Today (January 22, 2026), the Australian Bureau of Statistics (ABS) released the latest labour force…

Why no-one should vote for the Australian Labor Party

It is a public holiday in Australia today – Queen’s Birthday, a reflection of our past as a colony. Not a lot has actually changed and we still cannot shed the monarchy. Anyway, not many people reflect on the monarchy today given it is deep winter and football matches are on as part of the holiday. But in keeping with the holiday spirit, I will only write a short blog today. The topic is why no-one should vote for the Australian Labor Party although the argument is applicable to all parties like it, who formerly represented the interests of workers and who are now dominated by politicians who have embraced the neo-liberal macroeconomic myths as if they are truths and, if that wasn’t bad enough, have become active proselytizers of this destructive religion. I might write a few words about the on-going Eurozone saga too, given the extraordinary comments by leading European politicians overnight. Then I will head like thousands of others to the football!

The ABC news report (June 6, 2015) – Budget 2015: Opposition backs Government bid to scrap $3b income tax cuts – reported that the conservative Federal government is scrapping “$3 billion worth of income tax cuts” promised as part of the compensation package associated with the previous Labor government’s introduction of a Carbon Tax.

The tax cuts were cuckoo-land stuff given that the Carbon Tax was meant to send a price signal that buying carbon-intensive products was bad for the environment and should be reduced. The tax cuts were the political sop which nullified the price signal to consumers. The Labor government wasn’t prepared to tell consumers that some things would become more expensive and that this was by design to reduce carbon use.

The conservative government that replaced them in September 2013 scrapped the Carbon Tax as a sop to their mates in the mining industry and as a reflection of their on-going denial that there is any climate change issues that governments should be addressing.

They then determined that the tax compensation (tax cuts) were redundant.

On May 6, 2015, the Federal Opposition Treasury Spokesperson, Chris Bown said that the – Economy can’t afford another budget that is not in the national interest.

Which is an admirable statement but the devil is in the detail.

He went on to say that:

We continue to see a flurry of surveys pointing to sluggish aggregate demand which is directly impacted by consumers and businesses not feeling confident about the future.

The lack of confidence about the future is strongly influenced by the rising unemployment rate, which, in turn, erodes the incentive to invest by firms as sales flag. This lack of spending, lack of confidence, rising unemployment feeds on itself, which is why economists such as John Maynard Keynes advocated an intervention by governments in the form of a spending boost to arrest the malaise.

But the important point was that he introduced “aggregate demand”, that is, total spending into the frame that the fiscal policy strategy outlined in the fiscal statement (aka “The Budget”) had to address or be mindful of.

After all it is the state of spending relative to the availibility of productive resources, including labour that fiscal policy adjustments aim to influence.

The goal is to ensure that total spending in the economy is growing in line with the productive capacity of the economy such that there are no idle productive resources, particularly labour.

But we started to get a better impression of what the Opposition Treasury spokesperson thought when he addressed the National Press Club in Canberra on May 20, 2015, following the release of the Government’s fiscal statement.

In his speech – Labor and the economy: owning the future – he said:

You won’t hear me make the ridiculous claim that my predecessor as Shadow Treasurer, the now Treasurer, made that you can magically fix the budget bottom line without revenue measures.

To put it another way: the budget has a revenue problem and a spending problem following the Abbott Government taking spending to GFC levels in this Budget …

We have made clear that our fiscal plan will contain more savings than spending over the decade …

There is no doubt that difficult decisions are and will be necessary to ensure long term budget health.

Anyone who knows anything about fiscal parameters in a modern monetary economy, knows that the fiscal balance cannot be ‘sick’ and that neo-liberal metaphors about “budget health” are inapplicable.

The fiscal balance is what it is – the difference between government spending and revenue. Whether that is an appropriate balance is not something that we can assess without further information.

A fiscal deficit of 10 per cent of GDP might be very appropriate in one circumstance and outrightly irresponsible in another circumstance, just as a 2 or 3 per cent deficit might be. The number, in itself, provides no relevant information.

His reference to the “revenue problem” is his claim that the revenue is insufficient and that explains, in his view, the excessively high fiscal deficit. That is why his party is proposing lifting taxes to reduce the deficit.

What other information would we need before we could conclude this was a responsible strategy? Obviously, knowledge of “aggregate demand”. Is there enough spending in the economy to fully employ the available workforce?

