I started my undergraduate studies in economics in the late 1970s after starting out as…

Time for fiscal policy as we learn more about monetary policy ineffectiveness

The week before last, the Bank of Japan didn’t set off any bazookas and basically held ground on monetary policy. In its – Summary of Opinions at the Monetary Policy Meeting on July 28 and 29, 2016 – (released August 8, 2016), we detect some tension among the Board members as to the effectiveness of monetary policy as a counter-stabilisation force (altering the economic cycle). The distinguishing feature about Japan is that monetary and fiscal policy are working in harmony in contradistinction to other nations (or currency blocs) where monetary easing is being accompanied by fiscal contraction. The latter ensures that growth will not occur, while the former provides a virtuous cycle. The recent retail sales data for Australia, released last week by the Australian Bureau of Statistics provides further evidence that monetary policy is not very effective in stimulating spending. The same data demonstrated categorically in 2009 how effective fiscal policy can be. It is time for the Australian government to shift policy positions and introduce another major fiscal stimulus and stop relying on the central bank to salvage what is becoming an ugly situation. The latter simply hasn’t got the policy tools available to fulfill the task it has been (implicitly) set by the Government’s irresponsible pursuit of fiscal surpluses.

The tension on a range of topics was fairly clear among BOJ Board members.

One person said that:

The Bank should reject the idea that monetary easing has its limit and side effects. A limit to the Bank’s purchase of Japanese government bonds (JGBs), if any, would be the total amount outstanding of JGBs issued.

Which ducks the question whether the ‘monetary easing’ has it limits in terms of influencing output growth.

Another member said that the:

… positive impacts of a decline in super-long-term interest rates on business fixed investment are limited …

There was some disagreement also about whether the Bank’s massive QQE program was impairing the “Bank’s financial soundness”. One member categorically rejected that view.

Another comment recorded noted that:

The government’s stimulus package is likely to be extremely large in scale, which will considerably push up the growth rate and inflation rate.

That is – fiscal policy rules!

But if you ever thought the central bank and the Ministry of Finance (treasury) were not part of the same show, the Board seemed to be in accord:

– A combination of the government’s fiscal expansion and the Bank’s monetary easing aimed at achieving the price stability target is widely known as a “policy mix.” In this “policy mix,” the impact of the fiscal stimulus will be further strengthened. The Bank welcomes the government’s stimulus package, as it is very timely.

– The government’s stimulus package, which is being formulated, seems to be harmonious with the Bank’s monetary easing.

– By enhancing monetary easing, the Bank can demonstrate its stance to work closely with the government.

The financial markets read the decision by the Bank not to ramp up its bond-buying program nor cut interest rates further into negative territory as an admission from the Bank “that its current policy framework hit the limit” (Source).

A report for Pimco by Tomoya Masano (August 6, 2016) – The BOJ Hit Its Limit: A Summer Relief for Banks – said that:

The BOJ was (until now) operating with benign neglect regarding the costs to financial institutions of this dramatic move in the yield curve, emphasizing instead the intended economic stimulus impact of lowering long-term rates.

The argument the industry is making is that the “(e)xtraordinarily low yields and flat yield curves are the least favorite recipe for banks and any other financial institution: Margins get squeezed as reinvestment yield declines while liability costs, or promised returns, cannot be lowered.”

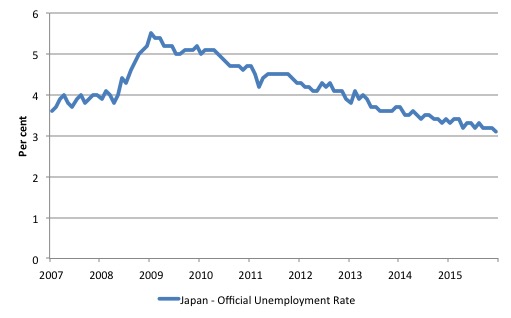

Whether the banks are happy or not does not hide the fact that the national unemployment rate dropped to 3.1 per cent in June 2016 down from its GFC-high of 5.5 per cent in July 2009. It is now lower than the previous pre-GFC low (July 2007) of 3.6 per cent. Further, participation rates remain stable.

Here is a graph of the Japanese unemployment rate from July 2007 to June 2016.

So the combination of aggressive fiscal stimulus supported by a very easy monetary stance has given Japan a labour market outcome that any nation would be envious off – notwithstanding all the claims about ‘lost decades’, ‘ageing population’, ‘excessive government debt’, ‘sclerotic society’.

