These notes will serve as part of a briefing document that I will send off…

Elites using monetary policy to deal with paranoid fears that power might shift towards workers

What a world we live in where we are snowed with propaganda from the elites about how the only way forward is that we accept “pain” or “sacrifice” to prevent some inflationary catastrophe from accelerating out of control and that if workers dare seek some cost-of-living redress as corporations go for broke in their margin push, then the pain the policy makers will inflict will be greater. The annual gathering of the elites at Jackson Hole in Wyoming over the last days has been one of those ‘can you believe this lot’ moments. First, we had the US Federal Reserve boss almost joyfully telling Americans that he will inflict pain on them because “these are the unfortunate costs of reducing inflation”. At the same event, the ECB Board member Isabel Schnabel told the gathering that the central banks had to inflict higher unemployment rates to control inflation to stop wages getting driven by inflationary expectations. And then we look at wages growth in Europe and see that real wages are in free fall (dropping 5.9 per cent in the June-quarter 2022).

The Federal Reserve boss presented this Speech (August 26, 2022) – Monetary Policy and Price Stability – at the Wyoming event.

It is light years away from what he was saying almost exactly two years ago (August 27, 2020) at the Jackson Hole event – New Economic Challenges and the Fed’s Monetary Policy Review – when he noted that:

1. “assessments of the potential, or longer-run, growth rate of the economy have declined.”

2. “More troubling has been the decline in productivity growth, which is the primary driver of improving living standards over time.”

3. “the historically strong labor market did not trigger a significant rise in inflation.”

4. “The muted responsiveness of inflation to labor market tightness, which we refer to as the flattening of the Phillips curve …”

5. “our revised statement emphasizes that maximum employment is a broad-based and inclusive goal. This change reflects our appreciation for the benefits of a strong labor market, particularly for many in low- and moderate-income communities.”

Observers believed the Federal Reserve had made a substantial shift in its way of thinking about monetary policy after this Speech.

But after last week’s presentation, it is clear that the pandemic speech was just an aberration, probably the result of the deep uncertainty everyone was facing at that time, which gave the elites pause for concern for their position.

Now it is back to normal, neoliberal business.

The central bank is now back to its dysfunctional best.

We get statements like:

… Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance.

‘Forcefully’ – brute force against the workers to create as much unemployment as necessary.

Then, it is not really about bringing ‘demand’ into line with ‘supply’, rather:

Reducing inflation is likely to require a sustained period of below-trend growth.

Demand has to be brought so that unsold supply rises and firms are forced to lower prices.

And all that means they are wanting to:

… bring some pain to households and businesses …

And if workers dare try to get wage rises the central bank will inflict:

… far greater pain.

All in a day’s work for the elites.

He admitted that the current inflation was global and about constrained supply (arising from the pandemic etc)

But did not articulate how rising interest rates would cure the supply constraints only that spending had to be cut back to the ‘artificial’ supply levels.

Well, the point here is that the supply disruptions are temporary (how long – uncertain) and when they ease they will ease quickly.

Some of the supply disruptions in Australia at present were flood related.

Fresh vegetables sky rocketed a few months ago and now they have fallen quickly as farming conditions are restored.

The other point is that unemployment is highly asymmetric.

When demand is repressed it rises quickly and then it takes a long time to fall again as demand improves.

The intervening period causes massive damage to the unemployed and their families and there communities.

A short period of elevated inflation causes no where near that damage.

So the Federal Reserve may be able to reduce demand via higher interest rates – maybe – but then when supply returns (and it doesn’t know when that will occur) – the US will be left with a pool of unemployed, stagnant spending, and unsold goods and services.

It is not a very sensible way to pursue price stability when the problem is not accelerating demand coming up against a full capacity supply side.

What we have now is a temporarily repressed supply side coming up against relatively normal levels of demand.

The Federal Reserve want demand to fall but has no way to stimulate the supply side unless it finds a cure for Covid, ends the OPEC cartel and stops the war in the Ukraine.

Powell claims they are taking lessons from the 1970s.

