I have been a consistent critic of the way in which the British Labour Party,…

British fiscal statement – no end to austerity as the Left face plants

Last night in Britain (October 29, 2018), the British Chancellor released the – Budget 2018 – aka the 2018 fiscal statement (my terminology, to avoid triggering the flawed household budget analogy). The detailed analysis is being done by others and I haven’t had enough time to read all the documents produced by the Government and others yet anyway. But of the hundreds of pages of data and documentation I have been able to consult, the Government is trying to win back votes while not particularly changing its austerity bias. That is fairly clear once you dig a little into the outlook statement produced by the Office of Budget Responsibility (OBR). The Government’s strategy is also unsustainable because it continues the reliance on debt accumulation in the non-government sector, which will eventually hit a brick wall as the balance sheet of that sector becomes overly precarious. Nothing much has been learned from the GFC in that respect. The Government can only cut its debt by piling more onto the non-government sector. Second, the response of the Left has been pathetic. The Fabians, for example, has put out a document that uses all sorts of neoliberal frames and language, making it indistinguishable from something the mainstream macroeconomists would pump out – the anathema of the constructs and language that the Left should be using. There is a reason the political Left has fallen by the wayside over the last 3 or so decades. And their penchant to write and speak like neoliberals is part of the story.

Fiscal speech highlight!

The highlight of Philip Hammond’s fiscal speech last night in the Commons was his desire to “send a message loud and clear to the rest of the world: Britain is open for busines” which culminated in his announcement that:

We’ll open the use of e-passport gates at Heathrow and other airports…

… currently only available to EEA nationals …

… to include visitors from the US, Canada, New Zealand, Australia and Japan …

Good on Brexit, I can’t wait.

This Fairfax story (October 30, 2018) – Australians will be able to use e-passports in UK – tells me that I will be able to fast track through Heathrow soon “after the UK government decided we can use their e-passport gates.”

Having been in and out of Heathrow four times in two weeks in October, not having to stand in the long queues for up to an hour will be excellent.

Laughing.

Framing and Language

The framing and the language of the fiscal statement including that used by commentators of all persuasions was unfortunate.

Larry Elliot, who is aware of Modern Monetary Theory (MMT), was representative of this unfortunate framing.

He wrote in his article (October 29, 2018) – Hammond’s budget giveaways highlight May’s weakness – that:

Less than 18 months into the current parliament, Hammond could have saved his windfall and met his stated aim of balancing the budget by the middle of the next decade. Instead he decided to blow the lot – in higher spending and an unexpected income tax cut.

He didn’t blow anything.

He used his spending capacity, which is not financially constrained, to make some spending decisions, mostly in the health area.

The rise in tax receipts did not mean the Chancellor had more money to spend.

As you will read further on, even the Left (Fabians) fell into this neoliberal trap.

While I agreed with the UK Guardian’s (October 29, 2018) editorial – Editorial: The Guardian view on the Budget 2018: austerity is not over – even they lapsed into unfortunate framing.

The editorial opined:

In doing so Mr Hammond has spent his better than expected tax receipts to present a crowd-pleasing budget. And he still has the room to borrow further.

Mr Hammond is spending none of his tax receipts, which are just drained out of the non-government sector.

And the state of the fiscal position now or yesterday tells us nothing about the Chancellor’s capacity to borrow in his own currency, should he be irresponsible enough to want to issue any debt anyway.

And the response from Labour leader Jeremy Corbyn continued the neoliberal framing.

He said that in relation to austerity that:

And far from people’s hard work and sacrifices having paid off, as the chancellor claims, this government has frittered it away in ideological tax cuts to the richest in our society.

It has frittered nothing away.

Its tax cuts do not come from a storage of funds created through austerity.

That is the neoliberal mythology that fiscal surpluses represent national saving.

They just represent a diminution in financial wealth for the non-government sector and a net flow of spending out of the monetary system.

The tax cuts were not facilitated by any ‘saved’ funds the government made.

The end of austerity?

It is not!

If you move through the OBR Economic and Fiscal Outlook October 2018 in its entirety, which I have done today, you come across Chapter 4 Fiscal Outlook, which documents various outlooks for “public sector receipts” and “public sector expenditure”.

Scanning through their analysis we come to analysis of the ‘Public sector expenditure’ (starting page 128), which provides the detail necessary to understand spending profiles across various categories.

