I have been thinking about the recent inflation trajectory in Japan in the light of…

Don’t fall for the AAA rating myth

We once believed the Earth was flat. Then someone sailed out to the edge and came back the other way or something like that with apologies to Pythagoras and others in 5BC. At some other point in history, alchemists were convinced that they could take base metals (for example, lead) and turn them into ‘noble’ metals (like gold). More recently, the German Nazis convinced a nation that there was a Master Race (them) which had to purify civilisation by exterminating the parasitic (non-Aryan) races. The lowest races were considered to be Lebensunwertes Leben. Millions died unnecessary and cruel deaths as a result of that piece of national deception. Sometimes these demonstrations of national ignorance are relatively benign. Other times, as history shows the outcomes are devastating. The World is, once again, in the grip of another major deception, which is generating negative consequences at the worse end of the scale. As Australia approaches May, fiscal hysteria reaches its apex each year. Add the prospect of a general election (as early as July 2016) and the lying politicians and the media frenzy that support them extend themselves beyond the normal day to day idiocy and prevarication. On the world stage, the IMF prances around, wiping the blood of millions of citizens that it has impoverished over the years with its incompetence and bloody-mindedness, lecturing nations on what they should do next. Whenever, a nation follows their advice unemployment and poverty rises and the top-end-of-town walk off with even more loot. Loot is what pirates stole. These looters, however, do not even have the panache and elan that we associate with the romance of piracy. They are just sociopaths and cheats. Welcome to a new day in neo-liberal hell!

For some background to flat earth theory and fiscal policy please read my blog – Flat Earth theory returns – budget aftermath.

In that blog I wrote that the current attacks on the use of fiscal deficits and the arguments being used to justify harsh austerity measures just when economies around the world need more fiscal support has about as much wisdom as those who believed that the Earth was flat. We are being told that we are leaving massive tax burdens for our children. We are being told that governments which issue their currency will have to default.

None of that is true.

Lets go to Japan first and the ravings of a former chief IMF economist. There was an article (April 13, 2016) in the Barron’s Magazine – The Endgame For Japan’s Pyramid Scheme?.

The journalist clearly thinks he is clever in suggesting that the Japanese government is running a Pyramid buying scheme, which if true, would cast Japanese fiscal policy into disrepute. Shonks run pyramid schemes.

Well, it is a pity that the author does not seem to know what a Pyramid selling scheme actually entails, nor does he seem to understand the basics of a fiat currency system where the national government issues liabilities in the currency that it has a monopoly over.

We are told that:

As the yen heads to 100 against the dollar, economists are fretting over Japan’s $10 trillion debt monster.

Monster = horrific, scary.

Trouble is that no-one is particularly scared – at least those who actually hold the debt. And each time the Japanese government offers more via auction there are queues to buy the bits of paper (or rather ‘accounts’ at the central bank) longer than there is debt to buy.

And recently, from February this year, these buyers are willing to pay the Japanese government for the right to buy 10-year JGBs. Who would have thought!

The journalist writes:

But what about Japan’s bond market? This, too, is an every-knows-that topic. Japan’s $10 trillion debt monster has long been the world’s most obvious, most dangerous and least understood asset bubble. How can a rigid economy with a shrinking population, negligible growth, miniscule immigration, flat wages, dismal productivity and waning competitiveness ever pay off its debt? It can’t without huge reforms, as everyone who’s ever studied economics knows.

I have a PhD in economics and I don’t know that. I know others who have doctoral awards in economics who do not know it either. So it is not “everyone” is it?

Futher, even though it has a “shrinking population, negligible growth, miniscule immigration, flat wages, dismal productivity and waning competitiveness” (and we could contest some of these descriptors but that would be straying from the point), Japan still has the magic bullet.

The Japanese government is never revenue constrained because it is the monopoly issuer of the currency

What does that mean? Everything in this context.

It means that it can never (unless it chooses to) default on liabilities that it issues in the currency it issues on an exclusive basis.

Moreover, it means that at any time it wants it can instruct the Bank of Japan to shift funds in an account called “Japanese Government Bonds” into another account called “Previous Bondholder savings account” – one keystroke at a computer would accomplish the operation.

