I started my undergraduate studies in economics in the late 1970s after starting out as…

Friday lay day – RBA acknowledges failure of government fiscal policy

Its the Friday lay day blog – and I promise it will be short. Today, we celebrate what would have been the 70th birthday of – Robert Nesta Marley. I wish he was still making music. There is an excellent retrospective on Bob Marley in the UK Guardian (February 6, 2015) – Bob Marley at 70: legend and legacy – from Vivien Goldman, who was his Press Agent at Island Records in 1975 and knew him well. It is well worth reading. Today also marked the release of the quarterly Statement of Monetary Policy by the Reserve Bank of Australia (RBA). They have further downgraded their real GDP growth forecast and consider it will remain below trend for at least another year or so. They also estimate that the unemployment rate will continue to rise and still be above 6 per cent by June 2017. In other words, they are acknowledging the failure of fiscal policy settings in Australia. For a national government obsessed with fiscal austerity, this Statement should lead to an immediate policy reversal and the announcement of a major fiscal stimulus to increase economic growth and reduce unemployment. Unfortunately, that won’t happen and the government will get its comeuppance in the 2016 federal election. It cannot come soon enough.

The non-rebel Bob Marley

Before we get into austerity and failure lets just sing along to one of my favourite songs. It was recorded in 1964 or 1965 at the famous Studio One studio owned by Clement Coxsone Dodd in Kingston Jamaica. The tremelo tone they get on the guitar is sensational – one of the best sounds there is.

It was Track 11 on the 1965 album – The Wailing Wailers – which was the debut album of The Wailers, who were a vocal trio comprising Robert Marley, Peter (Tosh) Mclntosh and Neville (Bunny) Livingston. The backing band is the famed Soul Brothers, the house band at Studio One upon the demise of the Skatalites.

The Soul Brothers consisted of ex-Skatalites Jackie Mittoo, Roland Alphonso, Johnny Moore and Lloyd Brevett and on guitar Wallin Cameron and Bunny Williams on drums.

This period marked the transition from Ska to the more measured Rock Steady, which was the precursor to Reggae. Rock Steady also featured organ and electric guitar more prominently.

Anyway, one of my favourites. Happy Birthday Bob.

And now onto austerity – as usual.

RBA acknowledges government policy failure

The RBA cut interest rates earlier this week by 0.25 per cent and they are now at record low levels. Today (February 6, 2015) the RBA released its latest – Statement on Monetary Policy – the document that explains in some detail the reasoning the bank is using to determine the interest on overnight loands in the money market – the so-called cash rate.

It is that rate that defines the monetary policy stance of the government and conditions the other rates available in the market – short- and long-term.

The Statement on Monetary Policy is a quarterly publication (February, May, August and November).

Today’s statement, effectively sees the RBA acknowledging the failure of the current government fiscal policy stance. The role of fiscal policy is to ensure that there is sufficient spending in the economy – either directly supplied by government or induced in the private sector by tax changes etc – such that the real economy grows along its potential path and their is full employment.

The condition for assessing the success of fiscal policy is that real growth occurs within a stable inflationary environment.

By any measure, the national government is failing. Real GDP growth is well below its past trend rate, unemployment is rising and inflation is falling.

In today’s Statement on Monetary Policy, the RBA has started to get real by downgrading its median 2015 forecast for real growth in Australia to 2.75 from 3 per cent. It is still not ‘real’ enough – growth is already lower than that and will probably get worse in the coming year.

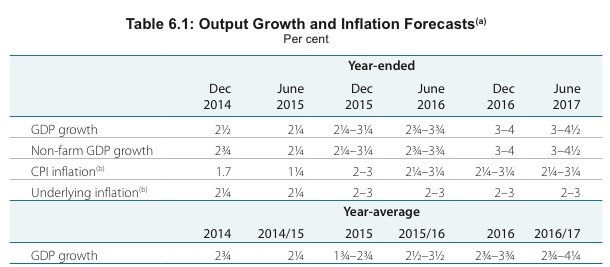

The following Table taken from the Statement shows their Output growth and Inflation forecasts out to June 2017. The RBA says that:

GDP growth is now expected to remain below trend over the course of this year and then to pick up to an above-trend pace in the latter part of the forecast period, in response to rapid growth in LNG exports and the lower exchange rate and interest rates … consumption will continue to grow at a below-average pace for a time and non-mining investment will remain subdued until at least mid 2015 … Public demand is still expected to grow at a below- average pace over much of the forecast period … a number of indicators suggest that spare capacity in the labour market has increased, consistent with below-trend growth in the economy.

