The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

Euro area inflation is not accelerating out of control

Last week (January 20, 2022), Eurostat released the latest inflation data – Annual inflation up to 5.0% in the euro area – which followed the release from the US Bureau of Labor Statistics data (January 12, 2022) – Consumer Price Index Summary , the latter, which shocked people, given that it recorded an annual inflation rate of 7 per cent before seasonal adjustment. The Euro area inflation rate over the same period was published as 5 per cent. It is obviously hard to see clearly through the data trends given the amount of pandemic noise that is dominating. But I stand by my 2020 assessment (updated several times since) that we are still seeing ephemeral price pressures as a result of the massive disruption the pandemic has caused to production, distribution and transport systems. In a sense, I am surprised the inflationary pressures have not be greater.

The following graph shows the evolution of the All Groups harmonised price index and the so-called ‘core’ measure (which excludes volatile items such as energy, food, alcohol and tobacco) from the measure, which is designed to give a more stable view of the underlying price pressure.

The lines are annual rates of change (per cent).

The annual All Groups (headline) rate is 4.96 per cent in December 2021, after being 1.22 per cent at the start of the pandemic (January 2020).

However, the All Groups less volatile items (core) was just 2.62 per cent in December 2021, having been 1.09 per cent at the start of the pandemic.

The larger factor driving the All-Groups index is energy prices, which rose by 26 per cent over the year. For Europe, this was mainly the result of reductions in the gas supply from Russia.

Food and industrial goods are rising at around 3 per cent per annum (and some of that is the energy price impact on costs).

If we examine the rate of acceleration in the indexes (the changes in the rate) then over a two-year period (since the pandemic began), the All groups rate is 3.64 per cent but the Core rate is 1.32 per cent.

And this is with the ECB buying almost all of the public debt issued since the pandemic and government’s spending a little more freely than before to deal with the health issues.

The assessment is that the Euro experience is not signalling a massive regime shift towards accelerating inflation.

If you think of the propagating mechanisms that might institutionalise these pandemic-driven price spikes – for example, wage pressures – then you would not find them operating in Europe at present.

Another interesting aspect of the movement in prices is the impact of government charges.

In research I have done in previous years (a while ago), I found for Australia that significant movements in the price level (CPI) are driven by government price impacts – the so-called administered prices, which include things like indexed health care charges, indexed utility charges etc.

Eurostat’s – Methodology Manual – explains that:

Administered prices (HICP-AP) are analytical indices that provide a summary of the development of product prices that are directly set or influenced to a significant extent by the government.

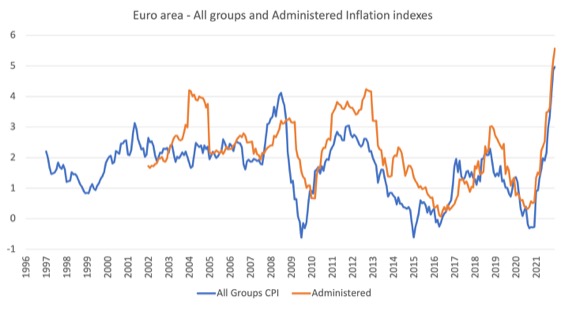

The next graph compares the annual rate of inflation for All-Groups and the Administered prices.

Since the pandemic began, the All-Groups index has risen 5.75 points, while the Core index has risen 4.64 points. However, the Administered pricing index has risen by 5.96 points, above the overall index movement.

We also see that the government charges impact has regularly been higher as indexation arrangements chime in.

I expect the Administered price impact to fall a little in the January 2022 data as a result of the expiration of the impact of the increase in the German standard VAT rate which on January 1, 2021 was increased to 19 per cent after being reduced to 16 per cent between July 1, 2020 and December 31, 2020.

The December 2021 observation is the last impacted by that adjustment. My estimates are that it will reduce the Core inflation measure by between 0.35 and 0.4 points.

Assessment

What about those propagating mechanisms?

First, there is no evidence that the European Union economies are being over-stimulated.

The latest IMF – Fiscal Monitor (October 2021) – provides estimates of the primary fiscal balance for government from 2012 to the forward-estimates period of 2026 – shown in the following graph.

The austerity mindset is still evident.

Prior to the pandemic the Eurozone Member States together were running primary fiscal surpluses and their response to the pandemic has been much more muted than the other advanced nations.

Further the estimated degree of fiscal retrenchment shown in the forward estimates suggest there is no chance that government deficits will drive accelerating inflation.

Further, the stimulus that has been received over the course of the pandemic will dissipate and cannot drive an inflationary process.

