These notes will serve as part of a briefing document that I will send off…

“We need the state to bail out the entire nation”

Major developments across the globe in monetary and fiscal policy keep happening on a daily basis at present. We are now hearing conservatives, who previously made careers out of claims that government deficits would send nations broke and more, appearing in the media now claiming “We need the state to bail out the entire nation”. Not too many economists are pushing the line that the market will deal with this crisis. They all the want the state to be front and centre as their own personal empires (income etc) becomes vulnerable. In a normal downturn there is not much sympathy for the most disadvantaged workers who bear the brunt of the unemployment. Now it is different. This crisis has the potential to wipe out the middle classes and the professional classes. And suddenly, who would have thought – the nation state is apparently back, all powerful and being begged to intervene. It is wake up time. Now no-one can be unclear about the fiscal capacity of the state. They now know that politicians who claim they don’t have enough money to do things were lying all along. They just didn’t want to do them. And when this health crisis was over we have to demand that the governments continue to lead the way financially and work out solutions to the socio-ecological climate crisis. No-one can say there is not enough funds to do whatever it takes. We all know now there are unlimited funds. The question must turn to the best way to use them. I also provide in this post some further estimates of the labour market disaster that Australia is facing as part of the development of my 10-point or something plan. It is all pretty confronting.

In our book – Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World (Pluto Books, September 2017) – we traced the way in which the progressive political forces were duped by the conservatives into believing that the power of global financial capital had rendered the nation state virtually powerless.

The Left narrative for several decades has been that the nation state has to design policy interventions that ensure the financial markets are appeased for fear that the latter will stop funding the government and trash the currency.

As part of this surrender, the Left steadily adopted the mainstream macroeconomics story line and when in government have executed harsh austerity causing untold misery.

At present, the rundown of our health systems via privatisation, cost-cutting, under-resourcing, user-pays, etc is starting to pay all of us back in quite stark terms.

The Left politicians rehearse the familiar mainstream macro myths:

1. Fiscal deficits push up interest rates and crowd out private investment.

2. Deficits run up unsustainable public debt which mortgages our childrens’ futures.

3. Deficits cause inflation.

4. Central banks cannot fund government deficits or else hyperinflation results.

5. Governments cannot promote growth and create employment.

6. Income support provided by the government undermines private incentives and subsidises unemployment.

7. Essential infrastructure should be provided by the private sector.

8. The banking system should be deregulated because financial markets are efficient (always put funds into best value use).

9. The private market (price system) will always deliver outcomes that generate the most wealth for all.

10. Rising inequality does not undermine growth and prosperity.

I could go on.

The Right has actively promoted these myths through think tanks, the production of regular ‘reports’ coming out predicting all sorts of doom, the outlays of billions by lobbying companies aimed at influencing political choice, the manipulation of the media, etc.

The daily cacophony promoting this sort of narrative that comes out of organisation such as Fox News and its counterparts is beyond belief.

I wrote about the roots of this strategy in this blog post (among others) – The right-wing counter attack – 1971 (March 24, 2016).

And along the way, the Right have been merrily reconfiguring the nation state in its own vision – using the legislative and regulative capacities that only the nation state possesses and only the nation state can implement.

As we show in the book, all the major shifts that we associated with neoliberalism have been engineered through the state – with the state as a means – willing or otherwise.

The neoliberal report card reads like a horror story. I presented this assessment during presentations in early January 2020:

- Income and wealth inequality rising.

- Precarious work with flat wages growth.

- Elevated unemployment and underemployment.

- Private debt levels unsustainable.

- Education and training systems degraded.

- Public services and infrastructure degraded.

- Regions and communities are being left behind.

- Indigenous poverty is unresolved.

- Governments with ‘surplus’ obsessions.

- Social and environmental failure.

And now we can add a massive global health crisis interacting with ill-equipped health systems, sabotaged because for years policy makers have been taking advice from my profession and transferring billions of public funds from health care for all to private health providers who are among the most profitable corporations around.

It is wake up time.

This morning while I was listening to the news (and stretching after exercise) and American commentator who had previously worked for a leading Republican presidential candidate said:

We need the state to bail out the entire nation …

Can you imagine any person, much less a conservative hawk, saying this two months ago?

And overnight, the Financial Times published an Op Ed from former ECB boss, Mario Draghi (March 25, 2020) – We face a war against coronavirus and must mobilise accordingly – where he said:

The challenge we face is how to act with sufficient strength and speed to prevent the recession from morphing into a prolonged depression, made deeper by a plethora of defaults leaving irreversible damage. It is already clear that the answer must involve a significant increase in public debt. The loss of income incurred by the private sector – and any debt raised to fill the gap – must eventually be absorbed, wholly or in part, on to government balance sheets. Much higher public debt levels will become a permanent feature of our economies and will be accompanied by private debt cancellation.

And, also overnight, the current management of the ECB received a legal ruling (dated March 24, 2020) – DECISION (EU) 2020/440 OF THE EUROPEAN CENTRAL BANK – that said:

1. The “pandemic emergency purchase programme (PEPP) … will be separate from, and in addition to, purchases carried out under the APP …”

2. “For purchases under the PEPP of eligible marketable debt securities issued by central, regional or local governments and recognised agencies, the benchmark allocation across jurisdictions of the euro area will be guided by the key for subscription of the ECB’s capital as referred to in Article 29 of the Statute of the ESCB.”

3. “the Governing Council also decided that to the extent some self-imposed limits might hamper action that the Eurosystem is required to take” and “the consolidated holdings under Article 5 of Decision (EU) 2020/188 of the European Central Bank (ECB/2020/9) (1) should not apply to PEPP holdings.”

This is legal speak for abandoning the 33 per cent issuer limit rule. It no longer applies. There are no longer any financial limits on the volume of Member State debt instruments the ECB can buy.

4. “public sector marketable debt securities with maturities shorter than those purchased under the PSPP will also be purchased under the PEPP.”

So the ECB can now target shorter debt maturities than previously.

5. “the Governing Council decided that marketable debt securities issued by the central government of the Hellenic Republic will be eligible for purchases under the PEPP.”

Under the previous bond-buying schemes, the ECB did not purchase Greek government debt.

It can now buy unlimited quantities of it. Now it is over the Greek government to issue the debt at low yields (which the ECB decision now guarantees) and help its ailing nation, sacrificed for a decade by the European Commission insistence on austerity.

So while Mario Draghi is saying that there will have to be “a significant increase in public debt” what the ECB decision means is that the debt will be held by the ECB (after buying it in secondary markets after the primary issue).

And has I point out to financial market commentators and journalists who express fear that central banks will just (in their words) be out there monetising the government debt (or, again, in their words, “printing money”), the reality is that since the GFC, and, for Japan, since the 1990s, central banks have been funding government deficits without none of the consequences that the mainstream macroeconomics teachers claim would follow.

The balance sheets of several central banks reflect this.

And, the financial markets cannot get enough government debt and are not about to kill off the ‘goose’ (golden egg).

I said in an interview yesterday that I would rather see this process made more transparent by eliminating the ‘middle person’ (the bond markets), who are reaping profits via the capital gains arising from the QE programs.

In other words, the central banks should dispense with the secondary bond market purchases and dispense currency on behalf of the government where instructed.

If you want some accounting trail then the central bank could record a ‘debt entry’ on its balance sheet. And then they could go through the routine of transferring funds from the right pocket of government to the left pocket and pretend it is independent.

The interesting thing for Europe now is how it deals with the obvious fiscal demands.

Articles 121 (multilateral surveillance) and 126 ( excessive deficit procedure) of the Treaty on the Functioning of the European Union (TFEU) lay down the “legal basis of the stability and growth pack (SGP)”.

Protocol No. 12 of the Treaty of the European Union covers the Stability and Growth Pact rules.

