I have been a consistent critic of the way in which the British Labour Party,…

The damage of the Thatcher sea-change

When socio-economic historians reflect back in the decades to come, they will see the insanity that ruled the economic policy choices that have been taken in the last three or so decades more clearly than we seem to be able to discern as we live through the nightmare. They will conclude that arrangements such as the Eurozone was the work of lunatics who systematically undermined the prosperity of millions of people and polarised their societies as a consequence. There is no possible way that the Eurozone can be constructed as a successful monetary arrangement. The deeply flawed design of the common currency in Europe, was, in part, the product of the shift towards Monetarism and its microeconomic analogue (deregulation, privatisation, outsourcing etc) that surged back into dominance in the 1970s, after its main ideas had been thoroughly discredited and dismissed during the Great Depression. While Margaret Thatcher was not the first Monetarist government (that title goes to the government of President Giscard d’Estaing who appointed Raymond Barre as the Prime minister and Minister of Economy and Finance in 1976), her regime certainly influenced the spread of neo-liberal thinking among policy circles, particularly in the Anglo world. What is still not acknowledged is the damage done by that swing to so-called free-market policies, which would be better called pro-business capture given there was no real market forces unleashed, just an industry of parasitic, rent-seeking profiteers closely followed by the massive growth in the unproductive, wealth-shuffling financial sector. A recently released report (June 10, 2015) – The Macroeconomic Impact of Liberal Economic Policies – from researchers at the University of Cambridge lets us know more closely how damaging this period was and challenges the view that the best way forward is even more austerity and deregulation.

The Report provides a bevy of facts and evidence to support their overall conclusion that it is “misguided” to think that “Britain’s economic performance improved compared to Western European competitors” as a result of the so-called “liberalisation” wrought by Margaret Thatcher and built upon by subsequent British governments from both sides of politics.

Rather, they note that British better:

… relative performance is due not to any improvement in the UK growth rate of GDP, but instead to a ‘dramatic slowing’ in economic growth in continental Europe beginning in the 1970s – with GDP growth of just 1.6% per annum in the original six European Union countries between 1979 and 2007 (compared with 4.5% per annum between 1950 and 1973) …

Britain’s own economic growth was lower from 1980 relative to the three decades previously and markedly so since 2007. They also note that the “deterioration in the growth of labour productivity after 1979 has been even more marked”.

And while growth has slowed, it has also become more unstable since the 1980s, with “large waves in contrast to the ripples of the 1950s and 1960s”.

Further, “since 1979, unemployment and inequality have been higher”.

Most of the economic growth has come from the unsustainable increase in “consumer spending” and housing expenditure, driven by credit which has manifest in the “rises in household debt ending in financial crisis”.

All the claims that “liberal market policies including lower tariffs and income taxes, free movement of capital, and labour, limited legal immunity for trade unions, privatisation, support for small firms and light-touch business regulation” produced higher growth in real GDP and productivity are rejected by the vast body of evidence that the authors of the Report have consulted and analysed.

The powerful conclusion, is that when we get beyond the ideology and consider hard facts, it is impossible to conclude that this ‘liberal’ era has made us better off as a collective. Indeed, the evidence suggests we are now collectively much worse off than we would have been if the neo-liberal era had been bypassed.

It also tells us that the intellectual foundations that motivated the design of the Eurozone were also flawed from the start before they even started putting their monstrous design into effect.

The failure of the Eurozone is thus the result of two forces:

1. The erroneous belief that self-regulating free markets will deliver stable and strong growth.

2. The incompetence of the sequence of Euro political leaders and their technical bureaucracies who have made the disasters caused by the flawed design worse by their repeated policy errors and implementation disasters.

Poor Europe.

It is a hard report to summarise because it is so dense with facts and analysis. A sort of feast. So I will only pick out a few of the constructions they use to make their case.

