I started my undergraduate studies in economics in the late 1970s after starting out as…

Eliminating the great superannuation rip off

I am currently doing some work on the superannuation industry. It will become part of a larger project with some European colleagues in the coming month. But it is also part of work I am doing on the design of a new financial system based on the application of Modern Monetary Theory (MMT) principles which will ensure that nations can pursue full employment and equity without severe disruptions caused by wayward financial markets. While this analysis is about Australia, the general principles are universally applicable and should be part of the reformed financial system that is adopted by all nations. Today I am concentrating on reforms to the way we structure and manage retirement incomes. But as one commentator noted last week, the sort of suggestions I have take us into “the realm of pure fantasy” given the vested interests that would have to be combatted. But ideas are worth something and as a research academic they are about all I have to offer.

Superannuation is one of those mysteries to most people and the industry would love it to stay that way. But some digging reveals that it is a lucrative industry for the managers and fund owners but not so for the “members” – the workers whose funds are used to make whooppee for the bosses.

In May 2009, the Australian Government announced a comprehensive review of Australia’s superannuation system: the Super System Review – Review home page.

According to the Review documents:

The Review has broad terms of reference. It has been charged with examining and analysing the governance, efficiency, structure and operation of Australia’s superannuation system. The Review is focused on achieving an outcome that is in the best financial interests of members and which maximises retirement incomes for Australians.

The Review is due to report in April but I don’t expect much given that the Panel is made up of industry insiders with no independent voice present. So how comprehensive it turns out to be will be the issue.

In terms of scale, the most recent Phase 3 Issues Paper on structural matters, released in December 2009, reports that:

At the end of June 2009, there were 416,622 superannuation funds, of which only 463 had more than four members … Total superannuation assets at June 2009 were $1.08 trillion, which is about the same as Australia’s annual gross domestic product (GDP).

The main type of funds are Corporate (190 managing $A54.8 billion); Industry (68 managing $A191.1 billion); Public sector (40 managing $A151.6 billion); Retail (165 managing $A306.0 billion), and Pooled superannuation trusts (PSTs) (82 managing $A69.9 billion).

So it is a big industry and growing rapidly. Australian law (as of 1992) now requires employers to contribute set amounts to a superannuation fund. Prior to the 1992 Superannuation Guarantee (SG), the coverage of superannuation was limited and usually part of union bargains captured within industrial awards.

In 1989, only 48 per cent of workers were covered and now almost all workers are covered (self-employed persons are excluded from the compulsion).

The SG became part of the so-called three-pillared retirement income system which Australia has popularised: (a) means-tested Age Pension and related social security provisions; (b) compulsory employer superannuation contributions; and (c) voluntary private savings and contributions to superannuation.

The previous conservative government accelerated the neo-liberal agenda over its 11 years in office (1996-2007) and made significant changes to the three-pillar system. First, they introduced policies that allowed the superannuation industry to become increasingly more market-oriented (more about which later). Members began to be offered “choices” that they were not qualified to fully appreciate which saw them trade off secure defined-benefits arrangements with insecure (but appealing) high return portfolios.

Second, they gave huge tax advantages to superannuation activity which has accelerated the third pillar – voluntary contributions – and placed significantly more funds in the hands of the greedy managers.

For example, salary sacrifice arrangements allow a worker to contribute income to their super at a low tax rate while at the same time reducing their gross taxable income. As the Australian Treasury puts it:

Salary sacrifice arrangements enable employees to effectively substitute the concessional tax rate applying to employer superannuation contributions for their own marginal tax rate.

There are a myriad of other tax advantages.

Consistent with the bias of the previous conservative Australian government, these tax and other advantages overwhelmingly advantaged high income and otherwise wealthy individuals. There have been huge transfers via the tax system to this cohort.

You just have to realise that in 2007, the mean superannuation balance was $A71,000 whereas the median was $A24,000 (Source).

Anyway, all that is context.

There was a wonderful article by the Australian Broadcasting Commission’s economics correspondent Stephen Long last week (March 9, 2010) which he entitled – Demolishing the entire superannuation system.

Stephen is a very civilised fellow who often gives me air time on the national current affairs programs.

