The other day I was asked whether I was happy that the US President was…

A primary fiscal deficit Never ever? I don’t think so

I know I am an armchair commentator hiding out in my research environment and not really accountable to anybody other than the funding agencies I win grants from. I am certainly not a Finance Minister with a nation in crisis on my hands. But with that said I wonder how any Finance Minister who aims to create full employment and expand equity and undo years of deliberately imposed neo-liberal hardship can claim his nation will “Never, never, never!” record a primary fiscal deficit again. That comment has to be dismissed as political rhetoric rather than an expression of a serious evaluation of reality. What worries me about Greece at the moment is that we are seeing a trend around the world where politicians over promise (or lie straight out) about their intentions to apparently appease the multitude of vested interests then proceed to do what they like. I discussed how this is now backfiring in the recent blog – Time is running out for neo-liberalism. An understanding of macroeconomics will tell you (and I know the Finance Minister in question knows all this) that a government cannot guarantee to never run a primary fiscal deficit forever unless they are prepared to allow for large swings in unemployment, something I thought the new Greek government was averse to, and it is that aversion, which defines their popular appeal.

The quote came from an interesting interview that the new Greek Finance Minister gave to the German weekly newspaper – Die Zeit (The Times) (February 4, 2015) – “I’m the finance minister of a bankrupt country”.

The relevant Q&A in the interview was:

ZEIT ONLINE: During the campaign, Syriza announced a spending programme worth billions. Can it be implemented without new debts?

Varoufakis: It has to. I can promise you: Excluding interest payments, Greece will never present a budget deficit again. Never, never, never!

Lets get some terms write first.

The government overall fiscal balance that is regularly reported is the difference between two flows – total revenue and total outlays. So if total revenue is greater than outlays, the fiscal balance is in surplus and vice versa.

Within that balance though are two components that are often separated out:

1. The primary fiscal balance – the difference between total government revenue and total public spending less interest payments on outstanding debt.

2. The interest payments on outstanding debt.

So the Finance Minister is talking about Greece never recording a primary fiscal deficit again.

Further, the primary fiscal balance is not something that the government can particularly control once it sets its objectives to be the maintenance of full employment.

I suggest you read this blog – The full employment fiscal deficit condition – if you are uncertain of the components of the fiscal balance and how they relate to the real economy.

We have noted in the past that movements in the final budget balance (net or gross of interest payments on outstanding debt) do not provide a reliable indication of the discretionary intent of the government.

We cannot conclude that if there is a fiscal surplus (primary or overall) that the fiscal impact of government is designed to be contractionary (withdrawing net spending to reduce economic activity), just as we cannot conclude that a fiscal deficit signals that the government is wanting to expand the real economy.

This uncertainty arises because there are so-called automatic stabilisers operating as a result of swings in overal economic activity, which are, in part, influenced by the discretionary shifts in government fiscal policy. But more fundamentally, these swings are driven by non-government spending (and saving) decisions.

Ignoring interest payments on outstanding public debt, then we have:

Fiscal Balance = Total revenue – Total spending (net of interest payments)

We can decompose that a step further to recognise the cyclical nature of the fiscal outcome:

Fiscal Balance = (Tax Revenue + Other Revenue) – (Welfare Payments + Other Spending)

We know that Tax Revenue and Welfare Payments move inversely with respect to each other, with the latter rising when GDP growth falls and the former rises with GDP growth.

Why? Tax revenue falls when employment drops and people lose their incomes. Many of the same people go onto welfare benefits.

These are the so-called automatic stabilisers. Without any discretionary policy changes, the Fiscal Balance will vary in a pro-cyclical manner over the course of the economic cycle.

When the economy is weak – tax revenue falls and welfare payments rise and so the Fiscal Balance moves towards deficit (or an increasing deficit).

When the economy is stronger – tax revenue rises and welfare payments fall and the Fiscal Balance becomes increasingly positive.

Automatic stabilisers attenuate the amplitude in the economic cycle by expanding the fiscal deficit (or reducing a surplus) in a recession and vice versa in a boom.

So just because the Fiscal Balance goes into deficit doesn’t allow us to conclude that the Government has suddenly become of an expansionary mind.

We can now appreciate that the Fiscal Balance is not a standalone accounting outcome. It is intrinsically linked to the spending and saving decisions of the non-government sector, which can, itself, be decomposed into the external sector and the private domestic sector (households and firms).

