In the annals of ruses used to provoke fear in the voting public about government…

The coronavirus crisis – a particular type of shock – Part 2

Yesterday in my blog post – The coronavirus crisis – a particular type of shock – Part 1 (March 10, 2020) – I discussed some of the considerations that governments need to take into account when dealing with the economic damage that will result from the coronavirus crisis. I did not consider the health issues because I am unqualified to assess those other than to take into consideration what the health professionals are now saying as they gain more knowledge of the particular disease. In Part 2 today, I extend that discussion and outline some specific issues that bear on the size and design of any fiscal intervention.

A coherent policy plan has to be announced

One of the problems of endemic uncertainty is that rumours abound and fear leads decision-makers to make very irrational choices.

In Australia, these days, we are witnessing unseemly spectacles of consumers engaging in physical fights in supermarket aisles over who will get a package of toilet paper.

The share-markets around the world are plunging.

OPEC is falling out with itself.

And there is still hardly any coherent policy interventions being announced other than the quarantines and blockades and closures.

Governments are elected to lead and in times of crisis should make clear statements of how that leadership will be executed.

In Australia, the current government has been in months of denial about the bushfire crisis (claiming it had nothing to do with climate shifts) and seems to be unable to give any surety that it knows how to deal with the coronavirus crisis.

The only thing they have really said is they will not consider increasing the unemployment benefit despite the fact that perhaps upwards of 300,000 workers are at immediate risk of losing their jobs as a result of the turmoil.

I will come back to that issue soon as it relates to the temporal characteristics of a stimulus package.

The other aspect of having a plan is to place the coronavirus in context.

It appears (and I am no health scientist) that the virus is not particularly severe for the vast majority of people.

The unseemly fights in supermarkets over toilet paper (or chicken as I am informed from Spain) are another version of the brain snap, share market sell offs in recent days.

The point is that economies run as much on sentiment as anything and panic will become a self-fulfilling movement if it is not stopped.

One of the roles for governments is to provide surety and ease pessimism.

So far, the federal government in Australia is failing in this regard. It should be saying we will do whatever it takes to stop a recession.

It should be saying it has as much fiscal capacity as is necessary to provide income and employment support and insulate the economy from the obvious demand impacts.

Instead, it is playing political games, trying to claim it will not behave as the Labor government did in 2008 (with a generalised stimulus) and will seek to protect its surplus targets while providing some (small) tax relief and investment allowances for business.

That won’t cut it.

The reality of the gig economy is being exposed

This complex economic shock is also exposing the structural weaknesses of economies that have evolved under neoliberalism to be dependent on consumer debt and casualised, precarious work.

Many workers are now without the usual buffers that have helped people risk manage in times of job loss.

While some eulogise the ‘freedoms’ of the ‘gig economy’ and young people think of themselves more as entrepreneurs than as workers as they buzz around on motor scooters delivering food to those who can no longer be bothered interrupting their reality TV viewing to venture to the shops, the harsh reality of their insecure positions will be exposed by the coronavirus.

An increasing number of workers are now dependent on casual work hours as their main source of income.

These hours are the first call by firms seeking to adjust their costs as their sales fall.

Most of these workers are low-paid and have little saving. Once they lose their hours, rents become impossible to pay and the precariousness of their true positions in society become obvious.

They might think of themselves as entrepreneurs but they will require substantial income support from government to survive the hours losses.

It is also not just the workers that lose their jobs (hours of work) as a result of the spending collapse that will need support.

The government should introduce legislation to ensure that all workers, irrespective of their current status, have sick pay and other leave entitlements, so they are income protected from health failure during the crisis.

In the interim, while the private employers adjust to these new labour market rules, the government should pay all these entitlements in full.

The government should also change all health care rules relating to insurance etc to ensure that every worker and their family has first-class health care available for the duration of the crisis irrespective of their current state of medical insurance.

Further, the government should cover the wages for all workers forced into quarantine, who, otherwise would not be paid if they didn’t attend their workplace.

Their jobs should also be protected by law so that capricious employers are prevented from sacking workers who are unable to attend their casual work because of the illness.

And, looking beyond the crisis, governments would be wise to introduce regulations to reduce the overal size of the gig economy and to provide workers with greater opportunities to risk manage their own lives in times of crisis.

These sectors have only grown because governments have changed the legislative terrain in which they operate, which has shifted the balance of power towards employers.

Governments should force firms seeking to operate in these ‘markets’ to pay better wages and to provide secure work, holiday and sick pay etc.

For example, Uber drivers are currently working under regulations that are much less stringent to those faced by taxi drivers who have licences. The government should require those gig drivers meet the same occupational health and safety conditions.

A more secure labour market provides a better buffer against these sorts of external shocks.

It is time to reverse the vulnerability that neoliberalism has created – both in the short-term as a response to the current crisis, but, also, in the longer-term to reduce the exposure to future crises.

Debt relief

Italy has suspended all mortgage repayments while the country is caught up in the coronavirus crisis.

If accompanied by appropriate central bank liquidity guarantees so that the banks are not made insolvent as a consequence of the lack of cash flow then this sort of intervention is a sensible strategy.

