In the annals of ruses used to provoke fear in the voting public about government…

A twitter storm of lies …

This is my short Wednesday offering, which will be quite short considering the last two days have been (necessary) epics. My three-part series created somewhat of a social media storm, which means people are interested in the topic and I think that is healthy. Democracy is strengthened if people educate themselves and contest propositions that are abroad in the debate. But, as I noted yesterday, social media storms have a way of getting out of control and out of the realm of being complementary to a more considered educative process and interaction. What the recent Twitter storm has demonstrated is that key people are just willing to make spurious accusations (aka lies) without having taken the time to consider the depth of the literature that is available on any topic. That is not helpful to democracy. It undermines it. Anyway, in this short blog post, I consider some of the responses to my three-part series. As a footnote, I have now retitled the three-part series “MMT is just plain good economics” rather than using the quotation from the British Shadow Chancellor’s advisor who said that “MMT is just plain bad old economics”. Framing. I took the points of several commentators on this blog seriously in this regard. Thanks.

Twitter was twittering away at a fast rate over the last few days on this topic.

And some of the claims being made by those defending the Shadow Chancellor’s advisor’s remarks, which I quoted faithfully were astounding and dishonest.

Here is a selection with my annotations.

First up is academic economist Jo Michell, who seems to want to make accusations about my work but not base them on what I actually write.

Here he is with one of his ‘smart-guy’ summaries of my blog where he accuses me of criticising British Labour by claiming that public “capital investment is ‘neoliberal'”.

Here is his tweet (August 13, 2018):

What I actually said was that the Labour Party’s Fiscal Rule is framed within neoliberal concepts and language. That is entirely different matter.

My points about the Golden Rule component of the Rule were fourfold: (a) there is a problem distinguishing capital from current expenditure; (b) in a deep recession, the Golden Rule may not be flexible enough to prevent significant output and employment losses; (c) in a recession, it would make it virtually impossible to meet the debt commitment within the Rule, and (d) it creates a private-debt bias.

Nothing in what I wrote indicated that I was “focusing on capital investment is ‘neoliberal'”.

I also did engage in Labour’s Manifesto including its investment program by going through it issue by issue and agreeing with most of it.

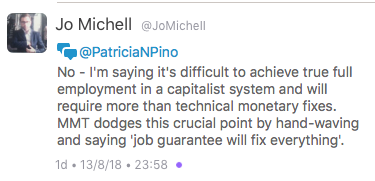

On the same day (August 13, 2018), Michell tweeted:

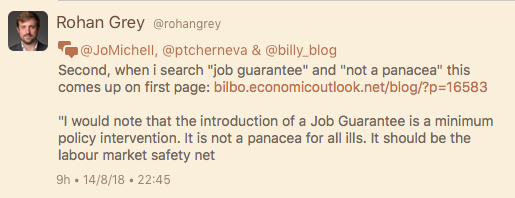

He was soon met with a torrent of responses. The first to point out that Michell was lying came from Rohan Grey as follows.

Then a range of people including those in the core academic MMT group (such as Pavlina Tcherneva, who has done so much excelelnt work on the Job Guarantee) followed up.

As the quoted section in Rohan Grey’s Tweet from my blog post – The scourge of youth unemployment (October 21, 2011) – indicates, I have always been careful to make that point.

One of the things that an academic is trained to do and required to do before entering public debate is to make sure they have read the relevant literature.

We are not paid to be attention-seeking, social media heroes who tweet our heads off by making stuff up.

We have a responsibility to the public to speak with authority and knowledge.

Michell just made his Job Guarantee put down up. He hasn’t read the literature that now spans 24 or so years (at least). He was just mouthing off.

I note that after the torrent of objections from those who have either produced the primary literature on this topic or who have taken the time to read it and understand our position on the Job Guarantee that Michell stepped back a bit and wrote something about his panacea accusation “went too far”.

No, it didn’t “go too far”. It was an untrue statement not supported by anything we have written. Plain and simple.

Next up is Jonathan Portes who was Gordon Brown’s chief economist and then took over as Director of the NIESR. His contract there was prematurely terminated by the Board. He is now employed as an academic. His 2014 paper with Simon Wren-Lewis mapped out Labour’s Fiscal Rule .

I commented in some detail on that paper in this three part series:

1. The New Keynesian fiscal rules that mislead British Labour – Part 1 (February 27, 2018).

2. The New Keynesian fiscal rules that mislead British Labour – Part 2 (February 28, 2018).

3. The New Keynesian fiscal rules that mislead British Labour – Part 3 (March 1, 2018).

In other words, I took some time (as an academic should) to understand their modelling and narrative.