In that vein, he rolled out the ‘inflationary expectations’ story that “the public’s expectations about future inflation can play an important role in setting the path of inflation over time.”

In the same breath almost he then admitted:

longer-term inflation expectations appear to remain well anchored. That is broadly true of surveys of households, businesses, and forecasters, and of market-based measures as well. But that is not grounds for complacency …

So there are no lessons from the 1970s here.

Real wages are falling in the US and workers are not driving this inflation.

Further, remember this Federal Reserve discussion paper (September 2021) – Why Do We Think That Inflation Expectations Matter for Inflation? (And Should We?).

I discussed its contents in this blog post – Federal Reserve research paper kills another core New Keynesian idea about inflation expectations (October 21, 2021).

The author of that Federal Reserve paper noted that:

Mainstream economics is replete with ideas that “everyone knows” to be true, but that are actually arrant nonsense … expectations … [are] … central to the inflation process; similarly, many central banks consider “anchoring” or “managing” the public’s inflation expectations to be an important policy goal or instrument … [there is] … no compelling theoretical or empirical basis and could potentially result in serious policy errors.

The paper essentially debunks the current claims from the boss of his own organisation (above) that pain has to be inflicted just in case the public expectations of inflation rise a bit.

One day later

Not to be outdone in the threatening of pain stakes, the next day (August 27, 2022), the ECB Board member Isabel Schnabel stood up at Jackson Hole with this Speech – Monetary policy and the Great Volatility.

She also channelled the 1970s inflation episode and the role that inflationary expectations played in that episode.

That role, by the way, is disputed but it remains core New Keynesian business in serving the elites.

Her offering was different to the crude ‘back to ideology’ Powell speech.

She acknowledged lot of future risks – pandemic, climate etc.

She also admitted that “monetary policy operates with long lags” which means that the outcomes are imprecise and uncertain and that short-run “inflation overshoots” should not cause policy makers to go feral and inflict the sort of pain that Powell is overseeing.

Importantly, she acknowledged, that the inflationary pressures are coming at present when the supply side is highly constrained by “the pandemic and the war”, which leaves two “broad paths” for the central bank:

one is a path of caution, in line with the view that monetary policy is the wrong medicine to deal with supply shocks … The other path is one of determination. On this path, monetary policy responds more forcefully to the current bout of inflation, even at the risk of lower growth and higher unemployment.

She then fell back into script by claiming the latter path is justified.

Why?

1. If “the degree of inflation persistence is uncertain” then it is best according to her logic to crunch it quickly.

Which is an extraordinary statement conclusion really.

There is no uncertainty about the ’causes’ of the inflation. They are all transient causes.

Why add further damage when before long the supply reversals will come?

2. “central banks should conduct policy assuming that inflation is persistent”.

So operate in the dark and treat the problem as if it is a case of excess demand coming up against an unshifting, full capacity supply-side and deliberately damage demand.

Almost unbelievable.

3. “risks of de-anchoring of inflation expectations are rising” – but, no sign that the actual expectations (even if they mattered) are rising.

The “risks” are rising … that is central bank code for cover to inflict pain on the unemployed.

Where might those expectations be rising?

Well, if it is the 1970s, then we would expect strong negotiated wage demands coming from workers who after a year of rising inflation would be building that knowledge into their annual wage bargains.

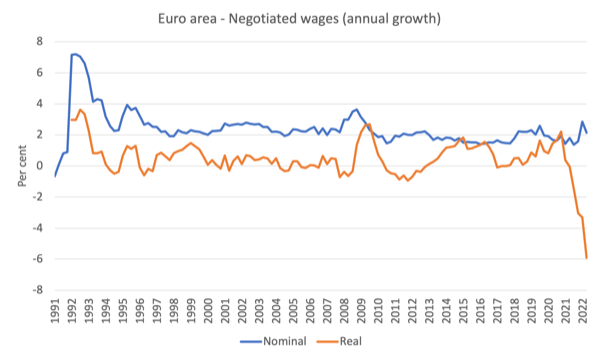

Here is the latest negotiated wages growth in the Eurozone up to the June-quarter 2022 in both nominal (blue) and real terms (orange).