Conceptually, that is all that ‘paying back’ maturing debt involves. A shift of funds from one liability to another, both of which are denominated in the currency that the government issues as a monopoly.

This weekend the football is on again (thank goodness!). Imagine that the mighty scoreboards at the Melbourne Cricket Ground (yes, they play football there) put up an announcement at some stage during a game ordering the game to stop immediately because the scoreboard (a very modern electronic affair) had run out of points to display?

The Barron’s article sought some authority to hide its stupidity by calling in the IMF or a ghost of the IMF, who apparently represents the “as everyone who’s ever studied economics knows.”

We read:

No one, perhaps, better than Olivier Blanchard, former chief economist at the International Monetary Fund. His tenure as the IMF’s top economist from 2008 to 2015 was an unusually active one from a debt-crisis standpoint, including the subprime loan mess that nearly toppled Wall Street … Blanchard is eying a much bigger issue: whether the “endgame” is nearing for Japanese government bond stability … “To our surprise, Japanese retirees have been willing to hold government debt at zero rates, but the marginal investor will soon not be a Japanese retiree,” Blanchard told the Telegraph. “If and when U.S. hedge funds become the marginal Japanese debt, they are going to ask for a substantial spread.”

Another mainstream economist who is “surprised” by REALITY! Like all those technocrats who seem to live in a state of continual surprise in the EU towers in Brussels – they always seem to be confronted with “unexpected” occurrences – like their forecasts being continually wrong.

Its been a very drawn out game of ‘chess’ (endgame!) hasn’t it. If you care to trace back through the media and academic articles since the early 1990s, you will find references to the ‘endgame’ being nigh.

Japan seems to always be ‘running out of money’, or about to default on its outstanding debt liabilities, or about to sink in into the Sea of Japan, the East China Sea, the Sea of Okhotsk, or perhaps the North Pacific Ocean.

Which sea it will sink into presumably depends on which side of the Japanese mainland all that debt is loaded up on. We clearly need Olivier Blanchard to offer some IMF modelling to help us determine the direction of the submergence.

Blanchard’s tenure as Chief Economist at the IMF was a disastrous period for the organisation. Remember the apology in late 2012.

In case you have forgotten the detail, please read my blog – The culpability lies elsewhere … always! – for more discussion on this point.

Remember the IMF (with Blanchard as Chief Economist) had been instrumental in the design of the Troika’s Greek bailout, which has devastated the economy and left it in an impoverished state.

The fancy IMF economic forecasting models underestimated the Greek contraction by 2.9 per cent in 2010 (based on the April 2010 predictions); by 6 per cent in 2011 (based on April 2010 predictions); and by a staggering 7.1 per cent (based on their April 2011 predictions).

The errors were systematic in direction and very large.

Why so? Apart from using a model that has no basis in reality, they also assumed (as part of the model) that the expenditure multipliers were below one.

What does that mean?

A multiplier of 0.5. say, means that for every $1 the government spends the economy will only grow by 50 cents. Where does the other 50 cents go given that $1 of spending adds that much to national income initially?

The answer is that the models assume that there is private sector crowding out and Ricardian effects (private sector withdrawing spending because they fear the higher future tax liability from higher public deficits) which lead to an offset of 50 cents in other production that would otherwise have occurred if the government didn’t spend the $1.

In late 2012, the IMF admitted that “Our results suggest that actual fiscal multipliers have been larger than forecasters assumed”.

This was revealed in a its publication – Growth Forecast Errors and Fiscal Multipliers – which appeared on January 3, 2013 and attempted to explain why the fiscal austerity measures foisted onto the advanced economies (especially Greece) by the IMF were more damaging than they had predicted.

In that paper, the IMF admits that the evidence supports the finding “that actual multipliers were substantially above 1 early in the crisis”. That is, the $1 of extra spending would multiply to be much more than $1 (crowding in) because of induced consumption spending and favourable investment response to the initial increases in output.

No IMF official went to prison or were sued for professional malpractice!

