I grew up in a society where collective will was at the forefront and it…

There is no umbilical cord between government deficits and bond issuance

The Financial Times article (December 19, 2013) – The long farewell to quantitative easing – concluded such: “Quantitative easing has demonstrated to politicians everywhere that it is possible to finance government deficits simply by printing money, a fact which had become obscure in the developed economies in previous decades. The umbilical link, previously unchallenged, between running a budget deficit and the requirement to sell bonds has been broken in the mind of the political system. Who knows what the long-term effects might be”. While mistakenly thinking crediting reserve accounts is activating any printing press it is true that there is no requirement to sell bonds to run government deficits. Today I am updating my analysis of the latest flow of funds data in the US. The US Federal Reserve recently put out the latest – Z.1 Financial Accounts of the United States – aka the Flow of Funds, Balance Sheets and Integrated Macroeconomic Accounts. If the FT author had have been studying this and related data he would have known years ago that there was no functional relationship between government net spending and its habit of issuing debt to the private sector. The former is financially unconstrained while the latter is just a system of corporate welfare. But recently, the government has given the game way by being the dominant purchaser of its own debt. Hysterical (as in comical) when you think about it!

The most recent data release covers the September-quarter 2013. This relevant data comes out on a quarterly basis with the latest publication being December 9, 2013.

If you combine it with other related data from the US Treasury Department you can get a comprehensive understanding of trends in US federal government debt.

The US Treasury Department provides an extensive data resource on the topic in its quarterly publication – Treasury Bulletin. The most recent public just came out for December 2013. You can also select – chapter by chapter in Word format.

A relevant chapter for our purposes is – Ownership of Federal Securities (Table OFS-2 Estimated Ownerships of U.S. Treasury Securities).

The US Treasury also provide data which provides a country by country breakdown of the major foreign holders of treasury securities – Foreign breakdown.

Further, the US Federal Reserve just released (December 19, 2013) its data covering – Factors Affecting Reserve Balances.

Taken together, this data provides the means for anyone to acquire a deep empirical appreciation of what is happening in with US public debt.

Anyone who has studied the data in detail will conclude – as long as they take off their rose-coloured glassed (aka deficit/public debt hysteria inducers) – that the US government can buy as much of its own debt as it chooses. And there is never an intrinsic financial constraint on a currency-issuing government.

So whether the private sector or the foreign sector chooses to buy US federal government debt that is on issue or not is irrelevant. The government can unlimited amounts of its own public debt as it wants. Which makes the whole matter nonsensical.

The author of the previously mentioned FT article might have just worked that out but its been in the flow of funds accounts and related data for years now.

I previously discussed this data in this blog – The US government can buy as much of its own debt as it chooses. Other related (earlier) blogs include – The nearly infinite capacity of the US government to spend and When the government owes itself $US1.6 trillion.