There is no upward trend in nominal wages growth and as inflation rises in the last several quarters, real wages are in sharp decline.

Since the September-quarter 2021, annual growth in real wages has fallen overall in the Eurozone by 1.5 per cent (September-quarter), 3 per cent (December-quarter), 3.3 per cent (March-quarter 2022) and then 5.9 per cent (June-quarter 2022).

Conclusion: wages growth is not driving the inflation and there is no evidence of any wage-price spiral forming as a result of elevated inflationary expectations.

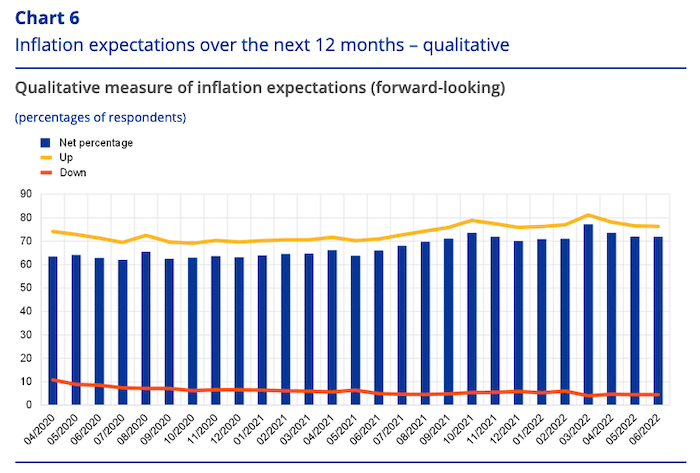

The ECB also publish a measure of consumer inflationary expectations – Inflation perceptions and expectation (last published August 4, 2022).

Chart 6 tells us what the survey respondents think will happen over the next 12 months to inflation.

Here it is (from the ECB publication).

Now unless a declining trend since early this year means something different than a declining trend, then there is no case to be made that consumers in the Eurozone are believing inflation is accelerating and likely to get out of control.

And there doesn’t appear to be much uncertainty about that.

Chart 12 (if you look it up) shows a flat “probabilistic measure of inflation uncertainty (forward-looking)” profile since February 2022.

Schnabel also admitted that the “Phillips curve has become flatter over the past few decades” (that is, much higher unemployment is now necessary to bring inflation down by a percentage point) and that bringing inflation down:

… potentially requires a deep contraction.

In other words, monetary policy is not really a suitable tool for dealing with these problems when they arise.

Conclusion

The message is clear though.

Neither the GFC nor the Pandemic, which both delivered massive dissonance for mainstream macroeconomics, have been sufficient to rid us of the fictions that the profession propagates.

We are back to using elevated levels of unemployment just in case workers get better organised and start to push for a higher share in national income.

The low unemployment – brought about mostly because Covid has wiped out thousands of workers who are now too sick to work – was too much for the elites to bear.

So they reinstate the scary inflationary arguments as cover to do something about their paranoid fears that the power balance has shifted towards workers.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Well, when their interest rate rises start crashing the stock market that their QE inflated so much, these poor elites really will have a dilemma on their hands…

It looks like they are out of options. Maybe that is why Macron is talking about the “end of the age of abundance”?

@koual,

Capitalists love to give capitalism the credit for the massive change in human societies since 1750.

AFAIK, capitalism was established in England by 1600 when joint stock comp. funded the American colonies. From 1600 to 1750 England saw some increase in wealth as a result of expanding into the rest of the world with massive tech advantages for the Europeans and English. Then, in 1750 the steam era began. it was followed by the oil era. During this period, the energy used by Europeans and Americans increased massively every decade.

. . So, with many times more energy every decade, of course wealth increased faster and faster in every decade. IMHO, the only roll that capitalism played in this was limited. Any economic system that discovered the ease of turning coal into energy to drive machines in factories would have also done about the same.