It is a simple question and one that should be asked always when discussing fiscal policy settings.

If the answer is No, then we would conclude that given the current private spending decisions, the government’s fiscal deficit is too small! The solution? Increase government net spending and/or seek ways to stimulate private spending. In the latter case, that might require further tax cuts, which would, initially, increase the fiscal deficit.

In this blog – What causes mass unemployment? – I explain why mass unemployment signifies that the fiscal deficit is too low.

Modern Monetary Theory (MMT) shows that taxation functions to promote offers from private individuals to government of goods and services in return for the necessary funds to extinguish the tax liabilities.

So taxation is a way that the government can elicit resources from the non-government sector because the latter have to get $s to pay their tax bills. Where else can they get the $s unless the government spends them on goods and services provided by the non-government sector?

The mainstream economists conceive of taxation as providing revenue to the government which it requires in order to spend. In fact, the reverse is the truth.

Government spending provides revenue to the non-government sector which then allows them to extinguish their taxation liabilities. So the funds necessary to pay the tax liabilities are provided to the non-government sector by government spending.

It follows that the imposition of the taxation liability creates a demand for the government currency in the non-government sector which allows the government to pursue its economic and social policy program.

Given that the non-government sector requires fiat currency to pay its taxation liabilities, in the first instance, the imposition of taxes (without a concomitant injection of spending) by design creates unemployment (people seeking paid work) in the non-government sector.

The unemployed or idle non-government resources can then be utilised through government spending injections, which amount to a transfer of real goods and services from the non-government to the government sector.

In turn, this transfer facilitates the government’s socio-economic program. While real resources are transferred from the non-government sector in the form of goods and services that are purchased by government, the motivation to supply these resources is sourced back to the need to acquire fiat currency to extinguish the tax liabilities.

Further, while real resources are transferred, the taxation provides no additional financial capacity to the government of issue.

Mmass unemployment arises if total spending is insufficient to support output levels that are commensurate with jobs being provided for the available labour.

For aggregate output to be sold, total spending must equal the total income generated in production (whether actual income generated in production is fully spent or not in each period).

Involuntary unemployment is idle labour offered for sale with no buyers at current prices (wages). Unemployment occurs when the private sector, in aggregate, desires to earn the monetary unit of account through the offer of labour but doesn’t desire to spend all it earns, other things equal.

As a result, involuntary inventory accumulation among sellers of goods and services translates into decreased output and employment.

In this situation, nominal (or real) wage cuts per se do not clear the labour market, unless those cuts somehow eliminate the private sector desire to net save, and thereby increase spending.

So we are now seeing that at a macroeconomic level, manipulating wage levels (or rates of growth) would not seem to be an effective strategy to solve mass unemployment. I will return to this soon.

MMT provides the insight that mass unemployment thus occurs when net government spending is too low, given the current spending plans and actions of the non-government sector.

To recap: The purpose of State Money is to facilitate the movement of real goods and services from the non-government (largely private) sector to the government (public) domain.

Government achieves this transfer by first levying a tax, which creates a notional demand for its currency of issue.

To obtain funds needed to pay taxes and net save, non-government agents offer real goods and services for sale in exchange for the needed units of the currency. This includes, of-course, the offer of labour by the unemployed.

The obvious conclusion is that unemployment occurs when net government spending is too low to accommodate the need to pay taxes and the desire to net save.

This analysis also sets the limits on government spending. It is clear that government spending has to be sufficient to allow taxes to be paid. In addition, net government spending is required to meet the private desire to save (accumulate net financial assets).

It is also clear that if the Government doesn’t spend enough to cover taxes and the non-government sector’s desire to save the manifestation of this deficiency will be unemployment.

Keynesians have used the term demand-deficient unemployment. In MMT, the basis of this deficiency is at all times inadequate net government spending, given the private spending (saving) decisions in force at any particular time.

Shift in private spending certainly lead to job losses but the persistent of these job losses is all down to inadequate net government spending.

This is the theoretical base that should inform the Opposition Treasury Spokesperson’s commentary on fiscal matters.

In his assessment of the fiscal position of the current government he makes no reference to these matters. He think a fiscal problem (excessive deficit) is to be understood with reference to the current $ value of the fiscal balance.

This becomes very evident in his latest statements in the ABC news report cited at the outset.