And for more on IMF incompetence:

1. The case to defund the Fund.

2. Governments that deliberately undermine their economies.

3. We are sorry.

4. And on the IMF on Japan – MF still away with the pixies.

So drawing on Blanchard as an authority is questionable to say the least.

And what of the “marginal investor” claim?

This argument is regularly wheeled out by the Japan is going to sink into one sea nearby or another crowd!

It says that sooner or later Japanese bond holders are going to get old and want to spend up big at which time they will stop saving and investing in Japanese government bonds.

Then who will provide the Japanese government with the money (yen) that it ‘needs’ to keep the islands afloat?

Well then it will be those Wall Street hedge funds and they are all powerful and will demand the Japanese government pay them more for buying those bits of paper (the “substantial spread” to quote Blanchard).

If you believe any of that, send me an E-mail and I will negotiate the sale of the Sydney Harbour Bridge with you are a good price. I can also offer London Bridge, the Eiffel Tower and the Statute of Liberty as a package deal. Good price, get in touch, they will be great investments.

The arrogance and self-opinions of ‘Wall Street’ Hedge Funds is obvious. But standing face to face with the currency might of the Japanese government with its central bank, the “great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money” and its mates are like little compliant pussy cats.

They can demand a “substantial spread” for all their worth but the Japanese government can force the yield on debt it issues down to whatever level it chooses.

Why are people buying 10-year JGBs at negative rates (that is, paying the government for the right to hold the paper)?

And if the hedge funds don’t want to buy the paper, the Bank of Japan can buy it all (just flicking a keystroke here and there to credit bank accounts (to faciliate Ministry of Finance spending decisions) and accounting for these flicks elsewhere in the ledger. There is no ‘hedge fund’ primacy possible unless the Japanese government wants to pay a “substantial spread” and it is too clever to do that – as history has shown.

Please read my blog – Who is in charge? – for more discussion on this point.

And then we get to the rating agencies … oh dear!

Let’s go back in history a little bit – it is always comforting to know that we have been here before.

In November 1998, the day after the Japanese Government announced a large-scale fiscal stimulus to its ailing economy, Moody’s Investors Service began the first of a series of downgradings of the Japanese Government’s yen-denominated bonds, by taking the Aaa rating away. The next major Moody’s downgrade occurred on September 8, 2000.

Then, in December 2001, Moody’s further downgraded the Japan Governments yen-denominated bond rating to Aa3 from Aa2. On May 31, 2002, Moody’s Investors Service cut Japan’s long-term credit rating by a further two grades to A2, or below that given to Botswana, Chile and Hungary.

In a statement at the time, Moody’s said that its decision “reflects the conclusion that the Japanese government’s current and anticipated economic policies will be insufficient to prevent continued deterioration in Japan’s domestic debt position … Japan’s general government indebtedness, however measured, will approach levels unprecedented in the postwar era in the developed world, and as such Japan will be entering ‘uncharted territory’.”

The then Japanese Finance Minister responded (with some foresight):

They’re doing it for business. Just because they do such things we won’t change our policies … The market doesn’t seem to be paying attention.

Indeed, the Government continued to have no problems finding buyers for their debt, which is all yen-denominated and sold mainly to domestic investors.

In the New York Times (July 6, 2002) the logic of the rating decision was questioned:

How … could a country that receives foreign aid from Japan have a better rating than Japan itself? Japan, with an economy almost 1,000 times the size of Botswana’s, has the world’s largest foreign reserves, $446 billion; the world’s largest domestic savings, $11.4 trillion; and about $1 trillion in overseas investments. And 95 percent of the debt is held by Japanese people …

The New York Times also missed the obvious point – Japan issues its own currency.

Former Moody’s President, John Bohn Jr. had in 1995 claimed that: “We’re in the integrity business: People pay us to be objective, to be independent and to forcefully tell it like it is.” (Reference: Ratings Trouble, Institutional Investor, October 1995: 245).

Later the agencies were forced to admit to the US Congress (at the height of the GFC) that they took money from firms in return for their AAA corporate rating. Many of the products the agencies gave top ratings to collapsed as worthless assets in the crisis. The agencies are one of the greatest cons around and can never be considered independent or important.

