In the annals of ruses used to provoke fear in the voting public about government…

Credit rating downgrades for Australian states – next

It is Wednesday and so just a few snippets before we get funky. Yes, jazz-funky. That should do it. In the last week, a credit ratings agency downgraded the rating of the state of Victoria to AA from AAA claiming that the the state was in fiscal trouble. They also downgraded the credit rating for the NSW government credit from AAA to AA+. You might wonder how the hell these corrupt and irrelevant organisations managed to survive the GFC, given the sectors complicity with the financial frauds and overreach that drove the world to near financial ruin? Well they survive because people still believe in the fictions that lie behind the whole concept of government debt ratings. Should anyone be worried about these changes in Victoria and NSW? Not at all. The announcements were just noise and tell us, in part, how far we have to go in expunging these fictions from our understandings.

Ratings agencies downgrade Victoria and NSW

I discussed these agencies before (among other posts):

1. Ratings firm plays the sucker card … again (February 25, 2013).

2. Ratings agencies and higher interest rates (April 26, 2009).

3. A credit rating agency spinning its usual nonsense (June 1, 2017).

4. Don’t fall for the AAA rating myth (April 19, 2016).

5. The ‘fiscal space’ charade – IMF becomes Moody’s advertising agency (June 4, 2015).

6. The moronic activity of the rating agencies (October 1, 2012).

7. S&P ≠ ECB – the downgrades are largely irrelevant to the problem (January 16, 2012).

8. Moodys and Japan – rating agency declares itself irrelevant – again (August 24, 2011).

9. S&P decision is irrelevant (August 8, 2011).

10. Time to outlaw the credit rating agencies (December 23, 2009).

So quite enough material to learn why these agencies are irrelevant and prone to corruption.

But most of the discussion above relates to sovereign nations – which means nations that issue their own currency, float it on international markets, do not borrow in foreign currencies, and use their central banks to set their own interest rates.

Victoria and NSW are not sovereign entities – they are currency-users within the Australian nation.

The major difference between the two levels of government is that the debt issued by the Australian states and territories carries some credit risk whereas the national government’s debt is risk free (in credit terms).

It is possible, though highly unlikely that the Victorian or NSW government could default on its repayments. There is also no explicit federal guarantee of the state government debt.

So, in that context, does this downgrade matter?

Short answer: Not at all.

Why not?

First, it is true that the fiscal response of the Victorian government especially has been historically huge and will push the state’s net debt out to record levels.

That is a consequence of the devastating impacts the second-wave of the virus had on the state, which enforced a very drastic lockdown for 12 weeks or so.

The restrictions have now expunged the virus from the state and it has gone 40 consecutive days without virus infections and all internal borders are now open.

Second, the Reserve Bank of Australia has made it clear in several ways that it intends to hold a close to zero interest rate environment indefinitely and it has also started to purchase not only federal debt in the secondary markets but also debt issued by the state and territory governments.

What does that mean?

It means that the federal government via the RBA (its central bank) is using its currency-issuing capacity to hold down state bond yields to close to zero, and, effectively funding the state government deficit expansion (in part) as a signal to bond markets that they will encounter no credit risk issues into the future if they hold state government debt.

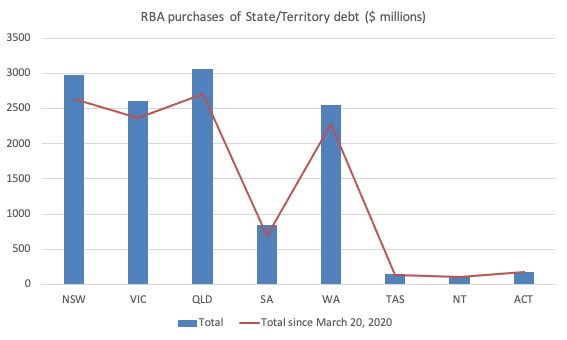

The following graph shows the RBA’s state/territory debt purchase program, which began April 2014 but intensified only after March 20, 2020, when the implications of the pandemic were becoming clearer.

The reality is the RBA is now holding a significant portion of the debt issued by the sub-federal governments since the pandemic began.

And if things became problematic, you can be sure they will purchase more.

On December 2, 2020, the RBA governor appeared before the House of Representatives Standing Committee on Economics, to update the legislature on monetary policy developments.

The – Hansard Transcript – is revealing.

The RBA governor has been urging the states to use their fiscal capacity to raise public sector wages and focus on job creation over preserving credit ratings.

He was explicitly asked this question by one of the Committee Members:

… Further to your answers before about how it may be important next year for the states to invest further, to that end does talk of Victoria losing their AAA credit rating and the fact that Queensland is borrowing so much as a state without a AAA credit rating concern you?

