The other day I was asked whether I was happy that the US President was…

The monetary and fiscal normality of Wolfgang Schäuble – stagnation and entrenched unemployment

I have been working on an article that will come out in the press soon on inflationary pressures. It is obvious that characters like Larry Summers and Olivier Blanchard are trying to stay at the centre of the debate by issuing various lurid threats about the likelihood of an inflation outbreak in the US and elsewhere. Last week, the Financial Times published an article (June 3, 2021) by the former German Finance Minister and now President of the Bundestag, Wolfgang Schäuble – Europe’s social peace requires a return to fiscal discipline. I was initially confronted with the juxtaposition of this author, who bullied all and sundry during to the GFC to ensure an austerity mindset was maintained at great cost to the millions who were deliberately forced to endure unemployment, with the photo of John Maynard Keynes under the title of the article. The title didn’t seem to match the picture. My first impressions were correct. Lessons have not been learned.

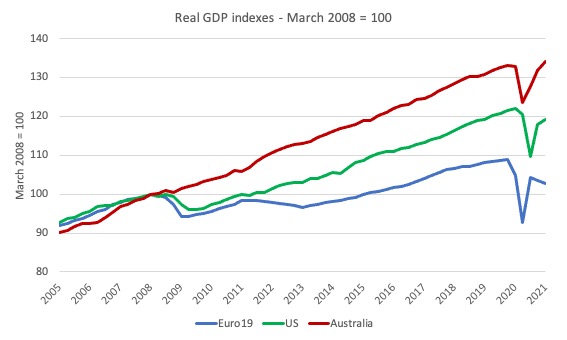

To refresh our memory, this graph shows the real GDP indexes for the Eurozone Member States (19), Australia and the US from the March-quarter 2005 to the March-quarter 2021.

It took until the June-quarter 2015, more than 7 years after the onset of the GFC, for the Eurozone as a whole to get back to the production size they achieved in the March-quarter 2008.

And, before the pandemic hit, the Eurozone economy was only 8.8 per cent bigger than it was in the March-quarter 2008. By comparison, Australia’s economy was 32.8 per cent larger and the US economy was 22.2 per cent larger.

These differences were mostly created by the different fiscal policy responses the respective governments took.

The austerity that the European Commission and its Troika mates imposed on the 19 Member States directly led to the massive waste of productive potential and income generation in that region.

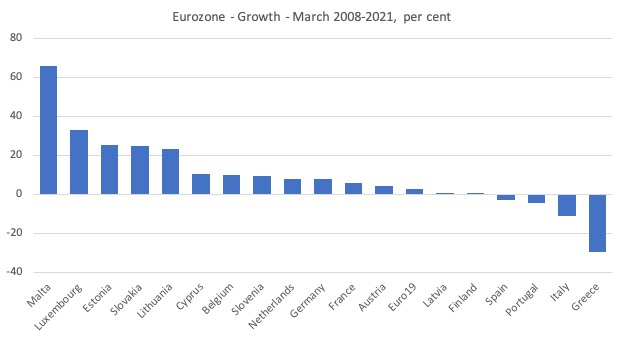

For individual countries the situation is also rather diverse and provides an empirical refutation of the crazy political narratives that the creation of the common currency was all about convergence and shared prosperity.

The next graph shows the divergence. Ireland was excluded because of the way their treatment of foreign firm relocations in their national accounts has distorted their growth rates.

With the overall Eurozone exhibiting very little growth (Euro19), the Southern states have fared very badly since the March-quarter 2008.

Spain has contracted by 3.2 per cent overall.

Portugal by 4.3 per cent.

Italy by 11 per cent.

Greece by a staggering 29.5 per cent.

There is no prosperity in these nations when assessed overall.

That is background.

When Wolfgang Schäuble advocated a return to “monetary and fiscal normality”, it is a normality that delivered this mess.

Wolfgang Schäuble started his Op Ed with a quote from John Maynard Keynes:

In the long run we are all dead …

The segment from Keynes was published in his 1923 work – A Tract on Monetary Reform.

He was discussing the reliance by neoclassical economists on the Quantity Theory of Money to underpin their notion of inflation – that excessive monetary growth would feed into spending in a fully employed economy and the only adjustment that would then be possible was for prices to rise to ration the excessive nominal spending.