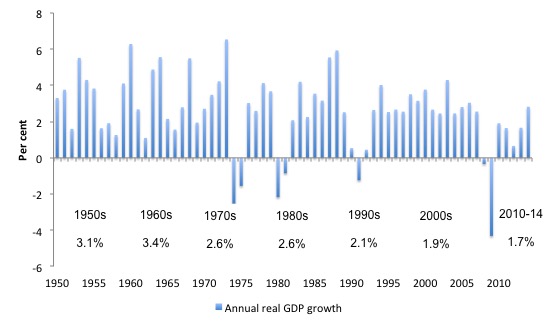

Here is a graph that I created which supports their case. It show annual real GDP growth from 1948 to 2014 which averages for the decades shown. The last entry is from 2010 to 2014.

The pattern shown is similar for most advanced nations. The Post World War II period initially spawned high real GDP growth rates with strong productivity growth and real wages growth. National government fiscal deficits were the norm and supported strong private spending and saving patterns.

That all came to an end once Monetarism antagonism to fiscal activism took hold in the 1970s and deregulation was pursued, first with large-scale privatisation, then attacks on the unions, and then full-scale financial market and labour market changes.

The growth performance of the economy started to slide (as did productivity growth). As the neo-liberal policy mentality firmed in more recent decades growth took a further step downwards and politicians claim success at growth rates that are nearly 50 per cent below what was the norm during the Keynesian period.

The period since 2010 in the UK has been a relative disaster in this sense.

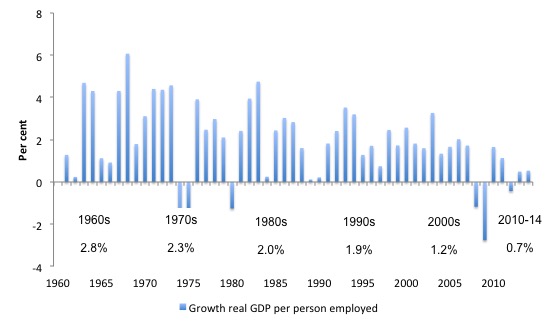

The following graph shows GDP per employed worker which gives some idea of what has been happening with labour productivity growth. The data comes from the – AMECO Macroeconomic Database – and the time series starts in 1960 (so for an annual growth rate the graph starts at 1961 and ends at 2014).

As in the previous graph, the numbers below the decade indicators are the decade-average growth rates. It is clear that labour productivity growth (using this conventional measure) has slowed rather appreciably in the decades since Margaret Thatcher took control.

The Report presents a number of different graphs that substantiate the summary results presented in earlier in this blog.

Only those who are trapped and patterned by the mob rule that defines the neo-liberal Groupthink dominating the policy debate these days would have the temerity or the blindness to deny the vast array of facts and evidence presented that the performance of the British economy deteriorated in significant ways after the ‘liberal’ era began and, ultimately, the dynamics unleashed by the neo-liberalism resulted in the GFC.

The evidence is unassailable.

But the valid question that is unanswered by the stream of graphs and tables pointing to the deterioration is what caused it. It is one thing to document the deterioration but another to fully understand why it occurred and to then implicate the policy shifts that accompanied the ideological “sea-change” (as the Report authors put it) that occurred when Monetarists expelled the ‘Keynesians’ and started wreaking havoc.

The Report notes that after this paradigm shift, the way “the UK economy was organised” went through this “sea-change” where:

… openness to trade, light-touch regulation of commerce and free competition have been the watchwords, alongside low income tax rates and constraints on trade union action. Most importantly, the removal of a raft of restrictions on banks and building societies, combined with the abolition of controls on the international movement of capital, allowed a huge expansion in household borrowing. These liberalisation measures extended an earlier trend including the bonfire of war-time restrictions, international trade agreements to reduce tariffs, the move to floating exchange rates between 1971 and 1973, and the switch from direct to indirect controls on bank lending in 1971. However, even by the late 1970s the UK economy was still strongly managed by government. Controls were still in place on capital movements, investment, prices and incomes. Trade unions remained powerful and the basic rate of income tax was at 30% with the top rate at 83%. Most lending to households was still undertaken by heavily controlled building societies. Government economic policies prior to the late 1970s still aimed to maintain full employment although the practice had become more difficult to achieve. After 1979 policy switched decisively towards controlling inflation, firstly through monetarism and later by using interest rates to meet inflation targets.

