I started my undergraduate studies in economics in the late 1970s after starting out as…

The glorious gouging of the public purse

It is budget time in Australia this month. The federal government will release their Budget next Tuesday and the State and Territory governments all put them out around the same time. Yesterday, it was the turn of one of our larger states Victoria. I will come to that in a moment. The mania intensifies around May and every day and night on TV, radio and in the printed media there is a constant commentariat and an almost uniform message, which was summarised by one so-called expert last night – “the Budget is broken”. I remember this chap in the 1980s as a junior Treasury official aspiring to be important. I wondered about the analogy. There are lots of “black holes” (buckets) and “drunken sailors” (big spending) but “broken”. I guess the only thing is that broken is bad – using broken as an adjective. All the commentary is about how bad the deficit is given the terms of trade are slowing and undermining tax revenue. While the deficit is way to low, it is good that we have one. It is good that America and Japan and the UK have deficits. There is at least some net spending flowing each day to support the economy. Anyway, time to look into the glorious gouging of the public purse that only the neo-liberals can make look as though it is financial responsibility at its best.

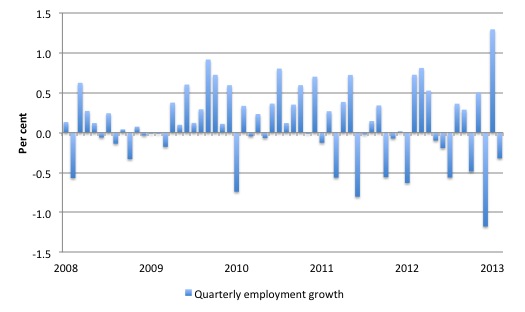

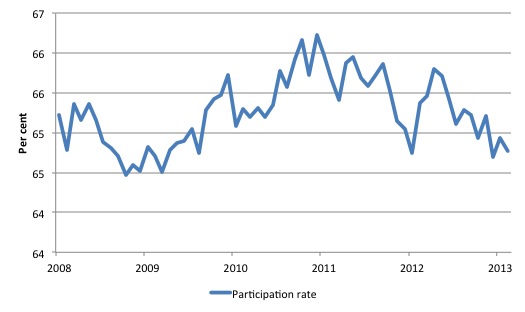

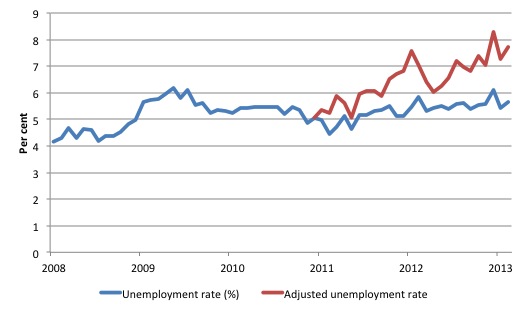

Here is a little quiz. Look at these three graphs showing monthly employment growth, the participation rate, and the unemployment rate) from February 2008 to March 2013.

The adjusted unemployment series (in red) is computed by working out what the unemployment rate would be if the participation rate hadn’t dropped from its most recent peak (given the poor employment growth). As you can see, the official unemployment rate is currently being reported by the ABS at 5.6 per cent but that is only because 69 thousand from a labour force of just over 3 million have dropped out of the active labour force as a result of the poor employment growth. If we added back these hidden unemployed then then unemployment rate would be around 7.7 per cent. That is what the red line depicts.

So it looks bad, no? We see the familiar pattern.

First, at the onset of crisis employment growth fell, unemployment rose fairly quickly through the early part of 2009, and participation rates fell as a result of the lack of employment opportunities.

Second, the federal government entered the fray with its fiscal stimulus package and employment growth resumed, unemployment started to fall, and participation rates rose as confidence returned and job prospects look brighter.

Third, the federal government begins its success in pursuit of a budget surplus and the wheels start falling off economic growth. At the same time, our terms of trade we can but the overvalued Australian dollar doesn’t follow the decline as it normally would, and manufacturing states, like Victoria, take a double whammy.

At that point, things start to look bleak.

The Victorian government’s response? Make matters worse! But in doing so make sure the pockets of capital a lined with public largesse.

Now if you were this government would you:

1. Be introducing a budget which projects a large surplus?

2. Be borrowing at above 9.8 per cent to build a toll highway and other public infrastructure when you could borrow at 3.7 per cent?

