I started my undergraduate studies in economics in the late 1970s after starting out as…

When fiscal policy is misrepresented

On Tuesday, Australians woke to headlines – Treasurer Joe Hockey faces $51 billion deterioration in finances between budget and MYEFO, economists say – and a story of “black holes”. The so-called director of budget and forecasting at a consulting firm in Australia (inaptly named Macroeconomics) claimed that the May fiscal statement (aka The Budget) was “economically sound”, which just tells you that the director is not worth listening to on matters macroeconomic. Then along came the US-China so-called ‘historic’ climate deal to muddy the waters further. And nothing I have read in the news since Tuesday about either issue makes any sense from a macroeconomic perspective.

The Assistant Governor of the Reserve Bank of Australia gave a speech today in Sydney – The Business Cycle in Australia – where he confirmed:

1. The dominating role of China in Australia’s economic growth prospects:

… overall growth of Australia’s major trading partners has actually been relatively stable at close to its long-term average. In large part, this reflects the sizeable and increasing share of Australia’s exports going to our fast-growing neighbours in the Asian region, most notably China. The relatively weak growth among the advanced economies in recent years has had minimal impact on our major trading partners’ growth figure because they account for a small share of Australia’s trade …

2. Indirect influence of global financial markets on Australian trade prospects:

… a further appreciation of the US dollar … would … [lead to] … a further depreciation of the Australian dollar, which remains above most estimates of its fundamental value, particularly given the substantial declines in commodity prices over the course of this year.

3. The Australian “unemployment rate has risen gradually over the past couple of years to a level that is high relative to its recent history”. Why?

4. Because the economy is experiencing “below-trend growth of economic activity … Growth over this financial year is likely to remain below trend” until at least 2016.

5. The mining boom is over with “Mining investment has been declining for about two years now” although “exports of resources have risen significantly as investment projects reach completion”.

6. But the “production phase” (export part of boom) “needs much less labour than the investment phase, this transition is freeing up labour from resource and resource-related activities” – that is, shedding labour and creating worse unemployment.

7. And “non-mining business investment, after picking up following the global financial crisis, has been little changed now for three years. It remains very low as a share of nominal GDP.”

And after all that, not a word on the fiscal stance of the government and its role in undermining growth by withdrawing the stimulus support too early.

An economy growing below trend will always see its tax revenue take reduced relative to a more robust growth environment.

It is no surprise that the fiscal balance in Australia is increasing as employment growth falls and the unemployment rate rises. That is the normal operation of the so-called automatic stabilisers which see tax revenue falling as people lose jobs and stop earning an income and welfare payments rise.

It is a major reason why governments should never try to target a particular deficit/surplus outcome. They do not control the fiscal balance and so why try to target something that is determined largely beyond your control.

The reality is that the private sector spending and saving decisions (for a given external situation) drive the final fiscal outcome in any year.

Now, those decisions are significantly influenced by government fiscal policy. The government can increase private sector confidence, for example, by stimulating an ailing economy and providing an initial spending impulse, which then kickstarts other private decisions.

Households are reluctant to spend much if they fear unemployment. Firms won’t invest much if their sales are flat.

It is the state of the private economy and the balance with the public sector economic activity that fiscal policy should address – not the state of the fiscal balance, which is largely irrelevant if the economy is delivering sustainable growth with full employment.

A fiscal deficit of 10 per cent of GDP would be just as appropriate as one of 2 per cent or even a fiscal surplus of x per cent if the policy stance was supporting that state of affairs.

The varying possible fiscal positions consistent with full employment will just reflect the contribution to total spending by the external sector and the desire to save overall by the private domestic sector.

If the external sector was contributing significantly to spending and hence growth, then a fiscal surplus might still support the private domestic sector’s overall saving plans without endangering the full employment objective.

But then again, if the private domestic sector desires to save overall (that is, not spending all its current income), then if there is an external deficit (that is, the trade sector is undermining spending growth in the domestic economy), then the fiscal balance has to be in deficit – otherwise, the economy will fall into below trend growth or even recession, depending on the circumstances.

All this is being played out but not understood in the reports that are predicting what will happen when the Federal Government’s Mid-Year Economic and Fiscal Outlook (MYEFO) is released (usually in December).