Stay tuned for a resumption of the Excessive Deficits Mechanism, which will further suppress the capacity of governments to add to the inflationary pressure via fiscal deficit expansion.

One also needs to consider the other components of aggregate spending.

And for Europe, the on-going and large trade surpluses are clearly a policy priority and have resulted, in part, from governments (particularly the Northern states) deliberately suppressing the capacity of domestic demand to growth.

Wages growth has been deliberately suppressed to maintain international competitiveness, which means household consumption expenditure is not about to fly away any time soon.

Second, those supply bottlenecks.

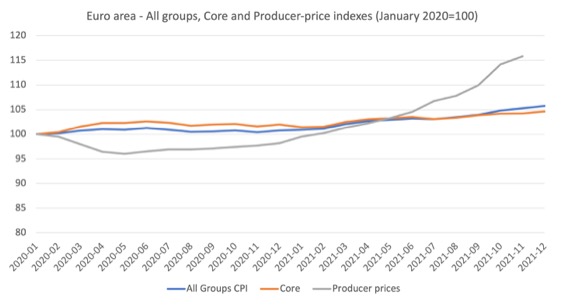

The next graph shows the All-groups and Core measures (indexed to 100 in January 2020) and the Producer-price index (from Eurostat).

Between January 2020 and November 2021, the All-groups index rose by 9.9 points, the Core index by 7.7 points and the Producer-price index by 20.1 points.

This is the pandemic effect.

It is not being driven by fiscal or monetary policy settings.

Various essential inputs to production have been in constrained supply – timber, semi-conductors – etc and that supply constraint coupled with difficulties in actually shipping freight around the world have led to these temporary price rises.

Once the pandemic eases and these prices get back to some sense of normality then the inflationary impacts will disappear.

The ECB published an interesting piece of analysis in its Economic Bulletin (issue 6, 2021) – The impact of supply bottlenecks on trade.

They conclude that:

1. “Shipping disruptions and input shortages are leading to considerable bottlenecks in global supply chains” – so goods getting stuck in places they shouldn’t be.

2. “During the recovery phase of the coronavirus (COVID-19) pandemic, households increased their purchases of certain products, such as electronics and home improvement equipment, which caused a stronger-than-expected surge in demand, especially in some sectors” – so a pandemic-driven and specific shift in the composition in spending.

I showed how this impacted on the inflation rate in the US in this blog post – Central banks are resisting the inflation panic hype from the financial markets – and we are better off as a result (December 13, 2021).

3. “coronavirus outbreaks in ports, accidents at plants and adverse weather conditions, led to bottlenecks in the transport sector and caused shortages in specific inputs such as plastics, metals, lumber and semiconductors” – hence the rise in producer prices.

4. “As inventories fell at the onset of the pandemic owing to the running-down of stocks and shortages of inputs resulting from closures and conservative inventory policies, companies struggled to keep up with the swift rise in demand and the replenishing of depleted stocks” – and some firms, with market power took advantage of this situation to maintain profits via higher prices.

5. “Overall, in June the global PMI suppliers’ delivery times index dropped to an all-time low (meaning longer delivery times) since records began in 1999.” (June 2021) – which means that shortages were prolonged.

6. The ECB estimated the “impact of supply bottlenecks on export growth beyond the role played by demand conditions” to be worth around 6.7 per cent in euro area exports and 2.3 per cent globally. That impact is substantial.

Then we come to the debate about regulation.

It is quite obvious that some large firms which can exercise market power (that is, increase prices and maintain sales) are taking advantage of the supply constraints to gouge increased profits.

This situation is not unlike what happens in times of major conflicts, for example, which is why governments introduced various regulations (rationing, price controls) to prevent that sort of predatory behaviour.

Already, the Hungarian government has frozen prices on some food items (sugar, flour, cooking oil, milk products) to reduce the capacity of corporations to take advantage of the supply shortages.

I note, of course, that the government is up for reelection this year!

Finally, when one considers all these issues, one is left wondering why economists are calling for hikes in interest rates.

We know why?

Because they are ‘one trick ponies’ and have been indoctrinated to think inflation -> monetary policy -> interest rates.

The world has moved on from this obsession with monetary policy dominance.

But think about it for a second.

With spending in danger of falling as governments retrench their stimulus support, with household consumption and business investment spending mute, awaiting more certainty in the future, and exports down due to supply constraints, how does anyone come to the conclusion that making it more costly to borrow money for investment will help.

