The Australian government has made an extraordinary decision to deeply divide the Australian community under…

Public infrastructure investment must privilege public well-being over profit

One of the principle ways in which so-called progressive political parties (particularly those in the social democratic tradition) seek to differentiate themselves from conservatives is to advocate large-scale public infrastructure investment as a way of advancing public good. You can see evidence of that in most nations. Nation-building initiatives tend to be popular and also are less sensitive to the usual attacks that are made on public spending when income support and other welfare-type programs are debated. Capital worked out long ago that public spending on infrastructure provided untold benefits by way of profits and influence. In the neoliberal era, the bias towards ‘competitive tendering’ and public-private partnerships has meant that private profit tends to dictate where and what public infrastructure is built. The problem is that large-scale projects tend to become objects of capture for the top-end-of-town. Research shows that these ‘megaprojects’ typically deliver massive cost overruns and significantly lower benefits than are first estimated when decisions are being made about what large projects to fund. Further, evidence suggests that this is due to corrupt and incompetent behaviour by private project managers (representing their companies) and empire-building public officials. They lie about the costs and benefits so as to distort the decision-making processes in their favour. Any progressive government thus must be mindful of these tendencies and behaviours. A progressive policy agenda needs to be more than just outlining a whole lot of nice sounding public infrastructure projects that the government will pursue. The whole machinery of public procurement that has emerged in this neoliberal era needs to be abandoned and replaced with decision-making processes and rules that privilege the advancement of public well-being over profit.

Australian construction boom

The Australian Bureau of Statistics (ABS) released the latest – Construction Work Done, Australia – data for the June-quarter 2018.

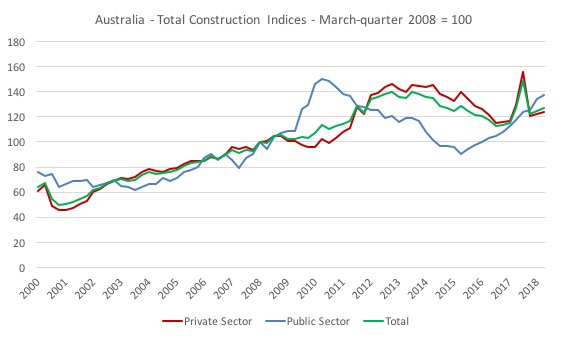

The following graph shows total value of construction work done (reflecting expenditure) from the March-quarter 2000 to the June-quarter 2018 by sector (public, private, total). The data is in real (chain volume) terms.

The March-quarter is set to 100 and the resulting index numbers tell you percentage shifts.

Private construction expenditure accounts for about 76 per cent of the total and so the total expenditure is driven by shifts in that component.

Note that the growth in both sectors is proportional (virtually equal) up to the onset of the GFC. Private sector expenditure fell in the ensuing period but the huge fiscal stimulus in early 2009 saw public infrastructure spending rise sharply and saved the construction sector from an overall downturn.

Historically, the construction sector leads the cycle, which means when GDP growth slows, it is led by a slowdown in construction. If the construction sector goes into recession, it usually follows that the overall economy endures a recession.

The fact that total construction activity continued growing as private sector spending fell was an extraordinary validation of the decision by the then government to introduce a rapid fiscal stimulus in early 2009.

The sharp contraction in public construction spending came as the initial projects expired and the then government shifted to an austerity mindset under assault from the media, mainstream economists, and the conservative politicians that the fiscal deficit was dangerously high!

It was nonsense.

The stimulus kick started the economy again and the Chinese government fiscal stimulus at the same time gave our mining sector a renewed boost which led to private construction spending recover and drive total spending in that sector upwards.

But the mining boom also expired around 2013 and with both sectors cutting expenditure in the construction sector, total activity fell and real GDP growth stalled.

The rise in public construction expenditure again in 2015, which is continuing, is largely being driven by large-scale public transport projects in Sydney and Melbourne – rail, road etc.

Relevant to today’s discussion, one of the signature public infrastructure projects in Sydney – the light-rail construction – is now mired in scandal.

I won’t go into detail but the Spanish contractor who is building the light-rail in Sydney is suing the NSW Government for $A1.1 billion because it claims the Government is guilty of “misleading or deceptive conduct” over the construction contract.

The project (a 12-km light-rail track) is more than 12 months behind schedule and was originally costed at $A1.6 billion.

