The other day I was asked whether I was happy that the US President was…

European Union is destroying the future for its citizens

One of the problems of neoliberalism is that it is anti-people. This makes it hard for governments to actually impose austerity and so they work out ways to lessen the visibility of their pernicious policy choices, except if you are in Greece that is. The ways they deflect the political fall out are many and include use the depoliticisation strategy – like appealing to TINA demands from external bodies such as the IMF (circa British Labour Party 1976), claiming central banks are independent, and hacking into expenditure items that delay recognition in the public eye that damage is being done. This blog post focuses on the latter. I have been studying the shifts in government spending in the European Union since the GFC and it is apparent that final consumption expenditure and outlays on social benefits have not been the focus of the austerity to the same extent as government spending on capital formation (public infrastructure). It is much harder politically for governments to cut recurrent spending because it usually impacts on people straight away. Cut a pension and the hurt is visible. Cut lots of pensions and there is a political problem. But cutting back on public infrastructure is less visible and the damage takes time to manifest as the depreciation process sets in, maintenance delayed and additional new capacity is lagging. But make no mistake – cutting capital spending undermines the future productivity of the nation and paves the way for a diminished future for our grandkids, the very ones, mainstream economists claim they are protecting by advocating austerity.

You can access the European Commission’s annual macro-economic database (AMECO) – HERE.

We don’t have to say much about the way the European Union handled the Global Financial Crisis.

The writing was on the wall back in the 1970s and 1980s, when Monetarism became the economic thinking of choice.

When Jacques Delors headed up his Committee which reported in 1989 and deliberately excluded the Finance Ministers, because he knew they would bring political concerns as well as ideology into the process.

He wanted ideology to rule – Monetarist, neoliberal ideology.

And it has been downhill for Europe ever since despite how many characters are wheeled out to say what a success the euro has been and how well the European Commission brings convergence across its geographical spread.

It doesn’t. It has fostered divergence – quite marked divergence.

The austerity started during the convergence process in the second-half of the 1990s.

There was a lull after the euro was introduced until the GFC hit. Then the Brussels gang worked with the IMF to wreak havoc.

They claimed the austerity would not be very damaging and would quickly get the economies across the zone back into growth. Remember all the claims of ‘growth friendly austerity’, ‘fiscal contraction expansion’ and similar buzz words and phrases that well-paid IMF and Commission officials would blithely mouth as they went from one summit to the next.

Plenty of food and good wine was served up at these events but no intellectual substance was present.

Please read these blog posts for more information:

1. The ‘fiscal contraction expansion’ lie lives on – now playing in Italy – Part 1 (November 267, 2018)

2. The ‘fiscal contraction expansion’ lie lives on – now playing in Italy – Part 2 (November 27, 2018)

The classic faux was the IMF use of multipliers.

As Willi Semmler wrote in his 2013 article in Social Research (p. 883):

MULTIPLIERS MATTER … is. Besides the size of the multiplier, policymakers also need to understand that the size and impact of the multiplier changes depending on how stressed the financial sector is and whether the economy is in recession or expansion. These gaps in the understanding of the multiplier appear to be a principal, if not the major reason that policymakers have dramatically underestimated the devastating effects of austerity policies in the European Union …

policymakers wildly underestimated the negative effects of austerity because the fiscal multiplier’s effect is asymmetric; it is larger in recessions and weaker in expansions …

Austerity in the form of government spending cuts, output, and income causes unemployment to increase, tax revenues to fall, and sovereign deficits and debt to rise, triggering more financial stress, and so on in a downward spiral. Instead of simply downsizing government spending, the entire economy shrinks as a result of government spending cuts. If governments respond to economic decline with further spending cuts, the negative spiral accelerates.