He vehemently disagreed with the notion that an increase in the volume of currency in circulation would not influence any real variables – like employment, output etc.

The neoclassical school embraced what was known as the classical dichotomy (the split between nominal and real) where monetary expansion would only influence nominal aggregates (prices) rather than have any real stimulative effects (reducing unemployment).

He considered that this might only be true “in the long run” to which he wrote:

But this long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again.

What he was railing against when he wrote that was the prevailing and dominant neoclassical view that the macroeconomy always tends to achieve ‘equilibrium’ (that is, full employment) if the ‘market’ to unfettered by government interference.

He considered that the capitalist monetary system was biased towards disequilibrium and entrenched unemployment, which would need an external prod to change from that state.

Later, in his 1936 General Theory, he obviously explained this view in more detail.

Keynes would never tolerate a situation where austerity was imposed by governments to reduce fiscal deficits at the same time private spending was weak and collapsing and unemployment was rising.

In other words, he would never have accepted the austerity that Wolfgang Schäuble and his cronies inflicted on the Member States after the GFC.

For Keynes, unemployment was not only a waste of resources but an evil.

In the 1923 Tract he wrote:

… it is worse, in an impoverished world, to provoke unemployment than to disappoint the rentier. But it is not necessary that we should weigh one evil against the other. It is easier to agree that both are evils to be shunned.

In his 1925 book – The Economic Consequences of Mr Churchill – Keynes wrote:

By what modus operandi does credit restriction attain this result? In no other way than by the deliberate intensification of unemployment.

It is obvious from his past record that Wolfgang Schäuble is prepared to tolerate mass unemployment, deliberately created by austerity, if his goal of “sustainability”, is achieved.

Sustainability is defined by Wolfgang Schäuble in terms of debt ratios and fiscal balances.

For him, the most important thing is that Member States repay their debts and maintain their spending within the limits set by the private bond investors, without central banks distorting the investment choice through asset purchasing programs.

This calculus is really independent of the state of the labour market, although the fiscal aggregates are clearly influenced by the health of the that market.

For Wolfgang Schäuble it is more important for a Eurozone nation to be able to issue debt to the private bond investors at stable yields than it is to ensure there is full employment.

It is clear that the aims of the bond investors are not necessarily aligned to the concept of generalised well-being. Their logic differs.

Wolfgang Schäuble also rehearses the standard inflation line by claiming that accelerating inflation will result from the European Central Bank’s public bond buying program, which has purchased most of the Eurozone government debt issued since the pandemic began.

He wrote:

This boosts the inflationary expectations of firms and private households. In this way, the eurozone risks a currency devaluation that could take on a virtually unstoppable dynamic.

There are misconceptions as to what inflation actually is.

Inflation is the continuous rise in the price level.

A one-off price rise does not constitute inflation. For example, after recessions, firms often withdraw discounts and return prices to pre-recession levels.

These adjustments do not constitute inflation.

Share market booms are also not akin to generalised inflation.

Inflation expectations data shows that they are largely stable at pre sent.

The latest Eurostat data – Inflation in the euro area (June 1, 2021) – which considers data from May 2021, shows that Euro area inflation is currently around 2 per cent, a 0.4 points rise from April 2021.

Eurostat write:

Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in May (13.1 %, compared with 10.4 % in April), followed by services (1.1 %, compared with 0.9 % in April), non-energy industrial goods (0.7 %, compared with 0.4 % in April) and food, alcohol & tobacco (0.6 %, stable compared with April).

Some price pressures have emerged as the pandemic eases.

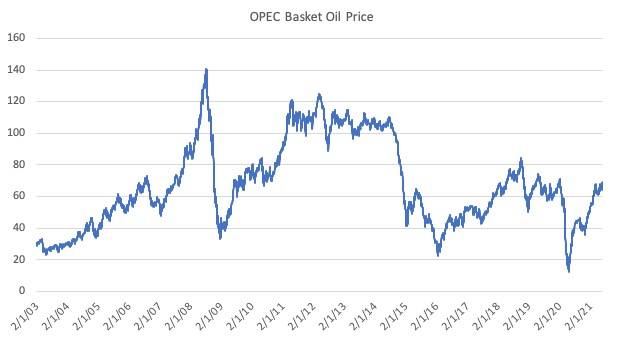

Shifts in oil prices are driving higher price levels at present, which is no surprise.

