In the annals of ruses used to provoke fear in the voting public about government…

When ABC journalists mislead the public and spread fiction

There is a difference between a journalist reporting news about economics and money and a journalist writing an opinion piece. In the first instance, the responsibility of the journalist is to ensure they cover the topic in a balanced way, seeking input from all viewpoints if the topic is controversial, as most topics in economics are. Too often journalists in this situation allow themselves to be used as mouthpieces for specific viewpoints, sometimes because they are coerced by editorial deadlines. Often they just uncritically summarise press releases put out by some group or another and represent the material as fact. In the second case, when a journalist is writing an analytical piece they are holding themselves out as experts. Then they better get it right. Usually, when they are writing about macroeconomics they do not get it right because they merely rehearse mainstream thinking, which most people by now should realise is off the mark. A case in point was a recent Op Ed (represented as analysis) published by the economics reporter at the ABC (January 10, 2022) – How the banks may profit from the taxpayer as COVID quantitative easing winds down. It is full of errors that journalists make when they don’t exactly understand the material they are dealing with. This should have been worked out during the GFC, when these issues arose in the general media. The fact that the same errors are being made more than a decade later doesn’t suggest any learning has taken place.

Update on RBA bond-buying program

I last wrote about this topic in this blog post – Australian government issues debt, buys most of it itself, and then pays itself interest into the bargain (October 7, 2021).

After analysing the trends in the federal debt market I calculated the way in which the Reserve Bank of Australia’s bond-buying program, announced in March 2020 had impacted on that market.

The RBA deviated from its recent history and introduced a large-scale government bond-buying program as part of its pandemic support initiative.

The RBA, itself, sought to disabuse the naive commentators, who claimed the asset purchases were just ‘printing money’.

In its explanatory document – Unconventional Monetary Policy – the RBA wrote:

Asset purchases involve the outright purchase of assets by the central bank from the private sector with the central bank paying for these assets by creating ‘central bank reserves’ (in Australia these are referred to as Exchange Settlement or ES balances). (Some people have referred to this as ‘printing money’, but the central bank does not actually print any banknotes to pay for the asset purchases.)

So, the RBA considers it is the height of ignorance to conclude that its asset-buying program involves ‘money printing’.

While the RBA said its policy was about lowering interest rates on risk-free assets and keeping bond yields low, they left out the other important point – for obvious reasons – that their asset buying program really amounts to one arm of government buying the other arm’s debt, which, in effect, once we cut through all the blather from politicians and RBA officials, is funding the fiscal deficits run by the level of government that have issued the bonds.

The program demonstrated that a central bank can control yields easily by increasing demand for the bonds in the secondary market, which as a result of the inverse relationship between yields and prices, drives down yields to the desired target.

It can target any maturity on the yield curve (1-year, 2-year, etc) depending on which rates it wants to control.

There is no question that a central bank can dominate the bond market if it chooses, which should put to rest all the claims that private bond investors can force higher yields on the debt issued by currency-issuing governments.

They cannot.

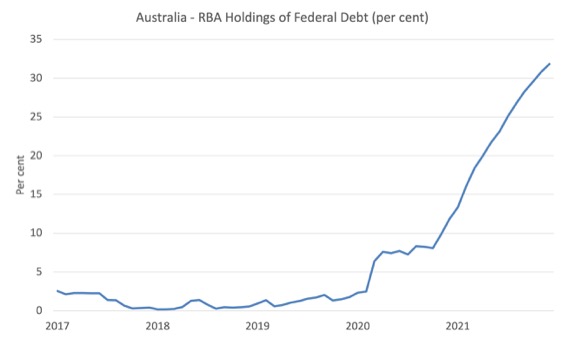

The following graph shows the impact of the RBA’s bond-buying program of its percentage holdings of Australian federal debt up until December 2021.

Since March 2020, the Australian government has issued an extra $A274,814,351,095 worth of Treasury bonds.

The RBA has purchased $A234,999,000,000 worth of those extra bonds.

So over the course of the pandemic to date, the RBA has purchased 85.5 per cent of all the extra debt issued by the Australian government.

At the onset of the pandemic the RBA held 2.3 per cent of all outstanding Federal treasury bonds.

By the end of December 2021, they held 31.8 per cent.

They have also purchased significant quantities of debt issued by the states and territories since the pandemic began.

The RBA will go broke myth

The impact will be that the Federal government is effectively having its deficits funded by itself and will be paying interest to the RBA, which will then be recycled back to the Treasury in the form of dividends – right pocket/left pocket governmental transfers.

In terms of the discussion today, the RBA noted in the document I linked to above:

In addition, investors can use the proceeds they receive from selling their assets to the central bank to purchase other assets. These portfolio adjustments by investors can affect the price of these other assets and the exchange rate.

So, while, initially, the bond-buying program represents an opportunity for the sellers to alter the mix of their wealth portfolio, it remains that the liquidity the RBA provides the sellers in return for the bond instrument can be used as a speculative fund to pursue other assets – financial or real (such as real estate).

It is impossible to estimate how much has gone in to fuel the ridiculous boom in housing over the last few years, but some of it probably has.

The problems this is now causing younger and lower-paid workers is a direct result of the government maintaining the fiction that it has to issue debt to the primary market in order to spend.

It doesn’t and given that, ultimately, the government just ends up buying its own debt, they could eliminate any negative consequences of the whole charade by abandoning the practice of debt issuance and just instructing the RBA to credit various non-government bank accounts as required to facilitate its spending program.

The crediting is already happening but it would be cleaner without the debt charade.

Now, make sure you understand that there is a difference between some private bond holder selling their bond holdings to the RBA and a commercial bank selling its holdings.

That is where the ABC article cited in the Introduction falls foul.

The journalist (David Taylor) who regularly Tweets sensational headlines that do not reflect the situation, started by claiming that the RBA was “engaging in a money-printing program, also known as quantitative easing”.

As above, if he had actually read the RBA notes on its program, he would realise there was no ‘printing’ going on.