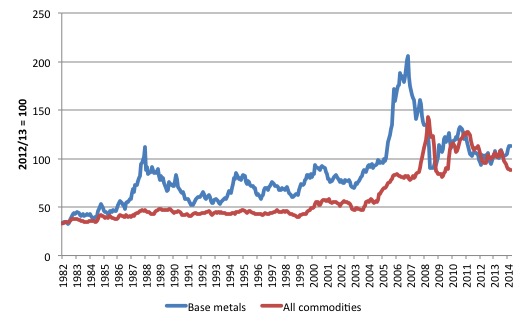

The following graph shows the movements in commodity prices in world markets for Australia (in $A) since the early 1980s.

The boom is well and truly over although the current prices are still above the pre-boom levels.

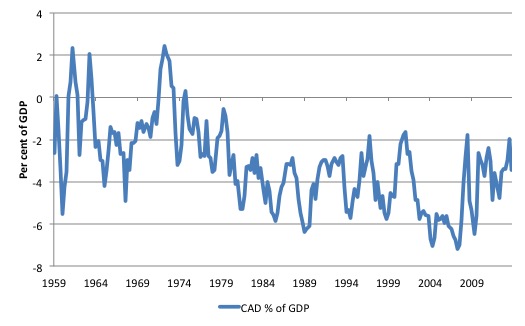

The next graph shows the external sector’s contribution to domestic activity – the Current Account balance as a percent of GDP from the September-quarter 1959 to the June-quarter 2014.

The external sector has not been a net contributor to growth in the domestic economy since the early 1970s. All the talk of the mining boom and what it would do for the nation in terms of growth trajectory miss that point.

Export income might be higher than in the recent past but if more spending leaves the economy via imports then the net effect is to undermine growth. Sure enough we get more foreign material goods and services than if we were not importing greater volumes but the macroeconomic effects are that an external sector deficit is a net drain on total spending in the economy.

At present, the external deficit is around 3.4 per cent of GDP.

The predicted fiscal deficit is around $A51 billion annualised or approximately 3.1 per cent of GDP.

Please read my blog – Norway and sectoral balances – for more discussion on the sectoral balances, which feature in the next few paragraphs.

Noting the following: Total private investment (I), total government spending (G), total household saving (S), total taxes raised (T) and external deficit (X – M).

Our understanding of sectoral balances tells us that there are three sectoral balances – the Fiscal Balance (G – T), the Current Account balance (X – M) and the private domestic balance (S – I). These balances are usually expressed as a per cent of GDP and must obey the following accounting rule.

(S – I) = (G – T) + (X – M)

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)), where net exports represent the net savings of non-residents.

Manipulating these balances allows one to tell stories about what is going on in a country.

For example, when an external deficit (X – M < 0) and a public surplus (G - T < 0) coincide, there must be a private domestic deficit. So if X = 10 and M = 20, X - M = -10 (a current account deficit). Also if G = 20 and T = 30, G - T = -10 (a fiscal surplus), the right-hand side of the sectoral balances equation will equal (20 - 30) + (10 - 20) = -20. As a matter of accounting then (S - I) = -20 which means that the domestic private sector is spending more than they are earning because I > S by 20. So the fiscal drag from the public sector is coinciding with an influx of net savings from the external sector. While private spending can persist for a time under these conditions using the net savings of the external sector, the private sector becomes increasingly indebted in the process. It is an unsustainable growth path.

So using the current Australian aggregates we would have:

Private domestic balance (S – I) = Fiscal Balance (3.1 per cent) + External Balance (-3.4)

Which solves to private domestic balance = -0.3 per cent of GDP – a small deficit, which tells us that the private sector is still accumulating increasing levels of indebtedness.

The household sector is currently saving about 10 per cent of its disposable income, so the overall private domestic balance reflects fairly weak private investment expenditure.

The below-trend GDP growth and the rising unemployment tells me immediately, given these aggregates that the fiscal deficit should be considerably larger than 3.1 per cent of GDP – more like 5 to 6 per cent given the state of the rest of the sectoral spending balances.

The national broadcaster, the ABC beat up the story about the “blow out” in the fiscal deficit on Tuesday saying that:

… the combination of a Senate hostile to key savings measures and slumping commodity prices looks set to make his festive season anything but.

Which immediately conveys the message to the readers that a rising fiscal deficit is something bad – not a cause for celebration.

Which immediately discloses the ignorance/bias of the journalist in question.