They produce “two administrative aggregates”, which they say Treasury uses “to manage public spending”:

1. “Departmental expenditure limits (DELs)” – mostly planned public spending.

2. “Annually managed expenditure (AME)” – which is difficult to plan for over time.

For a deeper understanding see the Treasury publication – How to understand public sector spending.

The Treasury further breakdown the DEL and AME components in to “resource and capital spending”, which then gives us sub-aggregates such as ‘Resource Departmental Expenditure Limits’ or ‘RDEL’, which is:

… the money given to departments to spend on day-to-day resources and administration.

The estimates show that the public sector current expenditure (PSCE) on RDELs will decline as a percent of GDP over the forecast period (out to 2023-24) but will rise from £295.6 billion in 2018-19 to £354.7 billion in 2023-24 and increase in nominal terms of 20 per cent.

The estimates for inflation over this period are for a rise of 13.5 per cent. So the real expenditure increase is just 6.5 per cent.

On June 18, 2018, the Prime Minister announced that:

… by 2023/24 the NHS England budget will increase by £20.5 billion in real terms compared to today

In this context, the OBR determined the “specific paths of spending for both NHS and non-NHS spending” over the forecast period (up to 2023/24).

The analysis thus was based on:

1. “NHS RDELs would rise in line with the Prime Minister’s announcement and that the overall DEL envelope would rise by even more to accommodate this and other non-health spending.”

2. “In 2023-24 the NHS settlement on the Budget scorecard is worth £27.6 billion. This includes an additional £23.2 billion for NHS England … and £4.4 billion … for Scotland, Wales and Northern Ireland …”

3. OBR “assumed that the difference between the overall effects of the NHS settlement and the total RDEL path set by the Treasury represents Government policy on non-health RDEL spending for this Budget.”

4. Treasury told OBR that: “From 2019-20 to 2023-24 RDEL spending, including the NHS settlement, will grow at an average of 1.2% annually in real terms … These figures imply no further real terms reductions in aggregate spending outside the NHS over this period.”

Now, what does that mean?

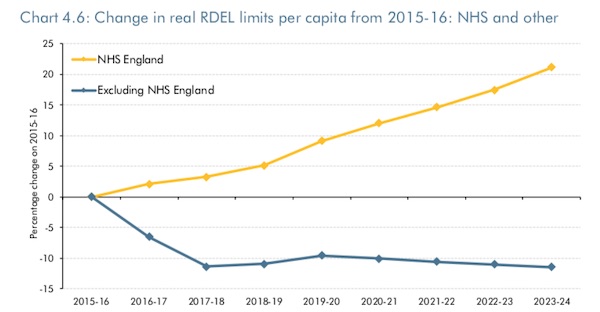

This graph shows you the outcome. It depicts the change in real RDEL limits per capita from 2015-16 to 2023-24 for NHS and all other departments.

In other words, while the Government is handling the political sensitivity around the current scandal that is the NHS by increasing real expenditure per capita, it is cutting real expenditure in all other departments.

That will further compromise public service delivery across the non-health departmental structure.

That doesn’t sound like an end to austerity to me.

Reliance on private debt accumulation continues

The accompanying OBR – Economic and fiscal outlook October 2018 – allows us to construct scenarios that are not explicitly outlined in the fiscal statements.

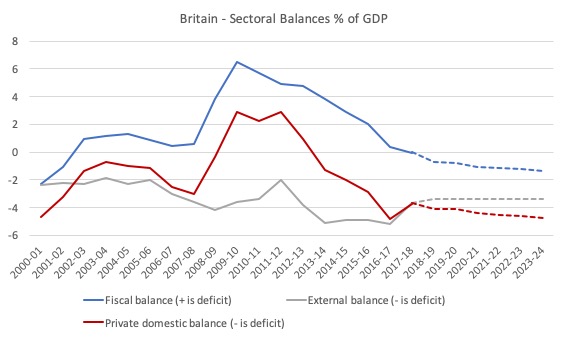

The following graph is constructed using those forecasts and actual data available from the Office of National Statistics.

I have assumed that the current account deficit will persist out to 2023-24 using the average value it recorded between 2000-01 to 2017-18 (3.4 per cent of GDP).

The dotted lines are the forecasts (from OBR) and my own projections (of the private domestic balance).

The private domestic balance is computed to be consistent with the sectoral balances identity derived from the national accounts framework.

The summary accounting identity is:

(S – I) = (G – T) + CAD

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)) plus net income transfers.

