In the annals of ruses used to provoke fear in the voting public about government…

The ‘fiscal contraction expansion’ lie lives on – now playing in Italy – Part 2

This is the second and final part in my discussion about the latest attempts by the IMF and notable New Keynesian macroeconomists to keep the ‘fiscal contraction expansion’ lie alive. The crisis in Italy is once again giving these characters a ‘playing field’ to rehearse their destructive ideas that rose to prominence during the worst days of the GFC, when the European Commission and the IMF (along with the OECD and other groups) touted the idea of ‘growth friendly’ austerity. Nations were told that if they savagely cut public spending their economies would grow because interest rates would be lower and private investment would more than fill the gap left by the spending cuts. History tells us that the application of this nonsense caused devastation throughout, with Greece being the showcase nation. The damage and carnage left by the application of these mainstream New Keynesian ideas are still reverberating in elevated unemployment rates, high poverty rates, broken communities and increased suicide rates, to name a few of the pathologies it engendered. In their article – The Italian Budget: A Case of Contractionary Fiscal Expansion? – Olivier Blanchard and Jeromin Zettlemeyer, from the Peter Peterson Institute for International Economics continue to argue the case for austerity in Italy as the only way to engender growth. In this second part of my analysis of their argument I show that there is little evidential basis for concluding that Italy is a special case. I argue that imposing fiscal austerity on Italy will turn out badly. The broader conclusion is that the mainstream economics profession has learned very little from the GFC. For them the story stays the same. It is one that we should reject in every circle it arises.

In – Part 1 (November 26, 2018) – I reflected in the current IMF proposals for Italy and the latest offering from former IMF chief economist Olivier Blanchard (with a former German economics bureaucrat) about Italy.

While the view of Blanchard and Co is now slightly more nuanced that some of the earlier statements along these lines (including the latest IMF salvo on Italy), the reality is that they are both offering the same solution.

They both want Italy to cut spending because they claim this is the only way to reduce public debt and, ultimately, boost growth.

The lessons from the GFC have not been learned.

Italy will go into recession if the government follows the European Commission’s demands to cut its net spending and increase its primary fiscal surplus.

Let’s look back in time a little

Blanchard and Zettlemeyer recounted the period around 2012 when interest rates in the Eurozone rose sharply, spreads on long-term bonds against the German bund increased and the recession intensified.

They concluded that clearly this demonstrated that cutting net public spending will in normal cases reduce growth, a position that Blanchard did not express when he was overseeing the IMF’s position on Greece.

However, they are now arguing that Italy is a special case where the typical IMF position holds – it needs to cut spending in order to grow.

The ‘fiscal contraction expansion’ lie lives on and is now playing in Italy

So nothing much that is new was offered in Blanchard and Zettlemeyer’s recent article – The Italian Budget: A Case of Contractionary Fiscal Expansion?.

It was still presenting the failed strategy that has left millions of people unemployed, destroyed personal savings and increased inequality and poverty rates.

Let’s look back in time a little to see whether Italy can be considered a special case.

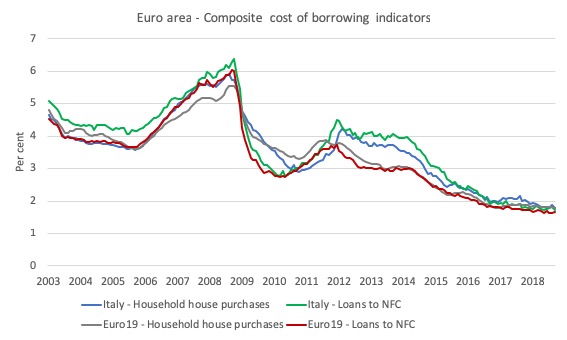

The first graph shows the ECB’s composite cost of borrowing indicators for households and non-financial corporations (NFC) in Italy and the overall Euro area from January 2003 to September 2018 (monthly data).

Around May 2010, the composite cost of borrowing rose for Italian households and NFCs more or less in unison with what was happening in the overall currency union.

This was a period when the ECB started increasing interest rates (from May 2009 through July 2011) even though it was clear that this was the last thing they should have done.

The next graph shows the spreads between the long-term bond rates for Italy against the bund. It is clear around 2012, the spread rose considerably.

In relative terms, the spreads for Ireland, Greece, Portugal rose much higher than for Italy. The Baltic states also experienced much more extreme rises in spreads and these came before 2012.

