Today (January 22, 2026), the Australian Bureau of Statistics (ABS) released the latest labour force…

Australian labour market delivers more jobs growth but still no trend emerging

The latest labour force data released today by the Australian Bureau of Statistics – Labour Force data – for September 2017 shows that total employment growth was positive but weaker than last month with most of the action coming via part-time employment. However, total hours worked continued to rise, which suggests that employers are offering extra hours to existing jobs. Unemployment declined with a constant labour force participation rate, which says that employment growth was slightly stronger than the underlying population growth – a good sign. Labour underutilisation overall (underemployment and unemployment) was at 13.6 per cent summing to 1,814 thousand persons, which tells you that there is still considerable slack in the labour market. The teenage labour market showed modest improvement but remains in a poor state. Overall, my assessment from last month remains – it still to early to conclude that the uncertainty of the last few years is giving way to sustained growth.

The summary ABS Labour Force (seasonally adjusted) estimates for September 2017 are:

- Employment increased by 19,800 (0.2 per cent) – full-time employment increased 6,100 and part-time employment increased 13,700.

- Unemployment decreased 11,800 to 711,500.

- The official unemployment rate decreased 0.1 points at 5.5 per cent.

- The participation rate remained steady at 65.2. It still remains below its December 2010 peak (recent) of 65.8 per cent.

- Aggregate monthly hours worked increased 11.2 million hours (0.7 per cent).

- The monthly labour underutilisation data shows that underemployment was estimated to be 8.2 per cent of the labour force (down by 0.3 points in September); the total labour underutilisation rate (unemployment plus underemployment) was 13.6 per cent (down from 14 per cent); there were 1,068.8 thousand persons underemployed and a total of 1,814 thousand workers either unemployed or underemployed.

- Using the seasonally-unadjusted quarterly data, the total labour underutilisation rate (unemployment plus underemployment) was 14.1 per cent (1,812.6 thousand workers). Underemployment was 8.5 per cent and there were 1,101.3 thousand persons underemployed.

Jobs Availability Snapshot 2017

Before I analyse the ABS data release, I note that today, Anglicare Research released its – Jobs Availability Snapshot 2017 – which paints a dire picture of the Australian labour market and demands government intervention.

The Jobs Availability Snapshot 2017 aims to shine:

… a spotlight on what the job market is really like for those facing the greatest barriers to work – for example people who may not have quali cations or experience to draw on, those trying to re-enter the workforce after a long break, or those living in regional or remote areas.

The findings are distressing:

1. “a grave situation for people with barriers to work, despite one of the strongest periods of growth in full-time employment in Australia for some time”.

2. ” In our sample month of May 2017, there were 711,900 people who were unemployed, including 124,385 jobseekers who may not have quali cations or experience. But entry-level jobs (or ANZCO Level 5 jobs) comprised just 25,979 (15%) of the jobs advertised. In other words, up to ve of these jobseekers are competing for each entry-level role across Australia.”

3. “there is no jurisdiction in the country where there is su cient suitable jobs for the number of people looking for them. The situation is particularly dire in Tasmania, South Australia and West Australia.”

4. “There are not enough entry-level positions for the people who need them.”

5. “People with signi cant barriers to work are not benefiting from the recent boom in full-time employment.”

6. “The growing casualisation of the workforce works against the ability of people with barriers to work to gain suitable and secure work.”

7. “The market cannot be relied upon to fix these problems without intervention.”

Anglicare say that the results:

… shows why government intervention must move away from failed policies that force people onto an endless hamster wheel of job searching and training unlinked to real job prospects. If we persist with an approach that’s failing, we are not simply denying people jobs. We are denying them stability, activity, dignity, and a connection to society.

An essential step that the Federal government should take is to introduce a Job Guarantee, which would provide inclusive jobs for all people who are locked out of the labour market because of an insufficiency of employment growth.

The problem with the Anglicare approach is that they do not place public sector job creation at the centre of their solution.