This is interpreted as meaning that government sector deficits (G – T > 0) and current account surpluses (CAD > 0) generate national income and net financial assets for the private domestic sector.

Conversely, government surpluses (G – T < 0) and current account deficits (CAD < 0) reduce national income and undermine the capacity of the private domestic sector to add financial assets.

The graph plots these balances from 2000-01 to the end of the Government’s fiscal forecast horizon (2023-24).

With the external deficit fairly stable over the entire period (relatively), the direct correspondence between the private sector surplus (overall saving) and the fiscal deficit is obvious.

As the British government has pursued its austerity policies and the deficit has fallen so has the overall saving of the private domestic sector and it went back into deficit in 2013-14.

This was a deliberate policy strategy of the Osborne years to rely on increasing private credit and rising private sector debt to maintain growth.

The current chancellor is clearly maintaining that strategy.

While austerity is normally taking to mean cut backs in net spending which undermines public services and reduces overall aggregate spending in the economy, I take a broader view of the concept.

I also include periods, where a government deliberately squeezes the non-government sector for liquidity in pursuit of lower fiscal deficits or higher fiscal surpluses and then relies on the non-government sector to increase its indebtedness to maintain growth.

This is an unsustainable strategy and the current fiscal statement indicates that the strategy is continuing.

Even the OBR recognises that:

We expect unsecured debt to rise steadily as a share of household disposable income …

They presented this graph:

They also that the household “saving ratio cannot decline indefinitely” even though they have it in negative territory after 2018 and flat lining below the zero line out to 2024.

Note the household saving ratio is not the (S-I) balance. The latter is the overall balance for households and firms.

OBR also:

… expect the ratio of household debt to income to continue to rise steadily but to remain below its 2008 peak, with the ratio reaching just under 150 per cent by the start of 2024.

So the balance sheet restructuring that started in 2008 didn’t last long and the precariousness of household finances is on the rise again, especially with flat housing prices and rising consumer debt.

I considered these issues in detail in this blog post – Household debt in Britain on the rise – lessons not learned (April 6, 2017).

Fabian face plant

The most disappointing aspect of the fiscal discussion yesterday was the release by the Fabian Society (in partnership with the Institute of Chartered Accountants in England and Wales (ICAEW) of their Report (October 2018) – The Fiscal Alternative Public finance choices for the left – which is about as neoliberal and mainstream as it gets.

Okay, Tweeters – pay me out for attacking the so-called Left again.

But really, if the Left is to make any progress it has to jettison this self-annihilating tendency to channel the economics of the Right.

The Fabians say that their report “examines the UK’s future fiscal policy choices” with a mind to considering “the options and dilemmas that would face an incoming Labour government after the next general election”.

They support British Labour’s unworkable and neoliberal fiscal rule. To make sure we know that they put the Rule in a callout box of its own.

They repeat, uncritically the ridiculous claims from the Office of Budget Responsibility that:

If Brexit leads to recession, the UK will have between £20-£50 billion less to spend in 2022 than under existing Office for Budget Responsibility (OBR) assumptions.

They even highlight that with a callout box in the margin to make sure the reader takes the warning in.

They claim that under a Labour government, which would increase spending in “the fields of health and care, pensions, education and investment”:

A lot of extra money will be needed to deal with existing and future spending pressures so there will be little left over to pay for new entitlements …

Any further increases beyond this level will only be possible in the future if politicians are prepared to noticeably increase the taxes paid by middle-income households.

They only want the government to “favour borrowing when it creates assets”.

They use terms like “to give up money through higher tax reliefs”.

They conclude that:

Now the deficit on current spending has been eliminated. This creates the economic headroom to start to debate post-austerity spending choices, since the Labour party’s proposed fiscal framework seeks to balance only day- to-day spending.

They claim that Britain now has “a radical left-wing Labour leadership which has shifted the ‘Overton window’ when it comes to the limits of conceivable tax and spending choices.”

And then tell us that:

… perhaps Balls and McDonnell are not so very different. Then and now, Labour is signed up to fiscal discipline with credible rules to set public debt on a downward path and keep borrowing under control.

They talk about fiscal discipline being:

… the right thing to do for future generations but it will also be essential in the short term to give markets confidence as they adjust to the novel context of a Corbyn government.

What was that about a “radical left-wing Labour leadership”?

Have you any hair left to pull out?

