Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

The Weekend Quiz – September 9-10, 2017 – answers and discussion

Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

The statement that lending is capital-constrained rather than reserve constrained would not apply if the banks had to maintain a reserve ratio of 100 per cent.

The answer is False.

This answer should also be read as being complementary to the answer in Question 2 below.

In a “fractional reserve” banking system of the type the US runs (which is really one of the relics that remains from the gold standard/convertible currency era that ended in 1971), the banks have to retain a certain percentage (10 per cent currently in the US) of deposits as reserves with the central bank. You can read about the fractional reserve system from the Federal Point page maintained by the FRNY.

Where confusion as to the role of reserve requirements begins is when you open a mainstream economics textbooks and “learn” that the fractional reserve requirements provide the capacity through which the private banks can create money. The whole myth about the money multiplier is embedded in this erroneous conceptualisation of banking operations.

The FRNY educational material also perpetuates this myth. They say:

If the reserve requirement is 10%, for example, a bank that receives a $100 deposit may lend out $90 of that deposit. If the borrower then writes a check to someone who deposits the $90, the bank receiving that deposit can lend out $81. As the process continues, the banking system can expand the initial deposit of $100 into a maximum of $1,000 of money ($100+$90+81+$72.90+…=$1,000). In contrast, with a 20% reserve requirement, the banking system would be able to expand the initial $100 deposit into a maximum of $500 ($100+$80+$64+$51.20+…=$500). Thus, higher reserve requirements should result in reduced money creation and, in turn, in reduced economic activity.

This is not an accurate description of the way the banking system actually operates and the FRNY (for example) clearly knows their representation is stylised and inaccurate. Later in the same document they they qualify their depiction to the point of rendering the last paragraph irrelevant. After some minor technical points about which deposits count to the requirements, they say this:

Furthermore, the Federal Reserve operates in a way that permits banks to acquire the reserves they need to meet their requirements from the money market, so long as they are willing to pay the prevailing price (the federal funds rate) for borrowed reserves. Consequently, reserve requirements currently play a relatively limited role in money creation in the United States.

In other words, the required reserves play no role in the credit creation process.

The actual operations of the monetary system are described in this way. Banks seek to attract credit-worthy customers to which they can loan funds to and thereby make profit. What constitutes credit-worthiness varies over the business cycle and so lending standards become more lax at boom times as banks chase market share (this is one of Minsky’s drivers).

These loans are made independent of the banks’ reserve positions. Depending on the way the central bank accounts for commercial bank reserves, the latter will then seek funds to ensure they have the required reserves in the relevant accounting period. They can borrow from each other in the interbank market but if the system overall is short of reserves these “horizontal” transactions will not add the required reserves. In these cases, the bank will sell bonds back to the central bank or borrow outright through the device called the “discount window”.

At the individual bank level, certainly the “price of reserves” will play some role in the credit department’s decision to loan funds. But the reserve position per se will not matter. So as long as the margin between the return on the loan and the rate they would have to borrow from the central bank through the discount window is sufficient, the bank will lend.

So the idea that reserve balances are required initially to “finance” bank balance sheet expansion via rising excess reserves is inapplicable. A bank’s ability to expand its balance sheet is not constrained by the quantity of reserves it holds or any fractional reserve requirements. The bank expands its balance sheet by lending. Loans create deposits which are then backed by reserves after the fact. The process of extending loans (credit) which creates new bank liabilities is unrelated to the reserve position of the bank.

The major insight is that any balance sheet expansion which leaves a bank short of the required reserves may affect the return it can expect on the loan as a consequence of the “penalty” rate the central bank might exact through the discount window. But it will never impede the bank’s capacity to effect the loan in the first place.

The money multiplier myth leads students to think that as the central bank can control the monetary base then it can control the money supply. Further, given that inflation is allegedly the result of the money supply growing too fast then the blame is sheeted hometo the “government” (the central bank in this case).

The reality is that the reserve requirements that might be in place at any point in time do not provide the central bank with a capacity to control the money supply.

So would it matter if reserve requirements were 100 per cent? In this blog – 100-percent reserve banking and state banks – I discuss the concept of a 100 per cent reserve system which is favoured by many conservatives who believe that the fractional reserve credit creation process is inevitably inflationary.

There are clearly an array of configurations of a 100 per cent reserve system in terms of what might count as reserves. For example, the system might require the reserves to be kept as gold. In the old “Giro” or “100 percent reserve” banking system which operated by people depositing “specie” (gold or silver) which then gave them access to bank notes issued up to the value of the assets deposited. Bank notes were then issued in a fixed rate against the specie and so the money supply could not increase without new specie being discovered.