Cyprus, Spain, Slovakia, and Slovenia all endured a similar rise to Italy, while France, Belgium, Malta experienced rises but not of the order of the rise Italy experienced.

So, except for a few Member States, this was generalised phenomena, which signalled growing uncertainty about the viability of the common currency overall.

It was not an Italian event exclusively. It reflected the chaos in the Eurozone at the time and the poor handling of the crisis by the European Commission and the ECB, which had presented the very real possibility that one or more Member States would become insolvent and/or exit the monetary union.

Between April 2011 and November 2011, the Italian long-term bond spread against the German bund rose from 1.5 points to 5.19 points – that is, 369 basis points.

To put that in perspective, between April 2018 (1.29 points) and October 2018 (3.07 points) the spread rose by 178 basis points.

The spread fell rapidly in late 2011 because the ECB included Italy in the Security Markets Program (SMP), which saw the central bank intervening in the bond markets to push down yields (as it always can if it chooses).

Now what was happening to non-government investment spending during this period?

Mainstream economists allege that this component of total expenditure is the most interest-rate sensitive component of aggregate demand in the economy, and, crucially, it is this sensitivity that forms the most important part of the Blanchard-Zettlemeyer-IMF claim that any fiscal stimulus in Italy now will destroy growth?

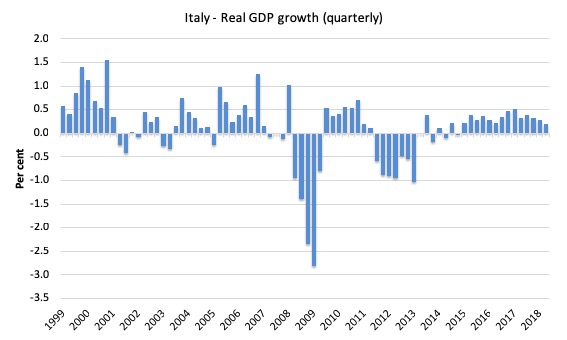

The next graphs show Real GDP growth for Italy (quarterly) from the March-quarter 1999 to the June-quarter 2018 in the top panel, and the ratio of Gross Fixed Capital Formation (investment) to GDP for Italy over the same period in the lower panel. I scaled the lower panel to start at 10 per cent to bring the variation into greater relief.

Focus on the period when the bond spreads rose sharply between April and November 2011.

The crowding out story that Blanchard and Zettlemeyer repeat from undergraduate mainstream textbooks ignores the fact that investment spending is not exclusively inversely determined by borrowing costs.

Even at low or declining interest rates, firms will not borrow to invest if their expectations of sales is bleak.

So investment behaviour is driven by expectations of sales potential over the life of the asset being created. If expectations are strongly positive then an interest rate rise may have no effect.

It is also driven by the current capacity relative to the state of demand. If austerity leads to a contraction in current sales, then firms will not invest, no matter how cheap they can get funds from the financial markets, because they have sufficient productive capacity already in place to meet sales.

And even if interest rates shifts do influence investment decisions, spending is typically insensitive in the immediate period to rises in borrowing costs because of the gestation period involved in purchases of capital equipment etc.

These are long-term decisions that may have been taken some years prior to allow for design, custom manufacture, delivery, implementation etc.

The opposite is true. When GDP growth is strong, firms regain confidence that future revenue streams and profits will be strong and also find themselves with capacity shortages, which constrain their ability to respond to the rising sales.

In that environment, even if the cost of borrowing is rising, firms start investing strongly to ensure they maintain market share in their sectors.

Now, turn your attention on the top panel.

Real GDP growth collapsed in the June-quarter 2009 and was negative for the next five quarters.

It then started faltering again in early 2011 as the Italian government was “prodded” into introducing an austerity program.

It went downhill fast from there as you can see from the top panel – Italy was in the throes of a double-dip recession within the space of a few years. GDP growth was strongly negative for 6 out of the next 7 quarters.

At that time, the IMF was claiming that Italy would continue growing – recall the graph I presented in Part 1 that showed the massive, unconscionable forecasting errors that arose in 2011 and 2012.

Now consider the investment ratio graph (lower panel).

While it started trending down from the March-quarter 2007 as the first round of austerity (large spending cuts) was imposed on Italy at the outset of the GFC.

Even though the overall trend was downward, there were two notable declines in the ratio and both were associated with the collapse in real GDP growth.

The first sharp drop off trend came when spreads were low.