In no order:

1. The Labour fiscal rule is a dud which will be unworkable in a major recession and bring them grief. Please read my last salvo on that topic (which has a host of links to previous analyses) – The British Labour Fiscal Credibility rule – some further final comments (October 23, 2018).

It also uses neoliberal frames and language that just triggers and reinforces exactly the beliefs that the Fabians think are working against the British people.

It is a sop to the financial markets and just shows that British Labour hasn’t progressed beyond the myths of the 1970s when the Left started losing its way by falling into the trap set by the Right that somehow financial markets could overpower a democratic-elected government and its legislative and regulative capacity.

2. Whatever the outcome of the Brexit negotiations, Britain will have no les money than it had today. Recession or otherwise.

In fact, if a recession did ensue then Britain would have more fiscal space because there would be more idle resources to bring back into productive use.

Why would a Left-leaning organisation believe that the currency-issuing British government is ever ‘short’ of that same currency?

3. Even if British Labour prioritises “health and care, pensions, education and investment” there will all the currency it needs to “pay new entitlements”.

Again, the Fabians have fallen into the government is financially constrained like a household myth.

The only question that the Labour government would have to deal with is to ensure the real resource usage is sustainable and reflecting their priority areas.

It might be that the available real resources will not allow them to do everything they want, in which case they have a choice – cut back on their aspirations or take some resources that are currently being used elsewhere and redirect them into their priority areas.

If those resources are currently being used in the non-government sector then they have to tax them into non-use and redeploy them through spending.

4. Cutting taxes does not reduce the currency available for the government to spend. It only reduces the real goods and services available for use by the public sector (should the economy already be at full capacity).

5. The reduced fiscal deficit provides no more or no less “headroom” for government spending. The constraint on government spending is not determined by the fiscal balance.

6. Fiscal discipline is one of those neoliberal terms that is designed to add a moral dimension to public decision making and bias it against expanding the public sector.

The financial markets are supplicants. They only have power that the legislative framework permits them. It is time that Labour woke up to that.

And a “radical left-wing Labour leadership” would never design policy out of ‘fear’ of what the financial markets might do.

It would only seek to limit the scope of those markets and ensure that they serve a productive function. That requires major legislative intervention to outlaw many financial activities, major re-regulation of banks, and strong oversight.

Please read my blog post – Prime Minister Corbyn should have no fears from global capital markets (October 17, 2017) – for more discussion on this point.

Anyway, you get the picture.

If you ever wanted a demonstration of why the Left side of politics is struggling everywhere then this Report is a great example.

The Duck Test allows us to identify something by “observing that subject’s habitual characteristics”.

The framing, language and conceptualisation in the Fabian report tells us that they are as neoliberal as they come despite their wish list of progressive things for governments to spend on.

It is not a progressive input into the debate in other words.

Tweet away!

NIESR trying to be important but demonstrating its irrelevance

In the lead up to the fiscal statement by the Chancellor, the the British Brexit debate was bombarded with another classic piece of misinformation – or lying – from the National Institute of Economic and Social Research (NIESR).

This organisation has continually offered up tripe about Brexit, instead of providing analysis basis on reality of the British monetary system.

Really, the Fabians and NIESR should get together.

While the Leave team has gilded the lily on occasions, the on-going misinformation from the likes of the NIESR is also disturbing.

In their latest Press Release to accompany the November Review – Prospects for the UK economy – the NIESR claim that Brexit will reduce the ‘fiscal space’ available to the British government and under a “no-deal Brexit scenario”, the Chancellor will lose “£14 billion” in fiscal capacity.

NIESR acknowledge that despite the lack of certainty about the “future relationship between the UK and the EU”:

… the economy has gained momentum over the last few months, fiscal outturns have been better and financial markets appear to be sanguine about the uncertainty.

Which presents quite a different perspective relative to the usual doomsday scenarios that are being pumped out regularly.

See for example, the latest diatribe from the UK Guardian’s William Keegan (October 21, 2018) – Brexit is like a Premier League side wanting to be relegated.

But after spending hours running their models and what-have-you, NIESR comes up with a mythical estimate designed to further the squawk squad pushing for another referendum.

That squad is operating on the principle that if you don’t win the first democratic vote, you keep lying about it and pushing for additional votes until you do win.

As I noted above in the discussion about the Fabian report, whatever Brexit outcome is negotiated or not, makes zero difference to the fiscal capacity of the British government.

