Well my holiday is over. Not that I had one! This morning we submitted the…

The ‘fiscal contraction expansion’ lie lives on – now playing in Italy – Part 1

Pathetic was the first word that came to mind when I read this article – The Italian Budget: A Case of Contractionary Fiscal Expansion? – written by Olivier Blanchard and Jeromin Zettlemeyer, from the Peter Peterson Institute for International Economics. Here is a former IMF chief economist and a former German economic bureaucrat continuing to rehearse the failed ‘fiscal contraction expansion’ lie that rose to prominence during the worst days of the GFC, when the European Commission and the IMF (along with the OECD and other groups) touted the idea of ‘growth friendly’ austerity. Nations were told that if they savagely cut public spending their economies would grow because interest rates would be lower and private investment would more than fill the gap left by the spending cuts. History tells us that the application of this nonsense caused devastation throughout, with Greece being the showcase nation. The damage and carnage left by the application of these mainstream New Keynesian ideas are still reverberating in elevated unemployment rates, high poverty rates, broken communities and increased suicide rates, to name a few of the pathologies it engendered. But the ‘boys are back in town’ (sorry Thin Lizzy) and Blanchard and Zettlemeyer are falling in behind the IMF and the European Commission against the current Italian government by demanding fiscal cutbacks. It will turn out badly for Italy if the government buckles under this sort of pressure. It once again shows that the mainstream economics profession has learned very little from the GFC. For them the story stays the same. It is one that we should reject in every circle it arises. This is Part 1 of a two-part analysis of the latest incarnation of this ruse my profession inflicts on societies.

This sort of analysis comes as no surprise. Blanchard was the chief IMF economist at the time the Troika was enforcing bailout terms onto Greece.

In early 2013, he was forced to publish a revealing admission that the IMF had made horrible mistakes in relation to estimating the impacts of fiscal austerity.

On January 3, 2013, the IMF published a paper – Growth Forecast Errors and Fiscal Multipliers – which was co-authored by Blanchard.

The paper attempted to explain why the planned fiscal austerity measures in advanced economies had been more damaging than the mainstream economists had predicted at the time.

I analysed it in this blog post – The culpability lies elsewhere … always! (January 7, 2013) – and if you are interested their is considerable detail provided about the IMF forecast errors and their implications.

I had traversed the problem of poor IMF forecasting previous to that date. For example – Governments that deliberately undermine their economies (November 19, 2012).

The problem is not the fact that forecasts are prone to errors. That is par for the course, when dealing with variable data generating mechanisms.

The issue is rather that the IMF and other major neo-liberal inspired organisations produce systematic errors – which mean they do not arise from the stochastic nature of the underlying forecasting process.

That is, the IMF tends to claim larger positive effects (or smaller negative effects) when they are advocating cutting fiscal deficits and large negative effects (when considering government plans to increase deficits).

It is easy to trace these systematic mistakes to the underlying ideological biases, which shape the way they create their economic models.

In their October 2012 World Economic Outlook, the IMF wrote:

Under rational expectations, and assuming that forecasters used the correct model for forecasting, the coefficient on the fiscal consolidation forecast should be zero. If, on the other hand, forecasters underestimated fiscal multipliers, there should be a negative relation between fiscal consolidation forecasts and subsequent growth forecast errors. In other words, in the latter case, growth disappointments should be larger in economies that planned greater fiscal cutbacks. This is what we found.

Which in plain English says that the theoretical structure that the IMF have based their policy advice – including battering nations with structural bailout packages that have created millions of jobless citizens – were wrong.

What Blanchard and Co. admitted was that growth will falter the most in nations with the largest fiscal withdrawals (in the context that these austerity measures are firmly pro-cyclical).

But when they were bullying Greece into accept the conditionality in the bailout they claimed that it was imperative that fiscal consolidation be instituted in most advanced nations.

In Greece’s case they wanted what could only be construed as radical deficit cutting along with other retrenchments within the public sector.

During the crisis, the IMF regularly bombarded us with forecasts of how export-led recoveries were in the wind as long as nations stuck to their domestic deflation strategies (aka cut wages and benefits and government spending generally).