So by using this sensationalist type of language (which is analytically incorrect anyway), the journalist is distorting the readers’ understandings from the outset.

Soon after we encounter the next error:

The process boosts the money supply, drives down interest rates and incentivises the commercial banks to increase their lending.

The program does not increase the capacity of the commercial banks to make loans. I will come back to that soon.

The intent of his ‘analysis’ is to work out who will have “to pay for this program” because according to his assessment:

Everything has a price eventually, it’s only a matter of time.

Portents of doom.

At least he realises that the way the RBA transacts is to “literally punch extra zeros on its computer terminals at its headquarters at Sydney’s Martin Place in order to create money”.

Computers are not printers.

The general point is that all government spending is executed in the same way.

One arm of government (Treasury and Finance) instructs its central bank (the other arm) to “punch” some numbers into computers to facilitate the desired transactions with the non-government sector.

It doesn’t matter whether the government is purchasing pencils for schools or buying its own debt held by banks, people, or itself.

The journalist tells his readers that QE:

It results in the commercial banks having fewer bonds on their books and more cash to lend out (cash received by the RBA) – and an incentive to do so since they’re only earning 0.01 per cent on it at the Reserve Bank.

This is the classic error that people make when they do not understand the accounting arrangements between the central bank and the supervised commercial banks.

I considered these issues in a series of blog posts 13 years ago – when people were starting to wonder what the impacts of the large central bank bond-buying programs would be.

They were scared that the so-called ‘money printing’ interventions from the various central banks early on in the GFC would be inflationary.

The reason they thought that is because they had either been taught that in economics programs at university or because they had been listening to politicians and their crony mainstream economists relentlessly pushing that message in the media.

This set of blog posts was designed back then to set the record straight.

1. Quantitative easing 101 (March 13, 2009).

2. Building bank reserves will not expand credit (December 13, 2009).

3. Building bank reserves is not inflationary (December 14, 2009).

4. Lending is capital – not reserve-constrained (April 5, 2010).

The ABC analysis article falls foul because it thinks bank lending is constrained by the reserves they have in the vault and that quantitative easing solves this shortage by providing those reserves.

So banks are conceived as being ‘desks’ where officials wait for cash to come in in the the form of deposits, which they loan out, profiting from the difference between deposit and loan rates.

But this is a completely incorrect depiction of how banks operate.

Bank lending is not ‘reserve constrained’.

Banks extend loans to any credit worthy customer they can find and then worry about their reserve positions afterwards.

Remember that Each commercial bank has to keep an account – a reserve account – with the central bank.

The role of bank reserves is to facilitate the clearing system for transactions that have cross-bank implications.

So if Bank A creates a loan which simultaneously creates a deposit in its books, the person can either draw down the deposit and spend the cash in a business that banks with Bank A or spend in a business that banks elsewhere, say, Bank B.

In the former case, there is no clearing issue. Bank A simply transfers the deposit funds from the customer to the business.

In the latter case, Bank B will call on Bank A to transfer the funds into the account of its business customer.

Those transfers are what the clearing house is about and there are millions of such transfers being done on a daily basis.

That is what bank reserves are for.

So Banks A and B have accounts at the central bank and the relevant entries are made in those accounts to satisfy the transaction noted above.

The banks never loan out reserves to commercial customers (borrowers).

They sometimes loan out excess reserves to each other to smooth out the clearing system.

If banks are short of reserves (their reserve accounts have to be in positive balance each day and in some countries central banks require certain ratios to be maintained) then they borrow from each other in the interbank market or, ultimately, they will borrow from the central bank through the so-called discount window.

They are reluctant to use the latter facility because it normally carries a penalty (higher interest cost).

The point is that building bank reserves will not increase the bank’s capacity to make loans.

Loans create deposits which generate reserves not the other way around.

The major institutional constraints on bank lending (other than a stream of credit worthy customers) are expressed in the capital adequacy requirements set by the Bank of International Settlements (BIS) which is the central bank to the central bankers.

They relate to asset quality and required capital that the banks must hold.

These requirements manifest in the lending rates that the banks charge customers.

But despite what is taught in mainstream courses in monetary economics, bank lending is never constrained by a lack of reserves.

Which is why MMT economists never considered QE to be an appropriate vehicle for increasing bank lending in order to stimulate the economy.

Quantitative easing merely involves the central bank buying bonds (or other bank assets) in exchange for deposits made by the central bank in the commercial banking system – that is, crediting their reserve accounts.

Quantitative easing is really just an accounting adjustment in the various accounts to reflect the asset exchange. The commercial banks get a new deposit (central bank funds) and they reduce their holdings of the asset they sell.

It was always obvious that the reason the commercial banks were reluctant to originate loans during the GFC was because they were not convinced there were credit worthy customers on their doorstep.

Further, after years of lax assessment practices in relation to credit-worthiness, the banks tightened their rules once the GFC threatened their solvency.

The ABC article’s focus then shifts to whether the RBA will make a loss on its bond-buying program.

The comparison is made between the support rate the RBA pays on excess reserve balances held by the banks and the yield it gets from the other part of government for its bond holdings.

If the yields fall below the support rate, then apparently we should worry because “it’s conceivable that the Reserve Bank could start recording losses as a result of the narrowing in the spread between what it receives and what it pays”.

And?

The journalist then claims:

The Reserve Bank, like any bank, is a business.

It is not a business like any bank.

It is part of government with an infinite capacity to “punch extra zeros on its computer terminals at its headquarters”.

No other bank has that capacity.

And a private bank is owned by shareholders who require it to have a profit motive or go broke.

The RBA is part of government and its mission is to serve the people of Australia by maintaining financial stability.

The fact that, in an accounting sense, it might have negative capital at some point in time, is irrelevant.

I discussed these ideas in these blog posts (many years ago):

1. The ECB cannot go broke – get over it (May 11, 2012).

2. The US Federal Reserve is on the brink of insolvency (not!) (November 18, 2010).

3. The consolidated government – treasury and central bank (August 20, 2010).

Clearly not understanding central banking, the ABC journalist insists that if the RBA records negative capital:

… the government would have to use taxpayers’ funds to recapitalise the bank.