The authors understand that:

Any support for the conventional wisdom that the liberal market regime since 1979 has had a favourable impact on growth of the UK economy thus depends on a view that economic performance would have been worse after 1979 even if the previous ‘corporatist’ regime had been maintained.

They also note that world trade underwent a “slowdown … from the mid-1970s” which slowed “real GDP per capita in the UK” by around 0.4 percentage points irrespective of the domestic regime that was in place.

They don’t explain this “slowdown” – which I would suggest was the result of more generalised neo-liberal policies around the world that slowed import growth as most economies fell off their previously higher trend growth rates.

But, once they take it into account to alter the projection of trend real GDP per capita they conclude that:

… per capita GDP in the UK exceeded the trend in the late 1980s and in all years from 1994 to 2008. It then fell well below the trend and now looks unlikely to regain it for many years, if ever.

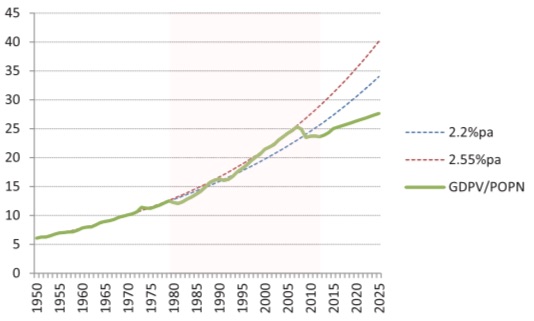

This conclusion is based on the following graph (their Chart 2). The red-dotted line is the trend growth in real GDP per capita between 1950 and 1979. The blue-dotted line is the adjusted trend to acknowledge “the slower growth in world trade after 1979” and the green line is the actual real GDP per capita.

While it might appear that the performance of real GDP per capita was actually superior (mostly) during the early years of Thatcherism and only collapsed during the GFC, the Report makes the point that:

… per capita GDP was maintained at levels above this trend after 1979 only by the build-up of high household debt levels. Once debt, and the rising property prices supported by rising debt, reached unsustainable levels, as it did by 2007, the banking system crashed and the level of GDP fell much further below previous trends than in any period since the Great Depression.

This is the same sort of argument I made in the early 2009 blog – The origins of the economic crisis – and has been a constant feature of Modern Monetary Theory (MMT) commentaries since the 1990s.

The point is that it took some time for the destructive dynamics

What the Cambridge Report doesn’t seem to get is that it was not just the financial liberalisation and poor oversight that led to the credit-binge and escalating household debt.

The years of fiscal austerity also squeezed the non-government sector of liquidity and to maintain consumption and investment levels private debt had to be expanded.

The periods in which the private domestic sector in the UK, for example, accelerated their indebtedness correspond to periods when the British government was pushing into fiscal surplus (mid-to-late 1980s and then early 2000s).

There is a bi-directional relationship operating here. The fiscal austerity puts a squeeze on the private liquidity but then the private credit-binge sustains growth in tax revenue which ‘ratifies’ the austerity in the form of surpluses.

The Report implicates the decline of manufacturing in the slowdown of productivity growth, which is one of the reasons, per capita GDP has slowed. They argue that the manufacturing was “a casualty of free market policies and globalisation”.

One of the main claims that are made about the shift to Monetarism (now called neo-liberalism to embrace a broader thrust of economic policy changes) is that inflation rates have been lower and more stable since the late 1970s.

The Report finds that British “inflation relative to other major economies in the post 1979 period has been similar to the 1950s and 1960s” and the “main improvement relative to the G7 average came not with the Thatcher Government’s monetarist policies over the 1980s but following the UKs ejection from the European exchange rate mechanism (ERM) in 1992”.

On balance, they conclude that if the pre-Thatcher policy framework had have persisted inflation “is likely to have been somewhat higher after 1980 … but unemployment would have been much lower”.