At the time, I wrote this blog among others – Fiscal austerity – the newest fallacy of composition (July 6, 2010) – which warned against the export-led dogma being pushed by the IMF, the OECD, the EU and others.

I think what I wrote in that blog post and more generally at the time has proven to be very accurate while the IMF predictions have proven to be grossly inaccurate.

Effectively, Blanchard and Co admitted in their January 2013 statement, that:

Our results suggest that actual fiscal multipliers have been larger than forecasters assumed.

They had claimed that the multiplier was around 0.5. That means that for every $1 the government spends the economy will only grow by 50 cents. Where does the other 50 cents go given that $1 of spending adds that much to national income initially?

The answer is that the models assume that there is private sector crowding out and Ricardian effects which lead to an offset of 50 cents in other production that would otherwise have occurred if the government didn’t spend the $1.

However, the IMF later admitted, after the damage was done:

… that actual multipliers were substantially above 1 early in the crisis.

Which means that the $1 of extra government net spending (rise in deficit) would multiply to be much more than $1 (crowding in) because of induced consumption spending and favourable investment response to the initial increases in output.

Which works in reverse and explains why Greece collapsed under the bailout austerity programs.

Blanchard and Co reflected in this way:

In particular, the results do not imply that fiscal consolidation is undesirable. Virtually all advanced economies face the challenge of fiscal adjustment in response to elevated government debt levels and future pressures on public finances from demographic change. The short-term effects of fiscal policy on economic activity are only one of the many factors that need to be considered in determining the appropriate pace of fiscal consolidation for any single country.

That sort of indifference and denial is typical. They just cannot admit that they were totally wrong – not just a little wrong – and as a result of their errors, millions of people unnecessarily became unemployed, private savings were destroyed, pensions were cut, health impacts were negative and suicide rates rose.

Tens of thousands of children died because of these “short-term effects”.

No one went to prison as a result of this incompetence.

The mantra of the neo-liberals lived on. No humiliation for their errors. No reflection as to why the errors occurred. What we get is a technical exercise which is of interest but hardly a mea culpa.

Blanchard is now back in town pushing the same sort of stuff in relation to Italy’s current plight.

His co-author in this latest pathetic attempt to justify fiscal austerity, Zettlemeyer was the “director-general for economic policy at the German Federal Ministry for Economic Affairs and Energy”.

So it is no surprise that he will be pushing the fiscal contraction expansion line that the European Commission and its austerity partners such as the OECD and IMF keep inflicting on the world.

The IMF on the current situation in Italy

Before I consider the Blanchard stuff, the IMF delivered their verdict on what Italy should do by way of their – Staff Concluding Statement of the 2018 Article IV Consultation (November 13, 2018).

No surprise there either.

The IMF always wants to sound important given they really don’t have any productive purpose now that nations float their exchange rates.

In their ‘Concluding Statement’, they say that:

The key problems of the Italian economy are low growth and weak social outcomes. Real personal incomes are at the level of two decades ago; unemployment has averaged close to 10 percent over this period; the living standards of middle-aged and younger generations have eroded; and emigration of Italian citizens is near a five-decade high. The authorities’ emphasis on growth and social inclusion, therefore, is welcome.

A realistic assessment.

So what should the Italian government do?

Any reasonable economist, who actually understood the way monetary systems worked, would recommend fiscal stimulus as one of the important planks to solve this long-term stagnation problem that the common currency has delivered to Italy.

The IMF differs.

They claim that the Italian government’s plan “to enact a notable upfront fiscal stimulus to bolster demand” would have an “uncertain … growth impact” in the short term but would be negative in the medium term because higher interest rates would crowd out private investment spending.

Same old!

Instead, these intrepid souls want Italy to to undertake:

… a modest and gradual fiscal consolidation to help put public debt on a firm downward trajectory and reduce financing costs.

In other words to cut spending in the economy immediately and for the next 4-5 years to bring down public debt.

They also claim that:

It would be prudent to consolidate public finances, while external conditions remain favorable and economic growth is above potential, thereby limiting the short-term output costs.

Which leads one to wonder which planet these characters reside on.

