Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

The Weekend Quiz – July 9-10, 2016 – answers and discussion

Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

Given government bonds represent a source of wealth for the non-government purchaser, a decision to allow the central bank to directly purchase government bonds to exactly match ($-for-$) the increase in net public spending will, initially, result in lower net worth for the non-government sector relative to the situation where the government sells the bonds to the private markets.

The answer is False.

The mainstream macroeconomic textbooks all have a chapter on fiscal policy (and it is often written in the context of the so-called IS-LM model but not always).

The chapters always introduces the so-called ‘Government Budget Constraint’ that alleges that governments have to ‘finance’ all spending either through taxation; debt-issuance; or money creation, just like a household.

The textbooks fail to convey an understanding that government spending is performed in the same way irrespective of the accompanying monetary operations.

They claim that money creation (borrowing from central bank) is inflationary while the latter (private bond sales) is less so. These conclusions are based on their erroneous claim that ‘money creation’ adds more to aggregate demand than bond sales, because the latter forces up interest rates which crowd out some private spending.

All these claims are without foundation in a fiat monetary system and an understanding of the banking operations that occur when governments spend and issue debt helps to show why.

So what would happen if a sovereign, currency-issuing government (with a flexible exchange rate) ran a fiscal deficit without issuing debt at all (or sold the debt to the central bank instead of to the non-government sector, which is an equivalent act).

Like all government spending, the Treasury would credit the reserve accounts held by the commercial bank at the central bank. The commercial bank in question would be where the target of the spending had an account. So the commercial bank’s assets rise and its liabilities also increase because a deposit would be made.

The transactions are clear: The commercial bank’s assets rise and its liabilities also increase because a new deposit has been made. Further, the target of the fiscal initiative enjoys increased assets (bank deposit) and net worth (a liability/equity entry on their balance sheet). Taxation does the opposite and so a deficit (spending greater than taxation) means that reserves increase and private net worth increases.

This means that there are likely to be excess reserves in the “cash system” which then raises issues for the central bank about its liquidity management. The aim of the central bank is to “hit” a target interest rate and so it has to ensure that competitive forces in the interbank market do not compromise that target.

When there are excess reserves there is downward pressure on the overnight interest rate (as banks scurry to seek interest-earning opportunities), the central bank then has to sell government bonds to the banks to soak the excess up and maintain liquidity at a level consistent with the target. Some central banks offer a return on overnight reserves which reduces the need to sell debt as a liquidity management operation.

There is no sense that these debt sales have anything to do with “financing” government net spending. The sales are a monetary operation aimed at interest-rate maintenance. So M1 (deposits in the non-government sector) rise as a result of the deficit without a corresponding increase in liabilities. It is this result that leads to the conclusion that that deficits increase net financial assets in the non-government sector.

What would happen if there were bond sales? All that happens is that the banks reserves are reduced by the bond sales but this does not reduce the deposits created by the net spending. So net worth is not altered. What is changed is the composition of the asset portfolio held in the non-government sector.

The only difference between the Treasury “borrowing from the central bank” and issuing debt to the private sector is that the central bank has to use different operations to pursue its policy interest rate target. If it debt is not issued to match the deficit then it has to either pay interest on excess reserves (which most central banks are doing now anyway) or let the target rate fall to zero (the Japan solution).

There is no difference to the impact of the deficits on net worth in the non-government sector.

Mainstream economists would say that by draining the reserves, the central bank has reduced the ability of banks to lend which then, via the money multiplier, expands the money supply.

However, the reality is that:

- Building bank reserves does not increase the ability of the banks to lend.

- The money multiplier process so loved by the mainstream does not describe the way in which banks make loans.

- Inflation is caused by aggregate demand growing faster than real output capacity. The reserve position of the banks is not functionally related with that process.

So the banks are able to create as much credit as they can find credit-worthy customers to hold irrespective of the operations that accompany government net spending.

This doesn’t lead to the conclusion that deficits do not carry an inflation risk. All components of aggregate demand carry an inflation risk if they become excessive, which can only be defined in terms of the relation between spending and productive capacity.

It is totally fallacious to think that private placement of debt reduces the inflation risk. It does not.

So in terms of the specific question, you need to consider the reserve operations that accompany deficit spending. Like all government spending, the Treasury would credit the reserve accounts held by the commercial bank at the central bank. The commercial bank in question would be where the target of the spending had an account. So the commercial bank’s assets rise and its liabilities also increase because a deposit would be made.