It will be able to purchase whatever goods and services are available for sale in sterling at any time not matter how Britain leaves the EU.

And given the NIESR is forecasting a major slowdown in GDP growth (from 1.9 per cent in 2019 with a “soft Brexit” to 0.3 per cent with a “no-deal Brexit”), then, in fact, if they understand the constraints on government spending, they would have told its readers there will be more fiscal space under a “no-deal Brexit” than otherwise.

That is because there will be more idle resources at a growth rate of 0.3 per cent than under a growth rate of 1.9 per cent.

As usual, the UK Guardian decided to produce an article (October 26, 2018) – Difference between soft Brexit and no deal worth £15bn – analysis – that gave this stupid NIESR analysis oxygen.

The article didn’t question the premises upon which the NIESR forecasts were produced.

Sad that.

And further, for all those predicting doom, even the NIESR is not forecasting a recession under even the most ‘extreme’ Brexit scenario.

In fact, under a “soft Brexit scenario”, they believe Britain will grow stronger than the OBR forecast in its October 2018 Outlook.

The latter forecast a GDP growth rate in 2019 of 1.6 per cent (compared to 1.9 from the NIESR) and 1.4 per cent in 2020 (compared to 1.6 per cent).

Remainers, what about that?

Conclusion

A pretty dismal picture really, especially from the Left.

We move on.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

Bill

The use of e passports isn’t restricted just to EU & Swiss passports you can sign up as a registered traveller https://www.gov.uk/registered-traveller/eligibility think you probably missed a trick there as you are a regular visitor (4 visits in 24 months). It really has nothing to do with Brexit.

With each edition of Economic and Fiscal Outlook (quoted by Bill above) the Office for Budget Responsibility becomes decidedly less critical of the government and its austerity policies. In the November 2015 edition, the section on ‘Sectoral net lending’ includes an opinion as to why the household sector is in deficit and will continue to be for some considerable time:

Notwithstanding the word ‘may’, I think there is a clear message there. But in the October 2018 edition the OBR offers no comment on the reasons for the existence and persistence of the household deficit.

There also seems to have been a conscious decision to alter the wording used in the reports. The phrase ‘fiscal consolidation’ appears 15 times in OBR’s 2015 report and ‘fiscal tightening’ is used 12 times. In the latest edition ‘fiscal consolidation’ is completely absent and ‘fiscal tightening’ appears only once. Similarly, in the 2015 edition the OBR often refers to the government as ‘the Conservative government’, but that doesn’t happen in the latest version.

Call me an old cynic, but it looks suspiciously like the the OBR has been told to keep its opinions to itself, watch the language it uses and not meddle in politics. So much for the oft-claimed ‘independence’ of Fiscal Councils.

It’s also interesting how the OBR has softened its understanding of sectoral balances. In 2015 the OBR said of the sectors: ‘By identity, these must sum to zero’. By 2018 this had become: ‘In principle, these sum to zero’. Could that subtle change be an attempt at deflecting attention away from MMT?

“the left” is a term that rings pretty hollow these days. Workers long for the good paying and abundant factory jobs their parents had, and that is the audience parties must give voice to if they want to remain in power.

It’s pretty sad listening to workers themselves become accepting of all the neoliberal nonsense. If only we can just recreate enough favorable conditions for those poor long suffering factory owners we can return to the good old days, seems to be the thinking, and with no one putting forward a coherent and viable plan to replace yesterdays plan (mass consumption driven factories), things will stay the same until the crisis becomes palpable for everyone. The macroeconomic toolbox is there but the vision and the courage to pursue change are lacking.

Well, as expected Budget 2018 was a waste of a perfectly good budget tipple, but all the people I would normally expect to be contesting this mindless squeezing are instead going on about “saving for Brexit” and such.

DiEM25 appear to have put a Jobs Guarantee in their European Spring program:

“We are calling for all European countries to come to a multilateral agreement to fund and guarantee jobs for every European in her place of residence. Such jobs would be created by European states or local authorities to ensure that they are (a) meaningful and required by the community and (b) don’t serve as a way to avoid hiring a worker with a regular contract. They would be paid at a common living wage rate at the national scale. The Jobs Guarantee will be closely linked with the Green Investment Program, which will deliver new opportunities across the continent to rebuild Europe’s infrastructure and contribute to community-based sustainability projects.”