They regularly have these ‘grandstanding’ reviews and downgrades just to drum up more busines to improve their bottom line.

Please read my blog – Time to outlaw the credit rating agencies and Ratings agencies and higher interest rates a – for more discussion on this point.

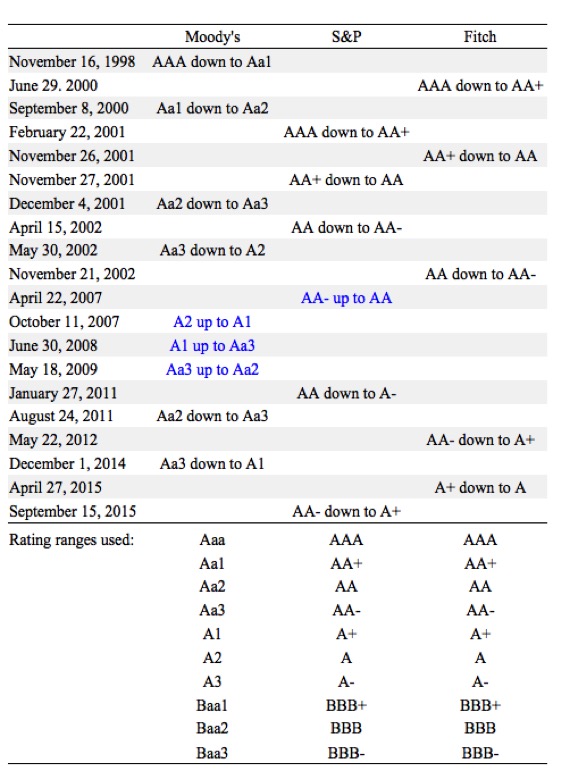

The following Table shows the decisions of the three major ratings agencies over the last 2 decades with respect to Japanese government long-term debt denominated in the homecurrency.

The bottom of the Table shows the range in which each of these organisations operate. So at present, Japan is rated around the middle of their ranges, although Fitch has them in the lower half.

What impact do you think these decisions by the rating agencies has had on the target bond yield? Answer: Zero!

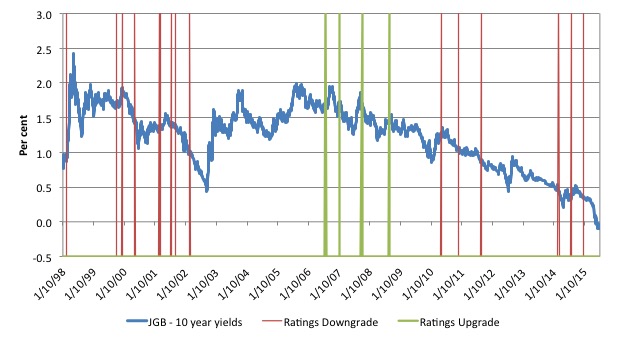

The following graph shows the history of the 10-year JGB yield from October 1, 1998 to March 31, 2016. It also captures the information from the previous table in terms of the timing of the rating agency decisions.

The 10-year JGB yield moves about a bit but has been trending down over the period shown.

On February 9, 2016, the 10-year JGB yield went negative for the first time (-0.02 per cent). It is now consistently negative and on March 31, 2016 it was at -0.049 per cent.

More often than not, the yield falls after the ratings agency decision.

But Australia is about to lose its AAA rating – run for the bunkers

Which brings me to the latest hysteria in Australia.

This week, one of the big three rating agencies came out with the claim that the Australian government has to increase taxes and cut spending if it is to balance the fiscal outcome by 2021.

The Australian economy is in decline at present as the most recent labour market data shows. The mining boom is well and truly over and non-mining investment is falling.

Households are carrying record-levels of personal debt and labour underutilisation is around 15 per cent (the combination of elevated levels of unemployment and underemployment and depressed participation rates).

So when the Treasurer (Scott ‘ScoMo’ Morrison) claims we have to impose fiscal austerity to help the economy you know one thing for sure – he hasn’t a clue about macroeconomics.

