Well my holiday is over. Not that I had one! This morning we submitted the…

Australia’s new central bank governor chooses to dissemble on fiscal issues

The new governor of the Reserve Bank of Australia (our central bank) gave a speech in Melbourne yesterday (November 15, 2016) – Buffers and Options to the annual dinner of the Committee for Economic Development of Australia (CEDA). CEDA is a seedy type of organisation that typically advances the neo-liberal agenda. Please read my blog – The CEDA Report – one of the worst ever – for more discussion on this point. But that is not the topic today. The new governor has already began his tenure in disappointing fashion. I discussed his first foray into public life in this role in the blog – First appearance by Australia’s new central bank governor disappointing. His latest public intervention suggests he is hardening this stance – perpetuating the myths that a currency-issuing government is dependent on bond markets for its spending capacity and that public borrowing puts a burden on future generations. While today’s blog is about Australia, the principles elucidated are universal.

The governor began by heaping praise on “Australia’s economic success over recent decades” and after listing various reasons for this (contestable) he said:

But also important to our prosperity is the fact that over the past quarter of a century, our economy has not been seriously derailed by economic shocks. After all, nothing undermines prosperity like a severe recession in which large numbers of people lose their jobs and see their wealth decline.

I agree that governments should always try to eliminate recessions, which is not exactly what he said.

However the period he is talking about can be divided into three discrete historical periods that are of considerable explanatory power.

1. The period between 1991 and 1996 – the worst recession since the Great Depression in Australia occurred at the beginning of this period and became deeper because of the refusal of the neo-liberal Labour government (under Keating) to intervene with a fiscal expansion until it was too late.

In the late 1980s, the federal government had run three consecutive surpluses which exacerbated the downturn that came in 1991. Household debt began rising in the surplus period and growth began to slow dramatically.

In the December-quarter 1989, real GDP growth turned negative under the strain of the fiscal drag. But worse was to come in late 1990 and for the first six-months of 1991.

The automatic stabilisers (loss of tax revenue and rising welfare payments to cope with the increasing number of recipients due to the mass unemployment that resulted), initially, pushed the fiscal deficit up from 0.1 per cent of GDP in 1990-91 to 3 per cent of GDP in 1991-92.

Then the federal government relented (relaxed the hard-line against deficits) and introduced a discretionary stimulus (One Nation) in 1992. The horse had already bolted but the fiscal stimulus pushed the fiscal deficit up to 4.1 per cent of GDP in 1992-93 and 3.9 per cent in 1994-95, higher than it had been for decades, which was a measure of the scale of the non-government spending collapse and the rise in mass unemployment.

The economy began to slowly recover with the fiscal support and recorded strong quarterly growth rate in the December-quarter 1993 of 1.9 per cent, followed in the March-quarter 1994 by 1.8 per cent.

Unemployment started to fall although underemployment had soared during the recession and effectively the economy was replacing joblessness with an increasing bias towards precarious, part-time and casual work where underemployment was rife.

Household debt, rose from 63.2 per cent of disposable income in the June-quarter 1988 to 98.6 per cent in the September-quarter 1996 under Labour, mostly as a result of their neo-liberal deregulation of financial markets and the rise of the financial engineer, who saw his/her sole meaning in life to push as much credit as possible onto as many people as possible in the shortest time period as possible.

This was the beginning of lax oversight by financial authorities and a spiralling in household indebtedness and declining saving ratios.

This period also continued the divergence between real wages growth and productivity growth as the federal Labor government, the so-called party of workers, hacked into the capacity of workers to enjoy wage rises.

The Labour government lost office in 1996 and the conservatives took over although it was hard by then to tell the difference – both major political parties had become infested with the neo-liberal myths relating to macroeconomic policy.

2. The period between 1996 and 2007 – real GDP growth continued although only just above the average achieved in the recovery period from the 1991 recession. Between the March-quarter 1990 to the September-quarter 1996, quarterly real GDP growth averaged 0.7 per cent under Labour.