(Reference: Semmler, W. (2013) ‘The Macroeconomics of Austerity in the European Union’, Social Research, Vol. 80, No. 4, pp.883-914. )

We all know that the IMF, which provided significant modelling and justification for the harsh cuts associated with the Greek bailout in 2012 was forced later in the year, when the economy fell off the cliff, to admit they had seriously underestimated the value of the expenditure multiplier.

While they had assumed a low value, well below unity, which would have meant very large government spending cuts would only lead to relatively small losses in GDP, the reality was the multiplier was actually around 1.7.

That meant that every euro cut from public spending would multiply out to a 1.7 euros loss in GDP and all the real losses that accompany that – drop in employment, public services, rising unemployment, rising poverty, rising suicide rates, etc.

I wrote about that in this blog post – The culpability lies elsewhere … always! (January 5, 2013).

The austerity that was inflicted has not achieved its aims.

There has been no ‘debt stabilisation’ and the only reason bond yields have remained relatively low is because the ECB has been purchasing massive quantities of Member State government bonds. The financial markets would have revolted years ago had that not been the case.

We got a taste of that sort of revolt tendency in 2010 and again in 2012. The ECB’s bond buying program was the difference between several Member States becoming insolvent.

That’s the risk that besets a nation that does not have its own currency.

Willi Semmler also notes that the austerity inflicted “damages on social cohesion, living standards, and the EU social model

I have been examining the data to see where the cuts actually were concentrated as part of my (one of them) upcoming book releases.

Recurrent spending

As noted in the Introduction, it is politically much harder for governments to savagely cut recurrent spending because it impacts rather directly and people are immediately affected.

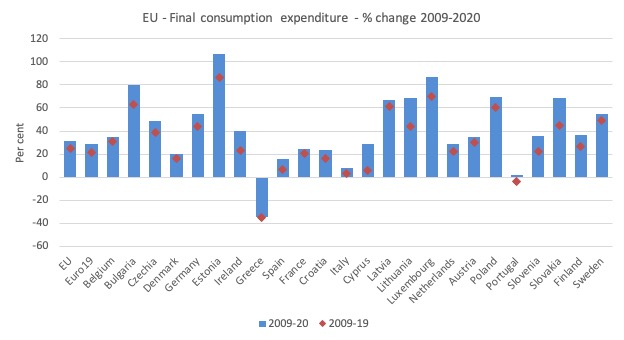

The following graph shows the percentage shifts in government final consumption expenditure between 2009 and 2020 across the EU (blue bars) and between 2009 and 2019 (red diamonds).

I left our Malta, Hungary and Romania because the data is clearly showing outlier qualities and needs further inspection.

But for the rest, the pandemic brought an increase in government final consumption expenditure but in some nations the shift has been minimal, which just confirms how poorly the European Union is handling the economic disaster that COVID-19 has presented.

But look at Greece, Italy Portugal – virtually no growth in final consumption expenditure in the decade since 2009 (and a dramatic decline in Greece’s case) and virtally no shift to deal with the pandemic.

It is a wonder there are not riots in those nations.

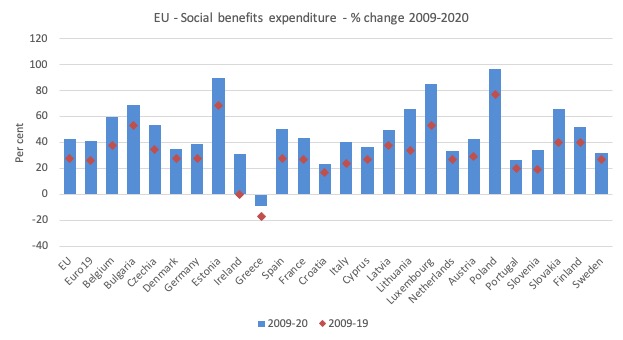

The next graph shows the outlays on social benefits.

Apart from the way Greece has been destroyed, the data reveals the political issue. Governments find it very hard cutting these benefits because they represent the difference between having a roof over one’s head or not, or, starving, or, dying from the cold in Winter.