In the current Tweet storm, Portes indulgently tweeted (August 14, 2018):

So, opinionated without having actually read my work. Another academic making false claims without actually checking the work he was criticising.

Why is he accepting a salary as an academic then?

And dishonest, because I went to great lengths in – MMT is just plain good economics – Part 2 (August 13, 2018) – to quote verbatim from Labour’s Fiscal Credibility Rule and from Speeches that John McDonnell had made outlining the Rule.

So his Tweet statement that I “couldn’t be bothered to read what our/Labour’s fiscal rule actually says” is an outright lie.

Then the Shadow advisor himself, James Meadway started tweeting about this topic. One tweet was demonstrative of the problem (August 15, 2018):

It is “absolutely farcical stuff” when someone says I haven’t read “anything” he’d “actually written, said, or done” when at the outset in the first blog post of the series – MMT is just plain good economics – Part 1 (August 9, 2018) – I quote written statements made by him about Modern Monetary Theory (MMT).

Those statements motivated the discussion.

So James are you now denying that those quotes were written by you?

Did you not write on Carol Wilcox’s Facebook page:

MMT is just plain old bad economics, unfortunately, and a regression of left economic thinking. An economy “with its own currency” may never “run out of money”: but that money can become entirely worthless.

Or?:

Well, I disagree – in terms of what a genuinely radical and transformative Labour government would need to do on the economy, its prescriptions are close to catastrophic (for all that it has grasped some correct formal insights ahead of neoclassicism). Any country that isn’t the US trying to apply MMT’s prescriptions would find itself in the same position.

You cannot have it both ways. Either I have quoted you fairly and your tweet is untrue or you didn’t write that stuff.

In which case, did Richard Murphy in this blog post – Labour’s chief economic adviser confirms it is committed to the thinking that will deliver yet more austerity (August 6, 2018) – falsely attribute those statements to you?

In Part 1, I also note that I had read and commented on earlier work Meadway had been involved in at the New Economic Foundation, where he was previously employed.

I didn’t write the critique to get a response from him. But for him to suggest I was not basing the three-part series on what he had actually written seems to be a false statement.

Finally (and I could have listed stacks more), we have Portes again (August 15, 2018) who previously had told his Twitter audience he couldn’t be bothered reading my discussion, but then a day later says that I wrote that the Labour Party’s Fiscal Rule “requires deep cuts now”.

So Jonathan, where did I write that?

I wrote something entirely different. For example:

1. “At the time, I wrote that if we consider what John McDonnell said carefully, it may not be as bad as, for example, the Guardian headlines suggested”.

2. Adoption of the rule “would still provide Labour with some flexibility for government to avoid harsh austerity.”

3. After quoting the rule directly (contrary to Portes’ previous tweeet above), I wrote “it is important to understand that this doesn’t negate on-going fiscal deficits. It just means that so-called recurrent (or current) spending must be matched by tax revenue over a five-year period. So an application of the rule will also not stop a fiscal deficit on recurrent spending in say year 1 of a new Parliamentary term either. It just means that over a rolling five-year horizon the balance has to be zero.”

4. “It allows ‘current’ spending (whatever that is) to exceed ‘current’ revenue (from taxes) in Year 1, Year 2, Year 3 and even Year 4, but after 5 years it has has to balance. And that rolling average then starts in Year 2 and ends in Year 6 (another balance), then Year 3 to Year 7 (another balance).”

That is what I wrote among other things.

Nowhere do I say it “requires deep cuts now”.

You didn’t read that anywhere did you Jonathan? You just made it up. Jumping on the Groupthink bandwagon.

You didn’t check what I had actually written.

And for those who are claiming I have got the rule wrong, consider this sequence of statements – and the focus in on the rule conditions for the ‘current fiscal balance’ not the ‘capital balance’.

John McDonnell’s – Speech at the Royal Society of Arts (March 11, 2016)- outlined the Fiscal Rule:

Sound finances are the foundations on which everything else is possible … We know a rule for spending is needed. It should make clear the framework in which a future Labour government will make its spending decisions so that the public can trust those spending decisions …

We believe that governments should not need to borrow to fund their day-to-day spending …

And that is why we would commit to always eliminating the deficit on current spending in five years, as part of a strategy to target balance on current spending over a target five-year period …

While there are exceptional times when shocks from the private sector mean that government has to step in to help, everybody knows that if you’re putting the rent on the credit card month after month, things needs to change.