And how does increasing interest rates, speed up ships, reduce the number of workers in the transport system who are ill from Covid, make ports work more quickly when there are not enough containers available (as they are in wrong ports), improve the weather to stop natural disasters impacting on timber supplies and we could go on?

We just need to be patient and concentrate on getting over the pandemic and then the inflationary pressures will ease fairly quickly.

Conclusion

When I say that I think the inflationary pressures are transitory, one shouldn’t conclude that means they are short-lived.

Transitory means that there are no institutional measures that are likely to keep the price pressures accelerating once the supply chain bottlenecks ease.

How long that will take depends on the course of the pandemic.

It could be some years.

Annual Helsinki Public Lecture and Teaching Program – January-February, 2022

I will be presenting my annual public lecture via a live YouTube stream tomorrow (Tuesday, January 25, 2022) on the topic of the global economy and the pandemic in my role as Docent Professor of Global Political Economy at the University of Helsinki.

This is an annual lecture which for the past two years I have had to deliver remotely due to coronavirus impediments.

The YouTube link for the stream is https://youtu.be/TEm_77Y7eNs

The lecture starts at:

- 19:15 Melbourne, Sydney time

- 10:15 – Helsinki time

- 08:15 – London time

- 03:15 – New York time

- 17:15 – Tokyo time

- 00:15 – San Francisco time

You are also invited into my Helsinki teaching class for the next two weeks.

While these lectures form part of a formal postgraduate coursework program at the university, I am permitted to make them publicly available as part of the outreach program.

The teaching program will be:

- Tuesday January 25, 2022 – Streamed public lecture (YouTube) starting 10:15 Helsinki time.

- Wednesday, January 26 – first Zoom lecture with class – 08:15-09:45 Helsinki time.

- Thursday, January 27 – second Zoom lecture – 10:15-11:45 Helsinki time.

- Tuesday, February 1 – third Zoom lecture – 10:15-11:45 Helsinki time.

- Wednesday, February 2 – fourth Zoom lecture – 08:15-09:45 Helsinki time.

- Thursday, February 3 – final Zoom lecture – 10:15-11:45 Helsinki time.

The Zoom link for the lectures is:

https://helsinki.zoom.us/j/5354174274?pwd=OHdTdWJzSHNndHpyVkV2Y0lJUExRZz09

Meeting ID: 535 417 4274

Passcode: ETZhk9

I hope to see some of you in the ‘class’.

This is an MMTed initiative.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

The Biden administration has been saying that prices are up all over the world and that fact shows that the amount of pandemic relief that had been provided earlier to Americans by the government really is not the cause of this inflation. Like opposite to what Larry Summers was maintaining a year ago and continues on about given any opportunity.

I read your posts about the situation as at least somewhat agreeing with what Biden says about the situation, which would be comforting if I read correctly. I’m not about to write that letter telling Summers he was right just yet.

Uncertainty has reached a peak in Europe: the eurozone remains in life suport by the ECB (and remains for 10 years now); decarbonization remains an empty word; the migration crisis remains at the europe’s borders; aging population threats the future generation.

And now, europe has found itself beeing pushed to the forefront of a war over Ukraine, between Russia and the EUA, that will be fought by the europeans.

Tchernobyl marked the end of the former Soviet Union.

Ukraine might be the end o the European Union.

Funny how Tchernobyl is in Ukraine.

Remenber how Putin and Trump were so good pals.

Remember how Trump used Biden’s son’s business with Ukraine to electroal ends.

Remeber how Ukraine has been in deep economic hardship for so many years.

Morning,

Why did they drop rates to zero and do QE at the very start of both the financial crises and the pandemic ?

Knowing that QE strips $ billions of interest income out of the economy ?

It could also be debated that they loaded up the system with reserves to hinder bank lending as bank lending can also be inflationary. Due to the leverage ratio and thus the banks would have had to raise more capital.

All of these things indicate they DO know how it works but just lie about it. Otherwise, if they actually believed their own propaganda at the start of both the financial crises and the pandemic they would have increased rates very aggressively. This has to be pointed out to them.

It can be debated the lies are used to offset what will happen in the markets. Drahgi was a master at it. Draghi tricked the world’s portfolio managers into selling the euro by doing things that the portfolio managers think are inflationary and expansionary and makes the Euro go down. Those are negative interest rates and quantitative easing. He used both to lie to the portfolio managers to offset what really happens when he carried them out.