The PIMCO article concludes by saying that:

Perhaps it is time for monetary policy to move to a back seat and let fiscal policy take the wheel.

Well it is hardly the case that the Japanese government has been shy in expanding the fiscal deficit at the national level. The reality is that the Japanese government knew full well that a solitary reliance on monetary policy would be insufficient to restore growth and reduce unemployment.

They operated their two large macroeconomic policy levers in harmony as one of the Board members from the Bank of Japan noted (see above).

This is quite unlike what has been happening in other places – for example, the Eurozone where the fiscal stance has been largely contractionary while the ECB searches for one bazooka or another to fire.

A similar problem exists in Australia where the Treasury (under the control of a conservative government) has been stifling fiscal policy flexibility in pursuit of a fiscal surplus – albeit they have struggled to cut the deficit given the cycle has turned against them and taxation revenue has not met their expectations.

The on-going fiscal deficit is thus supporting growth but needs to be much larger.

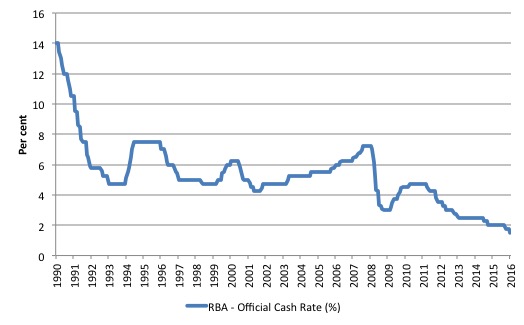

Meanwhile the Reserve Bank of Australia has been cutting rates towards zero. Last Tuesday (August 2, 2016), the RBA cut the policy cash rate by a further 25 basis points to 1.5 per cent.

This is the lowest rate on record and follows cuts two similar cuts since the beginning of the year.

Here is a history (since August 1990) of the Official Cash Rate administered (set) by the RBA. It has been sliding towards zero for some time now.

In the – Statement by Glenn Stevens, Governor: Monetary Policy Decision – the RBA said:

In Australia, recent data suggest that overall growth is continuing at a moderate pace, despite a very large decline in business investment … inflation remains quite low. Given very subdued growth in labour costs and very low cost pressures elsewhere in the world, this is expected to remain the case for some time … Low interest rates have been supporting domestic demand and the lower exchange rate since 2013 is helping the traded sector.

Unlike the harmony between the Japanese Ministry of Finance (fiscal policy) and the Bank of Japan (monetary policy), there has been tension between Australia’s two major macroeconomic policy setting institutions – the RBA and the Treasury.

In a speech to the Economic Society (June 10, 2015) – Economic Conditions and Prospects: Creating the Upside – the RBA Governor said that:

In Australia, recent growth in the economy has not been as strong as we want … the economy could do with some more demand growth over the next couple of years …

… we might give some thought to trying to create some upside risks to the growth outlook through policy initiatives. The Reserve Bank will remain attuned to what it can do, consistent with the various elements of its mandate – including price stability, full employment and financial stability. We remain open to the possibility of further policy easing, if that is, on balance, beneficial for sustainable growth …

… the bigger point is that monetary policy alone can’t deliver everything we need and expecting too much from it can lead, in time, to much bigger problems. Much of the effect of monetary policy comes through the spending, borrowing and saving decisions of households. There isn’t much cause from research, or from current data, to expect a direct impact on business investment. But of all the three broad sectors – households, government and corporations – it is households that probably have the least scope to expand their balance sheets to drive spending. That’s because they already did that a decade or more ago. Their debt burden, while being well serviced and with low arrears rates, is already high. It is for this reason that I have previously noted some reservations about how much monetary policy can be expected to do to boost growth with lower and lower interest rates. It is not that monetary policy is entirely powerless, but its marginal effect may be smaller, and the associated risks greater, the lower interest rates go from already very low levels. I think everyone can see that.

If I am correct about this, it really is very important that other policies coalesce around a narrative for growth.

A veiled attack on the conservative Government’s fiscal surplus pursuit-obsession.

He also said that:

… infrastructure spending has a role to play in sustaining growth and also in generating confidence … The real economy would benefit from the steady pipeline of construction work – as opposed to a boom and bust. It would also benefit from confidence about improved efficiency of logistics over time resulting from the better infrastructure. Amenity would be improved for millions of ordinary citizens in their daily lives. We could unleash large potential benefits that at present are not available because of congestion in our transportation networks.