He starts by asking the following question:

Is it worth having workers’ retirement savings put at risk, and traded at the mercy of the market?

He notes that the “usual critique of the superannuation system is that fees and commissions gouge out too much of Australian workers’ retirement savings, and financial planners paid kickbacks for spruiking super schemes give people poor advice”. Yes, that is clear and we will look at this issue again later.

But Long’s point is different this time and relates to the fact that our superannuation industry is become increasingly market-oriented and risky and thousands of people have lost significant amounts of their retirement incomes in the last two years as a consequence by being at the wrong age at the wrong time.

The alternative is that it is possible that:

… workers, and society at large … [would] … be better off if far more of the vast pool of savings in the superannuation system was held as cash in the bank, or put in near risk-free investments such as Australian Treasury bonds?

Long argues that the “industry” will deny that and that “the returns from investing workers’ retirement savings on the stock market, primarily, and in property are superior to cash in the bank”.

But how many people actually know what the relativities are? We often see only the upside when during the share and real-estate booms, the super funds are boasting “double-digit returns” and then we feel secure in our growing nominal wealth.

The issue is that the “asset markets are volatile. What look like solid gains can melt into air”. That is the nature of nominal (paper) wealth.

Long reports some data, which shows that the “the average interest rate for term deposits in Australian banks between March 2000 and February this year was 3.92 per cent … [yet] … the median retail super fund delivered a return of just 3.7 per cent.”

The results are broadly in line with more detailed data sources.

You can get good data from the RBAM on cash and bank rates (term deposits) etc and Treasury bond yields. Further, the Australian Prudential Regulation Authority provides excellent data on superannuation funds and their returns. So I did some digging.

Relative investment returns

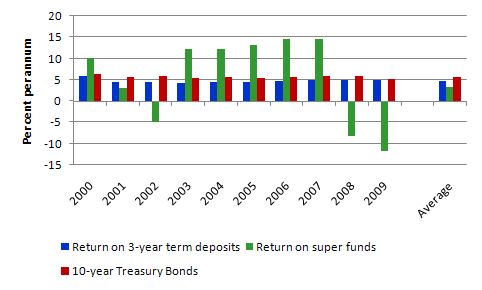

The following graph is a combination of data from those sources and shows the rates of return from 3-year bank term deposits (blue bars), 10-year Treasury bonds (red bars), and the average for all superannuation funds (green bars) between 2000 and 2009. The average return for each type of investment in the last set of columns.

It is clear that the risky superannuation return on average is below the risk free returns on offer by parking cash in the banking system or investment in 10-year Treasury bonds.

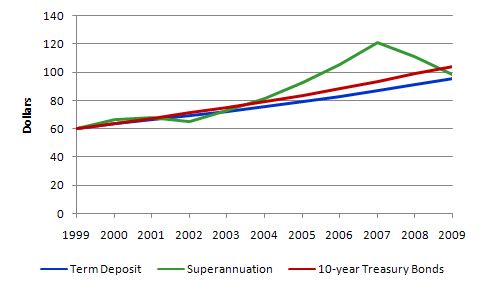

The following graph simulates what might have happened to a worker who in 2000 had the average superannuation balance (around $A60,000) if they had have invested it in bank cash (term deposit) or a government bond. So I simulated the three investment choices based on the actual data that is available from the above sources. By the end of 2009, the worker’s $A60k would have grown to $A96K if they had have left it in risk-free term deposits; $A98K if they left it in the average super fund, and $A104K if they had have invested it in Treasury bonds. I am ignoring any transaction costs in this comparison which are likely to be low anyway.

So super is a dud!

Given that the super funds are not great performers, Long notes that:

It’s only the generous tax concessions afforded to superannuation that allowed the industry to deliver a higher rate of return. Let’s put it another way. Banks and other financial institutions took workers’ money, profited by slicing out considerable money in fees and charges for investing and managing it, traded the savings on risky markets, and ended up with a 10-year return short of what a worker would have got by parking the money in the bank and taking no risk whatsoever.

That is astoundingly poor performance.

The super funds all blame the global financial crisis but Long disputes that (and so do I). This underperformance is a long-standing problem for those who analyse the data.