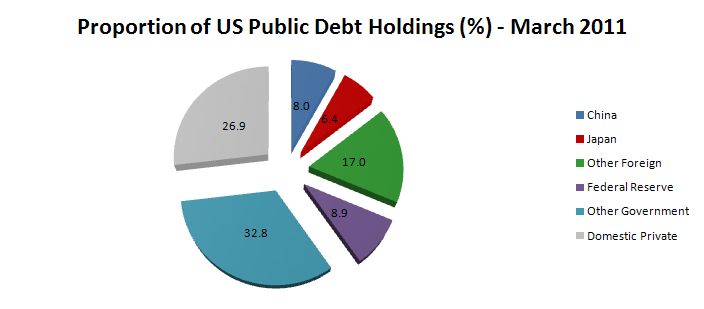

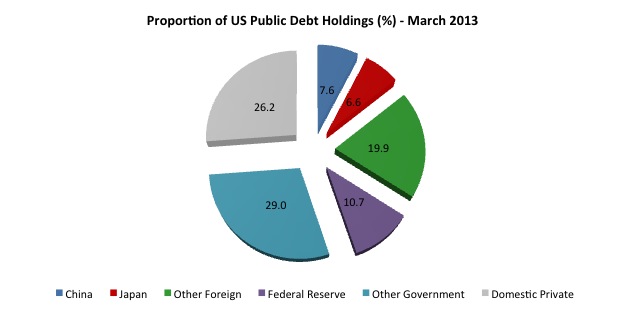

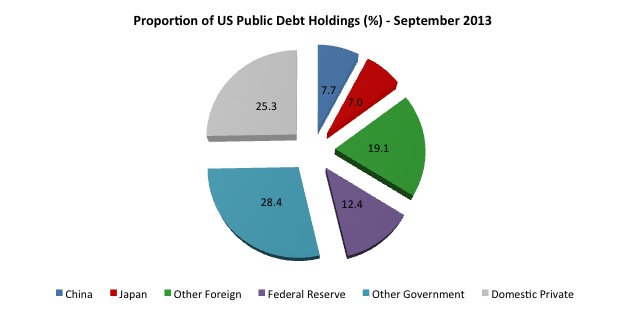

The following sequence of pie-charts shows the proportions of total US Public Debt held by various “interesting” categories at various intervals: March 2011, March 2013, and September 2013.

As at March 2011, the government sector held about 42 per cent of its own debt. These holdings were either in the intergovernmental agencies or the US Federal Reserve (which held 8.9 per cent of total US public debt). The total US Federal Reserve holdings were around $US1,340.4 billion.

The Chinese holdings were around 8 per cent of the total and hardly consistent with the rhetoric of the deficit terrorists that China was bailing the US government out. More about which later.

The three largest foreign US debt holders at March 2011 were China (8 per cent); Japan (6.4 per cent) and Britain (2.3 per cent). The total foreign held share was equal to 31.4 per cent in March 2011.

As at March 2013, the government sector held about 39 per cent of its own debt. The US Federal Reserve increased its share (from 8.9 per cent in March 2011 to 10.7 per cent in 2013) with a total holding of $US1,796 billion.

The Chinese holdings had fallen to 7.6 per cent which has been about constant since the end of 2011.

The three largest foreign US debt holders at March 2013 are China (7.6 per cent); Japan (6.6 per cent) and the so-called Caribbean Banking Centers, which include Bahamas, Bermuda, Cayman Islands, Netherlands Antilles and Panama (1.7 per cent).

The Oil Exporters come next (1.6 per cent). The Oil Exporters include (Ecuador, Venezuela, Indonesia, Bahrain, Iran, Iraq, Kuwait, Oman, Qatar, Saudi Arabia, the United Arab Emirates, Algeria, Gabon, Libya, and Nigeria).

The impact of the British austerity was noticeable. In March 2011, Britain was the third largest holder of US public debt (at 2.3 per cent of total US public debt). By March 2013, this had dropped to 0.95 per cent. They shed $US166 billion worth of US treasury securities in that 24-month period.

The total foreign held share of outstanding US public debt was equal to 34.1 per cent in March 2013 – which is a relatively stable proportion.

The most recent data (September-quarter 2013) tells us that the US government sector held about 40.8 per cent of its own debt with the US Federal Reserve increasing its holdings to 12.4 per cent of the total, worth around $US2,072.3 billion.

China’s share remained steady (7.7 per cent) while Japan’s share rose to 7.0 per cent. You didn’t read any Wall Street Journal articles warning the US of catastrophe ahead as the Land of the Rising Sun bought a higher proportion of outstanding US government securities. There is implicit racism in the phobia about China, which I will come to in a moment.

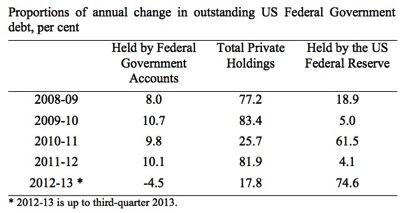

The following Table shows the proportions of the total change in US Federal Government debt for the calendar years 2009 (so the change is between 2008-09 and so on) to 2012-13 accounted for by the main holders – Federal Government Accounts, Total non-government (public), which is, in turn, decomposed further into US Federal Reserve holdings. There are other components not included.

In 2011, the increases in the US Federal Reserve’s holdings accounted for 62 per cent of the total increase in US federal government debt. That fell away to 4.1 per cent in 2012.

In 2013, the US Federal Reserve system has absorbed 74.6 per cent of the change in US Federal Government debt. The dramatic shifts in the proportions of take-up of the changes in debt outstanding is a policy choice. It is no accident.

The central bank can alter this proportion whenever they choose and that includes to purchase any debt that the private sector chooses not to purchase.

