I grew up in a society where collective will was at the forefront and it…

US Bond Markets cannot bring down Trump

By the time this blog is published I will be heading to Malta. I will have very little spare time in the coming days so the blogs will be shorter and perhaps non-existent or as normal as the case might be. There was an article in the ABC Opinion series (March 8, 2017) – Donald Trump’s presidency might be short-lived, because ‘something’s gotta give’ – which more or less claimed that the private US Treasury Bond markets had the capacity to bring Donald Trump’s Presidency to a halt. Apparently, if the bond markets form the view that Trump won’t deliver on his promises they can somehow end his term in office. What, by driving yields up? Not likely. And even if there was a way that higher US Treasury bond yields had some link to his political tenure, the central bank could control the yields at whatever level they wanted.

The article poses the question:

What if I told you a very wealthy, powerful collection of people are already starting to make up their minds about Donald Trump?

The crash in the Mexican peso predicted the Trump presidency weeks before the election. Now, however, it’s the bond market (and the peso to a degree) that is predicting how long Mr Trump may last in the top job.

The tenet of this claim – that the bond market is now the predictor of Trump’s longevity – is based on the observation that:

The bond market is worth many trillions of dollars. The US bond market itself (in its various forms) is worth well over $10 trillion. It’s one of the single largest markets in the world, and the biggest worldwide collection of debt.

The 10-year US Treasury bond is a benchmark debt security …

The thing about the 10-year Treasury bond market is that its movements tell a much bigger story. If the yield on the Treasury bond rises, it means that investors forecast better economic times ahead, and the need for higher interest rates. If the yield falls, investors are forecasting the opposite.

Well, not quite.

There are various reasons why the yields might rise on US government bonds.

First, here is a primer.

Bond yield primer

If the demand for government bonds declines, the prices in the secondary market decline and the yield rises. How come?

In macroeconomics, we summarise the plethora of public debt instruments with the concept of a bond. The standard bond has a face value – say of $1000 and a coupon rate – say 5 per cent and a maturity – say 10 years. This means that the bond holder will get $50 dollars per annum (interest) for 10 years and when the maturity is reached they would get $1000 back.

This is what is referred to as a fixed-income yielding asset. The $50 per year is fixed at the time of the issue and does not vary with subsequent price fluctuations of the bond instrument prior to maturity.

Why does the price of the issued bond (with a face value of $1000) fluctuate?

Bonds are issued by government into the so-called ‘primary market’, which is simply the institutional machinery via which the government sells debt to the authorised non-government bond dealers (some selected banks etc).

In a modern monetary system with flexible exchange rates it is clear the government does not have to finance its spending so the the institutional machinery is voluntary and reflects the prevailing neo-liberal ideology – which emphasises a fear of fiscal excesses rather than any intrinsic need for funds (of which the currency-issuing government has an infinite capacity).

Once bonds are issued in the ‘primary market’ they can then be traded in the ‘secondary market’ between interested parties (investors) on the basis of demand and supply.

When demand is strong relative to supply, the price of the bond will rise above its ‘face value’ and vice versa when demand is weak relative to supply.

Clearly secondary market trading has no impact on the volume of financial assets in the system – it just shuffles the wealth between wealth-holders. Please read my blog – Deficit spending 101 – Part 3 – for more discussion on this point.

Most primary market issuance is now done via auction. Previously, governments (such as in Australia) ran what were called ‘tap systems’ of bond issuance.

Accordingly, the government would determine the maturity of the bond (how long the bond would exist for), the coupon rate (the interest return on the bond) and the volume (how many bonds) that was being sought. If the private bond traders determined that the coupon rate being offered was not attractive relative to other investment opportunities, then they would not purchase the bonds. The central bank, typically, would then step in an buy up the unwanted issue.

This system, which was very effective and allowed the government to completely control the yield (it set the coupon) was anathema to the neo-liberals, who considered it gave the central bank carte blanche to fund fiscal deficits.