Long reports on a 2003 paper from APRA that concluded that “(a)djusted for risk, the average return on the profit-motivated retail superannuation funds was negative. Many of these funds delivered performance inferior to risk-free investments such as Treasury notes”.

So what accounts for this poor performance once you consider the risk element?

Long says it is:

… largely because, once it’s in the hands of the companies run for profit, so much of employees’ retirement savings is leached away in fees, commissions and charges, though poor investment decisions and high costs in funds lacking economies of scale is also a factor.

In considering the question of efficiency, the current review Phase 2 Issues paper said:

The Review Panel takes the view that wholesale investment markets are fairly efficient, and so there are only marginal potential gains in efficiency that can be made through increased gross investment returns. There seems, however, to be much greater scope to improve system efficiency overall by refining and streamlining operational processes and reducing costs and leakages (including agency costs). Therefore, the determinant of efficiency should, in the first instance, be the ability to reduce the aggregate of those costs and leakages, rather than looking for ways to increase gross investment returns.

Given the analysis of returns presented above, it is hard to agree that the funds are very efficient. Their returns are worse than cash on average!

Even the Phase 2 Report (page 16) also notes that “two-thirds of active managers did not perform better than the S&P/ASX 200 Accumulation Index for the five years to the end of 2008”, which agrees which the argument being put in this blog (and in Long’s article).

A significant factor is the gouging that the managers engage in. On page 25 of the Phase 2 Report we read:

In a survey done in 2008, Watson Wyatt found that superannuation and pension funds around the world were paying 50 per cent more in fees than five years earlier. The main reason attributed to the increase was that funds were paying for manager skill in delivering above market returns largely through alternative investments, even though the report concluded that this was not actually being delivered.

Most of the management fees are based on volume of funds being managed and flat rate charges are usually levied despite the obvious benefits of economies of scale.

As the size of the fund increases, the operating costs per member of running the fund fall but this is not reflected in the behaviour of the Australian superannutaion industry.

The fees actually rose as the returns plummetted during the crisis.

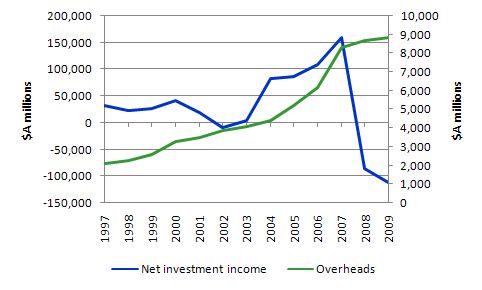

The following graph shows the evolution of net investment income generated by the superannuation industry between 1997 and 2009 and the overhead charges levied on workers. Not a pretty site.

On Page 2 of the Phase 2 Report an example is given:

Assume a single fund manager managed all of the superannuation savings in Australia from 1996 to 2006 for total fees of 1.25 per cent of assets under management per annum. Over that period, APRA data show that superannuation assets nearly quadrupled from $245 billion to $912 billion. 50 The manager would have enjoyed an increase in gross annual fee income of some 272 per cent or $8,337,500,000, equating to a compound annual growth rate of 14.05 per cent, compared to compound annual nominal GDP growth over that same period of 5.8 per cent.

Further, performance fees are asymmetric and encourage managers to take higher risks to boost their earnings knowing that if the fund loses their is no deduction forthcoming. So once again the fee structure does not work in the best interests of the members.

A related issue to that raised by the asymmetric performance-based rewards offered to managers is the tendency of the funds to become more short-term focused. The number of funds offering defined benefit schemes is falling and eventually, only accumulation-type funds will be available.

The industry claims this reflects increased complexity of the markets etc but the real reason is that they can gouge more out of members by avoiding the longer -term focus. It is clearly not in the long-term interests of members (workers) linking “super to a contestable financial product market”.

It matters how old you are when

While the risk-adjusted returns are very low compared to the alternatives, the other problem that Long notes is that the volatility of the returns “renders superannuation a lottery”.

So it matters very much how old your are when.

Long notes that:

Two people might be in the same occupation on the same income, even in the same super fund, but they’ll have vastly different prospects and life circumstances in retirement if one is handed the gold watch while returns were still booming and the other retires after a crash.

And this should raise serious questions about the whole logic of the industry which I now turn to.