Welcome to the crazy world of Victoria. It is so caught up in neo-liberal logic that it cannot see day from night.

The Victorian Government, a state in our federal system (and hence a user of the currency issued by the Australian government) published the – Victorian State Budget 2013-14 – yesterday (May 7, 2013) and announced a $A225 million dollar surplus for 2013-14 (and growing surpluses after that – reaching $A2.5 billion in 2016-17).

It also indicated it would be spending some $A6.1 billion on infrastructure over several years.

One of the major projects announced ($A224 million over two years) is the East-West link road project which will a 18km connecting road between two major freeway systems. A competing project – Metro Stage 2 rail tunnel was allocated a meagre $A10 million in 2013-14.

Infrastructure Australia, a statutory body of the Commonwealth Government “advises governments, investors and infrastructure owners on a wide range of issues” including “Australia’s current and future infrastructure needs”, publishes a national infrastructure priority list each year as part of the bidding process by State and Territory governments for Commonwealth funds.

The – 2012 infrastructure priority list is published in the June 2012 Report to the Council of Australian Governments (Appendix D at page 102).

Melbourne Metro Stage 2 which will create “more rail capacity in the inner-city to relieve pressure of existing congestion” and “boost the number of suburban services across the network to accommodate projected growth” is considered to be a higher priority than the East-West link road.

So once again a bias towards cars and roads, which will only worsen the traffic congestion in the city.

But this is an economics blog and so I did some reading of the budget papers as I do each year to find out how they are going to finance the infrastructure spending.

Victoria is one of our two large population states (NSW the other) and Melbourne has some 4.25 million people. It also has led the way in privatising and outsourcing.

Please read my blog – Welcome to the world of privatised electricity and canned music – for more discussion on the state of power generation in Victoria after the neo-liberals were let loose in the 1990s.

The state also considers Public-Private Partnerships to be the way to fund public infrastructure development – hospitals, schools, roads, rail and the like.

Somehow they have convinced everyone it is cheaper in a total-cost of ownership meaning of that concept for them to do that rather than build, own and operate the infrastructure service themselves.

Okay – Budget Paper No 5 Statement of Finances – contains all the detail that the headlines usually avoid.

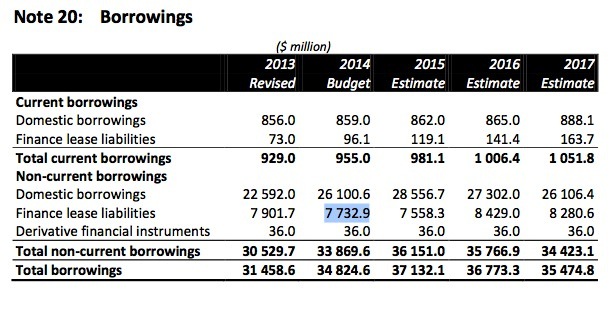

On Page 21, of Budget Paper No. 5 we learn that:

Estimates for borrowings are based on the ability to repay maturing debt and the need to finance capital expenditure. The forecast for finance lease liabilities across the forward estimates period relates primarily to the expected commissioning of public private partnerships.

Okay.

On Page 38 of the document we find Note 20: Borrowings, which tell us what the outstanding public debt is for Victoria by category. I produce the Note 20 below. You can see under Finance lease liabilities for the 2014 Budget there are $A96.1 million in current borrowings and $A7.732.9 million in non-current borrowings. That is a total of $7,829 million in outstanding debt relating to Public Private Partnerships.

Now, to those who don’t know the nuances of state government funding, the Victorian government borrows in the so-called semi-government bond market, which provides the state and territory governments access to funding at rates not far above those which prevail in the risk-free Commonwealth bond market.

State government debt is very close to risk free and when things became tight in 2009, the Commonwealth brought in a Guarantee of State and Territory Borrowing – which as the title suggested guaranteed all State debt issued between July 2009 and December 2010 as a way of maintaining low State government borrowing costs.

The Commonwealth charged the AAA-rated states 30 basis points on their borrowing rate in return for the guarantee – a bargain!

The Victorian Treasury publishes up-to-date (weekly) – Indicative borrowing rates – for the – Treasury Corporation of Victoria – Yield Curve.