Nor do the rating agencies.

The fiscal deficit in Australia is too small by at least 1 to 1.5 per cent of GDP. Attempting to impose discretionary cuts on net public spending would amount to irresponsible vandalism of the highest order.

In the UK Guardian article (April 14, 2016) – Australia can’t balance budget with spending cuts alone, says Moody’s – we read that:

Last week, Morrison rejected the view that the budget had a revenue problem and said the 3 May budget would focus on spending cuts and not raising revenue.

The …[Moody’s] … report said without measures to raise revenue “limited spending cuts are unlikely to meaningfully advance the government’s aim of balanced finances by the fiscal year ending June 2021”.

Although Australia had a favourable budget position relative to other countries with AAA credit ratings, Moody’s noted Australia’s government debt had risen to 35.1% of GDP in 2015 from 11.6% of GDP 10 years earlier.

“We expect government debt to increase further to around 38% of GDP in 2018,” it said. Climbing government debt is “a credit negative for Australia”, raising the prospect of a credit downgrade in future.

What! Not the dreaded credit downgrade! Please refer to the graph above to see what that might do.

How do these agencies approach the rating of sovereign debt? Moody’s defines a rating is “an independent opinion on the future ability and legal obligation of an issuer of debt to make timely payments of principal and interest on a specific fixed-income security”.

The agencies continually claim that they are providing an indicator of the “probability that the issuer will default on the security over its life …”

So when considering sovereign debt as opposed to corporate debt, the agencies are suggesting that as the public debt to GDP ratio rises, the risk that the government will become insolvent rises. And their logic must be that default follows sovereign insolvency even when the sovereign debt is denominated in the government’s own currency. It doesn’t take long to realise that this logic is no logic.

Rating sovereign debt according to default risk is nonsensical. The default risk on $A-denominated sovereign debt is nil given that the $A is issued by the Australian government in unlimited quantities (if it wants).

Think back to that football ground scoreboard.

Once we understand how a sovereign government operates with respect to the monetary system this point become obvious.

First, when a particular government bond matures (that is, becomes due for repayment) the Australian Government simply credits the bank account of the holder with the principle and interest and cancel the accounting record of that debt instrument. Simple as that. The banking reserves would rise by that amount and the wealth of the private investor would change in mix from bond to bank deposit.

One account number rises and another falls by the same amount!

Second, the fiscal deficits run by the Australian government just work in the same way – adding reserves on a daily basis to the banking system (as people spend the $As and deposit them back into bank accounts etc).

The bond issues are designed to give the private sector an interest-bearing financial asset to replace the non-interest earning bank reserves.

Take the case of Japan. The way the Bank of Japan (BOJ) has kept the interest rate in Japan at virtually zero for years now is that they leave excess reserves in the banking system overnight each day to force the interbank market to compete the rate down to zero. This is a very clever way of ensuring that the longer rates (the so-called investment rates) are as low as they can be.

Third, what if the Australian government decided it didn’t want to issue any more debt but still ran the deficits? The elected government would just instruct the Reserve Bank of Australia (it might have to alter some volutary regulations) to fund its spending.

So any net public spending would still occur – day by day – and provide stimulus to the economy. But the liquidity effects would just remain in the excess banking reserves and force the non-government sector to hold the new net financial assets pouring in each day via the deficits in the form of reserves rather than interest-bearing bonds.

The other angle on this that is often overlooked is that the bond holdings of the non-government sector also constitute an income source – that is, the government interest payments on its outstanding debt constitute another avenue for stimulus. So when the Government retires debt it reduces private incomes.

So any notion that a government that is running fiscal deficits might be a credit risk is ridiculous.

The most depressing aspect of this sordid little entry into the public debate has been the response of the Shadow (Labor Party) Treasurer Chris Bowen.

Like a pavlovian dog, he chimed in immediately the Moody’s nonsense was made public and said that the Labor Party, if elected in the upcoming election, would cut both public spending and increase taxes (by making the ‘rich pay more’ – the old Labour furphy).