Towards a national superannuation fund

In relation to the inefficiency of the super industry, business commentator Michael Pascoe wrote in his Sydney Morning Herald column today (March 16, 2010) that – Streamlining super is simpler than it seems. He says that one of the proposals of the current Government review is to streamline the payments system associated with superannuation to make it “all contributions electronic with no cheques, money orders or envelopes of cash allowed”.

He notes that the move:

… will save the industry $1 billion a year in manual processing and general inefficiencies, but it’s by no means clear how much of that billion might accrue to individuals and how much might be retained by the sticky fingers of sundry fund managers and platforms.

Once again pointing out that one of the largest ineffiencies in the retirement income system in Australia lies in those “sticky” – I prefer to call them “rapaciously greedy” fingers of the managers.

Pascoe notes that there is however an even better way forward which makes any current suggested improvements look “glaringly inefficient”. He is of-course talking about:

… the existing omnipresent infrastructure perfectly suited for collecting contributions: the Australian Tax Office …

Pandering to the dubious claims of the for-profit retail funds, the empire-building ambitions of industry funds and perhaps scared of ideological labels, federal governments of both persuasions have chosen to ignore the readily available and highly efficient option of simply tacking the 9 per cent compulsory contribution onto the income tax collection system.

The road already exists. The extra cost is incremental. The simplification benefits are immense. There would be another line on the individual’s tax return each year asking for his or her fund of choice and, voila, the job’s done.

He notes that the private funds would be appalled by this suggestion because it would remove a major smokescreen they use to hide the fact they do very little for their returns.

But then if we really want far-reaching reform why not extend this suggestion one step further and wipe out the private providers altogether.

In the Phase 2 Discussion Paper on operations and efficiency, poses the key question:

It is also important to question the key philosophical underpinnings of the super industry. Is it just another industry or is it a distinct and special sector deserving different treatment because it is largely a piece of social infrastructure provided by the private sector?

The current Review is proposing that for the majority of workers “the so-called disengaged investors” a low-cost funds management alternative should be offered. Long notes that the Review’s low-cost “universal fund” would still invest in so-called “balanced portfolios” (mostly shares) this “would still leave the vast majority of workers’ money at the mercy of the market place”.

Long starts to dream:

Suppose that a fair proportion of the money in the low-cost default funds covering the vast majority of workers under this new system went into low-risk investments, such as cash and government bonds … [or] … “green” bonds to finance the shift towards climate change sustainability. Suppose the money in super went into infrastructure projects that would help create viable public transport and liveable cities.

He says this would create “a bigger pool of deposits, reducing Australian banks’ big dependence on offshore funds”.

While that proposal would be far superior to the current arrangements even that modest change in the structure of the industry would be fiercely opposed by the monied interests that bleed the industry dry of reasonable returns to the members.

But I would take the industry head on if I was the federal government and not allow the retirement incomes of the vast majority of workers to be at the the behest of this lazy underperforming elite.

In that context, I would create a national public superannuation fund that offered full vesting to all current fund members and zero management fees. The operating expenses would be covered from the fund’s investment returns but with the elimination of the gouging from private profits and management fees the returns would be signficantly higher even if the fund only invested in risk free assets.

This would lead to a significant decline in the size of the private industry and the gouging would decline. But people would then have a real choice between guaranteed returns which had low volatility versus the higher returns but a strong chance of getting old at the wrong time. I think there would be a flood into the public fund.

This is not a new idea and has a long tradition in the progressive debate within Australia. In his famous 1969 federal election policy speech, then Opposition Leader Gough Whitlam said that:

Too few Australians now have the opportunity to join superannuation schemes. It is time this opportunity was extended to all Australians. Only the national government can create this opportunity … Our objective is to give the three-quarters of our people who are not able to enjoy the benefits of superannuation the opportunity to do so.

Whitlam didn’t win that election but he was successful in 1972. Unfortunately his tenure was derailed and he was dismissed by the Governor-General in 1975 with the help of the CIA. You can read about the dismissal HERE. Essentially, democracy was overrun by the interests of capital. But the upshot was that he didn’t get to introduce his national scheme.

Anyway, his rhetoric seems a little quaint now but the idea of a national superannuation scheme managed by the government is an essential part of any serious-minded reforms of the banking and financial system.

