I have closely followed the progress of India's - Mahatma Gandhi National Rural Employment Guarantee…

A 10 per cent unemployment rate is not a “tremendous achievement” – it is a sign of total policy failure

It’s Wednesday, and a quiet day for writing blog posts for me. But I want to comment briefly on the latest economic news that sees the IMF claiming the Australian economy will contract by 6.7 per cent in 2020 and the Treasury estimates that the unemployment rate will rise to 10 per cent (double) by June this year. While this all sounds shocking, the emerging narrative in the media and among politicians is that this is sort of inevitable given the health crisis and the Government’s Job Keeper wage subsidy, which the Treasury claims will constrain the unemployment rate rise to 10 per cent rather than 15 per cent without it is a jolly decent thing for the politicians to have done and keeping the unemployment rate down to 10 per cent is a “tremendous achievement”. Well, apart from the wage subsidy leaving a million workers outside of any benefit and cutting wages for thousands who will receive the support, I fail to see why the unemployment rate should rise at all. The government has options: (a) wax lyrical about achieving a disaster – 10 per cent unemployment; or (b) create jobs via a Job Guarantee and see the unemployment rate fall to 2 per cent or so. For the neoliberals who run the place and their media supporters, a 10 per cent as a “remarkable achievement” and that is the TINA narrative they are pumping out to assuage the population. For the likes of yours truly, a 10 per cent unemployment rate is not a “tremendous achievement” – it is a sign of total policy failure. The government can always intervene and create sufficient jobs that will be of benefit to the society, can be designed to be safe in the current health context, and maintain the connection for most of us with paid work? Even if some of them would require the workers stay at home while being paid. For me that is a no-brainer.

There was an article in The Australian newspaper this morning (April 15, 2020) – Coronavirus: Nothing will challenge Australia’s pre-crisis values (paywall) – which was written by one of the older political commentators, Paul Kelly.

I don’t intend to comment on the principle contention that Australia’s values are too entrenched to ditch our neoliberal ways – spare the thought that we would ever “revert to a new protectionism or socialism, despite the populist drumbeat that is under way to resurrect failed nostrums the country has permanently left behind”.

I actually cannot recall any time in Australia’s history that we have pursued ‘socialism’ and I am a fairly keen student of our history and history in general.

So it is hard to say we have “permanently left … [it] … behind”.

But trifling.

The point I want to take issue with is this:

If the Treasury estimates are correct and Australia’s unemployment rise is limited to a devastating 10 per cent, a doubling of the pre-crisis rate, that would constitute a remarkable achievement, sure to be below the US peak. Treasury’s estimate of a 15 per cent rate without the $130bn package quantifies the extent to which policy has averted a deeper crisis heading to depression.

The Australian Treasury is claiming that by June, Australia will have an official unemployment rate of 10 per cent but it would have been 15 per cent had the Government not introduced its Job Keeper wage subsidy plan ($A133 billion worth).

Here is the Treasurer’s statement – Jobkeeper payment supporting millions of jobs.

As a matter of fact, if the Job Keeper payment is only accounting for 5 per cent of the Labour Force then that amounts to 685.7 thousand jobs (based on February data) rather than “millions”. Typical political spin.

However, the question that is not being asked nor answered by anyone other than the likes of me (it seems) is why the hell is the unemployment rate going to be allowed to rise to 10 per cent?

There is no reason for that to happen if the Government adopts the correct fiscal interventions.

During the early days of the GFC, I wrote this blog post – There is no financial crisis so deep that cannot be dealt with by public spending – still! (October 11, 2010), which was based on a working paper I wrote in 2009.

Despite the COVID-19 crisis being somewhat different sort of event, the same logic holds.

If you recall, a few weeks ago I did some rough modelling of my own which I presented in these blog posts:

1. “We need the state to bail out the entire nation” (March 26, 2020).

