Today (January 22, 2026), the Australian Bureau of Statistics (ABS) released the latest labour force…

Governments can always create jobs if they choose

Last week, I posted a graph in this blog post – RBA cuts rates as a futile exercise as Dr Schwarze Null demands fiscal action (October 2, 2019) that showed that over the 12 months to August 2019, 312 thousand jobs have been created (net) in Australia. The stunning result is that 301 thousand (96.5 per cent) of those net jobs have been in the public sector. The private labour market is thus stagnating. I was interested to delve further into that result to see if I could bring more detail to bear. That is what this blog post is about. A data exercise to enrich our understanding and knowledge.

Spatial and sectoral shifts in Australian employment

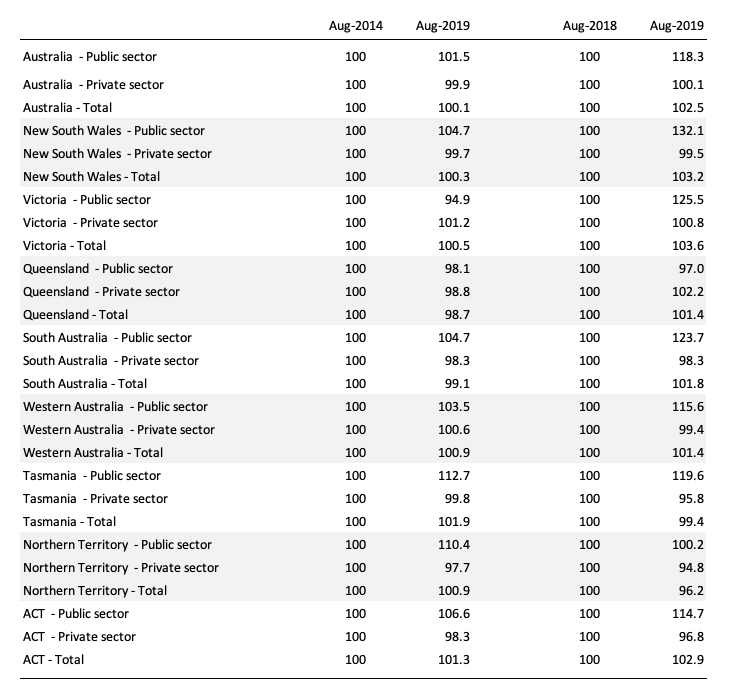

Since August 2014 (when this data first became available), total public sector employment has risen by 34.7 per cent whereas total private sector employment has risen by only 7.8 per cent.

Combined, total employment has risen by 11 per cent.

The following graph shows the evolution of the two series – noting the expansion of public employment ovewr the last 12 months.

Private employment growth has stagnated over the last two years.

The following supporting statistics are relevant for the same period:

1. Full-time employment growth: Public 32.6 per cent; Private 6.3 per cent, Total 9.8 per cent.

2. Part-time employment growth: Public 40.6 per cent; Private 10.8 per cent, Total 14.0 per cent.

3. Public sector employment is now 15.1 per cent of the total whereas in the August-quarter 2014 the proportion was 12.6 per cent.

4. Part-time employment has risen from 31.2 per cent of the total in the August-quarter 2014 to 32 per cent in the August-quarter 2019.

As I noted in the blog post – RBA cuts rates as a futile exercise as Dr Schwarze Null demands fiscal action (October 2, 2019) – the shift to public sector employment has intensified in the last year (see also previous graph).

We now have the stunning result that over the 12 months to the August-quarter 2019, 312 thousand jobs have been created (net) in Australia, of which 301 thousand (96.5 per cent) of those net jobs have been in the public sector. The private labour market is thus stagnating.