Conclusion

As part of the suite of initiatives I have been developing to reform the financial system and ensure that it delivers public purpose – the idea of a national superannuation scheme run by the government is a key component.

The compulsory superannuation guarantee while appealing in concept has transferred billions of dollars into the hands of the fund managers who could not believe their luck. While they were out partying on the gouged management fees, risk-free term deposits and government bonds have been outperforming them.

On a risk-adjusted basis, the super funds have been a dismal failure.

But the general point is that it is not in the best interests of the workers to have their retirement incomes exposed to the risk of the markets and the lazy incompetence of the fund managers.

A sovereign government that issues its own currency can always afford to provide adequate pension schemes. But it can also manage the superannuation contributions of employers and employees to ensure that when a person reaches retirement age their savings will have grown in a guaranteed manner.

Sad digression

Earlier this month there was a news report about a woman in the Victoria who “lost up to $125,000 after her handbag was stolen during a shopping trip to a local supermarket”. Why did she have that much in her handbag?

Answer: the woman, who emigrated from Iraq nine years ago, had a suspicion of banks and carried her life savings around with her for security.

That is enough for today!

Hm, a government run pension plan to compete with the private industry? You could call it a “public option”. Then all the crazy people would go on teevee complaining about SOCIALISM! GOVERNMENT TAKEOVER! you know the Nazi’s had a universal pension scheme? Ahem. Sorry, I’ve been paying too much attention to the health care fight here in the US. It’s depressing.

Bill,

You might be interested in the following Canadian proposal as a comparison. It suggests similar scale benefits in extending pension benefit coverage, but probably differs from an MMT type orientation in that the CPP considers itself in direct competition with private sector portfolio management, and has a governance structure that is intended to insulate it from government influence.

http://www.cdhowe.org/pdf/commentary_265.pdf

In 2008: “Buffett (Warren) offered to bet any taker $1 million that over 10 years and after fees, the performance of an S&P index fund would beat 10 hedge funds that any opponent might choose. Some time later he repeated the offer, adding that since he hadn’t been taken up on the bet, he must be right in his thinking.”

Why have a super-annuation fund at all? Have government supplied pensionsl, and those who want to save more or receive higher incomes can take their risks in the asset markets.

Financial markets are not the appropriate delivery mechanism for social commitments. First, any forced participation in the asset markets must deliver lower returns than a government-funded pension, due to overhead costs. You can pretend those costs are zero if they are siphoned out of earnings, but they will not be zero.

Moreover, you are not going to be able to deliver more income to retirees this way. The only way that you can deliver more income is to have the government supply high quality public goods and properly regulate demand. Gains in the asset markets net out to zero — the real gains are in the non-financial economy. And as savings does not fund investment, forced savings will not promote prudent investment, and will not help the society in aggregate meet its pension goals.

Moreover, this is harmful to the asset markets, distorting prices and increasing volatility. Passive investment strategies such as index-based investment are destabilizing. This is a “free rider” problem that government should discourage rather than promote. If government undertakes this on a vast scale, it will introduce significant feedback loops into what is already a volatile system.

Finally, the asset markets can go through 30-40 year bull and bear swings — they are not designed to deliver on social promises, but to estimate future returns over a long time horizon. Government should deliver social commitments directly and promote growth in the real economy, rather than encouraging pyramid schemes. Government funded pensions achieve both aims, as they regulate demand while improving social welfare.

Handbag note: the woman recovered almost all of her money.

My dad is still snakey that National Mutual (now part of AXA Asia Pacific) charged his insurance policies a fee to lobby against Whitlam’s proposed National Superannuation Scheme which would have benefited him.

Super contributions are made over about 35 years and the drawdown period is expected to be about 20 years on average, with peak fund balances during the age period of say 45 to 65, depending on age of retirement and possible unemployment/loss of career during the period after age 50.

Doing a 10 year analysis that happens to start at the absolute peak, in real if not nominal terms, of many global sharemarkets and end at a point that might well be part way through a recovery after the largest global financial crisis and stock market falls since the ’30s is IMO not a sound basis for analysis.

