These notes will serve as part of a briefing document that I will send off…

More political interference from the central bank – oh but its independent!

At last week’s National Cabinet meeting (August 21, 2020), the governor of the Reserve Bank of Australia continued to play a political role in the economic debate despite hiding behind the veil of ‘independence’ from such matters. A few weeks ago, the federal government claimed the state and territory governments were not doing enough by way of fiscal stimulus to reduce the job losses associated with the pandemic. The Federal government is essentially trying to force the political consequences of its own failure to increase its net spending by enough and the resulting real economic damage that has resulted onto the states and territories. The RBA governor seems to be playing along with this agenda. Last Friday, he called for the states and territories to double their fiscal stimulus outlays (by $A40 billion) and stop fussing about credit ratings. The problem is that if they did that, the conservatives would immediately start claiming the debt was unsustainable and would damage the states’ credit ratings. Just as they regularly do to advance their political agendas to cut the size of state governments. While the mainstream economists urge ‘fiscal decentralisation’ they do so because they know states are not currency issuers and will then be open to attacks about tax burdens etc, which then bias the political debate towards cutting services etc. In general, the spending responsibilities should be at the level of the currency-issuer. And, the RBA governor should get back to fulfilling the legal charter of the RBA – to ensure there is full employment and price stability. His institution is achieving neither – with negative inflation and massive labour underutilisation. If he really wanted to increase job creation he could signal that the RBA would purchase any debt issued by governments at all levels who announced, and, made operational, large scale job creation programs. That would work.

Some mainstream views

The existence of vertical imbalance is common in federal systems, but is mostly more pronounced in the Australian case (Austria and Belgium are exceptions).

The mainstream treatment of vertical imbalances is to claim that without hard ‘budget’ constraints at the state level, the states will overspend and then push the political responsibility on the federal government to make necessary transfers.

The mainstream literature claims that where sub-national governments have autonomy over borrowing, they spend more, which then undermines the federal fiscal position.

So, they claim that if the state-level jurisdictions are borrowing to fund their spending (they are currency users remember) then according to the IMF (Source):

… there are also potential impacts on the cost of central government borrowing through a crowding-out effect.

That is, rehearsing the flawed claim that government borrowing pushes up interest rates and damages private interest-rate sensitive expenditure (investment etc), which is considered to be more productive than public spending.

So the standard sort of nonsense.

The mainstream literature also extols the virtues of so-called ‘fiscal decentralisation’, where the major spending responsibilities occur at the local level to ensure local officials are more accountable.

And, then, according to the IMF:

… citizens can ‘vote with their feet’ by relocating to jurisdictions that provide the type and quantity of public goods that better fit their preferences, increasing the potential benefits from fiscal decentralization …

There is also the so-called “Leviathan hypothesis”, which claims that:

… decentralization is a mechanism that can help constrain the size of the public sector and provide incentives for the efficient provision of public services …

Why? Because apparently citizens prefer lower taxes, which then constrains the capacity of the government to offer services.

While the Modern Monetary Theory (MMT) literature does not broadly discuss tax systems in any structural way, although there is work being done on this question, MMT economists reject the basis of the decentralisation movement, which mainstream economists claim improves efficiency.

From an MMT perspective, pushing more spending responsibilities to the local level but then force the local units to rely on debt to fund the spending, exposes local communities to harsh variations in spending if bond markets work against a particular regime and also will lead to a lack of uniformity across the national space, thus undermining notions of a collective people.

It is better to have governmental structures where the large spending responsibilities are aligned with the currency-issuing capacity of the government.

The fiscal decentralisation idea, exploits the concept of ‘subsidiarity’, which dominated the discussions during the Maastricht process that created the Eurozone. And reflect on that mess.

The term, subsidiarity, a long-standing concept in political theory (as far back to Aristotle).

The Oxford Dictionary defines subsidiarity as “(in politics) the principle that a central authority should have a subsidiary function, performing only those tasks which cannot be performed at a more local level”.

The concept was popularised by the Roman Catholic Church in the 1931 encyclical, Quadragesimo Anno, which pronounced that “It is a fundamental principle of social philosophy, fixed and unchangeable, that one should not withdraw from individuals and commit to the community what they can accomplish by their own enterprise and/or industry” (Pope Pius XI, 1931).

The idea is thus generally taken to mean that in a federal structure, issues should be managed at the most decentralised level that is effective.

There is often an emphasis on the advancement of the ‘common good’.

British economist John Maynard Keynes used the concept of compositional fallacy to expose the flaws in conservative mainstream economics during the Great Depression.

Keynes demonstrated that the mainstream free market economics approach was prone to these fallacies, which are logical errors that arise when something is claimed to be true in general by dint of some specific part of the whole being true.

The important point in relation to the allocation of competencies across the levels of government is that there are some functions that have to be performed at the aggregate level in a federal system if the overall system and its components are to function effectively.

The fiscal policy capacity to offset major asymmetric private spending fluctuations is one such function and is intrinsic to the ability of the overall system to achieve common good, however, broadly that is defined.

When mainstream economists invoke ‘subsidiarity’ as a means of achieving common good, they also fail to understand the imperative for a federal fiscal or treasury competency.

Lower entities in a federal system cannot achieve desirable ends if they are denied access to support from the currency issuing level of the system and further constrained in the size of deficits they can run.

Think about the way this principle has been applied in the Eurozone system – the fiscal responsibilities were pushed down to the Member State level but the lack of trust (within a common currency) across those States, led to the introduction of unworkable fiscal rules, that biased those fiscal interventions to being procyclical (that is, destructive).

That is background.

The Australian situation

Australia is a federal system, the design of which reflects the colonial suspicions that dominated before federation in 1901. There are three levels of government: federal, state and local, with the latter being creatures of the state legislatures.

There are serious vertical imbalances in the design of our federation.

This means that:

1. The States are currency-users (with limited capacity to raise revenue) but have the largest share of the spending responsibilities. The states rely on what are referred to as ‘narrow’ and ‘inefficient’ tax bases such as stamp duties on real estate transfers.

2. The Commonwealth is the currency-issuer with limited expenditure responsibilities – it also collects income taxes (personal and corporate).

I won’t go into the historical record of how states gave up income tax rights during WW2 and how Section 109 of the Constitution has been used by the federal government to override any return to State income taxing ever since.

To overcome that imbalance, there has been large financial allocations from the Federal to the State level via the Commonwealth Grants Commission. This process has historically been highly politically compromised and subject to pork barrelling, particularly as it is common for the states governments to be dominated by the opposite party that is in power federally.

The imblance has intensified since 2000, when the Australian government introduced a broad-based value-added tax (the Goods and Services Tax) and persuaded the States to abandon a number of taxes that they were constitutionally allowed to levy, but which were not efficient vehicles (for example, payroll taxes).

The deal was that the Commonwealth would compensate the States for the revenue loss through GST redistributions but the formula used provides disproportionate gains to some jurisdictions over others.

The responsibilities for service delivery are distributed accordingly (Source).

During the pandemic, the distribution of Australia’s constitutional responsibilities and powers across the levels of government, particularly Federal-State relations is now becoming a major topic of dissent.

All our State and Territory borders are closed – so we cannot move between jurisdictions (without special permits which are extremely limited).

The tensions that have arisen are not unique to Australia of course. We can see the claims of the corporate sector across most nations urging governments at all levels to abandon lockdowns.

I am on the public record supporting the lockdowns, because the evidence is that they suppress the virus infection rates and reduce the death rates. Personally, I have not been able to go to my Melbourne office for 10 weeks now which is highly inconvenient. But I still support the border closures.

I do think, however, that some flexibility has to be given to border communities, who have to traverse borders on a daily basis in the normal course of their lives – work, shops, health care, schools etc.