2. The government should pay the workers 100 per cent, not rely on wage subsidies (March 30, 2020).

I provided this Table, which helps us understand the relationship between GDP growth and changes in the official unemployment rate.

| Period | GDP contraction (peak to trough) % | Increase in UR to peak (points) |

| September 1981 to June 1983 | -3.71 | 4.69 |

| June 1990 to June 1991 | -1.43 | 4.71 |

From that Table, we derive a rough rule of thumb that:

For every 1 per cent that GDP contracts, the unemployment rate rises by 2.5 percentage points, which given the current labour force would add 304 thousand workers to the unemployment queue.

There are cyclical effects on participation etc that are not included in these types of estimates but they help ground us in reality.

Accordingly, the following estimates can be derived.

| Fall in GDP (per cent) | Rise in UR (points) | Estimated UR (per cent) | Unemployment (000s) | Change in Unemployment (000s) |

| 1 | 2.3 | 7.5 | 1,024 | 304 |

| 2 | 4.5 | 9.7 | 1,335 | 615 |

| 3 | 6.8 | 12.0 | 1,647 | 927 |

| 4 | 9.1 | 14.3 | 1,958 | 1,238 |

| 5 | 11.4 | 16.6 | 2,269 | 1,549 |

| 6 | 13.6 | 18.8 | 2,580 | 1,860 |

| 7 | 15.9 | 21.1 | 2,892 | 2,172 |

| 8 | 18.2 | 23.4 | 3,203 | 2,483 |

| 9 | 20.5 | 25.7 | 3,514 | 2,794 |

| 10 | 22.7 | 29.9 | 3,826 | 3,106 |

The IMF is predicting a fall in real GDP growth of 6.7 per cent this year as a consequence of the crisis.

Based on past experience, that would drive the unemployment rate up to somewhere between 18 and 21 per cent.

The wage subsidy will clearly reduce that a bit but 600-700 thousand jobs being somewhat protected, albeit with substantial wage cuts in some cases, this is not the solution.

The government can always render estimates such as these irrelevant if it chooses the right policies.

So when Paul Kelly claims that keeping the rise in the official unemployment rate down to 10 per cent “would constitute a remarkable achievement” I take exception.

It would be an expression of the total failure of government policy.

Unfortunately, this Kelly-type narrative is being spread by many commentators.

That, somewhow, we should be grateful to our government for stopping the unemployment rate going to 15 per cent and ‘achieving’ a 10 per cent ceiling.

Next week, I will outline some specific ways in which a Job Guarantee can be implemented to effect in Australia right now which would allow the unemployment rate to fall to 2 per cent, notwithstanding the crisis.

That is the option – does the Government just sit back and leave another 1.4 million workers go to the scrap heap on top of the 700 thousand in February who were unemployed?

Or does it intervene and create jobs that will be of benefit to the society, can be designed to be safe in the current health context, and maintain the connection for most of us with paid work?

For me, that is a no-brainer.

But the neoliberals who run the place and their media supporters think that a 10 per cent as a “remarkable achievement”.

And I don’t see much pushback for that from the Labor Party or The Greens. But then they adopt the neoliberal path as well.

Take another article in The Australian today, which shows why the Australian Labor Party keeps losing elections.

Written by the former Labor Party Senator, Stephen Loosely, who was also the Party’s National Secretary for a time and was embroiled in a financial mismanagement controversy at the time about the way the HQ allocated funds, the article (April 15, 2020) – All is in place for nation to reconsider the rate of GST (paywall) – claims that the Government should not “never waste a crisis” (channeling the arch neoliberal, Raul Emanuel).

What should they do?

The best service the national cabinet can deliver us is to move to raise the GST from 10 per cent to 15 per cent.

Why the hell would they want to put taxes up when the IMF is predicting a contraction of 7 per cent this year in real GDP and the Treasury is claiming the unemployment rate will rise to 10 per cent?

Well according to this genius:

We all know the coffers are empty and we are in serious national debt, worsened by the pandemic. To act decisively and provide a more robust social and economic base for further generations, the GST … needs to be lifted and the additional funds raised dedicated to programs of national resilience.

Almost all the myths in a few sentences – concise neoliberalism at its most daft.