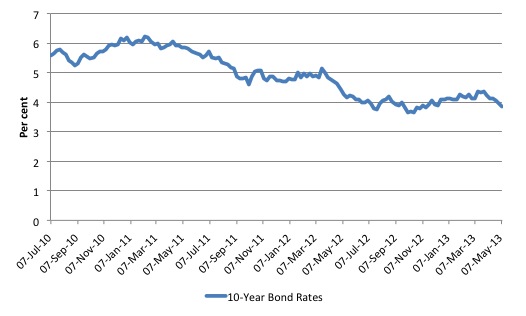

Here is a graph of the borrowing rates on 10 year debt that the Victorian Government faced since July 7, 2010 to May 8, 2010. Currently at 3.74 per cent and falling.

The Commonwealth risk-free rate 10 -year bond rate is at 3.06 per cent today, reflecting the fact that the State government does carry some solvency risk because it is not the currency issuer. The highest the State has paid in recent years is just over 6 per cent, when overall rates were higher in Australia.

The average indicative rate of the last few years and we would get 4.91 over the period shown in the graph. But that is not a good reflection of the cost of new borrowing.

But the message now is – low and getting lower – and, much lower by several percentage points than a private corporation could borrow at over the same time horizon.

Further, these yields are not going up fast because there will be a further deepening of the market as a result of the Basel III reforms, which require that banks hold larger stocks of liquid assets (including these semi-government securities).

Please read my blog – Bond markets require larger budget deficits – for more discussion on this point.

But even at that average rate we would be expecting the state to be $A383 million a year on interest servicing charges for these “finance leases”.

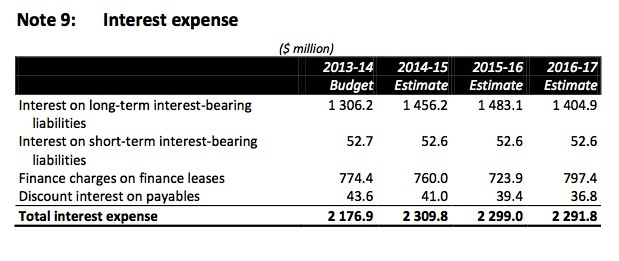

If we skip back from Note 20: Borrowings to Page 29, Note 9: Interest expense appears in Budget Paper No. 5 we find this table:

That looks remarkably like an entry Finance charges on finance leases = $A774 million. That works out to be an borrowing rate (averaged over the vintage of the outstanding debt) of 9.8 per cent.

More than 6 per cent on current borrowing costs in the semi-government market, which is highly liquid and has plenty of volume to accommodate any borrowing request from the Victorian government.

That is how much more the Victorian taxpayer is paying over what the government could be getting by using its status as a low risk borrower (and implicitly backed by the zero risk Federal Government).

So what gives?

Please read my blog – Public infrastructure 101 – Part 1 – for more discussion on this point.

From an Modern Monetary Theory (MMT) perspective there is clearly a distinction between federal and state governments, which carries over the the US and other federal systems excluding Germany (even the federal government there uses a foreign currency).

The Federal government in Australia is not revenue-constrained. So all the statements regarding insolvency, debt burdens and the rest of it are inapplicable.

Unfortunately, even the federal government seems to believe it will become Greece if it doesn’t penny pinch and this mentality has for years undermined its provision of a viable, competitive public infrastructure in this country.

Just come and try to get a fast broadband connection for example. When the current government embarked on its National Broadband Network (fibre to all homes) which involved an investment of $A50 odd billion the screams came up it would go broke and couldn’t afford it. Of-course, it might run foul if the world runs out of fibre optic cable but that is not likely.

The main opposition party, which will likely become the next government after September claims it needs to scrap the NBN and put in a cheaper system. It clearly doesn’t understand the concept of large, long-lived public capacity providing services over the next 50 years.

The reality is that the Federal government can build or buy what it likes if there are resources available in the economy to be bought. It is hard to mount an argument that there are not (increasingly) such resources. It then becomes a matter of political commitment.

There are a raft of voluntary fiscal constraints that the Federal government in Australia (and elsewhere) have imposed on itself to hide behind so they don’t have to show any real leadership.

These voluntary constraints, such as the – Charter of Budget Honesty – which suggests they balance the budget over the cycle are necessitated by any intrinsic financial constraints on its capacity to spend and buy whatever is for sale. They are also very rubbery – when did the cycle start and end, for example? Various government agencies have different views on that question.