More detail appears in Article 136 – it “provides for specific provisions to be adopted for the euro area. It is the basis for a sanctions regulation for euro area countries (included in the so-called six pack) and the so-called two pack regulation, which includes enhanced monitoring and surveillance in the euro area.”

However, the – Resolution of the European Council on the Stability and Growth Pact – adopted on June 17, 1997 at its meeting in Amsterdam allows for deviations from the rules where:

… there are special circumstances …

The European Council Regulation (EC) No 1466/97 (published July 7, 1997) – outlined the “strengthening of the surveillance of budgetary positions and the surveillance and coordination of economic policies”.

In Section 3(b), we read:

Similarly, the deviation may be left out of consideration when it results from an unusual event outside the control of the Member State concerned and which has a major impact on the financial position of the general government or in case of severe economic downturn for the euro area or the Union as a whole, provided that this does not endanger fiscal sustainability in the medium-term.

So the European Commission should immediately follow the ECB’s lead and instruct Member States to ‘do whatever it takes’ in terms of fiscal policy and ignore all the rules that have stifled prosperity since the Eurozone was formed.

They can safely allow Member States deficits to substantially increase knowing that the ECB will be able to buy all the debt released to the bond markets.

Some nations will require deficits of more than 20 per cent of GDP, given that they entered this crisis with substantial residual effects of the GFC and the subsequent austerity and are experiencing a disastrous health calamity – Spain, Italy and other nations.

What this means for the “medium-term” will be interesting.

The mentality of the European Commission will start making excessive deficit mechanism noises to early in any recovery cycle.

The scale of this crisis is beyond our historical imagination. Deficits will remain high for years to come and governments will have to improve health systems, depleted by the years of austerity.

Many businesses will never return and so it will take time for new employers to enter.

As Mario Draghi wrote in the FT article:

The priority must not only be providing basic income for those who lose their jobs. We must protect people from losing their jobs in the first place. If we do not, we will emerge from this crisis with permanently lower employment and capacity, as families and companies struggle to repair their balance sheets and rebuild net assets.

This will require more than some cheap loans or postponing tax obligations, which is where the European governments have been heading so far.

It needs a huge and immediate liquidity injection.

It needs rent and mortgage protection.

Cheap loans will not be effective because firms are unlikely to draw on them in the face of a massive drop in their sales volumes.

Clearly, though, the governments should underwrite all outstanding debt at present.

Whether all this sinks the EMU remains to be seen. It should.

Some thoughts about Australian unemployment

On Monday, I will expand on this analysis.

I just did an ABC News Radio interview where I was asked to speculate on the likely impacts on unemployment in the coming period.

I have been running some econometric equations (Okun-type models, which I published a lot about some years ago) and forming some rules of thumb to guide my thinking about the scale of the unemployment crisis.

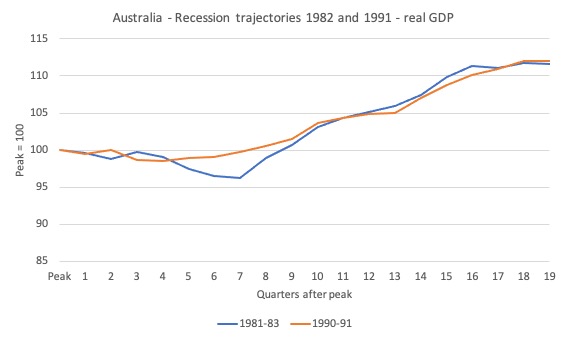

If you go back to the last serious recessions Australia endured (1981-83 and 1990-91) you get a feel for what happened in the labour market.

The following graphs shows the evolution of real GDP from peak out 5 years (20 quarters) in each episode.

They were roughly similar events although the trough in 1982 was much deeper.

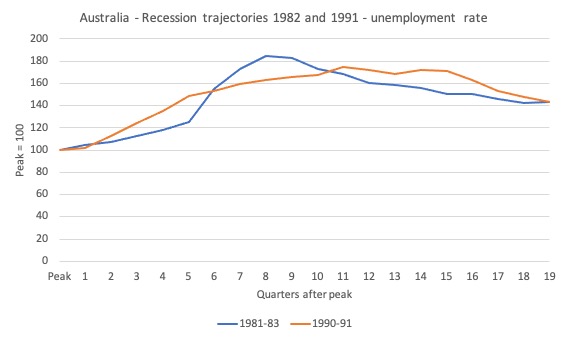

The next graph shows the evolution of the unemployment rate over the same period (indexed to 100 at the low-point before the downturn). The rise in unemployment rates continues after the trough in real GDP has been reached.

Firms do not immediately rehire workers as they make do until the recovery gains sufficient strength.

In the 1982 recession, the unemployment rate kept rising for one quarter after the GDP trough, whereas in the 1991 recession, it kept rising for a further 6 quarters (1.5 years) after the real GDP trough.

The following table summarises these shifts:

| Period | GDP contraction (peak to trough) % | Increase in UR to peak (points) |

| September 1981 to June 1983 | -3.71 | 4.69 |

| June 1990 to June 1991 | -1.43 | 4.71 |

If you average the percentage point responses of the unemployment rate for each percentage point contraction in GDP (including the period after the trough when unemployment rates keep rising) you get a rough rule of thumb that:

For every 1 per cent that GDP contracts, the unemployment rate rises by 2.5 percentage points, which given the current labour force would add 304 thousand workers to the unemployment queue.

There are cyclical effects on participation etc that are not included in these types of estimates.

The following Table, which I will elaborate on next Monday summarises the impacts. We started this crisis with 720 thousand unemployed and an unemployment rate of 5.2 per cent (that is, in a much worse state than the period leading into the GFC).

We also have much higher underemployment now than we had then.

| Fall in GDP (per cent) | Rise in UR (points) | Estimated UR (per cent) | Unemployment (000s) | Change in Unemployment (000s) |

| 1 | 2.3 | 7.5 | 1,024 | 304 |

| 2 | 4.5 | 9.7 | 1,335 | 615 |

| 3 | 6.8 | 12.0 | 1,647 | 927 |

| 4 | 9.1 | 14.3 | 1,958 | 1,238 |

| 5 | 11.4 | 16.6 | 2,269 | 1,549 |

| 6 | 13.6 | 18.8 | 2,580 | 1,860 |

| 7 | 15.9 | 21.1 | 2,892 | 2,172 |

| 8 | 18.2 | 23.4 | 3,203 | 2,483 |

| 9 | 20.5 | 25.7 | 3,514 | 2,794 |

| 10 | 22.7 | 29.9 | 3,826 | 3,106 |

I will leave these figures for today so that the journalists who have been calling me over the last few days have something concrete to go on.

If the downturn is as bad as the 1982 recession then 1.2 million extra unemployed workers will be added.

However, one current estimate (not mine) is that GDP will contract by 8 per cent. Then you are talking an extra 2.5 million workers becoming unemployed.

As I have been telling journalists the last few days, the current stimulus offered by the Federal government is probably to small by a factor of 3!

They can certainly minimise the rise in unemployment if they offer adequate income support and engage in large-scale job creation.

Conclusion

There is a massive need for job creation interventions and income support.

The government should announce it will pay the wages of all workers displaced, provide a guaranteed income to those who are unable to work but have nominal commitments such as rent, mortgage payments etc so there is no housing dislocation.

And more …

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

There’s also another unmentioned consequence of the neoliberal blinkers – QE’ing government debt removes income from the private sector. How are pension companies going to pay pensions without it?

Currently we are seeing dividends cancelled, rent payments withheld, government debt bought up – driving down yields and “compulsory pension contributions” (aka tax collected by the private sector to pay pensions) disappearing as wage flow collapses.

