I started my undergraduate studies in economics in the late 1970s after starting out as…

Don’t let neo-liberal (idiots) loose with a spreadsheet!

I was in the airport lounge yesterday and as one does I picked up the right-wing Australian Financial Review (which purports to present financial news and comment but is in reality a propaganda machine) and read an Opinion piece, which would serve as a classic demonstration for statistical students of how to confuse causation with correlation. It would also serve as a classic piece for macroeconomics students on how to completely misunderstand the role of fiscal policy and the dynamics that are associated with it. All round an excellent learning piece – in the right hands. But in the hands of the normal reader, not versed in these matters, the Opinion piece is a trashy piece of dangerous propaganda, which serves to indoctrinate the readership into believing that the correct policy path is, in fact, exactly the opposite of the responsible policy path for governments. It still amazes me how this sort of rubbish can parade as serious public offerings to the economic debate. It was an appallingly ignorant article. One of the worst you might read.

The article (August 1, 2016) – The higher the government debt, the slower economic growth – was written by a conservative (Liberal) Federal Member of Parliament, David Coleman, who doesn’t have a background, it seems in economics and was a management consultant before entering politics.

He claims that “Government debt matters” and the argument he presents is simple (and simplistic):

1. “The greater the debt, the greater the proportion of government revenue that’s spent paying off interest bills”.

Yes, that is true by definition at constant interest rates (yields). But then the country with the highest gross public debt (Japan) is now paying negative interest rates for debt that extends out beyond 10 years, so in fact, ‘investors’ are paying the government to borrow.

But the point is, how does a rising proportion of government revenue matched by interest payments to the non-government sector impair real GDP growth?

The government debt holdings are part of the wealth portfolio of the non-government sector, held presumably because the assets are risk free (where the currency issuer is the national government) and provide a safe haven in times of uncertainty.

The interest payments represent income to the non-government sector, which helps underpin its subsequent spending.

More spending, in turn, supports higher real output levels, which is ‘growth’.

2. “The greater the interest bill, the less capacity to reduce tax”.

This is a true statement, but not for the reasons that the author would comprehend given his approach.

The truth lies in understanding the purpose of taxation in a fiat currency system. In an intrinsic sense, taxation revenue is never needed to raise funds for the government in order that it can spend.

Please read my blog – Taxpayers do not fund anything – for more discussion on this point.

A sovereign government is never revenue constrained because it is the monopoly issuer of the currency.

In a fiat currency system, the government might impose taxes to control inflation – taxation is a way that government imposes limits on the non-government sector’s capacity to spend and thus create real resource ‘space’ for government spending in pursuit of its social objectives without overreaching the capacity of the economy to respond by increasing real output.

One way of thinking about this is that taxation creates unemployment in the non-government sector and government spending creates the demand for goods and services which solves the unemployment.

The other reasons why a government might tax are:

(a) To redistribute purchasing power from the rich to the poor (high income to low income) – a point that is obvious.

(b) To alter the allocation of resources away from undesirable ends – such as tobacco or carbon taxes – making undesirable products more expensive in order to discourage use.

(c) To provide some hypothecated public transparency for major projects/programs like highways – politically contentious spending should be transparent. Taxes are, in fact, ‘demand drains’ and so reduce the capacity of the non-government sector to spend. In this sense, the transparency allows the non-government sector to see exactly what ‘demand injection’ (say highway spending) is replacing the command on resources that households and firms would have had in the absence of the taxes. It has nothing to do with the taxes funding anything. Just a $-for-$ matching to help expose the opportunity cost.

In 1946, the American statistician and economist – Beardsley Ruml – who wrote that “Taxes for Revenue are Obsolete” clearly understood all of this.

He understood that a primary role for taxation was “the maintenance of a dollar which has a stable purchasing power … the avoidance of inflation” and wrote that:

If federal taxes are insufficient or of the wrong kind, the purchasing power in the hands of the public is likely to be greater than the output of goods and services with which this purchasing demand can be satisfied.

The result would be inflation. Note that implicit in this statement is that the government wants to command a certain quantity of the available real goods and services to fulfill its socio-economic program.

The excessive private sector purchasing power is thus assessed relative to the total available real output and the government’s desire to command some of that output.

So if you think about the primary purpose of taxation in a fiat currency monetary system is to control purchasing power then it is logically true that if income payments being received by the non-government sector in the form of interest payments on government debt holdings rise and the economy is already operating at full capacity, then the capacity to reduce taxes is reduced.