You, the taxpayer, would begin paying for the fallout of the RBA’s money-printing program.

Like those zeros that were punched in to computer terminals!

Conclusion

As a taxpayer, I would not be paying anything to the RBA to adjust some numbers in its balance sheet upwards.

I would know that the Treasurer would instruct the RBA to ‘punch’ some numbers in to satisfy the accounting relations.

End of story.

The logic of this article is so misleading that it becomes dangerous input to the public debate.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Thanks Bill. When I left a comment asking for your opinion on this article I wasn’t expecting an entire blog post!

David Spears became quite high-profile when he took over presenting the ‘Insiders’ TV programme which makes it more of a shame that he clearly isn’t one of your regular readers.

Whoops. Just realised I have confused David Spears with David Talyor (and therefore everyone else in the process!) My apologies to one and all.

I recently read the blog series concerning QE – and think I understand it now.

Accordingly, I started on the ABC article when it first appeared on their website but gave up when it didn’t ‘fit’ – assuming it to be mainstream rhetoric.

Glad to see my interpretation was right and I don’t need to go back and rework the material. What is troubling however, and never ceases to amaze me, is that these ‘errors’ still persist and are so pervasive. Doesn’t someone in the ‘media’ – other than Bill – feel it is in the public interest to get this right?

Reading and listening to ignorant financial journalists and self-important would be’s if they could be’s who just parrot the “economic” messaging of their compatriots is dangerous and more than tiresome for those who understand how money and banking functions. The ABC is a major offender where their only financial journo that seems to get it appears to be Gareth Hutchens. He even gets use of “taxpayer” right when he says in a recent tweet “In short “Can-Do Capitalism” costs taxpayers more” when talking about the non-government sector being burdened with pandemic costs (RATs in this case) that should be met with public funds as a matter of the public interest and duty.

It must be that the many ABC financial journos don’t talk to each other about their differing understandings but we’re never told. So many dinosaurs in a groupthink cluster.

Hi Fred,

Hope you had a fab festive.

” It must be that the many ABC financial journos don’t talk to each other about their differing understandings but we’re never told. So many dinosaurs in a groupthink cluster. ”

I’m curious – why not take the last step that comes to a logical conclusion that they know exactly how it works but just lie about it and spread propaganda ?

Why is it so difficult to take that last step ?

After all once you have read this white paper from 1945 it is clear everyone knew how it worked.

https://billmitchell.org/blog/?p=45069

Or you can go back to 1857

https://new-wayland.com/blog/report-from-the-select-committee-on-public-monies/

I’m just curious why automatically everyone assumes these people are just stupid. Rather than taking the view that it is nothing but propaganda to hide the truth to serve the leisure class and capital.

I believe it is down to our education when we are taken from our parents at 5 years old. An education built on division starting with dividing us into different houses for sports. learning the national.anthem and waving the flag. Why do you think Fred that everyone is so willing to give ABC the benefit of the doubt rather than saying something more sinister is at work ?

How can they know exactly how it worked in 1857 and 1945 but not in 2022 ?

I believe 100% ABC know exactly how it works.

I can no longer call ABC and the BBC stupid. It is quite clear something more sinister is at work.

I’ve sat in way too many management meetings in different sectors when somebody says of course taxes are not needed for spending. The higher up you go in any job the quicker the household narrative changes.

I also believe 100% the current economic paradigm was created to fully support NATO expansion. As explained in this fantastic RSA animation. David Harvey’s crises of Capitalism.

https://m.youtube.com/watch?v=qOP2V_np2c0

A MMT animation created by MMT economists and RSA would be excellent.

@

Derek Henry

Thursday, January 13, 2022 at 20:40

I am both willing to give the ABC the benefit of the doubt and say that there is something more sinister at work.

The government and the financial sector hold onto the belief that neoliberal ideology is all we have (groupthink) and will promote it by all means including sinister ones.

As for the media, economic editors and journalists would be facing quite a task. If they question the mainstream narrative they have all sorts of complexities thrown at them. Alan Kohler’s recent interviews with Peter Costello have very illuminating, both in the questions asked and the complexities thrown. Given the number of people who have been employed as mainstream media editors and journalists just over the last 20 years any conspiracy among them would have surfaced by now.

It is possible that David Taylor, and his editor, actually believe they published the truth.

There are certain things which are never discussed, never thought about, don’t appear

(people appear not to be conscious of them), which nevertheless form a grounding for social and political life. This is what [Pierre Bourdieu] called “habitus.” They are the hidden things.

Neoliberal habitus- Now in the mid 1990s we’re all neo-liberals now. This was a time when Blair and Clinton were articulating a progressive left politics which is actually straight neoliberalism. What Clinton was about, and Blair was about with the famous third way in Britain, this was

neoliberalism which was becoming, if you like, the habitus in which everybody all politics was

cast.

This is what Margaret Thatcher was about when she said there’s no such thing as society,

there’s only a family. There’s only individuals and their families. This is what she was about

when she said “there is no alternative.” And when the the perestroika came and the world

changed and Margaret Thatcher said basically to Gorbachev she said, “there is no alternative.”

It extremely difficult to get out of neoliberal ways of thinking!

Thanks Derek and I hope all went well with you over the silly season, too.

I take your point but in dealings with human nature, especially ego, and the ingrained ways of thinking, seeing and believing that each of us develops can’t, I think, be encapsulated in a binary of stupidity or perfidy. Our abilities for self-delusion, fear and greed seem to be boundless and politicians and media take advantage of those attributes in dealings with electors every day. Decisions based on headlines and sound grabs being more normal than not as so few us are paying attention, and they know it. I’ve read it expressed as “We have Paleolithic emotions, medieval institutions and godlike technology” (E. O. Wilson). What could possibly go wrong?