Modern Monetary Theory (MMT) uses the concept of sectoral accounting to derive so-called sectoral balances to demonstrate the intrinsic nature of these interrelationships. It is a recurring theme in my blog but needs to be repeated often to ensure that standalone statements about what the fiscal outcome might or might not be or become are assessed carefully.

The sources of spending which flow and add to total spending (aggregate demand in the textbooks) are:

- Household consumption (C)

- Private Investment (I)

- Government spending (G)

- Export revenue (X)

The income (payments to resource owners involved in the production of output) that is generated by these spending flows can be used in the following ways:

- Taxation payments (T)

- Household consumption (C)

- Household saving (S)

- Import spending (M)

Clearly, the sources of income have to equal the uses (as a convention of the National Accounts). This allows us to write the two sides of income generation like this:

C + I + G + X = C + S + T + M

Given C cancels out we know that:

I + G + X = S + T + M

The left-hand side of this equation always is brought into equality with the right-hand side via income adjustments (that is, variations in the level of aggregate activity brought about by spending variations). That is the essential first-principle involved in understanding how the macroeconomy works.

So if for example, Private Investment increases (G and X constant) this stimulates aggregate demand (spending) and firms react by increasing output to meet the new orders. This requires them to increase employment and the increased income is then used to increase saving (S), pay more tax (T) even if tax rates are unaltered, and increase imports (M).

The economy stops expanding again once the change in Investment is equal to the sum of the changes in S, T and M. This dynamic response and subsequent resolution is what we term an movement to a new equilibrium state of national income.

The left-hand side (I + G + X) are called injections – because they inject new spending into the economy whereas the right-hand side (S + T + M) are leakages – because they drain aggregate spending over some period.

Implicit here is the fact that the increase in investment stimulated rising consumption (C) and the induced consumption stimulated subsequent increases in income and so on. That is the basis of the spending multiplier.

Please read my blog – Spending multipliers – for more discussion on this point.

A macroeconomy is in a steady-state (that is, at rest or in equilibrium) when the sum of the injections equals the sum of the leakages. The point is that whenever this relationship is disturbed (by a change in the level of injections or leakages, however sourced), national income adjusts and brings the income-sensitive spending drains into line with the new level of injections. At that point the system is at rest.

Three points should be noted.

First, this position of ‘rest’ does not necessarily have to coincide with full employment. The system will adjust to dramatically lower levels of injections and come to rest even if there are high unemployment levels.

Second, when an economy is ‘at rest’ and there is high unemployment, there must be a spending gap given that mass unemployment is the result of deficient demand (in relation to the spending required to provide enough jobs overall).

Please read my blog – What causes mass unemployment? – for more discussion on this point.

Accordingly, if there is no dynamic which would lead to an increase in private (or non-government) spending then the only way the economy will increase its level of activity is if there is increased net government spending – this means that the injection via increasing government spending (G) has to more than offset the increased drain (leakage) coming from taxation revenue (T). That is, a fiscal deficit is needed to offset a non-government spending gap.

Third, this doesn’t mean that a fiscal deficit is always required. We need one more condition to establish that case for on-going fiscal deficits. If the non-government decisions taken together (so consumption and saving decisions by households, investment decisions by production firms and the external sector) indicate a desire to “net save” overall, which might be written as

I + X < S + M then the only way the level of activity can be maintained on an on-going basis (at any rate of unemployment) is if G > T. That is a fiscal deficit is required on a continuous basis to sustain a given level of activity.

In this case, a fiscal deficit “finances” the desire by the non-government sector to save by maintaining sufficient demand to produce a level of income which will generate that level of net saving.

Functional finance is very clear – responsible fiscal policy requires two conditions be fulfilled:

1. The discretionary fiscal position (deficit or surplus) must fill the gap between the savings minus investment minus the gap between exports minus imports.

In notation this is given as

(G – T) = (S – I) – (X – M)

Which in English says for income to be stable, the fiscal deficit will equal the excess of saving over investment (which drains domestic demand) minus the excess of exports over imports (which adds to demand).

If the right-hand side of the equation: (S – I) – (X – M) – is in surplus overall – that is, the non-government sector is saving overall then the only way the level of national income can remain stable is if the fiscal deficit offsets that surplus.

A surplus on the right-hand side can arise from (S – I) > (X – M) (that is, the private domestic sector net saving being more than the net export surplus) or it could be associated with a net exports deficit (draining demand and adding foreign savings) being greater than the private domestic sector deficit (investment greater than saving) which adds to demand.