The Daily Mirror analysed John McDonnell’s Speech (March 10, 2016) – Labour launches a five-year plan to tackle the UK’s debt crisis:

The Shadow Chancellor will pledge to get the deficit down within five years of Labour coming to power.

Simon Wren-Lewis (March 11, 2016) – A (much) better fiscal rule:

It involves a rolling target for the government’s current balance: within 5 years taxes must cover current spending.

The Independent (March 10, 2016) – Labour bids to win back economic credibility as John McDonnell vows to balance Budget over five years:

The main elements of the new fiscal rules … will be to achieve a balance on the current budget over a rolling five year forecast …

The UK Guardian’s interpretation (March 11, 2016) – John McDonnell’s new fiscal rule is strong, but it’s no election winner :

… the Labour party believes governments should balance the books on day-to-day spending … it is to be applied over a fixed five years, and it can be suspended when the Bank of England has no other ways of stimulating the economy.

John McDonnell explaining the rule to the Press(Source):

A Labour Government will always balance day-to-day expenditure …

And in the related BBC news report (March 11, 2016) – Labour announces ‘fiscal credibility rule’:

… over a five-year Parliament borrowing would only be allowed for investment … Mr McDonnell said the deficit on “current spending” would be eliminated …

Paul Mason’s interpretation – The thinking behind John McDonnell’s new fiscal credibility rule (March 11, 2016):

A Labour chancellor will have to show at every budget, according to Office of Budget Responsibility (OBR) calculations, that s/he can balance the books in five years’ time.

On November 204, 2016, John McDonnell appeared on BBC’s The Andrew Marr Show and this exchange occurred (Source):

AM: … Explain to me again what the Fiscal Credibility Plan actually is.

JMcD: … so what we need is a fiscal credibility rule that actually says yes, you bring down the deficit on a rolling five year programme, when it’s …

AM: So you balance the books over five years?

JMcD: Yes. In other words you spend what you earn.

Briefing notes from the Resolution Foundation – The deficit the election forgot> with a quote from John McDonnell (May 2017):

The Labour Party last year set out a “fiscal credibility rule”, which would commit it to “always eliminating the deficit on current spending in five years, as part of a strategy to target balance on current spending over a target five-year period” …

Nothing I have written is in contradiction with any of those statements including those made by John McDonnell himself.

They are intending to balance at some point. For those who think they can just push out the balance period if things get bleak, that is not what the Rule says.

It says that when the Bank of England’s Monetary Policy Committee determines that monetary policy is no longer effective (for example, the zero-lower bound story), then, and only then, can the Government suspend the rule.

And a zero-lower bound is rare but crises where unemployment rises quickly and needs strong fiscal support (both current and capital) are much more frequent.

Music I am listening to today …

There are some pieces of music that always kill me. Slabo Day written by Peter Green is one of those pieces.

It came out on Peter Green’s 1979 album – In the Skies – which was his second solo album after leaving Fleetword Mac in 1970.

There was an 8 year gap between the two solo albums as he struggled with mental illness, rumoured to be triggered by taking too much acid at a hippy colony in Munich (reference).

The album is hard to get and is one of my favourites – some of the tracks (Proud Pinto and Apostle) are equal to Slabo Day.

Three chords (Am G F) have never sounded so good!

This version is from a live concert given by English guitar player Snowy White, (who has played in Thin Lizzy and Pink Floyd) and who helped Peter Green out on the 1979 album, given that Peter Green was not in a very good mental state at the time.

It was filmed in the Netherlands in September 2011 at de Bosuil (a live music venue) in Weert. I was at that concert having caught the train up from Maastricht. There was some beautiful playing all evening.

And here is the entire ‘In the Skies’ album. The playing is masterly.

Slabo Day is at 3:51.

Apostle is at 37:08

Listen to those two at a minimum if you want to get a feel for this period in Peter Green’s immense career.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

I’m glad I don’t subscribe to twitter. It seems it’s much easier to be sloppy with the truth on this medium. Trump is a good illustration of it. He has lots of similar minded people who are not truthful in order to denigrate anyone they don’t support!

Hi Bill,

Thank heavens for your educational vocation that helps economic virgins like me get an impression that they are beginning to understand some of these issues. Which, as you emphasise, insults traded in however-many-characters-it-is do not.