A bit petty of me, but I’d be mildly disappointed in Labour if Britain is pipped to the post on this by the American Democrats AND the Europeans.

Once you’re tuned into MMT – especially at budget time – listening to mainstream politicians, economists and journalists feels like witnessing a coven of witch-doctors prescribing animal or human sacrifices to placate the evil spirits who have cursed the harvest, or a midwestern preacher promising fire and brimstone upon anyone doubting the literal word of Jesus.

The rubbish that is spouted is just flabbergasting – it becomes a toss-up as to whether to hit your head against the wall in despair, or to the throw TV at it instead!

Regarding the Fabian Society; its unhelpful approach is not really surprising, given its more recent history.

From a 2001 Graun article:

“In the 1990s the Fabian Society was a major influence in the modernisation of the Labour party. Its report on the constitution of the party was instrumental in the introduction of “one member one vote” and made the original recommendation for the replacement of Clause IV. A series of pamphlets on the attitudes of swing voters in the South of England (the Southern Discomfort series) paved the way for changes both to policy and electoral strategy.

“Since the 1997 general election there have been around 200 Fabian MPs in the Commons, amongst whom number nearly the entire cabinet, including Tony Blair, Gordon Brown, Robin Cook, Jack Straw, David Blunkett and Clare Short. The society has pursued its role as the new Labour government’s “critical friend”, seeking to ask challenging questions and to stimulate public debate.

“The Society’s two-year Commission on Taxation and Citizenship criticised Labour’s reluctance to discuss taxation and proposed, among other reforms, an earmarked tax for the NHS. Reports on environmental policy, capital grants to young people and parental leave directly influenced government policy in key areas. The society published both Tony Blair’s seminal pamphlet on the Third Way and Lionel Jospin’s philosophy of the active state.”

https://www.theguardian.com/politics/2001/aug/13/thinktanks.uk

OK, so it gave a voice to Jospin, and included Robin Cook in its membership, but those other names read like something of a neoliberal rogue’s gallery today.

And in spite of the nice-to-have parental leave, and young people’s grant suggestions, it also proposed hypothecation of taxes for the NHS (there we go again…), and the re-writing of Clause lV, which was pure Blairite class treachery.

I doubt its worth expecting any sense from that quarter. I noticed an “MMT for Labour” Group on FB that I was previously unaware of – perhaps those are more the kind of channels from which the breakthrough will occur?

In terms of the rhetoric, what was particularly sordid and disgusting about the Budget was Hammonds repetition of horrible condescending phrases ‘pioneered’ by the ghastly homonculus Osborne in the early years of welfare reform, where he tried (successfully) to drive a wedge between the in-work struggling and benefit claimants including the ill. This rhetoric was dreamed up by the Tory ‘nudge unit’, a sort of propaganda outfit that wanted to ideologically nudge the populace to accept neo-liberal concepts (/www.theguardian.com/politics/2013/may/02/nudge-unit-has-it-worked).

Here are the telling phrases that Hammond opened up with:

‘The perseverance of the British People finally paid off..’ Blaaaaarp!

‘A budget for hardworking families…’ Urrrrrgh!

‘People who get up early in the morning…’ Graaaaaaaargh!

‘The strivers and the grafters and the carers…..’ Bluuuuuurp!

The onomatopoeic words at the end of each supercilious and condescending utterance are an attempt to replicate the effect of barfing into a galvanized zinc bucket.

This was Hammond’s attempt to create a continuity between him and the vile Osborne in order to hide the fact that the austerity was never necessary, so he had to reuse those awful phrases to retrospectively endorse policy.

At least he didn’t use Cameron’s ultimate pat on the head ‘those that do the right thing.’ The Tories have done their usual, micro-tinkering with grossly inadequate amounts of spending with something like 1.7 billion to apparently assuage the ghastly suffering caused by Universal Credit and a laughable 2 billion towards (affordable!) housing after we have sustained a 40 year housing bubble.

I wonder if the British will ever wake up to the fact they are having the mickey taken out of them?

Thank you Simon Cohen you should take over from the useless (history degree) Larry Elliott and become the Guardian’s Economics Editorial writer. I especially liked your sentence:-

“The onomatopoeic words at the end of each supercilious and condescending utterance are an attempt to replicate the effect of barfing into a galvanized zinc bucket.”

I think the majority of UK voters are busy “barfing into a galvanized zinc bucket” as a consequence of decades of neoliberal/Libertarian brain-washing!

