Today's blog post is a little different to my usual posts because I am writing…

There is no financial crisis so deep that cannot be dealt with by public spending – still!

Today’s blog was a little later than usual for various reasons – travel, time differences and other activities that had to take precedence. The title comes from a paper I wrote in 2008 which was published last year and reflects the notion that fiscal policy – appropriately applied can always make a difference for the better. I have noted some scepticism about this proposition and claims that the situation in countries such as Iceland refute the confidence I have in the effectiveness of fiscal policy. My response is that these claims misconstrue my statement and like a lot of criticisms of Modern Monetary Theory (MMT) they choose to set up stylisations that are not those advanced by the leading writers of MMT. So I thought I would just reflect a bit on that today.

As noted in the introduction, someone rather pointedly commented the other day that Iceland categorically refutes my claim that “there is no financial crisis so deep that cannot be dealt with by public spending”. I am sorry to inform you all but that so called refutation is false and reflects a failure to understand what my claim means. In general, it also reflects a willingness of critics to invent characteristics of MMT have never been expounded by any of the key authors (as far as I am aware).

The statement – “There is no financial crisis so deep that cannot be dealt with by public spending” – was the title of a paper I published last year – you can read the Working Paper version for free (fairly close to the final publication). It reflects a basic insight that is derived from MMT once you fully understand that school of thought – its scope and its limitations.

There is a hint among the comments I have read on my blog about the external sector that would suggest that the leading proponents of MMT think that fiscal policy can “bail” an economy out of any problem. Where readers get that misrepresentation from is anyone’s guess but they certainly do not get it from my writing.

So lets get it straight and stop the misrepresentation once and for all. When I say (and the other leading MMT writers say) – “There is no financial crisis so deep that cannot be dealt with by public spending” I do not mean the following:

- That fiscal policy can overcome the real losses to a nation’s standard of living that are associated with a major fall in its currency when there is a significant dependency on real imported goods and services.

- That fiscal policy can ensure that debts denominated in foreign-currency (public or private) can be honoured at all times.

What the statement means is that a situation can always be improved from where it is as a result of the operations of a crisis in the private financial markets. It doesn’t mean the state reached after the fiscal intervention will be Shangri-La! It means things can always be made better. A nation has to confront its real resource constraints. Fiscal policy in the short-term cannot ease those constraints although it can ensure that the real resources available are utilised more fully.

A nation with heavy import dependencies (that is, real resource shortages) is also likely to suffer if its exchange rate collapses or world export markets for its goods and services slow appreciably. Fiscal policy can help to attenuate the losses but cannot “create food out of thin air”.

So in appraising what the statement means we should avoid setting up red-herrings or straw persons.

I last wrote about Iceland in this blog – Iceland … another neo-liberal casuality. I would read that as background to today’s post to get a better insight into what happened there.

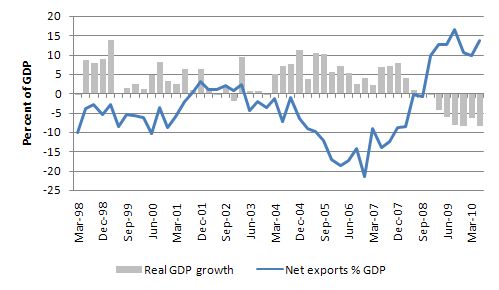

By way of updating some key statistics the following graphs might help.

The following graph shows you the evolution (from March 1997 to June 2010) of the kronor/USD parity and net exports. You can access excellent Icelandic exchange rate data from its central bank and National Accounts data from Statistics Iceland .

You can see that the external deficit widened significantly in the period leading up to the crisis and the kronor was strengthening against the US. the situation changed dramatically as the meltdown began.

Critics of MMT will use this sort of graph to make their case. I wouldn’t if I was them.

The next graph shows you the breakdown of the net exports into the growth of exports and imports over the same period. You can see that the net exports movement is dominated by the collapse of imports. There has been some volatility in export growth but imports boomed then collapsed. Why?

The final graph shows the evolution of net exports in relation to the primary causal factor – the collapse in real GDP growth and its impact on imports.

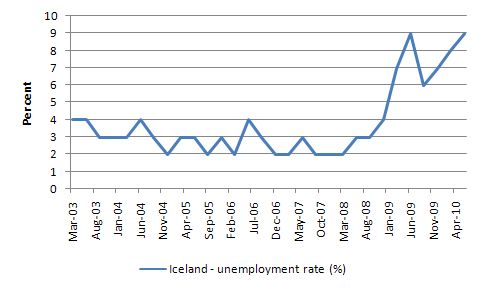

Finally, the next graph shows the evolution of the aggregate unemployment rate as pre-crisis and following the crisis (and the IMF bailout and austerity program). So there is a huge percentage of Icelanders being wasted at present. They are producing nothing and suffering heavy kronor income losses. There is great potential for fiscal policy to utilise this labour force and no financial constraint on the government in doing so.

Historically, Iceland grew and its citizens enjoyed a very high standard of living courtesy of its fishing industry. In 1999, fish products comprised 61.4 per cent of total exports and by 2009 this figure had dropped to 37.3 per cent (Source – Statistics Iceland ).

Under heavy neo-liberal influence, the government privatised and deregulated the banking system and provided financial incentives for the banks to grow.

Previously the Icelandic banking system was very conservative working within the local depositor base and lending to home buyers and local business. With the neo-liberal abandonment of proper financial oversight the privatised banks went crazy. They started to tap into the global wholesale markets and borrowed billions. They also developed the overseas retail operations like Icesave.

They then loaned huge sums to the newly emergent global entrepreneurial class in Iceland, imbued with the same free-market rhetoric that has brought the world to its knees. They engaged in a vigorous foreign asset acquisition program – buying incidentally a lot of British business assets. By the end of the growth period, the banks had grown to more than 10 times the size of the economy.

Most of the spending by the Icelandic banks collapsed in value as the crisis hit. It is clear that the claims that financial markets drive optimal resource allocation is false – Icelandic banks engaged in very poor investments.