The RBA also says that:

Growth of labour costs remains subdued … [and] … are largely consistent with other indicators of spare capacity in the labour market.

The growth in real wages is close to zero if not negative and well below the rate of productivity growth, which means that our distribution system is still redistributing national income towards profits. Yet, the investment ratio is falling putting paid to the claim by conservatives that firms need more profits in order to invest.

This subdued growth in labour incomes is working against the potential boost in aggregate spending that the falling oil prices would be expected to deliver.

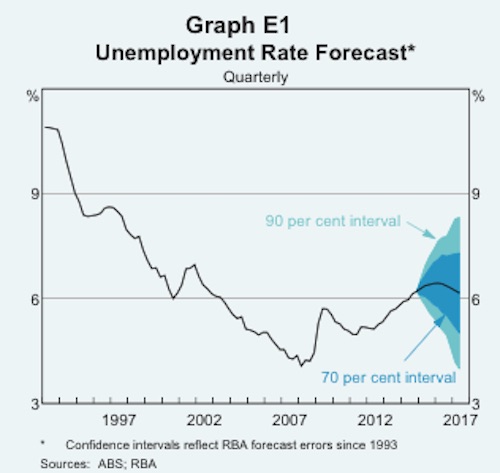

The following graph appears on Page 77 and shows the RBA’s forecast of the evolution of the national unemployment rate out to 2017. So two years from now the RBA thinks the unemployment rate will still be above 6 per cent (currently at 6.2 per cent) after peaking at around 6.5 per cent (inferred from the graph).

The RBA says that:

The labour market forecasts have been revised to be a little weaker than in the previous Statement, owing to the softer outlook for activity in the near term. The unemployment rate is now expected to rise a little further and peak a little later than earlier anticipated … [because] … forward-looking indicators of labour demand … suggest only modest employment growth in the near term, below the rate of growth in the working-age population … Consistent with subdued labour market conditions, wage growth remains weak.

So for all those mainstream economists who teach that unemployment rises because real wages are too high, take note. Firms hire workers when they can sell the output that those extra workers can produce.

If total spending growth is weak, then firms will not hire just to build up and store inventories.

The rising unemployment in Australia is due to weak aggregate spending, a state that the federal government could reverse if it wanted to. However, blind adherence to a neo-liberal ideology precludes such responsible policy making.

The Government is, instead, deliberately pushing more and more people out of work. This disregard for workers is now showing up in its deep electoral unpopularity and helps explain why the Prime Minister is facing a leadership spill motion next Tuesday, which will terminally damage his position even if he survives for the time being.

Governments around the world have to learn that the age where citizens will tolerate continuing austerity without the promised results manifesting is over. We are all sick of the lies and the damage that these neo-liberal zealots are creating with their mindless economic policies.

I did an interview today for the ABC national affairs program PM on the RBA Statement, which will be broadcast tonight. The – ABC PM homePage – publishes transcripts and audio of all its program content each night.

There was another report released recently by McKinsey on the build up of global debt since the GFC. This Fairfax article (February 6, 2015) – Spending binge: Global debt rises by $73 trillion since the GFC – discusses the Report.

I will consider this in another blog, but just note that in relation to downgraded growth forecasts and persistent fiscal austerity, governments around the world are setting up the conditions for another financial crisis, which will be worse than the GFC because the ‘stocks’ associated with the GFC are still at elevated levels.

By that I mean that instead of starting off with the Australian unemployment rate at 4 per cent (February 2008) and the broad labour underutilisation rate (unemployment and underemployment) at around 9 per cent, some 7 years after the GFC revealed itself the unemployment rate is still at 6.2 per cent and the broad rate is around 15 per cent.

Poverty rates are now higher than prior the GFC and public infrastructure is more degraded.

The same applies the world over.

It is madness. The McKinsey report agrees that high private “debt plays an outsize role in creating boom-bust cycles across the world and through history. High debt increases the amplitude of economic swings” and makes firms “more vulnerable to bankruptcy”.

The Report is full of myths though about fiscal policy constraints that high public debt levels impose. For example, the Fairfax report claims that “it is hard to look at the balance sheet of the world’s third-largest economy and not wonder how this can end well.”