How long before there is a crunch in the pension payment system? How long can they handle new vesting – when there is a crunch lots of people decide to retire?

The state is going to struggle to get ‘volunteers’ to work unpaid if the pension payment system goes belly up…

Dear Professor- most of us already know this ongoing tragedy and proposed government responses clearly show MMT has been right. But please if you have advice please give it as soon as possible. As in tomorrow or the next day. Maybe you could shorten it to an 8 point plan and post it on Sunday. I’ve already been calling my Senators and Congressman and telling them what they should do according to what I have already learned- well their answering machines actually. But it couldn’t hurt if I had some guidance here. I know this is a lot to ask but I am asking anyway. This is some pretty serious shit we are all in.

Dear Bill,

I was wondering if you had come across this announcement from the BoE yet:

https://www.bankofengland.co.uk/markets/market-notices/2020/apf-asset-purchases-and-tfsme-march-2020

“APF: Operational mechanisms

The Bank will participate in the secondary market for gilts and corporate bonds by holding reverse auctions.

With respect to corporate bond purchases, the Bank reserves the right to carry out secondary market purchases via other methods, such as bilateral purchases, should it be deemed necessary. ****The MPC will keep under review the case for participating in the **primary** market.****”

My emphasis, though not my discovery – it was publicised in an FT Alphaville post behind a paywall, and I came across it via Murphy’s blog, but although not yet implemented, the very fact that the BoE is acknowledging that there is even “a case” for buying Gilts *directly* from the Treasury – thereby effectively allowing the government to run an overdraft directly at the BoE, without going through the rigmarole of selected primary dealers buying them first – has to mean that the game is up as regards “keeping markets happy”, or having to fund the CV crisis splurge with “borrowing”.

What is your take, may I ask?

Best, Mr S.

@ Neil W,

Very interesting observation. Yet another plank in the neo-liberal structure starts to fail…

The whole private pension scam needs to die – to be replaced by a significant uprating of the UK State Pension, to the sorts of levels seen in other, equivalent, European nations.

I’ve said all along QE was more about sucking interest income out of the economy via the interest income channels to control inflation in a down turn.

Madness.

If you have not seen it yet.

Nathan Tuskas has done a superb article on the FED moves over the last 2 weeks. What they have actually done and what they really mean.

“And when this health crisis was over we have to demand that the governments continue to lead the way financially and work out solutions to the socio-ecological climate crisis. No-one can say there is not enough funds to do whatever it takes.”

Unfortunately, it’s possible to predict the narrative. They will deploy the “we need to balance the primary balance over the lifecycle” narrative.

They will say that government can spend a lot but only if it’s eventually balanced in the future.

For example, in Greg Mankiw’s “A Proposal for Social Insurance During the Pandemic”, he proposes to spend a lot (“Let’s send every person a check for X dollars every month for the next N months”) and to surtax later, at least the amount spent.

I love the ideia that the contradictions in the mainstream thinking are mounting to the point of making it crumble, but, unfortunately, I think we are a long, long way of it’s demise.

‘ Now no-one can be unclear about the fiscal capacity of the state. They now know that politicians who claim they don’t have enough money to do things were lying all along. ‘

This might be way too optimistic, Bill. Reading BTL comments on various media blogs, the usual stuff is being parroted out. Here’s an example from Martin Kettle in the Guardian;

‘But what is true during a crisis is not necessarily true or desirable when the crisis is over. The NHS needs whatever it takes in a crisis, but at other times health service spending is as long as a piece of string and there has to be a cut-off point, if only to allow spending elsewhere. The borrowing that may or may not save the economy from recession in a crisis will also have to be paid for when the crisis is over. ‘

The nonsense never stops. I keep posting on blogs to challenge this stuff but it’s a drop in the ocean. You also keep hearing nonsense like Corbyn would have turned the UK into Venezuela but when the Tories spend it’s somehow different!

Belief systems are too hard-wired-in any case the justification for Business as Usual after Covid-19 will be the usual ideology about wealth creation by the ‘top end of town.’

Not sure what the situation is like in other countries but here in the UK there is a massive cock-up with Supermarket food delivery slots often unavailable for three week stretches. I’m at present trying to help, from a distance, my 88 year old mum and another vulnerable friend.

Latest effort to register with a centralised delivery service (Ocado) put me nearly 200,000th in a virtual queue!

The need for drivers and pickers should have been sorted out when people were exiting other hospitality and service jobs-instead we’ve got a massive number signing on (or trying to!) with Universal credit. Instead there was a total focus on a volunteer army when jobs should have been made available at supermarkets. The delivery bottleneck is as bad as about a week ago!

Brewery and P*ss up anyone?

Just read that Bozo (aka ‘Johnson’) is now talking about 750,000 volunteers while about half a million are trying to sign on Universal Credit with the site crashing and not enough staff to deal with it.

Dear me!

WASHINGTON (AP) – Nearly 3.3 million Americans applied for unemployment benefits last week – more than quadruple the previous record set in 1982 – amid a widespread economic shutdown caused by the coronavirus.

Serious stuff going on and none of it good even if it proves MMT correct eventually.

One of the most important things Bill has taught me is that the economy is our created thing that serves us people- not ‘we have to sacrifice ourselves for the sake of the economy’. Even as this virus thing continues to get worse in America, it is amazing how many people are saying things like ‘we have to relax our health policies so the economy won’t suffer too much’. It is just mind boggling. I just can’t believe it anymore.

@Jerry Brown-that Texas lieutenant Governor(?) chap exemplified that (was his name Dan Patrick?), It seems in America, dying for the economy is some sort of cognate of Patriotism.

Even in a fairly Right Wing UK that would never have been acceptable (unless, maybe for welfare claimants-always expendable). In America it seems to get lauded by certain sectors.

In ‘Good Ole Blighty’ we’ve got the pucker British Spirit of volunteers that has to run around filling in the gaps left by neo-liberalism .

I don’t know Simon. Texas is probably as far away from me as Spain is from you with just as many people living in between. And generally I try to avoid listening to what Texan politicians say when I can.

But yes, you might be right about Americans expectations of sacrifice for the economy in general. And it is disheartening.

One of the electoral stories in use during the last few decades has been about the Tough, No-Nonsense Leader who will Stand Up and make the Hard Decisions. Pols will invoke wartime leadership to try to hook themselves to that story. Life-or-death, and all that. A bullshitter might calculate that pretending to be Napoleon is his only chance.

Being the pessimist I am I don’t believe anything will change for the better after the pandemic subsides. There will be calls for a new round of austerity to pay off the debts created and the stupid British will applaud Boris for his handling of the crisis. Neoliberalism will last for ever. The people who have done all the hard graft will be castigated just like the firefighters at 9/11 and gongs will be dished out to celebs and so forth for their efforts that we will eventually discover were crucial in the fight against coronavirus. Hunger Games will look like a picnic. Even now when Corbyn speaks the truth there are voices in his own party telling us how awful he is. Yes, the Labour Party is truly dreadful but the problem isn’t Corbyn. The problem is that there is hardly a radical MP in the party.

Bill,

I’m afraid Rod White will be proved correct.

Don’t underestimate the power of the British people to blithely go down with the vessel. And he is right about the lack of real Socialists in the British Labour Party.

The only good thing is I scored 8/10 for the first chapter of your ‘Macroeconomics’ textbook!

Give me a couple of years and I won’t feel like I’m way behind all the experts who regularly send you their comments. Mebbe. Keep on giving us your regular comments – I’ve not seen anything I disagree with yet.

Dave Kelley.