The campaign to open the borders is gathering pace though and was a central topic of the National Cabinet (State Premiers and Federal Ministers) meeting last Friday (August 21, 2020).

Enter the Reserve Bank of Australia …

Last Friday, the governor of the RBA addressed the National Cabinet meeting and claimed that:

1. The States and Territories should double their net spending – that is, spend an additional $40 billion on job creation.

2. This would reduce the federal deficit and debt needed to deal with the crisis.

He claimed that the reluctance of the States and Territories to spend more was driven by their determination to protect their credit ratings.

The Prime Minister has been also making the same claim.

As we have seen, the RBA governor has regularly played a political role, despite claiming that the RBA is independent of the political process.

See my most recent analysis of this – RBA governor adopts a political role to his discredit (August 18, 2020).

As an aside, I rejected a few comments on this blog post last week because they were just saying effectively – that I was wrong and should apologise because I wasn’t using mainstream analysis. More or less that point.

They did not address why the mainstream analysis failed to explain the data. They just reasserted the mainstream myths.

The point is that there are more than enough sites that propagate mainstream thinking. I don’t intend my blog site to add another space for this nonsense to be made public.

If you feel aggrieved that your mainstream narrative has been rejected by my editorial rules, then start your own blog site. You are free to do that.

And it is futile then bombarding me with ‘open letters’ accusing me of censorship.

There are no minutes published from the National Cabinet meeting but the Prime Minister issued a – Media Statement (August 21, 2020) – where he said that:

The Governor of the Reserve Bank of Australia, Philip Lowe, and the Treasury Secretary, Steven Kennedy, provided National Cabinet with an economic update. Both reiterated that the biggest economic challenge that faces Australia is jobs and unemployment.

The Governor outlined there is a need for a coordinated focus from all levels of government on three key areas:

1. Income support programs which includes the substantial investments already made in JobKeeper and JobSeeker;

2. Investments in our physical capital including infrastructure and human capital via skills and training; and

3. Greater ease of doing business through lower and efficient taxes and less regulation

He also told the media that:

The level of commonwealth investment in fiscal intervention in this crisis is well over 15 per cent of our economy … As a share of state product, the states in total (have committed) around 2.5 per cent …

Now that ranges across states and territories but the Reserve Bank governor called on the states and territories today to lift their fiscal investment over the next two years in programs of the nature I have outlined … to the tune of 2 per cent of GDP or $40 billion over the next two years …

Right now, all of the announced measures of the states and territories are currently sitting in the vicinity of just shy of $48 billion. So the governor is saying there needs to be an additional $40 billion on top of that by the states and territories over the next two years.

Then the corrupt ratings agencies bought into the fray claiming that there was ‘plenty of room’ for states to borrow more.

I will respond to those claims presently.

But we should step back to what has been happening pre-pandemic.

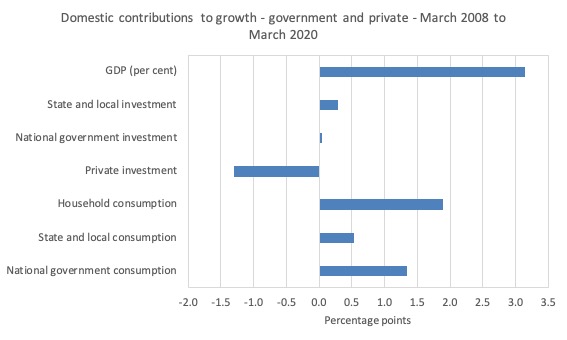

The following graph shows the contributions to GDP growth between the March-quarter 2018 and the March-quarter 2020. The component contributions are in points, while the GDP growth in in percent.

The States and local areas of government have not lagged (proportionally) in ‘consumption spending’ contributions and have outstripped the federal government in terms of capacity building (investment) by a significant factor.

The contribution of the states to growth via its infrastructure programs has been substantial – particularly the large public transport projects in Melbourne and Sydney.

In some quarters, for example, June-quarter 2017, the state infrastructure spending was the difference between negative overall national growth and positive growth – 0.74 points contribution to overall growth of 0.65 per cent. In that quarter, the federal contribution was -0.12 points.

Further, in that quarter, the States and local consumption spending contribution also outstripped a declining federal contribution.

The point is that as the federal government systematically pursued a fiscal austerity bias, in the face of negative private investment contributions and household consumption expenditure being driven by increasing (and record) levels of household indebtedness, Australia’s growth rate plummetted to below 2 per cent and nearly 1.5 points below trend.

If the states and territories, particularly Victoria and NSW, had not introduced their large-scale public works programs, Australia would have been in recession much sooner.

So it is a bit much for the Federal government, which has all the currency power, to now claim that its lack of willingness to use that capacity that has caused the resulting rise in unemployment and underemployment, should be offset by pushing the states and territories into even more debt.

Assessment

First, the data shows that the Federal fiscal stimulus which consists of “expenditure and revenue measures worth A$164 billion (8.6 percent of GDP), has been put in place through FY2023-24, and the majority of which will be executed through FY2020-21.” (Source).

So the Prime Minister’s claim that the federal response has been “well over 15 per cent of our economy” is an overstatement.

The federal government is clearly not expanding its discretionary deficit enough. I estimate it could easily expand it by $A100 billion more given the scale of unemployment and broader labour underutilisation that has arisen since March.

Second, the constitutional problems (vertical imbalance) do not preclude large-scale federal spending on infrastructure either alone or in partnership with the states and territories.

The Australian government should invest much more in our national broadband infrastructure to reverse its poor decisions not to provide fibre to the home and to force the NBN development agency to recoup costs.

It has sole constitutional authority to do that.

Trying to penny-pinch some years ago as part of their obsessive surplus pursuit has left Australia with a second-rate and expense Internet infrastructure at a time when more people are now relying on it for work purposes (home offices etc).

Further, there is a 400,000 shortage of social housing in Australia as a result of past austerity decisions from governments (federal and state).

With the construction sector contracting as a result of the pandemic, this would represent a perfect opportunity for the federal government to provide massive tied grants to the states and territories to build suitable public housing to help low-income earners.

Third, the federal government is not looking ahead at the climate problems that have not gone away. It could provide states and territories with massive tied grants to invest in renewables, particularly energy production and distribution, which since the states privatised those utilities has become increasingly unreliable and expensive.

Fourth, the university sector is now in crisis as a result of being excluded from the federal wage subsidy program. Institutions are cutting staff in the thousands and we will be left with a hollowed out research and innovation capacity as a result.

It is madness to hack into that capacity. This is a federal responsibility.

Fifth, imagine a few years down the track – the conservatives will hammer state and territory governments for having high debt ratios and forcing higher tax burdens on their citizens to maintain spending levels.

And then, they will demand spending cuts which would undermine service delivery.

There will be screams of risks to credit ratings – and the parasitic ratings agencies will be out there stirring the furore (because they make money that way).

The sensible strategy, given the scale of the pandemic, is the federal government to use its currency-issuing capacity to increase its fiscal stimulus and provide ample grant support to the states.

The principle of subsidiarity is fine but, if not moderated by an understanding of the capacity of the currency-issuer in a federation, will deliver situations where an austerity bias becomes the norm.

By denying its own fiscal capacity and pursuing its surplus obsession, the federal government has for years imparted an austerity bias down to the local level.

In part, the massive infrastructure projects that I mentioned above in Melbourne and Sydney were the result of trying to catch up from the years of public investment neglect by a succession of neoliberal state governments.

Sixth, the RBA governor would have offered more sensible advice if he said the states and territories might expand their stimulus outlays while the RBA would purchase any debt issued.