In any case, it is possible for a change in thinking within a segment of the orthodoxy, at least. Economist Asad Zaman was interviewed on Activist #MMT podcast ep56/57 under the heading “Realizing your entire career is a sham after thirty years”.

Thanks Bill – I was so disappointed when I started reading that article on the ABC News. Even my limited understanding of the subject told me the article was likely to be rubbish. On the positive side I will not waste time reading anything by David Taylor again, so there is a time saving!

@Derek Henry: it isn’t any more “difficult” to take that last step to assuming “they” are lying than it is to assume they are not. Both beliefs require evidence in order to form an informed opinion. I do not know the journalist involved and I have no evidence for or against the proposition. Lest we create more harm in the world, I think we should guard against applying the logic of climate change deniers, Q-Anon conspiracies and Anti-Vax “researchers”, ie all those who think their beliefs or suspicions are empirically “true”. As @Fred Shilling points out, there are other possible explanations, any one of which requires evidence before it is considered a “fact”. Let’s not add to the growing pit of social division – let us respect and educate others and build bridges until we have evidence of mal-intent (and yes, I agree there is abundant evidence for that in the world, unfortunately). Having said that, perhaps you have evidence that David Taylor is lying rather than confused and/or ignorant, or any other possible alternate explanation.

Go well,

Murray

Saul Eslake quotes also further contributed to the misinformation in that Taylor article. Eslake, because he is a professional Economist, is the worst offender.

Murray, perhaps an instructional email to David Taylor might help set him straight. Why stop there? Maybe we should write to all ABC journalists about MMT. If Alan Kohler can get it, then surely others will too. 🙂

Gidday Professor Mitchell, thanks for your take on Taylor’s article.

I’ve had a severe problem with what passes for debate on economic issues on OUR ABC for some time. Experienced journalists, I hold in high regard, have been educated in the neoliberal catechism and regurgitate the stuff consistently and persistently.

Without fail, every Sunday on Insiders, David Speers will talk about the debt we’re leaving our grandchildren. On Saturday Extra, Geraldine Doogue plays the BBC series “50 things that made the modern economy”. In one episode the narrator describes the evolution of the fiat economy. He describes in layman’s terms its benefits, before describing it’s downfalls by invoking Zimbabwe and hyperinflation

More recently, Geraldine Doogue interviewed Messrs Michael Keen of the IMF and Joel Slemrod, economics professor from the University of Michigan, authors of Rebellion Rascals and Revenue: Tax Follies and wisdom through the ages. In the program, the gents relate their history of taxation, with its neocon slant and discuss the fact that progressive taxation was invented to fund the world wars.

On RN Breakfast in September, Hamish Macdonald interviewed a Professor Justin Wolfers, also from the University of Michigan regarding the US debt limit and the likelihood of the USA defaulting. During the interview Wolfers stated that the situation was very serious and required a remedy. He said that the US had defaulted in the past and that any future default would result in the loss of the US reserve currency status and he spoke of US bondholders divesting and purchasing Euro Bonds.

Every afternoon on the business show in recent times, some economist from a major bank or think tank is trotted out to encourage the RBA raise interest rates, to prevent inflation. They never mention that such action will benefit their employer, or those they represent.

This propaganda is broadcast consistently on OUR ABC, the most trusted media organisation in the nation, most listeners and viewers accept uncritically what they hear on the ABC.

Is it time that someone with the knowledge got into a room with Ita and Gavin Morris and explained the damage such misinformation does to our democracy?

I’m pretty certain that the publishing of such mistruths on the ABC must constitute a breach of the charter.

My wife is an editor for the BBC and has been for years.

You need to understand the process of how the media works. The process and what is actually involved in getting an idea for a programme, pitching it and then getting it made. For example do You know the role a commissioner plays in the process? The actual person people have to kneel in front of before a programme is even made.

The BBC the production side has already been privatised. The public don’t even know it. BBC 4 is finished all It does now is repeats. Newsnight the flagship news programme is a revolving door with the city of London.

You are talking about journalists which are the equivalent to politicians in the scheme of things. Bottom feeders. Journalists can’t just say what the want the output is double checked. When they ask people the so called experts to come in a show they ask them for a certain point of view. A point of view they control. They’ll phone 10 people before they decide which person will appear with their point of view.

None of the above is a conspiracy. It is how it works we have very close friends who work in production who are the people who produce the shows. My wife is God parent to who used to be vice president of the Discovery channel. Before moving into producing You tube content that have budgets ten Times the size of Downtown Abbey for a 4 minute You tube production.

You have the directors who sit with the editors during an edit are the ones who tell the story the Director created. Under direction from the Director.

I’ve given you my evidence. How did the establishment which both ABC and BBC are part of know exactly how it worked in 1857 and 1945 but not in 2022 ?

None of you answered it. You talked about journalists and editors who have no power in the whole process. There is another half dozen layers of power above these people which none of you mentioned. You completely ignored the actual power who decide what gets produced. You are trying to sell toilet cleaner to a hotel by speaking to the receptionist who has no power to buy the product You are selling.

I’ll give you more evidence.

1. Warren’s example of the coffee plantation. How did the British establishment know exactly what to do it they never knew how it worked ?

2. The Romans – How did the Roman establishment know exactly how to use coins and taxes if they didn’t know how it worked.

3. The FED- How did the FED know when to abandon the leverage ratio and introduce the reverse repo agreements during the pandemic after they dumped trillions of reserves into the system if they didn’t know how it worked.

4. The EU – How did they set it up the way it did without knowing how it works.

5. The Last Colonial Currency the CFA Franc the treaty of Lagos and how the French signed up 15 African countries. How did they set it up the way they did it they didn’t know how it works.

6. Scotland – How did they set up the United Kingdom the way they did it they didn’t understand how it works.

7. How did New Zealand, Australia and Canada and the US know how to set up their monetary systems if they didn’t know how it works.

Again none of which are a conspiracy.