Another option might be that all reserves should be in the form of government bonds, which would be virtually identical (in the sense of “fiat creations”) to the present system of central bank reserves.

While all these issues are interesting to explore in their own right, the question does not relate to these system requirements of this type. It was obvious that the question maintained a role for central bank (which would be unnecessary in a 100-per cent reserve system based on gold, for example.

It is also assumed that the reserves are of the form of current current central bank reserves with the only change being they should equal 100 per cent of deposits.

We also avoid complications like what deposits have to be backed by reserves and assume all deposits have to so backed.

In the current system, the the central bank ensures there are enough reserves to meet the needs generated by commercial bank deposit growth (that is, lending). As noted above, the required reserve ratio has no direct influence on credit growth. So it wouldn’t matter if the required reserves were 10 per cent, 0 per cent or 100 per cent.

In a fiat currency system, commercial banks require no reserves to expand credit. Even if the required reserves were 100 per cent, then with no other change in institutional structure or regulations, the central bank would still have to supply the reserves in line with deposit growth.

Now I noted that the central bank might be able to influence the behaviour of banks by imposing a penalty on the provision of reserves. It certainly can do that. As a monopolist, the central bank can set the price and supply whatever volume is required to the commercial banks.

But the price it sets will have implications for its ability to maintain the current policy interest rate which we consider in Question 2.

The central bank maintains its policy rate via open market operations. What really happens when an open market purchase (for example) is made is that the central bank adds reserves to the banking system. This will drive the interest rate down if the new reserve position is above the minimum desired by the banks. If the central bank wants to maintain control of the interest rate then it has to eliminate any efforts by the commercial banks in the overnight interbank market to eliminate excess reserves.

One way it can do this is by selling bonds back to the banks. The same would work in reverse if it was to try to contract the money supply (a la money multiplier logic) by selling government bonds.

The point is that the central bank cannot control the money supply in this way (or any other way) except to price the reserves at a level that might temper bank lending.

So if it set a price of reserves above the current policy rate (as a penalty) then the policy rate would lose traction for reasons explained in the answer to Question 3.

The fact is that it is endogenous changes in the money supply (driven by bank credit creation) that lead to changes in the monetary base (as the central bank adds or subtracts reserves to ensure the “price” of reserves is maintained at its policy-desired level). Exactly the opposite to that depicted in the mainstream money multiplier model.

The other fact is that the money supply is endogenously generated by the horizontal credit (leveraging) activities conducted by banks, firms, investors etc – the central bank is not involved at this level of activity.

You might like to read these blogs for further information:

- Lending is capital- not reserve-constrained

- Oh no … Bernanke is loose and those greenbacks are everywhere

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- 100-percent reserve banking and state banks

- Money multiplier and other myths

Question 2:

A central bank can control bank lending by charging an increasing price for providing its reserves to the commercial banks while maintaining its target monetary policy rate.

The answer is False.

This question is related to Question 1 and the answers are complementary.

The facts are as follows. First, central banks will always provided enough reserve balances to the commercial banks at a price it sets using a combination of overdraft/discounting facilities and open market operations.

Second, if the central bank didn’t provide the reserves necessary to match the growth in deposits in the commercial banking system then the payments system would grind to a halt and there would be significant hikes in the interbank rate of interest and a wedge between it and the policy (target) rate – meaning the central bank’s policy stance becomes compromised.

Third, Any reserve requirements within this context while legally enforceable (via fines etc) do not constrain the commercial bank credit creation capacity. Central bank reserves (the accounts the commercial banks keep with the central bank) are not used to make loans. They only function to facilitate the payments system (apart from satisfying any reserve requirements).

Fourth, banks make loans to credit-worthy borrowers and these loans create deposits. If the commercial bank in question is unable to get the reserves necessary to meet the requirements from other sources (other banks) then the central bank has to provide them. But the process of gaining the necessary reserves is a separate and subsequent bank operation to the deposit creation (via the loan).

Fifth, if there were too many reserves in the system (relative to the banks’ desired levels to facilitate the payments system and the required reserves then competition in the interbank (overnight) market would drive the interest rate down. This competition would be driven by banks holding surplus reserves (to their requirements) trying to lend them overnight. The opposite would happen if there were too few reserves supplied by the central bank. Then the chase for overnight funds would drive rates up.

In both cases the central bank would lose control of its current policy rate as the divergence between it and the interbank rate widened. This divergence can snake between the rate that the central bank pays on excess reserves (this rate varies between countries and overtime but before the crisis was zero in Japan and the US) and the penalty rate that the central bank seeks for providing the commercial banks access to the overdraft/discount facility.

So the aim of the central bank is to issue just as many reserves that are required for the law and the banks’ own desires.