As explained here by Warren :

https://underground.net/warren-mosler-interview-about-money-the-euro-and-greece-dialogos-radio/

More importantly, are we really expected to believe that they learned nothing from the whole Volker affair who actually caused the crises to get Monetarism pushed through and independent central banks run by Wall Street. The IMF approach whenever they are in foreign territory only this time on American soil.

Starting in November 1970 when Arthur Burns was the Fed chairman the discount rate was 5.75% and inflation was running at 5.6% annually. By 1974 Burns had jacked up the discount rate to 8% — a 60% increase — and inflation had gone from 5.6% to 10% annually.

By November 1976 Burns had reduced the discount rate to 5.25% from 10% and inflation had fallen to 5% annually. Then by August 1979, which is when Volcker was appointed as Fed chairman, the discount rate was all the way back up to 10.5% and inflation had jumped to 11.8%.

Volcker continued to raise rates, pushing the discount rate to 13% by February 1980. The economy entered a recession in March of that year, but inflation was still running at 14%. Inflation would have kept on going and the recession, which at the time was the most severe in post-WWII history, would have deepened if rates had gone higher. However, other factors drove down prices: the deregulation of oil and gas industries; major oil discoveries in the North Sea and Alaska; and Ronald Reagan’s firing of air traffic controllers plus the period it ushered in, which was the breaking of the labour unions.

By 1992 the discount rate had fallen to 3% and inflation was running at about 3%. Then, when the discount rate was raised to 6% in 2000, inflation bounced back, too, and came in at just under 4%.

For example, in November 1976, when the discount rate was 5.25%, year-over- year loan growth was 7%. Yet in February 1980, when the discount rate was 13%, year-over-year loan growth was 13%.

As explained with a real data graph by Mike Norman here:

https://realmoney.thestreet.com/articles/10/19/2016/hey-volcker-thanks-nuthin

In my view It is impossible for them not to know how it works. So then the question becomes why the lies and why the propaganda. The answer to that very important question comes straight out of the horses mouth in this debate from 1990. The debate is between Christopher Hitchens and John O’Sullivan on the US programme firing line. John O’Sullivan was the architect of Thatcherism and Reganism worked at the Heritage foundation and set up the Atlantic alliance. Introduced Thatcher and Regans policies and wrote Thatchers memoirs. In the debate John O’Sullivan tells the viewers what needs to be done.

https://m.youtube.com/watch?v=ZdMszmjSAso

3:15 in the fracking morning Eastern Standard time!!! Sheesh!

I take it the lecture will be promptly posted on YouTube (not just streamed)?

Both Burns and Volker showed beyond any doubt that the MMT view on interest rates is 100% correct.

That interest rate hikes are price hikes as the increased cost of borrowing gets passed on to the consumer via higher prices.

The spot and forward price for a non perishable commodity imply all storage costs, including interest expense. Therefore, with a permanent zero-rate policy, and assuming no other storage costs, the spot price of a commodity and its price for delivery any time in the future is the same. However, if rates were, say, 10%, the price of those commodities for delivery in the future would be 10% (annualised) higher. That is, a 10% rate implies a 10% continuous increase in prices, which is the textbook definition of inflation! It is the term structure of risk free rates itself that mirrors a term structure of prices which feeds into both the costs of production as well as the ability to pre-sell at higher prices, thereby establishing, by definition, inflation.

The mistake a lot of people make is saying that our rulers don’t understand that.

My argument is of course they do, otherwise not only would they have raised rates aggressively at the start of both the financial crises and pandemic. They would also have introduced TARP instead of QE. If they actually believed their own lies and propaganda.

When you want to get your man into a country ( the political group you have funded that believes in free trade and free markets) to help expand Nato. What good would The truth do for your geopolitical and foreign policy agenda?

The last thing you want is the truth. You want the Orwellian IMF and world bank to Volkerise the country. Go in and spread the contrarian point of view after getting your man to borrow in a foreign currency. Using the economic paradigm to control the country. Cause a crises and push through the free trade, free market structural reforms. Change the judiciary so foreign capital and investors can not be held to account by the law.

See South America and the EU for details or Lebanon right now today and what’s happening in Lebanon right front of our faces.

https://www.aljazeera.com/news/2020/9/3/in-full-frances-draft-proposal-for-new-lebanon-government

John O’Sullivan told everybody in that debate above. ” We need an economic paradigm that reflects NATO.” Nothing to do with full employment or price stability. Everything to do with control and the theft of assets and real resources to extract rent.

Why MMT’rs even though we are correct are attacked relentlessly.

“Due to the leverage ratio and thus the banks would have had to raise more capital.”

What leverage ratio? Rational currency areas exclude claims on central banks.

😉