I get that the difference between current and capital spending is blurred but does that make it irrelevant?

If I understand it right, the social aim of a Job Guarantee is to relieve the stress of involuntary unemployment and the economic aim is to maximise the capacity of the economy. But does the efficacy of the latter not depend on what jobs are created? If money is created to pay wages to produce useful goods and services, I can see how that would pay for itself. But if the jobs created stimulated demand without commensurately stimulating supply, would that not lead to inflation? Obviously Keynes’ people digging holes and filling them in again; but also perhaps, socially useful but less economically productive services like environmental clean-up and social care (unless this frees up someone else for productive employment). I’m not saying that such jobs should be ruled out for JG but would there not be a need for balance. On aggregate, if a JG stimulated demand more than it stimulated supply by a sum of new money £X, would £X not have to be removed from the economy through supplementary taxation or borrowing? And does this not mean that there is a nugget of truth in the Labour Party rhetoric (assuming that capital spending is defined as spending that will ultimately bring a return in terms of more goods and services).

I’m sorry if this is all naïve but I’m new to all this.

Anthony Molloy (Chair of the Labour Land Campaign)

PS: looking forward to listening to you at the Gower thing

It took me a long time to get my head around not so much MMT in general; I was already a convert to Public Credit/OMF; but the use of bonds & taxes as inflation suppressing tools rather than financing tools & the obfuscation in how it is all accounted for in the national accounts. I tried to do a three part exposition of it related to New Zealand. Hope I got it right. Unbelievably for a nation with such a proud record of social reforms & a comprehensive welfare system, there is absolute zero interest by politicians & media in the Job Guarantee concept & no one under 50 remembers the role government departments like Railways & Ministry of Works used to play in employment. Probably the same in Australia

https://unframednz.wordpress.com/2018/06/13/modern-monetary-theory-the-magic-money-tree-overview-part-1/

https://unframednz.wordpress.com/2018/06/13/modern-monetary-theory-part-two-government-job-guarantee/

https://unframednz.wordpress.com/2018/06/13/modern-monetary-theory-part-3-deficit-spending-taxation/

Congratulations Bill on replying to these Twitter stormers with such patience and exactitude.

Keep up the great work Bill!

You are getting a twitter storm, because what you are saying is confronting to those still locked in the neoclassical / laissez fare ideological mythology. The irony of course is that if Jeremy Corbyn and the UK Labour Party do not embrace the descriptive veracity of MMT, (even if he does become PM of the UK), it will only be for one term. I predict the same for Jacinda Ardern, although she may get two terms because the NZ Nationals are currently so politically weak.

I keep saying to people on social, ‘we need one term of the ALP for people to appreciate that lite neoliberal won’t work either.’

The time for Modern Monetary Theory to become mainstream will come.

Rod, we can hope that MMT’s time will come sooner rather than later. Like Bill and others, I am getting sick and tired of these blowhards huffing and puffing their rubbish as if they were onto some great truth and have thereby found the limitations in those who don’t repeat the same nostrums as they do. What is really irritating, and I can attest to this as well, is that they don’t really listen to anyone else. They merely repeat themselves.

As for Corbyn and the Labour Party, I can say that, from what I have experienced and from what others have told me, the Labour leasership is resisting taking on MMT. For reasons that are not entirely clear, they want to stay with some form of neoliberalism. Which, as Bill has pointed out, is neoclassical economics married to some particular tenets of political philosophy, the latter differing somewhat as between the Tories and Labour. Some have suggested that this resistance is for political reasons, but I remain skeptical.

The reason for resistance of the Labour leadership to endorse MMT, I suspect, is because they fear the backlash from the right (capital supporting) wing media. “Labour loonies endorse crackpot economics” etc. You can easily predict the headlines. The amount of effort being made to smear Corbyn as anti-Semitic, because they know that his policies are popular, is astounding. Considering he has been an antiracism supporter for decades. And even worse given the right wing hypocrisy.

For the reasons @Averagejoe mentions, this is why we have to convert people at the grass roots level, and not (just) at the leadership level. When a critical mass of the voting public understands what MMT has to teach, then the leadership (of any political party) simply will not be able to get away with their lies; the right-wing press ditto.

Easier said than done though.

Well Larry, the ordinary people I talk to understand perfectly why the Labour leadership want to balance the books; because nobody out here on the streets can possibly survive any other way – and the same must apply to profligate government’s, surely.