Why? Because the higher income payments and low tax revenue at full employment would run the economy up against the inflation barrier and necessitate either higher taxes or less government spending.

But if there are idle productive resources, then the author’s statement is false. The government could increase total interest payments to the non-government sector and cut taxes to stimulate overall spending if it thought that the non-government sector should have a greater command of the increasing productive resources brought back into effective use.

3. “And the greater the debt, the less firepower government has to deal with issues as they arise. That firepower matters a lot in a low interest rate environment, where the impact of monetary policy is muted.”

By “firepower”, the author is presumably meaning the fiscal capacity to intervene when total spending is weak and unemployment is rising.

The author is just jumping on the mindless neo-liberal bandwagon, which claims that the capacity of governments to respond in the next crisis is exhausted because the deficits rose in the last crisis.

The proposition that the government has run out of ammunition/firepower, etc is regularly rehearsed.

It is a totally false proposition.

The author is clearly discussing fiscal policy, given he recognises that monetary policy is largely ineffective (although for him, it is because of low interest rates, which is another false proposition that I will leave for today).

How would he respond to the following points:

1. Doesn’t the Australian government issue its own currency? Doesn’t that mean it can purchase anything that is available for sale in that currency (AUDs) and that means all idle labour if it so wished?

2. How can a government that issues its own currency not have “much left in their lockers”? Such a government can never run out of money. Read: NEVER.

3. Even if the private financial markets were to turn against government debt (and they won’t!), the Australian government can still spend without issuing it.

It is just a voluntary (ideological) convention that says that a fiat currency-issuing government has to match its fiscal deficit with an equal $-value of debt issuance. There is nothing intrinsic in that convention.

4. Even if the Australian government chose to continue issuing debt to allow the private markets to have a risk free asset to price risk off (that is, maintained the current system of corporate welfare), could not the RBA purchase all that debt and control yields should the non-government sector boycott the issue? Clearly it could.

Under the old ‘tap’ system, where the government set the yield it would pay investors and then called for private bids, the central bank had to stand ready to buy whatever volume the private investors were unwilling to take up, including all of the issue.

This raised issues of ‘central bank funding’ and once the Monetarist/neo-liberals took over they altered the system to the ‘auction’ model where the private sector determines the yield on the basis of demand and the central bank stays out of the auction.

But all of that is just smoke and mirrors. The central bank could at any time buy all the (unnecessary) public debt. If you examine the rising proportion of public debt held by the US Federal Reserve, the Bank of Japan and the ECB you will see that is so.

The bottom line is that a sovereign government like Australia can never run out of money and never needs to issue public debt as a matter of necessity. The public debt issuance is entirely voluntary and such voluntary actions have a habit of being quickly changed if they present too many ‘political’ problems.

It is thus a total lie to claim that a government will inevitably run out of domestic funding sources. All the discussions about AAA ratings are also irrelevant (and for Britain today given the corrupt ratings agencies have tried to steal some limelight and downgraded the rating).

Please read my blogs – Ratings agencies and higher interest rates and Time to outlaw the credit rating agencies – for more discussion on why the ratings agencies should be ignored in the context of public debt.

Ratings agencies cannot push up yields on government debt issuance unless the government lets them.

So what sense might we make of the assertion that the Australian government has “less firepower” to respond to a new crisis? Answer: no sense at all.

Whether the government has been running surpluses or deficits in the past is largely irrelevant to what it can do in the future?

Its outstanding liabilities (public debt) do not place any constraint on its capacity to spend. As we are seeing around the world, central banks can ensure interest rates stay low if they want which has the effect of dramatically reducing any interest payments on the public debt.

The Australian government can always spend what it wants irrespective of whether it has been running surpluses or deficits in the past.

The deficits it created during the GFC after several years of surplus (with the result that private debt skyrocketed) do not constrain what it can do tomorrow.

So the claim that Australia has no further ammunition in a fiscal sense is a lie.

I wrote about this topic recently in this blog – When journalists allow dangerous economic myths to pervade

Which brings me to the next point the author makes which statistics students would see through straight away but which apparently evades the grasp (intentionally or not) of the author.

He says:

Our government inherited a large debt from its forebear, which managed to turn cash in the bank in 2007 into a big credit card bill by 2013. Reducing that debt is not the only economic task of government – but it is a major one.

