … is consumed, invested, or bought by the government.”

Mankiw then manipulates the closed economy identity to see what it “can tell us about financial markets”. So, Y – C – G = I and the LHS (Y – C – G) he terms national saving “or just saving” (S). From that he presents the famous national income equilibrium condition S = I.

He then introduces taxes (T) to help us “understand the meaning of national saving”. So national saving is either: S = Y – C – G or S = (Y – T – C) + (T – G).

The two equations are the same clearly but like in a lot of economics manipulating equations can open up a new path to follow which expands meaning (or increases the nonsense depending on the way you look at it).

Private saving is defined by Mankiw as Y – T – C – so what is left after spending (C) out of disposable income (Y – T). He then says that public saving is:

… the amount of tax revenue that the government has left after paying for it spending.

There are several things wrong with this seemingly harmless statement. Private saving, however accomplished, increases the future consumption possibilities for the household sector at the expense of current consumption. Saving is foregone consumption which in normal times (barring huge financial crashes) will enhance future consumption.

In this context, because the household sector is revenue-constrained, it has to sacrifice consumption possibilities now to improve them later. It can increase consumption now beyond income via increasing its indebtedness or selling assets (past saving) but the budget constraint has to be obeyed at all times.

But, of-course, this sort of reasoning doesn’t apply to the government. A budget surplus does not create a cache of money that can be spent later. Government spends by crediting a reserve account. That balance doesn’t “come from anywhere”, as, for example, gold coins would have had to come from somewhere. It is accounted for but that is a different issue.

Likewise, payments to government reduce reserve balances. Those payments do not “go anywhere” but are merely accounted for. A budget surplus exists only because private income or wealth is reduced.

The consequence of this is that running a budget surplus (T > G) last period, does not increase the capacity of the government to spend this period. Given the government is not revenue-constrained, it can spend whenever there are real goods and services available for sale irrespective of where they have been in the past.

So the “saving” analogy breaks down. The idea that the government saves in its own currency has no meaning.

That is a major error in mainstream reasoning.

Mankiw then asks:

For the economy as a whole saving must be equal to investment … What mechanisms lie behind this identity? What coordinates those people who are deciding how much to save and those people who are deciding how much to invest?

Mankiw tries to argue that the financial markets then mediate – “they take the nation’s saving and direct it to the nation’s investment”. You will note the causality here (which in the banking chapter manifests as the flawed money multiplier version of money creation). I will come back to that.

Market for loanable funds

The discussion then considers a “model of financial markets” which is:

… to explain how financial markets coordinate the economy’s saving and investment. The model also gives us a tool with which we can analyze various government policies that influence saving and investment.

Harking back to the pre-General Theory days, Mankiw assumes that it is reasonable to represent the financial system as the “market for loanable funds” where “all savers go to this market to deposit their savings, and all borrowers go to this market to get their loans. In this market, there is one interest rate, which is both the return to saving and the cost of borrowing.”

So we are back in the pre-Keynesian world of the loanable funds doctrine (first developed by Wicksell).

This doctrine was a central part of the so-called classical model where perfectly flexible prices delivered self-adjusting, market-clearing aggregate markets at all times. If consumption fell, then saving would rise and this would not lead to an oversupply of goods because investment (capital goods production) would rise in proportion with saving. So while the composition of output might change (workers would be shifted between the consumption goods sector to the capital goods sector), a full employment equilibrium was always maintained as long as price flexibility was not impeded. The interest rate became the vehicle to mediate saving and investment to ensure that there was never any gluts.

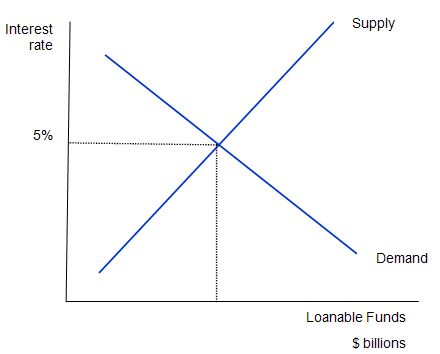

The following diagram (Figure 25.1 from Mankiw) shows the market for loanable funds. The current real interest rate that balances supply (saving) and demand (investment) is 5 per cent (the equilibrium rate). The supply of funds “comes from those people who have some extra income they want to save and lend out. The demand for funds comes from households and firms who wish to borrow to invest (houses, factories, equipment etc). The interest rate is the price of the loan and the return on savings and thus the supply and demand curves (lines) take the shape they do.