Oil prices fell sharply as the lockdowns kept us off the road. This was despite the production cuts that OPEC imposed early on in the pandemic to try to prevent such a fall.

But, now, the increased demand for fuel, as cars have returned to the roads, is pushing up prices.

No surprise there.

With energy prices heavily weighted in national statistical agencies price index measures, it is no surprise that the rapid increase in oil prices is driving a rise in CPI outcomes.

But look at this graph, which shows the OPEC Basket Oil Price from January 2003 to June 1, 2021.

The OPEC Reference Basket (ORB) for global oil prices is still below pre-pandemic levels and well below the stable post GFC levels.

And the US Energy Information Administration forecasts oil prices will flatten out through 2022.

When these cyclical adjustments sort themselves out the CPI rises will disappear.

More importantly, these rises have nothing much to do with fiscal or monetary policy.

They just reflect the into-and-out of lockdown variations in overall fuel demand.

Fear mongers point to the OPEC hikes in October 1973, when global oil prices rose from an average 2.48 US dollars per barrel in 1972 to $11.58 in 1974.

However, there is little prospect of a 1970s-style inflation emerging.

Then, strong unions and firms with price setting power engaged in a donnybrook aimed at shifting the real income losses from the rising oil prices onto each other.

But the strength of the relationship between oil prices and inflation has waned since the 1990s.

The ability of workers to engage in this sort of distributional struggle has been constrained by the rise of precarious work, persistent elevated levels of unemployment and underemployment and pernicious legislation that has reduced union capacity to pursue wage demands.

Since 1995, average annual inflation across advanced nations has been just 1.87 per cent.

In Japan, the average inflation rate has been 0.2 per cent.

A 1970-style wages breakout will not happen.

He wants a return to austerity or “monetary and fiscal normality”, a normality that maintained elevated unemployment levels and stagnant growth.

Extraordinarily, Wolfgang Schäuble considers that a return to austerity or “monetary and fiscal normality”, is required to protect the “social fabric”.

Refresh your memory of the graphs above.

This is a normality that maintained elevated unemployment levels and stagnant growth.

But it gets worse.

He thinks that government deficits widen “the gulf between rich and poor”.

Inequality in Europe has increased sharply since the adoption of the common currency.

In this article (April 22, 2019) – Forty years of inequality in Europe: Evidence from distributional national accounts – we learn that:

Inequalities have risen in a majority of European countries since 1980 …

Rising inequalities in Europe appear to have been mainly driven by dynamics visible at the very top of the income distribution. In the past four decades, the poorest 80% Europeans’ average incomes grew by about 20% to 50% … As soon as one looks at richer income groups, however, growth rates are markedly higher, exceeding 100% for the top 1% and culminating at 200% for the top 0.001% of European citizens. Between 1980 and 2017, the top 1% alone captured 17% of European-wide growth, compared to 15% for the bottom 50%.

I guess he could argue this occurred as a result of the rising deficits in the GFC.

But that wouldn’t cut it at all.

There is a problem when fiscal policy expansion is poorly designed and shores up, for example, the pay and benefits of banksters and neglects proper unemployment benefit coverage.

But that is not an intrinsic problem with using expanding deficits to protect jobs.

It is just that neoliberal politicians do neoliberal things and misuse the policy tools at their disposal.

I will write more about that soon.

But what Wolfgang Schäuble has in mind when he talks about “monetary and fiscal normality” is:

1. Cutting fiscal deficits.

2. Running “balanced budgets”.

The result: further stagnation, entrenched unemployment, rising poverty, rising suicide rates, and further damage to the social fabric of Europe.

Conclusion

Leopards don’t change their spots.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

I don’t believe for one minute that Wolfgang Schäuble does not know how it works.

If you believe that then that only leaves one reason for this madness and that is it is geopolitical.