Up until now, the states and territories have announced fiscal stimulus packages worth “$32.9 billion (1.7 per cent of GDP)” (Source).

Between March 20, 2020 and now, the RBA has purchased $11.1 billion worth of state and territory public debt in the secondary markets.

The RBA could do much more if it really thought the states and territories should borrow more.

Conclusion

The RBA governor is clearly playing a political role at present.

The Federal government is trying to force the political consequences of its failure to increase its net spending by enough and the resulting real economic damage that has resulted onto the states and territories.

The RBA governor is playing along.

He should get back to fulfilling the charter of the RBA – to ensure there is full employment and price stability.

His institution is achieving neither with negative inflation and massive labour underutilisation.

If he really wanted to increase job creation he could signal that the RBA would purchase any debt issued by governments at all levels who announced and made operational large scale job creation programs.

Then we would see something sensible.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

And I believe the US is doing something similar to that with their Municipal Liquidity Facility. Is that correct?

What’s stopping the government implementing a job guarantee program? Surely they can’t use the “inflation” argument at a time like this?

“He claimed that the reluctance of the States and Territories to spend more was driven by their determination to protect their credit ratings.”

It seems to me, having attempted to communicate with these characters over the past few weeks and months, that there is a bit of a split personality amongst the Rabid Right as there is amongst the Regressive Left.

The Rabid Right control everything with debt. They are obsessed with getting everybody else into debt while avoiding it themselves. Debt is their control mechanism. Everything has to be “borrowed” and then “paid back” – even education.

And they see everything in this light. Perhaps it’s because liabilities are always on the right hand side of the balance sheet and that’s all they can see.

Whereas the assets are on the left.

When dealing with the excess savings issue that is the core of the economic problem, the left are obsessed with confiscating it and the right are obsessed with obfuscating it via some sort of borrowing.

Neither can see that the best approach is to accommodate those savings and stop worrying about them so much.

“persuaded the States to abandon a number of taxes that they were constitutionally allowed to levy, but which were not efficient vehicles (for example, payroll taxes).”

Is that inefficient in mainstream terms?

ISTM that the federal injection via a Job Guarantee and withdrawal via a federal payroll tax is the most efficient structure – since it necessarily frees up people for use elsewhere.

State level taxes are more difficult since you can only rely upon the physical infrastructure to stay in one place. It’s like fishing rights – no use if you drive the fish away.

Same thing is playing out in Scotland over the last few years.

One minute the SNP scream about being allowed to borrow then after they get bored with that they scream about being able to control taxes.

But they’ll never control taxes as they leak across borders. Tax does not stop after the payroll tax because your spending is someone else’s income which is then taxed. Spending flows into England, Wales and Northern Ireland and the SNP cannot measure that leakage because they do not have their own currency.

Nurses go on a hen night to Blackpool or the police On a weekender to Cardiff for the Rugby. Their spending which is then taxed as income will not show on the Scottish government accounts. The hotel and bars and restaurants in England and Wales will be taxed but HMRC. They have no way of knowing where the currency came from. The hotels, bars and restaurants will save some of their income so good luck trying to figure out what Scotland’s deficit actually is.

If they ever go down the borrowing route they’ll regret it big time. Borrowing in a currency they can’t issue always ends up badly as the politics means they end up even bigger serfs with less control.

To stop Scotland from handing everything over to Brussels and becoming another EU slave. Which is the SNP plan. You introduce MMT for the whole union.

All that needs to be done is London credits £10 trillion,nah let’s make it 10 quadrillion into the Scottish consolidated fund. Then says when that runs out we will credit another 10 quadrillion. Whenever you need it you can have it. Job done. To highlight the complete farce that it is and show that they are just blips that can be created at will.

If nothing changes and the charade continues. If I was a right wing voter in Scotland I would fully support the SNP plan for independence. I would get everything I ever wished for. Brussels would hand me my right wing dream on a plate.

I would get the budget surpluses I’ve always wanted. I would get my low tax rates. I would get very low government spending and all the privatisations I ever wanted. Just by voting Yes for the SNP plan. It’s a good job the right wing voters in Scotland are as thick as mince or the SNP would win by a landslide.

Every time Scotland screams to borrow and screams to control taxes.

The London Gentleman clubs must be laughing their heads off and pointing up North playing a banjo.

English councils heavily invested in commercial property as a way of ‘offsetting’ the withdrawal of needed funding from central government. The same situation applies, the councils are merely users of the State currency and not a currency creator. Office buildings, shopping centres and such have taken a huge hit, this situation started well before the pandemic. Further cuts to needed services will need to be implemented if central government doesn’t act. You could view it as localised austerity measures, but it covers all councils, so it’s not so local. Councils are achieving bankruptcy status with Section 114 notices issued and many are on the edge of such notices. The same tactic and consequence are visible globally. I would suggest that governments need to take their foot of the fuel of economies and invest currency into, as Bill says, operations that promote full employment and price stability.

Senexx wrote: “And I believe the US is doing something similar to that with their Municipal Liquidity Facility. Is that correct?”

Yes, but in a limited way which is severely constraining the potential success of the program. Got to forbes.com and search for any of Robert Hockett’s columns between April and June of this year for an explanation of the considerable implicit potential of the MLF but also a critique of its half-heartedness.

“The sensible strategy, given the scale of the pandemic, is the federal government to use its currency-issuing capacity to increase its fiscal stimulus and provide ample grant support to the states. The principle of subsidiarity is fine but, if not moderated by an understanding of the capacity of the currency-issuer in a federation, will deliver situations where an austerity bias becomes the norm.” This “sensible strategy,” which recognizes the essential distinction between currency issuers (federal government) and currency users (lower levels of government, etc.) is, not surprisingly, also being largely rejected in the U.S., which operates under a similar system of a central government/federated states. As dismal as both current national approaches may appear, I hold out more hope, in the short run, for Australia than I do for my own “exceptional”–exceptionally obtuse–country. Also, I appreciate Bill’s take on the principle of subsidiarity, which is a useful guide in social and political theory but not in the economic arena unless the fundamental currency issuer/user distinction is kept front and center. I’m reminded of the so-called “broken windows effect,” a principle which began as a good faith code enforcement strategy to preserve healthy neighborhoods by promptly addressing slowly deteriorating buildings. Unfortunately, it morphed into abusive governmental practices, such as cops ticketing petty crimes like jaywalking in an obsessive, sometimes racist campaign to nip serious crime in the bud. Related, at least tangentially, to these examples are two old folk sayings that contain more truth than most realize: (1) the exception proves the rule, and (2) rules are made to be broken. The first saying, rather than refuting the notion of a general rule, affirms it by noting that if you must search for an exception to a rule, its general applicability is demonstrated. The second saying indicates, however, that even the best and wisest rules, those which seem most universally valid and beneficial, will occasionally bump up against situations where the right thing to do is to act counter to the rule. Might MMT profit from keeping these two old folk sayings in mind, as it lays out its axioms and applies them to a wide variety of macroeconomic contexts?

“The Federal government is essentially trying to force the political consequences of its own failure to increase its net spending by enough and the resulting real economic damage that has resulted onto the states and territories.”

Yet, this is the very same structural/institutional/human framework that the MMT crowd is going to utilize in order to implement ‘change’ and radical renewal?

i.e. government and state bureaucracies. My point is self evident.

HINT:

“Turnbull’s brown coal hydrogen horror show: $500m for 3 tonnes” by Giles Parkinson, April 12, 2018

“The $1 billion cost of pork barrelling revealed” By Eryk Bagshaw and Lucas Baird,

January 20, 2018, The Sydney Morning Herald

Now, back to my ‘homework’.