In other words, the US government (consolidated Treasury and central bank) can always assume the role as its own largest lender. That is, the Government can always borrow from itself! From one pocket to the other.

That is how nonsensical all the debate about debt limits etc really are. They sound robust but in the end the currency-issuer is the currency-issuer and can always work around the so-called constraints.

This also sounds like a strategy that the ECB should deploy in the Eurozone to give the member-states some growth latitude.

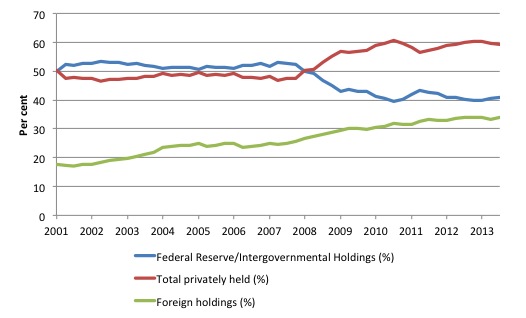

The next graph shows the evolution from March 2001 to September 2013 of the US public debt by private, public and foreign holdings (%). The foreign holdings are a subset of the private series.

There are some interesting points to note. At a time when the US public debt ratio has risen beyond what the mainstream claim is the tipping point (80 per cent) – the point after which those spreadsheet experts (R&R) claim insolvency is nigh – the private demand for US public debt has risen.

Private markets know that there is no substantive default risk involved in holding the US Treasury debt.

The other point, in relation to the rising foreign share is that you cannot conclude that the foreigners (China, Japan etc) are “funding” the US government. The US government is the only government that issues US currency so it is impossible for the Chinese to “fund” US government spending.

To understand the trend shown in the graph more fully we need to appreciate that the rising proportion of foreign-held US public debt is a direct result of the trade patterns between the countries involved (and cross trade positions).

For example, China will automatically accumulate US-dollar denominated claims as a result of it running a current account surplus against the US. These claims are held within the US banking system somewhere and can manifest as US-dollar deposits or interest-bearing bonds. The difference is really immaterial to US government spending and in an accounting sense just involves adjustments in the banking system.

The accumulation of these US-dollar denominated assets is the “reward” that the Chinese (or other foreigners) get for shipping real goods and services to the US (principally) in exchange for less real goods and services from the US. Given real living standards are based on access to real goods and services, you can work out who is on top (from a macroeconomic perspective).

Note that a worker in Detroit who is suffering from unemployment as a result of cheaper imports coming from nations with lower labour standards (pay and conditions) than the US is unlikely to agree with me. In his/her case I wouldn’t agree with me either.

But from the perspective of macroeconomics there is no issue.

This discussion also relates to an interesting article I was sent recently (thanks Bernard) that was published in Salon (December 21, 2013) – Newsflash: Claiming that China is America’s “banker” is misleading and racist – which relates somewhat to this data.

The Salon article by one Jesse Myerson is largely sound. He has written some interesting articles in Rolling Stone and elsewhere.

The tenor of the Salon article suggests that more and more people are realising that the world is being held to ransom by neo-liberal confidence tricksters. The main themes of Modern Monetary Theory (MMT) are spreading although I wouldn’t want to claim, necessarily, that writers such as Jesse Myerson came to his conclusions directly from contact with MMT.

He does reveal that he has been influenced by – Frank N. Newman – a former senior US treasury official who’s recent book acknowledges an intellectual credit to our own work.

Here is an interesting blog from my colleague Stephanie Kelton about Frank N. Newman – Former Dept. Secretary of the U.S. Treasury Says Critics of MMT are “Reaching”

Whatever the conduit might be, the fact remains that more and more writers are now realising the con. That can only be a good thing.

Jesse Myerson writes that the claims that Chinese bondholders will enslave US citizens (a regular claim in the neo-liberal presses of the world) is both wrong and “so, so racist”.

He also criticises Hillary Clinton for claiming that China is the US’s “banker” and for her claim that because China owns “so much of our debt” this constitutes “a great source of vulnerability”.

Jesse Myerson writes that:

… advancing the “Chinese bond holder” trope is misleading and economically meaningless, and therefore reliably results only in arousing anti-Chinese xenophobia and paranoia.

He notes (as we have above) that “China owns a little under 8 percent of American sovereign debt”.