The impediments to this outcome are not financial … The impediments are in our decision-making processes and, it seems, in our inability to find political agreement on how to proceed.

He also went on to talk about the need for more investment in education, technology, skills development etc – all areas that fiscal policy could address if there was the ‘political’ willingness to engage in a nation building exercise.

The unfortunate thing is that the conservative government and the opposition Labor Party are both so entrapped with neo-liberal Groupthink that they have devolved policy responsibility for growth to the central bank despite even the RBA itself knowing its effectiveness is limited.

I have been saying that for a long time now!

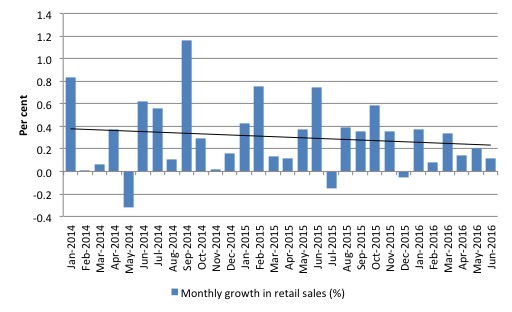

Further evidence of the ineffectiveness of monetary policy emerged last week (August 4, 2016) when the Australian Bureau of Statistics released its latest – Retail Trade, Australia – data for June 2016.

The results show that trend turnover is racing downwards.

The following graph shows the monthly growth in retail sales since January 2014 (to June 2016) with the solid black line being the simple linear trend.

In terms of current prices, seasonally-adjusted retail sales rose by just 0.1 per cent in month of June 2016 (0.2 per cent in May).

In volume terms, seasonally-adjusted retail sales rose by just 0.4 per cent in the June-quarter 2016. The average quarterly rate of growth since the March-quarter is 0.85 per cent. So, in real terms, the current rate of growth is less than 50 per cent of the longer term trend.

What accounts for the difference? The current-price estimates incorporate the inflation (price level) effect and with inflation at negative or very low levels, that has suppressed the growth in retail sales.

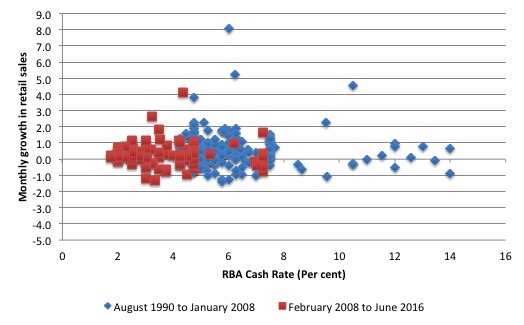

The following graph shows the relationship between the RBA cash rate and the monthly growth in retail sales volumes – for two periods – before and after the GFC.

Conclusion: no relationship.

Reflect back on what the RBA Governor said last year (cited above) – the household “debt burden … is already high. It is for this reason that I have previously noted some reservations about how much monetary policy can be expected to do to boost growth with lower and lower interest rates.”

So no surprises that retail sales have failed to respond to the lower interest rate environment, which is really a reflection of the RBAs desperation to try to do what it knows it cannot – kickstart spending – and the failure of the Government to take responsibility and provide the necessary fiscal stimulus.

Another contributing factor to the stagnant retail sales outcome is the static wages situation in Australia. Depending on how one measures it, real wages growth has either been around zero or falling.

The wage share continues to shrink and the business firms will not invest if sales are slow. Business investment is in dramatic decline, in fact.

Further, households are not only labouring under record debt levels but unemployment and underemployment remain at elevated levels and employment growth has been close to zero for the last few years.

The situation is screaming out for a major fiscal intervention.

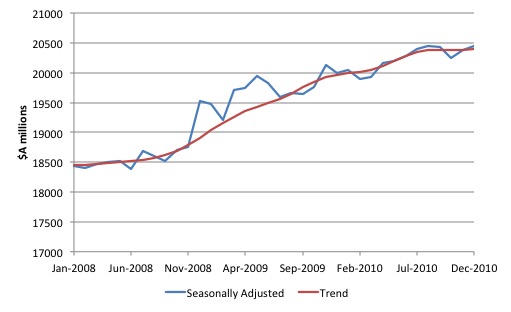

Consider the next graph, which shows retail sales (level and trend) in seasonally-adjusted terms from January 2008 to December 2010.