Their problems began came courtesy of the US sub-prime collapse. In the first 9 months of 2008 the Icelandic króna depreciated dramatically (over 35 per cent) and this put pressure on the private banks in Iceland who were very highly leveraged in foreign currencies. The global financial crisis made it very hard to refinance their commitments.

It is clear that the Icelandic government failed to implement proper prudential supervision or enforcement of the banking regulations that they had taken from the EU (as a result of their plans to enter the European Economic Area).

So one of the first principles of MMT – proper supervision and oversight of the financial system – was absent in the case of the neo-liberal obsessed Icelandic authorities.

While the sub-prime crisis forced the meltdown, the fact remains that the Icelandic banks were always going to fail given the high-risk strategies they were pursuing. If you go back through the document trails prior to the collapse you can see growing disquiet from foreign governments about the hedge fund mentality of the Icelandic monetary authorities and its banking system.

However, once the crisis hit, the government did not try to liquidate the banks. It could have easily nationalised the banks and guaranteed kronor-denominated deposits or guaranteed all deposits in kronor. The losses to depositors would have been much lower if it had have followed this course of action.

Further, when the banking system did collapse, instead of calling in the IMF – which may have supported the exchange rate but forced the country to adopt harsh domestic austerity policies – the government should have defaulted on all foreign-currency debt.

The lax regulation also manifested in the fact that the Icelandic government allowed private citizens to enter into foreign currency-denominated loan contracts with the out-of-control local banks. So the exchange rate depreciation sent these loan obligations soaring. The government should have prohibited its home mortgage market being funded with foreign-currency loans. That is a key element of a sound financial market oversight.

The Government of Iceland also failed to act according to best-practice sovereign government principles outlined by MMT. You can find data for the Icelandic government’s debt management HERE. This document gives a breakdown of the outstanding public debt holdings for Iceland for August 2010. It shows there has been some retreat from their earlier positions.

So 65.0 per cent of total domestic debt is in the form of various (conventional) Treasury bonds (with 6 per inflation indexed – why?), about 17.3 per cent of domestic debt is in the form of debt notes issued to the Central Bank (so the Treasury can issue debt to the bank), and 3.7 per cent of the domestic Treasury debt arises mainly from the operations of the state owned National Power Company.

20.6 per cent of the domestic Treasury debt arises from the capital contribution from the state to the new banks arising out of the restructuring of their banking sector post-crisis.

Domestic debt comprises 71 per cent of all outstanding public debt and the overwhelming proportion of foreign-currency debt is denominated in Euros (88.5 per cent) and all foreign debt is of a long-term nature.

If you go back a few years at the height of the neo-liberal madness you can find some interesting official documents. This presentation from the official debt management agency in Iceland showed how cocky they had become under the blind-cover of neo-liberalism. It was outlining the prospects for 2008 and claimed that their were “robust central government finances”. They said:

– Budget surplus due to privatisation income and economic growth

– 2005: 4.5%; 2006: 5.3%; 2007: 3.7%; 2008: 1.3%The surplus can be traced primarily to the recent economic upswing, income from privatisation and modest growth in government spending.

They tell us that “at the end of 2007” “Foreign debt amounted to … almost 51 per cent of total debt”.

Interestingly, they also admit that despite running surpluses they would still be issuing debt. Why? They tell us in the next slide:

The primary purpose of the new issuance is to promote an active secondary market and to strengthen price formation of the domestic fixed income market.

Role of Government securities in domestic market

– Price reference for other financial products

– Long-term investment vehicle

– Safe haven in times of financial instability

The point is that they are not issuing debt to “fund” government net spending (because the budget was in surplus). They are instead, providing corporate welfare, to allow the financial markets to make more profit and create risky financial products with the knowledge that a risk free asset was available in the form of the government bond.

The fact is that the Icelandic government didn’t have to issue any debt ever – that is, even when it was running deficits. It was 100 per cent sovereign in its own currency – the kronor.

The 2007-08 Presentation also boasted that the Iceland government maintained triple A to AA+ ratings with a stable outlook from the key international rating agencies.

Please read my blogs – Ratings agencies and higher interest rates and Time to outlaw the credit rating agencies – for more discussion on why the ratings agencies should be ignored in the context of public debt.

If you read the history of the debt management outlooks provided by the official debt management agency in Iceland it is clear that they were living in a neo-liberal dream world. They were running budget surpluses courtesy of privatisations and the nominal largesse being created by the debt-infested financial sector.

The government was borrowing (more than 51 per cent of its total debt) in foreign-currencies mostly Euros. None of the domestic debt (in kronor) presented a problem – meltdown or not.

The problem they faced was the significant proportion of non-kronor debt. Given this is in a foreign currency, meeting the obligations of the creditors represents a real impost on the standards of living for Icelandic citizens especially as the currency depreciates. This aspect of Iceland’s current malaise is not a result of its government following basic principles that arise from an understanding of MMT.

On the contrary, the conduct of the Icelandic government leading up to the crisis was in violation of sound fiscal practice as outlined by MMT. The Icelandic government was behaving as an exemplary IMT-ratified body – following all the principles laid out by the neo-liberals for prudent and responsible fiscal policy. The government set in place a growth strategy that did not exploit their natural and population resources but rather allowed the heavily deregulated finance (banking) sector to run free.

It was never sustainable and as soon as the crisis hit, the foreign-currency denominated debt (public and private) became the millstone. From the public perspective, it reduces the government’s capacity to lead the economic back into recovery. It means if it wants to honour this debt it has to sacrifice large chunks of its export revenue and cut back imports severely. In other words, undermine the real standard of living of its citizens.

Further, by agreeing to take over the debts of the failed Landsbanki which was privatised under the neo-liberal rush to obliterate public activity and developed very high international and risky exposure, the Icelandic government is breaching sound fiscal management. The debts of the private sector are not the problem of the sovereign government of Iceland.