The State or Territory governments are more like a household because it is not sovereign in the currency and has to “finance” its spending. The spending they cannot cover in taxation has to be covered with debt-issuance. But they are quite different to a household in another sense – they have huge tax dragnets to draw upon and the likelihood of them ever becoming insolvent is low.

As noted, when things got rough in 2009, the federal government stepped in and guaranteed all debt State or Territory government (if the state wanted to participate in the scheme).

That is why a State or Territory government can borrow to fund net spending (deficits) at much lower rates than the private sector. With the household sector now looking for safe havens to save outside of the creaky share markets, riskless public bond issues will remain very attractive.

As one commentator put it last year – The World Is Experiencing The Opposite Of A Sovereign Debt Crisis

Now the lobbyists from the major construction and infrastructure companies in the private sector know a good thing when they see it. They are continually hectoring us about the “reality” that the task of rebuilding public infrastructure, neglected for years by surplus toting madmen in state governments, was beyond the financial “capacity of the public sector alone.”

These were the same characters that lined up to get cheap privatised assets in the 1980s and beyond. They know a good thing when they see it.

Of-course, the claim is totally spurious. The private sector might have to be involved in the construction of the infrastructure given the years of privatisation has destroyed the public capital works capacity. But there is no financial reason why the public sector cannot fund all the projects currently being identified as worthy.

If there is any doubt then the simple solution is for the Commonwealth to guarantee the state government debt within sensible guidelines. Pretty simple. The only thing stopping this will be the politics (voluntary constraint).

The ratings agencies are also lobbying – they also know a good thing when they see it – a beautiful big and bountiful trough of public money for their dishonest, criminal snouts to get into.

The Victorian Treasury is obsessed by the ratings agencies. They maintain a page – Victoria’s credit rating – to tell everyone what these underworld organisations are up to.

It always amuses me that state governments are obsessed with their credit rating that try as hard as they can not to borrow. State governments were running surpluses consistently during the private credit binge claiming they were doing so to preserve their Triple-A rating. Duh.

In 2009, the Moody’s rating agency claimed that “financing new PPP projects will be a significant challenge in the immediately foreseeable future” (Source).

They were wrong, which is no surprise. But of-course they would say that. They want to push the terms of deals up to ensure their cosy arrangements with the creators of various financial instruments that they rate, as if they are independent judges, get better returns. Screw the state taxpayers.

The Victorian Government has just completed a review process for “next phase of Public Private Partnerships (PPP) in Victoria”. The final report released on May 2013 – Partnerships Victoria Requirements – was supported by a background paper – Future direction for Victorian public private partnerships (PPP) (released November 28, 2012).

Veteran economics correspondent for the Melbourne Age, Ken Davidson has written a story today (which I just saw) – Wasteful budgets mar state projects – that encapsulated the sophistication of the PPP document.

Kenneth Davidson writes that to keep its PPPs on track the government will use an:

… improved … [PPP model involving] … adopting modified financial structures including a greater range of services and streamlining PPP tender processes. The assumed alternative procurement option will be removed and where appropriate the comparator will be an affordability benchmark with a scope ladder.

Beautiful. Full of meaning and joy!

The Public Sector Comparator (PSC) is the benchmark upon which the government claims they assess PPP bids. The scope ladder refers to “items bidders can either remove or add should bids be over or under the PSC”.

In the new guidelines I linked above you won’t find any discussion about how it is possible to pay such a spread above the public borrowing costs and still deliver value for money to the public taxpayer. There are notes about risk management but no simple statement – this is why it is better to go the PPP route.

It is all shrouded in this PSC nonsense that is so black box, and deliberately so, that it evades any public scrutiny. The mates in the construction and infrastructure firms know a good thing when they see it.

As Ken Davidson says none of us a really meant to understand all this gobbledegook – “The main thing is that the financial engineers who build these edifices do. The politicians who are responsible probably don’t either but they know that acquiescing to the rorts is the most reliable way of getting a reputation for financial acumen”.

The rorts being the massive gouging of the public purse by the big private infrastructure firms.

In 2008, we wrote a detailed analysis on the failure of privatisation and PPPs then I invite you to read the Report – Creating effective local labour markets: a new framework for regional employment policy.