Another thing that resonates around the streets is the obvious demise of any organisation (public and private) that cannot compete with its competitors, both national and international. You’ll hear the word efficiency echo around the table in with the same frequency as productivity appears on these pages – especially with regard to public spending which apparently doesn’t benefit from the discipline of the market place.

We want the riches that a capitalistic society has historically provided and a million words of MMT doctrine sounds like an obsessive infatuation by comparison.

Yet, almost every one of these complainants in the street has benefited extensively from the NHS and its dedicated staff; acknowledged to strive under almost impossible circumstances and through lack of resources. But when it comes to finding more funding the threat of an unbalanced tax/revenue budget ensures that a political party that promotes a creditably enterprising future wins the vote.

I think Lenin coined ‘patiently explain’. Sure keeping to that maxim; not sure how you do it, but I guess the tonnage of merde thrown at you over decades must inure you, at some point, rather than ‘manure’ you…

Yes Twit’s a flawed medium, but there’s a large progressive think tank that uses it, and a well known market commentator who’s Labor-symp.; they both subscribe to household-debt/blown-the-Visa-card thinking.

There are a few of us who, despite our probably lowish level, manage a reasonable refutation. This tends to be in the nature of the London Blitz; we await the next drop of neoliberal doozeys.

Something that makes the job of MMT proponents easier in that situation is that their arguments are so tied to retrogressive outcomes that they expose themselves repeatedly. One recent retort implied that because the mindset generally, (including, I gather, on progressive side of FedPol) is so antithetical to considering MMT, that they are restricted to arguing within a limited framework.

I suspect, though, that this is a circuitous avoidance of saying whether, for instance, they agreed, or not, with, say, that ‘taxes don’t pay for FedGov expenditure’. They assiduously avoid saying yay or nay.

Thanks for your tireless output… and the music.

I understand (and intuitively sympathise with) the motivation which I believe underlies many MMT protagonists’ insistence on the centrality of the JG. Nevertheless I think that that insistence (unconditional acceptance of which gets used as a test of MMT purity) besides being out of all proportion is a serious tactical mistake, because thereby unscrupulous adversaries who ought to know better are enabled to set it up as an Aunt Sally and use it as a useful stick with which to beat MMT as a whole. (No better illustration of such tactics could be imagined than in the twitter-storm Bill clinically dissects above).

MMT allows us to see that, objectively-viewed, the unemployed constitute a buffer-stock. By providing a job paying the minimum wage (plus appropriate benefits) to any person who wants one, a JG would not cause the buffer-stock to be different *in magnitude* from what it otherwise would have been but different in composition – whereby it ceases to be a humiliating sink into which people are involuntarily dumped; instead being without a job becomes a self-chosen option (severely-incapacitated aside), which is an entirely different matter.

Admittedly, presenting it in that light makes a JG seem wholly benign – unexceptionable even. The trouble is that:- a) it is nevertheless a theoretical concept untested in the real world (the New Deal being the nearest, very rough, simulation – but that was 80 years ago); b) until trialled, and subject to whatever findings such a trial might reveal, it is open to a number of reasonable doubts and objections on practical not ideological grounds which can’t be just assumed-away; c) although, because unemployment if involuntary has highly damaging human consequences, it can as a conscious policy-choice be deserving of being strongly deprecated (eg NAIRU), *be it noted* that that is a value-judgment not something intrinsic to a descriptive theoretical framework such as MMT as opposed to a normative one.

Lenses don’t have political opinions, because that’s not germane to performing the job they’re designed for.

Until an actual, contemporary, JG has been operated for a while (eg as a pilot-scheme in a cross-section of suitable cases) and its operation studied and evaluated so that the defects (which experience will as with any such scheme inevitably reveal) can be examined and corrections be proposed, no one can know with certainty how viable the idea is in practice nor what exactly are its downsides; *but unquestionably there will be some*. In the meantime turning an untried idea into an ark of the covenant might be appropriate (though I doubt it) in the political sphere but is IMO definitely out of place in the theoretical one.

I get RSS feeds from most of the parties to this debate – many for several years. I have been thoroughly disappointed by the attitude of those you call out above. When usually polite and thoughtful people result to this level of comment (and abuse) you know a nerve has been found.

Sadly, having entirely lost the debate so far they will likely go silent. Let’s see. RSS archives are a useful resource 🙂

Whether MMT adequately describes reality is a bit beyond my knowledge, but that this Trump-level nonsense is consistently the only criticism against it is a strong endorsement.