Under the conservatives, real GDP growth averaged 0.9 per cent per quarter.

Three standout events occurred in this period:

(a) Household debt to disposable income accelerated out of control. When the conservatives came to power the ratio was 98.6. By the time they left office in late 2007 it had topped 171.6 per cent after years of credit bingeing.

(b) Relatedly, the federal government recorded 10 fiscal surpluses out of 11 years and claimed that this was the new norm.

(c) Later in the period, commodity prices went through the roof and spawned Australia’s so-called ‘once-in-a-century’ mining boom.

The point is that the self-styled (neo-liberal) ‘new norm’ was, in fact, an historically atypical period which was unsustainable.

While Australia continued to record economic growth in this period, a strategy based on running fiscal surpluses (withdrawing net spending from aggregate demand) and then relying on increased private sector indebtedness (negative saving) to keep demand growing is unsustainable.

It should be clearly understood that the fiscal surpluses that were recorded during this period were causally related to the private debt binge. If the private sector hadn’t increasingly loaded itself with debt then the government sector would not have been able to run surpluses for very long because the economy would have hit the wall in the face of the fiscal drag.

It was not a ‘new norm’ but, rather, an historical aberration.

3. The period between 2007 and the present – economic growth continues after a negative quarter in December 2008 as the GFC started to hit.

The then Labor government, which came to office in 2007, just prior to the onset of the crisis, quickly introduced a sizeable fiscal stimulus, shifting the fiscal balance from a 1.7 per cent of GDP surplus in 2006-08 to a 2.1 per cent deficit in 2008-09 and 4.2 per cent in 2009-10.

The fiscal shift was the single most important influence on sustaining economic growth in Australia during the GFC and defying the trends elsewhere in the international economy.

The mining boom did not save the nation from recession – commodity prices fell during the GFC and mining employment went backwards until China’s fiscal stimulus provided a commodity price recovery. But by then, Australia’s fiscal stimulus had done its work.

The core message is that the RBA governor glosses over these very different periods when he talks about “our prosperity … over the past quarter of a century”.

The breakdown into these distinct historical periods provides very clear lessons about the conduct of fiscal policy.

1. Fiscal policy is very effective in adding or subtracting spending to the economy and stabilising the non-government sector activity cycle.

2. We cannot talk about non-government debt dynamics in isolation from what is happening to the national government deficit. The two are intrinsically linked.

The RBA governor then claimed that in the face of several global shocks over the last 25 years (Asian crisis, tech boom bust, GFC):

… we have been able to ride out these and other shocks without too much difficulty. In part this is because of the flexibility of our exchange rate, monetary policy and the labour market. We have also avoided the build-up of large financial imbalances. But this resilience is also because when the shocks hit we have had buffers to absorb them. Because of these buffers, we had options that not all other countries have had.

Okay, the neo-liberal drift is being established here.

The myth about our excellent banks

The populist story of our so-called excellent banking system is repeated by the RBA governor to distinguish it from the imprudent development of banking in Europe, Britain and the US.

This is an oft-repeated myth. The fact is that our banking system is highly uncompetitive (our big 4 banks generate rates of return on equity of around 15 per cent when the industry norm is around 10 per cent).

It exploited lax oversight to lower the “‘risk weight’ on mortgages from 50 per cent prior to 2004 down to lows below 15 per cent … this meant that banks went from holding around $5 in capital for every $100 of homeloans outstanding to as little as $1.50, a wafer thin allowance for potential losses stemming from bad debts. That in turn meant that banks could make a lot more housing loans without having to raise more capital from their shareholders, supercharging profits. (Source).

The ‘big four’ major banks have waged a campaign for some time against the regulatory move to force them to hold more capital. They have used the usual stunts – ‘too much regulation’, ‘self regulation works fine’, ‘we survived the GFC’, ‘we are the strongest banks in the world’, etc etc.

All just special pleading for a highly protected, oligopolistic sector that can gouge huge returns on equity that are not enjoyed elsewhere in industry or across banking in the world.