Now the question seeks to link the penalty rate that the central bank charges for providing reserves to the banks and the central bank’s target rate. The wider the spread between these rates the more difficult does it become for the central bank to ensure the quantity of reserves is appropriate for maintaining its target (policy) rate.

Where this spread is narrow, central banks “hit” their target rate each day more precisely than when the spread is wider.

So if the central bank really wanted to put the screws on commercial bank lending via increasing the penalty rate, it would have to be prepared to lift its target rate in close correspondence. In other words, its monetary policy stance becomes beholden to the discount window settings.

The best answer was false because the central bank cannot operate with wide divergences between the penalty rate and the target rate and it is likely that the former would have to rise significantly to choke private bank credit creation.

You might like to read these blogs for further information:

- US federal reserve governor is part of the problem

- The US should have universal public health care

- Another intergenerational report – another waste of time

- Democracy, accountability and more intergenerational nonsense

Question 3:

If policy makers use the NAIRU to compute the decomposition between structural and cyclical fiscal balances, then if the estimated NAIRU is above the true full employment unemployment rate, the estimated impact of the automatic stabilisers will always be biased downwards.

The answer is True.

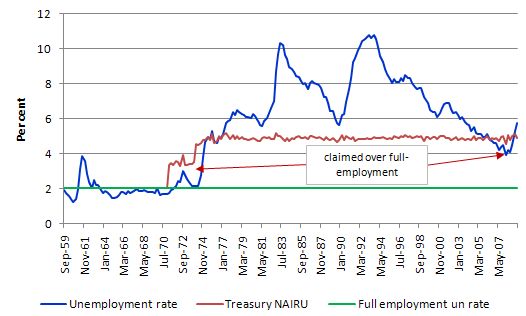

The following graph plots the actual unemployment rate for Australia (blue line) from 1959 to June 2009 and the Australian Treasury estimate of the NAIRU (red line). The data is available from the RBA.

You can see how ridiculous the estimated NAIRU is. Suddenly it jumps up just as actual unemployment rises although for such a jump to occur (according to the logic of the concept) there has to be major structural changes occurring. Historically, there is nothing that might convincingly explain that jump. Other estimation techniques give even more nonsensical estimates (they tend to just track the movement in the official unemployment rate).

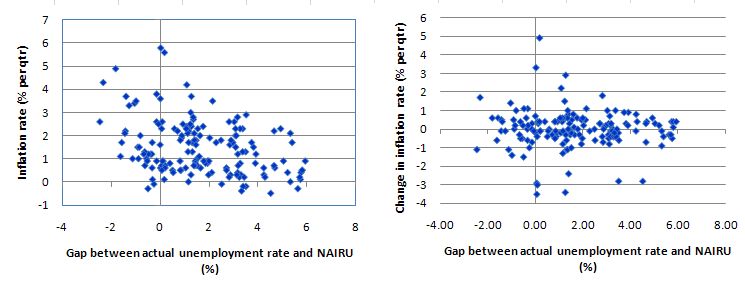

This graph show how little correspondence there is between the inflation rate and the NAIRU gap (measured as the difference between the estimated NAIRU and the actual unemployment rate). The left-panel is the actual inflation rate (vertical axis) whereas the right-panel is the change in the actual inflation rate (vertical axis). There has always been some dispute in the literature as to whether the Phillips curve (the relationship between the NAIRU gap and inflation) should be specified in terms of the actual level of inflation or the acceleration in the level.

I also tried various lags in the inflation measures (to allow for frictions) and you get the same general picture. If the mainstream economic theory was correct, then the NAIRU gap should be negatively related to inflation (whichever measure you like). That is, when the unemployment rate is above the NAIRU inflation should be falling and vice versa. The conclusion from the data is that no such relationship exists. There is no surprise in that – the NAIRU is one of the most discredited concepts in the mainstream toolkit. The problem is that governments have been significantly influenced by it to the detriment of all of us.

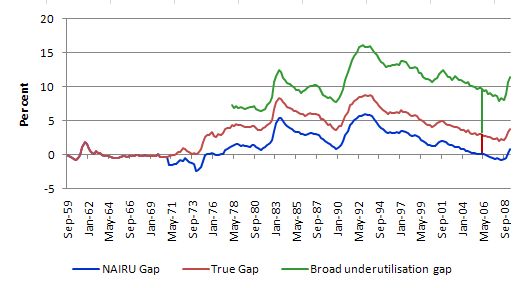

To see why this is the case, the next graph plots three different measures of labour market tightness:

- The gap between the actual unemployment rate and the NAIRU (blue line), which is interpreted as estimating full employment when the gap is zero (cutting the horizontal axis.

- The gap between the actual unemployment rate and our 2 per cent full employment rate (red line), again would indicate full employment if the line cut the horizontal axis.