The external environment is bleak at present.

Germany just recorded a negative GDP growth quarter (-0.2 per cent) and their exports were down by 0.9 per cent and their external trade contribution was a negative 1 percentage point.

It is the largest negative contribution from net exports since the March-quarter 2010.

That is not a favourable external environment for any Eurozone Member State.

And what about Italy itself and its so-called “economic growth above potential”?

As I discussed in this blog post – Italy should lead the Member States out of the neoliberal Eurozone dystopia (November 5, 2018) – the third-quarter 2018 National Accounts for Italy revealed its was now down to zero economic growth and was running a massive primary fiscal surplus.

The two are obviously connected.

Is the IMF seriously claiming that a nation operating at zero growth and heading back into recession is achieving “economic growth above potential”?

And what do you think will happen over the next 4-5 years if the Italian government continues to run contractionary fiscal positions as recommended by the IMF (and the European Commission)?

As I discussed last week in this blog post – Eurozone fiscal rules bias nations to stagnation – exit is the remedy (November 21, 2018) – the private domestic sector is running a huge surplus (withdrawing around 4.45 per cent of GDP from the spending system), which requires a very large fiscal deficit to offset it, given current external conditions.

It is almost unbelievable that the lessons of 2010-12 etc have not been learned.

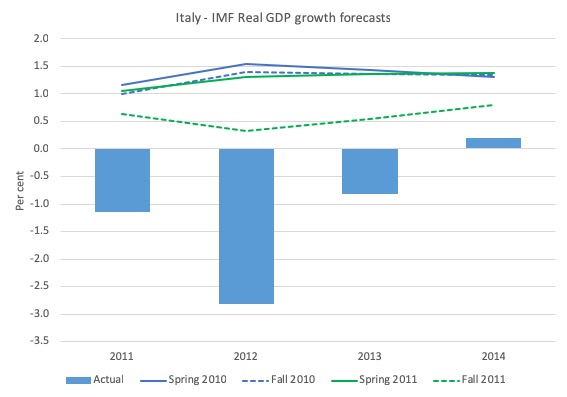

And just to remind you of the IMF’s track record with respect to Italy, here is a reflection on their World Economic Outlook forecasts in 2010 and 2011 for real GDP growth in Italy.

The IMF make two forecasts: Spring and Fall (Autumn). So the next graph shows what the IMF thought Real GDP growth would have been for Italy at various points in time.

Spring 2010 (solid blue line) records what they thought in April 2010 and you can see that for 2011, they thought growth would be 1.16 per cent (whereas in fact – blue columns – it turned out to be -1.15 per cent. A large error.

The other lines reflect further updates Fall 2010 (dotted blue), Spring 2011 (solid green), and Fall 2011 (dotted green).

Even by October 2011, they hadn’t quite worked out how deep the recession that was occurring as Italy was bullied into imposing a harsh fiscal contraction by the European Commission and the IMF.

In the Fall 2010, the IMF claimed that real GDP growth in 2012 would be 1.54 per cent. It turned out to be a decline in growth of 2.81 per cent.

These are massive errors – a complete failure to even understand that a change of state (growth to deep recession) was happening.

And, these sorts of errors are not reflective of the usual stochastic variability in the data.

They reflect a totally inadequate economic forecasting framework spiced with the ideological intent of justifying their demands for fiscal austerity in the face of all evidence that it would create a recession.

Blanchard was the IMF’s chief economist at the time overseeing these errors. No shame at all!

The IMF was not practicing the art of economics. They were engaged in the destruction of a nation state in order to ensure what resources and income the economy generated were captured by the top-end-of-town.

And Blanchard still thinks he has something to say about the current situation in Italy

Blanchard and Zettelmeyer present a nuanced view of the usual IMF ‘fiscal contraction expansion’ narrative.

They know how stupid it would be, given the events in Italy summarised by the previous graph, to just rehearse the usual IMF line, that Blanchard used to promote when he was chief economist there.

So now he has to come up with the same conclusion (cut fiscal net spending) but using a different ruse.

