I started my undergraduate studies in economics in the late 1970s after starting out as…

The Balanced Budget silly season is upon us again

Wasn’t Chuck Norris the muscle-bound guy with big guns and stuff who blasted the hell out of people and causes a lot of havoc? Well, apparently, he thinks he knows something about macroeconomics. In an article in the right-wing conservative media outlet WorldNetDaily (February 22, 2015) – Ready for a new U.S. Constitutional Convention? – Norris reveals what a knucklehead he really is. The article seems like an exercise in how many scary words, phrases and metaphors about government fiscal policy a writer can get into each sentence. Once you get over that there is nothing of substance left. Mr Action Man clearly needs to do some weights and leave the economics commentary to those who know even more than the slightest thing about it. American politics is once again come around to the more or less regular Balanced Budget Amendment (BBA) cycle. This is a regular comedy event that occupies Congress and all the commentators for a while as they reveal how little they know about the consequences of their grand plans for American prosperity. If they ever took it seriously it would be a disaster for the US economy and the people that depend on it.

The conservatives in the US have been trying for years to bring in this sort of fiscal rule. Chuck Baby thinks that the US should bring in the amendment via an Article V constitutional convention, which would mean the US states would combine to force the federal Congress to call such a convention.

Chuck quotes some two-bit economist from the University of Colorado (Barry Poulson) who claimed in this article (February 27, 2014) – It’s Time For States To Call A Constitutional Convention And Pass A Balanced Budget Amendment – that unless the US moves into fiscal surplus by cutting government spending:

… the task of balancing the federal budget becomes insurmountable. By then the economy will be stagnating; and eliminating deficits will require that federal spending be cut in half, something that will never happen.

If you examine the Forbes URL you will see it is published from a site labelled ‘real spin’. It surely is.

Poulson, it seems, has been tolling the bells of doom for years, presumably keeping an eye out the window for the day his prophecies of disaster and pestilence come to fruition.

The window is foggy now from all the hot air he generates in front of his computer pumping out one prophecy of collapse after another. But undeterred he continues, hoping to save his fellow American from something worse than (fill in the something that is worse than – whatever it actually is).

He is a master of the scary metaphor – regularly and liberally sprinkling his Op Ed articles (many for Forbes) with classics such as:

1. “profligate in their spending … crippling amounts of debt … the federal government is unsustainable and will eventually lead to default and bankruptcy … reckless spending …”

2. “Fiscal instability” … (for example) “Spain” (the classic conflation of monetary systems routine).

3. “a runaway Congress”

Unsurprisingly, Poulson is associated with various right-wing libertarian smokescreen-emitting organisations such as the Americans for Prosperity Foundation, the Heritage Foundation, and the Independence Institute. I hope they give him succour as he stares out that window waiting, in vain, for the Armageddon to subsume everyone and everything.

Chuck must have been mulling this all over the last year. Poulson wrote about the need for the states to call a constitutional convention to pass a BBA this time last year (February 27, 2014). A year later Chuck gets his computer humming and publishes his call for the same.

Although his article is mostly paraphrased from Poulsen including a bit of creative rearrangement of the order in which Poulson outlines his argument to give Chuck’s piece that air of originality.

I can’t say I wish Chuck had stuck to the movies because they were pretty awful as well.

Anyway, its silly season approaching in the US as the latest attempt at sealing a BBA looks like it is gathering pace. Hopefully, it will fail as have the many attempts in the past.

Australia is about to have our version of this stupidity when the Federal government releases its latest ‘intergenerational report’ this week, which will be full of scary claims about government insolvency, higher taxes, ‘budget’ repair, and all the rest of the weasel words that neo-liberals use to hide the fact that the challenge of an ageing population has nothing to do with financial ratio and everything to do with the future productivity of the workforce.

That productivity, in turn, requires massive investment now in public education and policies that ensure all our youth are engaged in schooling, training and work. With teenage unemployment rising sharply, the participation rate down significantly, and the NEET ratio rising, the current policy settings, which are claiming to be about reaching a fiscal surplus as soon as possible, are undermining the future.

