Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

The Weekend Quiz – February 13-14, 2021 – answers and discussion

Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern Monetary Theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

National accounting rules dictate that a national government surplus equals a non-government deficit (and vice-versa). If a national government successfully achieves a fiscal surplus through an austerity program then the private domestic sector must be spending more than it is earning.

The answer is False.

The point is that the non-government sector is not equivalent to the private domestic sector in the sectoral balance framework. We have to include the impact of the external sector.

This is a question about the sectoral balances – the government fiscal balance, the external balance and the private domestic balance – that have to always add to zero because they are derived as an accounting identity from the national accounts. The balances reflect the underlying economic behaviour in each sector which is interdependent – given this is a macroeconomic system we are considering.

To refresh your memory the sectoral balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

Expression (1) tells us that total income in the economy per period will be exactly equal to total spending from all sources of expenditure.

We also have to acknowledge that financial balances of the sectors are impacted by net government taxes (T) which includes all taxes and transfer and interest payments (the latter are not counted independently in the expenditure Expression (1)).

Further, as noted above the trade account is only one aspect of the financial flows between the domestic economy and the external sector. we have to include net external income flows (FNI).

Adding in the net external income flows (FNI) to Expression (2) for GDP we get the familiar gross national product or gross national income measure (GNP):

(2) GNP = C + I + G + (X – M) + FNI

To render this approach into the sectoral balances form, we subtract total taxes and transfers (T) from both sides of Expression (3) to get:

(3) GNP – T = C + I + G + (X – M) + FNI – T

Now we can collect the terms by arranging them according to the three sectoral balances:

(4) (GNP – C – T) – I = (G – T) + (X – M + FNI)

The the terms in Expression (4) are relatively easy to understand now.

The term (GNP – C – T) represents total income less the amount consumed less the amount paid to government in taxes (taking into account transfers coming the other way). In other words, it represents private domestic saving.

The left-hand side of Equation (4), (GNP – C – T) – I, thus is the overall saving of the private domestic sector, which is distinct from total household saving denoted by the term (GNP – C – T).

In other words, the left-hand side of Equation (4) is the private domestic financial balance and if it is positive then the sector is spending less than its total income and if it is negative the sector is spending more than it total income.

The term (G – T) is the government financial balance and is in deficit if government spending (G) is greater than government tax revenue minus transfers (T), and in surplus if the balance is negative.

Finally, the other right-hand side term (X – M + FNI) is the external financial balance, commonly known as the current account balance (CAB). It is in surplus if positive and deficit if negative.

In English we could say that:

The private financial balance equals the sum of the government financial balance plus the current account balance.

We can re-write Expression (6) in this way to get the sectoral balances equation:

(5) (S – I) = (G – T) + CAB

which is interpreted as meaning that government sector deficits (G – T > 0) and current account surpluses (CAB > 0) generate national income and net financial assets for the private domestic sector.

Conversely, government surpluses (G – T < 0) and current account deficits (CAB < 0) reduce national income and undermine the capacity of the private domestic sector to add financial assets.

Expression (5) can also be written as:

(6) [(S – I) – CAB] = (G – T)

where the term on the left-hand side [(S – I) – CAB] is the non-government sector financial balance and is of equal and opposite sign to the government financial balance.

This is the familiar MMT statement that a government sector deficit (surplus) is equal dollar-for-dollar to the non-government sector surplus (deficit).

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)) plus net income transfers.

All these relationships (equations) hold as a matter of accounting and not matters of opinion.

The following table shows a 8-period sequence where for the first four years the nation is running an external deficit (2 per cent of GDP) and for the last four year the external sector is in surplus (2 per cent of GDP).

| Sectoral Balance | Period 1 | Period 2 | Period 3 | Period 4 | Period 5 | Period 6 | Period 7 | Period 8 |

| (X – M) | -2 | -2 | -2 | -2 | 2 | 2 | 2 | 2 |

| (G – T) | -3 | -2 | -1 | 0 | 0 | -1 | -2 | -3 |

| (S – I) | -5 | -4 | -3 | -2 | 2 | 1 | 0 | -1 |

I have marked the cells where the government is in surplus and/or the private domestic sector is in surplus in yellow.

For the question to be true we should never see the government surplus (G – T < 0) and the private domestic surplus (S – I > 0) simultaneously occurring.

We will look for two simultaneous yellow squares for the government and private domestic sector to test that proposition.

You see that in the first four periods that never occurs which tells you that when there is an external deficit (X – M < 0) the private domestic and government sectors cannot simultaneously run surpluses, no matter how hard they might try. The income adjustments will always force one or both of the sectors into deficit.

Once we get into external surplus, we can see in Period 6 that the condition satisfied.

That is because the private and government balances (both surpluses) add up to the external surplus.