History is littered with examples that show the establishment fully understood MMT. Did you even read the 1857 paper ? There are hundreds of examples of debates in the House of Lords that shows they understand how the monetary system actually works. Then lie about it to the voters –

https://hansard.parliament.uk/lords/

I know how the media works and I’ve given you my evidence. None of which is a conspiracy.

It is very interesting that you defended the establishment institution so fiercely that gives you your news. Quite incredible really when you think about it. Education clearly works.

From the inside looking out. I believe 100% ABC and the BBC know exactly how it works. Those with the real power in both institutions that decide what is actually produced.

I simply refuse to give them the benefit of the doubt. The historical proof is stacked against them. Written right throughout Hansard like Blackpool rock.

Tunisia is another bit of evidence to go with all the other 1000 of pages of historical evidence.

https://billmitchell.org/blog/?p=48008

There are no mistakes here none whatsoever in Tunisia. History shows very clearly they understood MMT fully and then used the MMT understanding to create a monetary system that serves capital. To rape and pillage a nation state and expand NATO’s influence and then lie about it.

The Bremer plan in Iraq is another bit of evidence.

The Bremer plan which should sound familiar now opened up Iraq to foreign investment ( free movement of capital) privatised the whole economy to extract rent. Changed the legal system to support capital. Bremer dropped the corporate tax rate from around 45% to a flat tax rate of 15% and allowed foreign corporations to repatriate all profits earned in Iraq. Approximately 200 other state owned businesses and the oil industry was privatised. CPA Order 39, entitled “Foreign Investment”, provided that “A foreign investor shall be entitled to make foreign investments in Iraq on terms no less favorable than those applicable to an Iraqi investor. CPA Order 17 granted all foreign contractors operating in Iraq immunity from “Iraqi legal process,” effectively granting immunity from any kind of suit, civil or criminal, for actions the contractors engaged in within Iraq.

Yet, we are expected to believe they didn’t fully understand MMT in order to achieve it.

https://m.youtube.com/watch?v=ivJnAyGLcU4

In my view Is that the establishment institutions of both the BBC and ABC created the neoliberal habitus and fully supported and continues to support the mainstream economic paradigm of control. Fully supports the economic paradigm of NATO expansion. More importantly they understood MMT in order to achieve it.

All the historical evidence is on my side hundreds of pages of it are in Hansard. There is absolutely no historical evidence to suggest otherwise. If there is evidence that shows both the ABC and BBC are genuine and thoughtful and truthful. I’ve yet to find it. That isn’t just a token gesture.

If there is evidence in hundreds of years of Hansard publications that prove they don’t understand MMT it is still to be found.

GIMMS- Our very own Gower initiative of Modern money studies produced this below.

An Accounting Model of the UK Exchequer – 2nd edition

https://gimms.org.uk/2021/02/21/an-accounting-model-of-the-uk-exchequer/

How did GIMMS do it ? How did GIMMS produce such work and where did they find the facts ? GIMMS used the UK government official documentation.

Yet, we are led to believe the UK government and its institutions do not fully understand MMT. Of course they understand MMT otherwise the official government documentation couldn’t have been produced in the first place that allowed GIMMS to carry out their work.

What the Accounting Model of the UK Exchequer proves beyond any doubt is either the government institutions including ABC and the BBC are lying about it or have been hijacked by vested interests.

It’s one of the two as no other scenario is a plausible answer to what is taking place in front of our faces.

“Loans create deposits which generate reserves”

This is something I don’t fully understand. I understand that bank loans create deposits which is money the borrower can then spend, although it is encumbered money because there is a loan account against. But I don’t understand how they generate reserves. Perhaps this is because I don’t know exactly what is meant by reserves.

Can someone please explain?

When I was asked to do an interview on the BBC regarding MMT they didn’t even know who my wife was. I doubt I would have been asked on if they did. The shock in the room when I told them after the interview was quite hilarious. Thanked them for giving MMT a voice or in other words a token gesture.

As I knew within days the mainstream paradigm which is supported fully. Would be talking about slashing Scottish budget deficits as Scotland was living beyond its means and the deficit would need to be paid back, on the exact same show I had just been on.

The producer contacted me and said they just wanted a 5 minute interview on the basics of MMT. I prepared for the basics for 3 nights. When I sat down to do the interview they changed it completely and took the whole basic MMT agenda off the table. Interview lasted 28 minutes of which nearly 20 minutes were used. I had to wing it the whole time as the questions they had prepared dragged me into some deep dive areas.

I managed it and tried to take the interview down paths that I really understood and take the power and time away from the interviewer. Which is very difficult thing to do when you are thinking On the hoof all the time and just been bowled a massive googly. While trying to give examples of how MMT would help the left and the right.

They obviously did this to get me off balance right from the start to try and find out how much I actually knew and had questions ready that would try to expose any knowledge gaps. Which for me wasn’t quite cricket when what they had promised was a 5 minute interview on the basics.

You live and learn and put it down to experience. I just stayed calm on the surface as my legs were moving a million miles an hour under the surface and batted the questions to the off side hoping I wasn’t going to get caught. Ended up with 23 after 5 overs not out.

“Loans create deposits which generate reserves”

“Can someone please explain?”

I can’t. It bothers me too.

When I read that phrase, I think there has to be some kind of accounting identity, or deep-seated automatic process that leads from an increase in deposits to an increase in reserves. But it has always seemed that there is no “lever” that would boost reserve levels whenever loans are issued.

The best explanation I’ve seen is that the Central Bank (among other actors) has an interest in seeing that reserves are sufficient to keep the flows of interbank clearing running smoothly. That’s related indirectly to the stock of deposits. So the CB would act to increase reserves, sometimes, when it had to.

Another fantastic piece of evidence that they know how it works but use propaganda to then lie about it is the Treasury select commitee submission from 1999.

https://publications.parliament.uk/pa/cm199900/cmselect/cmtreasy/154/cor15402.htm

It is from November 1999 and describes the accounting and function changes that occurred as a result of Maastrict and with Bank of England independence.

How the Ways and Means account worked pre-1997.