When the Government announced its decision to withdraw the tax cuts associated with the Carbon Tax, the ABC said that:

Shadow treasurer Chris Bowen said Labor had taken the “responsible view” that the tax cuts were no longer appropriate.

“For somebody on around $65,000 a year, it will mean a difference of $1.50 a week. But it is a saving or a boost to the budget bottom line of around $2.8 billion over four years,” he told reporters in Sydney.

“Of course, everybody wants to see tax lower rather than higher.

“But given this is the Government’s position not to have these tax cuts and given the state of the budget deficit, the responsible thing for Labor to do is to give its support.”

At that point, you realise that the Opposition’s understanding of macroeconomics is pitiful and, if elected in next year’s federal election, they would continue with the high unemployment path that has characterised their times in office since the early 1980s.

Question: is their sufficient spending in the economy at present? How would we assess that?

Answer: Easy, by looking at the unemployment and underemployment rate?

At present, the unemployment rate stands at 6.2 per cent and since February 2008 it has risen by 2.2 per cent.

Underemployment is at 8.6 per cent having risen by 2.7 per cent since February 2008.

Even at February 2008, which was the lowest unemployment reached in the last growth cycle, total labour underutilisation stood at 9.9 per cent, which could hardly be construed as a full employment state.

At present, there are more than 15 per cent of available labour resources underutilised if you add the unemployment rate to the underemployment rate and also recognise that the participation rate is well below it last peak as a result of the lack of employment opportunities.

We also know from last week, that retail sales declined in the last month and that investment growth was negative.

So, applying first principles tells me that the fiscal deficit is too small by some margin.

So “given the state of the budget”, the Opposition should be advocating retaining the tax cuts and/or rather significantly boosting government spending.

It is doing exactly the opposite, which means it is advocating fiscal positions that are contrary to the national interest.

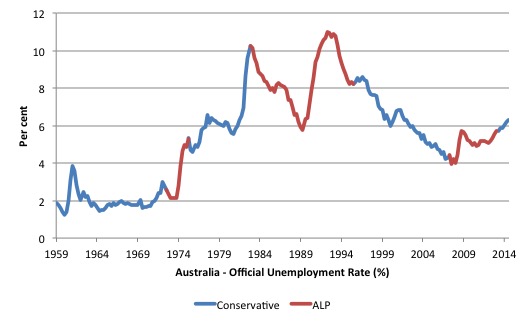

The following graph shows the history of the Australian unemployment rate since the September-quarter 1959 to the March-quarter 2015. The blue segments are the periods that the Conservatives (the current government) ruled at the federal level, whereas the red segments are the periods that the Australian Labor Party (ALP) were in federal office.

The ALP can hardly claim to be a party of low unemployment.

Since 1959, the average unemployment during the conservative period’s of federal office is 4.57 per cent, whereas for the Australian Labor Party it has been 6.91 per cent.

If we take out the full employment years (in this sample – 1959 to 1974), the averages are 6.24 per cent (Conservatives) and 7.30 per cent (ALP).

When the ALP embraced neo-liberal economic thinking in the mid-1980s, it became a party of entrenched high unemployment.

Since the September-quarter 1959 to the March-quarter 2015, the average unemployment during the conservative period’s of federal office is 4.57 per cent, whereas for the Australian Labor Party it has been 6.91 per cent.

If we take out the full employment years (in this sample – 1959 to 1974 – the averages are 6.24 per cent (Conservatives) and 7.30 per cent (ALP).

Eurozone issues

In the EUobserver article (June 8, 2015) – Juncker rebukes Tsipras after parliament speech – which recounted how EU President Juncker refused to meet with the Greek Prime Minister on Saturday last because the latter had failed to engage with the negotiation process properly.

Juncker accused Tsipras of lying to the Greek Parliament about the nature of the negotiations and the position of the EU within them.

Obviously, things are getting to the pointy end.

Relatedly, today’s Reuter’s press article (June 8, 2015) – EU chief rebukes Greece, demands swift debt plan – reported a comment from the EU Council President Donald Tusk in relation to the negotiations.

He is quoted as saying:

If someone says I will lend you money but please give it back to me in the future, that person is not a ruthless robber, and it’s not true (that) debtors are always moral and creditors are always immoral.

He clearly misses the point. The immorality that the Greek government is suggesting relates to the deliberate impoverishment of a nation’s people by the Troika, who set terms and conditions for loans that could never be met but which would cause untold social and personal harship.