So what is wrong with a Balanced Budget Amendment for a currency-issuing national government? Well, to be succinct – almost everything!

The first serious attempt at pushing such an amendment through was on May 4, 1936 when the Republic representative from Minnesota (Harold Knutson) introduced the bill House Joint Resolution 579, which proposed a per capita limit on federal debt. It didn’t get even get into the Committee stage of the legislative process.

Please see the – Report 105-3, 105th Congress, 1st session, February 3, 1997, pp. 3-7 – for a brief legislative history of the failed BBA efforts.

In 1936, the US was growing strongly (13 per cent between 1935 and 1936) on the back of the New Deal. The Fiscal Deficits as a percent of GDP was 5.5 per cent (up from 4.4 per cent in 1935). Inflation was falling (1.5 per cent in 1936 compared to 2.2 per cent in 1935 and 3.1 per cent in 1934).

The fiscal stimulus introduced as part of the New Deal was supporting growth from 1934 and the unemployment rate fell from 14.4 per cent in 1934 to 10 per cent in 1936 and 9.2 per cent in 1937.

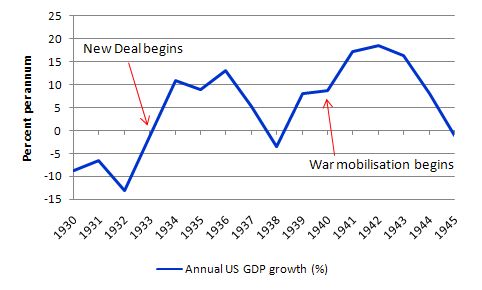

You can see this in the following graph which shows annual GDP growth in the US between 1930 and 1945.

The worst days of the Great Depression were seemingly behind the nation as governments learned that their fiscal capacity backed by their currency-issuing power was very effective at filling large spending gaps left by private sector caution.

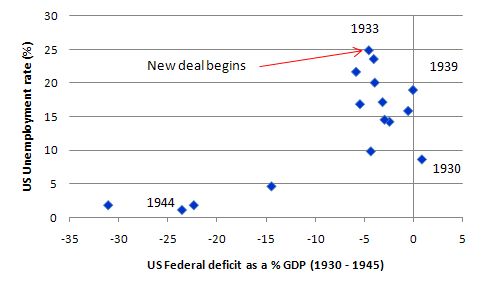

To see this in graphic terms here is a graph showing the US Federal budget deficit (-) between 1930 and 1945 plotted against the US national unemployment rate. The New Deal certainly reduced the unemployment rate but it wasn’t until the deficits really grew as a proportion of GDP that full employment returned. That did not occur until the defense spending was ramped up in 1940.

You can get the data in the graph from Bureau of Economic Analysis and Bureau of Labor Statistics – Historical Statistics US (1976) series D-86.

The same pattern occurred all over the Depression-ravaged world. It was beyond doubt that the war expenditure pursued by national governments in defense of their borders brought their economies quickly back to full employment. The experience did not render them insolvent and the main issue (or threat) was how to avoid inflation from occurring.

But back to the US in 1936. The inherent conservatism of the Treasury secretary Henry Morgenthau emerged in 1936. FDR was not a ‘Keynesian’. The fiscal deficits embarrassed him. He was being constantly berated by conservative deficit terrorists (he himself was one) and finally gave into the pressure that was being put on him.

Morgenthau was scared stiff that the fiscal deficits would ignite an inflationary spiral, undermine the capacity to save in the private sector and degrade the value of the US dollar – all familiar narratives even today.

Morgenthau also was obsessed with financial ratios – “budgetary cost and tax burdens rather than needs, rights, or obligations” (Zelizer, 2000).

[Reference: Zelizer, J.E. (2000) ‘The Forgotten Legacy of the New Deal: Fiscal Conservatism and the Roosevelt Administration, 1933-1938’, Presidential Studies Quarterly, 30(2)].

So he didn’t understand the notion of – Functional finance. He was obsessed with ‘morality’ about debt and public frugality. He came from a wealthy family and had never experienced unemployment.

By 1935, he was pressuring Roosevelt to cut back on spending and he succeeded in cutting the number of beneficiaries on public aid administered through the states.