“I am on the public record supporting the lockdowns, because the evidence is that they suppress the virus infection rates and reduce the death rates.”

I’m sorry Bill, I love your work but you are very much wrong on this point. The evidence overwhelmingly shows that lockdown stringency does not reduce death rates at all. Otherwise why were Belgium, the UK, Spain and Italy far worse off than Sweden (and that’s just from the EU).

A large Lancet study confirms this here – https://www.thelancet.com/journals/eclinm/article/PIIS2589-5370(20)30208-X/fulltext

Sweden? You cannot be serious. Their neighbors the Danes and Norwegians would like a word …

https://www.cnbc.com/2020/08/13/swedens-coronavirus-critics-urge-more-caution-to-avoid-a-second-wave.html

“Sweden? You cannot be serious. Their neighbors the Danes and Norwegians would like a word”

Why them and not Belgium. Why is Belgium never required to have a word with its neighbour Germany or Holland?

Why is Peru never mentioned – despite the harshest lockdown in the world?

When you disaggregate the USA into the individual states you get a similar picture.

Cherry picking aggregations is always curve fitting a belief.

“.e. government and state bureaucracies. My point is self evident.”

Really just the central bank – by paying the Job Guarantee wage directly using “QE techniques”.

The stabilisation is then automatic. No need for bank governors. No need for committees. We can sack them all.

The lockdown was, in my opinion, the correct course of action. The course of action taken, has evolved from historical inaction that didn’t help to prevent/slow pandemic contagion of the past with devastating consequence. Time was needed to gain an understanding of COVID-19 and how to approach and mitigate the effects of this newly discovered coronavirus. The Lancet: https://www.thelancet.com/journals/lancet/article/PIIS0140-6736(20)31201-0/fulltext

The Lancet: “Importantly, despite the low infection rate, the death rates in Sweden are considerably higher than those of its neighbouring countries and approximately 30 countries around the world that enforced lockdown rapidly and now are making use of testing, tracing, isolation, and masks to control the disease. The Swedish experiment has failed, but what is the cost? The death rate is much higher in countries (1) that delayed lockdown, (2) where posters calling for an approach like Sweden’s arguably led to people in these countries (eg, Brazil and the USA) attempting to follow the Swedish approach to the pandemic, and (3) that were released from lockdown early by their government. It is indeed difficult to calculate, but the increased death toll from following advice from Giesecke and the Public Health Agency of Sweden is going to be substantial around the world. The attempt to reach herd immunity, and the public promotion of herd immunity to others, has cost many lives.” https://www.thelancet.com/journals/lancet/article/PIIS0140-6736(20)31676-7/fulltext

“No need for bank governors. No need for committees. We can sack them all.”

According to your assumption [See above quote], the Job Guarantee, will be some sort of magical, spontaneous , self organizing entity, without the need for any planning departments, management, central and/or local administration, ect.

As well, further observations suggest that MMT is simply a post Keynesian/neo-liberal charade concocted/co-opted by Mosler and his friends, Rumsfeld, Laffer, ect., and a coterie of pliant academics/intellectuals seeking to maintain the current social [the current class/power structure] arrangement at any cost.

See for example, “The Economist Who Believes the Government Should Just Print More Money”

That is about as blunt as it gets, without having my comment deleted.

“the Job Guarantee, will be some sort of magical, spontaneous , self organizing entity, without the need for any planning departments, management, central and/or local administration, ect.”

It’s just buying your hours off you at a fixed price you so you can’t use them yourself. How complicated is that?

You drop onto a default payroll and money turns up on a Friday. You’re then on the volunteer list until you are called forth.

Which if you run a rabid libertarian/anarcho-communist system (either label will do. they’re the same really) you never will be.

If you don’t like the private sector operations around you, you quit your job and get paid at the living wage. The private sector operation then has to compete to get your labour back by paying a better wage or offering better terms. Or they close and a better employer turns up instead to service the demand.

Banks can go bust because you don’t need them to inject money. Interest rates are at zero so mortgages remain permanently low. Asset prices naturally increase as they are not being suppressed by the artificial market intervention that is “setting bank base rates”.

Demand is maintained spatially and temporally across the currency area. Entirely automatically. All parliament has to do is set up an employment tax and set a rate once a year – which business then pays. You can cancel income tax and corporation tax as they are unnecessary.

Everybody is better off. More flow. More wealth

Set the employment tax at a level necessary to employ the police and judges – assuming you want to bother with such trivia.

Unless you’re a complete banker, it’s nirvana.

“. . . ., it’s nirvana”

Sure it is. “The Economist Who Believes the Government Should Just Print More Money” and my comments vide supra.

“We’re always used to talking about the “stupidity” of the bourgeoisie. I wonder if the theme of bourgeois stupidity is not a theme for [artists, for intellectuals, for philosophers]: those who think that merchants are dim-witted, that financiers are obtuse, that those in power are simply blind. Sheltered by these caricatures, in fact the bourgeoisie is remarkable in intelligence. The lucidity and intelligence this class, which has captured and retained power under the conditions that we know, produces many effects of stupidity and blindness, but where? – if not exactly among intellectuals. We might be able to define intellectuals as those upon whom the intelligence of the bourgeoisie produces an effect of blindness and stupidity.”

Alan – Who says the bourgeoisie is stupid? I said the exact opposite. So did Kalecki and Quirk etc.. Trust the bourgeoisie, trust the extreme right and what they hate and fight against: Permanent full employment, the Job Guarantee. So Foucault’s quote is singularly inapt here – but it applies well to those I describe below.

By the way, I am the one here who goes out on a limb saying that the JG and thus MMT are socialist. Few go that far. The main MMTers don’t say such things, at least not very often, or loudly, though most of them have studied Marx, surely more deeply than I have or 99% of today’s Marxists have. But my position is firmly, irrefutably based in classical socialist theory. And history unequivocally shows that MMT-ish policy leads to decreasing class differences and changing power structures, not their maintenance. (I promise I’ll post something on the Skocpol/Goldstein debate you cited.) But so many modern “Marxists” and “socialists” abhor such obvious and inescapable conclusions and facts. Why?

IMHO, one should presume that a (long) 19th century socialist author is a sane person writing about the real world toward positive change, no matter how exaggerated, florid or frenzied their tone is. But for the (long) 20th century we are still in, the opposite – such people should be presumed insane until they prove otherwise, no matter how calm and sensible they seem. Most organized Marxists, the more ultra-Left or accelerationist the pose they strike, are ardent foes of Marx and socialism. Since they don’t really want to succeed at anything in the real world, the closer success comes despite all their efforts, the crazier they speak and act.

As for JG administration etc. Big deal. Of course there will be administrators and whatnot, people signing checks etc. But MMT and the JG opposes the learned helplessness so prevalent especially now in the USA. The first of the New Deal work programs, the CCC which employed millions of people, was enacted in the first hundred days and began hiring about 30 days after. Harry Hopkins ran the WPA – bigger than the US armed forces at the time – with a central organization of about 150 people. It’s not a big deal- ordinary people can do it, if they just stop telling themselves they can’t. Don’t listen to the teachers of learned helplessness, working everywhere to infantilize people and especially the left!

“Harry Hopkins ran the WPA – bigger than the US armed forces at the time – with a central organization of about 150 people.”

Your sincerity and enthusiasm is admirable; even though, you may be misguided in your assertions. For example, [NOTE: And read the following very carefully.]

1. “Disappointed by the slow pace in getting the PWA up and running, and concerned about growing political unrest among the unemployed, Roosevelt was quick to embrace Hopkins’s proposal. A week later the Civil Works Administration (CWA) was formally established by executive order, with Hopkins at its head and an initial budget allocation of $400 million diverted from the PWA.”