But this view pervades the Labor party thinking here and among social democratic political forces across the globe.

Which is why this side of politics mostly loses elections, and, in many nations, are in danger of disappearing altogether.

Loosely should ask:

If the “coffers are empty” then where did the $133 billion come from for the Job Keeper allowance?

I am always on the lookout when I read some text that starts with “We all know” or similar (‘As everyone knows’ etc, ad nauseum).

Well Stephen Loosely, I am part of “We” and I don’t know any of that.

Nor does anyone who actually knows anything about these matters.

If our health services are “under-resourced” as Loosely notes, then it is because government’s have made political choices to restrict these services to the population.

As we have seen in the last week:

1. Millions of medical supplies have been ‘found’ within weeks.

2. Whole new hospital capacity has been built (from scratch – Monash Medical Centre) or gained from repurposing or reintroducing old space.

3. Thousands of new nurses have been recruited and/or retrained in ICU methods.

4. etc etc.

The politics shifted – and the cash flowed – and the resources were garnered.

Call for MMTed Support

I imagine the current crisis will put a halt on people donating to causes.

But we are making progress in developing the program that will become – MMTed.

I ran my first Masterclass in London recently and it was well attended. I received good (useful) feedback from several people which will help tune the way we run these face to face classes.

The planned further Masterclasses (May in Australia, June in Europe, September in the US) are on hold while we assess the state of the world. But I hope we will be able to offer them sometime this year.

And on-line curricula is being developed.

But we still need significant sponsors for this venture to ensure that we can run the educational program with negligible fees.

If you are able to help on an ongoing basis that would be great. But we will also be appreciate of once-off and small donations as your

You can contribute in one of three two ways:

1. Via PayPal – which is our preferred vehicle for receiving donations.

The PayPal donation button is available via the MMTed Home Page or via the – Donation button – on the right-hand menu of this page (below the calendar).

2. Direct to MMTed’s Bank Account.

Please write to me to request account details.

Please help if you can.

We cannot make the MMTed project viable on a sustainable basis without funding support.

We will always maintain strict anonymity with respect to donations received, except if the donor desires to be publicly associated with the venture and gives their permission in writing to appear on the Donors Page.

Up until now, all donors have wished to remain private.

Music – Classic R&B from the 1960s

This is what I have been listening to while working this morning.

This was one of the earliest albums I seemed to have acquired although I am not sure whether my first exposure was because my older brother had it or whether it was one of my purchases.

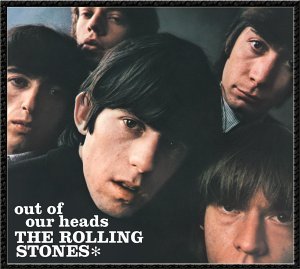

The Rolling Stones released – Out of Our Heads – on the Decca label on September 24, 1965 and it was one of those short albums that were common in those days (33:24 minutes).

In terms of covers, Australia received the US cover, while the Decca version had a different cover (and one which would show up on a later album – December’s Children – released by the band that arrived in Australia).

This was their third studio album and continued their development of British interpretations of American blues and R&B, although the original tracks were starting to enter the picture (4 out of 12 tracks).

But it was classic R&B and I learned a lot of guitar riffs off that album as I got older.

And this was their first number 100 on the US Billboard 200 rankings.

The sound was sophisticated relative to their previous albums, not in the least because Ian Stewart played piano and Jack Nitzsche played organ on this track.

This song – Cry to Me (Barry Berns) was, in fact, Solomon Burke’s second hit single (in 1962). Barry Berns, by the way, co-wrote that classic from the 1960s – Hang on Sloopy – which many a garage band from that era, I can report personally, covered. In retrospect, I am not sure why any of us did that. But the 1960s were back then!

The release of the song – Cry to Me – by Solomon Burke also marked a shift in nomenclature for the African-American artists in the US – he was termed a ‘soul’ singer and the name took hold.

It was about loneliness, which I thought might be appropriate in these days of social isolation.

