These notes will serve as part of a briefing document that I will send off…

Leopards do not change their spots

Only a short blog post today as it is Wednesday. My father, in fact, used to say that ‘leopards do not change their spots’, when referring to people who in one period behaved one way and then when sprung would pretend they were reformed. I was thinking about that when I noted that the queue to the magical reinvention door is getting longer by the day. This is the process, whereby a person, who previously advocated neoliberal macroeconomic policy interventions from the sidelines (as an academic economist or media commentator) and/or executed them from a position of power (say, as a Treasurer or Minister of Finance), starts attacking present day governments, who inherited their own fiscal surplus obsessions, and are, like they did themselves, driving their economies into the ground as a result of the same obsessions. Who is in the spotlight today? None other than the former Australian Treasurer, Paul Keating who was reported in the press this morning (October 30, 2019) – Paul Keating slams Liberal party ‘surplus virus’ (paywall) – as being critical of the current government for keeping the “Australian economy ‘idling at the lights'” as a result of “running Australia’s budget like a ‘corner shop'”. He urged the government to stimulate the economy with fiscal policy. Now before we get too excited, and this applies to all the goons who come out claiming they wanted fiscal stimulus all along, these characters typically blow their cover and reveal their true DNA when they reflect on their own track records on the subject. But it is an interesting, if not amusing, pastime watching these characters try to revise their CVs to look like they ‘knew it all along’ as they try desperately to retain relevance and get on the right side of history. We are not that stupid though.

In today’s article, Paul Keating was critical of the current government for acting:

… as if “it’s naughty not to be in surplus”.

He said that:

The budget of the commonwealth of Australia is not like the budget of a corner shop, that you must … be able to close the door on Friday night and be in surplus.

The economy is idling at the lights … it’s like the car idling at the lights and waiting for the lights to turn green to take off again. The economy at 1.4 per cent is simply idling …

I received several E-mails this morning when the article came out from friends or others suggesting that Keating was now channelling Modern Monetary Theory (MMT).

Don’t hold your breath though.

He also told the journalist that:

I had four surpluses in my years, the first since the 1950s … Peter Costello, after me, was right about surpluses. But I think Peter’s … put a surplus virus into the Liberal Party bloodstream. They think you’ve got to have a surplus.

This is the DNA give away.

Keating became Treasurer in 1983 and inherited the emerging neoliberalism about deregulation, privatisation and the obsession with the pursuit of fiscal surpluses.

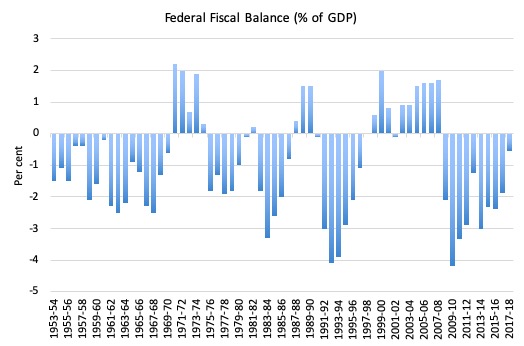

He inherited a weak economy but set about pursuing surpluses as soon as he could and by 1987-88 fiscal year recorded the first of three consecutive surpluses – 0.4 per cent of GDP, 1.5 per cent of GDP and again, 1.5 per cent in 1989-90.

The data shows that he only recorded three surpluses during his period as Treasurer.

Further, his praise for the Costello surpluses (he became Treasurer when the Conservatives took power in 1996) and was only able to achieve those surpluses because the financial market deregulation mania that both Keating and Costello implemented reduced regulations on banks and oversight by the authorities and led to the credit binge that saw the household saving ratio move into negative figures and household debt rise from about 60 per cent of disposable income to 180 odd per cent.

Without that unsustainable credit binge, the economy would have tanked under the strain of Costello’s fiscal drag (the surpluses) and he would have been back in deficit quick smart.

Just as Keating experienced after his obsessive pursuit of surpluses.

In 1990-91, Australia had its worst recession since the 1930s.