Some people, at times like this, call for debt jubilees.

These are far more contentious, not because the currency-issuing government is unable to fund them (that is a given) but because there are equity considerations that should be carefully worked through.

A legislative program has to be legitimate in the eyes of the people.

I often read, in the context of calls in the US to scrap outstanding student debt obligations, the angst of those who have already paid off their debts, presumably through various levels of sacrifice (including for some, not much sacrifice at all).

Their concerns are legitimate. It would be fairer to scrap current obligations but also return in the form of a cash payment, the net present value of the past debt relinquished back over some reasonable time period.

That sort of equity measure is much harder to provide in the case of credit card debt.

In that case, the government should provide income support but not write the debt off.

Share market crash

While the share markets are currently skittish – up and down – the fact remains that if there is a significant collapse in value then some superannuation/pension funds will be further compromised than they are currently with the extreme monetary settings that the neoliberal era has produced.

During the GFC, several superannuation funds were claiming they would have to review their contractual obligations (for defined benefit schemes, etc) if the share market losses continued.

Further, the so-called ‘market-based’ funds in Australia, which are just profit-sucking (via excessive management fees) ventures for the big four commercial banks, have been underperforming for years.

This would be a good time for the federal government to create a national superannuation scheme which it can always fund irrespective of the ups and downs of the share market.

I wrote about this in these blog posts (among others):

1. Time to nationalise superannuation in Australia – even conservatives think so! (October 23, 2017).

2. Eliminating the great superannuation rip off (March 16, 2010).

Clearly, as in the GFC, the currency-issuing government could also fund all the losses associated with share market gyrations if it chose.

But that would violate equity concerns.

The target for government action in this respect should be to ensure that all current superannuation entitlements are maintained and no balances are lost.

Considerations in designing a stimulus

It is clear that a substantial fiscal stimulus will be required to offset the obvious decline in non-government spending that is now evident.

But the size and timing of the stimulus depends on the context that it is being introduced into.

If, for example, the economy was at full capacity leading into the crisis, then the type of stimulus would be quite different to the intervention required if there was significant idle capacity already evident.

So to elaborate further, take the issue of unemployment benefits, which are highly contentious in the Australian political debate right now.

I have written about this issue on a number of occasions – see discussion and links in this blog post – ‘Progressive’ groups in Australia captured by neoliberal ideology (September 18, 2018).

Unemployment benefit payments have been increasingly below the standard poverty line in Australia and neither side of politics wants to alleviate that travesty.

They neither want to eliminate the unemployment via job creation programs nor improve the material circumstances of those that they force into unemployment via faulty policy settings (pursuit of surpluses etc).

In the current debate, the federal government has made it clear they will not include any relief for the unemployed in their upcoming coronavirus package.

The point is this:

1. If the income support payments were at a level that was deemed satisfactory (by health professionals, sociologists etc) and allowed a beneficiary to live a socially-inclusive life, then lifting the benefit should not be part of the stimulus package.

Why not?

Because lifting the benefit should not be a counter-stabilising measure that is reversed when the need for extra fiscal support is done.

2. But in the current situation, with the unemployment benefit way below the poverty line, the government should immediately increase the payments to reach a level consistent with a socially inclusive lifestyle, as part of the stimulus package.

It doesn’t matter that they are then permanently locked in to the higher level of payments.

Why?

Because starving the unemployed is one sign that the current deficit is too low anyway, quite apart from the short-term demands being placed on extra stimulus from the coronavirus.

The principle then is that a stimulus has to be calibrated in terms of where the economy is currently at.

We do not want a massive injection of government spending to be permanent if the economy is already performing well and needs temporary support while the dislocation and panic from the virus plays out.

But if the economy is already performing badly, then the stimulus has to divided into:

1. A component that targets a permanent increase in government spending.

2. A component that allows for a temporary increase that can deal with the negative effects of the coronavirus crisis but which can be withdrawn again once that crisis dissipates.

If a program is suitably designed according to those principles then the economy will avoid a recession and come out of the crisis closer to capacity than it currently is.

Given that, consider the shifts in the Australian aggregates between the peak of the last cycle and the trough:

1. In August 2008, the Employment-Population ratio was 62.9 per cent. By the time it reached its trough in November 2014, it had fallen to 60.5 per cent.

In terms of the January 2020 Working Age Population, that shift would amount to a loss of jobs of some 290.7 thousand jobs.

And, the January 2020 Employment-Population ratio of 62.6 per cent is still is below the pre-GFC peak.

2. The unemployment rate rose from 4.0 per cent in February 2008 to the peak of 5.9 per cent in June 2009 – a rise of 1.9 per cent.

That would amount to 260.7 extra workers unemployed if the same contraction occurred.

The unemployment rate is still 32.9 per cent above the pre-GFC low-point.