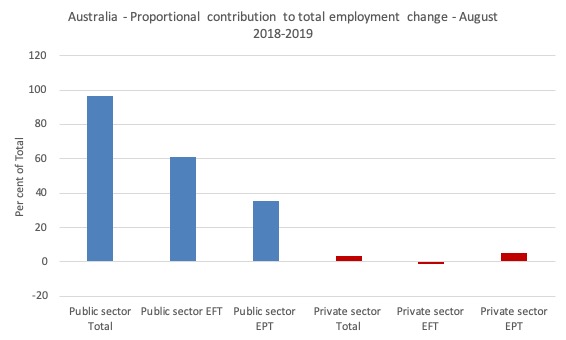

The following graph shows the proportional contribution to the change in total employment from August 2018 to August 2019 (in percent) by sector (public or private) and type of employment (full-time or part-time).

So when the Government keeps saying that the labour market is strong, one should just reflect on this result.

Imagine what would have happened had the public sector not engaged in some large stimulus projects?

Where have all these public sector jobs been created?

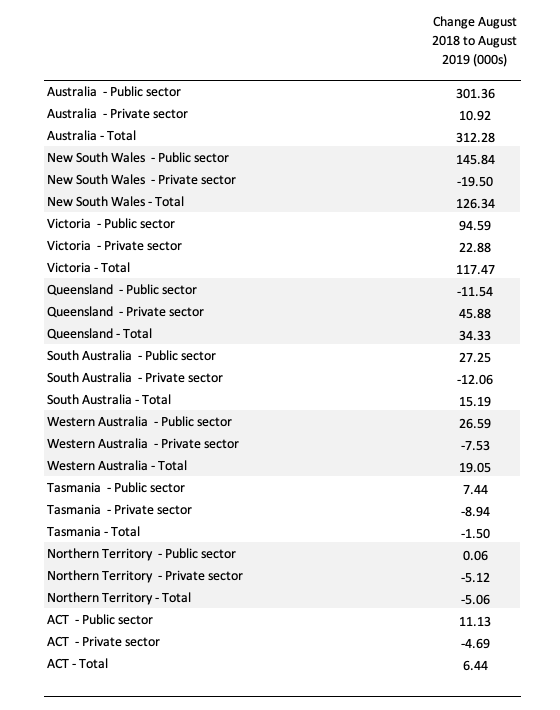

The following table shows the change in thousands between the August-quarter 2018 and the August-quarter 2019.

1. The total national change has been 312.3 thousand jobs.

2. The public sector in NSW has accounted for 145.8 thousand, while the Victorian public sector has added 94.6 thousand – that is, 76 per cent of the total jobs created (net) in Australia over the last twelve months.

3. In most jurisdictions, the private sector has contracted in terms of private employment (Queensland and Victoria are the exceptions).

The next table shows the same data in index number form – so the August-quarter 2019 columns show the growth in relation to the corresponding adjacent column (either August-quarter 2014 or August-quarter 2018.

It is obvious that without this growth in public sector employment, the Australian labour market would be in dire straits.

However, most of the growth is at the state government level as the federal government continues to pursue its damaging fiscal surplus obsession.

Occupational Shifts

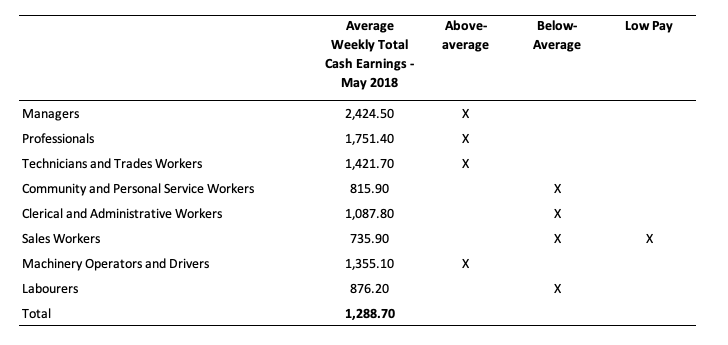

The Australian Occupation classification is shown in the following table along with the Average Weekly Total Cash Earnings at May 2018 (latest available).