The author fails to mention that in between 2007 and 2013, there was the worst global economic crash since the Great Depression and had the Australian government not introduced the rather large (but not large enough) and early fiscal stimulus in late 2008 and early 2009 (in three stages), our economy would have gone the way of the world – into deep recession.

The author fails to mention that Australia (as a result of that timely fiscal stimulus) was the only advanced nation to avoid an official recession.

The author fails to mention that had the government not introduced that fiscal stimulus, the resulting deep recession would have pushed up the fiscal deficit anyway (via the automatic stabilisers) and, as a result of the neo-liberal convention that the deficits have to be matched by public debt issuance (to pretend that the debt is funding the government spending), the debt would have also risen anyway.

Look around the world! The result would have been much higher unemployment and underemployment and greater income losses than actually occurred.

The author’s failure to contextualise the shift into higher public debt is a dishonesty. Whether it is a deliberate act or one of stupidity, I cannot tell.

Please read my blog – MMT Fiscal Principles – for more discussion on this point.

Further, a major goal of the federal (or any currency-issuing) government is not to reduce public debt. The major goal is to provide sufficient net deficit spending to allow the non-government sector to achieve its saving desires and ensure total spending is sufficient to fully utilise the available productive capacity.

At present, Australia’s labour underutilisation rate (according to the ABS) is around 14.2 per cent – with 734,200 unemployed and 1,067.3 thousand persons underemployed – making a total of 1,801.5 thousand workers either unemployed or underemployed.

Further, the current participation rate is well down on its recent (November 2010) peak, which means that hidden unemployment has risen since then by some 180 thousand workers as a result of the poor employment growth.

Please read my blog – Australian labour market – stagnating due to lack of overall spending – for more discussion on this point.

So in terms of the major responsibility of a national government, the current policy settings signify massive failure – and the way to redress that failure is for the Australian government to engage in a rather substantial increase in its fiscal deficit (by more than 2 per cent of GDP).

Given the institutional structure where debt is issued to match the deficit, the result of the Australian government conducting itself responsibly would be higher – not lower – public debt levels.

The author then engages in a bit of statistics – although it is about as sophisticated as the fraudulent (or incompetent) spreadsheet display that Rogoff and Reinhart presented in 2010 to try to convince people that an 80 per cent public debt to GDP ratio was a dangerous threshold for nations to pass.

Their research was widely qyuoted by mindless journalists and commentators around the world in articles attacking the use of deficits during the early days of the GFC.

At the time, when the paper came out in 2010, I immediately tried to replicate the results and failed. I wrote to Carmen Reinhart because I had met her a few years earlier at a function in the US. I requested the data. It appears I was in a queue of researchers asking for the data. I received no reply.

But then some researchers (one group) did manage to get hold of their original spreadsheet and did some checking. They initially failed to replicate the results. Upon further investigation they discovered the reason for being unable to replicate the results lay in “mistakes” made by the original authors.

Was it a simple spreadsheet coding error? Or was it a case of academic fraud? We will never be in a position to distinguish between incompetence or fraud. At the very least it is very sloppy work.

Please read my blog – Elementary misuse of spreadsheet data leaves millions unemployed – for more discussion on this point.

The author I am discussing today, similarly, fired up a spreadsheet, and apparently ‘found’:

… a striking relationship between levels of government debt and economic growth. Generally, the higher government debt, the less economic growth.

Well, isn’t that surprising!

He used OECD data “for 29 member nations” (conflating currency-issuing governments with those who use a foreign currency as in Eurozone Member States – huge error number 1) and:

Of the 29 nations, I grouped them into the 10 with the lowest levels of debt in 2014, the middle 10, and the nine with the highest levels of debt. I then compared their levels of debt with their levels of economic growth.

The results were striking. Between 2009-2014, the nations with the lowest levels of debt grew on average by 28 per cent in US dollar terms. The middle 10 nations grew by 21 per cent in the same period. And the nine nations with the largest levels of debt grew by just 12 per cent in the period from 2009 to 2014. The three nations with the lowest levels of economic growth – Greece, Portugal, and Spain – all had very high levels of government debt when compared to other nations.

Question for students in Economic Statistics 101: Critically evaluate the veracity of the statement and the methodology used?

Answer: the methodology does not substantiate any causality betweeen public debt levels and rates of economic growth.

Therefore the conclusion the author draws is unable to be supported from this exercise.