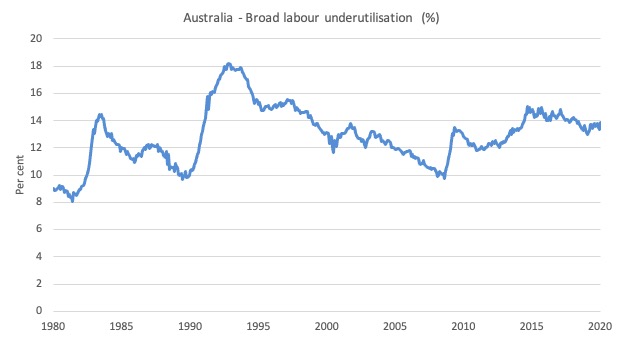

3. The broad labour underutilisation rate (unemployment plus underemployment) rose from 9.9 per cent in February 2008 to a peak of 13.5 per cent in May 2009, but as the then governments stimulus package started to work it to 12 per cent by August 2012.

Then as the government took fright, under pressure from the deficit terrorists, and started to cut net spending in 2012, the broad labour underutilisation rate started to rise again and is now at 13.9 per cent and rising further.

The following graph shows the history of this aggregate.

4. The recent GDP figures show the economy is slowing and operating well below trend output growth.

5. Wages growth remains at record lows and inflation is below the RBA’s lower-bound target range.

So we are starting this next cycle from a position a lot further from full employment than at the peak of the last cycle before the GGC.

Which means the stimulus package needs to contain initiatives that would have pushed the economy back to full capacity, which means these should be considered permanent increases in net government spending.

I assess the quantum to be around 2 per cent of GDP or around $A10,051 million sustained each quarter.

Investing in green transition public infrastructure would be an ideal way to create sector-specific demand which will deliver long-term benefits, help the ailing construction sector and tie up funds for several years.

The stimulus package also has to include a temporary injection of spending which could require anything from 1 to 3 per cent of GDP extra being sustained as long as the crisis is predicted to impact (tapered to approximate the trajectory of the disease impacts).

One recent estimate is that real GDP in Australia will fall by 8 per cent as a result of this crisis. If that was realistic then the fiscal stimulus will have to be more than 3 per cent of GDP, on top of the 2 per cent required to redress the existing slack.

Initiatives that would fall into this type of intervention would include one-off cash injections to low income groups as an example.

Given there is a supply dimension to this crisis, there is some danger that bottlenecks could be met in certain markets, as spending increased.

I assess that to be a relatively smaller concern. As I noted yesterday, I do not think the supply constraints will persist for very long, given the disease seems to have a life-cycle and workers will not be severely affected in large numbers.

Governments will try to minimise the spread, but once they realise they cannot fully contain the disease incidence, I expect it to become like a normal flu season – deadly for some people, inconvenient and temporarily uncomfortable for the rest.

It is time to introduce a Job Guarantee

As in my suggestion that now is a good time for the government to reverse the damaging trends like the gig economy, it is also time for them to introduce a – Job Guarantee – at this point.

The unconditional job offer at a socially-inclusive minimum wage to anyone who cannot find work elsewhere is an essential safety net and countercyclical capacity that every monetary economy should have.

The introduction now would go a long way to insulating casual workers from the damage that the loss of hours will bring.

It would also promote dynamic efficiency forces within the non-government sector to invest in more productive technologies so that they can maintain a business as the government increases the regulative demands on them – to ensure better work conditions, sick and holiday pay requirements, treating all workers as employees rather than independent contractors, and more.

It would guarantee income security for the workers who will be most vulnerable to the damage caused by the coronavirus and have long-term efficiency gains.

The shift from income support payments to Job Guarantee wages for those workers capable of working would not involve a stimulus of the size required. So this initiative would be part of the overall stimulus required.

And, the government could be assured that if it protects the economy from recession and reduces some of the slack its obsession with surpluses has already created, then the Job Guarantee pool at the end of the crisis would be fairly small (ideally around 2 per cent of the labour force).

But with the labour underutilisation rate of 13.9 per cent of the labour force and participation rates below their potential peak, there is a long way to go before we reach that desirable state.

Conclusion

I don’t hold out any confidence that the government will act to even protect the economy from recession.

They are too busy trying to wedge the Opposition to come up with a stimulus package that is of a sufficient size and design and has equity considerations at the forefront.

But it is clear they have the capacity, just as all currency-issuing governments have the capacity, to avoid this crisis.

Whether they use that capacity is another matter.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

This government has been elected because the ruling parties promised no action on climate change, developing coal mining as a long-term economic growth strategy, no changes to negative gearing, not closing various tax loopholes and peddling right-wing Christian stuff associated with so-called Western civilisation. It is not true that Labor has exactly the same program. I agree with the critique of the Australia Labor and the Greens but Bill Shorten or Albo are not exactly the same as Scott Morrison, Barnaby Joyce or Clive Palmer.

It is not “them”, the politicians and the oligarchs. It is the 51% of the Australian “nation”, society or how we choose to call these people. For example the significant proportion of the 60% who own properties do whatever possible to screw up the 40% who don’t. And they think that they deserve this. The majority actively support “wealth creation”, the greatest inter-generational theft I have seen.

If the government picks ups these of the ideas listed above which are not against its ideological agenda and this is enough to preserve the status quo, I can guarantee that the destruction of the environment will only accelerate, the humiliation of unemployed, the institutional racism towards the Aboriginal people and the exploitation of migrants / young people will go on. Because the COAL-ition will be re-elected again and nothing will change.