By December 1935, Roosevelt announced a massive cut in government spending claiming that he “wanted to impress on the country the fact that the budget is balanced except for relief” (Zelizer, 2000).

In the lead up to the Presidential election, Morgenthau continued his campaign to cut public spending, particularly in the area of the Public Works Administration (PWA), which had significantly reduced unemployment rates.

He spooked FDR by pointing to the size of the fiscal deficit which he claimed was introducing an “inflationary psychology” (Zelizer, 2000), despite the slowing inflation.

He came into direct conflict with the then Chairman of the Federal Reserve Bank (Marriner Eccles) who was actively disabusing people of the dangers of deficit spending.

Zelizer (2000) reports on a diary entry where Morgenthau wrote in late 1936:

This is one of the most important challenges to your intellectual ability because the President has absorbed Eccles’ philosophy and you have the job of dynamiting Eccles’ stuff out of the President’s brain and if you fail you will find that Eccles will become the President’s fiscal adviser.

No uncertainty about where he stood!

As it turned out, he was successful in securing significant fiscal cuts (spending) in 1937 with the aim of balancing the fiscal position by 1938 – which in the scheme of things was a massive fiscal shift.

His famous quote that these cuts were appropriate:

… to strip off the bandages, throw away the crutches and see if American enterprise could stand on its own fee

What followed was a disaster. The economic recovery came to an abrupt end and unemployment quickly rose again.

It was called the “Roosevelt Recession”.

Once again you can see this set-back in the real GDP graph above. This pattern has been played out over and over again in history.

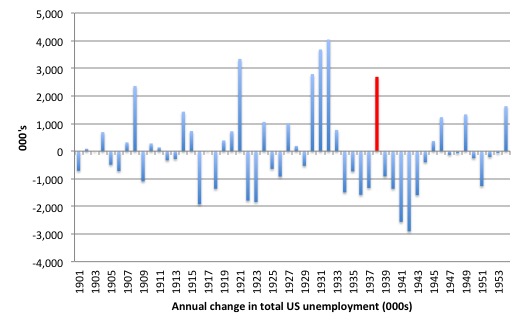

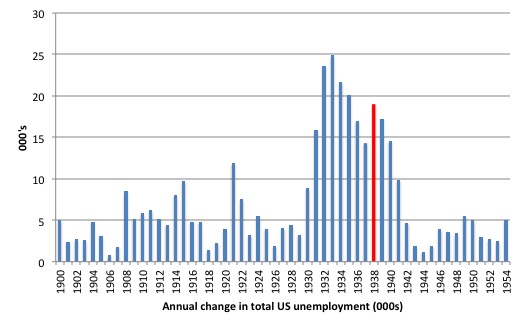

Consider the following graphs, which are created using data published by Stanley Lebergott in the NBER Volume – The Measurement and Behavior of Unemployment – published in 1957. The Chapter was entitled ‘Annual Estimates of Unemployment in the United States, 1900-1954’.

The first graph shows the annual change in total US unemployment between 1901 and 1954. The red column is the infamous 1938 – reflecting the change between 1937 and 1938.

The second graph plots the same data in terms of the unemployment rate. The red column is the rate in 1938 after the policy madness of 1937.

Morgenthau remained in denial. Zelizer (2000) wrote:

He blamed the recession on inadequate investment confidence, skepticism about deficit reduction, instabilities in Europe, and the tight money policies of the Federal Reserve. However, Morgenthau still wanted to continue a policy of budgetary austerity. He agreed with Lewis Douglas, who made the argument that the recession was a “corrective,” a result of President Roosevelt’s attack on the Supreme Court, sit-down strikes, trade restrictions, monopolistic price-fixing, and so many years of deficits.

Fortunately, the more reasonable heads prevailed and the so-called ‘consumptionists’ who favoured stimulus measures won the day.

Around 8 months into the 1937 downturn, the US government ramped up their large-scale federal spending which immediately saw economic activity improve.

By mid-1938 the recovery was back on track and gathered pace (apart from a minor blip in 1939) through to 1940 when the military build-up in the US was well underway.