2. “The administrative task of establishing the CWA – which moved from nothing more than an idea to a fully operational program with four million employees in about ten weeks time – was gargantuan. It employed seven and one-half times as many people as the rest of the federal government (civilian and military) combined.”

From: “When Government Helped: Learning from the Successes and Failures of the New Deal”, eds. Sheila D. Collins and Gertrude S. Goldberg (New York: Oxford University Press, 2013

CHAPTER 5: “THE NEW DEAL’S DIRECT JOB CREATION STRATEGY: PROVIDING EMPLOYMENT ASSURANCE FOR AMERICAN WORKERS” by Philip Harvey

Available online for free.

I stand by my initial assessments in the above comments. Palpable threats to the status quo [The Warren Moslers, Donald Rumsfelds, Arthur Laffers, ect. of this world] and the real, tangible threat of rebellion/insurrection requires that, in order to maintain the status quo as it is, a conjurers trick must be devised in order to soothe a potentially fractious public. That is why the ‘New Deal’ was created and that is why MMT is currently being offered up as a panacea. Who ultimately benefits is obvious, i.e., it is fully explained in “The Economist Who Believes the Government Should Just Print More Money”.

I am truly sorry that I cannot be more charitable, but it is what it is. What is truly required is the ultimate in skepticism and that is what I have to offer. In any case, I have more reading and ‘homework’ to do.

Peace be with you, God willing.

@Neil Wilson at 18:13,

There again you said, that the central bank of nation X should jst fund the JGP of MMT.

Before, twice, you have said that other than that the Gov. of nation X should carry on as it has in the past.

I think you also said, that the interest rate on bonds should be set in stone leaving nothing for the central bank to have to think about.

IStM, that nations could/should also use deficit spending to pay for investments in the public interest. Things like 5g internet, a new bridge, or repairing the existing infrastructure, etc.

We might even include health care for the workers. Without them the economy stalls.

You also said at 1:48, that most taxes should be repealed and mostly the Gov. rely on an employment tax on corps. and businesses. IMHO, this is not a good idea. Taxing comps. (at a high enough rate) for how many workers they have will make them want to automate a lot. This will make the Gov. have to receive less tax revenue or raise the tax rate (which will make comps. automate more).

IMHO, if we believe that ACC, aka AGW, is a huge threat. And, maybe lead to human extinction, then

it follows, that AUTOMATION of production should be strongly discouraged.

IStM, that having machines make stuff is always going to use more electric energy than having people make stuff will use.

At least, in the short run. Maybe someday enough solar, etc. energy will be produced. However, as long as any fossil fuel is being burned to make electricity automation is bad for the climate.

Therefore, we should tax automation more and tax payrolls less.

“Taxing comps. (at a high enough rate) for how many workers they have will make them want to automate a lot.”

That’s sort of the point of productivity. We can always fully employ people by switching shovels for teaspoons, but that would be really stupid since it is a waste of energy.

The task of the private sector is to automate everybody out of a job – and then pretty much everybody drops onto the Job Guarantee. Which then provides the money to buy the output of the firms, less what the owners eat for themselves, and because capitalists like to save to show off how rich they are the process ends there (savings and taxation are largely the same from an MMT point of view. Savings are essentially voluntary taxation – hence Japan).

People on the Job Guarantee can be used by the public sector “for free”.

Productivity is where the efficiency come from that reduces energy use. And energy is the ultimate limiting factor. Ideally we only want to use today what the big star in the sky supplies today.

Going back to the stone age isn’t an option. At least not one that is remotely electable.

“Things like 5g internet, a new bridge, or repairing the existing infrastructure, etc.”

Using what for resources? Where are the people coming from to do it. And what are they doing now that you will have to stop them doing to free them up for that task? How do you stop it without ending up in a bidding war for resources?

There’s no free lunch here. The only thing available in the economy is the unemployed. Once you have hired those, then you’re back to tax and spend.

Hi

“Neil Wilson

Monday, August 24, 2020 at 15:17

…When dealing with the excess savings issue that is the core of the economic problem”

Do you mean the excessive wealth and consequent power accumulating to increasingly small numbers of people or something else, Neil? If something else have you got a suggestion for a search term on the blog or a suggestion for a link to further reading on it.

i watched a debate hosted by Adam Tooze on international effects of a “savings glut” postulated by some economists. Quite a lot was beyond my understanding but I did wonder if that might be what you were referring to.

Thanks to Neil and other commenters for consistently interesting additions, illustrations and challenge to Bill’s insights.

John

Neil Wilson at 18:07,

IMO, you are wrong to assert without evidence that you are back totax and spend after the MMT JGP has hired all the unemployed.

For the last 30 years, American Repuds have been borrowing and spending. Not taxing and spending. Yet, there was little inflation. The national debt went form about $1T in 1981 to over $25T now. [I have to say “about” because there are a few ways to calculate the natl’ debt.] It took the US 140 years to get to that $1T, and then just 40 more years to add another $24T. And despite all of the $24T of borrowing, the inflation rate never got over about, IIRC, 3%. At least not since 1990.

My evidence is the historical record. What evidence do you have?

I think your assumption that all possible production *was* (or will be) *being used* over those 30 years (or in future years) is just wrong. More demand causes more investment or hiring to produce more stuff. Where is the evidence that the natural resources to do this are not present on the earth? Do you have any evidence to support that assumption?

OTOH, to fight ACC we need to cut back.

.

“Do you mean the excessive wealth and consequent power accumulating to increasingly small numbers of people or something else, Neil?”

Something else. The excessive wealth and power argument is largely another confection and myth to try and push an agenda. People with good connections are powerful, and will remain powerful.

The non-government sector over all tends to accumulate net financial assets ‘savings’ because it doesn’t spend as much as it earns. Those net assets can only come from the government sector – since everything else is balanced by something else in the private sector.

“IMO, you are wrong to assert without evidence that you are back totax and spend after the MMT JGP has hired all the unemployed.”

If you watch the video that Bill put up Today (Wednesday), you’ll see Bill confirming the point.

But you’re welcome to believe whatever you want to believe.

I think Neil would be right if there were two additional assumptions – that the JG effectively ended the ‘business cycle’, and that JG jobs were always the optimal use of people’s time and efforts.

The first means that private sector savings desires will remain static at all times.

The second means that the JG would no longer be functioning as a ‘buffer stock’.

Absent those, I see a role for Keynesian fiscal policy at times even with a JG in place.

As Bill says in the video- the Job Guarantee is not meant as a panacea.

“Absent those, I see a role for Keynesian fiscal policy at times even with a JG in place.”

Which completely contradicts what Bill says in the video today. Once you are full you are full. All you can then do is move things around.

Clear as day.

“As Bill says in the video- the Job Guarantee is not meant as a panacea.”

No it isn’t. But what else did he say in the video on the grid of fiscal/real choices. Why have you decided not to mention “taxation” that Bill mentioned very clearly. Time index 30:00 for +1.30.

Once you want to pay more than the JG wage for a public sector operation, (which is essentially that you don’t want the private sector poaching that person during a boom) you have to fund that transfer in real terms somehow. Somebody has to have less, so they can have more.

Productivity improvements don’t appear at the wave of a wand.

Neil Wilson at 22:23 and other times,

OK, Neil, I watched Bill’s video of Wed.

I think you heard Bill wrong. At about the 30:00 mark, Bill says (to paraphrase), “when an *economy* is fully employed there are real constraints.” He goes on to talk about “all resources and all labor are fully employed.” He didn’t say, “When there is full employment, there are real constraints.” It is as plain as day.

So, again I think you are making an assumption that is not necessarily true.