On the other hand if the wheels fall off and we get that 8% slump linked with the permanent bursting of the real estate bubble, the destruction of the small firms whose owners always support the Liberals, the collapse of the banking sector sucking blood out of the real economy, there is a slim chance that enough people realise that they have been fed neoliberal delusions. We may not have to endure again these clowns we have elected last time and maybe, just maybe, someone will start actually solving real problems, such as the destruction of the environment, not just talking about budget surpluses.

Sometimes a collapse is badly needed even if we later feel sorry for the victims of the collateral damage. We thought like this in the 1980s in Poland when we were waiting for the communist system to finally crumble and the Soviet troops to leave us alone. I am not a baby boomer. I am a so-called child of the martial law. Baby boomers learned how to make love and make money. They had a chance. They may not be able to make love any more but the money still flows… extracted from everyone else. And everyone else does not have a “fair go”. We learned in Poland something else, let’s call it a kind of bitterness and cynicism, because to earn money we would need to go to the West but the border was closed. I feel a lot of young people experience exactly the same here but they say nothing. They just don’t care because any resistance to the system is futile and life is too short.

Yes, everyone is panicking Bill.

Without saying what my job is and where I work, within a few months of Starting my job I was promoted and now see what happens at the cliff face. It is an excellent chance for me to see how it all works day to day after learning MMT over the last 10 years. The jigsaw of theory, the day to day and the narratives used on the box. Which is normally only for the ages of 1 to 4. In training they even teach you the loanable funds model along with the other 14 fatal fallacies of financial fundamentalism as truths.

The risk models range from low to high made up of bonds and shares. The higher the risk the holding of shares change by region. The key being bonds less risky and the shares no matter what region are all blue chip shares.

So when risk is managed they swap blue chip shares by region. Swapping Asia blue chip shares for UK blue chip shares for example. With UK blue chip shares in this instance supposed to be less risky than Asia blue chips. Or removing shares from the portfolios completely and swapping them for bonds.

it is ironic that Those invested are normally the ones who vote for the national debt to be reduced and they are the ones increasing it on a daily basis.

Now these models work as long as

a) You stay in them for decades and ignore the markets completely.

b) As long as all regions do not go down together. Their success is built on averages as long as On average more regions perform better than regions that don’t . UK, US and Asia blue chips doing well EU blue chips not so much for example. Three region’s doing well when one does not means these models grow over time.

Of course when the TV installs fear On a daily basis on a range of issues. Animal spirits and human nature do not work in tandem with many economic theories. The reverse normally happens.

Since neoliberalism has made a more connected world. As we have seen over the years, if one region of the world slumps more often than not the rest quickly follow. It never used to be like that far from it.

These types of model portfolios are used everywhere all over the globe by thousands of different companies holding trillions worth of savings. Each looking for a bit of the action.

So it quite easy to see, as neoliberalism now causes world slumps on a regular basis. Why panic is never far away and just around every corner. Which feeds on itself in many forms eating away at human nature.

MMT ideas would solve a lot of these issues. However, when a crisis hits as fast as this taxing skills and real resources to move them to be used where they are needed in the economy is a very slow process. Moving them for A to B and then C and D is not easy.

Especially when it comes to planning public works. Some spending can be highly responsive with minimal lags. The problem is in the world we live in today government policy departments are now just contract managers for outsourcing servicing delivery. So the overall capacity for the government to tax and move resources and implement complicated nation wide spending programs quickly and effectively has been hollowed out and in many cases no longer exists.

We could take a guess and say at a minimum it would take one term to get these structures put back in place. So even if the left wins it would take years before any of the big MMT ideas could be implemented. There is no guarentee they would get voted in for a second term if they fail on their promises.

It is fascinating watching from the inside and the cliff face with the MMT knowledge I have gained over the years and why I got the job and promotion in the first place. Every day is a school day similar to the MMT journey. It never gets boring.

I just feel because of what I posted above we would be bottle necked behind the corona virus. We no longer have the structures in place to deal with anything quickly.

We would need at least 4 terms with MMT policy makers in charge before we are even close to being ready for the next one.

Hi Bill,

Thanks for the thought-provoking blog post.

1. How likely is it that our ineffective government would even fancy a suspension of mortgage payments?

Plus, i see it being difficult to implement: I say so because in Italy c.13% have mortgages whereas in Oz i think it’s closer to 40%. I don’t see it being digestible?

2. What about suspending compulsory super for a time being–surely this would be an immediate boost to those who need it most? Again, i doubt it would even be considered.

Cheers,

Alex

Maybe a poster from Italy could post the truth. We are only taking media reports at face value.

It seems the virus is not what is killing people in Italy

What is killing people and not just the old and those with underlying health conditions is that when you get it bad you need intensive care beds.

They have run out of them and this decided who lives or dies ? There is simply not enough intensive care to cope with the crises.

A sobering thought as this will soon become the picture everywhere.

Yes there is an excess of panic. Never mind fights over toilet roll, we in the UK have people stealing protective equipment from hospitals.