The following table shows the Australian Occupational Classification divided by Above-average, Below-average and Low Pay (60 per cent of mean earnings in this case). The pay measure is Average Weekly Total Cash Earnings as at May 2018 (latest available).

At at the August-quarter 2019, Above-average pay occupations comprise 57.3 per cent of total employment. Of the 42.7 per cent of Below-average occupations, 8.5 per cent are Low pay.

In the February-quarter 2008, which marked the turning point of the cycle, the Above-average pay occupations comprised 55.7 per cent of total employment; Below-average 44.3 per cent of Low-pay 9.4 per cent.

So there has been a slight rise in the relative proportion of Above-average pay occupations.

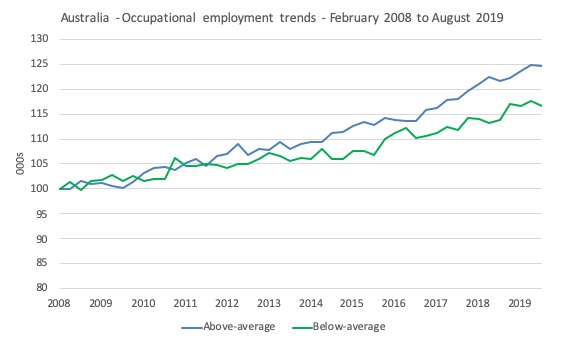

The following graph shows the evolution of total occupational employment by pay relation to the average since the pre-GFC peak (February-quarter 2008 = 100).

There was not a major cyclical downturn in Australia following the onset of the GFC. This was due to the very large and early fiscal stimulus, which saved tens of thousands of jobs that would have otherwise been lost.

You can see that the employment trends are diverging – slower growth in Below-average occupations and faster growth in Above-average occupations.

The additional factor that has to be understood in relation to this data is the movement in the cash earnings in these occupational categories.

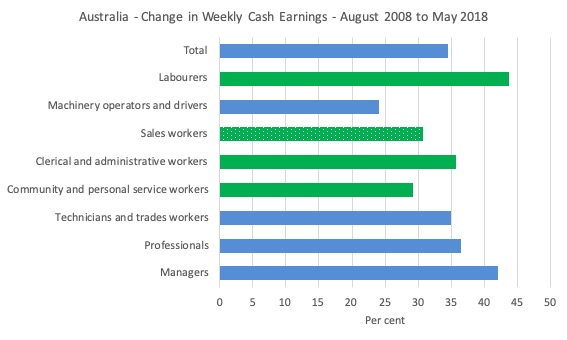

The facts are revealed in the following graph, which shows the percentage change in Weekly Cash Earnings between the August-quarter 2008 and the May-quarter 2019.

The blue bars are for Above-average occupations while the green bars are the Below-average (with the patterned bar for Sales workers denoting Low pay).

So not only is there a bias away from the Below-Average occupations, their total weekly cash earnings are mostly falling behind the growth enjoyed by the Above-average occupations. The exception is the Labourers occupation which has enjoyed strong growth and that is probably to do with the Mining boom that occurred during this period.

The Above-average occupations are enjoying disproportionately more of the net job creation and have had above-average growth in their total weekly cash earnings.

The period shown in has two-phases:

1. Peak (February 2008) to end of slowdown (August-quarter 2010 for Below-Average; August-quarter 2009 for Above-average). Above-average pay occupations grew by 0.2 per cent while Below-average pay occupations grew by 1.9 per cent, with a bias towards Low Pay (7.4 per cent growth).

2. Recovery period after slowdown to August-quarter 2019. Above-average pay occupations grew by 24.2 per cent while Below-average pay occupations grew by 14.9 per cent (Low Pay – 8.1 per cent).

So in the recovery period, Australian job creation has been biased towards the higher paying occupations.

The shift in employment towards the public sector also helps explain the behaviour of the cash earnings data.

In terms of Average Weekly Total Cash Earnings, the following facts are relevant (as at May-quarter 2018):

1. Private sector – $A1,227.10 per week.

2. Public sector – $A1,552.80 per week.

3. Total all sectors – $A1,288.70 per week.

Conclusion

We often hear the nonsensical claims that governments do not create jobs, only the private sector does.