The political fall out of that sort of problem is harder to manage.

Capital spending

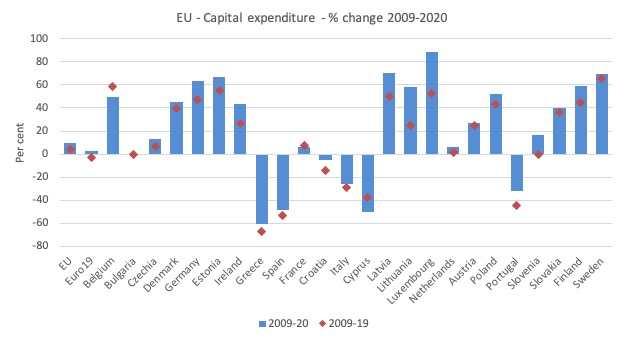

The final graph shows the percentage change in government capital expenditure over the same period.

This is where the damage has been inflicted. You can find exact numbers in the Table that follows.

But in the decade to 2019, Greece cut its government infrastructure spending by 66.9 per cent (unthinkable), Spain by 53.1 per cent, Italy by 28.7 per cent, Cyprus by 37.5 per cent, Portugal by 44.4 per cent.

The overall growth in the EU was just 4.2 per cent for the decade – virtually nothing.

The Eurozone actually recorded a cut of 2.6 per cent overall over the decade to 2019.

Vandalism is the correct word.

Undermining future prosperity for short-run ideology.

Starving public capital expenditure not only reduces current spending and employment but also reduces the opportunities for private business investment. The crowding-in effect that comes from high quality public infrastructure is lost when it is not maintained, replaced and expanded.

In turn, the cost structures in the private sector rise. Think about the ridiculous situation in Germany where freight trucks are diverted along lengthy (and time-consuming) deviations because bridges across main rivers have become dangerous due to a lack of government upkeep.

There are countless examples now of decaying infrastructure in Europe and those examples are the direct result of these cutbacks in government capital expenditure.

The costs might take a while to show up but they eventually do. And Europeans are starting to see the consequences of this policy folly.

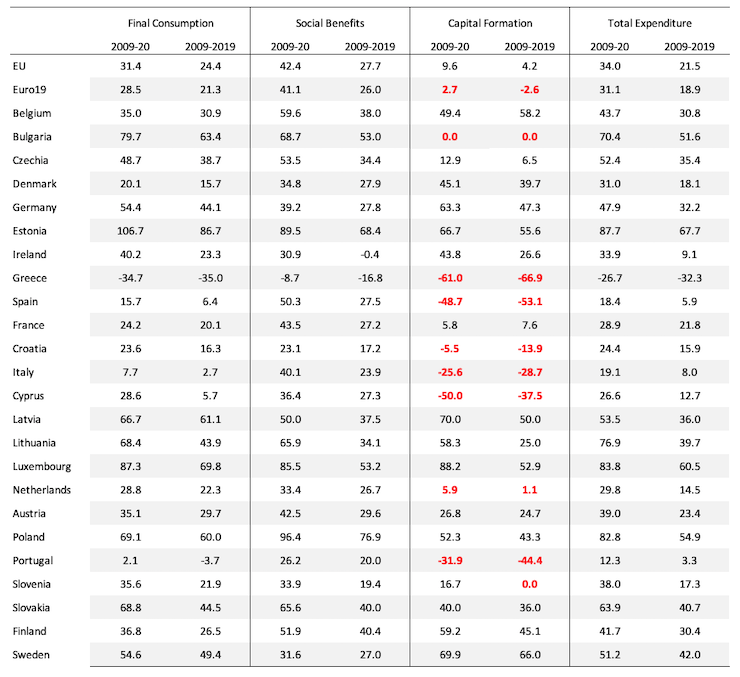

Complete picture

The following Table provides the numbers behind the graphs for those who prefer the data presented in this way.