(paragraph 37 onwards), the government simply spent according to direction from Parliament and this was expressed as money injected into the economy via the Bank of England. Then the Bank of England issued gilts (though always a liability of Treasury) solely with an eye on monetary conditions. In cases where not all of the government spending was drained – because the monetary objectives didn’t require it – then Ways and Means account simply acted as a balancing item. The Ways and Means account was therefore basically analogous to an overdraft (as I know other folk in here have always understood it), an IOU of the Treasury. So even in this case, we have Treasury IOUs backing central bank money creation, but as explicit, overt, unequivocal money creation by government spending. And the only concern in this system is the monetary target, i.e. inflation. Everything else is subsumed into that. All completely consistent with the claims of MMT.

Post-1997 we have the system that we have now. The Treasury (DMO) is now responsible for cash management which means it has to clean up after itself by issuing gilts to neutralise its spending. This leaves the Bank to focus on regulating the economy only with respect to prevailing conditions rather than the additional complication of government cash flows. So now when the BoE needs to add more money to the economy it cannot use any of the government’s direct spending (i.e. only drain part of it off) as before because the DMO has already drained it all. So now it has to buy back some of the gilts that the DMO sold. Again, we have net money added to the economy backed by a Treasury IOU, though this time it is a gilt rather than an entry in the Ways and Means account.

But apart from that, what else is really different? The only thing that stands out for me is that there are now two targets in the system: (1) the Treasury’s balanced cash flow target; (2) the Bank’s monetary target. In many cases the Bank will have to undo what the Treasury has done, instead of both simply acting together under one target as they did before.

What this shows is that the changes in 1997 really did just obfuscate and hide the reality. It is much easier to reconcile the pre-1997 system with MMT, as it is clear to see

1. that the spending happens first following Parliamentary direction

2. that spending creates money via accounts being credited as the central bank

3. that the only concern ultimately is monetary conditions (inflation not budgets)

4. that gilts are a monetary instrument

It is the most clear description from the horse’s mouth that shows the claims of MMT are correct.

Yet, once again we are expected to believe that the establishment do not fully understand MMT. I’m sorry guys for posting up so much evidence. I just fail to recognise why saying ” yes, of course they understand MMT but choose to lie about it using propaganda ” is so controversial.

That the current economic paradigm was created to fuel NATO expansion. I don’t see that as controversial either. See that as something that needs to be debated and talked about more often. Who the current economic paradigm actually serves and what is its purpose, because it is clearly not full employment and price stability. Which is the narrative and framing used.

Post War Banking Policy

https://new-wayland.com/blog/post-war-banking-policy/

This is from the book Post-War Banking Policy – a series of Addresses published in 1928.

The Right Honourable Reginald McKenna P.C. was a former Chancellor of the Exchequer (1915-16) and ended up as Chairman of the Midland Bank in the 1920s

The quotes show that the way banks actually operate was known a century ago. That building bank reserves will not expand credit, building bank reserves are not inflationary and lending is capital not reserve constrained and that loans create deposits.

https://billmitchell.org/blog/?p=14620

Over 90 years before the bank of England did a paper on it.

Yet, we are still to believe they don’t understand MMT.

@Mel and tonyw, the commercial banks are required to balance their books daily. After all the days trading is completed they need to ensure that sufficient reserves are on hand to cover future drawdowns, plus any government demands on reserves.

If they have insufficient reserves to cover what is mandated they initially obtain funds on the interbank, overnight market, if funds aren’t available in that market they borrow at the central bank window which always provides the cover required thereby increasing the size of the reserves. Commercial banks prefer to negotiate rates between banks as central banks generally take a larger haircut than between bank trades.

That is my understanding of the process.

@ Derek Henry. “None of you answered it. You talked about journalists and editors who have no power in the whole process. There is another half dozen layers of power above these people which none of you mentioned. You completely ignored the actual power who decide what gets produced.”

“It is very interesting that you defended the establishment institution so fiercely that gives you your news. Quite incredible really when you think about it. Education clearly works.”

Derek, I stated that all these journalists regurgitate the neocon catechism and that to fix the problem requires knowledgeable people to get in a room with Ita, Chairman of the ABC board and Gavin Morris, head of ABC news and explain to them the damage done to democracy by propagating this disinformation.

“

@Derek Henry

My comments are about the ABC. I do not share your view that the ABC is involved in a conspiracy to promote the neoliberal agenda. It does not shy away from reporting the many ill-effects of current macroeconomic policy. It’s flagship program Four Corners has sparked Royal Commissions into the Banks and the Aged Care and Disability sectors.

If you take all media in Australia alone over the past 20yrs the title ‘ex-financial journalist’ would apply to hundreds if not thousands of people. If a widespread conspiracy was in place then, by the law of averages, many of these people would be openly talking about it.

The ABC must provide news and opinion on neoliberal economic policy, it is the dominant economic policy in Australia. But as Bill points out in his very first sentence above there is a difference between reporting the news and publishing an opinion. A difference that David Taylor’s editor failed to notice.

The ABC is not part of a conspiracy and proves this regularly by publishing many pieces that align with MMT principals. It cannot and should not become an advocate for MMT just as it cannot and should not become an advocate for the Republic movement. That is not the role of an independent news agency.

@tonyw @Mel Hi. Hope I can help with a little accountancy knowledge. It helps to think of what a Balance Sheet shows. It’s a figurative record of the person/organisation’s wealth on a specific date, and whether that wealth is dependent on any future financial obligations, e.g. money owed to the organisation (debtors) or money owed by the organisation (creditors and loans). A Balance Sheet always balances: on a commercial bank’s balance sheet, the change in amount of Reserves (think of it as a measure of wealth) recorded as resulting from the Central Bank money creation, will at time of creation be matched by a change in Deposits, because the Bank has the obligation to pay the deposit holders. When we spend ‘our money’ held by the bank, we think of money circulating in the economy to match goods bought and sold, but really the banks just record the rise and fall of individual deposits. The extent to which the overall level of one bank’s deposits and reserves rises or falls depends on the value of transactions between people using different banks, and the reserves of the different banks will rise and fall to match.