When lenders conspire to undermine the prosperity of an entire nation to advance their own political and ideological interests, it is fair to call that immoral.

When elites in Brussels, Frankfurt, and Washington, who are not even elected by nor accountable to any electorate, deliberately create unemployment rates in excess of 25 per cent and allow around 60 per cent of a nation’s youth who want to work remain jobless, then that is immoral.

As we noted above, there is no secret to mass unemployment. The austerity that the ideologues in the Troika have imposed on Greece has cause the mass unemployment.

It is immoral for any system to deliberately seek to do that and then insist that the austerity is intensified to make the situation worse.

Mr Tusk should have his pay and future pension inversely linked to the Greek unemployment rate. Then we would see what he advocated.

Reuters also quoted the Slovakian Finance Minister Peter Kazimir who is an austerity “hardliner” saying that Greece has to “surrender, to continue with the programme”.

Surrender – all the connotations of subservience and defeat rather than partnership of equals.

I remain convinced that Greece should exit the Eurozone immediately, redenominate all debts in their new currency, and introduce a Job Guarantee along with other stimulatory measures.

Within one quarter they would be growing strongly – and demonstrating to Spain, Italy, and other nations what life can be like outside the sociopathological straitjacket of the Eurozone.

1945 White Paper on Full Employment Workshop – Sydney, May 30, 2015

This is the edited video of the five presentations at the Workshop in Sydney on May 30, 2015. The audio at times is not optimal but you can adjust volumes accordingly.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

In my opinion Tsipras will either surrender or be ousted within weeks. At least this is what has been said between the lines on G7 summit in Bavaria by the Leaders of the Free World. After Tsipras and Varoufakis have been removed they will “bail-out” or “bail-in” Greece again (like Cyprus) and everyone will forget about the story in 2 weeks time. It is just a matter of a few keystrokes and maybe sending a few people to Guantanamo Bay for re-education in neoclassical economics.

The Euro is irreversible. You cannot fully remove HIV from your blood once you have contracted it.

I propose the (admittedly far-fetched) hypothesis that Chris Bowen knows that more govt. spending is required to stimulate the economy, but removing a tax-break will push it even more towards recession. The hope is that the economy will be in recession when the next election is called and this will work in Labor’s favour.

Not only far fetched, totaram, but taking wishful thinking to an extreme. Labor/Labour parties in both Australia and the UK have surrendered to discredited orthodoxy, and for the foreseeable future will be a waste of time, and indeed a barrier to progress.

Dear Bill

Sometimes voting means choosing the lesser of 2 evils.

What is called football in Britain is called soccer in Canada and the US. Is football in Australia like football in Britain or like football in the US? Sorry, I really don’t know.

Regards. James

AUSTERITY IS A LIE

IT IS FEUDALISM – NOT CAPITALISM

Austerity in a recession is merely our feudal lords going back to making us all enslaved serfs.

The UK political class are stuck in a feudal aristocratic mindset of our Norman forebears.

They cannot comprehend capitalism.

This is what Australia’s Abbott is copying from our Tories current Labour parties in the UK.

No society in the world throughout history has not has a social uprising from extreme inequality – which means the poor left to starve, while the rich get richer.

Or in tis case the rich politicians get richer, whilst the very rich see the repeat of history imminent from the starving poor.

If Tsipras falls in Greece, the people will revolt against the EU. To give hope and then snatch it away.

But the current idea is to leave pensioners without a pension from all sources of pension, not just the state, but also works and private in Greece.

For wages to fall to nothing, which means capitalism is being wiped out in Greece.

Why?

This is empire asset grabbing.

We see this in the UK, where the utilities and railways are owned by foreign governments, not private companies.

[Bill edited out advertising]

Agree with you 100% on Greece.

I have difficulty computing the MMT perspective on taxation.

I understand that taxation creates unemployment,extinguishes private sector resources.

I understand that govt spending generates demand.which creates employment.

But how does taxation generate demand for currency when taxation liabilities are only incurred by firms /workers once they begin earning/ creating profits.i.e income tax.

Workers and firms don’t need to need to pay tax if they aren’t earning anything.

Worker and firms provide goods and services to earn a living(consume) not just save and pay a tax.