The disease itself causes about 10x the mortality of seasonal flu. It is significantly more dangerous than normal flu or SARS even, because for about 80 per cent it only causes mild symptoms, which is one reason the Ro number sits around 2.5, which means that around 60 to 80 per cent of the population could become infected. So even a 1 per cent mortality figure is a lot of dead people.

As far as the UK is concerned and for other nations such as Italy, the immediate problem is a lack of medical care for people with an acute respiratory infection. Italy has 3,000 known cases, and they are already running out of beds.

Of course 10 years of efficiency savings, which have resulted in a demoralised and under resourced work force is not a good start. And the suggestion that retired medical staff could return temporarily was greeted by one person saying “i would rather shove a rusty 6 inch nail up my arse”

Agree with Bill, Governments need to step up and take action to protect those who will experience the knock on unemployment, not least because if you demand that people self isolate, then they are likely not to do that if their means of survival is under threat if they dont work… And seeing as many of them will be in that dangerous 80 per cent who can go round infecting others group, Bill’s economic assessment makes sense from a containing an epidemic perspective as well.

Thanks for these posts, Bill and I very much agree with what you say. We need a bottom up approach initially – to provide liquidity to every citizen so they can prepare for the outbreak and to see them through the coming months. For sure, additional spending will be needed in the health and social care system – and other public services, but the initial focus must be on the individual, many of whom are embedded in penury from the austerity policies.

I made the following comment last week:

“The government must establish an emergency sovereign fund to be distributed immediately to every citizen in the UK

We are facing an adversary that doesn’t play to the same rules as the government. It doesn’t care about the rule of law. It doesn’t negotiate or compromise and has only one objective – to survive at our expense.

We are desperately unprepared for the fight. The NHS does not have sufficient capacity to meet even a modest outbreak – and greater reliance on self-care and isolation will be necessary.

Unfortunately, many millions of people have no liquidity or cash savings – and they are just as much at risk as those with co-morbidity – more often, they are in both categories. How do individuals in the same predicament as Errol Graham make adequate preparations for their survival? Where do they find the money to buy even the most basic of items?

As an independent country with its own fiat currency and central bank, the UK government is not constrained in the creation of new money for fiscal stimulus in times of national emergency – as it demonstrated in 2008 when Gordon Brown created £532 billion to bail out the banks. In this emergency, the financial assistance needs to be from the bottom up – not top down.

The pandemic emergency carries a far greater risk to the UK

The government should make available a cash sum of £3,000 for every adult in the UK and £1,500 for every child. This will help mitigate against some of the increased costs everyone will have to bear and will guarantee a basic standard of living in the coming months. This will require funding of £200 billion and can be distributed immediately to those most in need through the DWP to Universal Credit and Pension claimants – then through HMRC and Local Authorities. This payment should be reviewed and renewed every six months until the outbreak is under control.

The government should also order a moratorium on all mortgage payments for households – and introduce strict rent controls in the private sector.

Unless individuals are empowered to look after themselves – and have the ability financially to do so – we face a complete breakdown of UK society as the disease progresses. The prospect of looting, rioting or lawlessness and this virus is unthinkable. The creation and distribution of an emergency public fund will help mitigate against that particular scenario.”

What is quite interesting is that the response in Poland is so far as good as it can be in a not-so-rich member of the EU. The public health care system is quite weak after 30 years of “reforms” (I don’t think it is any worse than in other countries of the region) so they have had to undertake steps in anticipation of the epidemics, for example all schools are closed from Monday despite having fewer cases per 100000 people than Australia. They have started acting BEFORE the initial spread in the population not AFTER. The PM has already declared postponing charging interests on mortgages (the details are not clear at this stage). Of course there is some panic buying but this is obvious in a country where 50% of the people remember product rationing from the 1980s.

On the propaganda front, they are telling people the truth about the problem (what does not always happen) and I can read what is really going on in Italy or Spain (that young people either panic or don’t care, why would they? I have already commented on this). In fact it was the liberal speaker of the Senate Grodzki (belonging to the opposition party), who started spreading racist conspiracy theories about the Chinese who had brought virus to Italy, not the nationalists who usually invent these stories.

It is quite likely that the peak of the epidemics will be blunted in Poland and the right-wing authorities will pass the exam.

I bet we will see a real train wreck in the US as they are doing virtually nothing. Even the presence of so many homeless people – what has been done to help these people survive and not infect anyone else? It will get much worse in some places in the US than it is now in Iran, because of the much higher average age of the population. I believe that in a few weeks time some American local authorities will start begging China for help. We will see which system is better for the citizens – the communist-authoritarian one or the one where people are free to bear arms and all of that.

When we had skills and real resources working under ground in the pits and making ships in the ship yards.

With the wrong people in charge over the years, look how long it has taken to move those skills and resources into a productive capacity above ground to be used for public purpose.

50 years and counting and they have still not finished what they started.

Hi Bill,

While I always have the utmost respect for your economics prescriptives, including this series, which are otherwise excellent as usual, I think you’re understating the health aspect of this disease. It differs from the flu in significant ways. It’s not the kind of thing that we want to become a regular fixture and some nations have shown that it can be mitigated, if not yet eliminated, with serious measures. One wonders how many other

…diseases (like the flu) could be eliminated with a similar commitment.

Great articles.