- The gap between the broad labour underutilisation rate published by the ABS (available HERE), which takes into account underemployment and our 2 per cent full employment rate (green line).

The NAIRU estimates not only inflate the true full employment unemployment rate but also completely ignore the underemployment, which has risen sharply over the last 20 years.

In the June quarter 2006 the NAIRU gap was zero whereas the actual unemployment rate was still 2.78 per cent above the full employment unemployment rate. The thick red vertical line depicts this distance.

However, if we considered the labour market slack in terms of the broad labour underutilisation rate published by the ABS then the gap would be considerably larger – a staggering 9.4 per cent. Thus you have to sum the red and green vertical lines shown at June 2008 for illustrative purposes.

This means that the Australian Treasury are providing advice to the Federal government claiming that in June 2008 the Australian economy was at full employment when it is highly likely that there was upwards of 9 per cent of willing labour resources being wasted. That is how bad the NAIRU period has been for policy advice.

But in relation to this question, in June 2008, the Australian Treasury would have classified all of the federal fiscal balance in that quarter as being structural given that the cycle was considered to be at the peak (what they term full employment).

However, if we define the true full employment level was at 2 per cent unemployment and zero underemployment, then you can see that, in fact, the Australian economy would have been operating well below the full employment level and so there would have been a significant cyclical component being reflected in the fiscal balance.

Given the federal fiscal situation in June 2008 was in surplus the Treasury would have classified this as mildly contractionary whereas in fact the Commonwealth government was running a highly contractionary fiscal position which was preventing the economy from generating a greater number of jobs.

The following blogs may be of further interest to you:

- The dreaded NAIRU is still about!

- Structural deficits – the great con job!

- Structural deficits and automatic stabilisers

- Another economics department to close

Reclaiming the State Lecture Tour – September-October, 2017

For up to date details of my upcoming book promotion and lecture tour in Late September and early October through Europe go to – The Reclaim the State Project Home Page.

There are updated details today concerning the Madrid events.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

Bank lending is constrained by capital. Is this purely a regulatory thing, or is there also some kind of operational reason? (To just make up something for an example,) like capital limits the collateral that a bank could put up to borrow reserves.

I have the same question as Mel. And I am not even 100% sure what constitutes ‘capital’ in the first place for banks. Is it what a bank gets when they sell shares to investors? I remember Neil Wilson saying that banks can create their own capital by lending money to people who then use that money to buy shares in the bank. Or, I think I remember that- I don’t want to blame him for my bad memory.

Whatever ‘capital’ is, I think it is the part of bank operations that is supposed to be the first at risk and suffer losses when a bank fails or performs poorly- as in makes bad loans. And is not supposed to be guaranteed by the government.

But the financial crisis showed that it is somewhat insured because the Fed, at least, wasn’t going to let the whole system fall down. Which it would have without intervention of some sort. All the banks would have crashed and all their ‘capital’ would have been gone.

In the blog post “Lending is capital- not reserve-constrained”, Bill does describe two different definitions of capital. Maybe because it’s a post on the Basel III regulations, I can’t find any account of limits not due to regulations. So I’m not sure…

Thank you Mel, a blog post from back when I was starting my economics re-education- that helps a lot. It seems that SPVs were one of the way banks contrived capital for themselves and cooked their books. Capital that is not really capital. I guess in the absence of real and effective regulations, the banks are not really ‘capital-constrained’ either. Until the whole system comes crashing down.

But there is something I lacked the courage and knowledge to do back then. Describing Dean Baker as “so-called “progressive” US commentator Dean Baker” does an injustice to the man who is in fact a very progressive economist in the United States. Yes, he was mistaken on the particular point Bill mentions and hopefully he has since learned. Everyone makes some mistakes, including Bill, and they do not always deserve to be ridiculed for it. Baker is one of the good guys in my book.

Just a point to mention. The listed FRNY page on Fractional Reserve Lending has disappeared. Maybe they saw this post Bill, and scotched it? I couldn’t find a substitute for it.

“Bank lending is constrained by capital. Is this purely a regulatory thing, or is there also some kind of operational reason?”

Mel, there are two reasons why banks hold capital:

1) a “purely regulatory thing”, determined by the Basel Accord rules, that determines the amount of capital a bank must hold depending on its assets.

2) a market reason. When banks need funding for their operations, they will try to attract investors. Some of those inverstos will take into account the capital to asset ratio to assess the investment risks. The more capital the bank holds, the more prone to investing these investors are. So the bank may choose to have more capital than determined by the Basel Accords.

Capital is not directly needed for operational reasons other than those two reasons. Capital is an accounting concept. Maybe you are confusing Bank Reserves with Capital. They are not the same thing.