2. Most importantly, the prior discussion focused on the level of income remaining stable but as we have seen that doesn’t necessarily define a full employment condition.

We can define a full employment level of national income as that which is generated when all resources are fully utilised according to the preferences of workers and owners of land and capital etc.

Given that S, T and M are all positively related to the level of national income, there is a unique level of each of these flows that is defined at full employment. Changes in behaviour (for example, an increased desire to save per dollar earned) will change that ‘unique’ level but for given behavioural preferences and parameters we can define levels of each.

So lets call S(Yf), M(Yf) the corresponding flows that are defined at full employment income (Yf). We also consider investment to be sensitive to national income (this is outlined in the so-called accelerator theory) such that higher levels of output require more capital equipment for a given technology. So I(Yf) might be defined as the full employment flow of investment. We consider export spending to be determined by the level of World income.

Accordingly, to sustain full employment the condition for stable national income is written more specifically:

Full-employment fiscal deficit condition: (G – T) = S(Yf) + M(Yf) – I(Yf) – X

The sum of the terms S(Yf) and M(Yf) represent drains on aggregate demand when the economy is at full employment and the sum of the terms I(Yf) and X represents spending injections at full employment.

If the drains outweigh the injections then for national income to remain stable, there has to be a fiscal deficit (G – T) sufficient to offset that gap in aggregate demand.

If the fiscal deficit is not sufficient, then national income will fall and full employment will be lost. If the government tries to expand the fiscal deficit beyond the full employment limit (G – T)(Yf) then nominal spending will outstrip the capacity of the economy to respond by increasing real output and while income will rise it will be all due to price effects (that is, inflation would occur).

In this sense, MMT specifies a strict discipline on fiscal policy. It is not a free-for-all. If the goal is full employment and price stability then the Full-employment fiscal deficit condition has to be met.

The real world

So could a country always run a primary surplus or zero balance and still maintain full employment? The answer is yes.

If its external sector was continously generating injections of spending sufficient to match any desire to save overall by the private domestic sector net of interest payments from the government in relation to its outstanding debt then it is possible.

How likely is that for Greece?

Not very likely at all.

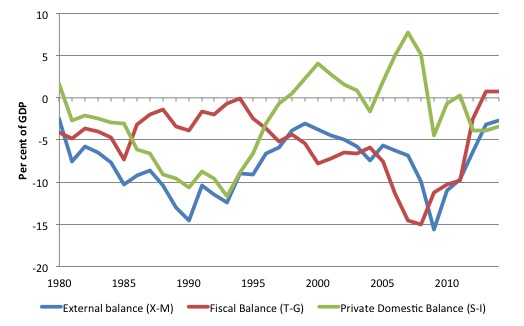

The following graph shows the sectoral balances for Greece from 1980 to 2014 (using IMF WEO data). The balances are expressed as percentages of total GDP.

You can see that Greece has typically run an external deficit of varying magnitudes over this 34 year span. Its deficit was reduced in 2014 mostly due to the dramatic decline in import spending as a result of the Depression the nation finds itself in.

If Syriza manages to stimulate the economy and lift employment levels to acceptable levels then imports will rise again. The nation is unlikely to record sufficient Current Account surpluses to allow the primary fiscal balance to be zero on an on-going basis.

The qualifier is that Greek households are not large net savers (Source). Combined witht the knowledge that historically, Greece’s investment ratio (as a percent of GDP) has been above 20 per cent. It has collapsed to 11.2 per cent (September 2014) as a result of the Depression.

Should Greece start growing again and investment rebounds it will certainly spur household saving but will also see the investment ratio return to more historically normal levels.

If we take the general government accounts in Greece, then in 2013, the Eurostat data tells us that the primary deficit was 8.6 per cent of GDP and interest payments were equivalent of 3.6 per cent of GDP.

For the central government accounts, the primary fiscal deficit was 10.7 per cent of GDP and interest payments were 3.7 per cent of GDP.

Total general (central) government spending was 59.2 (49.2) per cent of GDP and revenue 47.0 (34.8) per cent.

The net interest paid has averaged about 4.8 per cent since 2006 for the General government.

If GDP increases and public debt is reduced then at current interest rates the injection coming from interest payments on outstanding public debt will fall below the 3.6 per cent in 2013.