So if a national government was able to pursue an austerity program with a burgeoning external sector then the private domestic sector would be able to save overall (that is, spend less than they earn – which is not the same thing as the household sector saving from disposable income).

The injection from the external sector outstrips the drain coming from the fiscal position, which allows the private domestic sector to save overall.

Going back to the sequence, if the private domestic sector tried to push for higher saving overall (say in Period 5), national income would fall (because overall spending would fall) and the government surplus would vanish as the automatic stabilisers responded with lower tax revenue and higher welfare payments.

Period 8 shows what happens when the private domestic sector runs a deficit with an external surplus. The combination of the external surplus and the private domestic deficit adding to demand drives the automatic stabilisers to push the government fiscal position into further surplus as economic activity is high.

But this growth scenario is unsustainable because it implies an increasing level of indebtedness overall for the private domestic sector which has finite limits. Eventually, that sector will seek to stabilise its balance sheet (which means households and firms will start to save overall). That would reduce domestic income and the fiscal position would move back into deficit (or a smaller surplus) depending on the size of the external surplus.

So what is the economic understanding that underpin these different situations?

If the nation is running an external deficit it means that the contribution to aggregate demand from the external sector is negative – that is net drain of spending – dragging output down.

The external deficit also means that foreigners are increasing financial claims denominated in the local currency. Given that exports represent a real cost and imports a real benefit, the motivation for a nation running a net exports surplus (the exporting nation in this case) must be to accumulate financial claims (assets) denominated in the currency of the nation running the external deficit.

A fiscal surplus also means the government is spending less than it is “earning” and that puts a drag on aggregate demand and constrains the ability of the economy to grow.

In these circumstances, for income to be stable, the private domestic sector has to spend more than they earn.

You can see this by going back to the aggregate demand relations above. For those who like simple algebra we can manipulate the aggregate demand model to see this more clearly.

Y = GDP = C + I + G + (X – M)

which says that the total national income (Y or GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

So if the G is spending less than it is “earning” and the external sector is adding less income (X) than it is absorbing spending (M), then the other spending components must be greater than total income.

Only when the government fiscal deficit supports aggregate demand at income levels which permit the overall private domestic sector to save out of that income will the latter achieve its desired outcome. At this point, income and employment growth are maximised and private debt levels will be stable.

The following blog posts may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Question 2:

The relentless push by neo-liberals to cut real wages growth has ensured the share of national income going to profits has expanded over the last 30 years in many nations.

The answer is False.

A declining rate of real wages growth is not even a necessary condition for a falling wage share (rising profit share).

Abstracting from the share of national income going to government, we can divide national income into the proportion going to workers (the “wage share”) and the proportion going to capital (the “profits share”). For the profit share to rise, the wage share has to fall (given the proportion going to government is relatively constant over time).

The wage share in nominal GDP is expressed as the total wage bill as a percentage of nominal GDP. Economists differentiate between nominal GDP ($GDP), which is total output produced at market prices and real GDP (GDP), which is the actual physical equivalent of the nominal GDP. We will come back to that distinction soon.

To compute the wage share we need to consider total labour costs in production and the flow of production ($GDP) each period.

Employment (L) is a stock and is measured in persons (averaged over some period like a month or a quarter or a year.

The wage bill is a flow and is the product of total employment (L) and the average wage (w) prevailing at any point in time. Stocks (L) become flows if it is multiplied by a flow variable (W). So the wage bill is the total labour costs in production per period.

So the wage bill = W.L

The wage share is just the total labour costs expressed as a proportion of $GDP – (W.L)/$GDP in nominal terms, usually expressed as a percentage. We can actually break this down further.

Labour productivity (LP) is the units of real GDP per person employed per period. Using the symbols already defined this can be written as:

LP = GDP/L

So it tells us what real output (GDP) each labour unit that is added to production produces on average.

We can also define another term that is regularly used in the media – the real wage – which is the purchasing power equivalent on the nominal wage that workers get paid each period. To compute the real wage we need to consider two variables: (a) the nominal wage (W) and the aggregate price level (P).

We might consider the aggregate price level to be measured by the consumer price index (CPI) although there are huge debates about that. But in a sense, this macroeconomic price level doesn’t exist but represents some abstract measure of the general movement in all prices in the economy.

Macroeconomics is hard to learn because it involves these abstract variables that are never observed – like the price level, like “the interest rate” etc. They are just stylisations of the general tendency of all the different prices and interest rates.

Now the nominal wage (W) – that is paid by employers to workers is determined in the labour market – by the contract of employment between the worker and the employer. The price level (P) is determined in the goods market – by the interaction of total supply of output and aggregate demand for that output although there are complex models of firm price setting that use cost-plus mark-up formulas with demand just determining volume sold. We shouldn’t get into those debates here.