The Shadow Treasurer said:

Moody’s has made clear they think to protect the AAA credit rating going forward, the government should adopt a similar approach … The government has failed to offer a plan for the budget or for the economy. This year’s budget deficit has blown out by $33bn. Debt is $100bn higher than it was at the last election

Any politician who uses the credit rating agencies as an authority for anything deserves to be voted out of office or not elected in the first place.

As an aside, in the wake of The Panama Papers, the Labour Party reaffirmed that they would take no action against the use of tax havens to avoid tax.

Of course, making the ‘rich pay more’ might soothe the soul of the left-wing revolutionary, who has temporarily parked their guns and ammunition outside the cafe while they enjoy their latte and read the Saturday sporting section in the newspaper, but it is largely irrelevant from a macroeconomic perspective.

The moronic media coverage has been shocking.

The threatened loss of our AAA credit rating has led to predictions that home mortgages will become more expensive and I am expecting to read soon that Australia will be sliding into the Southern Ocean, under the weight of all that debt.

Here is the Murdoch press in Australia depicting the sinking of our nation into the sea. That is our Prime Minister at the rear and the Leader of the Opposition in front. Lucky I can swim.

Conclusion

Another very depressing week following economic matters in Australia. The problem is that all this lying and ignorance leads to elevated levels of mass unemployment and underemployment and actually ruins the lives of millions.

Prison is really too good for these fraudsters – which includes the economists who perpetuate the myths, the politicians who mouth it for their own gain (and the gain of the corporate interests they serve) and the ridiculous journalists who just are mindless mouthpieces for this sort of nonsense.

Upcoming Spanish Speaking Tour and Book Presentations – May 5-13, 2016

Here are the details of my upcoming Spanish speaking tour which will coincide with the release of the Spanish translation of my my current book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale (published in English May 2015).

You can save the flyer below to keep the details handy if you are interested. All events are open to the public who are encouraged to attend.

Modern Monetary Theory and Practice: an Introductory Text

The KINDLE edition is now out – Details

The first version of our MMT textbook – Modern Monetary Theory and Practice: an Introductory Text – was published on March 10, 2016 and is authored by myself, Randy Wray and Martin Watts.

It is available for purchase at:

1. Amazon.com (US 60 dollars)

2. Amazon.co.uk (£42.00)

3. Amazon Europe Portal (€58.85)

4. Create Space Portal (US60 dollars)

By way of explanation, this edition contains 15 Chapters and is designed as an introductory textbook for university-level macroeconomics students.

It is based on the principles of Modern Monetary Theory (MMT) and includes the following detailed chapters:

Chapter 1: Introduction

Chapter 2: How to Think and Do Macroeconomics

Chapter 3: A Brief Overview of the Economic History and the Rise of Capitalism

Chapter 4: The System of National Income and Product Accounts

Chapter 5: Sectoral Accounting and the Flow of Funds

Chapter 6: Introduction to Sovereign Currency: The Government and its Money

Chapter 7: The Real Expenditure Model

Chapter 8: Introduction to Aggregate Supply

Chapter 9: Labour Market Concepts and Measurement

Chapter 10: Money and Banking

Chapter 11: Unemployment and Inflation

Chapter 12: Full Employment Policy

Chapter 13: Introduction to Monetary and Fiscal Policy Operations

Chapter 14: Fiscal Policy in Sovereign nations

Chapter 15: Monetary Policy in Sovereign Nations

It is intended as an introductory course in macroeconomics and the narrative is accessible to students of all backgrounds. All mathematical and advanced material appears in separate Appendices.

Note: We are soon to finalise a sister edition, which will cover both the introductory and intermediate years of university-level macroeconomics (first and second years of study).

The sister edition will contain an additional 10 Chapters and include a lot more advanced material as well as the same material presented in this Introductory text.

We expect the expanded version to be available around June or July 2016.

So when considering whether you want to purchase this book you might want to consider how much knowledge you desire. The current book, released today, covers a very detailed introductory macroeconomics course based on MMT.

It will provide a very thorough grounding for anyone who desires a comprehensive introduction to the field of study.