The transactions are clear: The commercial bank’s assets rise and its liabilities also increase because a new deposit has been made. Further, the target of the fiscal initiative enjoys increased assets (bank deposit) and net worth (a liability/equity entry on their balance sheet). Taxation does the opposite and so a deficit (spending greater than taxation) means that reserves increase and private net worth increases.

This means that there are likely to be excess reserves in the “cash system” which then raises issues for the central bank about its liquidity management as explained above. But at this stage, M1 (deposits in the non-government sector) rise as a result of the deficit without a corresponding increase in liabilities. In other words, fiscal deficits increase net financial assets in the non-government sector.

What would happen if there were bond sales? All that happens is that the banks reserves are reduced by the bond sales but this does not reduce the deposits created by the net spending. So net worth is not altered. What is changed is the composition of the asset portfolio held in the non-government sector.

The only difference between the Treasury ‘borrowing from the central bank’ and issuing debt to the private sector is that the central bank has to use different operations to pursue its policy interest rate target. If it debt is not issued to match the deficit then it has to either pay interest on excess reserves (which most central banks are doing now anyway) or let the target rate fall to zero (the Japan solution).

There is no difference to the impact of the deficits on net worth in the non-government sector.

Note the use of the qualifier – initially – in the question. It is true that once the interest payments flow to the bond holders that their net worth is enhanced.

You may wish to read the following blogs for more information:

- Why history matters

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- The complacent students sit and listen to some of that

- Saturday Quiz – February 27, 2010 – answers and discussion

Question 2:

Assume that a national is continuously running an external deficit of 2 per cent of GDP. In this economy, if the private domestic sector successfully saves overall, we would always find:

(a) A fiscal deficit (public spending greater than revenue).

(b) A fiscal deficit (public spending less than revenue).

(c) Cannot tell because we don’t know the scale of the private domestic sector saving as a % of GDP.

The answer is Option (a) – A public fiscal deficit.

This question requires an understanding of the sectoral balances that can be derived from the National Accounts. But it also requires some understanding of the behavioural relationships within and between these sectors which generate the outcomes that are captured in the National Accounts and summarised by the sectoral balances.

Refreshing the balances (again) – we know that from an accounting sense, if the external sector overall is in deficit, then it is impossible for both the private domestic sector and government sector to run surpluses. One of those two has to also be in deficit to satisfy the accounting rules.

The important point is to understand what behaviour and economic adjustments drive these outcomes.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

(1) GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

Expression (1) tells us that total income in the economy per period will be exactly equal to total spending from all sources of expenditure.

We also have to acknowledge that financial balances of the sectors are impacted by net government taxes (T) which includes all tax revenue minus total transfer and interest payments (the latter are not counted independently in the expenditure Expression (1)).

Further, as noted above the trade account is only one aspect of the financial flows between the domestic economy and the external sector. we have to include net external income flows (FNI).

Adding in the net external income flows (FNI) to Expression (2) for GDP we get the familiar gross national product or gross national income measure (GNP):

(2) GNP = C + I + G + (X – M) + FNI

To render this approach into the sectoral balances form, we subtract total net taxes (T) from both sides of Expression (3) to get:

(3) GNP – T = C + I + G + (X – M) + FNI – T

Now we can collect the terms by arranging them according to the three sectoral balances:

(4) (GNP – C – T) – I = (G – T) + (X – M + FNI)

The the terms in Expression (4) are relatively easy to understand now.

The term (GNP – C – T) represents total income less the amount consumed less the amount paid to government in taxes (taking into account transfers coming the other way). In other words, it represents private domestic saving.

The left-hand side of Equation (4), (GNP – C – T) – I, thus is the overall saving of the private domestic sector, which is distinct from total household saving denoted by the term (GNP – C – T).

In other words, the left-hand side of Equation (4) is the private domestic financial balance and if it is positive then the sector is spending less than its total income and if it is negative the sector is spending more than it total income.

The term (G – T) is the government financial balance and is in deficit if government spending (G) is greater than government tax revenue minus transfers (T), and in surplus if the balance is negative.

Finally, the other right-hand side term (X – M + FNI) is the external financial balance, commonly known as the current account balance (CAD). It is in surplus if positive and deficit if negative.