What is meant by “notional demand”

‘men hew an image out of fear and call it god’

The new god is ‘the market’ .Fear is natural.It is an effective

weapon for reactionary politics .The old social democratic parties

have not only given up on Keynesian fiscal stimulus,they have

given up on the mixed economy as a necessary correction to the market for

both the development and distribution of real resources.Not only have they

given up on full employment they have given up on hope.

I have one problem with the analysis above.It is that unemployment occurs

when net government spending is too low to accomadate the need to pay taxes

and the desire to save.Just impossible to quantify the desire to save .It infers

that when some OECD countries did achieve frictional rates of unemployment

the private sector achieved its desired saving levels ,this is far from the truth

for the majority. Why would the poor not desire the saving levels of the rich?

Bill Shorten , and Labor, is Abbott’s secret weapon to retain government. It’s going well!

A pox on all of them! Even the Greens, who sponsored a talk on MMT in South Australia by Steven Hail have not taken it on board! Just vague talk of putting it on an agenda;

http://vimeo.com/117137212

Our politicians whatever the political stripe have all succumbed to limiting debate to that which can be acomplished by government inside the neo classical box that they have been taught to work within; lest they appear ignorant. That means that government must generate tax “revenue” or ” fill the coffers” now in order to spend later.

It’s really difficult to have any sort of meaningful discussion with politicians who believe things like: aggregate demand can be stimulated by inventing newer better gadgets so we need to give corporations tax incentives to support the development of these things in order to create jobs. Obviously those politicians don’t even bother to try and learn basic economic terminology if they think aggregate demand means lot’s of people wanting new gadgets!

It makes you laugh first and then cry. It’s as though reality about the issuer of money has been erased from memory. The new story resembles devine conception.

Much time I fear, is being wasted by politicians trying to figure out how to tailor their political program initiatives to make sense within a senseless economic paradigm, because they do not know how to argue their way out of that box in a way were the voters can clearly see what they are trying to do. Ignorance and fear are the only tools needed to derail progress.

Mutatis mutandis, the same would apply to the Spanish Socialist Party. Today I read in a local paper that the Socialist Party is proposing the creation of 200,000 jobs in Spain in the public sector (http://www.elmundo.es/espana/2015/06/08/55749a8e268e3ec0638b4574.html). This is their plan for a country where more than 5 million people are unemployed or underemployed. Is this the best that they can offer? Naturally they are mirred in the neoliberal narrative of fiscal budget sustainability and the need to save the Euro at all costs. It is simply a scandal. To add insult upon injury, the Organization representing businesses considers this plan a return to the “forgotten dogma that jobs cab be created artificially”.

Jake, look at it this way: (For ease, I’ll ignore imports/exports for the moment, and hope Bill can correct me if I go wrong anywhere)

Government imposes a tax on all individuals and businesses, and demands that the tax be paid in the currency of issue (£ in UK, AU$ in Australia etc).

As all citizens and businesses in UK (I’ll stick to UK as that’s where I’m from) require £ in order to relinquish these tax liabilities, they will offer goods and services in exchange for £. Many (but not all) will offer these goods and services to the Government, who are the ultimate source of £. Others can offer goods and services to these recipients of £ instead of to the Government.

In addition, individuals and businesses will wish to save £ for purchases later (capital investment or big spends), since these purchases can be made in £, as the suppliers of the CI/spending will accept £ as payment. For the business sector, this saving means some individuals will be unable to earn the £ required to pay their tax liabilities, so remain unemployed (their services are wanted neither by businesses or the Government).

If the Government wants to eliminate these unemployed individuals, there are two things they can do:

1) Employ them directly (Jobs Guarantee)

2) Increase spending by, for example, reducing business tax rates, sufficient so that those businesses can save what they want to and still have surplus £ resources, which encourages them to recruit. i.e. match their saving desires with spending.

Problems with 1) – increases deficit/debt, though realistically this is not an issue, since they choose to issue debt and can always pay any liabilities in their own currency

Problems with 2) – Businesses often use tax cuts to increase profits to shareholders and pay of top executives rather than increasing employed resources, even though increasing employed resources will, long term, increase demand for the goods and services they need (as the employed resources will, across all businesses, require goods and services they provide)

Oops, that comment above should have read “if the government wants to eliminate unemployment” rather than “eliminate these unemployed individuals” :/

@James Schipper Neither!