I did so enjoy listening to your video clip with Noel Pearson and particularly your description of how a job guarantee would actually work.

Irrationality, Aust Govt style: The very population group with greatest susceptibility to the lethality of Covid19 (elderly) is the one charged to save the economy by ‘getting out into shops and spend’ its $750 payments… when the very survival of this aged pensioner domicile, in this Pandemic situation requires maximum absolute social-distancing measures – such as eliminating non-essential exposure to potential transmission hotspots, such as shopping centres!

Pure Genius!

I agree with Bill that disruptions to supply chains will be temporary – I’m just wonder how temporary?

With all of Italy in lockdown, they may actually succeed in breaking the back of the local epidemic’s growth – but how long will national borders have to remain closed for in order for it to not simply sweep back in again?

What the GFC started, this disease will finish.

A casualised insecure workforce cannot afford to self-isolate without government support.

Public health care systems driven into the ground by austerity lack the facilities to cope with the scale of the problem.

Who’d of thought it? The shock that brings the neoliberal era to its final crisis might turn out be a virus that started in an unregulated “wet” market.

We’re in a pickle here, to put it mildly.

The measures that global health authorities say are necessary to prevent national health health systems from being completely overwhelmed cannot be implemented without inflicting serious economic harm – perhaps tipping toward an actual global depression.

This does not look set to be over quickly, extreme measures seem likely to be enforced for probably at least the next 6 months, in order to slow the rate of spread so that health systems don’t collapse under sudden massive load. The same (increasing) measures are causing economies to simply grind to a halt.

I’m uncertain as to how effective fiscal policy (or any policy) can be at offsetting this – we can put money into the hands of consumers but there’s high chance they are either unwilling or unable to spend beyond basic necessity as a consequence of both the extraordinary public health measures and out of individual fear and uncertainty, to say nothing of the fact that supply disruptions may limit choices anyway.

We can put money into the hands of business with the aim of preventing employment from collapsing but if collapsing demand means there is nothing for workers to actually do, companies may simply keep the money and stand down their workforces anyway.

We’re entering uncharted territory.

IMHO, (I’m a nobody with no credentials).

It would be better to give money to the people who can spend or save it (hopefully as cash, not paying down debt) and then buying stuff later.

Paying it to business owners does *not* mean they will pay workers with it. So, payments to business owners should be only to reimburse them for payments to workers.

As for debt, the Gov. could try to suspend *all* payments for all debts. “Try” here means it may not be legal. Also, some flexibility for *people* who live off investments is necessary.

Bill, do you have thoughts on Steve Keen’s recent piece? “A Modern Jubilee as a cure to the financial ills of the Coronavirus”

…and for that matter on his “Modern Jubilee” more generally?

For any readers unfamiliar with it, the idea is for a currency-sovereign government to reduce the problem of private mortgage debt by, firstly, giving a lump sum of newly created money to each citizen (equivalent to a large fraction of a typical morgage) with a rule that it is used to repay debt where applicable, and secondly, to prevent the problem recurring, banning mortgage lending of more than (say) ten years’ worth of the rental value of the property.

(In general, Steve Keen and Bill Mitchell seem to look at macroeconomics from different angles and concentrate on different things, but I’m not aware of any disagreements; both stress the money-creation power of a country with its own currency, and point out athat private debt tends to be problematic but government “debt” isn’t.)

The real problem is far more serious.

It is the question what is more important – the human life or the so-called economy, defined in a certain way.

It is stated in Hebrew Bible that human life is more important than anything else. The Romans built their civilisation on the opposite assumption. A lot of lower-grade humans, called “slaves” were treated as “speaking tools”, owned by higher-grade humans called “persons” (Roman citizens).

Unfortunately for us, the neoliberal version of the Western civilisation is yet another incarnation of “Rome” and the foundation of our legal system can be found in Roman law, especially in regards to the definition of private property (minus the right to own serfs, abolished in the 1860s in the US and Russia). Even worse, the target function in our economy is the maximisation of profits of private enterprises and the value of their shares. We no longer have the concept of “legal personhood” linked with being born as a free Roman citizen but we have superhuman legal persons in the form of corporations.

Let me contrast 3 views on human life

View 1 “Anyone who destroys a human life is considered as if he had destroyed an entire world, and anyone who preserves a human life is considered to have preserved an entire world.” (Talmud), the same view is expressed in Christian New Testament and in the Quran.

View 2 ‘In the days when Stalin was Commissar of Munitions, a meeting was held of the highest ranking Commissars, and the principal matter for discussion was the famine then prevalent in the Ukraine. One official arose and made a speech about this tragedy – the tragedy of having millions of people dying of hunger. He began to enumerate death figures … Stalin interrupted him to say: “If only one man dies of hunger, that is a tragedy. If millions die, that’s only statistics.” ‘ (The Washington Post, 1947)

View 3 We can watch on youtube “Milton Friedman justifies not recalling the ford pinto”.

Milton Friedman may not have agreed with the Stalinist vision of “homo sovieticus” but his own version of “homo economicus”, always free to choose products on the free market, is in my view equally inhumane and limited, leaving no room for analysing cases when the life of a group of people depends on the activities of another group of individuals.