Yes, the elites ae going to cause pain for many in the world as ACC makes everything worse.

Don’t look up, you might see the comet coming.

.

The medieval doctors of the Fed, having deduced that the current inflation is a fever, will now apply more and larger leeches (coupon clippers) to labour.

Once again, in order for the village to be saved, it must be destroyed …

” . . . the credit for the massive change in human societies since 1750.”?

“For a mere £49 (at pre-pandemic prices) the capitalist purchases £330,000 worth of work (at the current UK median wage). It is the exploitation of fossil fuels rather than the exploitation of labour which generates the vast majority of the surplus value ”

And: ‘Growth’ depends upon ‘cheap’ F.F. – those ‘halcyon days’ are ‘gone’.

From: The Consciousness of Sheep on Facebook.

Loving the way the Phillips curve changes it’s shape and position to fit the facts. So versatile! What a crock of shit.

The elite’s goal is very straightforward: maximize profits. Nobody in Jackson Hole was vaguely concerned about the social costs of austerity and nobody had any volition to manage the poly-crisis. Not even war will stop them.

They will do anything to stay on top.

Now, they need to keep the masses out of the streets.

And that is the reason why we are seeing fascism rise again.

The only quibble I have with this post is the use of the term “New Keynesian.” The policy recommendations put forth by the “New Keynesians” do a disservice to the memory of J.M. Keynes. I realize that they would love to wrap themselves in Keynes’s mantle — but isn’t there some other terminology we could use that wouldn’t require a postgraduate degree in bourgeois economics to understand?

Excellent analysis as usual, but I think your framing is as problematic as the Jackson Hole crowd in one key respect: The gas & other supply-side issues are indeed a result of ‘The War'[, but only to the extent that they are a result of ‘our’ response – ie. ‘The Sanctions’.

The adoption of your/their framing negates any discussion of this key issue – it assumes that The Sanctions were and are ‘our’ only response to The War. That they may be turning out to be counter-productive, self-harming and ineffective are issues that absolutely have to be addressed – but they will never be under the current framing.

FWIW I’m in strong agreement with Michael Hudson on this matter and would be very interested to here your views on his analysis (happy to send links if you need them).

Exactly correct Targeting inflation

The whole neoliberal trend in macroeconomic policy. The essential thing underlying this, is to try to reduce the power of government and social forces that might exercise some power within the political economy-workers and others-and put the power primarily in the hands of those dominating in the markets. That’s often the financial system, the banks, but also other elites. The idea of neoliberal economists and policymakers being that you don’t want the government getting too involved in macroeconomic policy. You don’t want them promoting too much employment because that might lead to a raise in wages and, in turn, to a reduction in the profit share of the national income.

So, sure, this might increase inflation, but inflation is not really the key issue here.

The problem, in their view, is letting the central bank support other kinds of policies that are going to enhance the power of workers and even sometimes manufacturing interests. Instead, they want to put power in the hands of those who dominate the markets, often the financial elites.

I’m a big fan of the understandings of geopolitical economics and the dollar hegemony of the US that Michael Hudson espouses. Also of the big picture of industrial economies resisting the advances of financialised, neoliberal, rentier economies of the neofeudal western hemisphere and its chorus of vassal states such as Australia & etc.

It is not that the powers of big oil and big capital are trying to reduce the power of government (as the currency issuer) but that they have co-opted that power for their benefit against the majority. The ideas of Guy Standing in segmenting society into the (indigent), precariat, proletariat, proficians, salariat, managerial, elites and kleptocrats has merit but he fails when he supports a (neoliberal) UBI because, I believe, he has no idea about the operations of a free floating fiat currency. It is from the upper reaches of the proficians through to the elites that have been significantly co-opted to do the bidding of big capital. This is done by having enough of them accept that they control part of the system from which they have financially benefited by making them just wealthy enough to believe its continuance is in their interests.

Those long disregarded (environmental) externalities are now becoming highly visible and threatening to blow the neoliberal, financialised crony capitalism wide open.