They want higher unemployment income support payments, less pernicious surveillance of the unemployed, better data collection, building pathways (whatever they are) and more.

But very little emphasis on the source of the problem – a lack of job creation.

But their closing comment “We can’t leave things to the market” is apposite.

Employment growth – positive but fairly weak in September

Employment increased by 19,800 (0.2 per cent) – full-time employment increased 6,100 and part-time employment increased 13,700.

This is a much weaker result than was recorded last month. Whether it is just monthly noise or a slowdown remains to be seen and we won’t know for a few months.

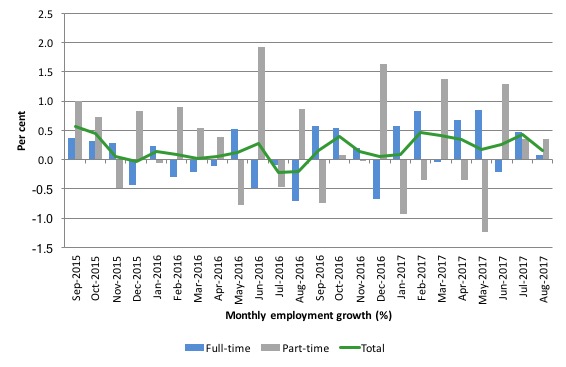

We observed a zig-zag pattern in total employment growth up until the end of 2016. The oscillating pattern has continued into 2017 but the level has risen above the zero line. There is still a switching pattern around the zero line for full-time and part-time that is evident although over the last two months both employment components have been positive.

The following graph shows the month by month growth in full-time (blue columns), part-time (grey columns) and total employment (green line) for the 24 months to September 2017 using seasonally adjusted data.

It gives you a good impression of just how flat employment growth has been over the last 2 years. The positive note is that there has been four stronger full-time employment outcomes in the last eight months.

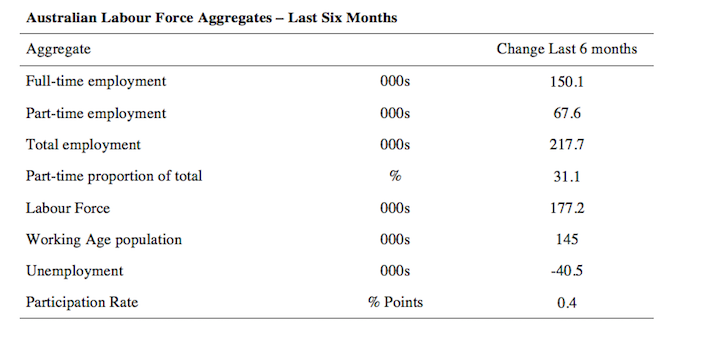

The following table provides an accounting summary of the labour market performance over the last six months. The monthly data is highly variable so this Table provides a longer view which allows for a better assessment of the trends.

Full-time employment has risen risen by 150.1 thousand jobs (net) over the last 6 months, while part-time employment has risen by 67.6 thousand jobs.

The conclusion – overall there have been 217.7 thousand jobs (net) added in Australia over the last six months while the labour force has increased by just 177.2 thousand. The result has been that unemployment has fallen by 40.5 thousand.

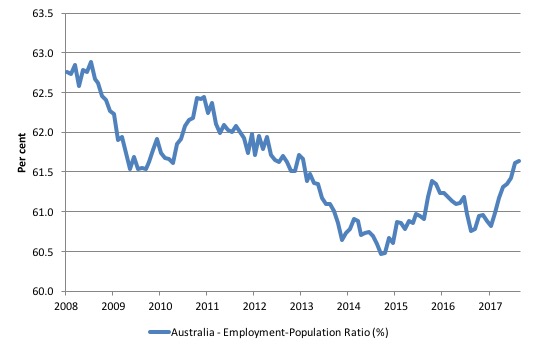

Given the variation in the labour force estimates, it is sometimes useful to examine the Employment-to-Population ratio (%) because the underlying population estimates (denominator) are less cyclical and subject to variation than the labour force estimates. This is an alternative measure of the robustness of activity to the unemployment rate, which is sensitive to those labour force swings.