The investment ratio did not fall much during the period of rising spreads. It wasn’t until 2012 that it fell sharply.

In the December-quarter 2011, it was 22.1 per cent of Valued Added. By the December-quarter 2013, it had fallen to 19.3 per cent.

But this is in the context of a rapidly plunging real GDP growth rate.

So investment spending in the economy was falling faster than GDP was falling.

It is almost certain that the investment decline had little to do with what was happening in the bond markets and everything to do with the collapse in growth and the negative outlook that that state presented to businesses.

Once the GFC ensued and the 2012 austerity intensified, the investment climate was decidedly sour and would have worsened even if the spreads had have remained low.

Both the declining GDP growth and the declining investment ratio were driven by austerity not the bond spreads or any cost of borrowing issues.

What about turning points? A turning point is considered to be the time when the movement in one direction for a time series variable ends and the movement alters direction (up or down).

There are more exact descriptions in mathematical statistics available but this one will do for our purposes.

Comparing turning points helps us understand causality.

Did the fall in investment spending drive the recessions or vice versa? Or are these aggregates co-determined. Clearly, investment spending is a component of total spending so if it falls, other things equal, one would expect a decline in GDP growth to follow.

But, investment spending also responds to economic growth – as the economy is growing, capacity shortages develop and confidence rises, which triggers rising investment expenditure, via what is known as the ‘accelerator’ effect.

So the causality runs in both directions although these different impacts could manifest in different lag patterns.

The point is that there is nothing in the turning points to suggest that the rising spreads in 2011 ’caused’ the decline in investment. The two aggregates – real GDP growth and growth in capital investment expenditure moved very much in lock-step in both cyclical downturns during the 2007 to 2014 period.

And if you reflect back on the first graph today – the costs of borrowing – even when the ECB were pushing up rates from May 2009 through July 2011, which pushed up the borrowing costs, the Italian investment ratio was rising.

And, guess what?

Real GDP growth was also recovering somewhat.

The next graph shows the loan behaviour over these periods.

Each of the noticeable drops in loans for Non-financial corporations (NFC) coincide with the two large GDP collapses. And only one of those times is concurrent with sharp increases in bond spreads.

Further, for the household sector, the growth in loans basically stops.

The downturns in loans also coincide with sharp contractions in consumption spending.

And all of these events are related to the collapse of real GDP.

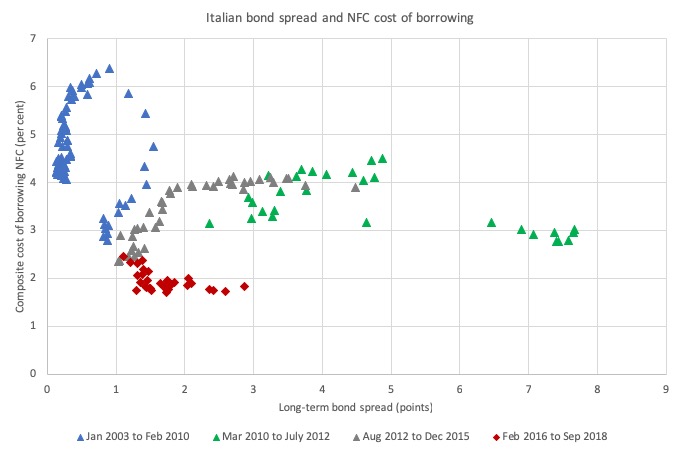

The next graph is interesting. It is just a correlation, which means that one has to be careful in interpreting it and not say try to draw too much out of it in terms of causality.

On the horizontal axis is the Italian long-term bond spread for various periods denoted by the different coloured symbols.

On the vertical axis is the ECBs composite cost of borrowing for Non-financial corporations.

Blanchard and Zettlemeyer want us to believe that when the bond spread rises, this spreads into rises in the broader non-government borrowing rates.

This is what they say:

The evidence, both from Italy today and from the past, is that government bond rates, bank funding rates, and bank lending rates move together.

The data doesn’t show that.

The green triangles are for the 2010 to 2012 period when the bond spreads rose sharply. The composite cost of borrowing did not uniformly rise.

Similarly, in the most recent period (red diamonds) as the spread has started to increase again, the composite cost of borrowing hasn’t moved much at all (downwards if anything).

Blanchard and Zettlemeyer admit that in the immediate period after the fiscal stimulus, real GDP will rise by some factor.

But for them, the related responses to interest rate will more than wipe that out.