They fail to mention that they were within days of insolvency in late 2008 when their massive exposure to the frozen global wholesale funding markets meant they were unable to repay their maturing loans.

At that point, like all those institutions that survive on ‘corporate welfare’ they went cap in hand to the Federal government and requested that it provide a guarantee on all new foreign currency borrowing.

The government duly agreed and the big four were immediately able to access funds and roll over their debt exposures.

Please read my blog – Banksters misbehaving again but Portugal offers hope – for more discussion on this point.

So while the RBA governor thinks our financial system is a ‘security’ buffer against crisis, the reality is that it was only the largesse provided to the banks (and the CEO salaries) by the federal government in 2008 that saved these scroungers from insolvency.

The RBA governor did slip recognition of that into his speech:

The banking system did have the capacity to support the economy during the global crisis, although it is important to point out that it did this with the assistance of the Australian Government through various guarantee schemes following the freezing of global capital markets.

But, in doing so, he seemingly ignored its contrary implications for his message that our banks stand out from the rest.

Fiscal buffers – entering the world of fantasy

The RBA governor then said that the “second area where buffers are important is on the fiscal front”.

This is an extraordinary part of his speech.

He compares Europe, where “we saw examples of what can happen when public finances are not in order when difficult times strike” to Australia “where the Australian government had the capacity to support the economy through a fiscal expansion”.

Eek!

Apparently, and this is revisionism at its best, in Europe, governments in “some countries, when troubles arrived … felt they had little choice other than to impose austerity measures to restore the fiscal accounts”.

The term “restore the fiscal accounts” has no meaning.

But the extraordinary revisionism relates to the choice construction.

Is the RBA governor really trying to tell us that Greece, for example, just came to the realisation, as more than 60 per cent of its youth was unemployed and more than 25 per cent of its workforce was similarly jobless, that it would make matters worse by imposing harsh fiscal austerity?

It might have been useful to preface his remarks with the insight that it is impossible to compare Eurozone countries to Australia given that the former use a foreign currency by dint of joining the monetary union and Australia’s government issues its own currency and can never run out of it – read never.

It might have been useful to preface his remarks with the insight that in the Eurozone, the technocrats in Brussels (and later in the crisis Washington and Frankfurt – via the Troika) impose fiscal austerity under the Stability and Growth Pact and its later iterations on governments.

Member State governments that defy that direction from the centre (European Commission) face penalties, unless, of course, Brussels wants to prop up some conservative government such as Spain’s PP regime. Then it will turn a blind eye to deficits that exceed the SGP rules.

There was no fiscal flexibility in the Eurozone once the crisis hit because the Treaty that established the monetary union deliberately built in restrictions that meant governments couldn’t respond to the collapse in private spending even if they wanted to.

The inability to respond, and the dependence on the private bond markets to ‘fund’ the fiscal deficits of the Member States, was deliberately created by the planners. Such was their lack of judgement.

Nothing similar can be said about Australia. Our national government is never dependent on the private bond markets for its deficit spending capacity.

It issues the currency by dint of its legal status and can change rules any time it wants to instruct the central bank to credit any bank accounts it desires.

The RBA governor claims that our ability to respond to the crisis in 2008 was directly the result of:

… the sound fiscal position that had been built up over previous years … the fiscal buffers that we had did provide us with options that not all other countries had.

There is zero economic content in that assessment. It is an economic lie to draw that conclusion.

The previous surpluses gave the Australian government no extra or no less capacity to run deficits of any size when the GFC came.

There is no such thing as a ‘fiscal buffer’ for a currency-issuing government.

Where is this ‘buffer’ allegedly stored? In what form? Answer: it is a meaningless concept when applied to a currency-issuing government.

A household, for example, can establish a risk-management buffer against future income losses, by saving. By postponing current consumption (which is what saving is), the household builds up spending capacity that can be released in the future.

But such a conception is inapplicable for a currency-issuing government. Running a fiscal surplus is not saving.