I know that for Friedman it was an individual choice to pay extra 13 dollars to decrease the chance of dying in a faulty car but what would Friedman have said if it was someone else deciding to spend or not to spend $13 to increase his chance of survival? (This was the original question but Friedman managed to reframe it, I am just putting it back where it was). When Peter Dutton sent corona virus infected people to Christmas Island it was OK but he himself decided not to enjoy time there when he got infected, despite the balmy tropical climate. How surprising it was!

Unfortunately this is where we are now. The good news is that as we can see in Mainland China, Hong Kong, Taiwan and South Korea, it is possible to control the spread of virus and suppress the epidemic using radical (and sometimes draconian) methods. The bad news (in the short-term) is that this comes at a significant economic cost of shutting down whole parts of the economy. Because of this, people in power here and there, inspired by neoliberal thinking, have decided to postpone the action, maybe only just “flatten the curve” a little bit, maybe ignore the problem for now, maybe do a little bit on Monday and then “reconsider the situation”.

Is the economy for humans or are humans just existing to feed the beast of the “economy” (either in the Stalinist or Milton Friedman’s sense)?

There is no possibility of making free personal choice if someone is 80 years old and living in a nursing home. It is impossible for him / her to spend or not spend $13 or even $50000 (what is considered by insurers to be fair value of extending someone’s life by one year, source: Wikipedia) buying an extension on a free market of medical services. It is a choice for the authorities to either go full steam ahead and implement draconian measures or relax and only worry about the falling stock market.

I have to admit that in my view the Polish government (which I am not a fan of) is doing the right thing. The border controls have been reintroduced and no foreigners can enter, only citizens and residents. If I return to Poland (as I have a passport) I will either go to a quarantine or straight to the hospital if I am suspected of having symptoms. What is really significant, only 50 people can congregate in a church (or anywhere else) at a time. All pubs, restaurants, malls are closed (one can only order food from a restaurant for home delivery). Obviously schools and universities are closed, too. Air traffic has been halted except for charter planes evacuating citizens back to Poland. Foreigners are free to leave but not come back. The restrictions are similar to the Martial Law of 1981 (except for political freedoms, of course). And both parties in the parliament approved them. Such is the gravity of situation.

The number of infected people in the whole Poland is far lower than in Sydney but this time they acted before the tragedy struck, not after. Because they know that the spread can be suppressed until the vaccine is developed and the Iranian/Italian scenario can be avoided. Old cold-war Civil Defence procedures are still well remembered – they worked in 1963 (against smallpox) they will work again now. They also know that the economy is something they can worry about later, especially when people hear heartbreaking stories from Northern Italy. Again – the EU rules are kind of important but when there is real emergency, nobody within the ruling political group in Poland will think about garbage budget rules and what Mrs Merkel would say. Poland is a sovereign country with a functioning government which took responsibility for the situation and Polish farmers can feed everyone in the country (and a few more). This is all what matters. On the other hand, the social destabilisation caused by an epidemic of the scale of the Spanish flu of 1918/19 (which was actually relatively mild in Poland) could well cause far worse supply-side slump than shutting down some parts of the economy for a few months.

Make no mistake, we can all live without going to a restaurant / shopping mall / church, flying overseas or watching rugby / soccer as long as we don’t have that virus. I can say that I personally don’t care as I am relatively young and healthy but this would be totally wrong. What is in the end the meaning of life? I don’t know, maybe I will never learn, but it is certainly not hoarding wealth.

We have a clear choice, either worry about the fate of restaurants, hotels, airlines and a few other corporations or kill thousands or millions of elderly people. If we choose the well-being of the so-called free market economy over the people we may still end up losing both.

I am writing all of this as the majority of English-only speaking people may not be aware of what is really going on. Some of the facts I am talking about are not known or some conclusions not obvious. By shutting down schools, banning mass gatherings, other “social distancing” measures and introducing mass testing leading to quarantining it is possible to lower the expected value of infected people (per one already infected) from around 2.6 to below 1. The virus will linger in the society until a vaccine is developed and applied or until it evolves into something less harmful and it is decided to let it infect anyone without much harm.

I strongly believe that in Poland there will be no repetition of what happened in Italy. On the other hand the epidemics bomb is to go off in the US and possibly here in Austraila, unless an immediate action is undertaken – “whatever it takes”. Just do the same what was implemented in Poland. If it is not enough, do the same what the Chinese did. It will work.

I wasted a few hours to research and write this but I think this was my duty. There is no monetary value of human life and it is still not too late to save many. The economy is for us not the other way around. We are not slaves of a “free choice”.

I think those deliveroo gig guys will still have jobs.

It is some of those working in hospitality relying on people to be physically there spending money

in hotels, guest houses ,bars, cafes and restaurants that will lose their jobs .Even if potential

customers are given money many will chose and be advised not to go.

The scenes in Wuhan,Iran and Italy are nothing like those seen in a normal seasonal flu season.

What is china doing, injecting money to level up stocks prices, is similar to what usa just did?

Adam K @18:48- Great comment. Yes the economy is for us not the other way around!