Paul Keating was then Treasurer, a Labor Treasurer and subsequently became Prime Minister for a few years.

He flippantly said in November 1990, when still Treasurer, that Source:

The first thing to say is, the accounts do show that Australia is in a recession. The most important thing about that is that this is a recession that Australia had to have.

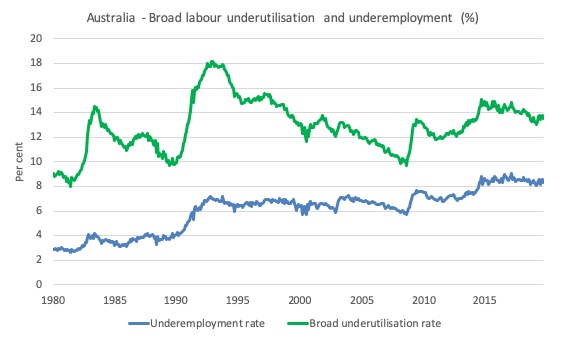

The recession was incredibly damaging in terms of lost incomes, rising unemployment and underemployment became entrenched for the first time as employers scrapped full-time work and converted the tasks into casualised fractional jobs. That was a one-way street – underemployment has never come back down to pre-1991 levels.

This was in the early period of monetary policy dominance and the fetish for fiscal surpluses that paralysed fiscal policy and created the conditions for that recession in Australia and elsewhere.

The following graph shows what happened.

At the same time, towards the end of the 1980s, the RBA had pushed interest rates up to the ridiculous levels claiming it was fighting inflation but really just setting the economy up, accompanied by the fiscal surpluses for a major crash.

This was in the context of the dominant view that had emerged that monetary policy should be left to do the counter-stabilisation functions, in this case, to slow the economy to wipe out inflation and the reduce the trade deficit, while fiscal policy had to be about running down the federal government’s debt balances.

It was straight neoliberal myopia.

And here is what happened to unemployment and underemployment.

The problem was that Keating refused to ease up on the contractionary fiscal stance despite the economy heading into its worst downturn for 60 years. He kept claiming there would be a ‘soft landing’ and there was no need to relax the tight fiscal policy.

He also believed that the cuts in the interest rates, as the RBA finally realised the ridiculously high rates were damaging the economy, would allow the economy to slow down and then transit back to strong growth.

This was the mindless faith in monetary policy to solve the spending gaps that occur over cycles. The problem was that monetary policy is incapable of doing the job these characters require of it. And exacerbating a declining economy with tight fiscal policy just guarantees a recession.

Eventually, Keating conceded and introduced a modest fiscal stimulus – but the damage was done and it took years before the unemployment rate fell much.

He was the architect of exactly the same crimes that the current government are committing in the name of ‘fiscal responsibility’.

In 1992, I published an article – Too Little, Too Late? – which is one of many articles I wrote at the time, both in academic circles and Op Ed outlets, criticising the Keating approach.

In that article I argued that in the decade leading up to the 1991 recession, there had been a major decline in public infrastructure as a result of the surplus obsession of our government.

I commended the Federal Government at the time for announcing a major infrastructure spending program (called “One Nation”) but was critical of the unwillingness of the Government to engage in large-scale job creation.

At a time when unemployment was at obscene levels due to government inaction (and surplus sabotage), the official line was that the mass unemployment was a “structural” problem “requiring more training provision”.

I did some calculations on how the Government could wipe out unemployment with a large-scale job creation program and argued that it “would quickly increase consumer and investor confidence, while lessening the social costs associated with high unemployment and low household income.”

My argument was that the “recession was engineered by restrictive policy” and that the solution was “an immediate and direct stimulus … followed by medium term initiatives like training and public infrastructure development”.

So, I welcome anyone who can concede they were completely wrong in the past and have changed their ways.

I do not welcome into ‘our’ camp those who criticise the current policy makers for doing exactly what they did themselves in the past and who still hang onto the myth that their pursuit of fiscal austerity was responsible.