It was plain for all to see – the relationship between the successive spending pulses between 1933 and 1940 and the spurts in renewed economic activity was undeniable.

What has to be understood is that deficits are not temporary events that have to be eliminated as soon as the production processes show the most tepid signs of moving again.

It is really important to keep saying this: as long as the non-government sector desires to save overall the government sector has to be in deficit of an equal (offsetting) magnitude – $-for-$. If the government doesn’t follow this national accounting rule then the economy will never get close to full employment.

All this history should warn any nation of pursuing balanced budget rules.

There is an excellent argument from John Harvey in Forbes (March 1, 2015) – Why Balancing The Budget Means Economic Catastrophe – which should be spread widely around the Internet.

He says that passing such an amendment would be “nothing short of insanity”. I totally agree.

The reasons are well known especially by those who have absorbed the basic principles of Modern Monetary Theory (MMT).

Please read my blogs – Balanced budgets are rarely appropriate and Balancing budget over the cycle is not a sound fiscal rule – for more discussion on this point.

First, no currency-issuing government can default on its own liabilities issued in its own currency as a result of financial pressures. They might default as a result of political stupidity. But such a government can always meet its outstanding commitments.

So there is no public debt level that is unsupportable.

Second, we know from an understanding of the national accounts framework is that the government surplus (deficit) will exactly equal ($-for-$) the non-government deficit (surplus).

Which means if the government is in balance over the cycle then the non-government sector will be in balance over the cycle.

However, once we decompose the non-government sector into its two constituent parts we can make a further conclusion. If the government sector is in balance over the cycle, then the private domestic sector deficit (surplus) will exactly equal ($-for-$) the external sector deficit (surplus).

That is, if there is an external deficit of say 4 per cent on average over the cycle then the private domestic sector will on average be in deficit – spending more than it is earning – over the same cycle – and accumulating increasing levels of debt.

Third, we need to understand the difference between stocks and flows.

A flow is measured the unit of time, whereas a stock is measured at a point in time. We don’t talk about the ‘stock’ of water flowing from a tap. We express the flow in terms of so many litres per minute or whatever. This water flow can fill up a swimming pool and we would say that at the current time, the pool has X thousand litres of water in it. The latter measure is a ‘stock’.

Spending in the economy is a flow. The three macroeconomics sectors – government, private domestic (firms and households) and the external sector (exports minus imports) – all introduce net spending flows to the economy, which combine to create overall spending and output (GDP) and national income.

Households consume and save (these are flows) while business firms produce and invest (also flows).

These three sectors thus combine to generate growth via their spending flows. We can summarise these net positions in the following way:

- The private domestic balance (Saving (S) minus Investment (I)) is positive if in surplus (private domestic sector is spending less overall than its income) and negative if in deficit (private domestic sector is spending more overall than its income).

- The Fiscal balance (Tax (T) receipts minus government spending (G)) is positive if in surplus (government spending less than it is taking out of the economy via taxation) and negative if in deficit (government spending more than it is taking out of the economy via taxation).

- The External (Current Account) balance (Exports (X) minus imports (M)) is positive if in surplus (external sector adding more to aggregate demand via exports than is being drained by imports and net income transfers) and negative if in deficit (external sector draining aggregate demand because export income is lower than the sum of import spending and net income flows).

Note that if the private domestic sector is in deficit we are not suggesting that the households are not saving. It just means that overall, once all the individual spending and saving decisions that make up that sector are aggregated, the sector is spending more than its income – that is, dissaving.

To explain this more, note that the (S – I) relates to the overall balance of the private domestic sector (not the household sector). It is clear that if we had a balanced fiscal position (G = T) and an external balance (X = M) then (S – I) = 0.

But this would not mean that there was a zero flow of saving in the economy. Households could still be consuming less than their disposable income which means that S > 0.

What it means is that the private domestic sector overall is not saving because it is spending as much as it earns.

It also means that when the government is running a balanced fiscal position, the non-government sector must be spending exactly what it earns and is not accumulating net financial assets (as a sector). When the external sector is in balance, then that conclusion applies directly to the private domestic sector.