In English we could say that:

The private financial balance equals the sum of the government financial balance plus the current account balance.

We can re-write Expression (6) in this way to get the sectoral balances equation:

(5) (S – I) = (G – T) + CAD

which is interpreted as meaning that government sector deficits (G – T > 0) and current account surpluses (CAD > 0) generate national income and net financial assets for the private domestic sector.

Conversely, government surpluses (G – T < 0) and current account deficits (CAD < 0) reduce national income and undermine the capacity of the private domestic sector to add financial assets.

Expression (5) can also be written as:

(6) [(S – I) – CAD] = (G – T)

where the term on the left-hand side [(S – I) – CAD] is the non-government sector financial balance and is of equal and opposite sign to the government financial balance.

This is the familiar MMT statement that a government sector deficit (surplus) is equal dollar-for-dollar to the non-government sector surplus (deficit).

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)) plus net income transfers.

All these relationships (equations) hold as a matter of accounting and not matters of opinion.

So what economic behaviour might lead to the outcome specified in the question?

If the nation is running an external deficit it means that the contribution to aggregate demand from the external sector is negative – that is net drain of spending – dragging output down. The reference to the specific 2 per cent of GDP figure was to place doubt in your mind. In fact, it doesn’t matter how large or small the external deficit is for this question.

Assume, now that the private domestic sector (households and firms) seeks to increase its saving ratio and is successful in doing so. Consistent with this aspiration, households may cut back on consumption spending and save more out of disposable income. The immediate impact is that aggregate demand will fall and inventories will start to increase beyond the desired level of the firms.

The firms will soon react to the increased inventory holding costs and will start to cut back production. How quickly this happens depends on a number of factors including the pace and magnitude of the initial demand contraction. But if the households persist in trying to save more and consumption continues to lag, then soon enough the economy starts to contract – output, employment and income all fall.

The initial contraction in consumption multiplies through the expenditure system as workers who are laid off also lose income and their spending declines. This leads to further contractions.

The declining income leads to a number of consequences. Net exports improve as imports fall (less income) but the question clearly assumes that the external sector remains in deficit. Total saving actually starts to decline as income falls as does induced consumption.

So the initial discretionary decline in consumption is supplemented by the induced consumption falls driven by the multiplier process.

The decline in income then stifles firms’ investment plans – they become pessimistic of the chances of realising the output derived from augmented capacity and so aggregate demand plunges further. Both these effects push the private domestic balance further towards and eventually into surplus

With the economy in decline, tax revenue falls and welfare payments rise which push the public fiscal balance towards and eventually into deficit via the automatic stabilisers.

If the private sector persists in trying to increase its saving ratio then the contracting income will clearly push the fiscal balance into deficit.

So if there is an external deficit and the private domestic sector saves (a surplus) then there will always be a fiscal deficit. The higher the private saving, the larger the deficit.

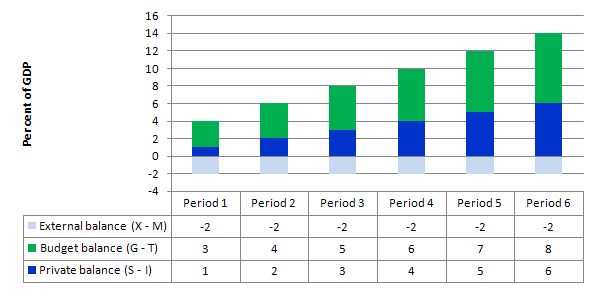

The following Graph and related Table shows you the sectoral balances written as (G-T) = (S-I) – (X-M) and how the fiscal deficit rises as the private domestic saving rises.

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Question 3:

If we assume that inflation and nominal interest rates are both zero and constant (not to different to reality), and consider a country with a public debt to GDP ratio of 100 per cent which the mainstream economists consider to be dangerously high. The mainstream prescription is to run primary fiscal surpluses (public spending net of interest payments greater than tax revenue) to stabilise and then reduce the debt ratio. Under the circumstances given, this strategy will only work if there is real GDP growth to generate the necessary extra tax revenue.

The answer is False.

First, some background theory and conceptual development.

While Modern Monetary Theory (MMT) places no particular importance in the public debt to GDP ratio for a sovereign government, given that insolvency is not an issue, the mainstream debate is dominated by the concept. The unnecessary practice of fiat currency-issuing governments of issuing public debt $-for-$ to match public net spending (deficits) ensures that the debt levels will always rise when there are deficits.