The inflation rate is just the continuous growth in the price level (P). A once-off adjustment in the price level is not considered by economists to constitute inflation.

So the real wage (w) tells us what volume of real goods and services the nominal wage (W) will be able to command and is obviously influenced by the level of W and the price level. For a given W, the lower is P the greater the purchasing power of the nominal wage and so the higher is the real wage (w).

We write the real wage (w) as W/P. So if W = 10 and P = 1, then the real wage (w) = 10 meaning that the current wage will buy 10 units of real output. If P rose to 2 then w = 5, meaning the real wage was now cut by one-half.

So the proposition in the question – that nominal wages grow faster than inflation – tells us that the real wage is rising.

Nominal GDP ($GDP) can be written as P.GDP, where the P values the real physical output.

Now if you put of these concepts together you get an interesting framework. To help you follow the logic here are the terms developed and be careful not to confuse $GDP (nominal) with GDP (real):

- Wage share = (W.L)/$GDP

- Nominal GDP: $GDP = P.GDP

- Labour productivity: LP = GDP/L

- Real wage: w = W/P

By substituting the expression for Nominal GDP into the wage share measure we get:

Wage share = (W.L)/P.GDP

In this area of economics, we often look for alternative way to write this expression – it maintains the equivalence (that is, obeys all the rules of algebra) but presents the expression (in this case the wage share) in a different “view”.

So we can write as an equivalent:

Wage share – (W/P).(L/GDP)

Now if you note that (L/GDP) is the inverse (reciprocal) of the labour productivity term (GDP/L). We can use another rule of algebra (reversing the invert and multiply rule) to rewrite this expression again in a more interpretable fashion.

So an equivalent but more convenient measure of the wage share is:

Wage share = (W/P)/(GDP/L) – that is, the real wage (W/P) divided by labour productivity (GDP/L).

I won’t show this but I could also express this in growth terms such that if the growth in the real wage equals labour productivity growth the wage share is constant. The algebra is simple but we have done enough of that already.

That journey might have seemed difficult to non-economists (or those not well-versed in algebra) but it produces a very easy to understand formula for the wage share.

Two other points to note. The wage share is also equivalent to the real unit labour cost (RULC) measures that Treasuries and central banks use to describe trends in costs within the economy. Please read my blog – Saturday Quiz – May 15, 2010 – answers and discussion – for more discussion on this point.

Now it becomes obvious that if the nominal wage (W) grows faster than the price level (P) then the real wage is growing. But that doesn’t automatically lead to a growing wage share. So the blanket proposition stated in the question is false.

If the real wage is growing at the same rate as labour productivity, then both terms in the wage share ratio are equal and so the wage share is constant.

If the real wage is growing but labour productivity is growing faster, then the wage share will fall.

Only if the real wage is growing faster than labour productivity , will the wage share rise.

The wage share was constant for a long time during the Post Second World period and this constancy was so marked that Kaldor (the Cambridge economist) termed it one of the great “stylised” facts. So real wages grew in line with productivity growth which was the source of increasing living standards for workers.

The productivity growth provided the “room” in the distribution system for workers to enjoy a greater command over real production and thus higher living standards without threatening inflation.

Since the mid-1980s, the neo-liberal assault on workers’ rights (trade union attacks; deregulation; privatisation; persistently high unemployment) has seen this nexus between real wages and labour productivity growth broken. So while real wages have been stagnant or growing modestly, this growth has been dwarfed by labour productivity growth.

So the question is false because you have to consider labour productivity growth in addition to real wages growth before you can make conclusions about the movements in factor shares in national income.

The following blog posts may be of further interest to you:

Question 3:

Unemployment can still rise when employment growth keeps pace with labour force growth.

The answer is True.

If you didn’t get this correct then it is likely you lack an understanding of the labour force framework which is used by all national statistical offices.

The labour force framework is the foundation for cross-country comparisons of labour market data. The framework is made operational through the International Labour Organization (ILO) and its International Conference of Labour Statisticians (ICLS). These conferences and expert meetings develop the guidelines or norms for implementing the labour force framework and generating the national labour force data.

The rules contained within the labour force framework generally have the following features:

- an activity principle, which is used to classify the population into one of the three basic categories in the labour force framework;

- a set of priority rules, which ensure that each person is classified into only one of the three basic categories in the labour force framework; and

- a short reference period to reflect the labour supply situation at a specified moment in time.

The system of priority rules are applied such that labour force activities take precedence over non-labour force activities and working or having a job (employment) takes precedence over looking for work (unemployment). Also, as with most statistical measurements of activity, employment in the informal sectors, or black-market economy, is outside the scope of activity measures.