(My home is in a group of islands midway between the nearest parts of the coasts of Finland (to which it belongs) and Sweden).

Galvanised by AdamK, I’ve now just sent the following letter to our local newspaper editor. I’m posting it here in case it might be of any interest.

“At the time of writing no cases of coronavirus infection have occurred here. However, self-evidently, the infection’s spread can change from one day to the next. For my part I have the impression that our authorities’ actions have up to now been confined to ensuring that they are fully-prepared to cope with an outbreak if and when it might happen. If that were the case then in my opinion it would not be sufficient.

Any island is able, obviously, to physically segregate itself from adjoining mainlands quite simply by severing transport connections. Unless it is entirely self-supporting such segregation cannot be made complete but nevertheless it can be made near enough so to suffice for the limited time it takes for the threat to subside.

Poland – which isn’t even an island – has done this. I would like to know what is preventing our authorities from introducing a similarly drastic policy. I would be loathe to conclude that their actions might be in the slightest degree influenced by pecuniary considerations when the survival of some of the population’s most vulnerable members could be at stake.

Hitherto our authorities’ attention seems to have been focused upon, by quarantining persons who have been exposed elsewhere to the possibility of being infected while they are tested to see if they have been, to reduce (if not eliminate) the possibility of the virus being introduced into the local population. However, unless that policy were to be 100% successful – a highly improbable outcome – the epidemic will sooner or later spread here too.

The cold fact is that if that should happen a certain number of people in the most vulnerable groups will inevitably be exposed to the risk of dying earlier than they otherwise would have. Having regard to that possibility, I (as a member of one of the affected groups) wish to question whether the authorities’ current policy is in fact a sufficiently radical or all-embracing one.

@Adam K

Great comments.

In Australia, and most developed countries, the amount of GDP a worker can purchase with the wage he/she receives for producing that GDP is just above 50%. It is as low if not lower than the levels it was just after WW2. It is has only ever reached 65-70% in the 70s I believe. Of the GDP produced, the other remaining almost 50% goes to property owners and government.

We have today globally the highest ratio of property owners to non-property owners, and what some have called a savings glut world-wide, all trying to chase yield and appreciation. We have the lowest interest rates in 5000 years.

Property ownership and too much government regulation means the average workers are constantly being asked to provide more and more for these people and yet, when it comes to risk, the people who take the real risks, the risk of life and limb on a daily basis are these very workers. Government employees and property owners (not to mention CEOs etc) do not take real risks, only financial or public risks. Too many of us have been brainwashed to look at the tiny slice of society who is unemployed and blame them for having to give up some of our hard work, and yet they make up such a small slice – the biggest slice by far goes to pay property owners and government workers.

The underlying problem is that our economic system is underpinned by assumptions about the human being, as if we are greedy, self-interested people with unlimited wants. The only people who continue to make these claims are the ones who don’t risk life and limb on a daily basis, but have convinced us all that it is they who we should hold in high esteem. It is they who have unlimited wants, not the average worker who, despite all the risks and insecurity, continues to grind out work on a daily basis. Shame on anyone who continues to assume these claims to be true.

I believe we need to allow alternative relationships to exist, so that the worker can produce but under different legal dynamics, i.e. not having to support property owners and regulators. Then we will find that there will be a huge move away from the contract and property system we are operating under today.

Canada is instituting the measures described by AdamK above. The weakness is that while our borders are now closed to nearly all non-Canadians, US citizens have been exempted. It seems the infection rate there will begin to explode soon and since more than one third of the people in that country have no access to health care the situation could become disastrous. The premiers of the 3 largest Canadian provinces have asked the federal government to close the border and our very pro-US Prime Minister, Justin Trudeau, has not ruled it out. The situation is changing day by day. Only a week ago there was concern but the situation was fairly relaxed. Now we are in a state of emergency: almost everything is shut or in the process of being shut down. Quite amazing. Importantly, it is demonstrating that if we so wish our governments have the power to run our society for the common good instead of for a navel gazing business elite and its servants. On the toilet paper front, there has been a run on the stuff here too, at least in Eastern Canada. This focus is quite bizarre, probably driven by images from elsewhere given that Canada has considerable domestic capacity to produce toilet paper.

@Dean. Could I just point out that ‘property’ is composed of two elements: building and land. Buildings are capital and need constant repair and renewal to retain their value. Land (in its economic sense, not ‘dry land’) is permanent and in fixed supply. Its that element which is the problem, which only LVT can fix.

Already the take up of MMT actions, [having been acknowledged, in the USA at least] and though very incomplete to date, and we hope will get more results consistent with MMT, is no sure thing. Already I have noticed voices talking about restarting austerity as soon as possible to allow the governments to pay back the deficits[I can’t recall exactly which blogs] which is totally stupid but not unexpected. No mention of how it would function beyond cutting welfare etc. as in the bad old days. There will be a concerted effort to return to neoliberal policies so expect to hear more about that and an effort to turn MMT into a niche , to be discarded as soon as possible.

We have to stay vigilant and jump on anyone who would return us to the neoliberal past. If circumstances get worse than now we may be able to recast neoliberal positions to the scrap heap. It depends a lot on whatever happens with the pandemic and how far down the economies sink.