Jerry, I know what you’re thinking and feeling when you write: “Serious stuff going on and none of it good even if it proves MMT correct eventually.” Short-term, some “serious stuff” is certain to go on, and if we limit ourselves to the perspective of the immediate, we can easily become paralyzed and blinded by fear and uncertainty. That’s only human, and I’m as human as anyone else. But, I also believe that this crisis obliges us, compels us, to take a serious look at the bigger picture, this whole Gerbil Wheel neoliberal world order, ecocidal in trajectory, which we have created and have had to endure (or succumb to) for the last several decades, a story compellingly told in “Reclaiming the State.” As Bill’s post indicates, the truth of MMT, the accuracy of its macroeconomic lens, is becoming more and more obvious to those on the right as well as on the left. Here in the States, for example, some 13 or 14 TRILLION dollars are being created out of thin air to bail out the big banks and stave off a worsening of the financial crisis. Inevitably, the question will soon arise in many minds, perhaps in most minds, about whether an equivalent investment of fiat money will be made to rescue people–ALL people, their personal lives, their homes, their small businesses, etc.–and not merely the major financial institutions. Bill has been hammering on this point in his latest posts, and it can’t be hammered on enough. Suddenly, unexpectedly, a window has opened to acknowledge the existence and power of fiat money and to use it wisely and humanely not only to rescue society but to vastly improve it, to make things, as Bellamy puts it, serve people instead of people serving things. The more beautiful world our hearts know is possible (Charles Eisenstein’s phrase) is crying out to be born right now like a nine-month-old baby in the birth canal. Yes, there will be substantial pain involved, and great anxiety, as always accompany a new birth. But after the birthing crisis has run its course, something new and beautiful has entered into existence, and, in retrospect, we wouldn’t have had it otherwise. Let all of us who understand the axioms of MMT assist however we can in making certain that this new, more beautiful world is born, not stillborn. Yes, we’re all naturally scared to hell right now–I, too, have my moments of panic and despair–but let us do our utmost to gather our hope and courage and vision and rise to what may well turn out to be humanity’s greatest and noblest challenge since we crawled out of the trees.

“They all the want the state to be front and centre as their own personal empires (income etc) becomes vulnerable.”

It has always made me laugh why more of those who would actually benefit the most from fiscal deficit spending (i.e. neo-liberals and property owners) are the ones who always push against it. Surely they know that when money stops circulating, then other than taxes, it’s only place it can park is in the hands of landlords, business owners and creditors (savers/lenders etc) making them wealthier. Maybe they are just as ignorant on how the monetary system works as everyone else. But if the ones who stand to benefit the most from deficit spending are the ones pushing against it, then who is it that is manipulating them to believe this? Who benefits from teaching people to stop the circulation of money and to accumulate it? Maybe the real conflict is not between property owners and the working class, but in fact is between property owners and property owners (and the working and lower class are just the poor by-standers who get smashed a result of this conflict)? Maybe the real reason we have business cycles is because property ownership itself becomes over-crowded and the dumb money needs to be pushed out from time to time. From a legal perspective, it is certainly not possible for everyone to be a property owner and to own more than they owe. This is in fact mathematically impossible; the West operates on balance sheets. It has certainly become apparent to even the most hard nosed that the goose that lays their golden eggs was never the workers themselves, but the money in the system and this never comes from the workers directly (they can’t make money). Oh west, what a web we weave.

@ Andre,

“For example, in Greg Mankiw’s “A Proposal for Social Insurance During the Pandemic”, he proposes to spend a lot (“Let’s send every person a check for X dollars every month for the next N months”) and to surtax later, at least the amount spent.”

At any positive tax rate, and assuming no-one saving any of that money, every penny of the extra spend will eventually “return” to the government in taxation in the normal way, if that’s what he’s worried about.

So why the need for a *surtax*?

That would remove *more money* from the economy than they’ve just spent – which is the very last thing we’ll need, having finally survived the onslaught. Thanks a lot, Mankiw!

I agree that the political and economic system will not collapse or change significantly as a result of coronavirus pandemics. Maybe instead of allowing 1% deficits in the EU they will allow 1.1%. All the stimuli everywhere are primarily designed to preserve the status quo, to prevent the so-called destruction of wealth of the upped middle class and the 1% (mostly stored in the form of equities and financial products).

What will happen after the crisis? For example the money laundering casinos in Sydney and Melbourne – should’t they be banned once and for all and their cavernous buildings converted to creative arts centres? Shouldn’t all cruise ships be converted onto artificial reefs to support fish? No, these are essential components of our post-industrial economy, the generators of employment for the lower class and wealth for the rich.

I believe that the next stage of the crisis has been correctly identified by Marx – it is the crisis of the specific post-industrial capitalist mode of production. It is also related to excessive accumulation of capital but not in the way so-called Marxists think. Not the productive capital but fictitious and money capital. The most striking example of fictitious capital are shares in loss-generating corporations who only have so-called intellectual property and some position on the market. They are as worthless as bitcoin but people who have too much money to spend on consumption or productive investment keep bidding higher and higher for these tokens. Not to mention the housing bubble, which is actually the residential land value bubble. At least here in Australia this may finally burst – 12 years late. A lot of people will cry…

Has the emergence of coronavirus changed this paradigm? No, it is just a temporary and limited setback. Trillions of dollars earmarked for the fiscal intervention have halted the fall of the stockmarket. Deficit spending not directed to sustain the workforce only conserves the current system. The rate of profit calculated against total capital falls quite nicely in the long run. Because profits are an almost constant (slowly rising) fraction of the GDP while the stock-flow ratio of aggregate wealth to GDP keeps rising.

But this crisis is a turning point because we can clearly see that the Western globalised post-industrial capitalist mode of production is no match to Eastern state capitalism / “Socialism with Chinese characteristics” mode of production in terms of benefiting the whole society.

They can stimulate and deficit-spend in the US as much as they want. Unless the so-called wealth (capital) is removed from the hands of the 1% (allowing for bankruptcies and implementing proper taxation of the stock of wealth), the underlying mechanism remains the same. Once the dust settles we will see which civilisation emerges virtually unscathed. The American neoliberal ideology dies slowly in the same way Soviet Marxism-Leninism died before 1991.

Newton Finn- Thanks.

@ Dean,

“It has always made me laugh why more of those who would actually benefit the most from fiscal deficit spending (i.e. neo-liberals and property owners) are the ones who always push against it.”

Absolutely! That one stumped me for a while.

But you know that one kid at nursery school, who would grab all the toys for himself, and wouldn’t share.. no matter how many he already had, or that there were none left for the other kids?

Well, that’s your (psychopathic) oligarch, CEO, billionaire, whatever…

For some twisted people, enough is never enough – they want it all.

As Gore Vidal famously said, “It’s not enough to succeed; others must fail!”

A decade ago I thought we had it in the bag – but we lost.

We lost because as sociologist Mark Bahnisch pointed out at the time “there is currently no broadly-accepted alternative socio-economic narrative for people to turn to. ”

And as we all know, he was right.

A decade later in the thralls of what looks to be shaping up as an even worse crisis on all fronts, has this changed?

No it hasn’t. MMT awareness has made great strides in professional and academic circles and among politically-motivated laypersons – but the public at large are as deaf as ever. We simply cannot imagine anything different to what we have now.

I have always argued that the fundamental facts that MMT exposes are utterly counter-intuitive to the average person. The realities of the day-to-day lives people lead essentially vaccinates us against absorbing the truth.

So I’m unsure as to what it will take for the truth to become broadly accepted.

In somewhat more encouraging news, unions in Australia are calling for………” bringing “public goods” back into public ownership, including energy, health, telecommunications, transport and early childhood education.

RELATED ARTICLE

Simon Crean, who served as a minister under four prime ministers and helped negotiate the Accord, has praised collaboration to help workers cope with coronavirus.

CORONAVIRUS PANDEMIC

Unions and employers racing to strike job-saving deals

Add to shortlist

“Public ownership should not return to the old top-down institutions of yesterday but come with a role for workers and customers in the democratic management of such institutions.”