As in the case of Rogoff and Reinhart who also ‘eye-ball’ two columns of data, the only thing that is established is some sort of correlation between the two columns. The causality issue is not explored at all – but merely asserted.

All the financial journalists and politicians – right up to the top – did not tell the world that Rogoff and Reinhart were only providing correlations. They treated the results as if they were causal – from public debt ratios to growth.

And in the case of Rogoff and Reinhart, when the ‘mistake’ was corrected – that is key data was added back into the ‘correlation’ analysis, the relationship they had found disappeared anyway.

In the current case, all that this author has discovered is that under current institutional arrangements where public debt is issued to match fiscal deficits, when economic growth falters, public debt rises.

Why is that? It is obvious. When growth slows down, tax revenue falls and welfare payments rise – automatically (this is the cyclical component of the fiscal balance). The government policy does not have to change for that to happen.

So when growth slows, fiscal deficits rise even if government policy is unchanged, and as a result of these unnecessary institutional arrangements (for currency-issuing governments that is), the public debt levels rise.

Once we understand these relationships it is highly likely the causality runs the opposite way to that being asserted by this author.

Countries with rising public debt or rising public debt to GDP ratios are those which are facing recession or economic slowdown. In the case of the public debt ratio, the denominator (GDP) falls while the numerator (outstanding debt) rises, given the cyclical response of the fiscak balance (independent of any discretionary fiscal stimulus that such a nation might enjoy).

In other words, the causality flows from growth to debt not the other way round.

There is a large literature on this issue. For example, this point was made in this article from April 22, 2012 – Is high public debt harmful for economic growth?.

The authors employ a nice statistical technique to try to sort out the causality issue between economic growth and public debt.

Their results allow them to:

… reject the notion that debt causes slower growth in OECD countries. We do confirm the oft-noted negative correlation between debt and growth, but show that debt does not have a causal effect on growth …

Indeed, none of the papers in the literature on debt-growth links can make a strong claim the debt has a causal effect on economic growth …

– There are many papers that show that public debt is negatively correlated with economic growth.

– There is no paper that makes a convincing case for a causal link going from debt to growth.

Okay, that is my reading of the literature as well.

So, if this author was in a Economic Statistics 101 class he would fail badly such is the poverty of his scholarship.

But then he wasn’t really engaging in scholarship anyway – more crude propaganda.

He finished the Op Ed piece by ramping up the hysteria about debt default and the problems Greece is currently enduring.

Dishonest analysis all of it.

Conclusion

After reading this I was hoping the day would improve. It didn’t. The flight I was on was diverted to Sydney because some passenger noted something was hanging loose off the wings of the plane.

After the delay to fix it, we were off again and a few hours late!

So I got what I deserved for reading the trashy Australian Financial Review – a dishonest propaganda rag – at best.

Neo-liberal efficiency – Australian government style

Next Tuesday, the Australian Bureau of Statistics (ABS), our national statistical agency, conducts its five-year Census of the population. It is compulsory and fines apply for failing to fill out the form.

In its wisdom (not!), the neo-liberal Australian government (and its Labor predecessor) imposed so-called ‘efficiency dividend’ on the Australian public service and its agencies, including the ABS.

Despite the fancy terminology, the ‘efficiency dividend’ is nothing more than a funding cut. The claim from the idiot government is that the ABS has to do things better with less and therefore reap ‘efficiencies’.

So with significant cuts to its funding, the ABS decided to make the Census ‘paperless’, meaning we now fill the questionnaire out on-line via the Internet.

One slight problem: a significant number of people (particularly the older citizens) do not have Internet access or even know how to use a computer. The ABS know that from previous censuses.

So, to deal with that little hiccup, the ABS install 300 help lines so that older people and others without Internet access can call up and get a paper form mailed out to them by Tuesday.

One slight problem further: the 300 lines are grossly insufficient to handle the number of people who have been seeking a paper document.

The result: the phone lines have been jammed for some time and people are complaining of being put into hold queues for several hours.

Some people are reporting extreme anxiety because they cannot get through and fear they will be fined for failing to lodge a paper form by next Tuesday.

Many will not get through in time.

The Government’s advice: ring early or late when the demand is less. Many older folk go to bed earlier than late! Many others cannot get to a phone at all!

The whole thing is a farce.

Efficiency – neo-liberal style.