There is nothing bad about a rising fiscal deficit if it is accompanying stronger growth in jobs and reduced labour underutilisation rates.

Focusing on numbers – deficit to GDP ratios – is a mindless exercise which is guaranteed to lead one to false conclusions and with little perception of what is required.

The ABC report is just a mouthpiece for the private sector consulting report that was released earlier this week. I hate the way journalists take the easy way out and just summarise some press release.

These private consulting firms are in it to make money and love all this national exposure for the flaky ideas and conclusions.

Why don’t the journalists take them to task instead of just mouthing the Executive Summaries of the Reports that get handed to them?

The ABC report (aka as the précised private consulting report) is all about how the government can make further cuts, which are considered by the population to be “fairer”.

The hostility to the May fiscal statement was huge (hence the Senate’s obstruction to the changes proposed by the Government) because:

… much of the fiscal adjustment burden on the poorest members of the Australian and international community (the unemployed, students, low income pensioners and foreign aid recipients) up to 2017-18, whilst failing to rein in tax concessions for high income earners.

That is a true statement but trying to make cuts that should never be fairer misses the point entirely. The deficit is too small.

US-China deal

And cutting across all this is the climate deal between the US and China, which makes Australia look positively wan in relation to its climate change fighting credentials.

The big G20 meeting in Brisbane starting tomorrow doesn’t even have climate issues on the agenda.

The two superpowers have signed a “secret” deal which up the ante with respect to carbon emission targets. The Australian press report (November 12, 2014) – Barack Obama praises ‘historic’ climate deal as Labor steps up attack on Coalition – tells us that the pace of carbon reduction will be doubled in the next 11 years.

Australia would have to reduced emissions by around 30 per cent by then to be consistent with the US-China deal. Our current policy position is to reduce by 5 per cent by 2020, which was dinosauric even before the new deal was announced.

Australia is a major polluter despite our small size but is way behind the world at present on these issues. Our Government policy reflects its climate change denial credentials where the Prime Minister claims coal is the way of the future for energy production.

But I am not a climate change scientist and it was the economic commentary that followed the announcement which were within my expertise.

Fairfax economist Peter Martin’s article today (November 13, 2014) – The China-US climate change deal: Australia’s coal exports at risk – told us that the US-China deal may see China import “no thermal coal” at all “As it ramps up its use of nuclear, wind and solar power”.

So what?

Well it would “render out of date the business models of Australia’s thermal coal producers”. They are already out of date from a climate perspective but Peter Martin is referring to the private cost and benefit calculus underpinning our coal exports.

If the producers had to factor in the social costs and benefits – including global warming costs etc) that they do no currently pay for (and are therefore not reflected in the final price that makes them privately profitable – then things would change dramatically.

But the US-China deal has the potential to wipe out volume demand. And not before time one might say.

Peter Martin concludes that:

China’s coal use will have to decline in order for its greenhouse gas emissions to stabilise … [and] … Australia’s budget will be hit whatever China does. Less demand for coal will mean a lower price and lower tax revenue.

Aah – linking back to the fiscal discussion – in case you were wondering.

Using terms like “hit” are neo-liberal in bias. A ‘hit’ is a punch or a collision – and the underpinning metaphors are that it is bad – something we don’t want to happen.

A rise in the fiscal balance is not bad per se. It might reflect a deteriorating economy if unemployment is rising etc.

But the US-China deal has not detrimental implications for fiscal policy. It just means that the external deficit is likely to be higher and that means that the fiscal deficit will have to rise too to bridge the gap in spending that is lost as China stops buying our filthy polluting coal exports.

Simple as that.

It gives the Government the chance to really craft a new coal-free era where they invest in public renewable energy schemes to generate power and jobs and skill development and invest more in research and development and urban infrastructure and public transport and all sorts of other green initiatives.

Conclusion

You can see how differently a person who understands Modern Monetary Theory (MMT) thinks about these issues.

The mainstream (neo-liberal) response is to be blinded by simple financial ratios (for example, the fiscal deficit to GDP ratio) which are meaningless in themselves.

The real challenge for fiscal policy is how to increase employment in sustainable activities so that the current 15 odd per cent of available labour is not languishing in enforced idleness of one form or another (unemployment, underemployment, hidden unemployment).

Italy

Next week, I am off to Italy where I will be a guest speaker at a major roundtable – How can we govern Europe?.