The obsession with surpluses caused the monumental recession in Keating’s period as Treasurer and he was too obdurate to change positions quickly enough. The same fate is approaching for Australia as the current government practices the same fiscal obsession.

Japan Speaking Tour – November 2019

Here are the details of my trip to Japan. I leave for Tokyo tomorrow.

- November 2, 2019: Seminar at Kyoto University from 14:00 to 17:00. The venue is the Shirankaikan, which is a conference hall in the Faculty of Medicine.

- November 4, 2019: Seminar at Ritsumeikan University, Kyoto organised by the Rose Mark Campaign group from 13:30 to 16:30. There are limited places for this event so write to info3@rosemark.jp for more information. The location is the Kyoto City International Foundation. For Details

- November 5, 2019: Tokyo Symposium and Press conference at the Diet Members’ Office Building (Parliament) from 14:00 to 17:00.

- November 6, 2019: Press and media engagements and private meetings.

- November 7, 2019: Press and media engagements and private meetings.

If you want to meet with me while I am either Kyoto or Tokyo then please send me an E-mail and I will see what I can arrange. The schedule is very tight though.

The Green Old Deal

Given we are all going green these days, I thought I would listen to this classic – probably some of the best guitar playing one could ever hope to hear.

This was recorded in 1967 and appeared on the expanded release version of the album – Crusade – recorded by – john Mayall & The Bluesbreakers – when the band had the incomparable – Peter Green – on guitar going out the door and the pre-Rolling Stones Mick Taylor coming into the band as an 18-year old.

Peter Green joined Fleetwood Mac after he left John Mayall.

On this track – Greeny – we have John Mayall (keyboards), Peter Green, Aynsley Dunbar (drums) and John McVie (bass).

It was John Mayalls’ third studio album and was released on Decca Records on September 1, 1967 (and followed the magnificent – Hard Road – album released earlier that year).

One cannot imagine better playing really.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

the tardis principle

whats interesting is that the financial hole that surpluses create, tend to need much larger government financial deficits to fill them in 😉

for a moment there i thought keating might have had a conversion on the road to damascus, but alas no

“for a moment there i thought keating might have had a conversion on the road to damascus, but alas no”.

Perhaps he has had. Whatever his past transgressions he certainly appears – like St. Paul – to have had a revelation of at least one part of the true message, namely “The budget of the commonwealth of Australia is not like the budget of a corner shop”, Compared with Maggie Thatcher and with her spiritual heirs the great majority of today’s politicians – who STILL haven’t got as far as opening their minds to that simple, crucial, insight – that makes him a convert in my book.

But about how influential he may be in Oz I have no inkling. Perhaps his conversion is a non-event in any case?

Currently we are witnessing: ‘The making of a recession we had to have because Morrison govt hung so tenaciously to their Budget Surplus and expected a cash strapped, overdebted, underpaid private sector with low business & consumer confidence to pick up the slack’.

Today we see RBA encouraging businesses to borrow while interest rates are so low. True insanity when even Lowe has dropped enough hints indicating govt should employ fiscal stimulus because current monetary policy isn’t working.

I must apologise for my above rant about the Morrison govt. The topic is keating’s seemingly incongruous statements regarding fiscal policy in light of his time as Treasurer/PM. I see no evidence of conversion here. All Keating has demonstrated is his attitude towards Fiscal & Monetary Policy – nothing more than a bag of mixed tricks to grab at will.

So can a Leopard change his spots? Sadly it’s part of an unprincipled politician’s job description to have the capacity to ‘change their spots’

The thing with Paul Keating was that he and Bob Hawke were so busy triangulating an opposition led by Andrew Peacock/John Howard/Andrew Peacock (again)/John Hewson into opposition by steeling policies from the emerging neoliberal agenda that they ended up thoroughly compromised.

This is why whatever Paul Keating says looks now has a ring of “Don’t do as I did, do as I say!” about it. It must have seemed quite clever at the time, and their approach predated the Blairite/Clintonian “Third Way” by about a decade.