Note that the entire analysis is in real terms with the real interest rate equal to the nominal rate minus the inflation rate. This is because inflation “erodes the value of money” which has different consequences for savers and investors.

Mankiw claims that this “market works much like other markets in the economy and thus argues that (p. 551):

The adjustment of the interest rate to the equilibrium occurs for the usual reasons. If the interest rate were lower than the equilibrium level, the quantity of loanable funds supplied would be less than the quantity of loanable funds demanded. The resulting shortage … would encourage lenders to raise the interest rate they charge.

The converse then follows if the interest rate is above the equilibrium.

He also says that the “supply of loanable funds comes from national saving including both private saving and public saving.” Think about that for a moment. Clearly private saving is stockpiled in financial assets somewhere in the system – maybe it remains in bank deposits maybe not. But it can be drawn down at some future point for consumption purposes.

Mankiw thinks that budget surpluses are akin to this. They are not even remotely like private saving. They actually destroy liquidity in the non-government sector (by destroying net financial assets held by that sector). They squeeze the capacity of the non-government sector to spend and save. If there are no other behavioural changes in the economy to accompany the pursuit of budget surpluses, then as we will explain soon, income adjustments (as aggregate demand falls) wipe out non-government saving.

So this conception of a loanable funds market bears no relation to “any other market in the economy” despite the myths that Mankiw uses to brainwash the students who use the book and sit in the lectures.

Also reflect on the way the banking system operates – read Money multiplier and other myths if you are unsure. The idea that banks sit there waiting for savers and then once they have their savings as deposits they then lend to investors is not even remotely like the way the banking system works. I will come back to that soon.

Mankiw then starts to analyse policy and first shows how taxes inhibit saving and investment. Bad taxes! I won’t go into this analysis but it is standard and riddled with errors.

Policy 3 analysis concerns government budget deficits, which is introduced as:

One of the most pressing policy issues … has been the government budget deficit … In recent years, the U.S. federal government has run large budget deficits, resulting in a rapidly growing government debt. As a result, much public debate has centred on the effect of these deficits both on the allocation of the economy’s scarce resources and on long-term economic growth.

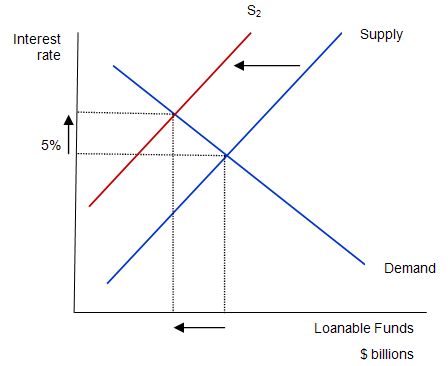

This was published 11 years ago but his “concern” would be even greater now. He uses his loanable funds model to answer some important questions, and I replicate his Figure 25-4 below. He asks “which curve shifts when the budget deficit rises?” The answer is the supply curve to S2. The twisted logic is as follows: national saving is the source of loanable funds and is composed (allegedly) of the sum of private and public saving. A rising budget deficit reduces public saving and available national saving. The budget deficit doesn’t influence the demand for funds (allegedly) so that line remains unchanged.

The claimed impacts are: (a) “A budget deficit decreases the supply of loanable funds”; (b) “… which raises the interest rate”; (c) “… and reduces the equilibrium quantity of loanable funds”.

Mankiw says that:

The fall in investment because of the government borrowing is called crowding out …That is, when the government borrows to finance its budget deficit, it crowds out private borrowers who are trying to finance investment. Thus, the most basic lesson about budget deficits … When the government reduces national saving by running a budget deficit, the interest rate rises, and investment falls. Because investment is important for long-run economic growth, government budget deficits reduce the economy’s growth rate.