It has now been confirmed that the project is more than $A500 million (around 30 per cent) over ‘budget’ already and the capacity “may not be operational for many years” (Source).

A “secret report” (date February 1, 2016) released earlier this month (August 2, 2018) has found that the (Source):

… the state government’s own experts warned the plan for Sydney’s light rail was talked up without knowing the “hidden realities” of the project …

The report, titled Lessons for Light Rail, identifies a range of problems, from rising costs to the design drawings being “dumbed down” and major stakeholders not involved in the early planning.

It says the project for a light rail from Sydney’s CBD to the eastern suburbs would be hit with “high prices and design delays” as a result of “onerous contract modifications” and the design process should have been more detailed with a longer “evaluation and negotiation period”.

I use this as an example of a broader problem that research has revealed – or rather verified what we have know all along.

Infrastructure mismanagement, delays, cost overruns …

A 2009 study by Danish economic geographer Bent Flyvbjerg – Survival of the unfittest: why the worst infrastructure gets built-and what we can do about it (published in Oxford Review of Economic Policy) – argues that these large-scale infrastructure projects (so-called “megaprojects”) are often ill-conceived and mismanaged which lead to massive delays in completion and massive costs overruns.

You need library access to get the final paper, but you can access it HERE.

Bent Flyvbjerg has written extensively about this topic.

In the paper I refer to his use of the phrase “survival of the un-fittest” relates to his conclusion that (Source):

…. the least deserving projects get built precisely because their cost-benefit estimates are so misleadingly optimistic.

Before I summarise his argument, we should understand why this is important.

As I noted in the Introduction, infrastructure expenditure seems to be at the forefront of social democratic parties’ manifestos to restore their electoral appeal.

For many heterodox economists, public investment is also seen as the best way to implement counter-cyclical fiscal interventions.

Bent Flyvbjerg writes that public infrastructure investment is:

… done right the investment boom could become a boon, because infrastructure investment is appealing in many ways: it creates and sustains employment; there is a large element of domestic inputs relative to imports; it improves productivity and competitiveness by lowering producer costs; it benefits consumers through higher-quality services; and it improves the environment when infrastructures that are environmentally sound substitute for infrastructures that are not …

It is clear that politicians love infrastructure projects that can make them look ‘big’ and the private sector (engineers, lawyers, project managers, construction firms, etc) lobby governments to build big because they know there are mega-profits forthcoming.

The British Labour Opposition has claimed virtue from its proposed investment agenda, holding it out as a progressive force, intent on radically altering the the way the public sector interacts with the economy.

The Shadow Chancellor, John McDonnell outlined his vision for Britain in his – Speech at the Royal Society of Arts (March 11, 2016).

He said:

Now is the time to break with the failed approach he has taken that has left this economy more exposed to shocks elsewhere in the world …

Society’s resources have been diverted away from productive use, and into low-productivity investments …

Labour’s alternative has to be nothing less than a radical break with the past …

The old rules have failed too many. They have meant extraordinary rises in inequality, and falling social mobility.

They have meant low investment, low productivity, and low pay, even as a lucky few have done extremely well …We also know investment is needed.

Others in my party are in agreement with me on the case for investment and jobs, but the public need more than platitudes from our party …

… we recognise the need for investment which raises the growth rate of our economy by increasing productivity as well as stimulating demand in the short term.

That is why our target for eliminating the deficit excludes investment …

It is essential for our future prosperity that we retain the ability to borrow for investing in capital projects which over time will pay for themselves …

The research from Bent Flybjerg and others suggests that John McDonnell better also reform the way that governments invest in public instructure – how it is contracted, managed, etc – if they want to seriously add to public welfare and avoid transferring massive rents to corrupt and/or greedy private contractors.

That will require a major shift in thinking – away from Public-Private partnerships, away from seeing the public sector as a contract manager rather than a service delivery agency, and all the rest of the capacities that have been eroded by the neoliberal capture of the State.

Bent Flybjerg’s 2009 paper is a very detailed study of these issues.

While governments love to tout these large-scale public projects, the story is more complicated and the research has great relevance to the design of a progressive policy agenda.

Bent Flybjerg concludes that under current arrangements (contracting etc) for executing major public infrastructure projects:

1. They turn out to require much higher public outlays – which for an Modern Monetary Theory (MMT) economist may not be a matter of concern.