The following graph shows the Employment-to-Population ratio, since February 2008 (the low-point unemployment rate of the last cycle).

It dived with the onset of the GFC, recovered under the boost provided by the fiscal stimulus packages but then went backwards again as the last Federal government imposed fiscal austerity in a hare-brained attempt at achieving a fiscal surplus.

The ratio began rising in December 2014 which suggested to some that the labour market had bottomed out and would improve slowly as long as there are no major policy contractions or cuts in private capital formation.

The series turned again as overall economic activity weakened. Over the last few months it has improved again.

The series was steady in September 2017 at 61.6 per cent and remains a 1.3 percentage points below the April 2008 peak of 62.9 per cent.

Once again, the steady ratio in September ends a period of increase, which might signal the recent growth spurt is over.

Teenage labour market – further improvement in September 2017

The stronger overall labour market position has not really filtered down to the teenage segment.

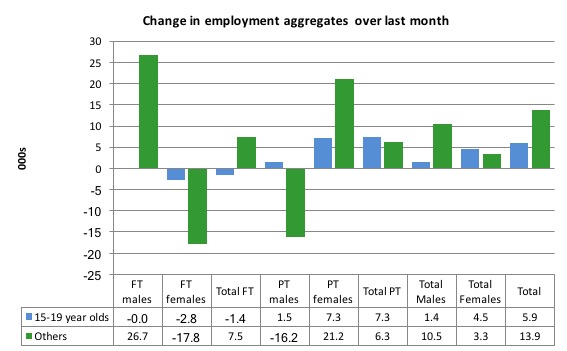

Despite the stronger full-time employment growth overall, full-time teenage employment fell by 1.4 thousand jobs in September 2017, while part-time employment rose by 7.3 thousand.

As a result, total employment rose by 5.9 thousand (net) in September 2017.

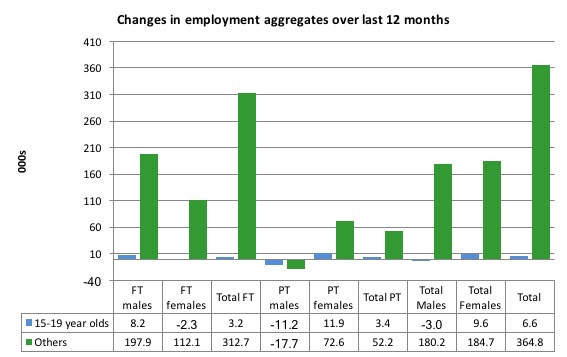

The following graph shows the distribution of net employment creation in the last month by full-time/part-time status and age/gender category (15-19 year olds and the rest)

Over the last 12 months, teenagers have gained 6.6 thousand (net) jobs overall while the rest of the labour force have gained 364.8 thousand net jobs.

Full-time employment for teenagers over the last 12 months has risen by 3.2 thousand while part-time employment employment has fallen by 3.4 thousand.

The following graph shows the change in aggregates over the last 12 months.

In terms of the current cycle, which began after the last low-point unemployment rate month (February 2008), the following results are relevant:

1. Since February 2008, there have been only 1,642.6 thousand (net) jobs added to the Australian economy but teenagers have lost a staggering 86.2 thousand over the same period.

2. Since February 2008, teenagers have lost 119 thousand full-time jobs (net).

3. Even in the traditionally, concentrated teenage segment – part-time employment, teenagers have gained only 32.8 thousand jobs (net) even though 885.5 thousand part-time jobs have been added overall.