It is that, the MMT JGP will provide enough Gov. spending to make the whole economy “fully employed”.

Now, I have made your point, but I used more careful language.

I have said that when there is full employment from a JGP *and* other deficit spending is using *all* the resources THEN there are real constraints.

I suppose that your assumption could always be true IF the GOV. MADE SURE the JGP wage was *large enough* to suck up *all* the available resources. However, you didn’t specify that level of JGP wage and I want there to be other investment spending.

And like you have said, it is also necessary to target the taxes or rationing programs (etc.) to free up just the right resources.

Therefore, I stand by my claim that it maybe necessary to have other so-called deficit spending on other programs like the Green New Deal, which is obviously a form of ‘investment’. You are denying this.

.

Neil, I am very optimistic about the JG program, but I am not so optimistic that I think it would completely end the private sector business cycle. Bill typically states that the JG would create a situation of ‘loose full employment’ at all times. Unless the JG jobs are such that they are the optimal use of workers’ time from a social standpoint, the government may want to counter-act slumps in private sector employment with additional deficit spending to stimulate demand. I don’t understand your objection to this- it really doesn’t seem like a big deal to me. What am I missing?

“I don’t understand your objection to this- it really doesn’t seem like a big deal to me. What am I missing?”

I thought it would be fairly obvious. Once everybody is fully employed in the private sector or the Job Guarantee, there is nothing left to buy.

What are you going to buy and where is it going to come from? How are you going to make the demand “effective”.

At that point you are up against the physical limits. You have a PPE problem – all the money in the world and no supply. Because any extra supply requires extra labour activity which itself has to be paid, which then has to be supplied and so on. You’re after a cascade of magic productivity from somewhere.

Less Magic Money Tree. More Magic Porridge Pot.

The reason the left failed last time was that they failed to address the supply side, which led inexorably to the “supply side economics” we’ve suffered for the last 40 years. They have the opposite problem. They forget that savings drains demand and you can’t supply people without any money.

MMT, as ever, takes the middle ground. Hence the point Bill was making in the video. Once people are fully engaged then you either move things around, or your improve productivity – which like training means you have to have less today so you may possibly be able to do more tomorrow, if the investment works.

Investment is still a transfer of effort today. There’s a limit to what you can use JG labour for on the investment side because the labour is largely going to be low quality, and the projects generally have to be “nice to haves”.

Eventually you need JCBs and their drivers, and they are already gainfully employed elsewhere.

Just like Keynes said that the economy can get stuck in a rut where there is high unemployment, I would think the economy might get stuck in a rut where there was overly high numbers on the JG. The solution in either case is for the government to increase demand by spending more or taxing less.

The opposite in the case of demand induced inflation if that was to occur- even with a JG.

I don’t understand the problem. If the economy reaches a state where all resources are being used then:

a) there is something to do that’s more important than things that are being done, or

b) there isn’t.

In case a) then free up the resources and do that thing, which is, after all, more important.

In case b) sit back, sniff the roses, ponder something, relax. “What do you always have to be *doing* something for?” — Tony Hancock, _A Quiet Sunday Afternoon at Home_

Maybe it just depends on how high the JG wage ends up being in real terms. I cant see that it would reach what is now the median wage and remain at that level in real terms after the initial inflationary burst that I assume that would cause. And even if it did, I don’t see that everyone who ends up on the JG would be happy to remain there at that level of income- many people would have financial commitments and real obligations that might exceed the income a JG wage provides. And I don’t imagine that the JG jobs will be the best possible use of all who are on them, as in the most productive use of all people’s time and efforts- not that private sector jobs usually are either. “loose” full employment with a JG is not the same as real full employment of resources and if it is then the JG is not acting as a buffer stock. But then I’m not the expert here and sometimes I lack imagination.

Imagine we had a good JG system in place with a decent wage and something far-fetched like a global pandemic occurred- can’t you imagine that the government might need to provide additional fiscal policy beyond the JG? I’m just saying I think it is a mistake to rule out that possibility.

Neil Wilson at 3:57 wrote, [quoting Jerry Brown and then replying],

[q]”I don’t understand your objection to this- it really doesn’t seem like a big deal to me. What am I missing?”

I thought it would be *fairly obvious*. Once everybody is fully employed in the private sector or the Job Guarantee, there is nothing left to buy.

What are you going to buy and where is it going to come from? How are you going to make the demand “effective”.[/q]

Neil goes beyond the statements of core MMTers. He asserts that a MMT JGP is all that is necessary and it will automatically make the economy fully employed, inc. all the real resources available to it.

When asked for evidence to support this, he replies, “I thought it would be fairly obvious.”

He miss quotes Bill. In the Wed. video Bill says, that there will be a real constraint when the economy (not labor) is being fully used. He even says “resources”. When Neil is asked about this he ignores you. This is like a typical person on the internet and also [quite tellingly] like a MS economist, who misquotes authorities and claims, “it’s obvious” as evidence. When a MS econ. says its *obvious* that the UK Gov. is like a corp. or a household, are you going to take that as proof?

Mel at 5:12

[q]I don’t understand the problem. [/q]

Mel, the problem is that Neil is making assertions without any evidence. He goes beyond our Bill and other core MMTers. He is being believed {by many here} based on the logical fallacy of argument from authority, his supposed ‘authority’.

And, if his statements are accepted by Congress then to get a Green New Deal we will have to “find the money”.

He also asserts that the super rich will still have total control over Congress if we take 99% of their wealth away from them. So, we *must* let them hoard their money & wealth, so they will let us have the “magic” of the MMT JGP, which will solve all the UK’s problems. [Yes, I’m adding my take on his words.] Note that he assumes that if we promise to let them get richer that they will NOT OPPOSE us tooth and nail. This assumption is, IMO, obviously false.

He also asserts that the only tax the UK should have is a tax on corps. and comps. for each worker they employ [in the UK?]. When asked about this [with evidence and opinions] he ignores you.

These are the problems I have with Neil Wilson’s statements.

.

Well Steve, I am pretty sure there is room for disagreement here. Especially when arguing about an as yet hypothetical program. Who could actually be an authority on what might be but has never been yet? I argue with even Bill Mitchell occasionally- even though I think he is brilliant and understands economics better than I do. We can have a disagreement with Neil and that doesn’t mean it is a situation where we just don’t get it or he just doesn’t get it- nobody knows for sure is the actual situation.

Jerry,

It may look like I’m arguing or discussing with Neil Wilson.

Actually, because Neil chooses *not* to reply to most of my points, I have found it useless to do so.

So, in fact, I’m trying to explain to the lurkers and other comment-ers why they should not believe Neil is right about what he asserts with such certainty.

OTOH, Jerry, you are right. Nobody knows *for sure* how it will play out. Neil says he does. At least he sounds like that. I hope I don’t sound as sure as he sounds.

BTW — did you go back and listen to Bill’s talk at the 30:00 to 32:00 mark to hear if I was right about what Bill actually said. You might also pause it so you can read the slides carefully.

.

Steve, I told you some time ago that no one ever tells you when are right on this blog- only hear it if they think you are wrong. Get used to it.

But I think you were on the right track there, even if I would have used different words 🙂 And if you read Bill Mitchell’s next post you can see that he does also, even though he uses different words and you have to read between the lines, so to speak.

Jerry,

It is unfortunate that there are always 2 possible reasons why a person here will not reply to you when you shoot their ideas down very well.

1] They can’t think of a comeback that makes any sense. So, you could take this as agreeing with you.

2] They don’t think that such a ridiculous reply merits a response. OR, they never read your reply.

So, you could take this as *disagreeing* with you.

“And I don’t imagine that the JG jobs will be the best possible use of all who are on them,”

It necessarily is by the way it works as it is introduced.