However, the idea of public spending providing massive ‘corporate welfare’ to deceptive, inefficient private contractors who use these projects to rort profits out of the public purse is clearly a problem.

2. The planners of these projects within bureaucracies (serving the dominant political ideology) typically significantly overstate the benefits that will flow to the general public from the projects.

3. For transportation projects (which he uses as representative), there is massive forecast errors in “travel demand forecasts” – actual rail passengers were 51.4 per cent lower than were initially estimated as part of the justification for the project; “an average overestimate in rail passenger forecasts of no less than 105.6 per cent”; ” actual vehicle traffic is on average 9.5 per cent higher than forecasted traffic.”

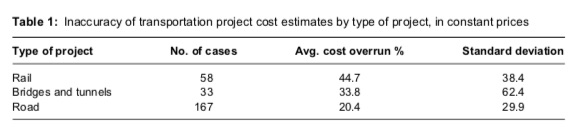

He provides this table (his Table 1) drawn from data for “transportation infrastructure projects” in 20 nations across five continents.

He concludes that in transportation projects alone “nine out of 10 projects have cost overrun” and:

Cost overruns in the order of 50 per cent in real terms are common for major infrastructure, and overruns above 100 per cent are not uncommon. Demand and benefit forecasts that are wrong by 20-70 per cent compared with actual development are common.

So very significant.

What are the factors he identifies for these “cost overruns and/or benefit shortfalls”?

He proposes that:

– Such projects are inherently risky owing to long planning horizons and complex interfaces.

– Technology and design are often non-standard.

– Decision-making, planning, and management are typically multi-actor processes with conflicting interests.

– Often there is ‘lock in’ or ‘capture’ of a certain project concept at an early stage, leaving r analysis of alternatives weak or absent.

– The project scope or ambition level will typically change significantly over time.

– Statistical evidence shows that such unplanned events are often unaccounted for, leaving r budget and time contingencies sorely inadequate.

– As a consequence, misinformation about costs, benefits, and risks is the norm through- r out project development and decision-making, including in the business case.

What all this means, of course, is that the pattern of projects selected and constructed does not satisfy scrutiny under appropriate cost-benefit analysis.

While a currency-issuing government does not have to generate ‘profit’ (as in the return a private investor has to receive to justify investing in a capital project), it does have to generate social returns that exceed the ‘cost’ of the real resources that are being diverted (or used if there is less than full employment) in the project.

Being a currency-issuer doesn’t exempt a government from being responsible for effective use of the real resources it deploys.

Waste is waste after all.

Bent Flyvbjerg concludes that many “projects should never have been built, at least in the form they were”.

Why were they?

Because the “benefit-cost ratios, presented to investors and legislators were hugely inflated, deliberately or not.”

He lists many projects around the World that are in this category.

He does wade in on the “deliberately or not” issue though:

Some forecasts are so grossly misrepresented that we need to consider not only firing the forecasters but suing them, too-perhaps even having a few serve time.

Where economic rents can be captured from public spending, any assumption that the ‘market’ will deliver bids and contracts that are honest and efficient is fraught.

When the Australian government introduced its fiscal stimulus in early 2009 one component was the installation of insulation in houses that were not currently insulated.

This was held out, legitimately, as a climate action as well as a spending stimulus to protect jobs.

The problem was that a number of fly-by-night private operators entered the market, were not properly scrutinised, in part, because in this neoliberal era the expertise within government departments has been hollowed out, and demonstrated incompetent and corrupt behaviour.

Given the characteristics of these projects outlined above, Bent Flyvbjerg narrows down the reason for the “cost overruns and benefit shortfalls” to three categories.

1. technical – essentially relating the uncertainty about the future, lack of forecasting experience and the like.

2. psychological – the so-called “planning fallacy” where “managers make decisions based on delusional optimism rather than on a rational weighting of gains, losses, and probabilities.”

3. political-economic – where “project planners and promoters as deliberately and strategically overestimating benefits and underestimating costs when forecasting the outcomes of projects”.

This is to distort tendering arrangements for public contracts.

He says that this amounts to plain-and-simple “lying” which “pays off” at least in the short-term.

In assessing the contribution of each of these sources to the overall problem he dismisses the relative importance of the technical explanations.

He thinks “psychological” explanations have more credence. There is clear evidence of “optimism bias”. But, overall, this is not the major source of the problem.