The feature for me was the incredibly clean guitar riffs. Perfect.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

Hey there

Exact same commentary here in New Zealand. With the coalition government (Labour plus Greens) putting in a little bit of “house money” to subsidise wages, they are rejoicing in keeping unemployment below 15%. Without the meager intervention, the unemployment rate could balloon to 30%.

The debt to GDP ratio keeps being referred to.

No good economic commentary except a slightly obscure interview with Steve Keen. Problem is, nobody knows who this joker is? They think he is a flunky from Aussie with crazy ideas about debt jubilee.

A debt jubilee could cause a bit of social order chaos and moral hazard for shy politicians. Is it a sneaky method to insert “house money” into the economy so we can pay our debts back a bit easier?

Thinking about the UK situation some more, I’m wondering if the Job Guarantee can be implemented simply by the Bank of England running a PAYE system that has everybody of working age on it, and then is filtered by an output from HMRC of any permanent resident National Insurance number that has received a payment from another registered PAYE scheme.

Anybody left is then paid at the living wage – completely automatically – and the individual becomes part of the “volunteer army” task force that government seems so keen on and who can be directed as required from that.

Once you have this in place then there is no need for a Universal Credit system – at least for work top ups. You automatically end up on the “Universal Credit list” simply by virtue of passing the “not being paid” filter.

If we did this now – rather than the half baked schemes Rishi has come up with – the lack of income flow problem would be solved permanently from next Friday.

This even works for the self-employed – who would have to pay it back on account as part of their tax payments. Although requiring everybody to run PAYE for payments to individuals is probably a better approach.

Bill says:

“1. Millions of medical supplies have been ‘found’ within weeks.

2. Whole new hospital capacity has been built (from scratch – Monash Medical Centre) or gained from repurposing or reintroducing old space.

3. Thousands of new nurses have been recruited and/or retrained in ICU methods.

4. etc etc.”

So, as well as highlighting some of the possible JG steps that governments can take, incidentally in very short order, Bill has focused on the social opportunities that this pandemic has uncovered – they were always there, but overlooked in our neoliberal attitude to the economy.

That doesn’t mean that our ideological shortcomings will be automatically extinguished just because we simply implement a JG.

The whole concept of social care will now need to be scrutinised in terms of its place in the health service (and the economy), the scale of its organisational reach, and the resources that will have to be re-directed to achieve many of society’s health goals.

This will have far reaching impact on the distribution of GDP (and to what extent re-directed resources can generate an ideally expanding (productive) economy). These changes will also manifest themselves in certain rationalisations of existing resources, which incidentally will lead to further employment disruption.

The eventual outcome (and this applies to the whole economy) is unlikely to occur without a full measure of historic-type resource conflicts and arguments about political priority. In other words, ideological disagreements.

“Is it a sneaky method to insert “house money” into the economy so we can pay our debts back a bit easier?”

The debt jubilee idea is the classic case of trying to solve a flow problem with a stock. Which is why it doesn’t work.

The main question is “why do you want to give a lump of government money to rich people who are debt free?”

Why let effluent build up and then do a big clean up rather than preventing the effluent in the first place?

I read and listen to Newsroom Pro here in New Zealand. Today there was discussion about reducing GST from 15% to 10%, lowering the income tax rate so that the poorer members of society benefit and recalibrating the different tax rates to reflect the existing income structures. There has been a lot of talk by Government that gives me some hope that there is a lessening of the emphasis on neoliberalism. Probably, not as much emphasis on MMT as I would like BUT the people are not stupid and will question how is it the Government can issue all this money in a time of calamity but let people live in poverty during times of plenty. I do live in hope.

Bill wrote: “… Or does it intervene and create jobs that will be of benefit to the society, can be designed to be safe in the current health context, and maintain the connection for most of us with paid work?”