It’s not just the abandonment of fiscal policy and the obsession with fiscal surpluses we should hold Keating accountable for.

Who initiated the deregulation of the finance industry?

Who oversaw the first privatisations?

Who gave corporate tax payers and their shareholders relief by introducing a dividend imputation system that allowed shareholders to claim a tax credit for any tax their investee deigned to pay “on their behalf” into the ATO?

Who tinkered at the edges of Australia’s award system in the name of flexibility?

Who launched an attack on the principle of a state funded old age pension by insisting workers invest in superannuation instead. Don’t get me wrong. I have nothing against households saving for their retirement in principle but at the same time the government did nothing whilst households loaded up on debt to fund current consumption expenditures, which gave the lie to the notion that we had turned into a nation of net savers who were building nest eggs to fund our retirements.

Who introduced student loans (HECS) on the spurious basis that University graduates had to ‘repay’ the cost of their education to the Commonwealth? In fact all they cared about was easing their path towards delivering surpluses in the future by reducing the alleged burden tertiary education ‘imposed’ on the budget.

All he and Hawke really did was to initiate the slide into neoliberalism that permitted the Howard/Cotello government to claim they were perusing an economic reform agenda and go “the full Monty” when they finally got into power.

PhillipR – you could also add current form of Negative Gearing

“In July 1987, after lobbying by the property industry, the Federal Labor government with Paul Keating as its Treasurer, reversed its decision once more, allowing negative gearing losses to be applied against income from labour.” (Wiki)

Peter Green — for sure. And loved the ending, “C’est si bon.” 🙂

Rock blues around here is louder, harder, faster, not as melodically tricky. I miss Peter Green kind of stuff.

Can I ask where the data for the federal fiscal balance as a % GDP was sourced from? Thanks!

Tina

I forgot negative gearing.

And who was it who when he was challenged for being too neoliberal (although the term didn’t exist then) responded with:

“Of course I’m an economic rationalist. Would you prefer me to be an economic irrationalist?”

PhilipR

Hadn’t heard that ‘economic irrationalist’ quote before…absurdly stupid

All this talk about Keating is giving me PTSD because and I remembered his expansion of TFN system (had a second job at the time in a false name…ooops).

And I’m flashbacking all those FOR SALE signs on properties…

But just today I heard Keating on radio complaining about Trump upsetting trading partners (esp China). Umm wasn’t it Keating who called Malaysian Prime Minister Mahathir Mohamad “recalcitrant”

Dear Joshua (at 2019/10/31 at 11:24 am)

Go to https://budget.gov.au/2019-20/content/bp1/index.htm

Then to Statement 10.

best wishes

bill

The only useful bit about the quote is the correct observation that the Australian government isn’t constrained like “a corner shop.”

I’ll take repetition of this, along with repudiation of “the household budget” analogy anywhere I can get it, because its entrenchment has been so perniciously thorough.

Bill,

Item (d) from Statement 10 (table 1) states:

“Between 2005-06 and 2019-20, the underlying cash balance is equal to receipts less payments, less net Future Fund earnings. For the years 1970-71 to 2004-05 and from 2020-21 onwards, the underlying cash balance is equal to receipts less payments”

Do you take Future Fund earnings into account to calculate the balance, or just receipts less payments for the entire period?

eg

I think you may like this idea…how about a $1,000,000 Challenge:

“The budgetary concerns (deficit/surplus/balanced) of the Australian Federal Government, being a Monetary Sovereign government, cannot accurately be compared, metaphorically or literally, to the same budgetary concerns (deficit/surplus/balanced) of a household.”

A million dollars to any entity that can disprove the above declaration.

Such a challenge would have to be worded very carefully to avoid ambiguity but just imagine if such a challenge was issued…and the shock & dismay when no one able to claim the prize.

eg. Your idea is good, but I suspect it will fail exactly where you have pointed out the weakness. It will be impossible to word it in such a way that someone will not find a “loophole” in it. That is how spin and obfuscation rule supreme these days. Sad but true.