Tap systems were replaced by competitive auction (tender) systems, where the the issue is put out for tender and the private bond market determine the final yield of the bonds issued according to demand.

When demand is high, the yield will be lower, whereas, if demand is low, the auction will push the yield up on the issue.

Imagine a $1000 bond had a coupon of 5 per cent, meaning that you would get $50 dollar per annum until the bond matured at which time you would get $1000 back.

Imagine that the market wanted a yield of 6 per cent to accommodate risk expectations (inflation or something else). So for them the bond is unattractive and they would avoid it under the tap system.

But under the tender or auction system they would put in a purchase bid lower than the $1000 to ensure they get the 6 per cent return they sought.

The mathematical formulae to compute the desired (lower) price is quite tricky and you can look it up in a finance book.

The general rule for fixed-income bonds is that when the prices rise, the yield falls and vice versa. Thus, the price of a bond can change in the market place according to interest rate fluctuations.

When interest rates rise, the price of previously issued bonds fall because they are less attractive in comparison to the newly issued bonds, which are offering a higher coupon rates (reflecting current interest rates).

When interest rates fall, the price of older bonds increase, becoming more attractive as newly issued bonds offer a lower coupon rate than the older higher coupon rated bonds.

Further, rising yields may indicate a rising sense of risk (mostly from future inflation although sovereign credit ratings will influence this).

But they may also indicate a recovering economy where people are more confidence investing in commercial paper (for higher returns) and so they demand less of the risk free government paper.

So you see how an event (yield rises) that signifies growing confidence in the real economy is reinterpreted (and trumpeted) by the conservatives to signal something bad (crowding out, increased cost of government spending).

The yield reflects the last bid in the bond auction. So if diversification is occurring reflecting confidence and the demand for public debt weakens and yields rise this has nothing at all to do with a declining pool of funds being soaked up by the bingeing government!

If you want a quick primer on yield curves go to these blogs – Operation twist – then and now and Japan – another week of humiliation for mainstream macroeconomics.

I have a video in the first of these blogs showing movements in the yield curve and you can relate the current Bank of Japan policy to the way in which the US Federal Reserve Bank successfully flattened the yield curve (controlled all rates).

The last point is important.

Any central bank can exercise complete control over bond market yields and render the desires of the private bond dealers and secondary market traders irrelevant.

There is never a time where the bond traders can drive the yields if the central bank does not allow them.

How does that work? Simply by the central bank announcing that it will buy unlimited quantities of bonds in the secondary market at a fixed price. Depending on legislative rules (voluntary), the central bank could also dominate primary issuing processes.

So never believe a person who says that governments are at the mercy of the bond markets. They might submit to bond market desires but they don’t have to.

US bond yield movements

You can access the daily US bond yield data HERE.

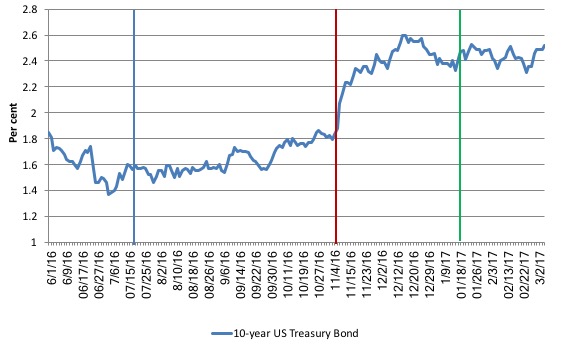

The following graph shows the yields for the 1-year Treasury bond, the 5-year and the 10-year from the beginning of June 2016 to March 7, 2017.

The blue vertical line denotes July 19, 2017, Donald Trump won the nomination for the Republican Party to stand for President. The red vertical line denotes the November 8, 2017 election day which elevated him to that office. The vertical green line denotes January 20, 2017 when he assumed office.