But the rising debt levels do not necessarily have to rise at the same rate as GDP grows. The question is about the debt ratio not the level of debt per se.

Rising deficits often are associated with declining economic activity (especially if there is no evidence of accelerating inflation) which suggests that the debt/GDP ratio may be rising because the denominator is also likely to be falling or rising below trend.

Further, historical experience tells us that when economic growth resumes after a major recession, during which the public debt ratio can rise sharply, the latter always declines again.

It is this endogenous nature of the ratio that suggests it is far more important to focus on the underlying economic problems which the public debt ratio just mirrors.

Mainstream economics starts with the flawed analogy between the household and the sovereign government such that any excess in government spending over taxation receipts has to be “financed” in two ways: (a) by borrowing from the public; and/or (b) by “printing money”.

Neither characterisation is remotely representative of what happens in the real world in terms of the operations that define transactions between the government and non-government sector.

Further, the basic analogy is flawed at its most elemental level. The household must work out the financing before it can spend. The household cannot spend first. The government can spend first and ultimately does not have to worry about financing such expenditure.

However, in mainstream (dream) land, the framework for analysing these so-called “financing” choices is called the government budget constraint (GBC). The GBC says that the fiscal deficit in year t is equal to the change in government debt over year t plus the change in high powered money over year t. So in mathematical terms it is written as:

which you can read in English as saying that Budget deficit = Government spending + Government interest payments – Tax receipts must equal (be “financed” by) a change in Bonds (B) and/or a change in high powered money (H). The triangle sign (delta) is just shorthand for the change in a variable.

However, this is merely an accounting statement. In a stock-flow consistent macroeconomics, this statement will always hold. That is, it has to be true if all the transactions between the government and non-government sector have been correctly added and subtracted.

So in terms of MMT, the previous equation is just an ex post accounting identity that has to be true by definition and has no real economic importance.

But for the mainstream economist, the equation represents an ex ante (before the fact) financial constraint that the government is bound by. The difference between these two conceptions is very significant and the second (mainstream) interpretation cannot be correct if governments issue fiat currency (unless they place voluntary constraints on themselves and act as if it is a financial constraint).

Further, in mainstream economics, money creation is erroneously depicted as the government asking the central bank to buy treasury bonds which the central bank in return then prints money. The government then spends this money.

This is called debt monetisation and you can find out why this is typically not a viable option for a central bank by reading the Deficits 101 suite – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3.

Anyway, the mainstream claims that if governments increase the money growth rate (they erroneously call this “printing money”) the extra spending will cause accelerating inflation because there will be “too much money chasing too few goods”! Of-course, we know that proposition to be generally preposterous because economies that are constrained by deficient demand (defined as demand below the full employment level) respond to nominal demand increases by expanding real output rather than prices. There is an extensive literature pointing to this result.

So when governments are expanding deficits to offset a collapse in private spending, there is plenty of spare capacity available to ensure output rather than inflation increases.

But not to be daunted by the “facts”, the mainstream claim that because inflation is inevitable if “printing money” occurs, it is unwise to use this option to “finance” net public spending.

Hence they say as a better (but still poor) solution, governments should use debt issuance to “finance” their deficits. Thy also claim this is a poor option because in the short-term it is alleged to increase interest rates and in the longer-term is results in higher future tax rates because the debt has to be “paid back”.

Neither proposition bears scrutiny – you can read these blogs – Will we really pay higher taxes? and Will we really pay higher interest rates? – for further discussion on these points.

The mainstream textbooks are full of elaborate models of debt pay-back, debt stabilisation etc which all claim (falsely) to “prove” that the legacy of past deficits is higher debt and to stabilise the debt, the government must eliminate the deficit which means it must then run a primary surplus equal to interest payments on the existing debt.

A primary fiscal balance is the difference between government spending (excluding interest rate servicing) and taxation revenue.

The standard mainstream framework, which even the so-called progressives (deficit-doves) use, focuses on the ratio of debt to GDP rather than the level of debt per se. The following equation captures the approach:

![]()

So the change in the debt ratio is the sum of two terms on the right-hand side: (a) the difference between the real interest rate (r) and the GDP growth rate (g) times the initial debt ratio; and (b) the ratio of the primary deficit (G-T) to GDP.