Just what these (or any) jobs look like In the new world where it is unclear when it will be safe to be near each other is a mystery to me and I look forward to concrete examples that can be implemented on a mass scale. I’m not against a JG, but I struggle to find a way of hiring people into jobs that can’t be done, even if they are needed. Even a modification — paying people for what might be considered social good volunteering (i.e. doing useful things that cannot generate a profit so are considered unfeasible by the private sector) – Is difficult to imagine when social distancing must be maintained. And configuring such jobs for lower skilled individuals is even more of a challenge.

Assistance in imagining this for millions is greatly appreciated.

The longer this goes on the more outrageous the claims about the debt burden being created.

The people reporting on this situation have a responsibility to understand the various macroeconomic theories that might be applied, including MMT, in order to do their jobs properly.

If they fail to do that they share the responsibility for the misery that will flow from 10% unemployment.

Government will not do what is necessary while the lies about deficit spending, and the need for bond sales to fund this spending are allowed to persist in the media.

Job guarantee wages would provide more net financial assets than demanded. That should create a one time inflation, right?

@ Neil Wilson:

Apart from the quantative level being higher, i.e. by being paid at Living Wage levels (currently circa £15K p.a.), how is your scheme qualitatively any different from recent proposals for a UBI, with the Personal Tax allowance abolished so that those who have other earnings don’t then benefit from it?

Sounds pretty much like the same idea, just a bit more generous!

“Although requiring everybody to run PAYE for payments to individuals is probably a better approach.”

So if you have a plumber come and do a £60 job in your house, are you suggesting you would have to set up all the PAYE payment infrastructure in order to have a tap fixed as a one-off transaction? Would that include employers’ NI and pension contribution? Sick pay and holiday pay? As a PAYE employee, how does the plumber then account for materials and other expenses? How do you differentiate between those expenses and his earnings when submitting the tax due to HMRC?

TBH, this sounds like a bit of a nightmare, unless you can clarify in practical terms exactly how you see this sort of idea functioning in reality.

There’s got to be a tax dodge donating money to the NHS.

Especially this time of year when they are sitting down with their tax consultants working out how they are going to use their allowances.

Or are famous people really that dumb ??

The word neoliberalism (used 9 times on this page) is so loaded with ideology these days that I’m not surprised when the mainstream population and political representatives tune out the moment they hear someone use it in an attempted discussion. And I wouldn’t blame them.

Could it be that an introduction of a new, factual, descriptive, precise, politically not loaded (esp. initially) -ism term for the incorrect understanding of modern money could do a lot of good in naming and unmasking the flawed assumptions?

Something along these lines :

Histomoneyist

Histomonetist

Obsolmonetist

Currencyobsoletist (rhymes with absolutist and elitist : )

Obsolete currencypeggist view

Historical staticmonetist belief

Moneyacontrolist

Obsolmonetarism

Strictomonetist

Fiscal balancesheetism

Prefreemonetarist

Legacymonetarist

Monetary premodernism

Flawed householdanalogism

…

“how is your scheme qualitatively any different from recent proposals for a UBI”

The Job Guarantee backs off when people get other work. UBI never does.

“So if you have a plumber come and do a £60 job in your house”

You wouldn’t be “in business on your own account” for that “excluded middle” argument would you. But once you cross the threshold to be a business you should have to incorporate and run PAYE for yourself – just as you have to fill in all the forms to register for self assessment and class 2 NI anyway. I run PAYE, and you just leave your accountant to do it if you can’t do it yourself. It’s all done automatically by the computer anyway these days. But it forces the business and you into two compartments – which then makes it easy to include the self-employed in a Job Guarantee.

Or we can just exclude everybody registered for Class 2 NI if you prefer – and let them starve when there isn’t enough work.

“Or are famous people really that dumb ??”

It’ll be free of tax under Gift Aid if they are well advised

But does it matter? It’s all voluntary taxation anyway. It’s not as if the NHS is actually short of money. What it is short of is stuff.

For example:

Historically relevant but now obsolete currencyconstraintarian views do lead to fiscal zerosumist policies which are economically damaging, as seen for example in the state of affairs in the southern members of the EU.