What do you think accounts for that big hump in the second-half of 2008 going into 2009? The answer is that the Australian government introduced a massive fiscal stimulus in late 2008, which included a cash handout to all households just before Xmas in 2008 – the so-called ‘flat TV screen stimulus’ because it boosted retail sales and contributed to the economy being among only 3 OECD nations to avoid going into recession during the GFC.

It has long been known that monetary policy is an ineffictive tool for stimulating total spending.

A famous article by Swedish economist Axel Leijonhufvud – Keynes and the Effectiveness of Monetary Policy – which was published in Economic Inquiry, Volume 6, Issue 2, pages 97-111, March 1968, noted that the American Keynesian tradition in the post World War II period:

… has been associated with a decided preference for fiscal over monetary stabilization policies … In the development of this school of thought, certain arguments to the effect that monetary policy is generally ineffective have historically played a large role.

He then argued that Keynes, himself, did express “doubts about the efficacy of banking policy and … argued for public works programs” (that is, fiscal policy initiatives) but that his position was more complicated than the American Keynesians made out.

Leijonhufvud wrote that Keynes was aware that expenditure could become insensitive to interest rate changes and that monetary policy was not a suitable tool when an economy was caught in a deep recession and no one wanted to borrow.

The current debate about monetary policy evokes a strong sense of déjà vu, given that these points were debated and understood during the 1930s.

The expression – pushing on a string – describes the situation where central banks may be able to inhibit credit creation by the commercial banks (by making the price it provides reserves prohibitive) but it cannot force the banks to lend.

The analogy tells us that the influence of monetary policy on total spending in the economy is likely to work in one direction (pulling the string) but not the other (pushing).

On December 16, 1933, as the Great Depression was worsening and policy makers were relying on monetary policy solutions, similar to the emphasis in the current crisis, Keynes, who is often credited with the ‘pushing on a string’ analogy, wrote an – Open Letter to President Roosevelt – and said:

Some people seem to infer from this that output and income can be raised by increasing the quantity of money. But this is like trying to get fat by buying a larger belt. In the United States today your belt is plenty big enough for your belly. It is a most misleading thing to stress the quantity of money, which is only a limiting factor, rather than the volume of expenditure, which is the operative factor.

In that context, he said that the government “must be called in aid to create additional current incomes through the expenditure of borrowed or printed money”.

In a similar vein, on March 18, 1935, the US House of Representatives Committee on Banking and Currency considered the introduction of the Banking Act of 1935, which was designed to “provide for the sound, effective, and uninterrupted operation of the banking system …” (Committee on Banking and Currency, 1935).

On that particular afternoon, the Federal Reserve Bank Chairman, Marriner Eccles was interrogated by Congressman Thomas Alan Goldsborough about what the central bank could do to address the parlous state of the US economy.

The US economy was mired in a deep depression, not unlike the situation that the euro-zone finds itself in today. The unemployment rate was around 21 per cent.

Their exchange was clear (p.377):

Governor Eccles: Under present circumstances, there is very little, if anything, that can be done.” (p.377)

Mr Goldsborough: You mean you cannot push on a string.

Governor Eccles: That is a very good way to put it, one cannot push on a string. We are in the depths of a depression and, as I have said several times before this committee, beyond creating an easy money situation through reduction of discount rates and through the creation of excess reserves, there is very little, if anything, that the reserve organization can do toward bringing about recovery …

The GFC and its aftermath has demonstrated categorically the power of fiscal policy (spending and taxation). When private spending collapsed, the solution was simple and well-known.

The US government knew what to do: ease monetary conditions and introduce a large-scale fiscal stimulus. The Chinese government did the same, as did the Australian government and several others.

All the governments that followed the basic rules of macroeconomics that spending equals income, which drives employment, were able to offset, to varying degrees, the private sector meltdown.

Australia’s fiscal stimulus package was large enough and was introduced early enough (in late 2008 and early 2009) to allow it to avoid a recession altogether.

The Australian Treasury – providing a briefing at a conference in Sydney on December 8, 2009 – The Return of Fiscal Policy.

They noted that the fiscal interventions, which combined cash transfers and investment:

… were designed to ensure that support was provided to the economy as quickly as possible …

The retail sales graph (above) shows what statisticians call the ‘intervention effect’ very clearly.