@RobertH: Unfortunately, almost by definition, a pilot-scheme of something like the JG cannot prove the case we (MMT-ers) are trying to make. It can only work (properly) at the macro level. “All or nothing”, if you like. Having said that, I would be in favour of pilot schemes; not to prove the macro-economic effects of the JG (because pilot schemes, almost by definition, could not do that), but to sort out some of the actual mechanics and logistics of how it could work.

I always believe in “proof of concept” & prototyping before you go into something on a large scale.

Perhaps the way to work a pilot scheme would be to take some administrative area (in the UK this would probably have to be a District Council or a Unitary authority – one of the smaller ones), and then (obviously with the council leaders being fully on board – something else easier said than done), operate it such that every person involuntarily unemployed within that area would be offered (public service) employment.

As well as the council being fully on board, the DWP (and local employment offices), and the Treasury and HMRC would have to be fully on board, and you’d probably need the co operation of local voluntary agences.

Then there would need to be some criteria for deciding whether the pilot had been a success.

The problem with all of this is that while we wait for the pilot scheme (there could be more than one, of course) to be instituted and then evaluated, what does the rest of the country do…?

On the other hand, just because something is difficult to do does not mean that it should not or cannot be done. Again, I come back to convincing the grass roots, the ordinary voter, that this sort of thing is a good idea. Because a government introducing this sort of thing is going to need at least two terms to prove its case.

Paul O says:

“When usually polite and thoughtful people result to this level of comment (and abuse) you know a nerve has been found”.

Perhaps that “nerve” is that they are being confronted – unlike I presume in the story thus far – with an outright challenge, backed up by a formidable scholastic armoury allied with forensic skill, not just to their cherished although barmy ideas but to everything which has contributed most directly to their being where they now are, namely to the foundations of neoclassical/neo-keynesian economics as an academic discipline upon which the validity of their credentials for claiming to be accepted as public oracles (and thence their earning-power) depends.

Their violent and abusive reaction seems to me to be the typical one to be expected of people (including ourselves?) finding the very basis of their place in society coming under attack. That pattern has been displayed countless times before in the history of ideas. Think Socrates…?

Dear Bill, it’s depressing to think that these demonstrations not only of wilful ignorance, but worse, verbal abuse, are coming from economists who are, nominally at least, meant to be, politically, on the same side!

All I can say is “non illigitimus carborundum”, and, once again, please believe that you are at the third stage of that quote that ends: “..then they fight you… then you win!”

Best wishes, Mr S.

Excellent riposte Bill, and as always, ‘thank you for the music…’

Paul O says:

“When usually polite and thoughtful people result to this level of comment (and abuse) you know a nerve has been found”.

It’s been said “Hell hath no fury like a woman scorned” but I disagree: I think it’s an academic scorned (or any public oracle, often the same thing) that takes that prize.

Just think:- there you are, sitting pretty in a well-paid job, with people fawning on you because you’re “famous” or even “a celebrity”, bedecked with academic laurels, your every thought greeted with hushed respect…and suddenly there’s this upstart subjecting your profoundest pronouncements to undisguised contempt and withering scorn. Moreover, he’s calling into question (and backing-up his critique with formidable erudition allied with forensic skill) the very basis upon which your credentials to practise – and hence your earning-power and your status – depend: namely the whole intellectual edifice of neoclassical/neo-Keynesian economics.

How can any such person (and I can think of quite a few others apart from those in the firing-line this time – Krugman for one, with his response to Steve Keene’s “ptolemaic astronomy” barb in mind) be expected to react than with more-or-less incoherent rage and vituperation?

That pattern has been repeated endless times throughout the history of ideas. Think Socrates…

When the neoliberals (and those who play along even despite themselves) speak of the so-called “marketplace of ideas”, they mean it *literally* (even though most think they’re speaking metaphorically).

@Mike Ellwood

“Unfortunately, almost by definition, a pilot-scheme of something like the JG cannot prove the case we (MMT-ers) are trying to make. It can only work (properly) at the macro level. “All or nothing”, if you like”.

I disregarded that. But you are right of course. Thanks for the correction.

We are clearly in agreement about the need for “proof of concept”. However it won’t have escaped you that my critique was broader than that; and I’m sticking to it – for now anyway.

“On the other hand, just because something is difficult to do does not mean that it should not or cannot be done. Again, I come back to convincing the grass roots, the ordinary voter, that this sort of thing is a good idea”.