Unless, of course, we are in election mode and then the government seems to create more jobs that one can easily count.

The truth is that the public sector can always create additional jobs.

At the federal level, the government can purchase anything that is available for sale in the currency that it issues, including all idle labour.

In that context, the employment rate (or if you like, the unemployment rate) is always a political choice.

Mass unemployment is the result of the federal deficit being too low (or surplus too high) relative to the spending and saving preferences of the non-government sector.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

I may be in a minority, but I seldom hear nowadays that a government cannot create jobs; indeed in the UK the government is committed to significant job creation as it expands the role of the NHS in economic GDP.

To the extent that there is controversy, this normally centres on the quality of the jobs involved; something that owes its origin to the perception of nationalised industries being propped up to support jobs rather than industrial advancement.

The controversy amounts to an argument about the role of productivity and competition in achieving adequate living standards.

Whilst an international productivity index can readily be calculated, the concept that competition involves the comparison of organisations in similar industrial sectors makes it a rather obscure form of comparison as new economic sectors come into being.

This suggests that productivity changes are really the overall measure of superiority, but this still leaves the abstract unanswerable: what constitutes a superior living standard.

I am not sure what Gog’s phrase ” indeed in the UK the government is committed to significant job creation as it expands the role of the NHS in economic GDP,” is intended to mean.

The NHS has always contributed significantly to the economy as a fiscal enhancer. Now it is happily diverting public money into shareholders pockets, tax havens and the business arms of huge charities.

https://publicmatters.org.uk/2019/10/08/how-much-of-the-nhs-in-england-has-already-been-privatised/

The happiness and wellbeing of a population, secure in the knowledge that they are valued and contributing to society, with pollutant free nutritious food, warm dry housing, free from the fear of debt, of insolvency and unavailability of medical help, will be a marker for a ‘superior living standard’.

Dear NHSforall

As someone who has lived their entire life among small businesses striving to provide first class service to communities they would regard as their own I get dismayed at incessant allegations of Capitalistic exploitation (even though I know it is to some extent inherent).

Tomorrow I am due to have some serious discussions with an NHS manager about the implementation of far-reaching changes – these are changes that any large organisation would have difficulty in implementing, so please leave off separating the “guilty” from the “pure”.

I know from experience that even the most conscientious socialist will unwittingly cost the country billions in the occasional poor quality decision and enactment.

In Reclaiming the State, the professor has stated that small businesses are also losers in the neoliberal era.

@prof bill- What type of jobs are these that the govt has created? You sure they haven’t reclassified people on welfare as having a govt job cause it sounds a bit fishy to me. And how well are these jobs paid?

Bill,

I know that you and Warren {and maybe others of the core MMTers} believe that the Gov. should pay zero rate of interest on bonds. Or, just not sell bonds and just spend currency into the economy.

. . . You said that you spoke in person with a group of European fund {IIRC} managers and that they said that they are desperate for the national govs. in the EU & UK, etc. to deficit spend more.

. . . Did they also say that they want to see bonds at zero interest for the next many years? Forever? This is what you want the govs. to do, is it that what they want the govs. to do?

. . . As I have said, I wonder if there isn’t a place for at least some bonds that the insurance comp. and pension plan agencies can use as a totally safe asset to hold and still earn some interest on it.

I personally would prefer that the private sector be used to make the goods and services we need rather than public sector hiring but MMT is politically agnostic mostly. It’s baffling how humans can simply ignore actual constant evidence from reality that government spending keeps economies going. Whenever there is idle labour it is wasted if not used and to suffer unnecessary downturns to simply balance the budget is truly crazy. You may hate Trump but at least he kind of gets it in that the US government spending combined with the private sector is keeping the US economy booming. Sadly their central bankers are clueless and recent pauses in their stockmarket are all due to the stupidity of their monetary operations adding reserves haphazardly. From early November we should see the market rise again once they sort out the mess they’ve created in emergency repo operations. If you want more info you should check out an MMTer Mike Norman on youtube who explains it.