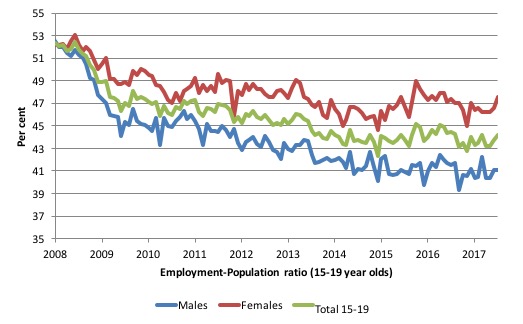

To put the teenage employment situation in a scale context (relative to their size in the population) the following graph shows the Employment-Population ratios for males, females and total 15-19 year olds since February 2008.

You can interpret this graph as depicting the loss of employment relative to the underlying population of each cohort. We would expect (at least) that this ratio should be constant if not rising somewhat (depending on school participation rates).

The facts are that the absolute loss of jobs reported above is depicting a very difficult situation for our teenagers. Males, in particular, have lost out severely as a result of the economy being deliberately stifled by austerity policy positions.

In the latter months of 2015, with the part-time employment situation improving, there was some reversal in the downward trends in these ratios.

The decline in recent months in the ratios has been arrested in August and September.

The male ratio has fallen by 11.4 percentage points since February 2008, the female ratio has fallen by 4.1 percentage points and the overall teenage employment-population ratio has fallen by 7.8 percentage points.

That is a substantial decline in the employment market for Australian teenagers.

The other staggering statistic relating to the teenage labour market is the decline in the participation rate since the beginning of 2008 when it peaked in January at 61.4 per cent.

In September 2017, the participation rate rose 0.4 points to 54.3 per cent, the third successive month of improvement.

But the difference between the 2008 level, amounts to an additional 108 thousand teenagers who have dropped out of the labour force as a result of the weak conditions since the crisis.

If we added them back into the labour force the teenage unemployment rate would be 27.5 per cent rather than the official estimate for September 2017 of 17.9 per cent.

Some may have decided to return to full-time education and abandoned their plans to work. But the data suggests the official unemployment rate is significantly understating the actual situation that teenagers face in the Australian labour market.

Overall, the performance of the teenage labour market remains extremely poor. It doesn’t rate much priority in the policy debate, which is surprising given that this is our future workforce in an ageing population. Future productivity growth will determine whether the ageing population enjoys a higher standard of living than now or goes backwards.

I continue to recommend that the Australian government immediately announce a major public sector job creation program aimed at employing all the unemployed 15-19 year olds, who are not in full-time education or a credible apprenticeship program.

Unemployment decreased 11,800 to 711,500

The official unemployment rate decreased 0.1 points at 5.5 per cent in September 2017.

Even though the decline in unemployment over the last several months is a good outcome, the labour market still has significant excess capacity available.

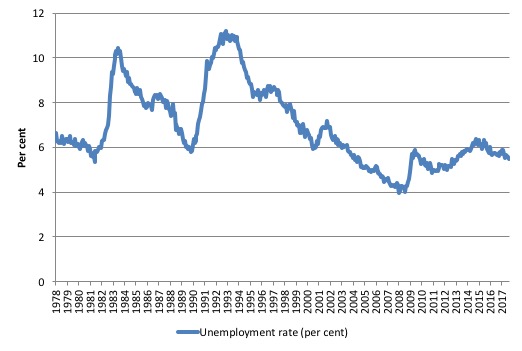

The following graph shows the national unemployment rate from February 1978 to September 2017. The longer time-series helps frame some perspective to what is happening at present.

After falling steadily as the fiscal stimulus pushed growth along, the unemployment rate slowly trended up for some months.

It is now still 0.6 points above the level it fell to as a result of the fiscal stimulus and 1.6 points above the level reached before the GFC began.

Broad labour underutilisation – at 13.6 per cent

The ABS publishes monthly and quarterly labour underutilisation data. The quarterly data was updated last month (for the August-quarter 2017) so for the latest data we will use the monthly (unadjusted series):

1. Underemployment was estimated to be 8.2 per cent of the labour force (down by 0.3 points in September).

2. The total labour underutilisation rate (unemployment plus underemployment) was 13.6 per cent (down from 14 per cent).

3. There were 1,068.8 thousand persons underemployed and a total of 1,814 thousand workers either unemployed or underemployed.