Aye there’s the rub; but when it comes to convincing the grass roots a very keen political sense is required in the choice of what to prioritise. Personally I don’t see the JG as the best choice but I can’t claim to be any sort of seer. Really I suppose it’s anyone’s guess (and it constantly changes anyway).

Thank you, again, Bill for the important work you do. It is an inspiration to me and to others I know.

Interesting that Labour economic big shots are responding. There is no doubt you have hit a nerve. I imagine it is because you have provided support for those within Labour who won’t be satisfied with neoliberalism lite. Otherwise they wouldn`t respond at all. Responding provides your ideas with a platform, clearly a propaganda error unless the responder has no choice.

With respect to politicians’ reluctance to overtly adopt the functional finance part of MMT, I do have some sympathy there. While they should never adopt neoliberal tropes such as balancing the budget I don’t see them surviving politically a statement like “taxes don’t fund spending“. A Canadian example: an expansion of public healthcare is now being considered. If done correctly it will be the largest increase in a social program in 50 years and increase the efficiency of the system tremendously, both money-wise and in real resources. Nonetheless our side faces the usual tropes : we must use taxpayers money responsably, how will we pay?, our grand-children will pay, etc. And these self-serving supposed concerns have traction. My understanding of functional finance is essential in elaborating a response but the arguments made must not set people off on side issues or appear to be from cranks who can be easily dismissed. I have batted the issue around with a number of MMT sympathisers and have come up with MMT-consistent arguments that are intuitively appealing (I hope!) but do not roll out some of the more aggressive MMT concepts (eg taxes don’t pay for anything). We’ll see how it goes.

I agree with almost everything you’ve said on this and have been following the blogs of those on the other side for much longer, but one thing about the fiscal rule I think you are slightly misreading.

when JMcD says: “And that is why we would commit to always eliminating the deficit on current spending in five years, as part of a strategy to target balance on current spending over a target five-year period …” I think this means that the target is that you should act to make current spending in year t+5 = tax take in year t+5 in each year t.

I think that this is the correct reading based on Simon Wren-Lewis’s writings and others who were involved, which is slightly different to saying you should keep the moving averages balanced and I think explains part of why they feel they are being misinterpreted.

Behind all the soundbite your argument definitely holds to me, I just think this is the intention at least as the economists who wrote it intended.

Twitter was set up in essence to be the school lunchroom where the bully can pull the earnest, unsuspecting kid’s pants down, to the laughter of the entire cafeteria. We know we shouldn’t laugh, and that was terrible. Think poor schmuck, nerd kid should be ready for that. And how many behind the scenes high five and congratulate the smiling bully. And the kid can say nothing, has no defense besides his lonely dignity.

Just don’t sell anymore treasuries and your national debt will go down to zero eventually. Problem solved.

There’s an amusing property to a scheme that balances accounts over rolling 5-year periods:

Consider the government’s fiscal balance over year n as B[n].

If we have a system that maintains that rolling balance, and pick an arbitrary year 1,

B[1] + sum (B[2..5]) = 0

for the next period

sum (B[2..5]) + B[6] = 0

subtracting gives B[1] – B[6] = 0, or B[1] = B[6]

continuing like that would give us B[2] = B[7], etc. since the choice of year 1 is arbitrary.

Therefore the pattern of government spending would have to loop forever in identical cycles.

Definitely a rule made to be broken.

In one sense the fact that the “New Keynesian Gang” are attempting a sort of clunky half-way MMT policy and convinced the UK Labour leadership to buy into it for a UK electorate and MSM that is severely under-educated in economic and monetary system matters should be regarded as a form of progress. The British move very slowly in changing their thinking. Heck it’s only 87 years since they understood why they had to junk the Gold Standard and then shortly after the Second World War ended they’d forgotten why! Give these Brits a break they’re educationally challenged!

Some comments about the Job Guarantee never being tried before.

In the 50’s – 70’s during the period of full employment, the government here in NZ would absorb any unemployed into the public service. I think you could define that as a de-facto JG that was successfully deployed.

robertH, I don’t think that Socrates is the best example for your purposes. To see why, have a look at I F Stone’s The Trial of Socrates.

You don’t need to say “taxes don’t fund spending”. That is technically true but quite confusing.

It is better to say, “The government does not need your money. The government needs YOU to need the government’s money.”