By way of summary:

If the Federal Government took over the responsibility for infrastructure provision much of the PPP debate should become irrelevant inasmuch as it is based on the revenue constraints faced by state governments in the face of their responsibilities.

But, even the state-level debate is based on false premises. There is no economic logic that says that state government borrowing is bad. The argument that a state government has to run a surplus to maintain an AAA rating is nonsensical in the context of a ideologically-driven unwillingness to use that rating to borrow on favourable terms which maximise social advantage.

There is nothing efficient about surpluses that both accompany the run-down of social infrastructure and the higher cost provision of essential infrastructure and services.

The role of government is to maximise social welfare rather than maximising private welfare. When we discuss the efficiency of a particular activity within the context of resource allocation we should always focus on the maximisation of net social benefits rather than the maximisation of net private benefits.

Generally, PPPs have failed to meet this performance benchmark and typically compromise social interests in favour of private interests.

There is a strong economic case for Government to provide public infrastructure because of market failure considerations – the existence of public goods, externalities and such does not support sufficient private returns from user charges to ensure the private provider will remain profitable.

Finally, public infrastructure services typically generate benefits across time and beyond the immediate users (schools, hospitals, sewage, etc.) which means that it is not an excludable good and therefore not appropriate for private provision.

Public infrastructure investment also promotes productivity and economic growth. It provides a fundamental training ground for skilled labour (for example, a national apprenticeship capacity), and, beyond its economic contribution, public infrastructure provides a social fabric and hence social benefits.

The proponents of PPP arrangements argue that they offer value for money which in the literature is an efficiency concept entailing: (a) Lower construction costs; (b) Lower operating costs; and (c) Higher quality services.

The evidence from Australia and the UK is mixed but generally does not support these alleged advantages across education, health and other sectors.

The standard attack on PPPs has been somewhat misleading. The argument goes that the private sector has to price its debt in the market whereas public debt prices at the long-term bond rate. Given that there is typically a 3-5 per cent difference between private and public funds, the PPP can never be cheaper unless services (employment) are cut dramatically or construction quality reduced.

However, we have to recognise that the difference in borrowing rates reflects project risk and lower public rate implies that government will rescue a failing project via drawing on consolidated revenue. Therefore the PPP is constructed by its proponents as an efficient transfer of risks from public to private and the critics are dismissed as being ignorant of this “risk transfer” argument. The gains are alleged to arise from the private sector being better able to manage risk – largely because they have a higher incentive to do so – private profit.

The real problem with the PPPs in this regard is that is a falsehood that the risk shifts from the public to the private sector. Who ultimately bears the risk? The risk premium in private financing is based on the fact that a private entity can become bankrupt with its product and service exiting the market. With an essential public service it is a fantasy to say that the PPP contract transfers risk to the private sector.

If the private partner defaults, the public always has to pick up the pieces. There is no real risk transferred.

There is substantial empirical evidence, particularly from the UK that shows that PPP partners in the private sector profiteer from the “risk” transfer component built into the contract payments.

The private provider aims to minimise financing costs over the life of the contract by early repayment and refinancing existing loans at lower interest rates. The risks are typically high in construction phases and drop to near zero once service operations begin.

The private partner reduces costs by refinancing at lower rates once construction is completed. The private partner captures these gains at the expense of the social good. The PPP contract may be able to prevent this from happening but then it reduces the incentive of the profit-seeking private provider to enter the contract.

Why should the public payments include a profit margin? Is ownership or management the key to sound project outcomes? This is a rehearsal of the privatisation debate which failed to show ownership mattered.

Kenneth Davidson summarised the matter much more succinctly than I could. In reference to CityLink, a major 22km electronic toll road in Melbourne operated privately under a PPP, he says that:

… if the project had been build with public debt instead of a PPP, tolls could be half to a third of what is charged now. Even better, a rail link into the airport would have cost a few hundred million dollars and passengers wouldn’t be in the situation where the cost of getting to the airport by taxi or parking costs as much as a cheap ticket to Sydney.

Conclusion

PPPs are just another tentacle of the neo-liberal hydra. The infestation that transfers as fast as is possible social well-being into the greedy clutches of the high income and wealthy. The lawyers make a killing. The big infrastructure companies make hay. And most nearly the rest of us pay through our noses to keep the trough full until the next big project comes along.