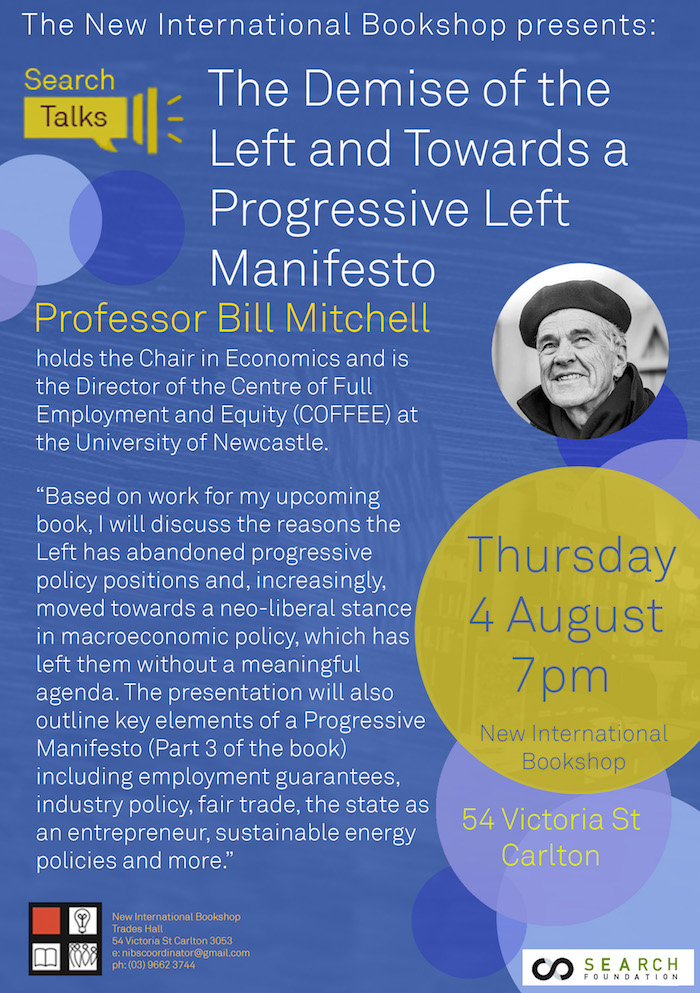

Upcoming talk at the New International Bookshop in Melbourne – August 4, 2016

On August 4, 2016, I will be giving a talk at the New International Bookshop in Melbourne (Australia) on the topic – The demise of the Left and towards a Progressive Left Manifesto – which is the topic covered in my latest book project that is nearing completion.

The talk will run between 19:00 and 20:30 and the venue is at 54 Victoria St, Melbourne, Australia 3053 – which is part of the Victorian Trades Hall.

The actual room will now be the Bella Union bar (upstairs from the Bookshop) and drinks will be available there.

There is a Facebook Page for the event.

The Bookshop is staffed by volunteers who appreciate any support they can get.

I spent many hours in my youth sifting through all sorts of radical books in its previous incarnation as the International Bookshop (operated by the now defunct Communist Party of Australia) in Elizabeth Street, Melbourne.

When I was a university student without much cash at all one – great staff member – there used to give me an orange on a regular basis – she always had one available and I guess she knew I haunted the place.

Here is the flyer. It would be great to see people at the event and the small entry fee goes to helping sustain the Bookshop, which has a long history in providing alternative and radical literature to Australian readers.

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

Are you saying that Japanese treasury bonds actually have negative coupons? Or is the negative yield just based of the secondary market, which is entirely understandable given the negative cash rates they have.

The negative yield of JGB’s is the so called ‘redemption yield’ or ‘yield to maturity’, not the ‘current yield’ (interest paid this year over current price).

In other words the coupon paid is insufficient to offset to the pull to par over the lifetime of the bond.

So when a government sells bonds at a negative yield they paid so much over the face value of the bond that they can never recover the difference from the coupons paid. The result is essentially a tax on money that people voluntarily pay.

G’day Bill. You often say that the monetarist are liers or are spreading misinformation. Unless you accept Hudsen’s view that there is a definite conspiracy for the corporations and banks to put every last one of us into debt with the banks, then perhaps it is just a matter that there is a mistaken and entrenched belief that there is no difference between households and government budgeting. Although it seems pretty bloody obvious once you have taken the trouble to acquaint yourself with the principles of MMT, it seems to be just a matter of plain pig-ignorance on the part of both major political parties and every last commentator that gets a voice on the ABC. Or perhaps Michael Hudsen is correct?