If they really wanted to bail out the banks, however, given that they are sovereign in their own currency they always pay in kronor and let the creditors of these private institutions take the exchange loss as part of their lack of due diligence in lending to these banks (which were really huge hedge funds) in the first place.

Further, the elite in Iceland are trying to force the country into the Eurozone and a lot of the kowtowing to the Euro bosses with respect to honouring debt and the acceptance of the IMF bail-out arrangements is being driven by that folly. Iceland should never borrow from the IMF nor should it join the EMU.

The government should immediately default on all foreign-currency loans as Argentina did in 2002. The threats that Iceland will be excluded from the world financial system if they behaved in this way are largely without any substance given what Argentina proved when they defaulted.

The government rhetoric also is claiming that by joining the EMU they will be “shock-proofed” from further crisis. They should cast their eyes to the south – across the sea – and see how badly Greece, Spain, Portugal and to the south-west Ireland are faring as a result of following that myth. Joining the EMU should be the last thing the tiny island should do.

All public obligations should only be in kronor. In that sense, Iceland does not constitute a good example of an “MMT-inspired” economy failing. Rather, it is exactly the opposite!

It is clear that Iceland has a heavy import reliance – for advanced goods and services. The collapse of the kronor pushes the price of those commodities up. This vulnerability is always there for a country that imports food and other essentials.

The correct role for the IMF in these situations is not to impose onerous conditions on the nation in difficulty but instead to buy the local currency to ensure the exchange rate does not price the poor out of food. This is a simple solution which is preferable to to forcing these nations to run austerity campaigns just to keep their exchange rate higher. But imported food dependence exposes a nation to exchange rate volatility.

The role of the sovereign government in these cases should not be to run policies that promote low levels of domestic activity.

There is no evidence that budget deficits create catastrophic exchange rate depreciations in flexible exchange rate countries? Iceland was running budget surpluses! There is no clear relationship in the research literature that has been established. If you are worried that rising net spending will push up imports then this worry would apply to any spending that underpins growth including private investment spending. The latter in fact will probably be more “import intensive” because many nations import capital.

The exchange rate depreciation in Iceland has caused considerable hardship. The government has implemented some restrictions to ensure that foreign currency (from exports) be used to buy essential products (food, medicine etc).

The government can in this situation use fiscal policy to ensure that the “costs” of the crisis are minimised. That isn’t the same thing as saying the losses will be small! But clearly the government could provide jobs at a minimum wage (which may be low in real terms given the exchange rate effects on the price level and the availability of real goods post-crisis) to any citizen who wanted to work in preference to being chronically unemployed. There are many activities that well targetted government spending could promote to create domestic activity which reduces the reliance on imports. For example, Job Guarantee workers could start making things that the nation would normally import including processed food products.

Moreover, a fully employed economy with skill development structure embedded in the employment guarantee are likely to attract FDI in search of productive labour. So while the current account might move into deficit as the economy grows (which is good because it means the nation is giving less real resources away in return for real imports from abroad) the capital account would move into surplus. The overall net effect is not clear and a surplus is as likely as a deficit.

Finally, even if ultimately the higher growth is consistent with a lower exchange rate this is not something that we should worry about. Lower currency parities stimulate local employment (via the terms of trade effect) and tend to damage the middle and higher classes more than the poorer groups because luxury imported goods (ski holidays, BMW cars) become more expensive.These exchange rate movements will tend to be once off adjustments anyway to the higher growth path and need not be a source of on-going inflationary pressure.

Please read my blog – Bad luck if you are poor! – for more discussion on this point.

The other point to note about Iceland is that it has a very advanced educational system with a highly skilled workforce. It also has huge untapped stocks of natural resources (for example, aluminium). However, I realise there is a huge environmental debate going on in Iceland about the exploitations

So the population has some choices to make. If it wants a higher material standard of living based around a recovery in imports then it will have to rely more on its natural resources and the value-adding that its highly skilled workforce should be able to provide. If the green lobby wins then it will have to accept lower levels of imports.

Finally, the government should also sack the officials at the Icelandic Tourist Board !

I have also read claims by commentators here that a sovereign government will eventually exhaust its domestic “funding” options and have to seek funding from foreigners. It is unclear whether this meant that the “foreign loans” would be in local currency or in the foreign currency.

The point is totally illogical from a conceptual perspective for any sovereign government.

It is interesting to note that in 2007 the functions associated with debt management in Iceland were transferred from the Treasury to the Central bank proving that the institutional machinery surrounding public debt issuance is largely arbitrary and can be changed by government fiat.

Further, ask yourself the question: What would happen if no one turned up to the next bond auction in Iceland? Would the government immediately stop spending – close its public services down, force unsafe hospital procedures, turn off all the lights, sack the police force? Answer: unless they were completely stupid – no! If this became a chronic inability to float public debt they would soon enough change the rules that they had voluntarily put into place in the first place.

In that sense, they probably allow the central bank to buy all or significant portions of the debt but then they would realise that all that was happening was that the fiscal spending was adding to bank reserves whatever accompanying arrangements were put in place and they could always deal with the interest rate effects (the downward pressure) arising from excess reserves by instructing the central bank to pay a support rate on overnight reserves held by the commercial banks with the central bank.

So would they ever have to seek foreign funding in any guise? Answer: never. A sovereign government can never run out of money and never needs to issue public debt as a matter of necessity. The public debt issuance is entirely voluntary and such voluntary actions have a habit of being quickly changed if they present too many “political” problems.

It is thus a total lie to claim that a government will inevitably run out of domestic funding sources.

And that is independent of the reality that the bond markets can not get enough public debt at present in most nations.

Now to important things

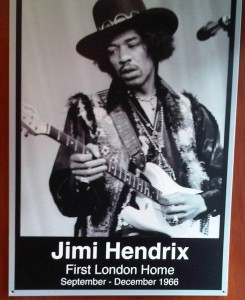

Let’s now turn to important things. I am currently in London and staying at the Hyde Park Hotel in Bayswater. It is a good spot – Bayswater that is, not necessarily the hotel. Our two-person room requires one person to exit the room while the other moves around! It makes me wonder how Jimi Hendrix fitted in here with his Stratocaster! Which brings me to the claim to fame of the hotel is that it was the first London home of Jimi Hendrix and he lived here between November 1966 and February 1967.