Deposits and Reserves will also be recorded as rising by equal value when a bank makes a loan. If a bank gives me a mortgage of £100,000 on a property, it records a deposit of £100,000 which is an obligation to pay me, and an increase of £100,000 in reserves (pending my instruction to pay the house-seller). The Balance Sheet also records the value of the secured asset and matching amount of the loan that I will pay over the years to unsecure the asset. When I instruct the bank to transfer the deposit to the seller, if he/she has an account with a different bank, my bank’s deposits and reserves will fall by £100,000. Left on the Balance Sheet will be the £100,000 value of asset that the bank has secured, but also the loan that shows the possibility I have of a future exchange of physical asset for £.

Note that the size of a bank’s balance sheet, with deposits on one side and reserves on the other, can increase or decrease as a result of central bank money creation, or its own money creation, but none of these ups or downs change the equity value in the business. Simply, that increases when the bank makes a profit through charging interest: then its wealth increases and the matching obligation is only to its shareholders.

It seems to me that we can say that as money circulates around the economy, in line with consumption or investment spending, i.e. individual bank deposits are recorded as moving up and down, more settles for longer with wealthier individuals/corporations, rather than being used to generate real resource movement and so aid people and society. What do the wealthy do with this money after commissioning yachts etc, which does at least keep shipyards going? Either 1. leave the money in a bank, onshore or offshore, 2. buy existing land/property/shares, in which case the money passes to a different account but with a side-effect of a distorting impact on that market 3. Pass it down generations or 4. Buy a government bond, in which case, the buyer gets a piece of paper to show his/her risk-free investment, and the holder’s bank’s deposits and reserves are shown as reducing. If the Central Bank decides to buy-back the bond, bank reserves and deposits rise. There is of course profit to be made in buying and selling bonds: welfare for the wealthy. One question that would seem to stem from an MMT analysis is whether the bondholders would make consumption/investment decisions more beneficial to society if they weren’t given the option of bond purchase. I suspect not, and that it would therefore be better for all, if, as well as ending their bond welfare, more of their non-productive wealth was taxed away.

Ted and Guy,

Well you are entitled to your own opinions and take your own points of view. I’m not going to brow beat you into submission to try and get you both to accept my point of view. Debating is healthy.

I’ve simply provided enough evidence above to show that you can’t run a treasury and central bank for over a 100 years without fully understanding how it works, all backed up by official government documentation. That it shouldn’t even be up for debate and written as opinion pieces because all of the official government documentation is easy to find.

If that is, ABC investigative journalists who have NO power within the organisation ever decided to take a look. Getting it to print after that is a whole different story. Involving a can and some worms.

Take care and all the best.

Tony A and Mel

This will help a very good description by Dan Kervick.

Bank Lending and Bank Reserves

https://neweconomicperspectives.org/2014/01/bank-lending-bank-reserves.html

> It is impossible to estimate how much has gone in to fuel the ridiculous boom in housing over the last few years, but some of it probably has. The problems this is now causing younger and lower-paid workers is a direct result of the government maintaining the fiction that it has to issue debt to the primary market in order to spend.

I must be doing something wrong as I don’t follow this explanation.

Scenario A: We agree that in the current situation the government first issues debt (the Treasury). I presume that debt is bought on the primary market by institutions (maybe they have a mandate to allocate X% to fixed income?), individual investors etc. Then, the RBA – when it announces a bond buying program – goes into the market and starts buying the bonds. It returns to these investors the cash they originally spent to buy the bonds. Since bond yields are pushed lower, they don’t see bonds as attractive anymore, and they buy other assets like stocks or real estate.

Scenario B: Okay, now let’s imagine the government can just spend without issuing debt. The same investors as before don’t have any government bonds to buy, but they still have the same purchasing power. So instead they will buy perhaps corporate bonds instead (if they wanted fixed income), and other assets like stocks and real estate.

But won’t they have approximately the same amount of purchasing power to buy real estate in both scenarios?

Bill,

There is something about QE I still don’t understand. Central banks have provided trillions of dollars in reserves to commercial banks in exchange for medium-long term bonds. The resulting “liquidity” for banks is a special kind of liquidity, however.

As Eric Tymoigne explains with respect to the US system, “banks cannot buy anything with reserve balances from anyone in the domestic economy except from each other and other Fed account holders….More reserves do not provide banks more purchasing power in the domestic economy to buy existing stocks, bonds, houses, etc.” (p. 142, Tymoigne’s manuscript The Financial System and the Economy- 2018.)

That being the case, how should I understand your statement below, that reserves resulting from QE provide a “speculative fund” for banks? Are banks speculating in real estate, etc. solely by purchasing assets from other banks? And more generally, does QE impair banks’ flexibility by transforming large quantities of their bond assets into restricted Fed reserve balances?

(you wrote) “So, while, initially, the bond-buying program represents an opportunity for the sellers to alter the mix of their wealth portfolio, it remains that the liquidity the RBA provides the sellers in return for the bond instrument can be used as a speculative fund to pursue other assets – financial or real (such as real estate).

It is impossible to estimate how much has gone in to fuel the ridiculous boom in housing over the last few years, but some of it probably has.”

@Derek Henry: I feel your frustrations but bear in mind that most of us out here don’t have the inside knowledge and experience of the workings of the BBC(/ABC) that is in possession of you and your wife. Consequently, we must rely on those in the know to enlighten us.

I’m no defender of the economic falsehoods that the ABC continues to peddle but without further knowledge can’t say that it is acting in good or bad faith. Bill has said (hope I’m not misrepresenting him) that he is one of a number of economists that various “financial” journalists contact for views and analysis before preparing some of their articles for publication. Such journos will go with the mainstream majority rather than being inquisitive and delve into a contrarian heterodox economist’s view in order to understand why the difference from the crowd. Thereby the groupthink nonsense of “the way things are” becomes the economic habitus via repetition.