Jake,

This article explains.

http://heteconomist.com/currency-viability-in-a-pure-income-tax-regime-with-a-basic-income/?utm_source=rss&utm_medium=rss&utm_campaign=currency-viability-in-a-pure-income-tax-regime-with-a-basic-income

Bill –

Is it any wonder the ALP aren’t doing what you want them to? They tried it in the 1970s and they ended up with high inflation but unemployment still more than doubled. What lesson do you think they should’ve learned from that?

That’s not a rhetorical question BTW. My own conclusion is that the wage share was too high, and the economy would’ve been more resilient had the wage share been lower. But you keep advocating a higher wage share…

And despite that rise in unemployment under Whitlam, your graph seems to show that most of the increase in unemployment occurred when the Libs were in power.

As for their allowing the tax break removal, that’s more likely to be political. Not as organised as totaram’s hypothesis, but they can see the Libs’ economic policy is likely to fail again, and they don’t want to be in a position where they can be blamed for that failure.

Hi Bill,

I’m trying to find a link between small deficits and unemployment by comparing 2 graphs here in the UK.

I’m using the UK sectoral balances graph between 1987 -2014

http://www.eoi.es/blogs/the-spanish-paradox/files/2015/04/Capture.png

And

UK unemployment rate between 1987-2014

http://www.tradingeconomics.com/united-kingdom/unemployment-rate

What I was hoping to find was a link between small deficts and an increasing unemployment rate.

However, what I have found is the UK unemployment rate mirrors the private sector part of the balance and not the government part of the sectoral balance.

It seems back to front to me ?

Comparing the 2 graphs – why does unemployment fall when the private setor is in defict and rise when it is in surplus ?

Why does unemployment rise when the government sector goes into defict ?

Thanks

“But how does taxation generate demand for currency when taxation liabilities are only incurred by firms /workers once they begin earning/ creating profits.i.e income tax.”

Not all taxation, fees or fines do that. There are property taxes, there are fees for official documents, there are fines for misdemeanours.

All of those create a demand for the currency on pain of jail time. Once you have an outstanding liability and make an offer to purchase output using the same scrip then people start to earn, and pay tax on the earnings freeing up more space to purchase output.

Remember that the taxation demand for currency is a sufficient condition to cause a currency to circulate. Once you have the circulation started you can wind back on the absolute liabilities and rely on the ongoing circulation to generate relative ones.

Just as you don’t need your starter motor on your car once the engine is going.

Hi Jake

Read these:

https://billmitchell.org/blog/?p=1075 A simple business card economy

http://moslereconomics.com/wp-content/powerpoints/7DIF.pdf pages 25 – 30 .

Then you’ll get it.

@Aidan Stanger

Full employment was not just something tried in the 1970’s. I recommend reading more of the literature and make a re-appraisal of the evidence. Bill’s book is a good start, Its a great read.

A good source is Mosler’s work on inflation modelling when put up against the real world data does a remarkable job.

Cost push inflation or supply shocks has ~90% causality (page 24, 48) with the inflation experienced for example in the 1970’s following from OPEC crisis. Wage share and employment levels with the Phillips curve correlation to inflation are discussed in section 6.

http://www.princeton.edu/~mwatson/papers/RelGoods_August2008.pdf

All the best.

The ALP appears to be as bad as the UK Labour party. Liz Kendall, one of those running for the leadership of the party, recently advocated that the government should be running surpluses. In fact, virtually all of the Labour ministers I know of tout the neoclassical line. In the 1970s, Ralph Miliband, late father of the recently deposed Ed, told me that he thought that the Labour party had sold out its constituents. I was a trifle skeptical then, only recently in the country, but it didn’t take long to see that he may have been right. And he certainly would have hated Blairism, another boil the Labour party has to lance, though currently it appears incapable of doing that. They will remain an irrelevance until they do that and, moreover, begin to change their economic narrative.

Starter motor: nice analogy Neil.

Hey Bill

How about this for a Greek strategy!

“borrowing from Greek banks in order to transfer Euros out of Greece. On exit and redenomination the loans would be converted to drachma, which would promptly devalue leaving the Greek borrowers in possession of stashes of Euros for which they would now pay much less.”

Guys,

Anybody able to help me with my 2 graph problem above ?

Thanks.

I can comment on Donald Tusk’s remarks, based on what Steve Keen had to say about Moral Hazard. When it relates to interpersonal loans, a default deprives the other part of real assets i.e., stealing.