Tina, for a million dollars I could get close to a metaphorically accurate comparison. I think you are right about wording that challenge very carefully 🙂

Who do I contact to collect the money?

Jerry Brown

Ok how about IOU 10 AUD if you can come up with a metaphorical comparison. (Sorry about the $s shortfall)

totaram

Yeah you’d need legal advice on the wording. I’d be interested to know Bill’s opinion on this.

Ok Tina. Your offer of an IOU is an example of a household acting as a currency issuer- assuming I accept it. Which I have. Metaphorically speaking, you are obtaining some product (of admittedly dubious value) from me by issuing an IOU. But that wasn’t what I was thinking about your challenge before you offered the IOU.

I was thinking about a household that rented apartments to people to live in. Call that ‘household’ me for the sake of this discussion. While I might be obligated to accept US currency as rent paid in full, there is nothing that would keep me from also accepting a different way of payment instead if both were agreed. So if I was renting to a painter, and the property needed painting, then I might offer say 3 months future ‘free’ rent for their labor if they painted the property this month. That puts me in the position of issuing a currency of a sort- at least metaphorically.

Oh Lordy Jerry Brown

An IOU is simply a signed acknowledgement of a debt denominated in a legal tender amount.

NB: I haven’t signed it : )

And your household example is using a Bartering System i.e. exchange (goods or services) for other goods or services without using money. You’d come unstuck at tax time when you send your painter to the IRS.

[Apologies to Bill Mitchell for all this off-topic stuff]

Tina Ryan, I’m afraid you got the ‘3 A.M. after watching the final Major League Baseball game while drinking beers’ quality of response from me last night. You also have to factor in that an uncollectable $10AU IOU is not much of an incentive compared to $1 million that might actually be collected… 🙂

But. all things considered, it wasn’t all that terrible of an explanation. I think. And while your challenge is off topic for this particular blog post, it is definitely on topic for Modern Monetary Theory in general. But Bill will be the judge of that.

I think Randall Wray has said something like ‘anyone can issue a currency- the trick is getting it accepted’ (I’m thinking of his excellent book ” Modern Money Theory” but going from memory here). The trick of getting it accepted is based on whatever power the issuer has.

A landlord actually does have a certain amount of power assuming he can convince his tenants to pay him rent, and that they need a place to live, and that he can evict them if they don’t pay the rent. There is no reason why a landlord could not issue a metaphorical currency (some sort of otherwise worthless token) that he would accept back as rent payments. But that token would have value to the people who rented from him. And that would not be a “bartering system” of exchange- it would be a small scale monetary exchange system.

My point is that the landlord (a particular household), when spending his rent tokens, could accurately be compared to a currency issuing government spending its currency- just at a way smaller scale. If you want a better explanation, the blog New Economic Perspectives has a post written by Randall Wray discussing the UMKC ‘buckaroos’ monetary system that they developed. Universities, apparently, also have a bit of power over the students that desire a degree from them. I might try to post a link to it but it is easy to find using the search function at the website there. Just type in buckaroos.

Don’t worry about sending me the $10. Australian currency in that amount is not very useful in the US 🙂

@Jerry Brown,

Wray was quoting Minsky of course. And in googling, just to verify that it was indeed one of Minsky’s sayings, I came across this old, but very interesting paper by Stephanie Kelton (neé Bell), in which she is quoting Minsky and Wray, and much else:

The link means this post will be moderated, but I think it’s a reliable source as far as Bill is concerned:

http://www.levy.org/pubs/wp231.pdf

Excellent paper. Thanks Mike!

The Keating books by Kerry O’Brian and Troy Bramston provide an incisive review of the Hawke/Keating years – especially for an MMT-armed reader. Keating did regret his “recession we had to have” and as a novice to economics he was cheered on by Treasury to more and more drastic measures to achieve his five surpluses (his first “surplus” missed the mark by few million and which could be claimed as a surplus – for all the damage it did).” Furthermore, the economic disaster Keating visited on Australia was as much created by Treasury Department – in a monetarist mindset, pulling all the wrong levers that gave us 18% interest.