In terms of macroeconomic costs – real income losses – the persistently higher unemployment has been much more damaging to the British standard of living than if inflation had have been “somewhat higher”.

In terms of the deregulation agenda that was followed, the Report argues that:

We conclude that the regulatory regime before 1980 had little negative impact, and the fact that the UK has had a somewhat lighter regulatory regime than other EU countries since has done little to increase economic growth or productivity.

The largest change was in the area of bank lending which delivered noticeable results in the form of faster real GDP growth but, as noted above, at the expense of an unsustainable build-up in household debt.

They also summarise the literature on privatisation and conclude (quoting the “official historian of UK privatisation”) that the “the strident claims of ministers during the 1980s and 1990s about the benefits of privatisation were exaggerated”.

It was often argued by the neo-liberals during the 1980s that all they were doing was transferring labour from the public sector to the private sector and making it more productive.

The Report notes that:

The persistently high unemployment of the 1980s and 1990s indicates that there was insufficient re-employment to growing sectors and fits our observation above that, far from improving, the trend growth in GDP per hour deteriorated substantially from the early 1980s.

The results of the analysis are clear enough. Of the raft of changes that accompanied the ‘liberalisation’ period, only financial deregulation seems to have had a significant effect on increasing real GDP growth. And the “freeing up of finance led to a huge, and eventually unsustainable, expansion of household borrowing.”

In other words, the gains were “temporary” and have evaporated with the onset of the GFC. Now, as the private sector embarks on a lengthy process of balance sheet restructuring, the real GDP growth projections are dismal.

One is led to conclude that the Thatcher period and beyond really only increased “welfare dependency”, stifled investment in productive capacity, diverted funds into speculative, unproductive financial asset investments, stifled real wages growth and increased unemployment.

It also unleashed highly destructive forces in capitalism that after the crisis has left the nation with a parlous real GDP growth outlook with low productivity growth and higher poverty rates.

Conclusion

The Cambridge Report is interesting but doesn’t integrate the sectoral relationships as fully as it might in telling its story.

The dynamic unleashed by the deregulation of the financial system also has to be understood in terms of the liquidity squeezes that resulted from the austerity ambitions of the national government in Britain.

You really cannot understand the deregulation impacts divorced from the fiscal dynamics.

IT matters and Greece

The Reports in the conservative Greek media over the weekend (July 26, 2015) – Varoufakis claims had approval to plan parallel banking system – which were summarised and extended in the UK Guardian article (July 26, 2015) – Greece rocked by reports of secret plan to raid banks for drachma return – would appear to add weight to the arguments I have been making about the IT issues relating to a potential Greek exit from the Eurozone.

It appears that Naked Capitalism consulted the wrong Columbia University expert and relied on a person (an ex Columbia University technical officer) who hasn’t direct knowledge of the operations of the European monetary system and who relied on a literature that was outdated and largely irrelevant to the issue being discussed.

We can always pose erudite questions about anything – who will decide, where will the systems be, how long will it take to test etc.

But they are largely ruses when it comes down to getting things done.

It seems that the Columbia University IT professor helping the former Finance Minister had a system up and running within about a week and they had planned “a payment system that could operate in euros but which could be changed into drachmas ‘overnight’ if necessary”.

So much for all those IT problems.

Advertising: Special Discount available for my book to my blog readers

My new book – Eurozone Dystopia – Groupthink and Denial on a Grand Scale – is now published by Edward Elgar UK and available for sale.

I am able to offer a Special 35 per cent discount to readers to reduce the price of the Hard Back version of the book.

Please go to the – Elgar on-line shop and use the Discount Code VIP35.

Some relevant links to further information and availability:

- Edward Elgar Catalogue Page

- You can read – Chapter 1 – for free.

- You can purchase the book in – Hard Back format – at Edward Elgar’s On-line Shop.

- You can buy the book in – eBook format – at Google’s Store.

It is a long book (512 pages) and the full price for the hard-back edition is not cheap. The eBook version is very affordable.

That is enough for today!

Bill,

Please send a complimentary copy to Schauble. Heck, offer to read it to him, as a bedtime morality story.