So if the external balance was to remain close to zero and not return to its more typical levels (say if Greek imports remained modest and exports boomed) then it is possible that the interest payments alone would be sufficient to fund the private domestic sector’s excess spending over income.

It is possible. But how likely? Not very likely.

Further, there would have to be a massive shift in the composition of spending and taxation to allow the government to advance its left-wing socio-economic program. How likely is that? Not very likely?

And what this all assumes that growth is consistently maintained.

What happens during the next major spending shock?

Well you know the answer, the primary fiscal balance would soon be back in deficit (should they actually get it consistently into surplus) or, alternatively, unemployment would get worse.

Conclusion

A government’s accounts cannot buck the economic cycle without causing dreadful damage to the real economy.

That is what austerity is all about. That is what I thought Syriza is railing against. Certainly it is what defines Syriza as a political movement.

As an aside, I note that there is now considerable attention in the media about the clothes that the Finance Minister happens to be wearing, which is a change from the usual gender-biased focus on clothing and appearance that female leaders normally have to suffer from the sexist press.

In his case, it is being seen as an asset – confronting the stodgy suits that define the austerity mindset. But the sexism remains.

Here is today’s journalistic clanger.

The Fairfax article – Can Andrews go the distance in a fraught time to be a political leader? – is mostly sensible.

It argues that lying and scheming politicians who over promise to get elected then abandon their promises are doomed and that accounts for the rapid demise in recent years of governments and leaders in Australia.

It then turns its focus on Victoria, which recently tossed out a conservative government. One of the big issues was infrastructure spending – roads versus public transport. The conservatives did a dirty deal to build a freeway tunnel that was overpriced and would not achieve its aim of reducing traffic congestion. In pursuing that policy, they abandoned a major public transport (train) project that would improve the congested rail system and would deliver a better social return on the investment.

The article notes that the newly elected Labor Government in Victoria has to get out of the nasty contract the conservatives signed “as an act of political sabotage” weeks before the election, which predicted they would be tossed out of office.

It also explains how the new government has “to make a start on the metro rail tunnel, a project that is expensive and incredibly complex from an engineering point of view – not to mention delivering 30 level crossing upgrades over the next four years.”

Finally, it notes that the new government is having to deal “with the loss of tens of thousands of automotive jobs likely once the car industry closes.”

All serious issues for the new regime – no doubt.

But then, by way of conclusion, the article says:

All the while Labor must keep the budget in surplus, without sacrificing the state’s AAA credit rating by borrowing more.

Why “must” the new government keep its budget in surplus given the massive infrastructure spending that will have to be undertaken to repair the damage of previous governments who neglected to maintain and improve basic public infrastructure in Victoria?

The new Victorian state government will probably have to run on-going deficits to achieve their aims, especially given the deteriorating state of employment which is the result of the federal fiscal austerity.

Intergenerational equity demands that debt be used to fund public infrastructure for a non-currency issuing government because the costs of provision should be matched with the temporal profile of the benefits.

Major transport projects deliver benefits over many generations and it is only fair and efficient that those generations participate in the cost of providing the infrastructure.

A different situation, obviously, faces a national, currency-issuing government – then no debt need be issued.

Too many US Phds in economics going back hometo China

I read a US news report this morning – China cuts bank reserves to ‘keep economy stable’ – and immediately came to the conclusion that too many Chinese students with Economics PhDs from US universities must be getting jobs in the People’s Bank of China – its central bank.

Apparently, the central bank has “increased its economic stimulus measures even further” by deciding to:

… cut banks’ reserve requirement ratio (RRR) by 50 basis points to 19.5 percent. The move, effective Thursday, is the first such cut since May 2012. This will lower the amount of deposits that each lender is required to hold as reserves.

The measure will help keep the economy stable, the PBOC said …

Well that is what the young PhDs would learn in most US graduate programs in economics, unfortunately.

As is obvious to anyone who understands the way the banking system operates, banks do not loan out reserves. They are used to facilitate the integrity of the payments system (cheque clearing etc) and might be swapped between banks to help settle overnight imbalances.

Having more less reserves in the system will not make any difference to the capacity of the banks to expand credit should there be sufficient credit worthy borrowers walking through their doors.

It is sheer idiocy to think otherwise.

So either the People’s Bank is becoming infested with these flaky mainstream Phd graduates or the journalists put their imprint on the story and didn’t understand what they were writing about.