Now if you believe all of that then please send me an E-mail because I have a good deal for you. I just heard that the Sydney Harbour Bridge is for sale and I am the preferred tenderer – but if you agree to give me commission I will cut you into the deal of the century. Don’t miss out … this is better than all those Nigerian fortunes that are available every day for the astute investor.

The analysis relies on layers of myths which have permeated the public space to become almost “self-evident truths”. Sometimes, this makes is hard to know where to start in debunking it. Obviously, national governments are not revenue-constrained so their borrowing is for other reasons – we have discussed this at length. This trilogy of blogs will help you understand this if you are new to my blog – Deficit spending 101 – Part 1 | Deficit spending 101 – Part 2 | Deficit spending 101 – Part 3.

But governments do, for stupid ideological reasons and to facilitate central bank operations, borrow – so doesn’t this increase the claim on saving and reduce the “loanable funds” available for investors? Does the competition for saving push up the interest rates?

Answers: no and no. But you will want more than that.

First, budget deficits build productive infrastructure which exerts a positive influence on economic growth.

Second, budget deficits typically help stimulate investment because they keep aggregate demand from plummeting.

Third, the loanable funds model is a total misrepresentation of the manner in which national saving is generated. The first two points I won’t focus on. The third point is very significant and occupied Keynes in the lead up to the publication of his General Theory. This is how Keynes addressed the issue.

Both consumption and saving were considered to be dependent on income (GDP) in contradistinction to the loanable funds theory which claimed that the real rate of interest was the factor that determined how much income was spent and how much was saved.

But then Keynes had to come up with a theory of interest rate determination and so he introduced the idea of a money market which linked the real and nominal sectors of the economy. The interest rate was now considered to be a nominal variable determined by the supply of and demand for money.

What Keynes was attacking was the notion that there could never be deficiencies in aggregate demand arising from excessive saving or inadequate levels of investment. The loanable funds doctrine (via Say’s Law) claimed as above that interest rates would always reconcile the two and ensure that involuntary unemployment was impossible.

Remember that this debate was going on during the Great Depression where unemployment hit 30 or more per cent in some countries as demand collapsed.

Keynes wanted to explain the dynamics of output and employment and he started by proposing that consumption is a function of income (the higher the income the more we are likely to consume) and saving is a residual at the macro level (unspent income) and is thus also an increasing function of income.

Further, the factors that determined investment decisions were different from those that determined consumption (and saving). This introduced a new dimension which is denied by Mankiw and loanable funds theory – that saving which is a leakage from the income generating process may not be transformed into an equal flow of investment.

This was a direct challenge to the Say’s Law logic that defined the sort of theory Mankiw is touting. So saving (a reduction in consumption) could lead to an aggregate demand deficiency which caused in involuntary employment as firms laid off workers as they reduced output to conform with the lower aggregate spending.

Changes in the interest rate were not longer significant in this conception and would not bring saving and investment together. I won’t deal with the interest rate determination debate in this blog – but it led to the rejection of the then dominant Quantity Theory of Money. I will write about that another day.

To see how this rejection of loanable funds doctrine leads to starkly different conclusions from those made by Mankiw, we have to clarify a few concepts. We will stick in a closed economy because nothing much changes if we make it more complicated and I wrote enough about the open economy yesterday to last a few days.

The S = I national income equilibrium condition noted above is actually incomplete. Obviously, in an accounting sense (given it is derived from an identity), S will always be equal to I if G = T (in a closed economy or NX = 0 in an open economy). But this might not be a state of rest or equilibrium.

Equilibrium is defined as a state from which there is no tendency for change. In the macroeconomics product market (where output is bought and sold), equilibrium occurs when planned aggregate expenditure is equal to aggregate output. If that condition doesn’t hold then output and income will change until it does.

So we also usually distinguish between desired or planned investment (Ip) which refers to the additions to capital stock, inventory and housing that are planned by firms and households and actual investment (Ia), which is the actual amount of investment that takes place. The difference between the two is called unintended or unplanned investment (Iu) and typically relates to unplanned changes in inventories.