Paid activities take precedence over unpaid activities such that for example ‘persons who were keeping house’ as used in Australia, on an unpaid basis are classified as not in the labour force while those who receive pay for this activity are in the labour force as employed.

Similarly persons who undertake unpaid voluntary work are not in the labour force, even though their activities may be similar to those undertaken by the employed. The category of ‘permanently unable to work’ as used in Australia also means a classification as not in the labour force even though there is evidence to suggest that increasing ‘disability’ rates in some countries merely reflect an attempt to disguise the unemployment problem.

The following diagram shows a partial view of the Labour Force framework used by the statisticians in this context.

The Working Age Population (WAP) is usually defined as those persons aged between 15 and 65 years of age or increasing those persons above 15 years of age (recognising that official retirement ages are now being abandoned in many countries).

As you can see from the diagram the WAP is then split into two categories: (a) the Labour Force (LF) and; (b) Not in the Labour Force – and this division is based on activity tests (being in paid employed or actively seeking and being willing to work).

The Labour Force Participation Rate is the percentage of the WAP that are active.

You can also see that the Labour Force is divided into employment and unemployment. Most nations use the standard demarcation rule that if you have worked for one or more hours a week during the survey week you are classified as being employed.

If you are not working but indicate you are actively seeking work and are willing to currently work then you are considered to be unemployed.

If you are not working and indicate either you are not actively seeking work or are not willing to work currently then you are considered to be

Not in the Labour Force.

So you get the category of hidden unemployed who are willing to work but have given up looking because there are no jobs available. The statistician counts them as being outside the labour force even though they would accept a job immediately if offered.

Now trace through the yellow boxes which are linked by the following formulas:

Labour Force = Employment + Unemployment = Labour Force Participation Rate times the Working Age Population

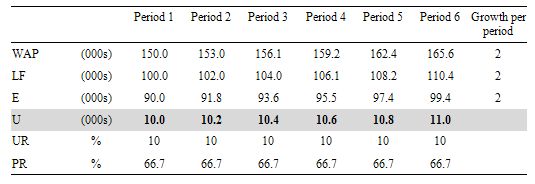

Consider the following Table which shows the Labour Force aggregates for a stylised nation and the WAP, Labour Force and Employment are all growing at a constant rate (in this case 2 per cent).

You observe unemployment rising although the unemployment rate is constant as is the participation rate.

The reason is that the Labour Force is a larger aggregate than Employment because it would be impossible for unemployment to be zero (frictions alone – people moving between jobs – will deliver some small positive unemployment).

So although both the Labour Force and Employment grow at a constant rate, the gap between them (Unemployment) gets larger each period although the proportion of the Labour Force that is unemployed remains constant.

You may wish to read the following blog posts for more information:

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

Hi Professor,

Can you comment on the impact of near-zero rates and the US stimulus on asset inflation/appreciation/speculation?

Everyone is saying how the US stock market is possibly in a bubble right now and has become detached from the real economy.

Obviously following your blog the US Labour Market is in dire-straights so expansionary fiscal policy is neccesary to put those real resources back into action. Are the speculative bubbles spill-overs from this expansionary fiscal policy I.E by institutions having ‘too much money’ chasing the economic units or do you believe its more because of behavioural reasons like the expectation of inflation from the stimulus?

When the Fed is expanding reserves in the system does this give banks and other institutions the ‘money’ to further increase asset prices?

Thank you

Question 2:

The relentless push by neo-liberals to cut real wages growth has ensured the share of national income going to profits has expanded over the last 30 years in many nations.

I refused to answer this question for good reason. Most everything you have written points to the conclusion that neo-liberalism has attempted to cause a decline in real wages of actual workers. I am not discussing the salaries of executives which may have grown. Lumping that in with the labor share of national income is well -I don’t know what that is. It is not fair to describe the multi-million dollar salaries of the CEOs of supposedly non-profit institutions like the hospitals in my city as ‘labor share’ of national income.

All your algebra fails at that point to explain things.

I was angry when I wrote the comment above. Not at Bill Mitchell or the quiz or anyone who reads this wonderful blog. Just angry because it was a difficult day at work and when I got home and had cooked myself some dinner around 9PM a man knocked on the door telling me he was very hungry and could I help him out. So I offered to cook him some eggs which was the same thing I was in the middle of eating for my own dinner. Whereupon he said he was ‘lactose intolerant’ and could I just give him cash instead. I got pretty angry at that point being fairly sure that there is no lactose in eggs for one thing. And angry with this whole situation where I live in a country that produces more food than anyone could eat and still there are hungry people here.

Well anyways, my response to question #2 was influenced more by emotion than by the answer Bill provided. The algebra used there is one way to explain things. I don’t have any better way even if I think it doesn’t capture the whole picture.