Think about this carefully. Clearly, if households do not consume all their disposable income each period then they are generating a flow of saving. This is quite a different concept to the notion of the private domestic sector (which is the sum of households and firms) saving overall.

The latter concept (saving overall) refers to whether the private domestic sector is spending more than it is earning, rather than just the household sector as part of that aggregate.

if the balanced budget rule was enforced for a nation with an external deficit, then the private debt problem would escalate and, ultimately be unsustainable. That would lead to a contraction in private spending and a recession would follow.

Basic principle of fiscal deficits

Fiscal deficits are flows of net spending into the economy. They are required if the non-government sector decides overall not to spending all its income.

That can come through a combination of the external deficit draining overall spending from the economy and/or investment being insufficient to make up for the household saving withdrawal.

In those circumstances, the spending gap – the shortage of spending that would be required to support the production of enough goods that would sustain full employment – will open and firms will slow down production and lay off workers.

A fiscal deficit flow is required each day to fill that flow of ‘non-spending’ from the non-government sector.

It is highly unlikely that the private domestic sector could support stable spending growth to ensure the growing labour force is always guaranteed employment.

Please read my blog – The full employment fiscal deficit condition – for more discussion on this point.

Conclusion

Anyway, the silly season is upon us again. BBA discussions, intergenerational reports, and all the rest of the nonsensical stuff that fills up the media. I suppose it at least creates employment.

Tomorrow, the Australian National Accounts for the December quarter 2014 will be published. We will see where the economy was 3 months ago.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Strange as it may sound I think perhaps it is time to encourage these people to succeed – as long as you couple the balanced budget amendment with no bailout conditions for any private operation.

That way when the spending contraction hits the source of income for these jesters is destroyed along with a lot of their asset base.

The only way to banish these ideas is to make them fail spectacularly – which of course is exactly what they did to mainstream Keynesianism in the 1970s.

Dear Neil Wilson (at 2015/03/03 at 17:41)

Except there are actual people’s livelihoods and welfare at stake and we know that suicide rates rise, family breakdown rises, and other pathologies accelerate when there is a sudden rise in unemployment and related poverty.

So it would be an interesting intellectual exercise encouraging these bozos to take us over the edge. But the bozos don’t suffer – their pensions etc are generally safe.

I think I would rather not undertake that exercise even though games of chess are entrancing in their own right.

best wishes

bill

Dear Neil Wilson (at 2015/03/03 at 17:41)

“The only way to banish these ideas is to make them fail spectacularly – which of course is exactly what they did to mainstream Keynesianism in the 1970s.”

Did ‘they’?

Not according to this economist?

http://www.press3.co.uk/publications/to_full_employment/chapters/

I understand entirely.

However I wonder whether the suicides, etc are not simply stretched out over a longer period and the total loss is therefore greater.

So are we succumbing to the natural human aversion to short term loss and ending up inadvertently boiling the frog?

Plus pensions are merely asset bases. Destroy the asset bases and there are no pensions – other than what the state pays already in asset interest. That could be switched to a more equitable state value related pension with the relevant lawmakers in power.

The problem of course is that you can’t guarantee a collapse will usher in change. 2008 showed that and the very timid move the Greeks have made for despite ridiculous levels of privation there.

All very frustrating.

Unfortunately, the proponents of a Balance Budget in the US are on the verge of getting the required number of states to call the necessary Constitutional convention. These people are well organized, and more importantly, well financed. (They also have closed all their commenting to allow only those who agree with them.)

Bill,

You said:

In some cases it might be wise to add something to this (not necessarily for this blog) along the lines of:

Or something. This is to counter the government protestations that in a global recession unemployment is lower than in other countries. It is no accident that Labour Market Surveys also include levels of pay, and hours worked.

Kind Regards

Chuck Norris is balancing the budget now and Bill is picking on Chuck. You know Bill, some magicans can walk on water, Chuck Norris can swim through land.

Kristjan, in case anyone else is taking Chuck Norris seriously here are 50 CN jokes, including yours.

http://www.chucknorrisfacts.com/chuck-norris-top-50-facts

It’s not merely silly, it’s downright dangerous, but a vast majority of Americans believe we need a balanced budget amendment and that’s why it’s pretty much a certainty that it will eventually happen.