We have the current situation where we have a suppressed private sector and a number of unemployed people U.

You introduce a Job Guarantee at the living wage. Let’s say the “default job” is to sit at home in isolation so we don’t complicate things with added production. Those on the Job Guarantee then have money to spend they didn’t have before, which caused the subdued private sector to respond by producing more *and hiring people off the Job Guarantee*. The Job Guarantee then backs off.

That process is a dynamic feedback loop that moves to a point where the JG injection balances the net savings of the private sector. The cohort U ends up divided between those remaining on the JG and those rehired by the private sector (R). So you have

U -> JG + R

At which point you have used up the output gap, and market operations have shuffled people around so they are in their best positions. Which will include some price rises in areas where people have been underpaying labour – and that is a redistribution since wages will largely not respond in those areas. However if the private system is degraded or the JG wage is too high then you may trigger an inflation which will require either taxation to quell, or the JG workforce to be engaged producing substitute goods and services (and selling those acts like taxation).

The reason we can introduce a Job Guarantee without taxation is that there is an output gap to use up. But it will use it up.

Beyond that you have to free up real resources to use elsewhere by suppressing the appropriate part of the economy.

“I would think the economy might get stuck in a rut where there was overly high numbers on the JG.”

That doesn’t happen, or certainly doesn’t happen for long. Unemployed in Keynes were *unpaid* unemployed. They were unable to demand those goods and services which would have caused them to be hired and paid to produce them.

If the private sector sees no profit in borrowing from a bank to hire people off the JG and use them more effectively to generate more output, then why would government think they can do better? Somebody has to be hired and paid by government to make the same decisions an entrepreneur would do. And as we’ve seen from the Covid crisis, risk taking and organising the efforts of others isn’t the strong point of government planners.

Ultimately there is no need to pay anybody on the JG any more until there is an alternative bid from the private sector. The JG anchor pulls wages and prices towards it over the cycle as businesses are forced to compete for labour, quantity expand and compete for sales.

But then I have the advantage of having a pretty Job Guarantee agent based model in front of me and can watch the process unfolding – rather than having to imagine it in my head. The dynamics are tortuous to get your head around based on a description on a page.

Neil Wilson

It would be great to see the JG agent based model or is graphical output. About time you revived your great blog?

Yes, Steve, Jerry. Neil is always worth listening to but it is sometime not clear enough that what he says is NOT what the core MMT authors say. One should always think “spend and tax”. That’s how it always works fundamentally. That when there is full employment, the economy begins to approximate the neoclassical picture and “tax and spend” and other neoclassical ideas begin to make some sense – is true, so some ideas of neoclassical origin can be grafted onto MMT, lessening the heavy workload of the poor core MMT authors. But thinking about it should be done very carefully and in light of the fundamental realities.

For another instance, the tax regime he suggests recently is pretty much the opposite of the standard “hut tax” MMT recommendations augmented by personal income and estate taxes. See Michael Hudson for the negatives of tax regimes similar to Neil’s. Which only become appropriate in a white-hot WWII type, tight full employment economy, not the loose full employment JG economy we usually talk about here. Conflating the two situations – when we aren’t speaking grosso modo – leads to some of the dispute here. Everybody makes mistakes or explains themselves badly sometimes – Stephanie Kelton did imho, on roughly the same matter – in the piece Alan criticizes.

For taxing paying productive work, payroll taxes, is usually wrong in principle- economically, though sometimes politically imperative. Such work is good and should be encouraged, not discouraged with a tax. Monopolies, bads, scarce resources controlled by a few private hands etc are what should be taxed. And that’s standard MMT/Keynesian econ – which was once and will be again applied as well as human beings can.

Neil Wilson at 18:41 wrote

[q]The reason we can introduce a Job Guarantee without taxation is that there is an output gap to use up. But it will use it up.

Beyond that you have to free up real resources to use elsewhere by suppressing the appropriate part of the economy.[/q]

Why will a MMT JGP — ALWAYS — use up ALL the output gap?

Why do you assume that the real resources are ALL then being fully used. Isn’t it usually possible to mine more ore or pump more oil? Isn’t it usually possible for industry to hire some JGP workers and make more stuff?

Corps. limit their production to about the amount they can sell. The amount they can sell depends on the effective demand. The effective demand requires the buyers have the money to buy. It seems clear to me that throughout history production has been increased to supply the effective demand. This was true even after WWI in what Bill calls the “Full Employment Era”. Production kept being increased. It never stopped increasing as long as there was demand.

. . . [Note: the OPEC oil crisis is an obvious exception.]

I’m sorry, but again it seems you are making false assumptions.

Perhaps your ‘model’ (I’m assuming that you meant to say it is a complicated computer ‘model’, like a climate model) doesn’t include or allow for the above historical facts.

Like I said, I *really* WANT the Gov. to be able to use so-called deficit spending to fund a massive Green-ND. So, it is possible that this desire blinds me to the truth of your claims. OTOH, it is possible that you are blinded by something and can’t see the truth of my claims.

.

.

The JG isn’t the end all, be all of government intervention in case of crisis now, and certainly doesn’t have to be. There’s no reason (in general) the government can’t create permanent jobs to fill the void left by capital, nationalizing if need be. Especially once it stops peddling to job creators and breaks monopolies and cartels, cutting their power to throw sand in the gears.

I say “in general” because there might be things that are a waste of resources, but I expect that would involve a relatively small amount of workers, even if some would need to be reskilled.

Bad terminology, replace “government jobs” with “public sector jobs”.

Neil, it seems to me you are saying that an economy where either 3% or 20% are employed in the JG are both at potential and neither has an output gap. I am saying there is a difference between the two- the 20% JG economy is not at potential output and the 3% is close.

One way to look at it is that JG participants are playing a similar role to today’s unemployed- except they are personally much better off with the JG as an option for them. Sure they might produce some things that are nice to have produced while on the JG- but those things that they do- those things have already been determined to be ‘not very important’ or we would be paying regular government or private sector workers to do them absent the JG.

So a JG payroll that has expanded due to a recession means that an economy is not at potential output in my opinion. And while the JG would be a strong automatic economic stabilizer and would reduce the severity of recessions, it would not have prevented what we are currently experiencing in 2020, nor would it have prevented the GFC recession that started in 2008. Would have been better for sure with a JG tho.

Neil, Bill Mitchell has described the situation with a JG as being a ‘loose full employment’. Why would he make that distinction from ‘full employment’ if the economy was optimal in either state?

“But then I have the advantage of having a pretty Job Guarantee agent based model in front of me and can watch the process unfolding – rather than having to imagine it in my head.”

Damn- they always send me the less attractive models. Must be that connections thing you were talking about.

Like Martin Freedman, I am always interested in your thoughts about the JG idea. Like I said before, this is a minor disagreement about things that might possibly happen in the future if we can get a JG implemented in the first place. My support of the JG idea does not depend on whether additional Keynesian policy might be warranted some time after it was finally implemented. I doubt yours does either.

Jerry [@ others too]: “One way to look at it is that JG participants are playing a similar role to today’s unemployed- except they are personally much better off with the JG as an option for them. Sure they might produce some things that are nice to have produced while on the JG- but those things that they do- those things have already been determined to be ‘not very important’ or we would be paying regular government or private sector workers to do them absent the JG.”

That’s very wrong, as is the “nice to have” characterization of the output of the JG, which in my humble opinion, even the core MMTers wrongly underrate. These “nice to have” things include a (Green) New Deal – contributing to a planet that is not much hotter than today’s. In the New Deal, these “nice to have” things included “not having a Dustbowl” – the main tool against it being the “JG” work by the CCC. Not having a JG is a psychotic idea, and without it the priorities become psychotic – the “essential” becomes massive welfare for the rich to do insane, disgusting things – what we see today. A JG is a major, essential part of the (Green) New Deal, not something opposed to it!