It is a high profile event in Italian terms. I will be in Florence for the Roundtable (Friday 21-23) then in Rome for two days Sunday night to Tuesday midday.

My blog will be disrupted by the travel but I will file reports when I can.

That is enough for today!

(c) Copyright 2014 William Mitchell. All Rights Reserved.

I suggest the importance of the Current Account situation needs more emphasis. With the loss of the automotive, rail car and wagon, and the whitegoods manufacturing industries, Australia will become very similar to a potential bank customer with no credit worthiness.

It is essential that the government take action to increase employment. That action should aim at generating employment in industries that would reduce our import bill. What Australia does not need is more employees staring at computer screens in the banks’, stockrokers’ and other financial services’ offices. An employee who loses a job in Holden or Toyota factory nor longer pays tax of his (or her) former $60-70,000 annual gross pay packet and the government is out of pocket for a further $15,000 per annum in unemployment benefits. So the government could afford to subsidise the manufacturer nearly half its wages bill before the government (really the rest of society) is worse off.

A further reduction in the overnight interest rate could lower the exchange rate to make the manufacturing industries that still exist more competitive.

I have plotted the Current Account and Budget Outcome figures on a fiscal space diagram for each government since 1972. The Howard Government’s performance was by far the worst.

This was in the Financial Review yesterday:

“Australia should raise more revenue from the goods and services tax and diversify its industries to ride out the end of the mining boom and fragile world economic recovery, managing director of the International Monetary Fund Christine Lagarde says.”

“Australia must boost its productivity after relying on ‘mother nature’s blessing by the way of commodities’ for the past decade.”

The second quote is perhaps a fair enough comment but how does raising the GST help?

What is she really getting at?

Bill. Back in 2001, the ABS had an article on “Real net national disposable income – a new national accounts measure”. http://www.abs.gov.au/ausstats/abs@.nsf/0/3FA94A5DA5F20EDDCA256B7400730B78?OpenDocument

This year, the UK ONS has published articles in its “Measuring National Well-being” series. It says “A more rounded assessment of changes in the economy and their impact on living standards, is provided by looking at measures such as GDP per capita and Real Net national Disposable Income (RNNDI) per capita alongside GDP”. http://www.ons.gov.uk/ons/dcp171766_371427.pdf

Have you found the ultimate metric that describes how households (the 99%), fare under laissez-faire, neo-liberal governments?

“That is a true statement but trying to make cuts that should never be fairer misses the point entirely. The deficit is too small.”

Bill, I’m just wondering about this statement. The proposal to address the tax avoidance strategies of major corporations seems sensible given that the profits extracted are not put to any productive use, but either feed excessive executive salaries or speculative investment.

The impact this sort of strategy would have on the sectoral balances starts to elude me, however. As a counterfactual, had the government released a series of budget measures intended to increase its revenue from large, profitable corporations (rather than attacking the lower income brackets as they did), and made no changes to its spending proposals, total taxes raised (T) would increase.

It follows then, that this would move the government’s fiscal position closer to surplus, and therefore lead to the domestic private sector spending more than they are earning by the same amount.

But when I think of the impacts this policy shift would presumably have in reality – it strikes me that the lower income households would save more (reducing the private debt load they are burdened with) – while the amount of speculative investment is reduced. The sectoral balances equation seems to enforce a mathematical certainty that the money extracted via taxation (T) will always be taken from savings (S), provided there is no change to the external sector balance.

What am I missing?

Bill,

Remind the Italians that Germany obtained debt relief in 1953 as well as ignoring SGP requirements whilst in the Euro!

Regards

Hello Commenters & Bill,

Are there favorable situations where private savings (S -I) turns negative and stays negative for a significant fraction of the business cycle? What if households were reducing savings rates to finance a home, or finance an education, or replace household white goods for more efficient models? Or, on the other term of the equation, that firms spent more money investing in more efficient or less-polluting capital goods?

I appreciate the dangers in increasing private sector indebtedness, and wonder if the headline number is not always a simple indicator of the financial and social health of the citizens of the economy.

Sincerely, Joel

From what you write, I gather the Senate has done Hockey a favour with the $51 billion deficit!

He’s stimulating the economy without the opprobrium of being responsible for the deficit, thanks to the Senate.

If I were Hockey I would shut up!