They focus on “whether the proposed budget would in fact boost Italian output, as the government hopes and counts on” and conclude that:

In fact, the proposed policies are more likely to achieve the opposite.

It is not a matter of “In fact” at all.

Their conclusion has little grounding in facts!

It is drawn from the same sort of economic ‘reasoning’ that generated the sort of forecasts the IMF were making in the graph above. Fiction.

Rather contrarily, they admit that the presumptions made in 2012 that forcing Italy to impose fiscal austerity would end its recession were wrong.

They couldn’t really say anything different after what the Troika did to Greece and what actually happened in Italy during that period.

As they note:

Prodded by the European Central Bank (ECB) and its European partners, the Italian government tightened its fiscal policy by over 3 percentage points of GDP in 2012 … Output in Italy fell by almost 2 percent in 2013, even though borrowing spreads in Italy did in fact start to fall in 2012.

Notice the euphemism – ‘prodded’. Outright threatening bullying was more like what happened.

But the point is obvious.

There was not an “contractionary fiscal expansion”, which is a concept Blanchard and Zettelmeyer admit “are theoretically possible” (if you define the world to be nothing like that which we live in) and that:

… fiscal expansions generally expand output, and contractions contract it-including in high-debt countries.

But then the “theoretically possible” world is reasserted by claiming that Italy is an “exception” to the general case that they now reluctantly admit is the case.

Why is Italy an exception to the general case?

Because the “rise in interest rates on government borrowing in response to the government’s expansionary policies has been very strong”.

And what will that do?

Well according to these characters:

… the direct effects of the fiscal expansion … [will be] … more than offset, by the increase in interest rates.

And they go through a pathetic piece of arithmetic to make their point.

They now assume the expenditure multiplier is 1.5 and so a 0.8 per cent of GDP fiscal expansion will generate increased output of 1.5 times 0.8 = 1.2 per cent over 2019.

But then the sleight of hand comes into play.

They also assume that for every 100 basis points rise, output falls by 0.8 per cent – the ‘crowding out’ effect.

They use a rise in interest rates of 160 basis points and assume the ECB will not repeat its QE policies to bring them down.

And once you do that, bob’s your uncle you get an overall contraction from the fiscal stimulus.

The problem is (as I show in Part 2), the ‘crowding out’ effects are unlikely to accompany the proposed fiscal expansion, which is modest by any standards (against the problem) anyway.

Conclusion

So the ‘fiscal contraction expansion’ lie lives on and is now playing in Italy.

Same old. Mainstream macroeconomics remains in its death throes but still has hold of the reins of power, which is a common pattern as degenerative paradigms slowly die out.

In Part 2 tomorrow, I will consider how well this latest offering from Blanchard and Zettlemeyer stacks up with reality.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

I can’t believe this from Blanchard after his prior mea culpa (sort of). This is outrageous. Makes my blood boil. I love Italy and I can see how it’s suffered since joining the Euro. Blanchard seems so mild mannered and innocuous when he speaks. But his ideas have powerful consequences. Now this! Italy needs to get out. Perhaps Lega and 5 Star will have the guts?

I started to read the article and became annoyed, as I read on I became furious and at the end I’m now filled with rage.

How on earth can Olivier Blanchard and Jeromin Zettlemeyer be so detached from humanity ? What will it take to actually get rid of these people. Is it really going to boil down to mass demonstrations on the streets.

Never foget this evil masquerading as normality.

Dear Money Monopolist (at 2018/11/26 at 11:53 am)

Stay calm.

It will take a calm, concerted effort to clear away these ideas.

And remember that the likes of Peter Peterson has poured billions into these propaganda exercises.

best wishes

bill

I do not think they care they know exactly want they want to do follow the neoliberal mantra!

The whole neoliberal trend in macroeconomic policy. The essential thing underlying this, is to try to reduce the power of government and social forces that might exercise some power within the political economy-workers and others-and put the power primarily in the hands of those dominating in the markets. That’s often the financial system, the banks, but also other elites. The idea of neoliberal economists and policymakers being that you don’t want the government getting too involved in macroeconomic policy. You don’t want them promoting too much employment because that might lead to a raise in wages and, in turn, to a reduction in the profit share of the national income.