The RBA governor replied:

A downgrade of credit ratings doesn’t concern me. What I want to see is strong public finances in Australia. I think we have that and we’re going to continue to have that. The AAA credit rating had more political symbolism than economic importance. It was important that we have disciplined fiscal policy and a credible medium-term plan, but a downgrading of the credit ratings from AAA to one notch below that is not of economic concern. What is of more concern is that people don’t have jobs. To borrow now, to make sure that the economy is recovering strongly and that people have jobs, I think is entirely sensible …

The next Q&A was:

Mr SIMMONDS: So it’s of more concern, if they are borrowing, that they’re borrowing to fund infrastructure and create jobs as opposed to borrowing for operating expenditure?

Mr Lowe: I think it would not be prudent to just increase the level of public spending going forward just on operating expenditure which got baked in at higher levels of expenditure indefinitely. The state governments collectively are running a budget deficit of five per cent of GDP this year. The federal government is 10 or 11 and the states five. The states running a collective budget deficit of five per cent is affordable. I think it’s the right thing to do. The debt situation is manageable; total interest payments are as low as they have been in many years, because of the low level of interest rates. So it’s exactly the right thing to do, but it wouldn’t be the right thing to do to have budget deficits of five per cent of GDP forever.

So there you have it.

Any scaremongering that will undoubtedly emerge (and is) about living beyond the states’ means etc is just lies.

Ultimately as a currency-user, the states do not have the infinite spending power that the federal government possesses.

But they are also quite different to a household, another class of currency-user, because they have massive taxing capacity and access to credit at extremely (near zero) interest rates.

And they have the RBA backing them with the infinite capacity of the currency-issuer.

MMTed update

We are working on building content at the moment with the limited financial resources available to us.

The scarcity of finance is slowing the project down but we are making progress.

I will have a very exciting announcement (I think) to make in the early new year about a development in this regard that we are working on.

But we still need significant sponsors for this venture to ensure that we can run the educational program with negligible fees and to ensure it is sustainable over time.

If you are able to help on an ongoing basis that would be great. But we will also appreciate of once-off and small donations as your circumstances permit.

You can contribute in one of two ways:

1. Via PayPal

The PayPal donation button is available via the MMTed Home Page or via the – Donation button – on the right-hand menu of this page (below the calendar).

2. Direct to MMTed’s Bank Account – which is our preferred vehicle for receiving donations.

Please write to me to request account details.

Please help if you can.

Music – The Jazz Crusaders

This is what I have been listening to while working this morning.

The – Jazz Crusaders – who shortened their name to The Crusaders, were one of the foundation – Jazz Funk bands of the 1960s and into the 1970s.

They formed in 1960 when a number of musicians from Texas (of all places) starting playing jazz together.

Their evolution is interesting having fused R&B with with hard bop (influenced by Art Blakey and John Coltrane) and soul music. A really nice mix.

By the 1970s, they were evolving into what became known as Jazz-funk with a really defined smooth backbeat embellished with the analogue synths that were becoming popular at that time.

We started to get bands combining traditional improvisation with all sorts of soul, funk and R&B rhythmic forms.

Most people will recall their 1979 album – Street Life – (with Randy Crawford singing the title track), but their earlier work was much more enticing to me and I listen to it quite regularly.

The earlier albums I liked were:

1. Freedom Sound (1961).

2. The Jazz_Crusaders at the Lighthouse (1962).

3. The 2nd Crusade (1973).

4. Southern Comfort (1974).

5. Chain Reaction (1975).

This is the title track of their 1975 album where they get very funky indeed. The drummer – Nesbert ‘Stix’ Hooper – is one the all-time best and is one of the few original Crusaders still alive.

The feet keep tapping even though I am reading about credit rating agencies. A sort of palliative.

Pressure Drop Live

My Melbourne band hasn’t been able to play since March this year due to the tough lockdown restrictions imposed by the Victorian government.

We have now been able to reassemble and start rehearsing again together in the same studio.

The gigs are not opening up yet – given the small bars we play at are not able to stack many in with the on-going crowd density restrictions.

So, given we can play together in one room again, we are going to start back with a live streaming event on Friday, December 18, 2020 at 20:30 Melbourne time.

It will be streamed via YouTube and I will send links out next week for the stream via my blog and Twitter.

Now the whole world can come to our gigs.

And you might want to plan a party at your house and turn up the volume on YouTube and reggae/dub your night away – at least for an hour.

Stay tuned for that.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

Studio legend Larry Carlton on guitar as well.

He’s probably played on more hit songs than he can remember.

I don’t know how anyone takes credit ratings agencies seriously after “The Big Short”.

If readers have not seen this film, there’s a scene in which the ratings agencies are exposed as being complicit in the protection (AAA rating) of the major bank’s holdings of “collateralised debt obligations” prior to their disposal on an unsuspecting market, thus allowing the banks to secretly hedge before the big subprime crash of 2008.

Yet they continue on, delivering untruthful judgments on governmental borrowing capacity and solvency.

Joe Sample is a superb musician.

The opening bars of the song remind me of Stevie Wonder’s “Superstition.”