Anyone heard of the ‘World Transformation Movement’?

https://www.humancondition.com/description/

Founded by biologist Prof. Jeremy Griffith in Australia, about the same time that Prof. Bill Mitchell began work on MMT, it explains “the human condition” in terms of the conflict between consciousness – and the search for knowledge – and instinct, tackling every aspect of the divisiveness, alienation and psychosis that afflict human relations.

WTM currently appears to be gaining traction around the world in much the same way as MMT.

btw, WTM even had it’s fierce resistance experience a decade ago (similar in some respects to the MMT ‘ban’ in the US senate), resolved when member Tim McCartney-Snape AO won a huge defamation case against the ABC and other media outlets. (Tim is the first person to walk from sea level to Everest’s peak – without oxygen aids).

Perhaps a tie-up between MMT and WTM would be mutually beneficial?

Steve_American wrote:-

“As I have said, I wonder if there isn’t a place for at least some bonds that the insurance comp. and pension plan agencies can use as a totally safe asset to hold and still earn some interest on it”.

As I understand it, that’s the use to which the insurance/pensions/investment-management cohorts have traditionally put govt bonds – as a safe haven and source of steady income-stream, not for speculative gain, and you are essentially arguing for its perpetuation – for ever, one assumes.

But if, as rigorous MMT analysis has it, there is no compulsion upon a currency-issuing govt to issue debt (because absolutely no *functional* purpose is served by it), what is the justification for govt to continue with that practice? Isn’t doing that just “corporate welfare”, as Bill asserts? What place is there in a truly capitalist system for corporate welfare?

Surely, there will always exist other safe havens (ie low-risk, low but reliable income-stream) investment-vehicles for *private-sector* financial agents to utilise? Corporate bonds for instance. Why should these private entities be kept supplied by govt with an inexhaustible flow of RISK-FREE BUT INTEREST-PAYING bonds? “Gilt-edged” aptly describes them, or rather golden eggs which the govt (the goose) obligingly goes on laying solely for their benefit.

If witholding them led to some of these funds becoming un-viable (which some private pension funds are on the verge of becoming already – threatening the continued existence of the companies which maintain them), perhaps that would give a salutary impetus to a much-needed re-think of the entire private/public pension-funding question at a fundamental level. And, if it did, wouldn’t that be long overdue?

@ robertH,

Correct me if I’m wrong, but didn’t GM bonds become worthless in 2008?

Would pension plan managers be able to know when to get out of a comp. like General Motors in time?

It sounds fine as long as it isn’t your pension being destroyed. When it is your plan, then it sounds dreadful.

And, I said 1% or 2% only.

@Steve

I was postulating a need for a radical alternative to the existing private-pension-scheme model (of which I myself happen to have been a beneficiary BTW). If as a private-sector financial instrument it depends on govt feeding it with debt (bonds) which MMT says would otherwise not need to have been issued, just to prop it up, then it seems to me something is fundamentally wrong with that model and it needs replacing – not overnight obviously – with a better one (like nationalising it for instance).

Either that or the MMT analysis is wrong. I believe it’s right.

@Steve

My understanding of Bill’s critique of the issuing of bonds is that it is primarily an interest rate setting mechanism and, as it merely soaks up excess reserves, it does not remove spending power from the real economy. Since bonds allow banks to swap un-tradable reserves for fully tradable bonds and also provide revenue, they constitute an unconscionable direct subsidy to the finance industry.

But, as you say, some form of genuine risk-free savings mechanism may be of value to the private sector. I recently saw a presentation by Scott Fullwiler on 5 Buffer Stocks for Macroeconomics (google it) which included, as I understand it, a proposal for sale of bonds direct to individuals, rather than via banks.

I would highly recommend this presentation as a brilliant discussion of the use of buffer stock for economic stabilisation.