The Cambridge lot claim, “The failure of the Eurozone is thus the result of two forces: 1. The erroneous belief that self-regulating free markets will deliver stable and strong growth.”

Er… free markets are not a characteristic unique to the EZ: i.e. had Euro countries retained their own currencies, they could have and probably would have ended up just as much “free market” as they are today. Indeed, if anything, the Euro was imposed by non-market forces: politicians and bureaucrats.

Which leads nicely to the second alleged reason for “failure of the Eurozone” namely “The incompetence of the sequence of Euro political leaders and their technical bureaucracies who have made the disasters caused by the flawed design worse by their repeated policy errors and implementation disasters.”

Now wait a moment: there are only two ways of allocating resources, namely free markets, and second, bureaucracies. If “political leaders and technical bureaucracies” are as hopeless as the Cambridge lot claim, that suggests that free markets are better. Not that I’m saying they always are – I’m just suggesting the Cambridge lot don’t seem to have thought this thru very clearly.

Apologies for being slightly off topic but I’d just like to share this Mark Steel link:

“What a relief that the Greeks have finally seen sense, and agreed to Angela Merkel’s demand that their Prime Minister Alexis Tsipras must scrub Berlin with a dishcloth, and crawl along the banks of the Rhine in a thong barking like a dog.”

Always good value is our Mark!

http://www.independent.co.uk/voices/comment/poor-alexis-tsipras-forced-to-crawl-along-the-banks-of-the-rhine-in-a-thong-10395090.html

Hi Bill,

How do you explain the fact that public spending as a % of GDP in many European countries hasn’t really dropped since the rise of Monetarism?

Thanks,

Alex

Bill,

The purpose of privatisations was to break union power – Reagan with airtraffic controllers and Thatcher with electricity workers hence multiple companies with duplication on a divide & rule basis!

”Of the raft of changes that accompanied the ‘liberalisation’ period, only financial deregulation seems to have had a significant effect on increasing real GDP growth.”

Financial deregulation may have led to an increase in aggregate demand. However, without an increase in the output of an economy, there could be no increase in ‘real GDP growth’?

‘And the “freeing up of finance led to a huge, and eventually unsustainable, expansion of household borrowing.” ‘

Agree.

Bill,

Don’t worry. Naked Capitalism have now published an article claiming that Varoufakis’ system would never have worked and that it was only due to his ‘hubris’ that he dared put such a scheme together.

http://www.nakedcapitalism.com/2015/07/greeces-drachma-drama-why-planning-is-too-important-to-be-left-to-economists.html

The idea seems to be. (1) Attack the finance ministry for not having a Plan B. (2) Then complain that a Plan B cannot be accomplished because of IT restrictions. (3) Attack the finance minister personally when it is floated that he had a Plan B and had sorted out the IT issues.

Naked Capitalism is a good site usually. But their coverage of Greece has been embarrassing to say the least.

I don’t understand NC agenda on the Greek drama reporting tbh, it leaves me puzzled. They have made a whole bunch of assumptions from the beginning regarding the requirements of setting up initially a new currency and/or payment system. Initially it wouldn’t have to have been perfect or support every clearing capability or function.

Never in the history of mankind have technicalities (real physical limits ofc) got in the way of politics or the economy. Never, they are just way over their head trying to whitewash this hole IT story they have been building up from the first day.

@Ignacio

Basically Smith completely misread the situation from the very beginning. She was especially blind to who the people involved were and what their motivations/strategy were. Because of this the editorial policy has been basically hostile toward the government and has pretty much bought into much of the propaganda and misleading nonsense being pumped out by the mainstream press. The site takes a “damned if you do, damned if you don’t” attitude toward the Greek government which ensures that they can never do anything right and NC’s criticisms, which are mostly focused on rumours about Syriza pumped out by the mainstream media, are always correct. It is weird and I think it is doing damage to the site’s credibility because it making them come across as cranky.

Dear Ignacio and others

On NC – I would recommend steering clear of the site from now on. It pretensions to progressive thought are suspect and every time you visit the page you provide advertising revenue to the convenor.