I consider that projection to be dogma and not based on evidence.

Essentially, Blanchard and Zettlemeyer are claiming that investment will decline in a period of increasing real GDP growth.

We don’t see that behaviour in the real world.

That sort of behaviour is confined to the mainstream textbooks.

If anything, a growing economy as a result of fiscal expansion, crowds in, rather than crowds out private spending.

When governments improve transport infrastructure, for example, it opens up new opportunities for private profit, which then drives investment.

That will happen in Italy. The investment response will take a while as firms wait to see if the expansion is not undermined by subsequent austerity.

Conclusion

It will be madness if Italy bows to the pressure from the European Commission and the IMF and its related bullies like Blanchard and Co. and engages in more fiscal austerity.

2011 won’t come quickly enough if that is the case and GDP growth will collapse again.

Italy is on the edge right now. It recorded zero growth in the September-quarter 2018.

It simply must engage in fiscal expansion and enjoy the positive reinforcing private spending effects that will flow from that.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

Great to have this analysis. Last graph seemed especially undermining of Blanchard’s argument. (I don’t know how you manage to churn out all that statistical evidence so quickly – but thank you)!

For me the simple idea that firms invest when sales go up is far more convincing than firms investing just because money is cheap. There’s no point investing if you can’t sell anything the investment produces. Why is that so hard for the mainstream to grasp?

where do they get that magical 1.6 figure from. they explain the other 3, but pull that one out of thin air.

@cs:

I’m convinced it’s ideology driven thinking. I’m sure they start with the result they wish for (are paid for?) and proceed to pile up bogus stats and correlational bullshit with a heavy dose of cherry picking to later proclaim a causality where there is none.

It’s really interesting to follow the history of “think tanks” and their role in promoting neo-classical economics back since Friedman’s times. I read somewher that, in modern times, “conservative” and “centrist” (really just less callous conservatives) think tanks account for 90% of media citations. That is particularly impressive, since they produce so little valuable info, as Bill repeatedly proves in this blog.

Ultimately, it’s kind of a symbiotic relationship between big finance and economists: you tell them it’s best for them to cater to my interests and I’ll keep your faculty/think tank well funded or flat out offer you a well paid job. The work in high echeleons of finance and government is then used to bolster the quack’s reputation and by extension that of their (group-) think tanks.

Add to that a dose of Murdoch controlled media and you’ll find, that it is probably more difficult to be well informed in this times, in which information abounds, than in the past were one wasn’t constantly flooded with bovine excrement.

I agree with HermannTheGerman. What would be the point of funding private think tanks if not to add the flesh and bones to an ideological skeleton?

The ideology appears to be to attack the working class by any means possible.

We see the same types of ideological talking heads on publicly owned media here in Canada, were the effects of long term fiscal policy inadequacy is producing a perfect storm in combination with the outcome of Neo Classical Liberal oriented trade agreements. The lack of demand was cited by General Motors as the reason for it’s decision to close an auto plant employing 26000 directly and many more indirectly who work in machine shops etc across the country, just a day ago.

At the same time, the Liberal government here has duplicated the behavior of the prior Conservative government by legislating the end of a postal workers strike, which was more about health and safety of workers who are injured at a rate 5 times higher than other sectors, and pay equity,rather than wages.

Back to work legislation for striking workers at Canadian crown corporations, has become the norm despite having been found unconstitutional by the supreme court. All the transnational corporations especially those doing online parcel based business ,have to do is say their bottom lines are being affected by the strike and any negotiation that could have taken place is over before it starts.

It eludes the leadership that there was never any need to to recast the postal service as a crown corporation in the first place. If it is an “essential service” as claimed by the government, and the transnationals esp near Christmas time, then it should have remained a government provided utility without the burden of generating profits (which it does) to return to it’s only shareholder (the government) at the expense of workers health and that of the overall economy.

Thanks for this Bill.

Unfortunately there is no debate between mainstream and heterodox (let alone MMT) economists. As HermannTheGerman summed it up yesterday ”…there is more money for private interests to be made with an absentee state”. So economists with no shame are selected, employed and their ”research” funded to produce nonsense in universities, think tanks, and journals. Not everywhere luckily.