He wrote the great song – Stone Free from Room 86 at the hotel. Take a moment out of what you are doing and listen to – Stone Free – its a poor quality recording but the live footage was recorded in February 25, 1967 (so early days in London) from a small club in Chelmsford, England. Most notably check out the Marshall stack which was a modest set up when compared to his later wall of amps/speakers.

| This poster confronts you when you walk in the hotel door (click for a larger image): |

Here is the entrance plaque to my hotel (click for a larger image).

I tried to stay out of the photo but it was hard given I was holding my phone up and the plaque was so shiny: |

There was also an exhibition at the Handel House Museum where the composer Handel lived for many years and wrote some of his famous works including the Messiah. The residence is at 23 Brook Street, Chelsea, which is just up the road at the other end of Hyde Park. In February 1968, Jimi Hendrix moved into the top floor flat of that property and lived there for a few years.

The exhibition celebrating the Hendrix-connection had among the items on show some self-portrait sketches by Hendrix and handwritten lyrics to Love Or Confusion written on notepaper from the Hyde Park Towers hotel.

And before we finish with Jimi for the day here is an epic recorded live at a Paris concert. This song is the “tasteful” guitarist’s “stairway to heaven” (for all the guitarists out there you will know what I mean):

Anyway, I always carry a travelling guitar with me to keep my practise up and later today my scales may morph into a few riffs of Stone Free.

Travels

Yesterday, I travelled from Maastricht to London via the marvellous Eurostar.

It is clear to me that Australia needs a Eurostar between Newcastle and Sydney and then onto Melbourne. It is a much more relaxing way to traverse distance than flying. From Maastricht it is also a much easier way to get to London or Paris. You end up right in the centre of London and within 20 minutes I was out at Bayswater via the underground. Flying would see you land at Heathrow then having to take at least an hour to get through the queues, then an hour by underground into King’s Cross-St Pancras – where the Eurostar arrives.

I am doing some research (out of curiosity) on transport policy at present because while the arguments in Australia against a very fast Eurostar-style train are all centred on whether it could make a profit I cannot see why the government should not just create a national resource as part of the policy towards meetings its environmental targets. So I am investigating whether the concept of profit – once you add in the social dividends (reducing social costs and enhancing social benefits) would yield a positive figure.

Bruce McFarling? You know a lot about trains – what say you about that idea?

Anyway, I am in London for the rest of the week and have several meetings. My blog may be a little late each day (Australian Eastern Time) given the time difference and my need for exercise each morning. I am staying right next to Hyde Park and without my bike here I have to make do with the fabulous running tracks all through the Park. The perimeter track is 4 miles or so and so a few laps of that each day will do the trick.

Listening to?

As I work this morning I am listening to Linton Kwesi Johnson on my iPod – album – No More Time. LKJ is one of my favourite artists.

One of my favourite tracks of all time is from this album – Hurricane Blues – the lyrics are great and the guitar playing is supreme.

Keeps me company while I rage against the neo-liberal machine sitting here typing just above the room where Jimi wrote Stone Free. Good mix really.

Conclusion

Back tomorrow – lots of work to do today.

That is enough for today!

Hi Bill,

If a sovereign country cannot {does not wish to} finance a budget deficit by borrowing and resorts to printing money wouldn’t there be exchange rate and inflation implications?

I am assuming {rightly or wrongly} that people {speculators} lose confidence in the currency and there is a large depreciation.

Countries {like the UK} that import a large proportion of their raw materials will be faced with a large rise in import prices that may ‘trigger off’ an inflationary spiral {especially with an endogenous money supply?}.

Would you be in favour of some type of incomes policy in this situation? Or some other policy?

Hi Bill,

Thanks for the link to Linton Kwesi Johnson. Really super laid back reggae music.

John,

I’d be more worried about straw shortage resulting from too many straw men being erected by misinformed neo-liberal sympathisers.

Where did you get the idea that MMT endorses printing money to fund deficits ? It’s certainly not something Bill has ever endorsed.

John, what MMT observes is that “financ[ing] a budget deficit by borrowing” is not a meaningful phrase. Government “borrowing” is just a tool to keep up interest rates that would otherwise be depressed by deficit spending. The actual difference between “printing money” and the “borrowing” gymnastics is small, with the psychological component, as you point out perhaps dominant. QE, as practiced recently, makes the difference practically nonexistent, and it has not had the effects you suggest. An environment with incipient trade wars and nations trying to depreciate their currencies makes them less likely.

Some Guy,

“QE, as practiced recently, makes the difference practically nonexistent, and it has not had the effects you suggest.”

Have you been watching the depreciation in the USD and appreciation in commodities recently? Don’t you think QE might have something to do with this?

The US is getting closer and closer to a MMT-endorsed monetary system. We’ll see how it plays out!

“There is no financial crisis so deep that it cannot be dealt with by public spending”. Except that if Western economies tried to pump themselves up to where they were pre-crunch without sorting out banks, we’d just get another crunch (as Steve Keen pointed out). Given Bill’s criticism of bank regulation, that point is presumably implied in his article, though he does not explicitly state it. As an article in the Wall Street Journal said a few days ago, Basle 3 is feeble – we need to start on Basle 4 right now.

Bill,

I was wondering what you thought about the winners of this year’s Nobel Prise for economics as their work is in one of your areas of expertise:

http://www.bbc.co.uk/news/business-11515509

“Americans Peter Diamond and Dale Mortensen, and British-Cypriot Christopher Pissarides, have won the 2010 Nobel economics prize.”

“The Royal Swedish Academy of Sciences praised their work on why unemployment stays high in times of many vacancies.”

“The citation from the Swedish academy said that the laureates’ work on so-called friction theory “help us understand the ways in which unemployment, job vacancies, and wages are affected by regulation and economic policy.