Do you really want to fund these ideas?

I will delete comments from now on that provide links to NC.

best wishes

bill

Bill, what comes after “destructive dynamics”?

“The point is that it took some time for the destructive dynamics

What the Cambridge Report doesn’t seem to get is that it was not just the financial liberalisation …”

NC Watcher, while agreeing with what you say, and apologies to Bill for bringing the subject up this last time, I think there is more going on than you say. I honestly think the site has undergone some kind of implicit transformation over the past year or so. The convenor has claimed that she has gotten no sleep trying to keep up with all that is going on with the Greek drama yet gets it wrong much of the time, and coruscates some critics for not agreeing with the analysis, some of it justified but others … .

Another issue is that the convenor seems to be worried about the lack of comment on financial essays on the site, as “important people” read the site for guidance. In consequence it seems, the site has blocked comments to some articles which were said to be composed by trolls.

In short, something is going on with the site that is not clear to me. It appears as if the principal function of the site has altered since its inception, or so it seems to me. I was not aware that visiting the site provided revenue to the convener, as the site asks for donations couched in terminology that makes it seem like the site is functioning much like an intellectual “charity”. I realize that these functions are not incompatible; except perhaps ethically?

Wasn’t it labours’ Dennis Healey who first started to push for Neo-liberalism and deficit cutting long before Thatcher.He even put the country effective IMF administration and did their bidding,cutting the deficit by 3.9 in one year,all for a foreign currency loan(something which I still don’t understand).

That most of been when the left first gave way to the right’s arguments on economic management. No wonder the right has had a near monopoly on political management since!

“How do you explain the fact that public spending as a % of GDP in many European countries hasn’t really dropped since the rise of Monetarism?”

I’ll have ago at this if no-one else will take it up. For “monetarism” I’ll read neo-liberalism.

The size of the State is essentially a political choice. Should it be 30% or 50%? Or any value in-between? There’s no easy or correct answer to that question. I’d say the fundamental mistake made generally by those who would prefer a value at the lower end of the range is to think they can cut the size of the State by reducing the size of the government’s deficit.

All that does is reduce growth; and, so the GDP isn’t now what it should be. Therefore reducing the ratio of public spending to GDP is harder than it need be for those of a more rightward political inclination. If we add in that there is an increased need for discretionary public spending when the economy is in a state of recession that makes it harder still.

Or, to put in another way, if workers have lowly paid jobs they won’t be able to afford private education for their children or private health care for their families, and may even end up jobless or homeless forcing the “taxpayer” to pick up the tab for that too.

I was worried when Yanis kept saying there was no plan B. Surely he has been thinking of it I said to myself. Glad to know that he and others were.

James Galbraith has been working with YV unpaid on a Plan B for many months. It was completed a while ago. The reasons everyone kept stumm was that it was felt that it would interfere with the “negotiations” that were taking place and not help at all. Any need for secrecy is now moot.

“Britain’s own economic growth was lower from 1980 relative to the three decades previously and markedly so since 2007.”

And yet, between 1995 and 2008, the UK had the highest increase in GDP per caput of the G7 countries.

The impact of poor economic policy choices on this side of the pond…my two cents worth…..

President Obama/Council of Economic Advisers:

WE have an unemployment crisis in America- with oft dire social consequences…but no viable solution.

For instance, we have 60% minority unemployment in our inner-cities, with drug cultures and economies common, and an epidemic of homicides…

Further, given “automation”, alone, the jobless rate is increasing exponentially the further we advance into the 21st Century-with robots/automation in our manufacturing and warehouses, replacing million of jobs, currently well underway-

We are a “CanDo” nation and a comparable metaphor for our current job creation policies, would be our using a lawnmower engine in the Saturn V rocket in our historic trip to the Moon….[and it doesn’t take a rocket scientist to predict the result, if we had…]…

The over-arching question, here, is why are we clinging to an archaic and unworkable 18th Century job creation model, to solve a 21st Century problem?