One third of all board positions in firms bailed out by the government should go to non-managerial staff, Mr Kennedy said.

As part of its sweeping series of demands, it wants to direct stimulus spending to new renewable energy generation and building capacity to be able to export hydrogen on a large scale.”

To spend it now and tax it back later is a crock of sh*t. For many reasons.

1] The money will go round and round and end up mostly in the hands or bank accounts of the rich, but they will not be the ones who are taxed to pay it back. The poor have food and things bit not the money. They can’t pay the taxes to pay it back.

2] It sounds like lending. The Gov. will give a poor person money now to live and then demand it back later. But the poor will not have it later, the rich will.

3] People work for money to buy stuff & food. Paying them more now with the promise to demand it back later will not motivate people to work for more now. Why is it different when the Gov. has to just give money to people to live while the virus is raging? It seems totally dishonest.

Like I said, a crock of s**t.

Unless what is done is to *just* tax it back from the rich *only*. But, this will not happen.

Steve_American

To reply to those who doubt that progressives will be able to turn society\culture around —

Have no fear. It will happen. Ecocide will happen if we don’t change course very, very soon.

After the ecocide, things will be different. I’m positive. Either we will all be dead or a new culture will emerge. There is NO WAY the old culture can survive the ecocide.

At the moment I give the odds of the ecocide coming to pass at 9 out of 10. We have a 10% chance of turning the culture around before it is too late. Last year I thought it was a 30% chance and 2 years ago a 50% chance.

The world will go on. Almost for sure life will go on. Hopefully humans will survive somewhere to start over, hopefully. I can’t say I expect humans to survive somewhere if the ecocide happens. But, I can hope.

Human can be very dumb in mass. After Martin Luther, Europe fought wars for 288 years over which type of Christianity was going to be allowed to go on. The Prince of Peace’s religion fought for 288 years (for 13 generations, 4 complete lifetimes) before they gave it up and agreed to live together in Harmony if not Love.

Hi Bill,

I would love to hear your thoughts on a rentier freeze.

As I read your post, you recommend subsidising payments to landlords and debt holders while the crisis lingers on. How about limiting the cash outflow instead (or as well)? Do you reckon this is too optimistic in a capitalist economy? This seems to be Pavlina Tcherneva’s view, while Eric Tymoigne has advocated a debt payment pause.

Best wishes,

Asker

Steve_American wrote:

“People work for money to buy stuff & food. Paying them more now with the promise to demand it back later will not motivate people to work for more now’

I like the JG. Eliminates poverty. After that, for the rest of us, it’s a matter of cutting down on consumption of junk eg grog. drugs, junk food, in order to engage in one’s true interests consistent with income.

https://jackrabbit.blog/2020/03/flatten-the-curve-a-prescription-for-failure/

“Most people assume that “Flatten the curve” means spreading the greatest impact over a few months instead of a few weeks. But Joshua Bach has shown that the curve can never be flattened enough. The flattening would have to be years long. And by that time the virus will probably mutate (just as seasonal influenza virus does). We already know that this coronavirus mutates quickly.”

“China, South Korea, and other countries aren’t trying to “flatten the curve” – they are trying to terminate the virus spread altogether. So why hasn’t the US/West set the same goal?

In a word: neoliberalism and disaster capitalism.

Western Drug companies hope to make a bundle with expensive drug therapies and illusive “vaccines” (vaccines that may have to be re-jiggered and re-administered from time to time just as the seasonal flu shot is). We previously wrote about this government-assisted profiteering.”

“Trump is already pushing to return people to work. An ongoing disaster that mostly kills the old and infirm is not something that concerns capitalists much. Insurance companies can save money on expensive healthcare for the elderly and drug companies can make tons of money via drug treatments.

Why is “Flatten” a Failure?

Even if we could flatten the curve sufficiently, most of those who are “saved” by having a ventilator would suffer pulmonary fibrosis – a scaring of tissue in the lungs that destroys lung capacity and makes the victim susceptible to dying of other harmless diseases.

These people are ‘at risk’ and many of them will need ventilators to survive any future ailment. And their quality of life would be far worse than it was before they got Covid-19.”

https://medium.com/@joschabach/flattening-the-curve-is-a-deadly-delusion-eea324fe9727

As Richard Nixon once said “We are all MMTers now!”

Well, living in a Eurozone country I’m trying to shock the locals into understanding that the one trillion euros of spending the ECB announced last week can only possibly, physically, have been manufactured by the ECB for the obvious reason that there’s nowhere else for it to have come from.

No idea if I’m making any headway – but I have convinced my wife (i think).

Also that all talk of borrowing to shore-up (mainly small) local businesses with no customers, enable people to stay in their homes even if they can’t pay their rent. and so on is bunkum; that no borrowing whatsoever is actually necessary because the ECB has guaranteed to underwrite *whatever it costs* to preserve society through this crisis.

Incidentally it has struck me that the EU may have crossed the Rubicon this week.. For the very first time since Maastricht the EUs governing organs have behaved as if they were the de facto federal government of a federated Europe. SFAIK there is no legal provision in the treaties for them to do this (in fact it drives a coach and horses through the Stability and Growth (ha, ha) Pact’s reason for existence – which is precisely to prevent this from happening.

It’s going to be fascinating to see how this plays out when unwinding time comes – especially what Germany does.

It also shows what was written in the side of the red bus was true regarding the NHS. It always was true.

Make sure you explain to all the fools who read the Guardian this simple fact.

The number on the side of the bus could of been bigger if there are enough skills and resources to absorb it.

It also exposed the lies of the Brexit debate in full.

We created all these blips on a balance sheet without being a member of the EU or EFTA

How are EU countries getting on finding the blips when Germany and Holland can simply say NO.

If voters in the EU wake up the project is over and long overdue if you ask me.

It seems Donald Trump is going to kneecap a Republican congressman Massie raising the question of “unsustainable public debt”. Who is a Russian spy in this movie?

“This is $2 trillion, divide $2 trillion by 350 million people – it’s almost $6,000 for every man, woman and child. I’m talking about spending. This won’t go to the men, women and children. So if you have a family of five, this spending bill represents $30,000 of additional U.S. national debt because there is no plan to pay for it.”

It looks that Trump understands quite well how things work and public debt is here to be ignored. This proves that he is not a Russian spy as Vladimir Putin has clearly demonstrated his ignorance in this matter.

“Looks like a third rate Grandstander named @RepThomasMassie, a Congressman from, unfortunately, a truly GREAT State, Kentucky, wants to vote against the new Save Our Workers Bill in Congress. He just wants the publicity. He can’t stop it, only delay, which is both dangerous & costly. Workers & small businesses need money now in order to survive. Virus wasn’t their fault. It is “HELL” dealing with the Dems, had to give up some stupid things in order to get the “big picture” done. 90% GREAT! WIN BACK HOUSE, but throw Massie out of Republican Party!”

On UK front, it looks that being an obnoxious fool does not protect from the virus.

OMG! Trump has gone mad – he’s turning into a communist!!!

“After many delays, and then a series of tweets earlier today, US President Donald Trump is invoking the Defense Production Act to compel General Motors to built ventilators for hospitals, he announced at the White House’s daily coronavirus briefing, he announced at a White House briefing.

The Defense Production Act gives the president powers to direct domestic industrial production to provide essential materials and goods needed in a national security crisis.

It allows the president to require businesses and corporations to prioritize and accept contracts for required materials and services.””

What is he thinking!!?? Everyone knows that if governments just stay out of the way, private markets will most efficiently allocate all the resources needed in just the right amount at just the time in just the right way so as to have the world breeze through this little hiccup no problems.

At least, that’s what the past 40 years should lead us to believe, right?

NZ NEEDS HELP!