“This may refer to benefit levels in unemployment insurance or rules in regard to hiring and firing. One conclusion is that more generous unemployment benefits give rise to higher unemployment and longer search times.”

Kind Regards

Any ideas on the Nobel Prize? Both the Wall Street Journal and the New York Times are suggesting that it’s been awarded this year for showing unemployment benefits increase the unemployment rate.

Is this now considered economic doctrine? And how many unemployed economists also subscribe to this notion?

http://www.marketwatch.com/story/nobel-for-explaining-why-markets-fail-2010-10-11

http://www.nytimes.com/2010/10/12/business/economy/12nobel.html?_r=1&hp

Have you been watching the depreciation in the USD and appreciation in commodities recently? Don’t you think QE might have something to do with this?

Some argue that this is one of the intentions of QE and soon to be QE2, along with dampening LT rates to support the housing market from collapsing. The US is intentionally depreciating the dollar to improve its trade position and has publicly declared its position to increase exports. No mystery here.

Ralph, we need to address fraud and less than best practice in banking. The unspoken reasons that the US is not doing are twofold. First, some of the perps are too well connected and the rest are too numerous to prosecute. Same reason that the US is not prosecuting war crimes and addressing its constitutional crisis. Secondly, it would take down a huge swath of the financial sector.

I highly doubt QE has had anything to do with this. Mosler predicted (in a CNBC interview, no less) back in May at the height of the rise in the US$ that the fundamentals were consistent with a significantly weaker US$ once the flight to safety had run its course, without any recourse whatsoever to QE.

I should qualify my comment by granting that to the extent QE has brought down US interest rates this could have had an effect on the decline in the US$.

Dear CharlesJ (at 2010/10/12 at 4:47)

Their work has made it harder for governments to maintain full employment and their analysis – which is full of holes and misrepresentations has been used to justify supply-side policies which deny mass unemployment and which focus on the victims of the job shortage rather than the true cause.

They are worthy choices for a Nobel Prize – so bad is their work.

best wishes

bill

Scott,

“I should qualify my comment by granting that to the extent QE has brought down US interest rates this could have had an effect on the decline in the US$.”

I think this has contributed. It will be fascinating to see what happens if long-term rates are kept low for a long period.

Professor Diamond, in a news conference at M.I.T., echoed his colleague’s advice about getting people back to work as quickly as possible, but said fears about permanently higher unemployment rates and structural displacement of workers were overblown.

“I think the economy is very adaptive,” he said. “Workers and employers will adapt to what will make the economy function. I see no reason why, once we get fully over this, we won’t go back to normal times,” with more “normal” unemployment rates.

Does he not believe his own work or is his work being misinterpreted by the neoliberals and/or journalists?

Gamma . . . I should also add that it’s certainly possible that traders’ interpretations of the effects of QE have mattered, too. I’m talking more about fundamentally if there’s actually a transmission mechanism (aside from interest rates already noted), which I don’t think there is (aside from purchasing foreign currency with QE, I guess, which the Fed’s obviously not doing). So, to qualify yet again, QE can matter, but not as most think, in my view.

Why does President Obama want Peter Diamond on the Fed Board of Governors so much? He nominated him on 4/29. The Senate rejected his nomination on 8/5. Then he renominated him on 9/13. Now Diamond has been awarded a Nobel prize. I see in his Wikipedia entry that Diamond was one of Ben Bernanke’s professors. If he gets a seat on the Board, it’s only until 2014, so is he expected to play ball with something major before then, or is this appointment a reward for having *already* played ball? Also, while I haven’t studied the history of the Board of Governors in depth, it seems President Obama has had a considerable influence on the board by getting to appoint 4 out of 7 members. Shouldn’t there be rules that prevent a single President from exerting this much influence over the supposedly non-political central bank?

Just like to point out. I have never heard a proponent of MMT cite QE as a effective form of stimulus. As Bill makes it quite clear again in this article. MMT advocates stimulus spending to address specific areas lacking in domestic resource.

In the UK context this could be for example: Primary food production, high technology industry, automotive sector, improvements in high speed rail and renewable energy. I’d leave it to others more qualified to fill in the details. The gist is clear.

In the US case: Obama highlighted some worthy infrastructure projects yesterday. Which the Neo-lib talking heads laughingly dissed with comments like “who will pay”.

I too was getting a bit fed up with the chicken littles last week. The general modus operandi is to take one facet of MMT and develop it to a nonsensical extreme. They conveniently ignore the probability of sentient policy decisions and proper control of the financial sector. It doesn’t matter how well the argument is dressed in technical and semantic finery. It’s intellectual conceit in my book.

Scott,

It’s pretty clear the market is fixating on some connection between QE2 and dollar depreciation. It’s all over the financial media.

But I thought the same thing as you, precisely.

There must be a QE2 version of Keynes chapter 12 going on here, where average opinion about the wrong connection has no doubt been galvanized in monetarist blogs:

“It is not a case of choosing those [faces] which, to the best of one’s judgment, are really the prettiest, nor even those which average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practise the fourth, fifth and higher degrees.”

Just wondering if you saw Mankiw’s article in the new york times a few days back. Although he is a deficit hawk, the prospect of higher marginal tax rates on the top income bracket does not suit him well. In reaction to this tax on his productivity he has decided to work less.

http://www.nytimes.com/2010/10/10/business/economy/10view.html?_r=2

There really is nothing to be said, but it continues to amaze me how pompous and arrogant some people can be in times like these.

Bill “There is no evidence that budget deficits create catastrophic exchange rate depreciations in flexible exchange rate countries? Iceland was running budget surpluses!”- when ever you say this,it seems to me as fatuous as someone saying that there is no evidence that CFCs caused ozone depletion because Antarctica had the worlds lowest consumption of underarm deoderant and yet that was where the ozone hole formed. As you yourself know better than anyone and actually describe in this very post, the money driving the bonkers financial sector expansion is global money – budget deficits in Japan can create high powered money used in iceland to destroy hospitals in the UK (the Christies NHS cancer hospital where I was treated lost £5M to icesave and our local council also lost loads).