So a slight improvement in September on August data.

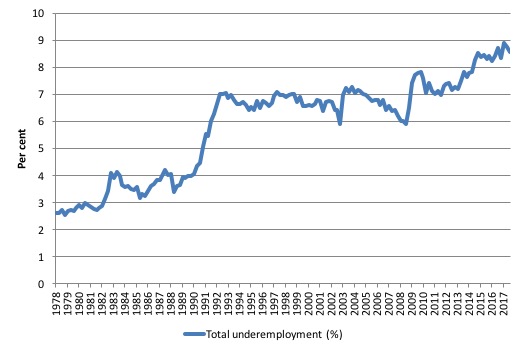

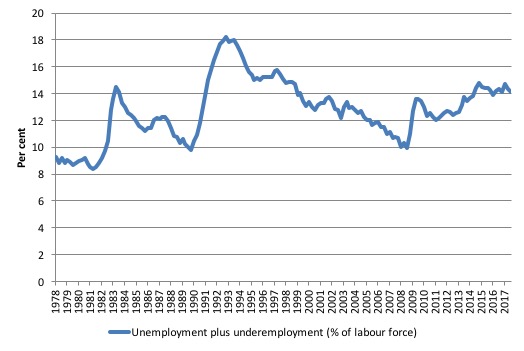

In terms of the quarterly data, the following graph plots the history of quarterly (seasonally-adjusted) underemployment in Australia since February 1978 to the May-quarter 2017.

The next graph shows the evolution of the broad underutilisation rate over the same period. You can see the three cyclical peaks corresponding to the 1982, 1991 recessions and the more recent downturn.

Unemployment was a higher proportion of the two earlier peaks but underemployment now dominates the current cycle (just).

The other difference between now and the two earlier cycles is that the recovery triggered by the fiscal stimulus in 2008-09 did not persist and as soon as the ‘fiscal surplus’ fetish kicked in in 2012, things went backwards very quickly.

The two earlier peaks were sharp but steadily declined. The last peak fell away on the back of the stimulus but turned again when the stimulus was withdrawn.

If hidden unemployment (given the depressed participation rate) is added to the broad ABS figure the best-case (conservative) scenario would see a underutilisation rate well above 15 per cent at present. Please read my blog – Australian labour underutilisation rate is at least 13.4 per cent – for more discussion on this point.

The next quarterly update will be for the November-quarter 2017 and will be published published in the December 2017 Labour Force release. In between those releases, the monthly estimates guide our thinking.

Aggregate participation rate – steady at 65.2 per cent

The participation rate remains below the most recent peak in November 2010 of 65.8 per cent when the labour market was still recovering courtesy of the fiscal stimulus.

What would the unemployment rate be if the participation rate was at the last November 2010 peak level value?

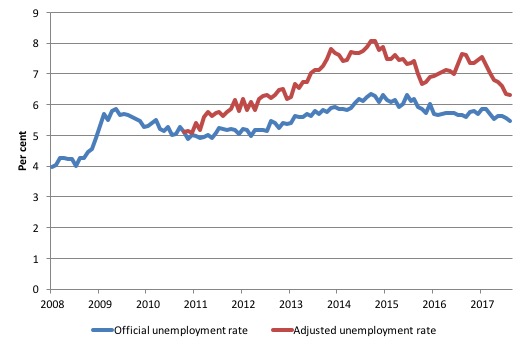

The following graph tells us what would have happened if the participation rate had been constant over the period November 2010 to September 2017. The blue line is the official unemployment rate since its most recent low-point of 4 per cent in February 2008.

The red line starts at November 2010 (the peak participation month). It is computed by adding the workers that left the labour force as employment growth faltered (and the participation rate fell) back into the labour force and assuming they would have been unemployed. At present, this cohort is likely to comprise a component of the hidden unemployed (or discouraged workers).