More Milton Friedman. They serve wealth and power. That’s how they got the prestigious positions they now hold. That’s how they got the affluence they now have. Truth has no meaning to them. What’s right and true is what’s good for them. They have a lifetime of self censorship. They lost the ability for critical thinking. That’s what happens when you serve. The way to wealth and power is to serve wealth and power. When you advance their interests, they reward you. They are in a conflict and they are out to win, like most businessmen, issues of truth and morality have no meaning. They will never admit error and want to garner more wealth and power. Period. Wealth and power doesn’t step down because it has been wrong. It has to be deposed.

Here in the UK I’d like to hear from our brilliant neo-Keynesians who hold sway within the Labour Party how they see Italy’s situation. I don’t think they ever pronounce on anything outside UK.

My blood boils as well!!!

Michael Lacey,

You claim “they know exactly want they want..”. So what do they want? Darned if I know. Strikes me they don’t want anything in particuar. The explanation for Blanchard’s loony ideas seems to me to be just plain simple stupidity.

It is amazing how much bad economics is needed to simply state the fact, that there is more money for private interests to be made with an absentee state. In the end, Reagan and Thatcher were way more succesful with simple statements like “Government IS the problem!” and “There is no such thing as society” than all those “pointy-heads” with all their number crunching and faulty assumptions.

“Germany just recorded a negative GDP growth quarter (-0.2 per cent) and their exports were down by 0.9 per cent and their external trade contribution was a negative 1 percentage point.”

Though I’m sure my countrymen will find a way to blame “them southerners” or “Johnny Foreigner”, one small part of me hopes the German love affair with austerity ends when the greek medicine is prescripted to them. Then again, after the exchange in a recent thread here about the core elements of fascism, I think it might as well end up fueling the resentment of the then “humilliated” middle class.

I feel like I understand that chinese curse better and better every passing day:

“May you live in interesting times”

About the Chinese curse, Hermann, I, too, deeply understand it and wish I was watching this pantomime from outer space, inured from any effects of this bullshit.

The Labour Party is macroeconomically hopeless. Any good effects they introduce may well be by accident. Almost whatever their macro position, they can’t be worse than the current lot. But that isn’t saying anything.

My vision becomes blurred when I read Blanchard and his ilk.

Dear Bill,

“Mainstream macroeconomics remains in its death throes but still has hold of the reins of power, which is a common pattern as degenerative paradigms slowly die out.”

It could be said that Mainstream macroeconomics could be in its death throes, but this (ie ‘Mainstream macroeconomics) is merely a blanket under which Capitalist efforts to minimise raw material and other costs are sought. Degenerative paradigms (I take it these are the basics of neoliberalism?) may go, but will be replaced by newer and just as unconvincing arguments.

When I see the number of USA Naval forces surrounding the Asian continent (all concerned with extracting raw materials, but superficially concerned with promulgating the ‘freedom’ of the populations) I wonder not how important are the paradigms but rather the physical presence of the USA military around the world – and how long will it ever take to return them to the green green grass of home?

And to Carol Wilcox I say that many people believe in joining the EU so they may cause the EU to change its nature – but I haven’t seen one jot of change forthcoming. When do the left wingers of the EU start to force the changes? I don’t think that the ‘Remainers’ ever consider the conditions which the people of Europe are forced to endure. They are the people who think about this nation, without thinking of the suffering which the people of the EU experience daily.

best wishes,

Dave Kelley

David Kelly; The problem with the Remainers seems to be that, because the EU made concessions about consumer protection and privacy, it’s going to turn into a progressive utopia. They place a higher value on deleting yourself off of Facebook than on the millions of jobless in the EU because of the austerity mantra.

Of course the fruit is poisoned — it’s from the Peterson tree.

Despot in Hungary, riots in Paris, Greece … Needless austerity breeds corrosive discontent throughout Europe. It is rendering the European project counter-productive.

Apparently they disagree with Nobel Prize winner William Vickrey

http://www.columbia.edu/dlc/wp/econ/vickrey.html

And Keynes’ views on the Paradox of Thrift! Taught in Economics 101