And as they are counting their cash the snouts write articles and appear on TV etc telling the rest of us that we cannot afford to help the most disadvantaged among us with a few extra bucks a week, how climate change is a myth, how public education is unaffordable (so give more the private schools), how public hospitals cannot cope with the financial strain (so give billions to the private hospitals, some of which are owned by the same companies that build tollways) and so it goes … Neo-liberalism at its finest and we vote these characters into office.

Back to federal issues somewhere tomorrow.

Fantasy Budget 2013-14

Crikey published a shorter version of my – Budget – today. You may well be interested in the comments – if there are any.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Early comments on fantasy budget are quite favourable.

As you can see, the official unemployment rate is currently being reported by the ABS at 5.1 per cent …

… 5.6%

Thanks apj

Fixed now.

best wishes

bill

It’s striking how uniformly the neo-liberal methodology has been applied globally. It’s as if all governments were receiving direct instructions from some higher power?

I have recently tried to convince my MP and MPP (both Liberals) here in Canada to take a look at the policy directions we are moving in through a MMT perspective to see that what they seem to support is really not consistent with traditional Liberal thinking at all and will harm the economy in the long run.

The current policy framework for public infrastructure projects begins with conditions for federal transfers to provinces which seem to have lead to the development of various low profile publicly funded agencies to promote and guide the process of P3 formation. Years before these agencies were created, a legal framework was created to allow for concealment from the public of the names of private sector financial players based on privacy arguments, and the overall process is ridiculously difficult for the public to follow because there are so many obfuscating measures to ensure this. Those of us with busy lives simply don’t have time to dig into things very far.

Another observation is that when public jobs are transferred into a P3 under the promise this will save us money while providing the same level of service, the highly paid positions which would have been disclosed in the public sector somehow eventually become exempt from disclosure rules, despite the fact the public are supposedly both full partners, and at the same time, the only clients of the organization.

Conflict of interest potential within the P3 organizations cannot be ignored. Sometimes we find that much of the work these P3’s are supposedly doing may well be completely farmed out to private and even foreign firms who benefit from having direct unfettered daily access to the public sector institutional managers who make the decisions on what is purchased with public funds. There is little to no oversight on this that I can see.

All kinds of claims are made about the savings from these arrangements with little evidence to back them up. Once the P3 is in place, the public option has been foreclosed and can no longer be used as a comparator. The few feeble attempts to compare a P3 with the displaced former public organization do not show these savings once services no longer available or quality of service are taken into account.

Because of the way the governments have set things up to favor development of P3’s we are blinkered to the greater economic benefits re-organization and modernization of the public sector infrastructure the government itself could have provided.

I thinks it’s truly dangerous that so many politicians do not seem to be armed with sufficient knowledge to form their own informed opinion. Our elected leaders, those democratically chosen to represent our interests, and do the studying, have become the followers of those whispering into their ears from behind a curtain.

>>John says:

>>Thursday, May 9, 2013 at 2:14

>>

>>It’s striking how uniformly the neo-liberal methodology has been applied globally. It’s as if all >>governments were receiving direct instructions from some higher power?

Hi!

I’m from Sweden and I have noticed that myself.

It’s funny listening to the way our politicians talk on TV. The way they construct

their words and sentences it’s obvious that the whole thing is foreign to our language,

they are translating directly from english. Or American to be more precise.

The whole thing is very odd, but if you read american newspapers like I do it’s

obvious that they are simply parroting exactly the same story. Often word for word.

Even more odd is listening to a Social Democrat of all people going on about the

economy and sounding like a rightwing hawk from back in the day. Having read

“Har vi råd att arbeta?” (“Can we afford to work?”) by Ernst Wigforss, a pamphlet

written in 1932 which pretty much demolished the very same stupidity that is

so rampant these days, the current state of affairs strikes me as being so very tragic.

The Pamphlet might as well have been written today. The very things people fought

against and overcame back then, are back again, stronger than ever. One thing that

is hard to reconcile is that Wigforss was a Social Democrat. There is a vast difference

between what the party used to be and what it is now. They sound nothing alike. Oh,

how far we have fallen.

The generations before ours overcame this nonsense and built a society which in

some ways was superior to ours. Unemployment in Sweden was at around 2

percent for nearly half a century. They obviously did something right.

Why are we repeating the bad part of history?

Building a better society is possible, I know this, for it has been done once before.