The sample is a little longer than the graph of the same movements presented in the ABC article (cited in the Introduction).

The ABC article says that:

As you can see from the chart, the yield on the US 10-year Treasury bond market started to rise around the time Donald Trump won the election. It continued to rise for several weeks. Recently, however, the yield has fallen.

Which is not quite correct. It was rising prior to the election and prior to the date that Trump was nominated by the Republican Party to be the Presidential candidate.

The most recent low rate (1.37 per cent) was recorded on July 5, 2017. It then rose steadily from then before jumping on the day Trump was elected on November 8, 2017.

It is also true that in recent weeks the yield has fallen, but only from 2.6 per cent (December 16, 2017) to 2.52 per cent (March 7, 2017).

But it is hardly a bond market rebellion.

At the most recent 10-year Bill auction (February 1, 2017), there were bids from dealers (and others) worth $US52,562,600,000 for an issue worth $US22,965,537,000, a bid-to-cover of 2.3.

No sign of ‘investors’ picking up their stumps and going home(cricket analogy for you US readers!).

Apparently, the slight shifts in the bond yields signifies:

… trillions of dollars’ worth of international and American debt saying something about Mr Trump.

We should be clear – it is all American government debt. It doesn’t matter whether foreigners buy it, the debt is still American.

The ABC article’s premise is that:

1. Trump promised to “make America great again”.

2. “he said he’s going to bring back manufacturing, boost spending on infrastructure, and offer up some big corporate tax cuts as well.”

3. He has so far failed “to deliver on detail”.

4. “So at this point, the bond market is making up its own mind about Mr Trump’s likely success as a president, and it’s far from encouraging.”

His point is that the bond yields rose upon Trump’s election because bond investors sold them off (as risk-free assets) to diversify into more risky but higher returning assets (maybe in infrastructure sectors) because they were riding the confidence wave.

Now he hasn’t said how he will deliver on his promise, the investors are becoming pessimistic again and selling off other riskier assets and retreating back into bonds, pushing their prices up in the secondary market and pushing yields down.

If that is what is happening, then the shift back to pessimism is slight. A slight nervous twitch rather than a large scale panic.

But it could also be that the fall in bond prices in November was the result of increased pessimism about Trump and irrational fears he would send the US government broke with wild spending plans.

And now they have come back realising that US government bonds are risk-free and therefore safe.

Or else, the shifts in prices mean nothing about Trump other than the surge in November when Wall Street thought Trump might ‘drain the swamp’ and clean out the banksters who infest government corridors.

And now Trump has installed a host of Wall Streeters as his inner advisors etc they are feeling secure that their influence will remain and are investing again in bonds.

You can see how difficult it is trying to make stories about yield curve movements.

The ABC article also notes that “The Dow Jones Industrial Average has easily cleared the psychological 20,000 level, and seems to post fresh record highs every day”. Which doesn’t sit with the new wave of pessimism argument.

The ABC journalist also opines:

I suspect a major market judgement on the presidency is imminent given the all-time highs the stock market is pushing, and the degree to which the bond market has pulled back …

There are three options: Mr Trump sees out two full terms in office; he serves just one term; or he’s thrown out of office (replaced).

Markets are powerful. If trillions of dollars’ worth of global funds continue to turn against the President, his chances of even making to the end of the first term are diminished.

The problem with winning an election on the back of big economic promises is that you open yourself to market judgement.

If the markets turn on Mr Trump, and the economy falters, Mr Trump’s voters will start to question if he really can make America great again. If the populace turns on the President, he’s finished

All of which is a step to far.

To claim that the bond markets could bring the Presidency down is far fetched. There is no reason for the economy to falter should the bond yields start falling again.

There is a tenuous link being drawn between the wealth shuffling in the bond markets and the capacity of the US government to continue to spend in sufficient quantities to prevent a downturn in the economy.

The bond markets are really irrelevant in that regard and will soak up whatever auction issues they can.