Finally, the “political-economic explanations and strategic misrepresentation account well for the systematic underestimation of costs and overestimation of benefits”.

What can be done about this issue?

1. Use the concept of – Reference class forecasting – which entails a statistical procedure to compare current proposals against previous, similar projects.

2. Governance – the evidence is that project managers “lie with numbers” to tilt the tendering process in their favour.

Bent Flyvbjerg writes:

They are busy not with getting forecasts and business cases right and following the PMI Code of Ethics but with getting projects funded and built.

So assuming the private project managers lie as a matter of course, government has to get smarter in the way it contracts.

He lists a number of requirements that are necessary to “achieve accountability through transparency and public control” in public infrastructure projects.

Many of them are so obvious that one wonders why they are not standard practice anyway.

I will leave it to you to explore them if you are interested.

Proposals such as stronger roles for “National Audit” offices; project appraisal to be taken out of specific agencies who have a vested interest (’empire building’ issues), etc.

When I was doing work on the Expanded Public Works Program in South Africa it was clear that the Public Works department overseeing the projects were staffed by construction engineers that were educated in the UK and the US (for example) and had little experience in ‘development’ issues in poor communities, or broader goals that might be ascribed to large-scale projects of the sort we were dealing with.

So, for example, in the case of road building projects, they were keen to use the state-of-the-art techniques that they had learned as part of their degree studies, which, of course, were highly capital intensive.

The task at hand though was to use the road building to hire as many people per km of road built to ensure material living standards were improved for as many as possible.

That required labour intensive techniques – people bashing rocks into the ground.

I recall a conversation where a couple of engineers said to me something along the lines of “Australia hasn’t used these road building techniques since the 1950s, so why should we?.

To which I responded that Australia was one of the wealthiest nations and didn’t have 12 million people (60 per cent) living in abject poverty, unemployed and without adequate housing or transport and other public infrastructure.

Apartheid had effectively created a dual world in South Africa – the whites lived very well. The townships were, in contradistinction, like Australia was probably like soon after the first settlement (200 years ago).

In those instances, the public policy benefit of the project was to use old-fashioned techniques which were anathema to the bureaucrats.

One academic I collaborated with – a civil engineer with an expertise in African infrastructure – demonstrated in his research that the modern and old road building techniques delivered similar quality road surfaces in all respects.

It was a no-brainer – but this is the type of problem that is encountered in these ’empire-building’ type instances.

While he doesn’t place the cost overrun and benefit-shortfall problem, specifically in the ideological space, which is a strong interest of mine, some of his proposals reflect this perspective.

For example, he writes that:

– For publicly funded projects, forecasts, peer reviews, and benchmarkings should be made available for public scrutiny, including by the media, as they are produced, including all relevant documentation.

– Public hearings, citizen juries, and the like should be organized to allow stakeholders and civil society to voice criticism and support of forecasts. Knowledge generated in this way should be integrated in project management and decision-making.

– Scientific and professional conferences should be organized where forecasters would present and defend their forecasts in the face of colleagues’ scrutiny and criticism.

But in this neoliberal era, where private profit drives public infrastructure planning – via public-private partnership arrangements etc – the public scrutiny (in any of the forms above) is precluded by ridiculous roadblocks such as ‘commercial-in-confidence’ stipulations.

I have first-hand experience in that dodge.

Back in the 1990s, I was asked to help a community group oppose the privatisation of a regional base hospital. It was clear that the Project was dodgy.

That was reinforced when I gained ‘off the back of the truck’ access to Treasury documents that were used to convince the Cabinet of the government in question to privatise the public asset.

At the time, these Treasury and Finance departments were becoming infested with neoliberal economists and they were intent on privatising everything that moved.

The analysis in the Treasury document was deeply flawed – fraudulent in fact. Inflated discount rates, fudged revenue estimates, etc.

The matter went to the relevant court and for several days the government in question and the private developer tied up the process with arguments about admissibility of my evidence, given that my analysis relied on documents that were not publicly-released.

They won. My analysis was not allowed to be part of the case. The community group saw their hospital privatised and services degraded by the greedy private developer and health provider.

The government claimed they would not release their analysis as it was ‘commercial-in-confidence’.

My prediction in my Report was that the private provider would go broke in a few years but not before pocketing millions in public outlays.

And, it transpired that prediction was accurate. The government was forced to resume control and ownership of the hospital. The private provider went off with the millions and no-one went to prison for lying and cheating the public.