Specifically, we are applying policies driven by “Fix the market, and this fix unemployment-[HR 2847]”, rather than “Fix unemployment, and this will fix the market-[HR 1000]”….

And no doubt just plain “tradition” offers a partial answer-as Dr. David Ewing observed in his book Freedom Inside The Organization, “employee rights are like a black hole in space, so impacted by tradition, light can barely escape”….

But, we would be disingenuous if we ignore that the 1% have spent tens of millions, since WW II, buying governors, legislators, etc., to cement “at will” employment in every state [to eliminate “Job Security” in America–only Montana limits “at will” to probationary employees]; And, to destroy labor unions in America!

In short, the 1% have spent tens of millions to abolish “employee rights” in America, and subsequently are indifferent to the adverse consequences of unemployment-i.e., we are clinging to 18th Century job creation-because the 1% wants it that way-and thus far Washington has been unwilling, or unable to counter this destructive agenda….regardless of the adverse consequences of unemployment.

It is destructive because unemployment is a No One Wins, the jobless lose, civility loses, And the market loses, to wit:

THE LAW OF DIMINISHED INCOME TO THE MARKET FROM UNEMPLOYMENT [hereafter D/UE LAW]

3% is the zero-sum threshold above which unemployment triggers inflation by diminishing labor training and skills, under-utilizing capital resources, reducing the rate of productivity advance, increasing unit labor costs, reducing the general supply of goods and services–and the loss in income to the Market is compounded exponentially with each percentage point of increase in unemployment, above 3%.

Ref: THE MARKET IS INCAPABLE OF CREATING ENOUGH JOBS, & FULL EMPLOYMENT IS A PRO-MARKET CONCEPT, Amazon/Kindle

Jim Green, Democrat opponent to Lamar Smith, Congress, 2000

Jim, your conception that fixing unemployment will fix the market is not far off what Keynes said in a radio program in 1933: Look after unemployment and the Budget will look after itself.

Larry, then I am in good company….in sum, I support our being solution-driven–I feel our objective should be singular: What Works?

@Bill

“On NC – I would recommend steering clear of the site from now on. It pretensions to progressive thought are suspect and every time you visit the page you provide advertising revenue to the convenor.

Do you really want to fund these ideas?

I will delete comments from now on that provide links to NC.”

I read this blog every day and I enjoyed Eurozone dystopia, but this kind of reaction is a bit sad. If NC is not progressive, then who is? By and large, they share your economic ideas, and now you’re excommunicating them because of an IT disagreement?

@petermartin

Thanks for your explanation. Maybe monetarism/neo-liberalism is more about redistributing income than shrinking the state (despite the propaganda, as we’ve seen with Cameron).

@ larry

Unlike YV I don’t have any game-theory credentials. But on the rare occasions when I do play poker I know enough to not bluff with my cards face up! If I get dealt an ace I don’t put that on one side, for all to see, and declare my intention to never use it!

Wasn’t that the big mistake made by the Greek negotiating team? “Everyone kept stumm”. Yes but why? There should have been at least tiny hints that a plan B existed. There shouldn’t have been quite so many statements that Greece was determined to remain in the EZ come what may.

@postkey

“And yet, between 1995 and 2008, the UK had the highest increase in GDP per caput of the G7 countries.”

You’re right. The economic performance wasn’t bad at the time. It was certainly good enough to give Tony Blair his three election victories. Tony Blair was lucky to start when he did and even luckier (or smarter ? ) to finish when he did. His economic success was based on the principle that the economy could be controlled by interest rate adjustments and the creation of ever increasing amounts of private debt in the economy.

In his early years he presided over the dotcom bubble. The UK govt deficit shrank and even turned to a surplus. Just like Clinton in the USA he claimed it was all due to his succesful economic policies. Gordon Brown proclaimed the end of boom and bust. But the dotcom bubble did burst and that was replaced with a new housing bubble – lasting until 2008.

So it was good while it lasted. House owners would often make more from their houses than they did from their job. But this is no way to run an economy. It all had to end in tears and it did.