These surprises arise because the future is uncertain and business firms have to guess what household consumption will be in the period ahead and make production decisions accordingly. If they are overly optimistic and household saving is higher than expected then they will have over-produced and this will manifest as unsold inventory – that is, Iu > 0 – they have invested more than they wanted to and planned to.

In the output-expenditure model it means that Y > C + I + G, that is, aggregate output (GDP) is greater than planned aggregate expenditure; inventory investment is greater than planned; and actual investment is greater than planned investment.

So this situation describes a macroeconomic disequilibrium and as such is an unstable position – that is, things will change. What? Output and income will change.

What are the consequences of that? So firms in general produce on the basis of expected aggregate demand (spending) and set employment levels accordingly. They thus decide on a level of planned investment and if they achieve that they are content.

However, if we have a situation where planned saving turns out to be greater than planned investment (meaning aggregate spending is below that expected by firms and which they made all their output and employment decisions in the past period) then, even though actual S = actual I, the planned aggregates do not mesh. So actual I > planned I, because Iu > 0 (that is, firms have unsold inventories in excess of their desired levels).

What do firms do? Cut output and employment thereby generating unemployment. This reduces GDP (national income) and as a consequence household saving falls (as does consumption spending).

This invokes a downward spiral characterised by the so-called expenditure multiplier process. How does this work? As firms lay off workers they reduce their spending. This leads to further lay-offs and so on. Each sequence gets less damaging than the last (if consumers consume less than 100 per cent of their income) and so there is a finite dynamic process involved.

The downward spiral continues as long as Sp > Ip. What brings the two into equality? Income adjustments rather than interest rate adjustments. The economy will continue contracting and reducing income levels until the drop in savings is in line with the expectations of the business firms (investors). Total saving drops as income drops.

These dynamics also allow you to understand why the rubbish that Mankiw feeds into students’ heads about budget deficits is erroneous.

First, there is no finite supply of saving that are available for borrowing. Aggregate saving increases with income and the latter responds positively to spending. So aggregate spending, however, sourced “brings forward its own saving” as the dynamic adjustments occur to ensure that the planned aggregates are brought into concert with each other as required.

The upshot of this is that the notion that government borrowing competes for scarce savings which then drive interest rates up is nonsensical. As I have explained before – governments only borrow back their own spending. The issuance of debt is just an offer to provide an interest-bearing asset in place of non-interest bearing (or low bearing) bank reserves. Exactly the same outcome would occur if the government just paid a return on overnight (excess reserves). This would accomplish all the central bank operational requirements to stop competition in the interbank market from driving the overnight interest rate away from that targeted by the central bank.

And this strategy would have absolutely no implications for the government spending which created the reserves in the first place. The government doesn’t need to borrow remember. When you are meditating this might be a nice mantra to work with – the government is not revenue-constrained.

Second, you can readily understand that budget deficits (net spending) by adding net financial assets to the non-government sector actually finance saving by that sector. It does this by providing the aggregate demand that keeps output and employment from contracting when the non-government sector is increasing its desired saving. So far from undermining saving (as in the second graph above) budget deficits are essential for the non-government sector to save.

Without a budget deficit the non-government sector cannot save net financial assets in the currency of issue. If we go back to the beginning of this blog and focus on the only sensible thing Mankiw says in the whole Chapter 25 “The rules of national income accounting include several important identities”. Yes they do. The first one that all children should learn is that the government deficit (surplus) is equal $-for-$ (peso-for-peso) (yuan-for-yuan) to the non-government surplus (deficit).

Starting from there will put you on the path to correctly understanding the consequences of behavioural changes in saving desires etc that produce income and employment changes and how budget deficits can intervene in a positive manner.

Third, without the government deficits, if the non-government sector desires to increase its saving (in an open economy (S – I) > – NX or in a closed economy (S – I) > 0), then the only way the economy can grow is if (G – T) > 0 offsets the saving increase. If it is insufficient, saving will fall as income losses arise.

Conclusion

I think one of the things that the current downturn across the globe has established – fiscal policy (budget deficits) are very effective and monetary policy is not.

I am not saying the way that the stimulus packages have been implemented is optimal or that there hasn’t been any unintended consequences (waste) but the negatives are relatively minor compared to what would have happened if the governments had not have acted so dramatically. The Great Depression wiped out a massive amount of wealth and the lost income during that decade was lost forever and the lives of many people who lived through it indelibly etched with failure and poverty.