Had Bent Flyvbjerg’s proposals been followed that disaster of public policy would never have occurred. The documents would have been publicly scrutinised and the Treasury would never have fudged the data because it would have known characters like me would have called them out.

As these public outlays have been constrained within so-called ‘competitive’ tendering arrangements and the capacity of public service departments to deliver services themselves (without the private profit motive), the issues identified by Bent Flyvbjerg have, in my view intensified.

There is a fundamental conflict in the public funding of a private profit-seeking activity when the public is unable to scrutinise any of the details.

Another example is in my local government area, which is administered by politicians that deliver what are disastrous outcomes by way of property development and use of public spaces.

Like our inner city park has been cut up and concreted over because a profit-seeking private company is allowed to run a car race around our city streets.

The park is concreted over to allow the ‘pit lane infrastructure’ to be built each year.

The race promoter is heavily subsidised and would lose money if not. Yet local community groups are unable to access data about the subsidies, the revenue for the race etc – ‘commercial-in confidence’.

On another property development in our neighbourhood which is an outrageous profit grab, our little community group filed a Freedom of Information request in April because we believe there were improper communications between the council officials and the property owners.

There was a period of appeal which ended early August. We wanted the information to assess whether we would have legal grounds for appea.

The council has held the FOI request up – making up all sorts of reasons – and we still haven’t the data despite paying all the asked-for fees.

Meanwhile, the relevant State Government Minister has approved the process as the appeal period lapsed.

This sort of obstruction – which is designed to favour private profit-seekers at the expense of community and create infrastructure that will not benefit the community – is common in this neoliberal period.

Conclusion

Why this is important is that when the likes of John McDonnell propose large-scale infrastructure expenditure to ‘radically’ alter Britain, he must also be prepared to ditch all these ‘commercial-in-confidence’ ruses and, preferably, restore construction capacity within the public sector rather than engage in public-private partnerships.

That will not, alone, do away with the problem. But it will help.

We will only restore community if we root out all the neoliberal elements that have infested the public sector.

Companies should not be able to hide behind ‘commercial-in-confidence’ clauses to resist public scrutiny.

To be continued ….

The following blog posts (among others) consider this topic in more detail with specific case studies in some cases:

1. Public infrastructure 101 – Part 1 (March 20, 2009).

2. The glorious gouging of the public purse (May 8, 2013).

3. Privatisation failure – the micro analogue of fiscal surplus obsessions (January 6, 2015).

4. The myopia of fiscal austerity (June 10, 2015).

5. British floods demonstrate the myopia of fiscal austerity (January 4, 2016).

6. Greek bailout money goes to banks and corporations – who would have thought? (May 24, 2016).

7. We starve the state and public infrastructure development at our peril (June 30, 2016).

8. Austerity is the enemy of our grandchildren as public infrastructure degrades (December 14, 2016).

9. Planning public works – history has a lot to say if we listen properly (January 30, 2018).

The turmoil of Australian politics

Overseas readers might not laugh at this graphic but Australians will get it.

Dutton is a federal conservative MP who is now challenging the incumbent Prime Minister for his position. Dutton is about as nasty as one can get in politics. He is positioning himself as a Trump-style candidate – whipping up migrant and refugee hatred, walked out when a former PM apologised to our indigenous citizens for the government’s past policies of stealing their children to make them ‘white’, more extreme surveillance of dangerous groups (like ‘left-wingers’), etc

Anyway, some creative soul has decided to provide a most accurate representation of Dutton’s character and qualifications for leadership of our nation by updating the sign outside of Dutton’s electoral office in Queensland.

Very accurate assessment.

The always excellent First Dog on the Moon’s latest offering will provide you some context – Peter Dutton almost became prime minister. But wait! It could still happen!

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

The conservatives in my country are talking about Australian immigration policy as a model objective. Strange times we live in. Brilliant analysis again. Thanks.

Yet another ‘scandal’ in the UK with the nefarious G4S making a mess of running prisons. G4S have messed up so many times that it must be the case that ‘reputation’ is no longer and issue (if it ever was) and the short term pocketing of rent extraction is . They leave a mess and dance of into the sunset with dosh flying everywhere.

British Public response..zzzzzzzzzzzzzzzzzzzz . Grift and Graft is the norm and part of the mental wallpaper.