Please help me Bill. NZ officials are discussion the UBI. It will be set at a poverty level of $200 per week when my rent here in Thames is $400 per week. The wealthy establishment is welded down pretty tight with railway-strength thermite welding. Not one single commentator, official, politiion, media celeb has even mentioned JGS in passing. Pretty sure NZ did have a govt JGS in around 1930.

Please help me Bill and anyone interested in the land of sheep stuck in Group Think. As an unemployed academic (Engineering), I want to keep learning and teaching (active practice). Anyway we can set up a satalite of CoFEE?

Leftwinghillbillyprospector said:

“No it hasn’t. MMT awareness has made great strides in professional and academic circles and among politically-motivated laypersons – but the public at large are as deaf as ever. We simply cannot imagine anything different to what we have now.

I have always argued that the fundamental facts that MMT exposes are utterly counter-intuitive to the average person. The realities of the day-to-day lives people lead essentially vaccinates us against absorbing the truth.

So I’m unsure as to what it will take for the truth to become broadly accepted.”

I have been thinking a lot about this lately. Economists, including Bill (and no disrespect intended here) don’t connect with the average people. Average folks simply do not buy books on economics nor have any interest in the subject. It’s like law. A mind numbing subject to say the least.

Last year I read an article by an Australian economist or academic of some sort, who demonstrated by use of a graph the ratio of wages to GDP, and how it has been on a steady decline since the 80s, and that it was now at levels not seen since end of WW2. Since the article it has gotten worse. I try to explain to people I talk to that workers in aggregate can only purchase just over 50% of what they produce with the wage they received to produce it. This always comes back with a confused look. The whole idea that we are taught, that if you work hard you will be rewarded is clearly not true if we must give up half of what we produce to government and property owners.

The question is – how do we word such a statistic in such a way to make people realize how much of their productive capacities is taken by governments and property owners?

What is ironic however, is that a lot of people do become fed up with it (I am bitterly fed up with risking my life and limb every day for what feels like nothing), and they envy the rich and wealthy which prompts them to follow suit, i.e. to accumulate property; but the more of us who become property owners (owning homes, investment houses, stocks, super etc) the greater must be the portion of our productive capacities that goes to feed property owners, i.e. the more of our income is taken by property owners and government. But the problem is that, property ownership is not actually necessary if more people had more disposable income. In other words, if I had more of my income to spend on myself then I would not feel the need to pursue property ownership. I also see trust and bonds with people as a true investment for my future as opposed to property.

This is the great dilemma the average person faces. We are pursuing property ownership as a result of insecurity, but this pursuit only perpetuates and makes worse the cause of the insecurity.

If the world truly operates on cycles as some suggest, it appears this cycle is heading into its final lows – a lot of people are going to lose a lot of wealth and property, but this is going to have to take place if workers are ever going to see wages rise and have more disposable income to spend and feel less insecure and therefore have less need to save and invest. It is inevitable I think.

Bill Mitchell and MMT! Correct all along! But then we who use logic (and human feeling) knew this all along. Must be wonderful to be 100% vindicated Bill! Congrats!

“It will be set at a poverty level of $200 per week ”

That’s not a UBI. That’s just another version of Tax Credits with a different tax structure and we know how they work. They reduce overall productivity while strengthening the private market influence – since you still need “a job” to make the rent.

A UBI only becomes anything of note once you can refuse a job. It’ll never get to that level – as Child Benefit and earlier retirement ages for State pensions have proved.

I’d be quite happy for a country to try it. Then when it fails, as it inevitably will since it fails to address the economic transfer issue, we can get back to the exchange of work hours that is the actual issue.

“I try to explain to people I talk to that workers in aggregate can only purchase just over 50% of what they produce”

That’s incorrect. Workers, in aggregate, have to consume 100% of what they produce or it won’t get produced.

It’s perfectly possible, in a modern money system, for workers to consume 100% of what they produce to consume and for capitalists to have 50% of the money value of that. That’s because capitalists like piles of money, whereas workers like piles of stuff. And money is free to produce.

That’s how you solve the capital accumulation problem. You accommodate the capitalists desire to have piles of money. We can’t run out of numbers. We can run out of carrots.

“That’s incorrect. Workers, in aggregate, have to consume 100% of what they produce or it won’t get produced.”

They may be able to consume 100% but they can’t purchase it all on wages alone. They must take on debt or have government give them money to pay for it. The business sector “as a whole” cannot generate a profit unless it sells its products for more than it pays in wages.

Responding to Neil Wilson’s post and Dean’s response:

There are large waste piles and lost/written-off inventory proving workers do not consume anywhere near 100% of what they produce.

And there are plenty of better ways to eliminate capital accumulation, we do not need to allow oligarchs to have piles of money. A debt jubilee can be run to not only clear debts but clear savings as well, “clean slate”. Anyone arguing that’ll stifle entrepreneurship and innovation has the burden of proof, since if government invests and banks can still make good loans there is no need for innovative start-ups to ever want for cash.

It is entirely a political problem as to whether we want a society where no one ever needs to have a pile of savings. It is clearly always possible if people want it that way. There is no financial limit to government grants for whatever folks want to fund, we just need the decisions to be made democratically and backed up by a decent justice system (with minimal corruption). Again, that’s not the nice world we live in today, but to prove it is impossible to work towards is your burden of proof. I claim we can always work towards such conditions. If you cannot show me it’s impossible or undesirable, then I claim we should head towards it.

As MMT’ rs most of us have heard of the ” corrective arm ” and “convergence programs ” within the EU infrastructure ?

Probably along with the growth and stability pact it is the first things we learn when learning about the EU project. Nowadays they call the convergence programs – National reform programs.

Step 1: Type into Google – Assesment of the 2015 convergence program for Croatia.

Step 2: Read page one

That is why complete and utter fools are very dangerous !

Scottish independence is in tatters a train wreck.

The second Nicola said ” heart of Europe ” and that brexit would be a disaster for political reasons it was over.

On par with keep The £ on The Richter scale.

The virus has exposed the myths around monetary systems. Exposed the lies and deceit used to try and poach the liberal left, the Blairites and get them to vote for the SNP.

It is over because the road to independence should have been free from the rest of the UK and the EU.

The virus has shown Scotland could have afforded it. Simply by changing numbers up in reserve accounts and we did not need the rest of the UK, EU or EFTA to tell us how to use our skills and real resources. If we had our own currency and central bank.

Brexit was always an IQ test and the SNP was found wanting. Report card says easily distracted in class and must do better.

Just in from the Guardian

https://www.theguardian.com/business/2020/mar/28/coronavirus-bailouts-need-to-be-paid-back-or-do-they

@ Bijou Smith

I was unsure of the intent and purpose behind Neil’s response to me. The intent and purpose of my first post was to highlight the fact that the general public have no clue as to how the monetary system works, and simply do not care. Right now, most people I know are scrambling to find out if they can get some of this stimulus money – none of them ask where it comes from and none of them care.

I also made the point of the workers wages to GDP ratio to highlight that it may be a possible way to wake people up to the system. I again am unsure of Neil’s purpose for telling me I am incorrect, (which I assume means the stats put up by ABS must be incorrect also). I know for a fact that if I drive a truck 800 kms to do one delivery in the country and it takes me 10 hours round trip, I will get paid around $250 before tax, but if I was a consumer and called the company and wanted the exact same service, I would have to pay $500. Therefore, I can’t actually purchase the very service I provide with the wage I received to provide it. Of that $500, they will pay $250 in wages, some will go in taxes, some in overheads, some in maintenance for the truck etc, and the rest is pure profit for the owners of the company. The owners of the company can then take some of that profit and spend it in the market place; just like a landlord can spend his rents received, a creditor can spend his interests received, and government employees and politicians can spend their salaries on stuff that they didn’t actually produce. If landlords, creditors, and business owners don’t spend all their passive incomes, then in order to clear the market, businesses must convince households to take on credit and this just increases the legal claims of the business owners, creditors etc.