But then he focuses in on the real issue:

… it does not matter who owns the public debt, because its repayment places absolutely no budgetary burden on anyone. It might take a minute or two out of the day of some operations person at the Fed, but that’s all. That person might bring up the spreadsheet of a Chinese bank’s savings account at the Fed (its “Treasury securities” account) and deduct a certain amount, by a keystroke, thereupon to bring up that same bank’s checking (“reserve”) account spreadsheet and add that same amount, by a second keystroke. The debt is thereby paid. Ta-da!

This is mainstream Modern Monetary Theory (MMT) and contrary to what the mainstream economics profession is pumping out daily in the form of peer-reviewed articles, Op Eds, and lectures to students.

If the world start to understand that point alone, we will be a long way toward dispensing with the neo-liberal mythology and can start to refocus the narrative so that the economy serves us – advances our well-being rather than being some sort of deity that we have to bow down to, while the elites make off with all the spoils!

Jesse Myerson quotes Frank N. Newman in the following explanation:

Since the U.S. doesn’t need to borrow back the dollars it originally spent into existence in order to spend them again, the purpose of issuing Treasuries is really just for “providing an opportunity for investors to move funds from risky banks to safe and liquid treasuries,” … Investors aren’t doing the U.S. a favor by buying treasury securities; the U.S. is doing investors a favor by selling them. Otherwise, without the option “to place their funds in the safest most liquid form of instrument there is for U.S. dollars,” would-be bondholders “are stuck keeping some of their funds in banks, with bank risk.”

Yes, as we have noted often – government debt issuance is just an elaborate system of corporate welfare. The bond holders are better thought of as being parasites than anything else. And it is Xmas so I am trying to be generous.

He also notes that the reason the Chinese have funds to buy the US bonds is because US citizens (via the trade deficits) get:

IPhones for which it exchanges digital entries in a spreadsheet at the Fed.

His conclusion is that the frenzy about Chinese bondholdings is really just “activating racist mistrust of “the Chinese,” long a component of the American bigotry cocktail.”

Conclusion

As a proponent of MMT, I do not consider there to be a public debt problem in the US so the analysis presented here is out of interest rather than establishing anything substantive.

However, what it shows is that even within the voluntarily-constrained system that regulates the relationship between the US treasury and the central bank, the latter can still effectively buy as much US government debt as it likes.

The so-called monetisation of the deficits that the mainstream macroeconomists go on about and claim to be inflationary also seems to be totally misconstrued. What they tell their students is that when the central bank buys treasury debt associated with deficits the result is accelerating inflation. We have seen the opposite in the US and elsewhere over the last 5 years. Get over it!

Finally, in terms of the opening paragraph – the “umbilical link, previously unchallenged, between running a budget deficit and the requirement to sell bonds” was broken when the Bretton Woods fixed exchange system was abandoned in 1971.

And the FT author might broaden his reading list because the “link” has been constantly challenged by Modern Monetary Theory (MMT) proponents for decades now.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Bill,

‘The impact of the British austerity was noticeable. In March 2011, Britain was the third largest holder of US public debt (at 2.3 per cent of total US public debt). By March 2013, this had dropped to 0.95 per cent.’

I am confused about this.

Are these holdings of US public debt held by the UK Government? This seems unlikely. They could just be holdings of City of London based financial institutions everyone from a teachers pension scheme to a Russian oligarchs ill gotten gains. Does this say much about austerity? Or does it just show how the speculative money in the City of London has moved out of US Government bonds into something else (shares?).

William Posters

Bill,

Couple things. Since you mention Detroit, I presume you’re alluding to the auto industry. The average price of an imported vehicle in the US has been higher than the domestic average since 1982 (https://www1.eere.energy.gov/vehiclesandfuels/facts/2008_fotw520.html). One reason I believe is that most of our imports come from Europe, Japan or South Korea, all of which have relatively high labor standards. China may be the world’s largest auto maker, but does not sell cars in the US (yet).

The US auto makers are doing okay since the bailout. Michigan’s unemployment is still higher than the US average (at 9%) but the manufacturing sector has been on the rise. Detroit’s unemployment is nearly double Michigan’s, however the fate of Detroit including its recent bankruptcy status has little to do with the auto industry and more to do with inequality, as local wealth has flocked to the suburban areas surrounding the city.