ECB bastard act

This morning we woke up (in Australia) to the news from Franfurt that overnight the ECB had effectively closed the door on Greek banks access to euro liquidity.

The Press Release (February 4, 2015) – Eligibility of Greek bonds used as collateral in Eurosystem monetary policy operations – tells us that the ECB has lifted its:

… current waiver of minimum credit rating requirements for marketable instruments issued or guaranteed by the Hellenic Republic …

What does this mean? The ECB will no longer allow Greek government bonds to be used as collateral. Previously, as a result of the waiver, the bonds would be used throughout the Eurosystem to facilitate monetary operations – so-called open market operations where a bank might sell these bonds to the central bank to access necessary liquidity in euros.

The waiver was in line with the assessment by the ECB that these bonds “did not fulfil minimum credit rating requirements”. So the waiver basically cancelled the higher risk in dealing in these bonds.

Why? The ECB claims it is “currently not possible to assume a successful conclusion of the programme review”.

Real speak: This is a bullying bastard act which clearly sees the ECB dropping its so-called ‘independence’ and acting as the front-line attack dog for the Troika (of which it is a member).

Of course, it dropped any semblance of indepedence when it became part of the austerity pogrom on Greece in 2010.

Their decision only reinforces my view that the Greek government should bail out of the bailout, exit the Eurozone, redenominate the outstanding public euro liabilities to its own advantage in its own currency, ensure the Bank of Greece (central bank) can maintain financial stability (keeps its banking system liquid) and flip the rest of them the ‘bird’ as they implement a national Job Guarantee program.

Otherwise …

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

“Lets get some terms write first.” Should that be ‘right’?

Forgot to mention, great article!

Check “Satanic Verses” on Wikipedia.

In this context let me be a devil’s advocate, too.

“if there is no dynamic which would lead to an increase in private (or non-government) spending then the only way the economy will increase its level of activity is if there is increased net government spending”

In the former Soviet bloc a very simple workaround was found – people not willing to work were simply told to work or else…

“Work for dole” is based on the same idea but the details of the implementation differ. But some of the members of the Greek Government are former communists so – who knows what they are up to? This will obviously screw them up forever on the path of zero economic growth. Historic experience has proven that socialism is utopian because of microeconomic issues – the total lack of true motivation to deliver results as opposed to performing “work” – but hey they will have full employment like Cuba.

Also – what about a balanced Keynesian stimulus? I think that J.K.Galbraight (the real heavyweight behind the Modest Proposal) would agree.

Also – from the Modest Proposal – “Additionally, if the EU introduces a financial transactions’ tax, or stamp duty proportional to the size of corporate balance sheets, a similar case can be made as to why these receipts should fund the ESSP.”

This looks like a kind of tax on financial assets (a tax on a form of capital) – see Political Aspects of Full Employment by Michal Kalecki, 1943]:

“Another problem of a more technical nature is that of the national debt. If full employment is maintained by government spending financed by borrowing, the national debt will continuously increase. This need not, however, involve any disturbances in output and employment, if interest on the debt is financed by an annual capital tax. The current income, after payment of capital tax, of some capitalists will be lower and of some higher than if the national debt had not increased, but their aggregate income will remain unaltered and their aggregate consumption will not be likely to change significantly.”

Finally, the analysis based on the assumption “given that S, T and M are all positively related to the level of national income, there is a unique level of each of these flows that is defined at full employment.” is actually hydraulic-Keynesian and inconsistent with the very idea of Job Guarantee offering a minimal wage to everyone willing to work, no strings attached, as long as this person actually performs his/her duties – rather than throwing money on the whole economy “as is”. In the Greek situation it is probably possible to get full employment at a very depressed level of wages which would mean low import (because people would be buying cheap locally-made products of inferior quality). This would not work for every country in the world at the same time.

The trick which broke the back of hyperinflation in Poland in 1923/24 can also be repeated in Greece – impose a tax on real estate – it is relatively easy to collect (more difficult to dodge) and hits these who are really rich.

Whether staying in Euro is worth performing all these experiments and whether the Germans eject Greece from Euro anyway for the lack of obedience are more kind of political question. The Americans may intervene to prevent the Russians gaining a bridgehead on the Balkans and tell the Germans to shut up. In this context probably J.K.Galbraight knows quite well what he is doing.

“that overnight the ECB had effectively closed the door on Greek banks access to euro liquidity.”