Thanks for your blogs

It seems that bad ideas regarding government “efficiency” seeking, travel around the globe very rapidly.

The national census here in Canada has just been competed. There was a similar experience here with the finger prints of the previous conservative government’s obsession with “efficiency” all over the entire process.

The prior conservative government had not conducted a census for 10 years prior and had eliminated the long form on the one census they did conduct (No data no problems eh?).

Similar to the situation you now have in Australia, there was a huge drive to get people to use computers to complete the forms leaving those without internet access with a far more painful experience. Never fear, the contracted temporary workers will be knocking at the doors of anyone tardy in completing the census to try and save people from conviction and a possible criminal record.

There was some temporary private sector job creation by Statistics Canada, who hired the enumerators at well below $20/hour in a work environment were they used their own vehicles, computer, internet, printers, paper etc covered vast areas, and at times absorbed significant financial losses due to the unfair compensation schemes constructed by management. Workers didn’t know where, when or if they would be working from one day to the next due to the micromanaging of their caseloads and could have performed their duties far more efficiently had they been able to decide how to approach each days work by themselves.

Another model of “efficiency” is the new federal payroll system which appears to deposit random amounts (if anything at all) into the accounts of government employees. Some workers are in great financial peril now due to the extended time being required to sort this problem out.

You certainly can illustrate the ludicrous idiocy that passes for journalism and knowledge in the current debates.

I hope someone sends this to Coleman. Of course he wouldn’t read it. It’s so against their world view that sense just bounces off. I can’t see how it’s going to change. Even minor parties are “victims”.

Steven Hail gave a lecture on Hokey’s [sic] “budget emergency ” hosted by the Greens. But I was told the party took no action to take it aboard. A wasted opportunity. We might get a bit of deficit spending a la Canada etc but it will be a herd response with no real understanding behind doing it.

We now live in a world where everybody knows economics basics, it’s so simple it’s just like a household. Similar in the field of education where everybody is an “expert” because of they once attended school, it’s so simple if the education system fails the pupils haven’t been punished enough for not doing the “right” thing. And anyone that can manage to open Excel and make a simple chart is a “researcher”.

The age of enlightening is not in risk of being ended, it already has.

From what i understand the Carmen Reinhart and Kenneth Rogoff Excel Error was so bad that if you include the data omitted it shows the opposite result:

http://www.msnbc.com/rachel-maddow-show/the-excel-error-heard-round-the-world?lite

“Take a look at the chart I put together: according the Reinhardt/Rogoff research, once a nation’s debt-to-GDP ratio tops 90%, the result is economic contraction. The revised research based on the same data points to 2.2% growth. It is, in other words, an enormously consequential error.”

Rob Holmes @21:05:

Neoliberalism is a political ideology rather than a conspiracy per se. Like other political ideologies it adopts it’s own views on economics.

There are several problems with the whole neo liberal picture. First, to my knowledge none of the political parties promoting neo liberal ideals and policy (which seems to be nearly all of them!) are named or have declared themselves neo liberal (sneaky). Various brands of petty divisive populist platform are used to get elected. Once elected neo liberal policy is implemented vigorously.

Secondly, only a very small segment of the population benefit from the implementation of neo liberal policy. It is therefore an undemocratic ideology since no one would actually vote against their own interest in the absence of deceptive politics and a faulty democratic process.

While a political belief can be held, one is not free to believe macroeconomics behave in some arbitrary way. MMT describes the macroeconomics as it applies to the fiat money issuing nations period. This is not ideology it is fact which cannot be denied.

It’s not difficult to understand either, at least not the most fundamental aspects. I recently heard a ten year old who had never heard of MMT give a perfect description of it’s basics. It’s a testimony to the capture of most adults whose thinking has been placed within small boxes defined by political rhetoric that those slowly being financially strangled by neo liberal ideology still trumpet it’s political memes.

Conspiracies are shrouded in secrecy, neoliberalism has been in pain sight for those with a critical eye to see for some time now.

“…accept Hudsen’s view that there is a definite conspiracy for the corporations and banks to put every last one of us into debt with the banks”

I would call it a plan rather than conspiracy. That said, virtually every dollar in existence is owed to the banking system, so I would say their plan has succeeded.

David Colemsn is my local federal member so I’ll be sending him this and some other info. Unfortunately I’m out of the country or i’d actually try and book an appointment to discuss his article. Maybe once back but it won’t be for a few months likely, I’d prefer to talk to him while its fresh in his mind.