The Australian Treasury concluded that:

… the first cash transfers to households were distributed in early December 2008. Retail trade jumped by 4 per cent in that month, having shown almost no growth earlier in 2008.

So even though interest rates were declining, the stimulus to retail spending only came with the fiscal intervention.

The Treasury also note that the fiscal stimulus saved the construction sector, which normally is one of the first sectors to go into recession as aggregate spending collapses.

Their overall conclusion was that:

… the expansionary macroeconomic policy response was large enough and quick enough to convince the community – both consumers and businesses – that the slowdown would be relatively mild … Macroeconomic policy supported economic activity, which in turn convinced consumers and businesses that the slowdown would be relatively mild. This in turn led consumers and businesses to continue to spend, and led businesses to cut workers’ hours rather than laying them off, which in turn helped the economic slowdown to be relatively mild.

And that:

… absent the discretionary fiscal packages, real GDP would have contracted not only in the December quarter 2008 (which it did), but also in the March and June quarters of 2009, and therefore that the economy would have contracted significantly over the year to June 2009, rather than expanding by an estimated 0.6 per cent.

So it was fiscal policy that saved Australia from recession, not monetary policy.

The Treasury concluded that even though interest rates had come down quickly and significantly (by record proportions in fact):

… this fall in real borrowing rates would have contributed less than 1 per cent to GDP growth over the year to the September quarter 2009, compared with the estimated contribution from the discretionary fiscal packages of about 2.4 per cent over the same period.

So fiscal policy was 2.4 times more effective than monetary policy at meeting the problem wrought by a collapse in private spending.

Subsequent evaluations by government bodies including the American Congressional Budget Office (CBO) and many other economists found that the fiscal interventions were highly successful albeit too conservative and withdrawn too early.

The fact that many of these same governments sooner or later were bullied by the conservative political lobbies into withdrawing or modifying the stimulus packages, which then undermined the emerging recoveries they had earlier created, doesn’t alter the point.

Conclusion

Tese lessons appear not to have been learned – except perhaps in Japan – which has achieved substantial cuts in the unemployment rate because it has not relied exclusively on monetary policy.

Monetary and fiscal policy have operated harmoniously!

The Australian government should take heed and ditch its neo-liberal obsession with fiscal cuts and, instead, take the RBA Governor’s advice and spend up big on productive infrastructure that will take Australia into the latter part of this century.

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

the government might have a neo liberal obsession with surpluses, but the economic pitchfork in the eye that’s going to determine what they do is the unemployment rate.

a rising unemployment rate for any government in this country isn’t a optional extra anymore. the two dozen or so marginal electorates that win and lose elections also happen to be the very ones that have one and half to two income families supporting large household debt levels.

the elephant in the room is the level of household debt. right now both parties are in a state of denial, and we have excuses and recaliberations about the fiscal predicament of the government.

political realities will kill off the surplus mantra , its a dead man walking, and overt monetary financing will be here by the end of the decade .

I hope you are right Mahaish, but if you have seen the rearguard action being fought on climate change by the denialists, you can be sure they will not give up easily.

“Reserve Bank governor Glenn Stevens has implored the Turnbull government to take on more debt and spend on worthwhile projects, saying the central bank can’t be expected to do all of the work to maintain economic growth.”

Just saw this. Maybe something is sinking in somewhere.

mahaish and totaram:

Maybe just maybe the neoliberals will be forced to abandon their austerity push? Stevens has suggested a role for fiscal policy before but it fell on deaf ears. The current regime has made less noise about debt and deficits than the Abbott one but still seem committed to more cuts to public programs that will do nothing but reduce growth, unless the private sector picks up its spending. And as Bill has pointed out, the private sector wants to save financial assets and unless they can see demand for their goods and services they will not spend or invest or employ.

you have a point totarum, in that the current right wing comentariat position in oz, is that the fiscal stimulus post gfc was too large, and that treasury got it wrong in going all in. they conveniently forget that we avoided a recession by the skin of our teeth, even with the government running deficits well north of 3% of gdp.

unfortunately , no one gives you credit for avoiding problems in the first place, and people only think there was a problem, once we have to extricate our selves from the mess.

the question is, how big is the next problem going to be, given that the odds are its going to be orders of magnitude bigger than the last one, and how quickly and strongly will the current government react , given the denial they are in, if the forecasts don’t stack up, which is inevitable, because they have the accounting arse end backwoods , because of their ideological pecadilos.