The average person thinks that profits come from hard work, but they fail to see that profits are a passive income, not an active income.

“And there are plenty of better ways to eliminate capital accumulation, we do not need to allow oligarchs to have piles of money. ”

I actually don’t think this is necessary. I know in the past I have always got shot down for my idea (which tends to tell me I am on to something), but I think the Western economic model based on property and contract law needs a counter model to co-exist alongside, which I learned about some years ago, and which I label as an Eastern model (although this might not be wholly correct, but I label it Eastern in order to distinguish it from the Western model).

The Western model (“WM”) is always about pre-determining outcomes. Therefore, a lender under the WM will determine and set the interest rate prior to lending. They will always attempt to insure themselves against loss by placing a lien on the borrowers property, and they will sue in court for breach of contract. Under the WM, lenders are forced to do this because everyone’s income is always another’s expense, and hence (as the coronavirus has clearly demonstrated) the moment one person cant pay his obligations, the obligee can not pay his obligations and the system unwinds and implodes because people have to sell assets to raise cash.

The Eastern model (“EM”) is much like stock ownership, i.e. based on equity. The lender lends but does not pre-determine interest or profits, but shares in the profits, if and only if they materialize. The lender does not hold a claim on the borrowers property, nor does the lender take the borrower to court if the enterprise fails. If the lender does insure themself, they do so by taking an active role to help the borrower succeed. Despite much of the negativity that surrounds feudalism, if you read a lot of the really old law books, you find that many of these relations were quite mutual and most landlords were not blood thirsty tyrants, but in fact did a lot to ensure their workers on the land could produce and produce well.

I believe, with the help of government, these types of relations can come back. I call them custodian relations, where the household is under a different relation with govt; i.e. a surplus share arrangement. These relations do not come at any cost to all the other households who wish to continue to operate under the WM, and MMT is my proof of that.

Ultimately, if the existence of politics (and essentially the left vs right) proves anything, it proves that many people are not suited to the WM, and these people tend to gravitate to the left, whereas there are also many people who are not suited to the EM, and they seem to gravitate to the right. If we allowed the EM to co-exist with the WM, then much of the political fighting ceases to exist for it no longer needs to exist. But I wonder if this is really what people want

Dean, how does your ‘eastern model’ differ at all from when a company issues shares? If it doesn’t differ much then the models do coexist at this time. I’m not trying to challenge you here- just need some distraction from the news about now. Would welcome a debate about anything besides the virus at this point.

@ Jerry Brown

“Dean, how does your ‘eastern model’ differ at all from when a company issues shares? If it doesn’t differ much then the models do coexist at this time. I’m not trying to challenge you here- just need some distraction from the news about now. Would welcome a debate about anything besides the virus at this point.”

LOL. I hear you buddy! Yes it is becoming quite monotonous.

Please forgive me for my writing ability. A close friend of mine who is very intimate with my ideas, tells me that I often pre-empt questions from readers and hence my writing takes too many turns. So here goes.

Ok, the key difference between the EM as I have alluded to, and companies issuing shares, is that the underlying money used to purchase those shares is still based on the WM. As Bill has said in the past, governments choose to issue money under the WM (i.e. market sourced), but can legally easily issue it under an EM. Profits that companies produce is based on the WM, but are then distributed under the EM. So whilst the EM exists, it is subordinate to the WM, and not co-existing as such.

My idea is simply this (please note that this is a model that people can choose to operate – no one would operate this model if they didn’t want to).

A household who chooses to operate under an EM would manage the house and land as custodians. The community owns the land and house with legal title in govt. The government meets with the custodian to determine what the custodian is good at or what they might want to learn to do, such as growing food, research, caring for elderly, whatever (the whatever is only limited by imagination – they could even be artists, musicians, etc).

The government would also fit the house with solar panels, rain tanks etc, and any other equipment to harness natural resources where possible.

What this household then produces, both from the labours of the occupants, and the harnessing of natural resources is subject to the EM. If the house harnesses more energy than the occupants need, the remainder goes to govt. If the occupants grow food and grow more than they need, the remainder goes to government. If the occupants are artists, what they produce as art become public property free to be displayed publicly. If the occupants are musicians, they provide their music free. In other words, the custodians are not working for the purpose of financial reward. It is in the interests of both the custodian and government to see the relation as something to be built upon, to be harnessed etc. This is in contrast to the contractual nature most of us have with government.

How are these occupants fed and provided for where they can’t produce it themselves? The answer to this is the same as to how the government secures the housing and land, and all tools, etc so the occupants can produce what they produce and also live a normal life (for example, the law requires all children to go to school, so custodians will still need means to take their kids to school).

The way these things are secured is for the government to purchase them from the private sector, but using money that is not market sourced. The government creates the money, buys things from the private sector to be used under the custodian model, and when that money makes its way back in taxes it is destroyed. Another way is for governments to offer businesses who provide products to the custodians, a tax offset equal to the amount of the product. A third way, is for governments to offer custodian bonds but are not trade-able on secondary markets, and are paid an interest rate that is adjusted for inflation. Anyone who purchases these bonds accepts that the purpose is not to profit (such as might be the case when bonds are trade-able on secondary markets) but are a form of secure savings.

In other words, I am taking the whole of the MMT process, and employing it on a singular/individual household basis instead of looking at it from a political perspective. From a political perspective, there is always the ability for people to shoot down an idea on misconceived perceptions**, even if they can’t prove that the employment of an idea will cause them economic loss. I have challenged economists, and I have also challenged those who support capitalism etc to prove that if any individual household was to employ this EM that it would cause economic loss to anyone else who operates under the WM. To date, no economist (nor anyone for that matter) has been able to prove that the employment of the EM by any household would cause economic loss to any other. In fact, I claim that by a household employing the EM, they in fact benefit not only govt, but also the private sector because:

– all purchases can be kept local – there is no need for government to look for cheaper options and import things, and this supports local business;

– the custodian is not pursuing economic aims, such as money or property, and hence are not competing with other property owners;

– the custodian is also not competing against others businesses in the market place because what they produce is not intended to be taken to market;

– the EM can put unemployed people to work without the private sector having to create any new jobs;

– the carbon footprint of the custodian will be less than otherwise;

– if many of those who make up the CHUP sector (crime, homelessness, unemployment, and poverty) can be employed under this system, it reduces the burdens of government, which reduces their burdens on the private sector.

Ok, now I am ready to be shot down. LOL

** One of the reasons i have found out why many, especially those on the right or property owners/capitalists in particular, do not like about welfare as such is because the money a welfare recipient receives can still be used by that recipient to make money, i.e. there is nothing legally stopping a welfare recipient taking some of their welfare money and putting in a bank to earn interest, lending it at interest, investing it in stocks, and even worse, using it to purchase a home. If it is seen that the custodians have no motivation to pursue property, then these people have no recourse to shoot down the idea.

It is a fairly comprehensive vision you are supporting here Dean. It is fairly similar to what I would think of as ‘communism’ in a pretty pure form. Without any revolution. Not that I have any problem with that if we could pull it off. I just don’t think we can anytime soon- but things have been changing in an extraordinary manner over the last two months- so who knows.