And the Federal Reserve Bank can always buy as large a quantity of bonds that it likes should there be any issue about high yields affecting confidence in the real economy.

According to the March 2017 edition of the Treasury Bulletin – Ownership of Federal Securities:

1. As at December 2017, The total US public debt was $US19,976.9 billion.

2. $US11,971.3 billion was held by privately.

3. The rest is held by System Open Market Account (SOMA) – that is, the Federal Reserve – and Intragovernmental Holdings – in other words the government itself (40.1 per cent of total).

4. In December 2006, the percentage holdings of total US public debt held by the SOMA and Intragovernmental Holdings category was 52.5 per cent.

5. That proportion can rise as high as the government chooses any time it really wants (up to limit of 100).

Conclusion

I guess bond market types have to assert their alleged power to bring down the government of the day and hold it to ransom etc.

The fact is the government always calls the shots in these cases.

Please read my blog – Who is in charge? – for more discussion on this point.

Moreover, trying to interpret small daily bond yield movements as significant shifts in confidence overall is not something that one should take seriously.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

Dear Bill,

Well planned!! You got out of the UK just in time!

The Budget is today, and we are being subjected to an unrelenting torrent of “Government as Household” nonsense from all directions – it’s depressing and infuriating, in equal measure.

Bon voyage!

Bill, your blog seems to be misbehaving. What has happened to all the comments?

Dear Larry (at 2017/03/09 at 5:15 am)

You might have accessed it during an upgrade that I did while waiting for the plane in Brussels. The wi-fi speed was quite low.

It is working fine, I think, now.

best wishes

bill

‘You got out of the UK just in time!’

Mr. Shigemitsu, yes, Hammond delivered a real ‘Government is a Household’ ‘rap.’ I think the public’s mental faculties are now so saturated with this garbage that it’s too far gone and with Labour utterly incapable of challenging anything it’s pretty hopeless -one needs to develop a Zen-like mental calm in order to survive this stuff.

Greens as well are incapable of challenging the economic model.

My son’s school (state school) is now asking parents for contributions to help keep class sizes down -incredible.

More incredible is that the headteacher told me it tends to be the less well-off that give proportionately more.

I have been somewhat confused about the process that takes place at the point of original issue of U.S. debt.

There is a primary dealer network in which the members of the dealer network are obligated to purchase the bonds on offer by the U.S. Treasury, even if there are no other bids.

It seems to me that the Fed has the ability to control the interest rate of original issue U.S. debt by making loans available to the primary dealers (directly or indirectly) at a short term or overnight rate set by the Fed.

The interest rate charged by the Fed would, in effect, be a “cost of goods sold” for the primary dealers in negotiating the resale of the bonds. On the one hand, this cost of borrowing by the primary dealers would establish a floor under rates, as it is unlikely that they (or anyone) would borrow from the Fed at, say 3.00% and then resell at 2.50%. At the same time, it is likely that the rate at which the Fed lends would also become a ceiling, in that if anyone tried to buy bonds at a price that yielded, say 8.00%, when the primary dealers could make a profit on resale on a markup over 3.00%, then the bid to yield 8.00% would fail.

Does this seem like an accurate description of what, in fact, takes place?

Since Trump assumed office I have spent my late night hours watching MSNBC commentary – what I have garnered in some detail is the White House chaos and that Trump could be impeached on a number of grounds -all in his first 40 days. Regardless of this – the story is that the business community have their eyes fixed firmly on tax cuts and infrastructure spending as indicated by what happened after the vertical red line in the graph above.

@SimonCohen: “More incredible is that the headteacher told me it tends to be the less well-off that give proportionately more.”

No surprises there, my friend; before going to college I did a stint as a milkman (remember them?).

As the new face, I got the longest round – which ranged from very poor council estates, to smart stockbroker-tudor detached houses.

Guess who gave the biggest tips? And who gave none at all?