Jamie Galbraith has an article worth reading that touches on this. A couple of quotes: ”…in this generation of top-level economists, practically no original thinkers of the first rank. On the left, a leading voice such as Paul Krugman espouses a paper-thin version of 1960s textbook pseudo-Keynesian theory … which Skidelsky accurately dismisses as a “teaching tool. In the center and on the right, the field is peopled by pompous mediocrities occasionally exposed as such-as in the film Inside Job. They hold their positions only through the interlocking tribalism of American academic life.”

K. Newman comment: Only in the U.S. could Krugman, who opposes ”medicare for all”, be described as on the ”left”.

But there is hope, back to Galbraith: ”… Harvard, MIT, Stanford, and Chicago-are sterile. The backwaters, on the other hand, are full of life. Post-Keynesians, New Pragmatists, Biophysical Economists, Institutionalists, and especially Modern Monetary Theorists are scattered throughout the diaspora of liberal arts colleges and second-tier state universities, as well as in universities abroad, from Australia to Poland to Brazil. They have been busy…”

K. Newman comment: I have followed Galbraith’s writings, heard him speak, and even chatted with him a couple of times in the last 10 years. He has always been very restrained, even gentlemanly. No more it seems.

Bill, you on the other hand are the one now who is quite restrained, at least in your writings. Quite a feat given the intensity of the nonsense churned out by these mainstream characters. I commend you for that.

Galbraith’s article is at : https://americanaffairsjournal.org/2018/11/the-past-and-future-of-political-economy/

In passing, it occurs to me that Trump’s thinly-veiled attack (judged against his accustomed brutal approach) on May’s Brexit “deal” as making a future UK-USA trade agreement less probable throws a more favourable light on her deal – even though that predicted outcome is the exact opposite of what she claims to be the one she’s aiming for!

Since anything worse than a future UK-USA trade agreement (along the lines of NAFTA) can possibly be imagined, maybe all progressives ought now to hurriedly rally around the hapless May? For all the wrong reasons from her POV of course but that just adds to the idea’s entertainment value….

Yes to the German and the Christian. It’s ideology. We are supposed to learn that all human advancement comes from the actions of the wealthy and the powerful. Community action, the action of everyday people amounts to nothing. Playing. We must learn that we are dependent upon wealthy and the powerful individuals. We must court them. Build their “confidence.” IF we are good little boys and girls, and a little bit lucky, and do our best, to lure and cajole them back, by making an environment welcoming and rejoicing in them, they just might find it in their hearts to come back and bestow their bounty with us. THE (job) CREATORS.

Of course it’s the exact opposite: they mean to strip us of our assets and subjugate us to their will and control. Business, people, act to gain; to gain all the things they need and monetary wealth. Once the wnp have satisfied their material wants, the only thing left is monetary and subjugation. If your customer base cannot afford to buy, then you have no reason to produce for them, to meet them. The extraction of maximum surplus value leads to exhaustion of demand. The southern plantation owners didn’t grow cotton to sell to their slaves. No, it was to export for gold and goods for themselves. There’s unvarnished human nature.

About a year ago, I spent several hours listening to some of the Peterson Institutute talks – Blanchard, Larry Summers etc etc – trying to contrast what they were saying about the GFC and the long recession with what I’d been learning about from MMT as a lay person.

One thing I noted was that they didn’t seem to have much new to say but said this in a lot of (slow ponderously-delivered) words and no solutions apart from “more education” to offer.

I noted their various ways of very begrudgingly admitting that fiscal policy might be a good idea sometimes or that something was sort of wrong with the world they hadn’t foreseen (“secular stagnation” is the cause apparently) whilst still maintaining that their economic theory was basically still sound.

But the biggest thing that struck me was their constant fawning and praise of one another. “Oh how wonderful to have you here… what an honour to be here…how just fantastically wonderful we all are and hallowed be thy name Pete Peterson!” Despite the fact that, you know, Blanchard had just destroyed Greece with mindless austerity and was on record saying “the state of Macro is good” – prior to Lehman’s collapsing and all hell breaking lose.

If I made that many mistakes in my job I’d have been fired long ago. Yet here they all are, pontificating on high…. such arrogance.

As Galbraith says, they really are “pompous mediocrities occasionally exposed as such…..[who] hold their positions only through the interlocking tribalism of American academic life.”

Bill W

This is Blanchard’s equation

0.8 * 1.5 – 0.8 * 1.6 ≈ -0.1.

I think the 1.6 refers to the 160 basis point rise in interest rates supposedly caused by the Italian government’s audacity to challenge the EU. 100 point rise is supposed to automatically cause a 0.8% fall in gdp or something like that…