The next expanded edition will introduce advanced topics and more detailed analysis of the topics already presented in the introductory book.

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

Brilliant. One of your best posts!

I can tell you are very angry Bill!

It really is time that sovereign nations started to flex their muscles over the ratings agencies to show who is actually in charge.

If you instituted a good old fashioned crime of high treason for calling into question the ability of the sovereign state to repay the national debt denominated in its own currency, then the nonsense would stop instantly.

Hi Bill

“It says that sooner or later Japanese bond holders are going to get old and want to spend up big at which time they will stop saving and investing in Japanese government bonds.

…

Then who will provide the Japanese government with the money (yen) that it ‘needs’ to keep the islands afloat?”

If the Japanese people decided to spend more of their savings, won’t also there be much less of a need for the Japanese government to issue bonds anyway? As the government would have a higher tax intake (and maybe reduced spending). And it might also result in higher interest rates, not to attract foreign hedge fund managers, but due to the growth and inflation from the increased spending/demand.

perhaps our politicians need to pass what we in the UK call the ‘Highway Code.’ (before you can get a driving license). The should all have to pass a test on macroeconomic literacy. If we had politicians worth their salt this would be the case-why do we have people in these jobs when they don’t have the requisite qualifications? And these ‘bums’ lord it over us!

The BOJ governor Kuroda does not seem to be ‘worried’?

“QQE with a Negative Interest Rate” is a very powerful framework enabling the Bank to pursue monetary easing by combining a negative interest rate with quantitative and qualitative easing. The Bank will continue with “QQE with a Negative Interest Rate,” aiming to achieve the price stability target of 2 percent, as long as it is necessary for maintaining that target in a stable manner. It will examine risks to economic activity and prices, and will not hesitate to take additional easing measures in terms of three dimensions – quantity, quality, and the interest rate – if it is judged necessary for achieving the price stability target. It is probably no exaggeration to say that “QQE with a Negative Interest Rate” represents the most powerful monetary easing in modern central banking history. The Bank of Japan will achieve the price stability target of 2 percent for sure by making full use of “QQE with a Negative Interest Rate.”

To Simonsky. Your idea of a test is not a good idea. It would be if Bill set the questions and marked the results. But you would have the mainstream nonsense set up by adherents from the mainstream. Fat lot of good that would do!

John – well I did mention a test in ‘macroeconomic literacy’ which implicitly precludes the mainstream crap!

This neo-liberal menace is increasingly being recognised as the scourge that it is. George Monbiot has this week written a cogent denunciation ;

http://www.commondreams.org/views/2016/04/15/neoliberalism-zombie-doctrine-root-all-our-problems

Lets hope that more and more voices sound the alarm. The politicians won’t move without first being dragged along by the electorate. I see many more who are learning some of the MMT reality set up.

Brilliant post.

Bill, I do hope you don’t end up so frustrated that you stop writing. As I trudge and wade through these seemingly confusing macroeconomic realities, I am now slowly starting to understand them. This leaves me to see how wildly off and insane the world is. My hope is that by strongly believing what you say, (not only because you hold a PhD in Economics, but because it agrees with my own reasoning and common sense), I am not the crazy one.

I know I have only scratched the surface, however, when I gain enough confidence, I will start spreading the word.

Beautiful, Bill. And beautifully sarcastic. One of your greatest posts.

@Neil,

“It really is time that sovereign nations started to flex their muscles over the ratings agencies to show who is actually in charge”

I think you are making the mistake of assuming that there is some conflict going on here between countries like the UK and Australia, or at least those who run them, and the ratings agencies. Malcolm Turnbull is a smart enough guy. He could easily enough call out the agencies and point out just what a poor record they’ve got. If he said that their opinion wasn’t worth tuppence he’d have no problem being believed on that.

But of course that’s the last thing he wants. He’s using them, and their warnings, to back up his call for cutting spending and bringing the budget “back into surplus”.

No doubt it’s the same story in the UK too. Cameron is just the same. I’d be slightly more optimistic if it were Corbyn instead, but in Australia I wouldn’t expect Shorten to be much better.