In comparison, the government of Japan has long been practicing policy of comparatively high debt-issuance, resulting in high public wealth – including transport infrastructure that western former superpowers can only envy. Since Japan factor the country’s available real production in designing their deficit spending they can predictably achieve a contra-intuitively low inflation,

While Modern Monetary Theory economists would probably describe Japan’s approach as hybrid due to a continued notional split between the operations of the Treasury and the central bank (BoJ), this traditionalism has no negative impact on the policy’s effect, and the independent accounting through the BoJ’s balance sheet provides a much needed transparency in this political financial “magic”.

Within just a few weeks, we have been humbled and cowed by an invisible adversary, which continues its relentless spread amongst us with deadly, ruthless efficiency. We are all at risk – young and old – but it is our children and grandchildren that face the bleakest of futures unless we can halt its painful progress soon. But it is clear that will only be achieved by isolating ourselves until the present outbreak has run its course. That creates many challenges, but is by no means impossible, providing we take decisive, simple steps now. We have no time left for prevarication or indecision. We are at immediate risk of social and economic collapse and that will amplify the impact of the virus catastrophically.

We can be in no doubt, our way of life, as we knew it, has been destroyed completely and can never be resurrected to what our ‘leaders’ call “normal”. Nor should we even try. Our “normal” is what has brought us to this nightmare. It is not possible to treat this fragile planet with impunity and destroy the delicate environment without serious consequences. We all know this. Humanity has become the greatest threat to life – not just to itself – but also for many creatures that we share this place with. Our selfishness and greed were never sustainable.

As a consequence, many of us and our loved ones will perish in the weeks and months ahead. How well we survive this ordeal depends on what action is taken within the next few weeks – in every nation, not just Britain.

The first responsibility of any government is to protect its citizens. Therefore:

Within a week, everyone should become an employee or student of the State, receiving a monthly salary and golden handshake into a new bank account referenced to their NI number. This will provide every citizen and their children with a regular income – with key workers receiving an additional stipend. This should be further supported by:

• No debt repayments of any kind – mortgages, rents, loans, taxes including VAT, will cease immediately.

• No payments for utilities, communications, prescriptions.

• A weekly free-of-charge package of groceries and household items.

• Emergency grants and funding for all community activities assisting the response and for restoration and support of essential business and services.

This would represent a critical investment for a workforce we will desperately need if we are to survive intact and in sufficient numbers to bring with us the expertise, skills and knowledge that will be essential in the years and decades ahead.

To achieve this, the State must take control of all utilities, telecommunications, mobile and Internet providers, insurance and other essential business such as food production and distribution, supermarkets and pharmacies. The commercial banks can be nationalised and serve as a conduit for funding from government, whilst all off-shore banking activities and financial markets under UK control, will be suspended immediately.

Without this investment and reforms, our children will never know or benefit from anything we have learned and achieved in our lifetimes. Instead they will face the bleakest and most savage future imaginable.

In seeking to ‘protect the economy’ politicians in government are only trying to save themselves – their own wealth and position in society. This selfish stupidity has already cost lives and will continue to do so until the reality of the situation becomes clear to them – or they are absolved from responsibility. Providing loans and credit to business is futile. It is individuals not institutions, first and foremost, that must be supported throughout this plague. We have the means and the ability – and if we have the courage and determination, then we will have a remarkable opportunity during the long months ahead.

It will provide us with the time and space to think what kind of world we would like to see for our children without the constant stress and fear of complete socio-economic collapse.

It will offer us a precious moment in time to reflect and consider what is important, desirable and beneficial – as if we don’t already know – and what we desperately need to leave behind. Our solitude and isolation need not be difficult if we have a worthwhile goal and the essential support to see us through. It could well bring our own enlightenment, individually and collectively – and with that, a sense of real purpose and value.

”It’s not as if the NHS is actually short of money. What it is short of is stuff.”

Neil, I’m guessing you don’t work in the NHS. If you worked in the NHS (as I do) you’d know that the NHS is short of both money and stuff.