Rolling 10 year returns of each asset class used based on an average asset allocation to determine overall returns from super vs the other asset classes is required. An example of a rolling returns analysis (shares only) is at:

http://dshort.com/charts/SP-returns-roller-coaster.html?SP-Composite-20-year-real-returns-with-dividends

The analysis should also be done on an after tax basis. My understanding is that savings outside super will have their income taxed at normal rates after 60 while income from savings within super can be tax free after 60.

The analysis should also take into account that inflation can change dramatically during the life of a super fund, for example from 1972 to 1990 inflation was generally above 7.5%. As inflation subsided from 1974 levels yields on bonds reduced and stock market PE’s generally trended up, influencing share prices and returns.

While I appreciate that a comprehensive analysis would require significant resources and thus not be possible, the simple analysis presented could be dangerous to use as a basis for decision making.

I do agree that the average person is not well equipped to do the analysis and decision making to maximise returns, and it would probably be a poor return on time to attempt it for those with relatively small amounts of super and so super choice is not really a practical option for many people, but many people realise this and take a default portfolio that is generally reasonably balanced/diversified at least within Australian dollar denominated asset classes.

Bill, I notice that you have not mentioned Self Managed Superaannution Funds (SMSF -funds with less than 4 members).

Firstly, a disclaimer for readers, I am a Chartered Accountant, and have been involved in helping clients run their SMSFs for about 15 years.

The SMSF sector is consistently under-attack from the big retail fund managers.

For example, they often make comment that SMSF assets are structured properly because of their high cash balances. They got such traction that the Commissioner of Taxation (the regulator of SMSFs) came out a few years ago and said that he was concerned that SMSF maybe non-complying because they did not have a properly structured investment strategy (as required by law) because of their high preference to cash. This voliates the rule that clients should only invest in assets that suit their risk profile. I have seen SMSFs 100% in cash. Why? Because they do not trust the big retail fund managers, and/or the sharemarket.

Another example was the introduction just over 10 years ago of what we in the industry refer to as SLAB4. SLAB4 amended the Superannuation Industry Supervision Act (SIS – the law that regulates superannuation funds) to prevent superannuation funds from investing in related geared trusts. Geared trusts were used to basically get around the prohabition on super funds borrowing (SLAB4 was introduced by the Howard government, who then a few years ago changed SIS to allow a limited form of borrowing, when APRA and the ATO came to the conclusion that SIS did not allow the ownership of instalments warrants (which are issued by the big banks) by superannuation funds). In the geared trusts that I saw, most were used to build new commercial property that the client operated their business out of. So in those cases, the tax concessions were being used to increase the productive capacity of the economy.

I notice that the latest push is to get superannuation monies into infrastructure such as toll roads.

Since becoming a reader of Billy Blog, my opinion of superannuation has crystallised as being a good idea at the time and theory but has failed in the real world.

For example, one of the reason put forward for superannuation was that it would increase the economic capacity of Australia. However, except for some SMSF prior to SLAB4 and CBUS (the construction industry fund – which as its investment strategy would invest in the construction of new commercial property) this has not happened because the biggest investment catergory are listed shares. Generally, the purchasing of an existing asset that does not added to economic capacity. Also, why has Fortescue Metals had to go Canada in the first place, and now the Chinese to finance the construction of their new mine?

But if you think about it, it was not going to occur because those with the largest balances are those closest to retirement, and who have the more to lose if the new mine/infrastructure (ask those invested in BrisConnections) does not work out.

Also, in conjunction with the employee share scheme concessions, compulsory superannuation has resulted, I my opinion, in the skewing in remuneration to the biggest listed companies. How? Firstly, because of the industry structure outlined above by Bill, there is an bias towards investing listed shares, especially, the top 50 companies, because they have to be in the market (as they would not be able to justify their fees for sitting on cash, and a booming share market funds will flow out of funds sitting on large cash balances as people chase returns). Therefore, the market performance is more due to the weight of funds than the peformance of the underlying business. This evident when total shareholder returns (dividends and capital growth) are emphaised becuse if you looked at the dividend yield it would be very hard, if not impossible to justify investing in share that pays a dividend yield less than the cash rate, neither mind Government bonds. As employers have to remit superannuation each quarter, they is always underlying demand for shares, and in a gaining market, the number of shares available for sale declines and therefore, the price keeps going up. Therefore, employees receiving concessionally taxed shares could find willing buyers when they wanted to cash out. Also, a company is not constrained in how many shares they issue as against their cash restraint. If they issue too many shares could mop up the excess though a share buyback, which once the tax-benefit of the franking credits, and the capital gains tax loss, were more beneficial for superannuation funds to participate in, even though the company was offering to buyback its shares at lower than the market value.