So it’s not just a question of who is in charge vis a vis Governments or the ratings agencies, its who’s in charge of Governments, and society, too.

Interestingly, some Tory politicians in the UK do get it. Here’s Jacob Rees-Mogg (for non-UK readers he is one of our more aristocratic politicians and a prominent Eurosceptic) in the House of Commons on 25 February 2013 (including the Chancellor’s silly reply):

Neil Wilson says:

“It really is time that sovereign nations started to flex their muscles over the ratings agencies to show who is actually in charge.”

Unfortunately the agencies of note are an integral component of US imperialism.

Going against the wishes of the Empire of Chaos has very real and often deadly consequences.

How to overcome that reality is the real question in need of a solution.

Actually, on reflection, I think Osborne was cleverly deflecting the electorate away from the truth: “For goodness sake, Jacob, don’t let them know we have a fiat currency. We are ‘revenue constrained’, remember? Be a good chap and stick to the script”.

A Luta Continua, that was a quick response on Osborne’s part. Either he had been briefed beforehand or he remembered his history. He got a 2.1 in history at Oxford.

@larry @ Luta Continua

Or he just made it up? I can’t find any reference to either of those quotes from Lord Chesterfield.

http://onlinebooks.library.upenn.edu/webbin/gutbook/lookup?num=3361

time for a LOL – http://www.theage.com.au/comment/the-lessons-of-peter-costellos-debtfree-day-are-worth-remembering-20160420-goauk5.html

Peter

Osborne wasn’t referring to the Letters, rather to the book Advice to his Son on Men and Manners. This is essentially about etiquette and ‘good breeding’, but there are one and half pages devoted to ‘Economy’. Chesterfield seems concerned mainly with warnings about servants and tradesmen (neither of whom should be trusted with your money) and although the exact phrase Osborne quotes is not there, the general tone concurs.

I am sickened by the fact that what passes for Parliamentary debate in this country is often showing off how much you know about the irrelevant lives and writings of eighteenth century aristocracy.

If I were to quote from ‘Advice to his Son’ I would direct Osborne to Chesterfield’s take on lying (I know, I’m playing their little games too):

The bit about foolish people and foolish business that Rees-Mogg quotes is neither in the letters nor in the the book. It’s a reference to Chesterfield’s outburst at John Anstis, the Garter King of Arms.

Larry

Yes, Osborne would certainly have had sight of Rees-Mogg’s comment beforehand. And I sincerely hope Chesterfield’s etiquette advice doesn’t count as ‘History’ at Oxford!

Great post

Dear Bill,

I link to this wherever I can and will continue to do so whenever any related issue arises. Great job. Should wake up a few misguided souls.

And regarding the exchange in the House of Commons: Of course they all know it is a fiat currency. It’s impossible for anyone except a cretin not to know. They just keep the myths alive. Or just maybe their brains have been “damaged” by listening to long to neo-liberal twaddle.

totaram

Oh, there are plenty of cretins. The worst are those who know the true nature of Sterling and don’t like it. For example, here’s one from Carswell when he was still a Conservative:

There’s lots more like that from other Conservatives. And I strongly suspect that, although they will have heard the term, 90% of Labour MPs have no idea what having a fiat currency actually means in terms of policy options.

Thanks Bill. This answers lots of my questions.

Sadly Scott (Let the children out for Christmas.) Morrison and his ilk don’t care for reality. They have constructed their own self-serving reality which they promote in spite of all evidence to the contrary.

I had thought that this was some kind of carry-over of the fears of the right from the ‘cold war’, but now I think it’s more likely due to the corrupting power of the super-rich.

Governments the world over seem determined to keep a pool of unemployed as a measure to control workers, and to force wages down. This is in their, and their corporate sponsors’, interests. They have to maintain their myths, such as governments cannot create businesses to employ their citizens, to do this.

Bill, I wonder what would happen if a government formulated it’s policies based on economic reality? Wouldn’t that be the ultimate subversion of the capitalist system? So would having politicians not amenable to corruption, threats, extortion and blackmail.