It is, in fact, equivalent to the destruction of non-government wealth as the fiscal squeeze forces the non-government sector to liquidate wealth in order to generate income flows capable of paying the gap between government spending (injection of net financial assets) and the taxation requirements (withdrawal of net financial assets)>

The Australian government was able to respond quickly to the GFC with a major fiscal stimulus because it issues the currency not because it had been imposing fiscal drag on the economy by running surpluses.

The RBA governor is implying that the run down of public debt when the government was running surpluses gave it more capacity later to borrow.

Again, a myth. There is never a shortage of tenderers for Australian government debt. The bid-to-cover ratios are always high.

If there was a shortage, then that would make no difference to the capacity of the government to spend. It could just instruct the central bank to take up the debt that the bond dealers refused to bid for.

But, then, it is also obvious that the whole debt issuance charade is just a voluntary exercise designed to provide corporate welfare to the financial market elites. The Australian government could abandon the whole ridiculous exercise and its spending capacity would remain the same – unlimited in terms of idle resources for sale in Australian dollars.

The RBA governor’s dissembling on these matters is very disappointing. He is just making himself part of the lying establishment.

According to his flawed logic, the move to austerity (which he calls “rebuilding our buffers on the fiscal front”) has merit.

Since when does the self-styled ‘independent’ central bank governor, who has a remit only to set monetary policy become an advocate for misguided, neo-liberal fiscal austerity?

And how does he think the more than 15 per cent of willing and available labour resources in Australia that are currently idle in some form or another (unemployed, underemployed, hidden unemployed) will have a snowflake’s chance in hell of getting work if the government continues to pursue fiscal austerity?

With private investment weak, household consumption fairly subdued, and the external sector draining net spending from the economy, the fiscal deficit should be pushed up – by at least 2 percentage points of GDP to move us closer to full employment.

Household debt in Australia at record levels

The RBA governor then told his audience that “The third set of buffers … are those in household balance sheets.”

It is true, revenue-constrained entities such as households and business firms (but not a currency-issuing government) can:

… draw on their savings a bit, and perhaps even access credit, so that they don’t have to cut their consumption sharply. Of course they can do this only if their balance sheets are in reasonable shape.

And the reality is that Australian households are now carrying record levels of debt (mostly mortgage related) – 185 per cent of disposable income, with interest payments as a percent of disposable income standing at 8.7 per cent.

The RBA governor recognises this fact.

There are several consequences of this.

First, many households “feel that they are closer to their borrowing capacity than they once were and have adjusted their behaviour accordingly.”

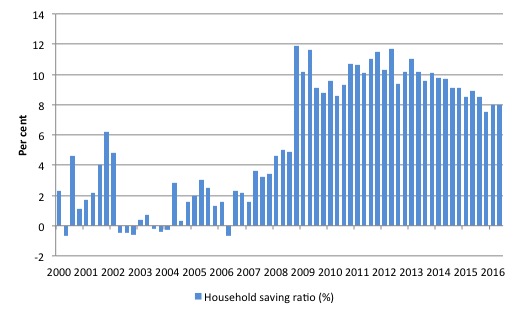

The following graph shows the household saving ratio (% of disposable income) from 2000 to the current period. The household saving ratio was stable at 8 per cent in the June-quarter 2016 arresting the decline from 2013.

Further, even though Household consumption expenditure remains positive and helping maintain overall growth in the face of negative private investment and faltering exports, it is decelerating as a result of subdued real wages.

The decline in the Household saving ratio from its 2011 levels was associated with a renewed rise in household indebtedness – back to record levels.

After the GFC hit, the household sector sought to reduce the precariousness in its balance sheet exposed by the GFC.

Prior to the crisis, households maintained very robust spending (including housing) by accumulating record levels of debt. As the crisis hit, it was only because the central bank reduced interest rates quickly, that there were not mass bankruptcies.

In June 2012, the ratio was 11.6 per cent. Since the December-quarter 2013, it has been steadily falling as the squeze on wages has intensified.

While the recent trend has been downwards, it is unlikely that households will return to the very low and negative saving ratios at the height of the credit binge given that the household sector is now carrying record levels of debt.