To but in context, imagine you were offered two jobs. One from a private company for $50,00 per year, and one from a listed company for $50,000 plus $1000 of tax-free shares per year. Which one sounds more appealing?

As another issue, is there any benefit of forcing employees to save 9% of their income (complusory superannuation was brought in under the accord between the government and unions which provided for the superannuation instead of pay rises)? Would employees be better off having the cash so that can pay off their debt, or conversly, not need the debt on the first place? MMT would say that that this would not be an issue if the goovernement ran deficits higher enough to allow the private sector to undertake this saving. But as we all know, during the majority of the era that we have had compulsory superannuation, Australia has had a government that has run budget surpluses and we have run a current account deficit. So whilst we have policital parties wanting to run a balanced budget, even if over the business cycle, then superannuation probably does not make sense.

Sorry about the long post, but I thought they you would all enjoy some comments from the coal face of superannuation.

Politically to get the National Fund up, my suggestion would be to continue with the current structure with the National Fund being just another fund. This National Fund would also be the default option under superannuation choice.

Super is an excuse for the Gov to abandon its retired workers to the market.

If the average Joe tax payer could understand investment he would not be an average Joe, he would run his own super fund. Average Joe leaves it up to the super industry thinking the Gov would keep him safe from sharks.

Poor Joe could have moved his super from growth to cash management in 2007 as anyone who understood investment risk did. Poor Joe looked to the Gov to see who was to blame for loosing half his lifetime savings.

The Gov says its nothing to do with us its the Super Industry and we will have an enquiry. In the meantime Joe keeps putting money in his super account because the Gov keeps telling him he needs more to retire on.

A fellow working for a super fund told me last year when I asked him what his super funds business model was:

he responded “same old model, fee gouging”. Poor Joe.

Found another promoter of the cause Rob Paranteau

http://www.nakedcapitalism.com/2010/03/rob-parenteau-data-challenges-deficit-terrorist-beliefs.html#comments

He has had a few posts at Naked Capitalism the last few weeks. He\’s very passionate. You can tell by reading some of his responses to comments

Always good to have passionate voices fighting for good ideas.

Dear Greg

Yes, Rob is a friend and we know him well. He works in the financial markets.

best wishes

bill

Superannuation, Health Insurance rebates, BOOT Schemes. – It’s the same dog with a different leg action.

The good news for the Government is that the general Australian citizen is a complete idiot who will acccept whatever they are told.

Alan, that is entirely unfair remark to make about the Australian public. I’ve recently moved here from the UK and even if you opposed the Austrailian Superannuation guarantee scheme it’s enforced in such a way there is no way you can opt out but I suppose it’s better than the system we have back in England!

With Steve on that one. The current system in the UK is laughable but mind u, most things here are at the moment.

It’s a nice theory, but wouldn’t the creation of a government fund to compete with the public funds lead to the loss of many jobs (probably from the higher tax brackets), which could cause a lot of instability in the economy? Good luck finding a politician good enough to push that through.

At any rate the funds should be performing much better than they are. An individual investor can get 200% return over 10 years, why can’t a fund made of many investors (who are actually paid to invest, not just as a sideline) do the same? It’s bad enough that Joe Worker gets poor investment performance, even worse that he has to pay through the nose for it!

The best thing the government could do is stop making super compulsory. Perhaps they could stop taxing interest on savings accounts that appreciate by 10% of ones income each year, or *gasp* abolish negative gearing of income and provide tax breaks for funding the place of primary residence?

Nice one you shared a very informative blog. It is very helpful for us. The good news for the Government is that the general Australian citizen is a complete idiot who will acccept whatever they are told.