There may be some truth to it – though I am two-minded.

If there is a QE2, the sale of Treasury securities (or Agency Debt and Agency Mortgage-Backed Securities) creates deposits for the non-banking private sector. To the extent that the private sector does not want to hold the deposits, they may purchase foreign currency/assets.

Deposits are not fixed and are endogenous and that takes care of the argument that someone else may hold it etc or argument that the private sector cannot get rid of the deposits created.

One may ask why did the private sector sell the securities to the Federal Reserve if they didn’t want the deposits. That is because the intention was to sell the securities and book profits on the sale.

The demand for foreign assets may depreciate the dollar.

Scott Fullwiler “I should qualify my comment by granting that to the extent QE has brought down US interest rates” .-understatement of the century- now as they say the USA is the land of the free loan (unless it is to do something useful)- hence anyone can get 400x leverage to “invest” in gold- supprise supprise there is something of an increase in the price of gold. QE is just a way to transfer financial power to those holding assets prior to the implementation of QE. If Obama had genuinely wanted to moderate the USD/RMB exchange rate wouldn’t he have sold the US gold reserves to buy RMB?

Andrew Wilkins;-“The general modus operandi is to take one facet of MMT and develop it to a nonsensical extreme. They conveniently ignore the probability of sentient policy decisions and proper control of the financial sector.”-talking for myself, the facet of MMT I object to is one shared by the current system (multi-decade time period budget deficits) and I recognize that it is already well past having in reality developed to a nonsensical extreme. This is a macroeconomics blog- the response of the financial sector to grow in response to a predictably growing glut of “leakage to savings” (the flip side to deficits) is about as basic a macro development as any. Proper control of the financial sector will always be essential. There is some hope of achieving it in a non-expanding currency enviroment. There is none against an ever rising tide of savings.

” MMT advocates stimulus spending to address specific areas lacking in domestic resource.”

Some do. Warren Mosler advocates tax cuts – essentially privatising the stimulus spending. In an environment where people are struggling to make mortgage payments that has a logic to it, and of course its very popular on the hustings.

“To the extent that the private sector does not want to hold the deposits, they may purchase foreign currency/assets.”

That doesn’t get rid of the deposits. They just change hands. Until the deposits are turned into flows there is no change in the real economy. Up until that point its just asset shuffling between the players.

Neil Wilson, I think both “To the extent that the private sector does not want to hold the deposits, they may purchase foreign currency/assets.” and also your “That doesn’t get rid of the deposits. They just change hands. Until the deposits are turned into flows there is no change in the real economy. Up until that point its just asset shuffling between the players.” are true- if people don’t want to hold the deposits, they will pass them on like a hot potato so as to get foreign currency/assets. As you say, that doesn’t get rid of the deposits but it does change the values relative to the foreign currency/assets. Hence using QE to further bulk up the unwanted deposits is a way to accelerate asset price inflation so as to hand over more power and influence to the oligarchy :).

Stone,

I do understand your fear in this instance. If an ever increasing quantity of private savings is chasing after yield. The savings will get leveraged up by the financial sector. Then burn around the globe inflating and bursting asset bubbles.

Your postion stems from a belief that the flow of investments between asset classes may be controllable in a non-expansionary financial regime. In an expansionary regime, the investment flows will be uncontrollable and cannot be regulated appropriately.

All I can say is: Logically there appears to [to me] little difference between the regulatory process in either scenario. If you can regulate successfully in a non-expansionary regime. Surely it must be possible in an expansionary regime. If we all refuse to consider the financial sector can be tamed and regulated. You indeed have a fait accompli and we can end the MMT discussion today.

Personally, I am far more fearfull of the consequences of wealth transfer in a fixed regime.

Neil,

“Warren Mosler advocates tax cuts.”

Yes I am aware of this. I believe it is a cultural preference and political expedient in the US. A frosty glasses view of European socialist history, fear of Russian style communism and distrust of Government dating back to the original tea bags are the reasons for that.

I prefer direct spending into the economy. Tax cuts will likely get spent on a Yamaha jet ski’s, slightly diluting the effect.

Diamond: “I think the economy is very adaptive. Workers and employers will adapt to what will make the economy function. I see no reason why, once we get fully over this, we won’t go back to normal times,” with more “normal” unemployment rates.

Adam: “Does he not believe his own work or is his work being misinterpreted by the neoliberals and/or journalists?”

The reporting on Diamond that I have seen fits with that statement. The point should be made strongly that the recent rhetoric about structural unemployment is overblown. It has been used as an excuse to do little or nothing about unemployment, “because it is (largely) structural”. Diamond is pointing out that, even if structural unemployment hinders recovery, it is not that big a deal.

As for the gov’t providing jobs to all who apply, Diamond’s work is based upon “search markets”. There is not much search to do if you know that all you have to do is go down to the employment office to get work. 🙂

CharlesJ:

BBC: “One conclusion is that more generous unemployment benefits give rise to higher unemployment and longer search times.”

What should be added, I think, is that that is generally a good thing. It means that people will find more appropriate jobs, which will benefit themselves and others. 🙂

Neil,

“That doesn’t get rid of the deposits. They just change hands. Until the deposits are turned into flows there is no change in the real economy. Up until that point its just asset shuffling between the players.”

Banks are big in fx markets and create money endogenously. Suppose an economic “agent” purchases foreign currency, the bank debits his account and credits his foreign account. (The bank may have to report “Due to Foreign Offices” to the Federal Reserve for its H.8, but lets avoid the complication). The agent may then purchase foreign assets.

In case you want to bring in non-bank intermediaries, one can again do some transaction flows. Such as the non-bank intermediary reducing its indebtedness to the banking system when obtaining the deposits from the agent in exchange for foreign assets.