While the current downturn is still very damaging and costly to certain cohorts in our communities the fiscal interventions have put a floor under the free-fall and reduced the costs.

Time to stop.

You really need to educate Brad Delong. He seems to be stuck in 1970 (or 1932):

http://delong.typepad.com/sdj/2009/10/yes-we-can–afford-more-short-run-deficit-spending-that-is.html

Dear Jim

There are causes and lost causes.

best wishes

bill

The most striking aspect of this, for me, is that: “budget surpluses … actually destroy liquidity in the non-government sector (by destroying net financial assets held by that sector).”

Simplistically, since the budget balance is equal to revenue – spending then obviously to have a surplus the Government must take more (in taxes) than they give (through spending). But I never understood, before reading your blog, that the consequences of this is that private assets are destroyed.

It seems that if we were able to get that simple message across, “budget surplus = destroyed private assets”, then surely no Government would dare to run a surplus for the political backlash that would follow from them destroying private assets.

Now how do we get that message out there?

It’s not just Brad who needs education.

This is a pet peeve of mine, but if we called earning more than you spend profits instead of savings, then many things would become clear. It is much easier to understand that profits arise from investment rather than trying to explain to someone that “savings” arise from investment. Fewer people would believe that we need a “pool” of profits from which to invest, as a good idea and credit is all that is needed. But for the endeavor to succeed in generating profits, others must also be spending more than they take in — they must be investing. So a constant stream of investment is required to fund profits, and the total amount of cash-flow surpluses realized must be the total amount of cash-flow deficits, or the total amount of investment.

Also, people would more intuitively understand that in a downturn, it may be better to sacrifice present profits rather than liquidating capital or laying people off, and that if you do sacrifice present profits in a downturn, you are more likely to see a faster return to profitability in the future. Not in all cases, but at least some of the issues would become apparent, and the “paradox of thrift” would easily be explained.

And no one would argue that the government should turn a profit by taxing its citizens more than it spends on providing services. People intuitively understand that, yet at the same time they hold in their heads the nation that the government should “save”, because it would good for a household to do that. For some reason, we have been hoodwinked into thinking that retained corporate earnings and household surpluses are the result of deferred consumption, rather than successful return on investment. The demographic data says otherwise, as does common sense: the widow saving her mite just doesn’t appear in the national accounts, but a small group of households account for the vast majority of all “savings”. And those profits certainly don’t come from deferred consumption, not as this term is commonly understood.

But economists still keep using this morality-laden term to the detriment of understanding.

Another way I have been thinking of this is to start using that dreaded term “value” again.

I was discussing with a friend some basic economics with a friend (job layoffs, etc.) when he stated that getting less for the same amount of money was equivalent to inflation. While not arguing the point, I said that that was equivalent to saying that since California just drastically cut services while keeping taxes at the same level that was tantamount to a tax increase. We then had a dialogue concerning whether the state could provide services that had value in excess of the costs (taxes).

Surprisingly this somewhat conservative (although these terms are getting less and less useful nowadays) friend started to agree with me – at least until he realized what this might mean. Very small victory – but more importantly people are starting to question old assumptions.

Your theory about “aggregate saving increases with income and the latter responds positively to spending” is based on the assumption that the economy is all about moving money around, and issues of actual produced goods, etc. are tangential.

That, I think, is the flaw in Keynesianism. It neglects the fact that money actually is just a tool that stands for the value of real assets. It is not what the economy is actualy based on.

Glaivester,

You have made an important point. Fortunately or unfortunately in the economic system, that is how it is. They call it the M-C-M (Money-Commodity-Money) framework. You may want to check the page 8 of this article http://www.cfeps.org/pubs/wp-pdf/WP26-HenryBell.pdf – Its on a slightly different topic but the discussion of MCM vs. CMC is really nice in Stephanie Bell’s article.

The scariest article in recent times by none other than Mankiw http://www.nytimes.com/2010/01/17/business/economy/17view.html

OMG!! Greg Mankiw is revising his textbook Help Wanted