Here in Oz back in mid-2020 there was a well done short form portrayal of MMT on ABC TV (Bill had involvement in script vetting, I understand) https://www.youtube.com/watch?v=uEqucQNLIko. As part of the bottom up process of challenging the habitus such one-offs have a sort of here today, gone and forgotten tomorrow. The quantity of MMT information out there for anyone to access on the internet is growing and that’s all to the good. The Problem being how to infiltrate what MMT means for choices for the wellbeing of society by facilitating a livable planet into the ignorant many who don’t know that they need to know this stuff. There’s a need to get enough folks across that “Aha” moment threshold to demand change. Challenging the capital co-opted managerial classes to come over from the dark side is worth continuing but I think real pressure for change will come from below and not from above.

I’ve come to the view that the political parties do understand MMT but use the politics of balanced budgets, blah, blah, blah to bash their opponents as and when it suits. The householders get it, as that is their real world experience. So it becomes a simple sell to the voters who’ve been conditioned to that mindset.

At present there’s a movement afoot in Australia with a range of independent candidates working loosely together (mainly women who’ve had enough of the corruption, game of mates and incompetence and consider themselves socially progressive and often fiscally conservative – little do they realise that holding that pair of views is cognitively dissonant) standing against sitting members of our current failed right wing neoliberal federal government at the upcoming election (likely around next May?). Such a cohort looks to be a group ready made to be introduced to MMT. How to get to them in a way that cuts through is a maybe achievable goal. Talking amongst ourselves is not going to get us there.

tonyw

Friday, January 14, 2022 at 22:37

and

Mel

Saturday, January 15, 2022 at 2:42

“loans create deposits which generate reserves”

I have seen this before and I, too, found it hard to equate with my understanding of MMT. I should mention that I have been studying macroeconomics since 2014 and have corresponded extensively with several senior Bank of England Executives. As a result I wrote a paper on the monetary operations of the BoE which was peer reviewed and approved by Randy Wray, but was never published as it was upstaged by the much more comprehensive and thoroughly researched Berkeley et al paper “An Accounting Model of the UK Exchequer”.

I have also estabished good lines of communication with several MMT scholars, so I asked one of them about this and received the reply “…deposits tend to imply an increase in the demand for reserves from banks and the central bank then has to ensure those additional reserves are available or interest rates would rise.” And also “[O]f course in the QE world of excess reserves, the above doesn’t apply.”

So in normal times loans increase the amount of deposits, which require underlying reserves in order to facilitate the settlement of transactions when the loans are used. Therefore the Central Bank somewhere along the line will have to provide those reserves. In abnormal times – like the days of QE – the banks are awash with reserves so they are effectively created in advance.

It might be more accurate to say “Loans create deposits, the use of which gives rise to the generation of reserves”.

@Nigel Hargreaves Sunday, January 16, 2022 at 22:54

Thank you. I can believe that. I think we can attribute agency behind “generation of reserves” and point to the Central Bank and its policies for adjusting reserves.

It’s a pity that there’s such an indefinite — can I say Chaotic? — relationship between aggregate deposits on the one hand, and the detailed state of clearing flows on any particular day on the other hand. It tempts us not to talk about clearing at all, given there’s so little we can definitely say.

David Taylor should talk to his young colleague Michael Janda. This piece contains a little more sense.

https://www.abc.net.au/news/2022-01-17/economics-set-for-post-pandemic-shake-up-covid-19/100756832

@Derek Henry re: “Loans create deposits which generate reserves” referenced article by Dan Kervick. I think my explanation is clearer. It isn’t necessary to complicate the explanation with holdings or payouts of banknotes. If you think my explanation is incorrect, do please tell me.

@ Nigel Hargreaves re: ‘It might be more accurate to say “Loans create deposits, the use of which gives rise to the generation of reserves”. No, it’s not more accurate. Deposit and reserve adjustments are a matter of double-entry book-keeping as I explain above. The instruction given by deposit holders for use of ‘their’ deposit, may lead to a transfer of deposits and reserves to another bank, but it won’t normally affect the overall balances for the banks combined.

Replying to @tonyw question on January 14 at 22:37

“Loans create deposits which generate reserves”… how????

PatrickB and Ted Carter did ok. I think I can make it clearer (anyone feel free to correct me if I am wrong, it can be country/institutional arrangement dependent). The basic process is the bank takes your promissory note to repay and marks-up your deposit account (money creation). No bank reserves are created. Before the end of the settlement period the bank will check to see if it has enough reserves (by their capital adequacy requirements or whatever subset of Basel III they adopt). If their reserves fall short they will borrow from the interbank market or take a slap and borrow from the central bank discount window. Because they borrow at a lower interest rate than that which they issued you the credit, they make a net profit. Banks operate on the interest rate spread. That’s how reserves end up being generated from “loans”.

When/if they (your commercial bank) borrow from the central bank, that is the fiat money creation step, because no matter how you look at it, when the CB types numbers into reserve accounts it is score-keeping, fiat money creation out of someone’s fingertips.

The “loans,” as Richard Werner points out, and well documented, are never technically loans of anything, they are a swap: your promise to repay for digits typed into your deposit account (credit cards work the same way, only you sign the promissory note just once, when they hand you the plastic). Firms can loan to one another, but licenced banks do not loan anything to their customers. This is what makes a bank a bank rather than a savings & loan company.

@Derek Henry

Thanks for all the historical information, Derek. You make a good case for those “in power” understanding MMT while simultaneously doing the opposite of what the understanding requires if they truly were/are working in the public interest (a dubious proposition, I know). I agree that the journo’s in question have little or no power over what is broadcast. So, when one says “they” are lying, I guess my point is we should take care to articulate who exactly “they” are, as you have done. I still have no idea whether the journalist in question understands MMT or not. Given what you say about your knowledge of the media, it is safe to assume such a judgement of David Taylor is irrelevant.

As others have said, we need to educate as many citizens as possible so they too know when they are reading or listening to rubbish, and then to ask “Who benefits from this untruth being spread?”.

Go well,

Murray