Andrew Wilkins “All I can say is: Logically there appears to [to me] little difference between the regulatory process in either scenario. If you can regulate successfully in a non-expansionary regime. Surely it must be possible in an expansionary regime. If we all refuse to consider the financial sector can be tamed and regulated. You indeed have a fait accompli and we can end the MMT discussion today. Personally, I am far more fearfull of the consequences of wealth transfer in a fixed regime.”

Andrew Wilkins, To me the crucial difference is that basically by committing to multi decade deficits, the government is telling the financial sector (in the widest possible sense) that there is going to be a ramp up in asset prices on a global basis (but with some short term volatility) for the forseable future. If the government committed to running balanced budget with a wealth tax and plenty of fiscal stimulus the financial sector as we know it would be wiped out even without any onerous regulations being imposed on them. Conversely if the global pool of savings predictably increases 2x then 4x then 8x then 16x then 32x etc etc, no amount of increasingly complex and onerous (and open to favour and corruption) regulation will be able to hold back the tide.

You are teachers pet if you echo teachers values.

You get promoted if you echo the bosses values.

You get a Nobel prize if you echo who’s values?

Some pompous Norwegian asses ……

Stone,

No worries. We disagree on the potential efficacy of financial regulation. I understand and respect your view.

You will say Potaato and I will say Potarto 🙂

Neil Wilson; A massive fiscal stimulus effect could be induced without changing the level of tax or government spending simply by changing the nature of the tax system. If all the taxes were replaced by a wealth tax and inheritance tax and much of the spending was in the form of a citizens dividend and/or JG with a reduction in pay for top public sector workers, then that in itself would get money into the hands of those who would spend it rather than “leakage to savings”. As for the Yamaha jet ski worry- to my mind the poorest people are much less likely to waste resources than the state is. Concord and the Apollo moon missions are tragic examples of how governments squander resources.

Andrew Wilkins, cheers for saying my viewpoint is just a different interpretation of understood facts rather than a misrepresentation or “illogical” as Bill puts it. I understand that you have faith that the FIRE sector can be constrained as the “leakage to savings” escalates. The other thing that worries me about this is how a glut of savings leads the private sector to make deranged resource allocations. Do you also believe that as the global stock of savings becomes an ever increasing multiple of GDP, the private sector will be able to allocate resources rationally? I could understand the MMT position if MMTers were of a disposition that believed a Soviet style command economy is the way to direct the non-financial sector of the real economy. I find it very hard to follow how the private sector can discern what work needs doing and get it done (and avoid the wasteful work that should be left undone ) in an environment where asset price inflation and volatility out-weigh genuine earnings.

re the QE debate

could it just be the case that the market believes in the economic mytholygy, of IGBC(intertemporal government budgetary constraint) and a loanable fund, and so with government debt build up, and excess reserves in the banking system , the market is expecting a high inflationary future, and hence shorting the dollar.

Stone,

Do you also believe that as the global stock of savings becomes an ever increasing multiple of GDP, the private sector will be able to allocate resources rationally?

For simplicity I just look at a closed system. The world economy.

Firstly, I think private sector allocates resources either based yield or Ponzi style asset growth. There are many regulatory ideas to address speculative gains in non-productive assets. LVT springs to mind and Steve Keen has been doing some thinking in regard to stocks.

Assuming we can minimise speculation in non-productive assets. The FIRE sector will relentlessly and efficiently search for the best yield/ risk reward.

In a stable environment with evenly weighted risk. IF financial assets accumulate faster than GDP growth the average yield return would be driven downwards.

Eventually IF yields are driven low AND our FIRE heroes can’t create another Ponzi scheme. Savers have a choice to either accept the low returns or spend into the economy. If the spent savings compete for scarce resources this could raise the specter of inflation.

We must remember fiscal policy stimulates GDP growth, the FIRE sector also finances productive assets and stimulates GDP growth. Savings growth can only become an potential issue, if the monetary growth is faster than productive capacity can respond. I’m thinking it won’t be a major concern until the day comes if/ when savers decide to spend en masse.

This is where I make a point about sentient policy. Policy makers, central banks (whoever) should have the charter and responsibility to keep monetary growth within the bounds of productive capacity, They must also match savings growth with the desires/ requirements/ demographic characteristics of savers (with sustainable criteria of course).

Andrew Wilkins-“Policy makers, central banks (whoever) should have the charter and responsibility to keep monetary growth within the bounds of productive capacity, They must also match savings growth with the desires/ requirements/ demographic characteristics of savers (with sustainable criteria of course).”-The issue for me is that there hasn’t been any genuine GDP growth in the non-FIRE sector in the USA or UK for decades. As the currency expands, the FIRE sector expands and that is where the “GDP growth” illusion befuddles people. So if you say the government should expand the currency to keep pace with GDP growth- then it is a self fulfilling prophecy that you will be able to expand the currency evermore (until the finite real world packs in) with the FIRE sector accounting for all of the consequent expansion. I agree a FIRE sector is vital to the economy. The vital functions of the FIRE sector were all amply met by the tiny (by todays standards) FIRE sector of 1960s USA. With modern information technology those vital functions of the FIRE sector could be met with an even smaller (perhaps much smaller) use of man-power and resources.

Andrew Wilkins-“Firstly, I think private sector allocates resources either based yield or Ponzi style asset growth. There are many regulatory ideas to address speculative gains in non-productive assets. LVT springs to mind and Steve Keen has been doing some thinking in regard to stocks.”-To my mind this all boils down to the macro issue of whether money for investment has scarcity value. In a non-expanding currency with a wealth tax and fiscal stimulus, money for investment would have very great scarcity value so there would be great yields. That would crowd out the ponzi nonsense. With regard to the LVT etc – I think it is vital that a wealth tax does not favour or disfavour any asset class. The wealth tax should apply equally to real estate, stocks, cash anything. To have legal ownership of anything would depend on having paid the tax on it (in the case of exchange tradable assets it would need to be levied on a continuous basis eg like inverse continuous compound interest).

mahaish, I don’t think even the most ardent MMTers are expecting anything other than an (asset price) inflationary future. For the markets what matters is the value of the USD in relation to asset prices rather than in relation to consumer prices. As such it seems perfectly rational to me to try and pass on any USD in exchange for an asset with inflating price.