Maybe someone can help me here.

a) Is superannuation considered “s” or “i” in the sectors balance equation, or some combination of both? (For that matter, are government bonds and treasuries considered savings or investments?)

b) Does the answer to the above question even matter? Don’t all superannuation dollars have to be someone else’s debt at some point regardless?

Surely (at some level) it needs to be understood by the population that whether the older generation lives on superannuation or the aged pension, that no matter which way you slice it, the working generation (in the real economy, at least) must provide goods and services as a one-way transaction to retirees, and there is no fiscal trickery or political rhetoric that can make it any other way? Is must understood by most that we don’t needlessly stockpile goods for decades so that retirees can enjoy the fruits of their own generation’s labour, so why does almost everyone get their knickers in a knot about public and private debt which might reflect that reality in some way?

Am I missing something?

” … Except there are actual people’s livelihoods and welfare at stake and we know that suicide rates rise, family breakdown rises, and other pathologies accelerate when there is a sudden rise in unemployment and related poverty. ”

One of those pathologies is the growth of extremist political movements. History bears this out, does it not?

What Bill essentially says (and I agree with him) is that it is the real economy that matters not the formal or notional numbers of the budget and financial economy. This statement requires qualification. The numbers of the budget and financial economy have no meaning in and of themselves. They do have meaning in the sense of whether they contain or embody appropriate or inappropriate macroeconomic settings and value relationship estimates for the real economy.

If our current budget settings supposedly “save” government fiat currency dollars for say future public defined benefit scheme superannuation then this supposed saving is not only meaningless it is very likely to be counter-productive. Those fiat currency dollars or rather their budget number equivalent could be spent now, in an economy characterised by capacity under-utilisation (idle labour and idle plant), and could build stuff for the future, maybe aged care facilities and investing in trained staff for such facilities. That money could be spent increasing our productivity so in future we are more productive and can afford to care for more elderly people.

But “saving” dollars by running a budget surplus means nothing and does nothing positive (unless you are damping an over-booming economy with full capacity utilisation and a significant inflation problem of say 5% to 10% or more but that is not the current case).

Dollars are not saved by a budget surplus. Actually, dollars are destroyed by a budget surplus. A surplus means you tax more than you spend. The net result equates to destruction of all the dollars taxed in excess of spending. Thus there is no sense in which a surplus saves dollars for the future.

If you create a Future Fund to fund future government superannuation liabilities then this is a complete smoke and mirrors trick. Let us assume your budget has a $500 million surplus after all other receipts and expenditures are netted out. Then you decide to set up a Future Fund with the $500 million. This actually means the government is now spending or transferring this $500 million to another entity. The budget is no longer in surplus. It is balanced. It is a lie to say the budget is still in surplus. It is not. That $500 million has now been transferred to the Future Fund. It goes into circulation in the economy as the Future Fund invests it. This same $500 could have been left untaxed, left in the pockets of citizens and companies. In that case it also would have circulated in the economy but would it would have been very unlikely that it would ALL have been invested. Thus the Future Fund very likely acts to subsidise or inflate share values. It causes asset inflation.

If the Future Fund is investing in arguably bad investments (like in the tobacco industry which actually did happen) then it is doing nothing to build infrastructure and capability to care for old and sick people in the future. Indeed, it is promoting more sickness for the future.

Indeed, I could go on but I think I have laid out enough.

“Not according to this economist?”

And as we all know economists are never wrong and the left never wear rose tinted spectacles about any of their ideas or actions.

The triumph of monetarism came about with the greater organisation of financial capital and the changes within the financial system those ideas brought about.

Which keynesian governments then failed to respond to because they were stuck in the past – run by lower quality individuals than the people that created the systems and actually understood *why* they ran things like that.

The right are better organised, better financed, can work together on ideas and aren’t afraid to throw people under buses if it advances their cause. The system is almost designed to appeal to the psychopath in them.

“lower quality individuals’?

Ignorance is bliss?