Not sure that is strictly true. They have certainly increased its price.

The only difference is that Greek banks now have to get Euro liquidity from the Greek central bank, rather than directly from the ECB at the slightly inflated ELA rate. So the Greek central bank takes the Greek government bonds as collateral and marks up the Greek bank accounts in the usual fashion with the Euros created on the Greek central bank balance sheet.

The real fireworks start if the ECB tries to withdraw ELA from the Greek central bank, because I’m not sure the rules allow them to do so. My reading of the rules (which admittedly are gibberish and badly written – precisely so the ECB can do what they want) is that the Greek central bank has to refer *itself* to the ECB or there has to be a two-thirds vote of the Governing Council before the ECB can pull the Greek central bank overdraft at the ECB.

Then at that point we really do have an unelected dictatorship trying to tell a democratic elected government what to do. Which should cause a constitutional crisis about the fundamental nature of democracy in Europe.

It’s a fairly safe assumption that if the Greeks exit the euro the new currency will devalue significantly. Greeks can’t produce all the goods they need (or want) to live a reasonable quality modern lifestyle. Imported goods will become more difficult to procure for the average Greek.

If they were to achieve full employment, many would gain in living standards, however many others would face a loss. The loss in living standard might be psychologically easier to bear if they don’t have to watch Greek elites swanking around, not paying tax and looking down their noses at the hoi poloi. I suggest they have to rein in elite privilege and excess as a matter of urgency.

The reactionary backlash will be severe. Elite sabotage will be hitting them left, right and center and it won’t be so benign as a toilet roll shortage. Without the implicit support of the military I just can’t see Syriza surviving a Grexit. Prognosis is grim, Syriza doomed to fail whichever way they turn, neoliberal elites still firmly in charge and getting more sinister every day.

I believe they will end up introducing their own currency, otherwise Syriza would be disbanded quickly, which they will never risk. Because of that I believe they already have a Plan B in their pockets.

I think this is the right path as most Greeks don’t want to get out of Euro, doing otherwise without actually trying would be a betrayal to their election promises. Discussing whether they should have promised that or not is on political realm, not economics.

Afterwards, they can legitimately claim that they have tried to stay within Euro. Then, after their welfare starts to increase, the Greeks would also see the advantages og having own currency.

Maybe there’s a tiny possibility Syriza could last the term and achieve a modicum of social justice by implementing a more progressive tax structure and other social changes staying within the leash of the eurozone. Though it’s hard to see them achieving anything without the Troika snakes twisting their arm on privatisation and labour reforms. If the Greeks game is to try and change the Eurozone from the inside by building support with other countries to dial back Germanic mercantilism and their sado-masochistic austerity tendencies …. good luck with that!

The neoliberal elites game will be to mercilessly snuff out all hope of a socialist revival. If Yanis is really into game theory and genuinely wants to do the people of the Greece and the world a favour. I suggest he and Alex should smile and agree with the euro clowns until the minute they whip out the middle finger and the Grexit card, Syriza can at least have a good honest go before they crash and burn in a blaze of glory. Who knows? Spain and Italy may join in and start a movement rolling, saving the day for the good guys. Whatever happens, in the aftermath at least there will be an ember of hope for Greece and 99% of mankind.

“Imported goods will become more difficult to procure for the average Greek.”

Why? Where else are the exporters going to sell their output. Mars?

The whole world is vendor financed. That is how ‘export led growth’ works.

It really is time that people realised exporters need to export.

Bill,

You must take this in context. Varoufakis wants to turn Greece into the equivalent of a US state and then run fiscal stimulus in massive proportions through the European Investment Bank who will issue bonds to the ECB. Basically he wants to federalise the fiscal deficits and run them through an institution that will allow them not to be counted as fiscal deficits thus getting rid of the silly scaremongering. It is all there in his Modest Proposal.

http://yanisvaroufakis.eu/euro-crisis/modest-proposal/

Bill,

Aren’t you’re being a bit harsh on Yanis? Greece is engaged in what is nothing less than an economic war against reactionary forces. Syriza, and the Greek working classes, are on the front line of the class war too. Since when was absolute honesty a requirement of the Geneva convention?

We should reserve judgement. It could all be part of some game theory which is Yanis’ speciality or so I understand!