Great article, as always. I’d welcome more economic analysis of our city but I don’t really expect it from someone who writes halfway around the globe!

If one is looking for rational reasons for not ‘printing money’, there is the fear that when the populace realizes this is the case, there will be pressure to spend too much. It’s too much to ask I suppose for leaders to lead, and simply not do that.

Is exchanging government debt for reserves printing money … don’t know? Maybe, but as people have found out … so what. It didn’t really accomplish much, not in comparison to what running a bigger deficit would have done.

If people knew that there was no limit to Government investing directly into the economy for social purposes (other than distant threat of inflation), it would be a great step forward in public awareness. If they realised that Government can purchase anything for that is for sale in Australian dollars they might then start to ask why don’t we have better funded public education, schools etc. Lack of money could be removed as the excuse for not doing anything Then a debate might start about the the reasons we can’t have these things which has nothing to do with lack of money.

You can demonstrate the arithmetic and explain the logic until you’re blue in the face, but it makes no difference. You’re not up against people who form their beliefs by a rational process seeking to know the truth of the matter. You’re up against people who form their beliefs by an instinctual

process that seeks to serve their narrowly conceived short term self interest. Their reasons are “rationalizations”, not empirically grounded logic. You’re not arguing with Socrates. You’re arguing with Goering. The big lie, repeated incessantly, works. People believe it and don’t even question whether it’s rational or true, especially people who personally profit by it. Socrates, on the other hand, was given the choice of fucking off or drinking hemlock. We live in a new age of empire. Power, not enlightened reason, says what is true and not true. Bill is the Baptist opening eyes in the wilderness. Meanwhile back in Rome, Goering is spinning his bullshit, and that’s what the ‘civilized’ world believes in. You can’t defeat power with truth. John got his head served up on a platter. Jesus was nailed to a cross. History is not kind to people who speak truth to power. Power wins the world. Truth only wins the minds of the few who are prepared to make their own way outside the systems of power, or martyrs who fight and lose. The powers don’t care if you are “right”. You are not powerful enough to change their system, so you don’t matter to them. If you had some power to embarass or hurt them, like Manning or Snowden, then being right is dangerous to you, even though it will not change the power system. I’m all for spreading understanding of the truth about how things like the money system works. Just don’t expect truth to have any effect on the ongoing operation of the system, which is designed to serve the interests of the powers, and which very successfully serves that function.

Of course, it is not the case that “because China owns “so much of our debt” this constitutes “a great source of vulnerability””.

However, it is the case that the shifting of the manufacturing base from the USA to China does constitute a source of vulnerability for the USA and is the reason why the worker in Detroit is out of a job.

I would like to see Bill do more real economy analysis and put it beside the macroeconomic financial analysis. Manufacturing capacity utilisation is an interesting field for example. How do the US and China compare on that one? And what are the long term trends of real output in the USA and China (for example). Anything from concrete and raw steel to construction data, heavy machinery production, consumer goods production and high tech production would be interesting.

The financial economy only exists to facilitate the real economy. In the final economic analysis only real production counts (along with efficiency of production and sustainability of production). And the only point of the real economy is sustain and develop people, all the people, of course.

Is the Chinese strategy to move the bulk of world manufacturing (real production power) to China? Asking a question like this is realpolitiks not racism. The US’s strategy is forward containment of China.* China’s strategy apart from building up its navy is to seek a long term weakening of the US economy by de-industrialising it and moving the world manufacturing centre of gravity to China.

* Note: We know how the US reacts to attempts to forward contain it. Think of the Cuban Missile crisis. But forward containment of China is an established fact which China must contend with geo-strategically. (The presence of American military in Afghanistan, Uzbekistan, and Tajikistan; recently strengthened ties with South Korea and Japan; efforts to improve relations with India and Vietnam; and the Pivot to Asia Strategy for increased American involvement in the Pacific have been pointed to as evidence of a containment policy. – Wikipedia) Becoming preferred trading partner with the US was really an outcome tailored to Chinese needs. China can hollow out the US by trading with it and making a small US elite very rich (paper wealth) whilst transferring world real manufacturing capacity to China.

Hi Bill. I wonder how this debt issuance applies to the situation in Venezuela. In terms of why that government is defualting on interest and debt payments, if they have issued bonds in their currency? I see that creditors in the US are going to court to seize assets associated with the V government.

Thanks, Mark