Well, they have been saying the same thing for more than two decades and last time I was in Tokyo, the sky was still sitting above us all, and was surprising blue to boot!

Privatisation and Corporatisation of the electricity sector in Australia

The conservative Queensland government lost last weekend’s state election partly because they were proposing to privatise the power industry.

Privatisation is now looking ugly to most people – finally it is dawning on all these would-be shareholders that they already owned the asset when it was in the public sector and prices were lower and service delivery generally better.

This video from the Undercurrent News team documents the way in which prices are rigged, reporting data is fudged to line the pockets of executives and owners of the Australian electricity industry.

Further privatisation or corporatisation is to be resisted.

Greece

I have written a few things about Greece since the election and made ‘armchair’ assessments about the statements from the new Finance Minister, who I know and like personally.

I am not naive enough to think that political statements have to be interpreted literally. He and his government are now representing millions of people and operating in a very hostile environment where the dominant policy options are destructive to say the least.

I don’t pretend to know the inside stories although I know some of them.

But it is the role of academic commentators to discuss conceptual matters and provide knowledge in that way. Clearly, it is the role of politicians to be strategic, to withhold information that might undermine their options, and to overstate certain things to take them out of the discussion.

Those are different roles.

I am wishing Greece the best and hope like hell they get the European Investment Fund to act as a federal-type fiscal authority and pump much needed aggregate spending into the Greek economy so that the Greek government can run its balanced budget and still attain full employment.

But the question remains – if that was likely, why hasn’t it happened to date given the massive real damage that austerity has inflicted on all the Member State economies, including Germany.

I suspect there is little will to adopt such a ‘federal’ stimulus act. Besides, the funds would still come from the Member States rather than where they should come from and that is the ECB.

But at the end of it I write as an academic whose job is not at stake – I know that. But that is my role. Someone has to play it.

Something to soothe the soul sore from austerity talk and practice

This is what musical mastery is all about (even if you don’t actually like the music). I just happen to also like the music.

Husband and wife team Tuck Andress and Patti Cathcart put a different but good spin on the magnificent lyrical sense that Jimi Hendrix brought to melody and guitar playing.

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

The electricity supply industry in Australia is an appalling mess,mainly due to fashionable privatization.

The industry is an essential service and a natural monopoly so it belongs in the hands of the state governments and the citizens who elect them.That way there is some semblance of accountability.

In my home state,Queensland,the generators and distributors are government owned. The Tories who wanted to sell them off have been given the boot.But the retail side was privatized years ago by the ALP.

And what a collosal cockup that has been as I can personally attest from multiple experiences. I have had to call on the services of the electricity ombudsman on several occasions in order to get some sense out of Origin in particular. One retailer,Jack Green,went belly up owing me money. They made some silly moves on the electricity market,apparently.

What is the sense in having a “market” in an essential service? What is the sense in having to set up another government bureaucracy,an ombudsman, in order to keep electricity retailers under control?

Apposite, but not very soothing…

Hi again Bill,

When you get a moment, could you please go back to the discussion about the Crikey piece on debt so we can resolve any misunderstandings?

Thanks, Bill.

AA

Excellent musical choice. It was pleasant to be reminded of how good Tuck & Patti are. How much fun was Tuck having playing that?

Bill,

This fellow (Michael Pettis) is interesting. He is not an MMT proponent so far as I can see but amongst the “orthodox” economists he seems to be the closest to understanding what is wrong the EU as a currency union. I am not sure how many links your filter will tolerate so I have added asterisks in strategic places to stop these being direct links. I hope it works.

http://blog.mpettis.com/2014/08/can-pedro-sanchez-save-the-psoe/

https://www.creditwritedowns.com/2015/02/syriza-and-the-french-indemnity-of-1871-73.html

In relation to Greece, yes of course Greece should leave the EU and float its own currency. Being currency independent worked for Iceland. I just wonder if the Greek generals would tolerate left wing policies or if we would see a military coup and a right-wing military dictatorship again in Greece? Also, given the highly interfering nature of the USA and the CIA would they become involved in Greece’s strife? It seems likely to me they would. After all, the USA supports military dictatorship in Egypt (to name but one example).

Thanks for that great Wailers track, Bill. It wouldn’t be out of place in a Northern Soul collection. Haven’t heard it before. I watched Bob and the Wailers play at Hammersmith Odeon in 1976, when he was at the peak of popularity in my house.

Thanks for the Marley song. So chilled now.

Punchy