Geopolitics today is all about keeping the top 0.1% happy of each country, so they stay on side as the West tries to defeat Russia and China. They are not interested in keeping the 99% within their own borders happy as they have no power and are mere sheep that the media can control.

Brexit and the rise of populism are the by products of the geopolitics being played out today.

Which then leads to the question does Schäuble have a choice ?

You see these people getting wheeled out from time to time to spread their propaganda with smiles on their faces. Gordon Brown is the UK version of Wolfgang Schäuble.

They play their role for Wall Street and the City of London and Frankfurt the Pentagon and the CIA and are adored by the 0.1% within their own borders. It’s an addiction for them and they get paid well for doing it.

“… lurid threats about the likelihood of an inflation outbreak in the US and elsewhere”: see Mervyn King, leading letter in today’s FT.

Hi Derek Henry. I’m not sure that you don’t overplay the geo-politics. Germany for instance, seems to be settled presently in a much more comfortable relationship with China than is the US, or that the US would like, not that US firms are not as well integrated in using Chinese labour as German firms are. To me, the likes of Schäuble and of course the UK politicians are much more parochial. Northern Europeans cater first to their industrial elites and bankers, UK politicians to landlords, arms manufacturers and bankers, the US to arms manufacturers, bankers, big pharma. and oil. And these people are closeted. I doubt Schäuble gives much thought to the privations of an unemployed family in Greece, a sometime troublesome little backwater in the Empire. I feel you’re a little unfair on Gordon Brown. Strikes me as being a little more aware and with some ethical underpinning.

Re: Schäuble, ‘In this way (ECB bond buying) , the eurozone risks a currency devaluation that could take on a virtually unstoppable dynamic.’ Apart from not establishing that relationship, he seems to ignore the fact that other central banks are playing the same game.

In January 2015 SYRIZA won the snap elections in Greece and the newly appointed finance minister Yanis Varoufakis called on Wolfgang Schäuble to renegotiate the terms of memoranda, which imposed a permanent austerity on the country by the troika. Schäuble replied by saying “who said that elections can change anything? What we’ve agreed stays as it is”.

A firm believer in democracy!

At some point we have to realize that in fact our own stupidity to believe the likes of schauble.

I find it highly annoying that when prices simply return to pre-pandemic levels as economies open up and normal demand is restored that it is characterized by ”learned” commentators as evidence of huge inflationary pressures and misguided fiscal profligacy. As always, the 1970s inflation bogey man looms large in their imaginations. They can’t seem to move on from the paranoia.

Really great to see your article on inflation in Guardian, Bill.

Reading the comments to the Guardian article it looks as though most of it flew right over the heads of many. GB now very much stands for Gormless Britain!

Echoing Carol Wilcox, I too was pleased to see the Guardian today but I had to look twice. William? Is that the same guy that I read daily and refer to my friends as Bill? Sure was, but how come the Guardian is publishing this stuff? The BTL comments showed the usual trolls were at work.

The starting point for any decent functional economy should be real full employment with an above poverty minimum wage. Inflation should be directly managed by government, not markets. Full stop.

I wonder if China has the nous to achieve it, since China already has a combined public state-control/private free-market system.

Think of the freed-up available resources, if junk production and consumption were diverted to R&D into AI and IT, and environmental/ecological care (including climate change if it’s real and urgent). (The CEOs of Coca cola and Exxon can always be guaranteed a job….).

Yes, great to see “William” ‘s (who he?) Guardian article. And to see quite a bit of pushback BTL against the uninformed was heartening. Some people ARE “getting it”.

Anyone,

What does BLT mean here?

Steve_American

BLT is short for , , and .

BTL is abbreviation for below the line: used to describe discussions or replies from readers that are published below an internet article, blog, etc.

When I read a letter in yesterday’s FT headed ‘It’s time Europe stopped fetishising fiscal discipline’ I assumed the writer had been reading this blogpost – until I saw the list of signatories which included Stephanie Kelton.

Professor Bill Mitchell, your reference to Olivia Blanchard in the first paragraph, is really to Olivia Blanchard, or is it Olivier Blanchard?

Dear Francisco Tavares (at 2021/08/17 at 1:09 am)

Thanks very much for the typo correction. Olivia becomes Olivier.

best wishes

bill