You can’t surely have Dutton, he of the Final Solution, as PM.

Sorry, it was Fraser Anning who used the phrase, Final Solution, in Parliament, in his maiden speech.

Great piece.

Just huffing and puffing about infrastructure is not enough. Need to be smarter about it.

“We will only restore community if we root out all the neoliberal elements that have infested the public sector.”

Bill, it sounds like you are relating public infrastructure projects corruption with neoliberalism (I may be wrong).

I can’t see why neoliberalism is worse than any other ideology in that sense.

Left-wing anti-privatisation governments are infested with corruption too. It doesn’t seem to me that this specific kind of problem is related to neoliberalism somehow. Of course, there is not corruption database out there – corrupt people do not disclose their doings.

In my country (Brazil), probably all infrastructure projects of all governments (left and right) in the last decades (maybe last centuries) were overpriced. The government pays an additional price of at least 15% to the private companies, and then such companies inject that money back to the government’s political party usually through illegal money laundering schemes. A tiny part is actually transfered to the political party as legal donations, but most part is donated in secret illegal schemes. The money is mostly used to buy votes in elections (at federal, state and municipal levels) and some to enrich politicians and their allies.

Everyone knows that, but no one could solve the problem yet.

Here the media is now (this year) relating this kind of problem to the previous left-wing governments, because it is interesting for their agenda. In other countries or periods the blame is/was on right-wing governments. The fact is that such problems are much more related to politians, and not to political ideologies, in my view.

I believe that we will not restore community just by changing the economic political ideology…

I agree with you Andre.

The core of all political ideologies is still the commodity based framework, i.e. that “all” resources must be subject to debtor/creditor relations. As long as we continue to subject all resources this way a large part of society will get to live off the hard work of others irrespective of ideology. Until we get passed this belief system/paradigm, then we will continue to do what we’ve always done, which has been to cycle between public and private debt.

Interestingly, I have been working on a custodian model which allows some people to operate under surplus share arrangements which, for the purposes of these particular relations, take resources (human needs and tools for producing) outside of the commodity based framework (i.e. not subject to debtor/creditor relations and thus out of the reach of the FIRE and commercial sector etc), and where the custodian is like a trustee and the government (or more to the point the community as a whole) becomes the investor/partner/beneficiary in the ‘real’ sense. The whole premise of this idea is that it operates irrespective of whatever political ideology is in control, and more importantly, that it can reduce the CHUP (crime, homelessness, unemployment, poverty) sector because it provides an alternative model to a lot of these people, and it will not cost the tax-payers a single cent or cause economic or property loss to anyone (this is where MMT becomes the evidence).

However, as I have been compiling my report/proposal which I have been planning to table to government, I realized that my biggest problem is not convincing anyone of the facts which MMT provides but rather, that the level of employment which relies on the CHUP sector is so high that people are going to see such a program as damaging to those jobs. Once I realized how many jobs rely on this sector, it became extremely depressing. A friend of mine only told me yesterday how his job network provider are moving to computers to assess eligibility and that as a joke he said to the girl ‘is this going to put your job at risk?’ to which she replied ‘I hope not’. Another example, just recently they created 1000 new jobs just to man phones so that people who ring centerlink don’t have to wait 45 mins. I mean it has become an embarrassment that our smartest cannot see the problem here. It has then become obvious that the whole political spectrum is nothing more than a job creator – it exists to give people occupations which rely on political debating.

I believe the best avenue now to take the crux of MMT and other teachings which properly show how the monetary economy works is to human rights advocates and other people like this who are genuinely concerned with reducing the CHUP sector. At least people in this group spend less time debating and more time actually doing.

Andre, the ‘neoliberal’ part of it is the idea that the government must always bid these projects out to private sector companies, rather than hiring and doing the work ‘in house’. Because that will supposedly always be more ‘efficient’ or whatever. That is my take on it.

Andre, you are mistaken about there being no corruption databases. I have seen a fraud list that had Deutsche Bank’s name on it. And DB’s debts are greater than Germany’s GDP. There may be no general corruptio databases. However, for certain kinds of crimes, there are relevant databases. How accurate they are is another matter.

larry,

Well, there may be some limited databases on corruption, but, you know, there is not enough data for us to assess claims like “this year politicians robbed $ 5 billions through corruption schemes” or “50% of the votes for the federal elections were bought” or “political party X is more corrupt then Y” etc.