@Schofield,

I thought Randeep Ramesh was the Graun’s economics editorial writer? He gave a talk at the GIMMS launch.

Perhaps he alternates with Larry Elliot; there do seem to be conflicting attitudes regarding public finances in editorials – but then the Graun is no stranger to self-contradiction – dire climate warnings sitting alongside articles recommending weekend trips to the Maldives and so on!

I was heartened to see JMcD apparently having come to the realisation that money might not in fact grow on rich people, as he has declined to oppose Hammonds top rate threshold hike. Of course it’s probably just a cynical grab for the middle class vote, not a bad strategy in the circumstances, but, in an unexpected outburst of political transvestism, hilariously opposed by the likes of Yvette Cooper!

Interesting times, that’s for sure!

@ Mr Shigemitsui

Well all I can find out is he’s labelled the Guardian’s Chief Editorial Writer but can’t find out if he has anything more relevant than Larry Elliott’s history degree for writing about economics. Perhaps you might know if he has an economics degree and under whose tutelage?

@ J Halberstadt

They may have put a job guarantee in there, but it’s not the MMT Job Guarantee. It’s not there as an inflation anchor, an automatic stabiliser or a mechanism for setting the minimum wage. A few paragraphs later there is also the proposal for a Basic Income in the form of a Universal Citizen’s Dividend (‘funded’ by taxation). That’s certainly not compatible with the MMT Job Guarantee. The DiEM25 job guarantee and UCD are both examples of cherry picking ideas from here and there without any thought about how they can be put into practice.

The DiEM25 job guarantee, together with their Worker’s Compact and a magical ‘convergence of wages across Europe’ are designed to prevent ‘social dumping’ (their phrase) between nations and to prevent ‘young Europeans [from] leaving their home countries en masse to pursue economic opportunity elsewhere, leaving behind their homes, families, and communities’. It seems to me that the easiest way to achieve these aims is to end freedom of movement. In other words, an orderly break up of the Union.

@ Schofield,

I’m afraid I don’t know, but there are those amongst us (Neil Wilson in particular, I seem to remember) who believe that an economics degree (especially from the last few decades) could well be more of a hindrance than a help!

Mr S

This was a deliberate policy strategy of the Osborne years to rely on increasing private credit and rising private sector debt to maintain growth. bill mitchell

A major reason the banks can safely create large amounts of new deposits/liabilities for fiat is that, except for mere coins and bills, the non-bank private sector may not even use fiat! Thus the new liabilities for fiat the banks create are, except among themselves and other account holders at the Central Bank and the Central Bank itself, a sham.

Now how can the inability of citizens to use their own Nation’s fiat in convenient, inherently risk-free account form at the CB or Treasury be anything other than a gross dereliction of duty on the part of the monetary sovereign? That and a pathetic relic of the Gold Standard when fiat was too expensive for the entire economy to use?

Mr S, what does FB stand for?

Schofield, Larry Elliott is the G’s economics editor and Randeep Ramesh is the G’s principal editorial writer. That is my understanding.

Alan, nice parsing of the OBR. both the OBR and the IFS go off piste when they leave the comfort of the analysis of numbers. Anything in the way of policy statements borders on if it does not become completely absurd.

Given the number of bad jokes in this budget, it had the look of being a swan song for Hammond. Robert Peston had the impression that some of the budget was in preparation for an election. And he allowed Hammond to be hoist on his own whatever in his critical remarks on the budget — cf. ITV: ‘Chancellor Philip Hammond delivers Budget 2018 and declares ‘era of austerity finally coming to end” and check out the first video clip. Oh dear.

Peston showed only one of the many awful jokes, nicely chronicled by the Independent and Sky News — Sky: Budget 2018: Philip Hammond jokes about rabbits, toilets and fiscal rules during speech; Indy: Budget 2018: Philip Hammond jokes about rabbits, toilets and fiscal rules during speech. The best joke, however, came from a Labour MP. From Sky News:

“Next year we will give the low pay commission a new remit. I will confirm the remit at the budget next year.”

“You won’t be here!” shouts Labour MP Paula Sherriff.

As I mentioned at the outset, it was difficult to not come to the conclusion that Hammond was preparing for this to be his last budget. Whether it is or not, a comedian he is not.

“Mr S, what does FB stand for?”

Seriously, larry?

FB = Facebook.

I know, I know… but this is 2018!

Duh! Thanks, Mr S.