Just a thought, but why don’t you lot – and Bill – compile a simple business plan for humanity during the lockdown. What our aims and objective are, our proposed activities and how we intent funding and administering the project. Keep it simple and accessible so even the dimmest of us can understand the principles and how it can work.

It would certainly be a more attractive proposition than what’s being touted currently.

Lyle: Bill addressed your legitimate concern with these words: “The government can always intervene and create sufficient jobs that will be of benefit to the society, can be designed to be safe in the current health context, and maintain the connection for most of us with paid work? Even if some of them would require the workers stay at home while being paid.” Indeed, the JG is tailor-made for a society with intermittent social distancing. Employees are paid either to work, or to stay home when directed to do so, and personal income streams continue running smoothly either way.

Boris: I agree that “neoliberalism” is an unduly vague term with amorphous connotations. I still use it because it has become commonplace in social discourse, but would prefer a clearer term or phrase–something along the lines of “global capitalism on steroids (or warp drive)” or, more simply and concisely, “hyper-capitalism.” Does anyone else have a suggestion about a better name for that to which, it was once said, there is no alternative?

Here in the UK we have a chancellor desperate to keep the neo-liberal express on the rails. Whilst appearing to be bounteous and saying “whatever it takes”, the ‘whatever’ is about keeping the wealth siphoning and debt peonage system intact from which he and his mates have become uber-rich.

Most of the flows will go to rentier activity:

1. Mortgages (there is a ‘holiday’ on them but not a cancellation so the debt will acrue)

2. Unsecured debt which is the bank money designed prop up low wages and aggregate demand.

3. Landlords-given an absolute fall in house ownership since 2003 there are plenty of them.

This is the system the Tories want preserved and Sunak will indeed do ‘whatever it takes’. There is much discussion about how Covid-19 might change our economy but I’m sensing it will be a gradual reset. There is zero class consciousness in the UK and decades of social fragmentation mean that even severe food shortage (affecting about 1.5 million at present) will not represent a threat through protest.

Mark Russell: Now that’s the spirit and the kind of big picture thinking we must summon forth from the best within us. When the majority see what you see, understand what you understand, the evolution/revolution will happen, can’t be stopped. Until then, we must try to figure out the most effective ways to go end-around the MSM and reach the masses, especially the young. Has anyone who participates on this blog tried to use Snapchat, Instagram, Twitter, etc., which are apparently the media through which youth communicate these days. I’m more familiar with YouTube, but are there other alternative media vehicles we should be test-driving in our efforts to open eyes, minds, and hearts?

That’s very kind, Newton, thank you. I was offered good advice many years ago by Sarel Emeirl, the editor of Time Life Books, who stressed that the most important rule in writing is that the reader must always want to turn the page. Keep it simple and understandable – whether they are a reader in Tokyo or Toronto, Adelaide or Auchterarder. It’s like good music, it should resonate with our own inner rhythm and frequency.

I think if you can construct a narrative encompassing all the excellent principles explored here but in a dialogue a child could understand, then I don’t think it matters what platform you choose. The audience will find you. This is one performance everyone is desperate to see.

I hope Bill doesn’t mind me posting this. A little tune I wrote many years ago with an apt title.

https://youtu.be/Hybbv5J_fWM

Well, you are only off by about 100 year or more. Soddy “Wealth, Virtual Wealth and Debt” (1926) eloquently challenged the impact of less than “full” employment. The pandemic will strip away the veil to reveal the uselessness of many of the jobs people now waste their lives pursuing. I think the WPA has already been covered as well.

Thanks, Mark, for some twelve minutes of delicately tranquil beauty in the midst of a world gone mad.

Thank you again. Have you heard of this concept?

https://www.theguardian.com/world/2020/apr/08/amsterdam-doughnut-model-mend-post-coronavirus-economy

Yes, Mark, I was aware of the concept. The devil, of course, is in the details, but who wouldn’t like the thrust of it? Some overriding ideal like this, both visionary and viable, must guide whatever reset position we achieve after this sudden meltdown. Thanks for the article about Amsterdam stepping forward in “doughnut” mode.