With banks there is no moral hazard. Banks are factories, not warehouses.The deposits they create are just notations in the accounts. If a borrower defaults the bank loses no assets. The numbers in it’s accounts just get written down to match the default. It still adds to Zero.

Derek Henry,

When the private sector’s doing well, businesses can afford to expand therefore it tends to employ more people and run a deficit.

When the private sector’s doing badly, it makes less money but typically has debts left over from the previous boom so has to use the money to pay those off rather than paying more (or even the same number of) employees. Meanwhile profits are down so government revenue declines, and government spending doesn’t rise anywhere near enough to make up for the decline in private spending. Indeed the government may even try to cut its spending.

Why did you expect to find a link between small deficts and an increasing unemployment rate?

@sam w

I’m well aware that the oil price was the main cause of the inflation. But the issue is what to do about it. There’s a perception that inflation destroys the ability of a government to spend its way out of trouble. Bill’s not done much to counteract that perception, and by largely ignoring the issue he’s made it easier for the ALP to ignore him.

A very good question what should a progressive government do in the face of a

major price shock.It should not be afraid of using all its powers for its citizens,spending,

taxation/welfare and regulation.Directly regulating prices and wages is very problematic.

Adjusting welfare and taxation to protect the majorities income to avoid the necessity of

wage rises to match inflation is within the bounds of monetary sovereigns.Pro active spending

on provision in vital areas ,Energy,Food((generally subsidies ),Housing,Transportation.

Of course this means expanding government sector deficits and the government sector of

the mixed economy.

@Aidan Stanger

Ok. Thanks i think they are good points.

Government will tax excess spending capacity to attenuate Demand-Pull inflation so that would be the case for a surplus or specific taxation of behaviours or earnings anyway? So thats counter to the scenario where they need to spend.

As for resource bottleneck Cost-Push inflation that would be anticipation of future resource scarcity. This mostly comes from the scientific community has issued about 500+ warnings by now about large scale agricultural systems failing due to climate change (basically pick your topic/resource).

I dont think the ALP Is even remotely on the ball park for this issue as it spans multiple domains not just economics. Using that argument by corollary many disciplines have not done enough to counteract ‘that’ perception in each respective field.

I agree yes the ALP will probably throw about the word inflation as an uneducated knee-jerk response to expansionary fiscal policy but Bill has done a fine job communicating how much spending is the right level of spending.

Its the media, politicians cognitive dissonance and groupthink which is the problem.

A test for this is try emailing your favourite politician/media outlet about some of the most rudimentary mechanics about modern fiat monetary systems (even tied in with a political stance said party holds). The response is often appauling.

Thanks Aidan,

When the private sector’s doing well, businesses can afford to expand therefore it tends to employ more people and run a deficit.

This makes sense.

Is the reverse true then. When they are not doing well they tend to save ? Which explains why the government sector has a bigger deficit. When the non govermental sector has a larger surplus on the sectoral balance graph ?

When the private sector’s doing badly, it makes less money but typically has debts left over from the previous boom so has to use the money to pay those off rather than paying more (or even the same number of) employees. Meanwhile profits are down so government revenue declines, and government spending doesn’t rise anywhere near enough to make up for the decline in private spending. Indeed the government may even try to cut its spending.

I’m lost on this part as the sectoral balance to me never shows this as the goverment sector and the non goverment sector are normally a mirror of themselves.

Why did you expect to find a link between small deficts and an increasing unemployment rate?

Because reading all of the blogs I’ve learned that the reason we have unemployment is because the goverment defict is too small. So I expected unemployment to rise as the goverment defict got smaller.

Maybe I’ve picked a wrong time period for the graphs as this was all under Neoliberalism and when goverment deficits did increase the money was not spent on tackling unemployment.

Or I need a crash course on reading the sectoral balances so I can interpret them better.

Aidan,

If the UK goverment had been a MMT government between 1987 -2014. Would there have been a link between the unemployment rate and the size of goverment deficits ?

Thanks

Aidan,

Also when Stephanie Kelton does videos on the sectoral balances she says the last thing we want is the non govermental sector going into deficit.

Yet, when it did between those 2 perios unemployment fell this threw me big time.

Derek Henry,

In answer to your last question: no. Unemployment would be constantly low whereas the government deficits would fluctuate according to economic cycles (probably going into surplus some of the time).