At some point, household consumption growth will fall unless growth is supported by public spending (given the poor outlook for private investment and net exports).

This also means that government surpluses which were only were made possible by the household credit binge are untenable in this new (old) climate.

The Government needs to learn about these macroeconomic connections. It will learn the hard way as net exports weaken if it tries to impose austerity.

Second, the massive debt held by households means that the central bank has limited capacity to raise interest rates – any significant movement in rates would trigger a raft of personal insolvencies that would further dent non-government spending.

Please read my blog – Non-government debt lessons are not being learned – for more discussion on this point.

The RBA governor considers the attempts by the household sector to increase the saving ratio to be “more prudent behaviour” and “a positive development”.

But the extraordinary part of the speech is that earlier he calls for more fiscal austerity and later he is happy household spending growth remains muted as part of a restructuring of private balance sheets.

He is seemingly intent on avoiding instructing his audience of the direct link between government and non-government sector balances.

A dollar government deficit (surplus) is a dollar non-government surplus (deficit).

If the government sector tries to run surpluses at the same time the non-government tries to run surpluses, then recession follows quickly.

If the non-government sector is carrying precarious debt levels (as a whole) and needs to lift the overall saving to reduce these debt levels, then the government sector has to sustain larger deficits to provide the income support to facilitate the private overall saving.

Conclusion

It is clearly desirable that private debt levels be reduced at this time to reduce the precarious nature of the private balance sheets. But in saying that there are no parallels that can be drawn about public debt. It is simply a totally different construction.

We need to learn that the fiscal surpluses are causally related to the private debt binge. If the private sector hadn’t loaded itself up with debt then the government sector would not be able to run surpluses for very long unless net exports were very strong.

My core message over many years has been that if the government tries to run fiscal surpluses, then growth can only proceed with private debt if ou have a Norwegian situation where the net exports are very strong (which cannot be a universal model)

Net government spending has to fill the saving desires of the non-government sector.

The public needs to understand that public debt never becomes an issue of solvency. The level of risk does not remain the same in the economy when a $ of private debt is replaced by a $ of public debt.

This was a very disappoint foray into the public arena by our new central bank governor.

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

Typo – second sentence in section 1 should be late 1980’s?

So it is clear Paul Keating was a rubbish treasurer just like Peter Costello, but Swanny did OK apart from cutting the post GFC stimulus a bit too abruptly presumably to make the economy dip and deficit increase just as Hockey took the reins?

Yep the new RBA Governor Philip Lowe is sub par just like Glen Stevens.

Right. Essentially the buffer is unlimited. The governor should announce all spending should be done by overdraft at the central bank rather than the curent intraday overdraft and ask the govt to modify legislation.

Bush the minor had tax cuts and weaponized war stimulus, but all we got was too much mortgage debt. Why didn’t these fiscal stimulus policies produce better results?

Tax cuts for the wealthy are economically contractionary as the wealthy will usually save or invest in share market or real estate speculation and less money will flow around the mainstream economy. The wealthy will not invest in production if consumption demand and sales are stagnant. Defence spending will stimulate the economy but leave no lasting productivity benefit unlike infrastructure spending for example. As unemployment was high during Bush’s (and all other recent administrations) term this is an indicator that any stimulus was inadequate.

hi bill,

where would we find the data on how much government debt the banking system owns.

wouldn’t this debt holding be a hedge against any future funding crisis for the banks, since it could undertake liquidity swaps with the central bank?

Mahaish, about 60% of Australia’s treasury bonds and similar securities are held by foreign banks, sovereign wealth and pension funds.

Last night at the BCA dinner ‘Mad Mal’ gave a speech stating that he wanted to reach a ‘balance’ on the “budget”. The ABC missed what he said! Maybe he has stopped talking about Govt surpluses?

great blog post,pretty much sums up everything wron with western economies.

-over leveraged oligolpolistic banking sector

-govt pursueing austerity for nonsensical reasons