The money story starts with a government that wants to provision itself. The governments needs some real goods and services to be transferred from the private domain to the public domain. So the government spends a currency into existence by crediting bank accounts. And it requires households and firms to pay taxes in that currency. It penalizes households and firms that don’t comply. The tax obligation creates demand for the currency. Millions of people owe taxes in the currency. That makes the currency valuable.

Point out that the purpose of taxation is to remove some private sector spending power to create non-inflationary space for the government’s spending.

If the economy is already at full capacity – everyone who wants a job has a job, every factory in the nation is being used at full capacity, every piece of equipment is being used, business inventory has been run down completely – and the government wanted to expand its role in the economy, then it WOULD need to raise taxes to remove some non-government spending power and free up space for its own increased spending.

BUT: right now the economy is far below full capacity. So the government can increase its spending without raising taxes, or cutting spending elsewhere. And of course, the government never needs to borrow its own money. So it could stop issuing Treasury bonds immediately.

The government buys and sells its own bonds to enable it to maintain its target overnight interest rate in the interbank lending market. But it doesn’t have to use bonds to achieve this. It could just pay interest on excess reserves. Or it could allow the interest rate to fall to zero, instruct the central bank to focus on enforcing high underwriting standards, and rely on fiscal policy to influence output, employment, inflation, composition of output, social outcomes.

Tom: “Just don’t sell anymore treasuries and your national debt will go down to zero eventually. Problem solved.”

But you will still (probably) have a deficit, which is what the Labour Party claims to aim to eliminate over the cycle.

@William – Very interesting about the NZ example. People might counter that NZ has a very small population, so the example “doesn’t count”. Also that it was a long time ago under very different conditions, which is perhaps a more valid argument.

Paul & RobertH are right. To lie. To bear false witness. They hate because MMT challenges the foundations of their lives, as well as the people they serve.

larry says:

“robertH, I don’t think that Socrates is the best example for your purposes. To see why, have a look at I F Stone’s The Trial of Socrates”.

@Larry

I expect you’re right, and am content to take your word for it. But my reference was to an archetypal pattern of behaviour of which – even if Socrates’s case might not be the best example – I’ve no doubt a scholar (which I’m not) could readily find plenty more suitable instances from history either ancient or modern.

We better not avert from the righteous path of neoliberal “truths” on economics, although religious dogmas of the Inquisition seem sound in comparison.

Private companies always do it better than the government?

Like infrastructure in Italy.

The Beneton family control the company (Atlantia’s Autostrade per l’Italia) that have the concession of 3000 km roads including the Genova bridge. In 2017 it had €3.9 billions in revenue and a gross margin of €2.4 billion. A profitability of 61%.

Although traffic and tolls are on the rise (well above inflation), are employment in the sector declining and investments are falling. Italy’s private “road keepers” have recovered well from the GFC and do good profits but investments are on record low.

It is said that 2 of 3 the bridge constructor Riccardo Morandis large bridges of the same type with his patented concrete construction is claimed to have collapsed, the 3:e in Libya was closed 2017 due to safety reasons. Italy an industrial nation in EU and Libya a failed state in North Africa that close insecure bridges.

What are going on in EU? Not long ago we could read about how Germany (economic engine of EU) are closing bridge for trucks on important infrastructure routes. Not because of environment concerns, due to safety reason so the bridges wont collapse. A part of many neglected infrastructures investments in Germany.

https://valori.it/autostrade-bancomat-benetton-sicurezza/

https://www.libyaobserver.ly/inbrief/authorities-east-libya-close-wadi-el-kuf-bridge-safety-reasons

We had the same policy (unofficially) in Australia from 1945 to about 1970. Kept unemployment under 2%.

Bill has also written extensively on Argentina’s government “Heads of Households” jobs program that created jobs for the poorest of Argentina’s unemployed in 2001, and started the return to recovery.

I caught the tail-end of a BBC interview last night when an Italian government minister was blaming the EU “Stability and Growth Pact” rule that limits deficit spending to 3% for the tragedy.

Gosh, who could’ve have possibly foreseen that?

What folks miss on the Job Gty is that the added currency production is offset by the added private sector goods and services produced by business people who go waky waky, after the Job Gty workers wave their paychecks in front of their noses, and hire MORE unemployed. Added production supply offsets added currency so — no added inflation. This should be stressed in every Job Gty/Inflation discussion. It isn’t, I don’t think, and perhaps that’s why Labour (and Dems in the US) haven’t embraced MMT.

That’s the spirit Bill – !!!! – ah the old days with Philip… sigh….