“They are worthy choices for a Nobel Prize – so bad is their work.”

The Nobel Prize was a commendable idea by the old dynamitard Alfred, but it have been seriously soild by the Bank of Sweden prize lending prestige from the old dynamiter Alfred Nobel. I’m not sure but I have some memory that the Nobel Prize foundation was in economic troubles then and did need an economic infusion to keep the prize alive, and the savior was Bank of Sweden how required a kick back in form of a economic prize.

This years winners of “The Sveriges Riksbank [Bank of Sweden] Prize in Economic Sciences in Memory of Alfred Nobel” is fully in line with the right wing gov. Sweden have had the last 4 years and was reelected last month, albeit with a thinner margin. The right wing gov has an outspoken policy of the this year’s winner of the Bank of Sweden prize, increased supply of labor by cuts in social benefits for unemployed, sick and so on shall put a downwards press on wages and lower unemployment. So far it hasn’t materialized – that is the lower unemployment- and so far it’s rather the opposite. Deadly sick people with serious cancer diagnosis and people that have had brain tumors, stroke and so on that hardly can walk and have to relearn speaking is cut off from social benefits and pushed on to the labor market to increase the supply of labor.

Well we only have 8-9 % official unemployment now, probably way to low to put a serious downward pressure on wages to reduce unemployment. More unemployment will decrease unemployment, I don’t really get the logic here but that’s just me, our gov of course know better than us simple peons.

stone – the economy (and in particular the poorest section of it) needs help in the form of more resources allocated to it NOW. Your preference is that the resources come from forced redistribution rather than any policies which would risk inflation.

I would love to see your redistribution vision effected – but surely you have to accept that this is pie in the sky stuff which the entrenched interests would never permit – they would brainwash the middle third of the population into thinking that IHT is theft and should be rolled back.

I am less ambitious; lobbying for a more accommodative fiscal stance should benefit the poor in the short term, and ought to be a bit more realistic an outcome than your redistributional scenario (much as we should fight for more redistribution in the longer term).

I also think your 32x savings scenario looks too extreme. Yes there are asset bubbles but much of the saving is paying down debt which is less malign. Surely the govt would have withdrawn its stimulus long before savings reached such a massive level, as the economy would be reaching full capacity.

Best wishes

MMT Proselyte, First of all, it is not risk of consumer price inflation that concerns me, what concerns me is global asset price inflation being greater than consumer price inflation- thus causing a continuous artificial transfer of financial power to the most wealthy. As Bill has pointed out on this blog deficits are not occasional expedients offset by following surpluses (if they were I would have not have this concern). Under the current (and any MMT type) set up, deficits are the usual course of action. When looked at globally (and money acts globally) each decade is in greater deficit than the previous – it is an ever escalating exponential situation. There is some current deleveraging that is temporally offsetting some of the input of high powered money by governments but that is just a minor correction in the course of a much greater general trend. Remember much of the cash may not be held by people in the USA or UK but much of the value is in the form of inflated assets held by people here (eg real estate, stocks etc). If the government spending was balanced by a wealth tax, assets would need to be sold to get hold of the cash to pay the tax. That would bring down asset prices to the point where yield rather than ponzi effects were what guided investment decisions.

In terms of it being pie in the sky stuff to address my concerns- I don’t think it is an all or nothing question. To my mind any step in the right direction would be a good one. If progressives were more focussed on moving taxes over towards a wealth tax to replace the current bunch of taxes then that would be a step in the right direction. Also progressives could be more thoughtful about asking for deficits. If what they want is fiscal stimulus, then they should ask for fiscal stimulus period -rather than specifying that it should be “unfunded” fiscal stimulus. What positive benefit do you guys think comes from not having the taxation? In the UK only £20M straight after leaving office by Landsdowne partners to reward him for his policy that New Labour were “extremely relaxed” about excessive wealth. Obama got much of his funding from Goldman Sachs- basically if a politician seems decent, the oligarchy just budget a bit more for the corruption fund :).

About your point “I also think your 32x savings scenario looks too extreme. Yes there are asset bubbles but much of the saving is paying down debt which is less malign. Surely the govt would have withdrawn its stimulus long before savings reached such a massive level, as the economy would be reaching full capacity.”-The point is that the 32x savings scenario would not lead to the economy reaching full capacity. As savings increase, the FIRE sector increases but sectors that are able to employ “the average Joe” do not. The FIRE sector is not grounded in the real finite world- it is the only sector that can expand freely as the amount of money expands. The few million people employed in Wall Street and the City of London will get paid ever greater amounts but that will get put straight into savings because those people are so rich anyway. The activities of the enlarged FIRE sector are actually counterproductive for the real economy so the 32x savings scenario entails worse unemployment and deprivation outside Wall Street and the City of London. Under MMT that would lead to further deficit spending and a worsening slide to a position where everyone not in the FIRE sector would be either administering the JG scheme or employed under it (or both).

Stone – you suggest that stimulus be provided in the form of increased spending AND taxation. The trouble with this is that whilst the increased spending is welcome (if properly targeted, unlike the recent experience) the taxation will have some multiplier effect too (even if one isn’t a “trickle-downer”), lessening the overall benefit. I think this means that to achieve the same level of stimulation as (targeted) deficit spending of say £100bn, your approach would need (targeted) spending and taxation both to rise by perhaps £200bn.

I agree we should be pushing wealth tax – and wheeling out Churchill’s 1909 speech on Land Tax – but in the short/medium term politically it’s far more realistic to simply push for deficit spending, and then hope to whack up tax progressively (incl Tobin tax) when the economy recovers.

This is why the Left is always so screwed – you and I presumably have close views on preferred distributional outcome in the UK but are diametrically opposed how to get there 🙁

Best wishes

I quoted you here. Nice analysis.