And in answer to your earlier questions:

Yes, businesses and households tend to save more (which in some cases actually means they take on less debt) when the future seems bleak or uncertain.

The government and private sector balances do mirror to a large extent, hence government spending cuts won’t have their intended effect of balancing the budget, but will instead result in declining tax revenue, damaging the private sector in the process.

It is the combined effect of the government and private sectors that determines unemployment, not one or the other.

Derek Henry

There’s a difference between small and too small. As things stand in the UK the government deficit is too small, but in earlier times under different conditions a similar deficit may have been big enough, or even too big. The appropriateness of the government’s fiscal balance depends on the net saving of the non-government, and that saving varies.

The answer is not to target the deficit at all, but instead target the things that matter, the real limits. Full employment, price stability, and environmental sustainability. Get those right and whatever fiscal balance the government finds itself running will be the right one, however big or small it is in absolute terms.

Derek Henry

the trouble with warren mosler’s explanation is that he side step the income tax and simply explains how property taxes will create demand.which doesn’t address my question.

but other commentators have helped to explain it anyway.

“Because reading all of the blogs I’ve learned that the reason we have unemployment is because the goverment defict is too small. So I expected unemployment to rise as the goverment defict got smaller.”

your question and data does surprise me as well. I would have thought that decreasing budget deficits would translate into increased unemployment too, (providing a trade deficit). I thought this is how sectorial balances would work.

Jake, the statement in the heteconomist link “Even so, in a hypothetical system with a tax imposed solely on income, the tax would still drive demand for a state money.” is just plain wrong. Wray makes this point occasionally: Income taxes cannot drive demand for money all by themselves. They can increase it if there is something else like property taxes, head taxes etc to initially drive demand. So you seeing this indicates a good understanding!

Jake,

I have posted link in the comments. Read it!

Great post Bill, amazing how you keep going. Your point about Labour parties is well taken and quite serious, re ref latest UK election d

Result is ukip and other extremists parties

Keep on, thanks for your energyiOy.

For confirmation of Bill’s article heading see this rubbish (if you can bear it): http://www.theguardian.com/commentisfree/2015/jun/09/our-ageing-population-isnt-a-disaster-we-have-the-tools-to-make-it-a-triumph

Neale, that’s the sort of waffle you get from all politicians! It doesn’t tell you anything about who’s worth voting for.

@Bob

Thanks!I did read it.much obliged for the help.

I’m starting to think the sectoral balances are telling us nothing.

They are so hard to make sense of. Too many variables.

Especially when we are being told you can’t run a budget surplus becuase our non govermental sector will be in a deficit which will create unemployment.

But that’s not the case if x+y = z under varying circumstances.

On the contrary, Derek, sectoral balances tell us a huge amount about what should be done in specific situations as most of the variables tend to be fairly predictable in the short term. And the employment rate rarely changes very quickly.

Crucially, sectoral balances tell us that austerity will fail to achieve a surplus unless the private sector is strong.

I don’t know who’s telling you you can’t run a budget surplus becuase our non govermental sector will be in a deficit which will create unemployment but they’re wrong. (Is it Stephanie Kelton? I’ve not seen her videos but if she’s making the silly claims you previously attributed to her, I wouldn’t be surprised if she claimed that too). The reason you can’t (at the moment) run a budget surplus is because doing so would reduce demand, thus reducing private sector investment, therefore our non governmental sector won’t be in deficit. But when the economy is doing well, fiscal policy can be a better way of controlling inflation than monetary policy. Reducing the deficit (or increasing the surplus, as the effect doesn’t change when you cross zero) has a similar effect to raising interest rates, but is less damaging to business profitability.

Derek, what are x, y, and z?

Low unemployment can coincide with private sector deficits, those deficits are spending after all. That situation is not sustainable though; it builds debt which eventually becomes impossible to service, and a slump occurs.

The sectoral balances may not tell us what will happen next week or next month, but they can indicate that the current state of affairs is unsustainable.

Aidan, I thought it was clear that was my point. Rubbish is the term used. Bill is making the point that “progressives” keep pointing at labour/labor parties as decent alternatives.

Sooo….really malcolm?? Your electorate carries a large number of yuppy negative gearers? More lies on this from you…what a surprise….its beside the point that it doesnt benefit the ordinary voter? Shame