With the rise in participation in recent months, the red line is dropping quite sharply, which is a good sign.

1. Total official unemployment in September 2017 was estimated to be 711.5 thousand.

2. Unemployment would be 827.4 thousand if participation rate was at its November 2010 peak.

3. The unemployment rate would now be 6.3 per cent rather than the official September 2017 estimate of 5.5 per cent.

The difference between the two numbers mostly reflects, the change in hidden unemployment (discouraged workers) since November 2010. These workers would take a job immediately if offered one but have given up looking because there are not enough jobs and as a consequence the ABS classifies them as being Not in the Labour Force.

There has been some change in the age composition of the labour force (older workers with low participation rates becoming a higher proportion) but this only accounts for less than 1/3 of the shift. The rest is undoubtedly accounted for by the rise in hidden unemployment.

Note, the gap between the blue and red lines doesn’t sum to total hidden unemployment unless November 2010 was a full employment peak, which it clearly was not. The interpretation of the gap is that it shows the extra hidden unemployed since that time.

This gap shrinks as participation rises relative to the November 2010 peak.

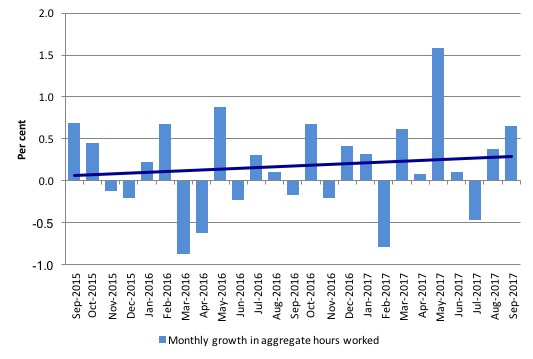

Hours worked – increased 11.2 million hours (0.7 per cent)

Over the last three months we have seen swings in both directions.

This month there was a sharp rise in hours worked even though the growth in full-time employment was weak. The reason is that existing jobs are offering longer hours, which could include part-time jobs.

The following graph shows the monthly growth (in per cent) over the last 24 months. The dark linear line is a simple regression trend of the monthly change – which depicts an upward trend – driven mostly by the outlier in May 2017.

You can see the pattern of the change in working hours is also portrayed in the employment graph – zig-zagging across the zero growth line.

The last two months have seen improvements.

Conclusion

My standard monthly warning: we always have to be careful interpreting month to month movements given the way the Labour Force Survey is constructed and implemented.

Today’s figures show that the Australian labour market improved again in September 2017, but the incremental change was relatively modest, especially in full-time employment.

Unemployment fell with a steady participation rate which says that employment growth was slightly stronger than the underlying population growth – a good sign.

There was a slight improvement in the teenage labour market in September 2017, but it remains in a poor state.

Overall, my assessment from last month remains – it still to early to conclude that the uncertainty of the last few years is giving way to sustained growth.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

Bill, I can understand that, with a need to remain professional you use the official ABS stats. However, perhaps using the dodgy ABS stats is a pointless exercise. Maybe the Roy Morgan survey is more accurate and would paint a clearer picture of where unemployment is really at?

Dear Bill

Can’t express how much you have helped me over the last 18month. I was going mad over the illogical convulted and confusion in the main stream media. Admire your strength and intellect.

Some anecdotal evidence.

In the last week we have hired 3 new people one permanent and 2 casuals. 56y old and 23yold and 19y old. All our work is low skilled. All are working full time. Around us there appears to be increasing employment due to gov’t infrastucture spending. All our casuals are working as many days as they want. Amazingly they don’t always don’t want to work.

We have more confidence in the business than 12 months ago.

As you have noted above we have people coming in all the time for work who have been on the unemployment roundabout. As suggested the current policy has destroyed their esteem their confidence and life. Anxiety and depression is their key characteristic. We as a society have been so cruel anxious only for ourselves.

Admire your strength and leadership

Kind thoughts to your family