Ultimately, such ideas as “potential output”, “output gap” and optimal state of the economy, full resource utilization etc are contingent on definitions, fantasies, guesses. There is no practical way to attain genuine full employment and get a real evidence for what they are – except by having a Job Guarantee.

WWII white hot economies with tight full employment are only really possible when there is something like WWII – a catastrophe. Tight full employment creates its own inflationary, bottleneck, conflict problems which can only be solved when entire societies agree on priorities far more than usual. Wishing for that is foolish.

In any case, these matters are irrelevant to today. We are in depression economics land. It’s like worrying about the precise diet to avoid getting fat when you are starving.

Some Guy @3:32,

Hey. I don’t understand everything about everything. But the JG proposal is designed to address the social and economic problems associated with unemployment in my understanding. Maybe it can be used in a way that moderates the problems associated with global climate change while dealing with unemployment at the same time- that would be terrific. In my estimation, the issues of climate change are large enough to deserve their own program with their own workers that we pay just like we pay for the military. And if JG workers can help out well that is great.

The JG is not the panacea to all that ails society. It ain’t going to solve global warming and it isn’t going to cure the corona virus or cancer or recessions or a whole lot of other things we want to have happen. It is still a great idea though that we should do.

“These “nice to have” things include a (Green) New Deal ”

Green New Deal stuff will not be done with Job Guarantee labour. With the best will in the world the disabled and the low level staff that tend to remain on the Job Guarantee are no good at putting solar panels on roofs.

Throwing training and people and expecting to turn low level people into brain surgeons is a mainstream myth. We need to deal with reality here.

Green transformation requires technology and skills – which have to be freed up from what they are currently engaged in. And banning all the dirty stuff to make room.

All of which requires political discussion about what they are currently doing and whether stuff that is dirty is actually dirty. Not trying to hide with with monetary illusions – whether from the left or the right.

“So a JG payroll that has expanded due to a recession means that an economy is not at potential output in my opinion.”

Well that depends what you ask them to do. You can ask them to do anything within their skill level and not have to pay them any more – because there is no alternative bid in the marketplace. By definition you could say.

However the issue is that the private sector rapidly regroups and bids people off the Job Guarantee. As Warren would say, the JG is there to help people transition back to a private sector job as quickly as possible.

And from my modelling that is exactly what happens. And the JG is practically empty of people most of the time.

You have no time to set up anything else, or anything long term – except for the type of people the private sector really isn’t interested in at all. And it only isn’t interested in them because they can’t deliver a surplus of output.

To do anything long term, you have to hold back the private sector permanently. Which means running tighter tax policy in general and ideally specifically to release just what is needed.

“About time you revived your great blog?”

Already revived – at the new location. I’ve put a post up today with the link to the Job Guarantee model.

“Such work is good and should be encouraged, not discouraged with a tax.”

It has to be discouraged with tax if you want to free up resources for use by the public sector.

Necessarily.

The hut tax is a “valorisation” tax. It is there to ensure that money is accepted and frees up the general fungible stuff. After that you need a “resource” tax to get the stuff you need to do public sector things.

And there is little better targeted than a payroll tax – as long as that payroll tax is paid by the employer, not the employee. The employee should be blissfully unaware of taxation completely – given it is utterly irrelevant to them and should always take home just what they earn.

Since what I am proposing is just the de facto operation of the current UK PAYE system, I’d suggest it works pretty well – when combined with an injection by the Job Guarantee.

MMT show you can abolish both income tax and corporation tax – since neither make a lot of sense in MMT terms. And that fixes a whole host of problems with the avoidance of those taxes.

Let’s fix the distribution at labour exchange time.

I haven’t found your model yet- but it can’t possibly rule out the possibility that additional deficit spending could be necessary in something like what we are dealing with today.

Large sectors of the economy suddenly experience a gigantic drop in demand for the services and products they had been providing. Millions of workers who had been working productively but now cannot due to that drop in demand. Among other things for sure. And they all go on the JG if we had it in place.

But that economy is no longer close to potential at that point even if they are employed as JG workers rather than maybe airline pilots or hotel room cleaners or whatever they were doing before as employed people who were skilled in their particular jobs.

Sure, the fact that they have some income due to the JG wage moderates the recession comparatively. But it is still a large hit to the economy in terms of income and output- and a responsible government might want to do some additional fiscal policy adjustments as in Keynesian policy to speed up the process.

Is it really asking too much to admit that circumstances might arise where additional government policy might be warranted?

Neil Wilson,

I googled this data.

US Gov. revenue 2019 = $3.46T= $3,460,000 M.

US employment 2019 = 157 M.

Then I calculated $3,460,000 / 157 = $22,000/worker/year

And if the JGP wage is $20/ hr then the average wage in the Private Sector will have to be over $25/hr.

Then $25/hr x 40 hr/week x 52 weeks/yr = $52,000/yr.

Then add $22K + $52K = $74K/yr

And cal. $22K / $52K = 38.6%.

So, a comp. or corp. pays 38.6% more than the wages they pay for your payroll tax. How can a restaurant make enough sales in a year to pay that to/for each worker?

At this point I’ll say that this is adjusted for inflation and make the 2019 dollar worth 100 cents. If thee is inflation then the 2025 dollar will be different. This is just a rough calculation

Also, you have said that your model shows that most of the workers soon are working in the Private sector.

IStM, that many comps. will move many jobs overseas to avoid that $22,000/worker tax. So, what will all those 157 M workers be doing? Will service jobs be profitable with $22K/yr added to the cost for the employer?

Middle class people who want to hire a comp. to send a housecleaner once a week, will have to pay about 2.5 times what they pay now. OTOH, they would have to pay at least 2x as much just for the new min. wage.

I truly wonder just how useful your “model” is. How can you check it against reality? Many people don’t trust climate models that predict disaster soon. Climate models are based on physics and have been checked against the history of changing temps vs CO2 levels over the last 40 years and are pretty accurate and also checked over deep time for many millions of years.

. . . Your model may not include all the critical effects. How can you predict all the critical interactions of an economy that has never existed? Why should we, your readers, trust your model?

. . . It sees like you put a lot of faith in the accuracy of your model. Has anyone else reviewed it , is it peer reviewed? If not and if it can’t be checked against economic history, then why should I put *any* BLIND faith in its results?

I’m a total amateur at this, but I have created many spreadsheets to calculate things. Things like curve fitting the cost of space warships vs their weapons and shields strengths. I create a formula and get one fixed point near the middle on that curve and look at what the formula says all the other warships should cost. It is easy to get the formula wrong. But, how would you know? I look at the extremes. That is the smallest warship and the largest, and see what I think of those costs relative to the cost of that middle size ship. That is, would I buy those ships at that cost to fight battles in the game? I have to fiddle a lot to get anywhere near right.

You are asking us to put blind faith in your model. Why should we do that?

At least tell us how many other people have looked deep into your black box and approved your model. If you don’t answer, I hope the readers assume the answer is zero. And then think about the reliability of your model.

NW:”Green New Deal stuff will not be done with Job Guarantee labour.”

Not according to most Green New Deal proposals, AOC, Green Party, Bernie Sanders etc, which make it an integral part. Most of the Green part of FDR’s quite Green New Deal was with “Job Guarantee Labor”. Commenters here like to think they are ahead of the curve. But some are clearly lagging, behind the politicians and the masses, with strange, deprecatory ideas on the JG.

Jerry suggests that a JG won’t cure the coronavirus. Maybe, but it surely can be used to fight it.