Neil,

I see your point, but in reality Greece is a relatively small market, exporters generally wouldn’t price their goods in Greece significantly lower than neighbouring countries because of grey market and parallel import issues. E.g. if Greeks were buying an American medicine at 100€ before Grexit and the new Greek currency loses 50% of it’s value against the Euro they will still be paying ~100€ for the medicine but with half the salary to buy it with.

If the euro devalued 50% against the dollar, US exporters would probably accept reduced US$ value for the medicine because they would need to retain market share in a large market that may have indigenous competitors.

How did they manage to sustain a negative external balance for so long? For example, during the Drachma era …. does this imply leakage of Drachma abroad …. foreigners wanted to hold them? For example, that explains why the US can run a consistent external deficit …. rest of the world wants to hold dollars. Having a hard time seeing that for Greece.

Or is it all explained by borrowing abroad either in foreign currencies, or in recent times, Euros?

Dear Carlos Fandango (at 2015/02/06 at 2:47)

You said that a new Greek currency would significantly depreciate against the euro once issued. Why would that happen? Foreign exchange parities are determined by supply and demand.

Who would be issuing the new Drachma? Answer: Only one institution – the Greek government via the central bank.

What is the current volume (supply) of new Drachma in the foreign exchange markets? Answer: zero – it doesn’t exist.

If the Greek government restricted its supply but were able to require people to demand it – to pay taxes etc – then why would the currency depreciate violently in the period after issue?

You are thinking (like most people) of an existing tradable currency that is unpegged or something like that. Then the depreciation can be sudden because there is a lot of supply.

best wishes

bill

“Imported goods will become more difficult to procure for the average Greek.”

It depends what you mean by the “average Greek”. A typical Greek might be a better comparison. He or she might well be unemployed or have a very poorly paying job. Any Greek government in charge of its own currency would find it hard not to improve on the current situation.

In which case, after the initial turmoil has settled, imported goods will be easier to procure.

Dear Bill,

You stated that

“Foreign exchange parities are determined by supply and demand.”

…

“Who would be issuing the new Drachma? Answer: Only one institution – the Greek government via the central bank.”

I am still waiting for a post about the so-called “capital flight” from Russia and Ukraine – if such a thing exists in your view.

The trouble with the supply and demand is in my opinion by the presence of savings that is financial assets currently denominated in EUR (or “an inflationary overhang” in the economic dictionary of the Real Socialism). If the savings in Greek banks are re-denominated into new drachmas (this might be forced very soon if Greece is cut off from the Eurosystem) then this will constitute the initial stock of money. We need to think about M3 not M1.

The first signs of instability and artificially seeded panic will lead to a stampede. The saving propensity in drachmas will be equal to zero. I remember perfectly well changing Old Zlotys into USD or DEM immediately after pocketing money from my scholarship or when I earned some cash as a student in 1989/1990. At that time Polish economy was effectively “dollarised”, prices of apartments and cars were given in USD or DEM because nobody would bother giving prices in PLZ falling 20% a month. This was a transitional result of freeing prices of food and other basic goods.

So the forex market will be created overnight on the streets of Athens. Knowing the experience of Greeks in avoiding taxation, what is the likelihood that the new Drachma will be firmly anchored as a new currency? This was achieved in a very brutal way in Poland in 1990 by imposing a progressive tax on wage increases in the public sector. This is impossible in Greece. Once the confidence is lost it will take months to stabilize the situation – more than enough for Golden Dawn to do their dirty job.

The panic will be used by speculators trying to take loans in new drachmas to perform a trick with exchanging them into EUR and then back after a while to pocket the difference between exchange rates minus the cost of the loan. The only cure is to set interest rate at a very high value (like in Russia during the latest bout of panic). We need to acknowledge that Greece is a very corrupt country and there is a lot of enemies there and abroad of the Syriza government.

Chartalism needs to acknowledge the existence of credit money which actually constitutes the most of the stock of money in existence.

After grexit and default markets will eventually accept that Greeks have become a good, or at least better, credit risk, a la Argentina. And all that will have happened is that Greek debt is written off now rather than later.

Tsipras would now like to be called by his full name: “Alexis Obama Tsipras.”

Bill,

Correct me if I am wrong, but my logic is this. If Greece denominates existing Euro bank accounts into Drachma, many Greeks with the capability to move their money will prefer to convert their Drachma into Euro. There will be intense mainstream media scaremongering about inflation and currency devaluation, whether or not this follows economic logic, the financial movers and shakers love to provoke instability they can profit from. A lot of wealthier Greeks long term savings (most of the money) will try to move to accounts denominated in other currencies.