The real interest rate is the difference between the nominal interest rate and the inflation rate.

This standard mainstream framework is used to highlight the dangers of running deficits. But even progressives (not me) use it in a perverse way to justify deficits in a downturn balanced by surpluses in the upturn.

Many mainstream economists and a fair number of so-called progressive economists say that governments should as some point in the business cycle run primary surpluses (taxation revenue in excess of non-interest government spending) to start reducing the debt ratio back to “safe” territory.

Almost all the media commentators that you read on this topic take it for granted that the only way to reduce the public debt ratio is to run primary surpluses. That is what the whole “credible exit strategy” rhetoric is about and what is driving the austerity push around the world at present.

The standard formula above can easily demonstrate that a nation running a primary deficit can reduce its public debt ratio over time. So it is clear that the public debt ratio can fall even if there is an on-going fiscal deficit if the real GDP growth rate is strong enough. This is win-win way to reduce the public debt ratio.

But the question is analysing the situation where the government is desiring to run primary fiscal surpluses.

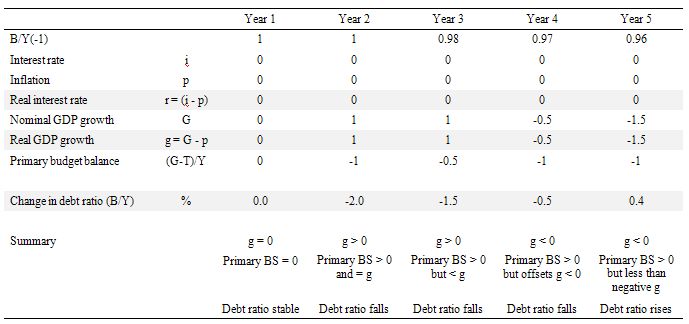

Consider the following Table which captures the variations possible in the question. In Year 1, the B/Y(-1) = 1 (that is, the public debt ratio at the start of the period is 100 per cent). The (-1) just signals the value inherited in the current period. We have already assumed that the inflation rate and the nominal interest rate are constant and zero, which means that the real interest rate is also zero and constant. So the r term in the model is 0 throughout our stylised simulation.

This is not to dissimilar to the situation at present in many countries.

In Year 1, there is zero real GDP growth and the Primary Budget Balance is also zero. Under these circumstances, the debt ratio is stable.

Now in Year 2, the fiscal austerity program begins and assume for the sake of discussion that it doesn’t dent real GDP growth. In reality, a major fiscal contraction is likely to push real GDP growth into the negative (that is, promote a recession). But for the sake of the logic we assume that nominal GDP growth is 1 per cent in Year 2, which means that real GDP growth is also 1 per cent given that all the nominal growth is real (zero inflation).

We assume that the government succeeds in pushing the Primary Budget Surplus to 1 per cent of GDP. This is the mainstream nirvana – the public debt ratio falls by 2 per cent as a consequence.

In Year 3, we see that the Primary Budget Surplus remains positive (0.5 per cent of GDP) but is now below the positive real GDP growth rate. In this case the public debt ratio still falls.

In Year 4, real GDP growth contracts (0.5 per cent) and the Primary Budget Surplus remains positive (1 per cent of GDP). In this case the public debt ratio still false which makes the proposition in the question false.

So if you have zero real interest rates, then even in a recession, the public debt ratio can still fall and the government run a fiscal surplus as long as Primary Surplus is greater in absolute value to the negative real GDP growth rate. Of-course, this logic is just arithmetic based on the relationship between the flows and stocks involved. In reality, it would be hard for the government to run a primary surplus under these conditions given the automatic stabilisers would be undermining that aim.

In Year 5, the real GDP growth rate is negative 1.5 per cent and the Primary Budget Surplus remains positive at 1 per cent of GDP. In this case the public debt ratio rises.

Of-course, the public debt ratio will be reduced if the

But the best way to reduce the public debt ratio is to stop issuing debt. A sovereign government doesn’t have to issue debt if the central bank is happy to keep its target interest rate at zero or pay interest on excess reserves.

The discussion also demonstrates why tightening monetary policy makes it harder for the government to reduce the public debt ratio – which, of-course, is one of the more subtle mainstream ways to force the government to run surpluses.