Conclusion

And then came the pandemic – and things just go worse.

Vaccine chaos.

Vaccine nationalism.

And so it is – just a day in the European Union.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

“It is a wonder there are not riots in those nations.”

For Portugal, because the government restored some decency after the previous one went “beyond the troika”, a period also marked by emigration levels, and because the “serious” opposition is still weak after an exodus through the revolving door of privatization and similar opportunities. Well, and a debt moratorium postponing the harshest effects.

Of course, the expected cracks raging over Europe are all here, including a “radical left” that is more and more europhile and plenty of The Others to blame. But the EU is still off limits, all failures are simply the government not using the wonderful opportunity of The Recovery Plan (which, of course, isn’t).

Two comments – the first not quite on topic but apropos “That’s the risk that besets a nation that does not have its own currency” . Thanks, Bill for mentioning Jacques Delors because it reminded me of a notable headline in Britain’s The Sun tabloid newspaper on his proposed introduction of the European Currency Unit in 1990 – “Up Yours Delors” – picture of that Nov 1st front page here: https://www.pinterest.com.au/pin/326792516712370333/

The second is the EU’s woes are perpetuated by its shuffling of elites into senior roles… The head of the IMF (Christine Lagarde) becomes the head of the ECB. The head of the ECB (Mario Draghi) becomes the Prime Minister of Italy… and I’m sure there are many other examples. Just shuffle the deck a bit and surprise, surprise, the same characters pop up again and again in only slightly different clothes. Question: are they wearing any?

“Vaccine chaos.

Vaccine nationalism.”

Vaccine banning – to cover up the lack of supply and try and downplay a British success story.

The whole European project isn’t just destroying the future for its citizens. It’s killing them in the present.

(You’ll note they haven’t banned the contraceptive pill – despite a proven link to higher thrombosis levels, rather than one that correlates precisely with the background level).

If you back the EU project after this debacle, it’s time to send in your moral compass for recalibration.

What is your opinion about the French experiment when they let the government take over all major industries and banks in 1982. Is this something EU should do now?

What is the Netherlands doing!? (1% capital growth in a decade) It used to be a sensible country but with poldas to maintain. The contrast with China could not be more extreme. Travel across China (and now beyond) and in cities has been transformed in the last 10 years by high speed train lines, highways and subway systems. The completion of the high speed rail line in 2017 between Xian and Chengdu, reduced the journey time from 16 to 3 hours. That’s worth putting resources into, unlike the UK’s HS2 nonsense, which ploughs on while other rail upgrade projects are cut. And the capital expenditure clearly isn’t at the expense of consumption. Yes I know Germany and the Netherlands aren’t in such need of brand new train lines, but they (and Italy) do need to prevent bridges from collapsing.

Neil, re. the EU, with it’s Astra Zenaca vaccine scare trying to ‘downplay a British success story’, the politicians really are no better than primary school age children going off in a huff after an argument over toys, and caring less about the damage done.

RE: Banning of ChAdOx1 nCov-19 vaccine in the EU = all the more for us!!

@ Neil W, excellent point on the Pill; besides which, catching Coronavirus itself is also a very good way to get thrombosis/pulmonary embolism, with about 20% of hospital-admitted patients developing blood clots; and 31% in ICUs.

@ Patrick B, the High Speed Rail in China is extremely impressive. I was expecting a kind of budget shinkansen, but it was every bit as good as in Japan. Pudong makes Canary Wharf look like Canary dwarf, and the amount of tree planting to accompany ubiquitous road building, as well as in urban settings, was also impressive.

The US can’t even organise a HS rail link between SF and LA, running out of state funding after just 40 miles, and with no desire at the Federal level to pay for it.

The UK isn’t really big enough to need an extensive HS rail network, and for as long as the rail infrastucture in the North generally is so poor, it’s just vanity to blow such huge amounts on HS2.