For my superannuation I have nothing left the fees have 0 my super with sunsuper, the last account statement given to me was the total of $58 dollars left and when I rang sunsuper they told me don’t worry about transferring it as it will be nothing left which means their fees which should be made illegal to charge as they invest your money to make money but no they are allowed to charge account fees that are getting higher, to what is earned what crap, what BS, what a criminal fraud scam of a system. After 32 years of super their system has given me only $8000 in super and $2500 in tax to the government and being forced to take before nothing is left and now being unemployed. Their is no protection for the poor and are ripped off completely.

The Government and the superannuation system is a SCAM, but most of all its criminal and the dumb people allow it to exist, and the poor can’t fight against it. Government and private are given the right to act in what ever criminal way they can get away with, and the justice system allows it, because its criminal in its own right, Their is enough evidence to completely sack the lot and go on the witch hunt and jail every Politian, and arrest so many that their would be non left. Ignorance, is no excuse to criminal crimes being committed by anyone in any position.

I am so angry to be treated like an idiot. What a bunch of dumb blind monkeys. Justice there is no justice in a system that is rife full of criminal minds, so the saying’ Birds of a feather do flock together in this nation. and the Justice system is liken to the three blind mice, and the people are liken to the three dumb monkeys see no evil, hear no evil, speak no evil. What a rotten evil generation that now exist.

Sorry their is no fixing a system with criminals in control, unless you get rid of the criminal minded individual’s first and that is imposable when they are a criminal organization already in control.

The Banks are even a greater problem to all nations, and the stock market is the gambling machine of investors and banks have share in the crimes it makes as well. To many systems are being criminally operated that makes it near impossible to fix unless you remove the human bent on making more than what is fair and greed is in the mind of every person now living.

The more complicated a system is made is to hide the criminal actions within it as it is well known by good investigators after the truth.

Thank you for letting me have my say’ I know its a bit over board, but the rotten root of the truth is plain and to the very point. Good Luck

Debate: is the new means test for the aged pension fair?

The meanest means-test of the age pension.

The Australian government provides every retired person with the safety net of the age pension, subject to the means test.

According to the means test of income, a single pensioner loses 50 % of the age pension after his/her income exceeds $162 a fortnight or $4212 per annum; a couple loses after an income of $4288.00 per fortnight or $7488.00 per annum.

If a single self funded retirees income falls below $1896.00 per fortnight or $49296.00 a year, or a couples income falls below $2902.00 per fortnight or $75452.00 per annum they can claim a part age pension.

The government is using the means test of the age pension, that the pensioner on a modest extra income above the allowable income, before his/her pension is reduced by 50%, to subsidise the generous tax concessions for the self funded retirees; the cost of the tax concessions is now almost as much as the total cost of the age pension.

When the Howard-Costello introduced the obscenely generous tax concessions in 2007,it was hardly mentioned by the media.

As it is now becoming obvious, that cost of the tax concessions are becoming unsustainable, the government should scrap the means test of the age pension and scrap all tax concessions for super.

What complaints would the self funded retirees have, if they were paid the full age pension, for losing the tax concessions for super?

A government in any civilised society should provide a basic living income for its retired citizens, but the government should not use a devious means test, so that citizens on modest incomes should not have to subsidise a luxurious lifestyle for the very rich.

The huge tax concessions for super do, and will in the future greatly contribute to Australia’s government debt problem.

I really like the idea of a national super fund and the semi-nationalisation of a number of industries is absolutely required, especially energy and renewables. However, isn’t the entire idea of the Superannuation Guarantee (and therefore the entire super industry) rooted in the myth that taxpayers are needed to fund their own retirements, as opposed to it being the domain of the currency issuer and their pension policies?

Incidentally, we’ve clearly seen the concern of this post vindicated in the last decade as the super industry has become increasingly more volatile.

As a young financial adviser, I also support the need for government-owned superannuation for retirement incomes – I’d much rather talk to my clients about their personal and cashflow affairs than the uncertainties of financial speculation in markets! Under such scheme, the government can provide a guaranteed income, and this is something that would be attractive to the public.

Unfortunately it will be difficult with our current government, and the opposition has already bought into the neoliberal agenda by having a vested interest in the super system (Industry Super Funds)

I have started reading your Macroeconomics textbook, and I also form the view that the real wealth is in the real economy, and not the financial economy.