I don’t see countervailing forces of non-Greeks wanting to invest or save in Drachma.

Don’t banks create huge highly leveraged funds for forex trading? The Drachma issuing banks will have to be tightly controlled to stop them short selling billions of Drachma for profits. Asian countries introduced capital controls in the 90’s to prevent this happening I believe. In this world of dark pools and synthetic derivatives, the manipulators will still try to find a way to create the currency instability they crave.

Maybe I’m erroneously thinking all Euro accounts will be converted to Drachma at the get go. If Greece defaults then simply pays out in Drachma and demands tax in Drachma the demand will all be for Drachma.

To rub more salt… a low-intensity bank run is actually already going on in Greece.

A week ago WSJ reported:

“Bank deposits in Greece fell to a two-year low in December as Greeks yanked 4.6 billion euros ($5.2 billion) from lenders amid rising political uncertainty.

Total deposits fell to €173.2 billion in December, the lowest level since November 2012, according to data from the Bank of Greece-the country’s central bank.”

AFP reported that “The European Central Bank has given the green light to make up to 60 billion euros ($68.5 billion) in emergency liquidity available to Greek banks, a source close to a national central bank told AFP on Thursday.” (that is on 05/02/2015)

So if the bank run continues and EUR 60bln is nearly-exhausted at some point of time (rather sooner than later), the Greek Central Bank has to declare bank holiday and impose limits on withdrawals. Just like before the haircut in Cyprus. It is actually better for them to help themselves with these EUR 60 bln rather than exit immediately. It is also better to impose limits before the re-denomination because of the reasons outlined in the previous comment.

This needs to be followed by deployment of the Police on the streets and by re-denomination of all the assets and liabilities in new drachmas. Foreign debt will have to be re-negotiated and pro-austerian propaganda tackled. “It was not my fault it was a default” This is how Grexit is going to unfold unless the Germans and other austerians relent and agree to one or another form of the “modest proposal”. Or the current government toppled at the last moment and replaced by austerian “technocrats” willing to implement the policies of Mr Schauble (e.g. deploying 500 German tax inspectors with German-shepherd dogs on leash).

All depends on whether the Americans (Kerry and Co) instead of wasting time in Kiev, pay a visit to Berlin. We need to keep in mind that some Syriza members and Golden Dawn (not to mention powerful Orthodox Church) have nothing against developing closer ties with Russia. Very close.

The so-called middle class – the social base of conservatives and “social democrats”- will pay the price with their life savings – as in Cyprus, Argentina or elsewhere. As long as strict deposit withdrawal controls are in place, violent swings of exchange rate may be avoided but I am not aware of any historic precedences when a country effectively defaulted and there was no depreciation in the currency. (the Czecho-Slovak split was another issue).

However if the current government is not toppled and replaced by another breed of austerians or fascists, this painful adjustment offers the best long-term hope for economic recovery. If it is toppled – Yanis has an Aussie passport and a job in the US so he will be fine.

If Greek government were to accept new curreny in payment of taxes alongside euro, and one new unit of currency would extinguish 1 euro of tax liability, how much could exchange rate deviate from 1:1? Not by much I recon. Anyone with tax liabilities would have incentive to trade in the FX markets buying the weaker currency thereby bringing them to parity.

And Greece could offer a job for anyone able and willing to work paying for them in this new currency, thereby letting the quantity adjust to demand.

Bill,

I’d be interested to hear your detailed view on what types of capital controls and regulatory changes the Greeks would need to make to achieve the best possible result from a Grexit.

For example:

Would nationalization of the banks would be a prerequisite… How would this best be achieved within the existing rules and regulations.

How would they deal with the different financial assets denominated in Euros, e.g. Various bond categories, term deposits, current accounts etc.

Would Greek banks be able to lend in euros? I’m guessing not without support from ECB, although I believe some countries (Slovakia?) use the euro without being a euro member state (how does that work?).

Where would you choose to value the new Drachma against the Euro? How would you manage the exchange rate (like Singapore, HK, China or Japan?) If significantly devalued, how would this affect Greek living standards?

How to prevent attacks from currency speculators if you wish to operate at a higher exchange rate than Mr Market believes.

How would Greece manage their current account defecit.. Boost exports/ devalue?

Any other problems/ challenges they might face and how to mitigate them?