The following blog may be of further interest to you:

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

Bill (or anyone else who understands this),

How do the daily repos between the central Bank and the commercial banks work in relation to this question.

I think I mean: If a bank i short at the end of the day and needs more reserves it might need to use repos to do this. This is then an asset swap (bonds/reserves). In a scenario where bond sales are discontinued, how would the function of repos be replaced or rendered unnecessary?

Simonsky, I really want to answer your question but I am not an expert, actually I don’t know but I imagine that a bank short of reserves that had no bonds to offer as repos would have to borrow from other banks or sell some of its assets (loans) or borrow from the central bank’s discount window. If the bank was unable to do that for some reason, it would be insolvent.

Simonsky, the key words in my reply are “I don’t know” and “I imagine”. Hopefully someone who does know will either confirm or contradict the suppositions in my reply.

I’m posting something here which is not directly relevant, but it does have a connection to question 3 which is about govt. budgets, debt, deficits, etc.

1) Since I am not an economist, I may have simply rediscovered a well-known argument, in which case I will be happy to be informed of that (good to know my understanding of the subject has improved).

2)If there is an error in my reasoning, that too should be pointed out, so that I can improve. Thanks.

The argument pertains to “balanced budgets”, one of the desired outcomes in neo-liberal thinking.

We start with the simple relation used often in discussing the quantity theory of money:

PY = VM

Where, P is the price, Y is the aggregate demand so the left hand side is the GDP, while on the right hand side, V is the velocity of money and M is the quantity of money (HPM). We understand that this relationship holds at any time, by definition.

Let us assume we have a country that issues a fiat currency (such as Australia) and denote the values in the year 0 by

P0*Y0 = V0 *M0 . …..(1)

Now assume we have a very clever treasurer (VCT), who can somehow ensure that the ex-post fiscal balance of his govt. is always exactly zero (balanced budget). Because of his expertise with budgets, VCT is applauded by the public and continues to be treasurer for many, many years, and since we are now in neo-liberal heaven, the economy grows by leaps and bounds. In the year “t” we again have the identity, Pt* Yt = Vt* Mt . But, because the economy has grown the GDP has doubled, and so, Pt Yt = 2P0* Y0. Substituting into the identity for year 0, we get that

2 V0M0 = Vt Mt . …….(2)

Now, because VCT has always balanced the budget, the amount of money (HPM) in the economy has remained constant, implying that M0 = Mt . It follows from equation 2, that Vt = 2V0. Now, it has been argued by the mainstream economists who propound the quantity theory of money that the velocity of money should remain unchanged, for “behavioural” reasons (people pay only fortnightly, or monthly and so on).

The above analysis shows that balanced budgets must cause a strain on the functioning of the economy, since they force an increase in the velocity of money. Alternatively, difficulties in increasing the velocity of money in the economy will cause problems and be a drag on growth.

Totaram

The money supply denoted in PY=VM is not high powered money. High powered money is just reserves and notes/coins. The M refers to a measure of money supply that includes deposits at commercial banks, which would usually increase when the economy grows.

Vernon, thanks for your response.

Maybe I have misspecified M in the equation. However, how can deposits at commercial banks + reserves +notes and coin (your new definition) grow, when the govt. is not injecting any nett money into the economy? A person/entity can only make a deposit into a bank if (and only if) it has the money of account, namely HPM. And we know that HPM has not grown, because of the balanced budget.

Once again, I ask your indulgence in case I have misunderstood something. I am just trying to clear up my own understanding.

I forgot to add that I am arguing from the neo-liberal/mainstream position of fractional reserve banking, where the amount of deposits created by banking loans are totally constrained by the amount of HPM in the economy.

Hi totaram

You anticipated my response to your second post – the money supply is increased by commercial bank loans. Arguing from the mainstream position does change things. So I guess in their world, once the lending has been maxed out then the money supply cannot increase. If the GDP really has increased (e.g. doubled) then I think you are right, the velocity has to increase. I am also no expert totaram and I have not thought a lot about velocity. I can imagine people making sending transactions more often even if they are not paid any more often. But there would be a limit and then a problem if households want credit to satisfy their demands but cannot get it. So yes, I think you are right, even in the mainstream world a balanced budget would eventually limit growth. You would have to factor in the foreign sector but eventually I think the story is the same. Interesting. Good one.