A friend was travelling by train (well, I say train – they are often just an old 1970s bus carcass mounted onto a rail chassis) from Leeds to Harrogate a couple of years ago when it started to rain. Through the roof. That’s what needs attention, not extending the London commuter belt to Birmingham.

UK absolutely is big enough for a HS rail network.

Spain has the second largest in the world after China.

There’s no reason why any country shouldn’t pursue first class infrastructure.

What a ridiculous assertion

Revamp/improve northern railways and install advanced HS rail to connect up all of the Country

“There’s no reason why any country shouldn’t pursue first class infrastructure.”

You can’t do anything if you are still within the mainstream framework, period.

Debated a guy in my union. The lesson is that once you use mainstream economics, you can’t do anything and you can’t go anywhere.

I asked him again and again if making public transportation more robust in Los Angeles would actually save carbon emissions because of fewer cars and more reasonable time for commuting to work. He kept saying money this and money that etc, as if money measures carbon emissions as if money measures carbon emissions and as if money is an actual resource that we need a pickaxe to mine out. Then he went on saying we should support carbon tax and market based “solutions.”

Lenin was right. 90 percent useless nonsense to weigh people down and one-tenth distortions.

@Tom Y it really is terrible how people’s thoughts and expectations are narrowed by going along with neo-liberal wealth extractors. Ask that guy if China’s HS rail network has come about because it has more money than the US and he’ll probably say that the US is restricted by the size of its debt (apparently owed to China). China does certainly have more man-power, but the US (and all the neo-liberal countries) would have enough man-power if it trained up some of its citizens left idle by the current system and raised sights beyond being a nation of ‘barristas’ supplying coffee to techies.

@Jake one can already travel (in the UK) from London to Newcastle in 3.5 hours. Do we really need to shrink a small country any further? All of the country does need to be connected up with modern public transport, but significant resources (all the bridges are too low) are currently employed on part-electrification of lines, while the govt continues to expand the fossil-fuel car network (though not repairing it).

@Mr Shigemitsu China’s cities’ tree-lined avenues are good aren’t they? It’s a shame the people’s parks are a bit concrete, but with the numbers of people, there would be no grass left if it was there to be walked on. The industrial areas have been turned into a bit of a wasteland, but elsewhere the natural forest cover is still rather more extensive than here in the UK.

@Patrick B,

Problem is that he has an advanced degree and has a good job at a university. He does NOT feel the pain young unemployed people feel. He CAN afford to entertain himself with mainstream economic theories, unlike people that are in more dire straits. There are so many young men especially that are out of work and believe that they have nothing to live for. So many wasted potentials!

@Patrick B

I’m Dutch, but I suppose it’s much the same story as elsewhere. Privatisations, cuts, the “shedding of ideological feathers”, as a Labour politician famously described their turn to neoliberalism. I was born in the time of Reagan and Thatcher, so for as long as I can remember all discussion of public spending has been in terms like “who will pay for it?” and “how will you pay for that?”, by politicians, journalists and common people alike. Exactly like Tom Y. describes; it is everywhere.

Of course, if you actually want to find out how money works, you can reach the conclusion that mainstream economics doesn’t understand it very well at all. I didn’t really go this road until the disastrous treatment of Greece. I didn’t have any education in economics, but was aware that governments seemed to have spent considerably more in the past without issues, and that it seemed extremely ridiculous to demand procyclical austerity even by the standards of mainstream economics. This made me discover how conflicted it really is and that there are different ways of studying economics. And that people pursuing such devious ways have actually predicted what could go wrong, like Wynne Godley did in 1992, when I was still in primary school… quite depressing.

That the tragedy of Greece was inflicted by, among others, Jeroen Dijsselbloem of our Labour party really sums up the movements in political and economic discourse of the recent decades.

What a wonderful analysis by Prof. Bill!

I really appreciate it when he made the comparisons between before and after the pandemic, within as well as among the countries.

Many states should move a bit faster if they want to prepare better for the future.