Why they allow opinion pieces by people with no macroeconomic understanding let alone education is beyond me. Guess it’s a free space filler for their papers.

Mr Mitchell

I have been watching your videos and reading ypur stuff.

I have not read all of it, so maybe my point has already been dealt with.

It seems to me that you need to explain your theories in the context of historical events going back in history, or they will remain hard to accept because they are counterintuitive. When you say that a government can issue its own currency, you are obviously correct, but you need to explain more because the third reich issued its own money too, and we have all heard that printing money is not a good thing.

This aspect of your theories is not clear and not convincing. You need to provide us with a demonstration of the applicability of your theories over past events, if we are to see the workings of the economy from a different viewpoint.

Marco not necessarily arguing with you but Bill has many blog posts on hyperinflation myths. Maybe it needs to be clarified more but Google bill Mitchell hyperinflation you’ll find articles explaining it better than I can.

Look at the huge money printing in Japan, Europe and USA and it’s a complete straw man argument which is nonsense in any functioning economy that is functioning as normal.

A quote i like by an MMT proponent is something like Zimbabwe “shoot all the farmers” and expect everything to function normally. Hyperbole but that’s Literally very much what Zimbabwe did. Germany was forced in deep depression to pay unplayable debts (bit like Greece) and expected to grow.

History has taught so many lessons that seem to be forgotten between generations sadly. It should be included in teaching as basic macroeconomics classes for all.

Jason,

I’m converted.

But Bill does not come across as convincing when he makes the statement that a government that issues its own currency will never run out of money. His attitude seems to be that the viewer or listener or reader is supposed to accept and understand that fact, and is almost glossed over.

Well, it’s difficult to understand and accept, and must not be glossed over.

My point is that irrespective of the truth of the sentence, there is an innate resistance in the mind of an ordinary person to such a statement. It’s a major statement, and needs to be very carefully explained in the utmost detail, something which Bill fails to do.

It’s obvious that a government will never run out of money if it prints it. But what is not clear in people’s minds is what the effects of printing money are. And just to say that, look ,everyone has been printing it anyway, or even that whenever it has happened things have been good, is not good enough an explanation. What is needed is a precise explanation that shows causality. Doubts have not been dispelled by Bill’s arguments. You can see it in the face of the listeners and the interviewers.

For me, all of Bill’s subsequent arguments are easy enough to follow and very clearly presented when he talks, but they are all predicated on the assumption that deficit spending is ok, and such an assumption creates an image in one’s mind that government is producing cash out of thin air, and that is NOT a good image.

Bill, et al., have been working on dispelling the linguistics-based myths of neo-liberalism; a worthwhile exercise, but nevertheless, in my opinion, one doomed to failure if the underpinning premise of MMT, the real meaning of money, is not adequately explained.

Macro, I agree and as Bill has said he can’t do it all alone he needs our help. His job is to provide the theory to back it up but we need to help create the narrative.

A really good dissection of an economically clueless piece. Really, why do people think being a businessman makes them an economist? Over and over, you can’t get people to see two very simple things:

(1) by definition debt is someone else’s asset.

(2) if the debt is in a currency you control you never have to pay it all back – and because of (1) you shouldn’t.

Though you don’t need an MMT framework to show why most developed countries should be running large monetised deficits at the moment – many perfectly orthodox DSGE types (Summers, Wren-Lewis, lately even Blanchard and Woodford – plus of course non-DSGE Keynesians like Stiglitz and Krugman) have been saying so. In academia, as distinct from politica, its really only been a fringe who’ve cried “but Greece! Hyperinflation!”.

And guess who The Australian tells us Malcolm Turnbull is about to appoint to Chair the House of Reps Economics Committee? The very same David Coleman.

Dear Prosopon (at 2016/08/06 at 10:06 am)

That is what the state of Australian politics has come to. Mindless Groupthinker without any evidentiary basis or relevant theoretical knowledge is in charge of one of the important Parliamentary committees.

best wishes

bill

Derrida and co.

you’ve got to get off your high horses.

Those two very simple things are not very simple at all. You’re asserting that everyone is too dumb to grasp your argument, but your course of action is to insult them for being dumb. You’re going backwards. Nobody likes to be insulted. Explain. And you can’t leave it to people to find out on their own. They just won’t. Get that ten year old mentioned by J Christensen above to put a video on YouTube.