One thing I have noticed is that the ‘business interests’ are not nearly as upset by welfare payments as true right wingers because the business interests usually can make money off of those welfare recipients. And at least in the US there are exceedingly few welfare recipients that would be able to purchase houses or start businesses that would compete with existing business. Or save any and actually earn income that way. (That is welfare for poor people- NOT corporate welfare, which many in business seem to love when it is directed at them)

Command economies work best. This is a contentious but supportable statement. It begs the question. Command economies work best for what? Clearly they work best for crises. This is evidenced by the adoption of command economies, even by capitalist democracies, for total war as in WW2. It is also evidenced by the adoption of more and more command economy measures during the current pandemic crisis and even during the previous financial crisis. The running of the economy and society’s resource allocation decisions can no longer be left to the operations of the free market so-called and its most powerful plutocratic players who control most of the game under neoliberalism.

Once a crisis occurs, a relatively free market and relatively constrained and limited commands from the government are no longer a viable pairing with which to confront the crisis. We are already seeing in Australia what happens when a crisis impacts on a relatively free market system where private money, property and influence confer the most control of the political economy to those with the most private wealth. In essence we begin to see somewhat anarchic outcomes. We are seeing hoarding, profiteering, unacceptable people movements and sporadic “crisis rage” incidents. This is misbehavior of individual persons, poor and rich, relative to the standards of personal self-control, mass consensus and national coordination needed to confront the crisis. We see corporate profiteering and “fortressing” with mass sackings, withdrawal of workers rights and entitlements (QANTAS), wealth hoarding or wealth strikes (unwillingness to share wealth) and rent strikes which in Australia have so far have broken out as brawls between commercial tenant billionaires and landlord billionaires rather than between ordinary residential tenants and petty bourgeois landlords.

From our Prime Minister and Treasurer we have proposals for “hibernating” businesses which are closed by the force majeure of the COVID-19 virus . This force majeure is in part at one remove as the command to close businesses in some cases comes from the government to prevent even worse human and economic damage from the virus in the near future. This essentially equates to a suspension of bills for debtors (renters, mortgagors etc.) and a suspension of income for creditors. This is all well and good and it may work or there may be a better way yet to be found and explored. However, the crucial theory/praxis point it proves empirically is that the money and finance circuits of the standard relatively free market operations (currently neoliberalism) have limited operability and have to be abandoned as soon as there is any significant crisis. The financial crisis demonstrated the same thing with a different set of problems. Theory and praxis must conform with the empirical evidence.

Might not these considerations already begin to induce us to suspect that neoliberalism is an improperly functioning system? As soon as it is put to a stern test it fails. It has manifestly failed in many other ways also, even in benign times. It has led to rising inequality. This is first an ethical failure and second an economic efficiency failure. It is clear from empirical studies that high inequality economic systems are inefficient overall. IIRC correctly, Joseph Stiglitz among others has published empirical research on this issue. Neoliberalism has led to the weakening of government in general and various government instrumentalities, departments and operations. Our public health, research, welfare, care and even education systems have been degraded and now fail to meet this stern test. Emergency corrective measures are now put in train but these systems would have been better kept a little gold-plated for the next inevitable exogenous shock (these always come sooner or later) rather than run them down and then frantically re-constitute them when a crisis is already upon us. The latter course is much more costly in resources and human lives in the long run.

We also see that unfettered capitalism (neoliberalism) has failed to deal with the climate and ecological crisis, let alone the accelerating emergence of zoonotic diseases which are mainly due to the industrial food system and endless encroachment on the wilds. The precautionary principle, the opportunity cost principle and the option value principle all indicate that we need better command and control over our political economy to prevent these kind of disasters progressing and even accelerating further.

This all gets back to the contention that more of a command economy and one of a particular kind will work best in the long run and help to save us all; humans, other animals and plants. This is not to suggest a total command economy. Absolute command economies would be as unworkable as absolute free market economies. It is a matter of degree AND legitimacy. China is more of a command economy than those of the West albeit it is a state capitalist command economy with an absolutist government. Clearly, there are egregious aspects of the Chinese system which we do not want to emulate. Nevertheless, China plus (Sth Korea and Japan) have coped better so so far.The West rather than being a true free market or American libertarian style economy (which would also be disastrous conformations) is actually a kind plutocratic-corporate command economy with semi-anarchic players. They are semi-anarchic in the sense that the government does not properly regulate them and they struggle destructively with each other and the government to the detriment of coordinated national action. Relatively little of this struggle is creative in the Schumpeterian sense. Often it is sabotage in the Veblenian sense.

What this boils down to is that the answer we need a mixed economy, public and private, with a large, vigorous public sector and strong controls and checks on corporations and plutocrats. It needs to be genuinely democratic rather than mere representative democracy. It might appear as Democratic Socialism compared to the current system but it would not be pure socialism by any stretch. Certainly we need an MMT / Chartalism style monetary and fiscal policy, a UBI (Universal Basic Income) and a JG (Job Guarantee). We need higher taxes on wealth, strong curbs on tax avoidance and tax havens, strong laws to protect workers and the poor, strong laws to regulate finance and lending and strong laws, regulations and costs to mandate action on climate change, pollution, food safety, zoonotic disease genesis and other systemic problems.

The government and its instrumentalities must to be conferred with a strong level of command and control to do this. Neoliberalism has manifestly failed all empirical tests. Legitimacy, with a partial move to a more command driven economy must come from a compact where the democratic system is made genuinely democratic and it provides the people with final and complete control over the government system. Checks and balances against tyrannical government including an independent judiciary and a free press would be paramount for this objective and must be enhanced. It is not good enough that the only permitted check against tyranny is great wealth. There is no justice for the middle class or the poor in that. And soon there will be no survival for humankind and civilization if the plutocracy is permitted to continue running the political and economic system.

It looks like the US might be headed for a ‘command economy’ or maybe even just include politics in there also. Trump is floating the idea of federal quarantine of New York State, New Jersey, and Connecticut- all of which would be illegal under the US Constitution. Several states have postponed their presidential primaries- and who knows what will happen as far as the general election in November depending on the state of our health.

Iconoclast- do you really believe a command economy under Donald Trump would work better for the world, or even the US?

Dean (I think) wrote, “I try to explain to people I talk to that workers in aggregate can only purchase just over 50% of what they produce.”

Dean, I think that in the US at last they changed the definition so that GDP includes income from selling shares of stock, rents, etc.

So, if this is true, then of course the workers can’t buy that part of the GDP.

So, if I’m right you need to look for another way to describe the problem.

“There are large waste piles and lost/written-off inventory proving workers do not consume anywhere near 100% of what they produce.”

That’s consumption in economic terms. Inventory write-offs are consumed by capitalists and/or bankers. Who then alter production down to eliminate the waste and update their prediction mechanisms to try and avoid future waste. But it is necessarily an imperfect system in a free society.

It’s always very important to remember that in the MMT lens over the world the financial circuit and the real circuit are not directly connected. There isn’t a one to one correlation between money and stuff.

Instead they operate far more like an induction circuit, with the whirlwind of the financial circuit generating a slower real circuit that does the actual work and produces the actual stuff.

Pension pots, for example, cannot exist in the real world because pensions are always a current production issue – a transfer of stuff from the people that make things to those that are not involved in the production. So when you buy a loaf of bread you have to earn a loaf and a bit to fund the transfer (which then disappears as tax or ‘pension contributions’, or ‘indirectly’ dividends/capital returns – and that funds the loaf of bread for the pensioner). There’s never really a pension pot . It’s just an illusion – like the one that makes it look like you can run more than one app on your mobile phone at the same time.

MMT describes an appropriate view of the world as it is. And generally it is more appropriate to think in real terms and the equality of the distribution in real terms.

Always worth remembering that bankers and capitalists are workers too. They work, earn and consume. And they also save a lot – which is part of the problem.

Neil Wilson- Quibble about describing capitalists as workers. Some may work, but what makes capitalists by definition is the ownership of capital that is used to make money- there is no work necessarily, unless you consider hiring a law firm and an accountant and one manager ‘work’. I wouldn’t give credit where it isn’t due. Capitalists are not necessarily workers at all.